Key Insights

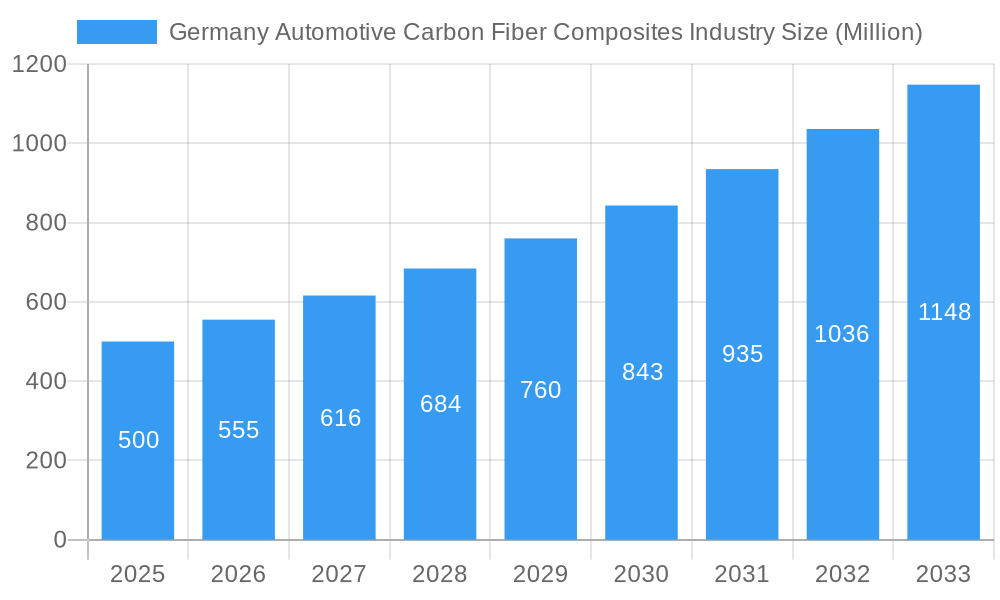

The German automotive carbon fiber composites market is experiencing robust growth, driven by the escalating demand for lightweight vehicles to enhance fuel efficiency and reduce emissions. Projections indicate a significant market expansion, with a Compound Annual Growth Rate (CAGR) of 14.98%. The market size was valued at 4.5 billion in the base year of 2025 and is expected to continue its upward trajectory. Key growth drivers include the automotive industry's pivot towards electric vehicles (EVs), which significantly benefit from the lightweight properties of carbon fiber, stringent governmental regulations promoting sustainable transportation, and advancements in manufacturing processes that improve cost-effectiveness and integration into vehicle designs. Major application segments encompass structural assemblies, powertrain components, and interior/exterior elements. Leading market players are actively investing in research and development and production capacity expansion to meet surging demand. Regional market concentration aligns with Germany's prominent automotive manufacturing hubs, underscoring the direct correlation between automotive production and carbon fiber composite adoption. While the initial cost of carbon fiber presents a challenge, ongoing technological innovations and economies of scale are progressively mitigating this barrier.

Germany Automotive Carbon Fiber Composites Industry Market Size (In Billion)

The German automotive carbon fiber composites market is set for substantial expansion, propelled by the increasing adoption of lightweight materials in vehicle production. The market is strategically segmented by production type and application, highlighting the versatility of carbon fiber in automotive applications. Leading enterprises are actively pursuing growth strategies through R&D investments, manufacturing efficiency enhancements, and strategic alliances. Substantial investments in electric vehicle infrastructure and the ongoing national drive for sustainable transportation create a conducive environment for continued market growth. The market's concentration in key automotive manufacturing regions emphasizes the critical role of localized production and supply chains in effectively serving this dynamic sector. While the cost of carbon fiber remains a consideration, continuous innovations in production technologies are enhancing its cost-competitiveness.

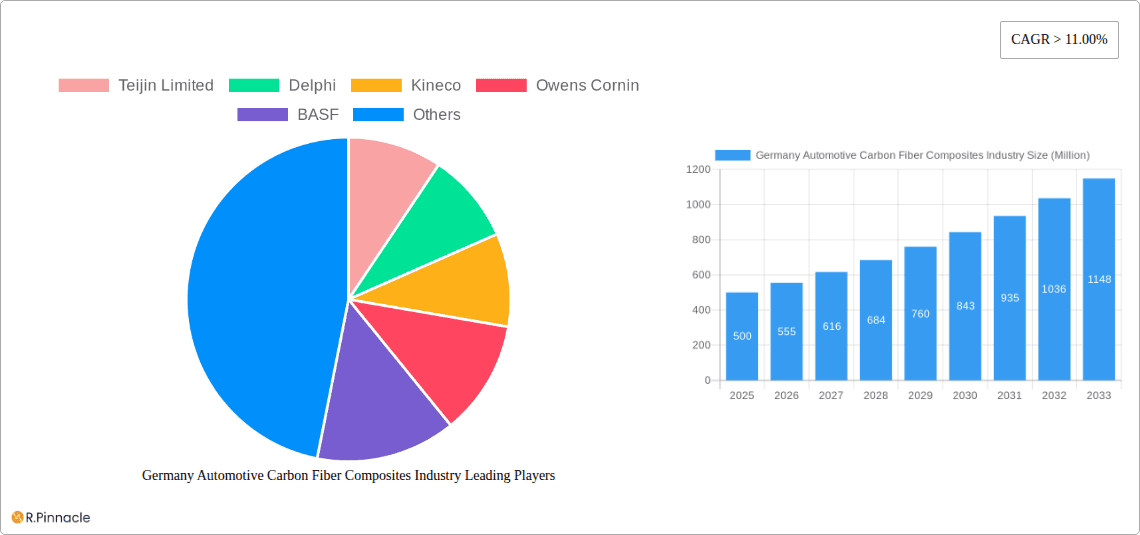

Germany Automotive Carbon Fiber Composites Industry Company Market Share

Germany Automotive Carbon Fiber Composites Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany automotive carbon fiber composites industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. The report utilizes data from key players like Teijin Limited, Delphi, Kineco, Owens Corning, BASF, General Motors Company, Toray Industries, Cytec Industries, Far UK, Gurit, 3B-Fiberglass, Johns Manville, Base Group, BMW, Nippon Sheet Glass Co Ltd, Jushi Group Co Ltd, and SGL Group, to provide a complete picture of this dynamic market. The market is segmented by production type (Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, Compression Molding) and application (Structural Assembly, Powertrain Component, Interior, Exterior, Others). The report projects a market size of xx Million by 2033.

Germany Automotive Carbon Fiber Composites Industry Market Structure & Innovation Trends

The German automotive carbon fiber composites market exhibits a moderately concentrated structure, with a few major players holding significant market share. Teijin Limited and Toray Industries, for example, collectively command an estimated xx% of the market, driven by their technological prowess and extensive global reach. Innovation is fueled by the automotive industry's relentless pursuit of lightweighting to improve fuel efficiency and reduce emissions, along with the increasing demand for high-performance vehicles. Stringent environmental regulations within Germany and the EU further incentivize the adoption of carbon fiber composites. Product substitutes, such as aluminum and high-strength steel, continue to compete, but carbon fiber's superior strength-to-weight ratio often provides a decisive advantage. The market has witnessed several significant M&A activities in recent years, with deal values totaling approximately xx Million. These deals mostly focused on consolidating production capabilities and expanding market access. End-user demographics show a strong preference for high-performance and luxury vehicles that utilize carbon fiber components.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Innovation Drivers: Lightweighting, fuel efficiency regulations, high-performance vehicle demand.

- Regulatory Framework: Stringent environmental regulations driving adoption.

- M&A Activity: Significant deals totaling xx Million in recent years.

Germany Automotive Carbon Fiber Composites Industry Market Dynamics & Trends

The German automotive carbon fiber composites market is projected to experience robust growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by several factors: increasing demand for lightweight vehicles, advancements in manufacturing technologies (such as automated fiber placement), and the growing adoption of electric vehicles (EVs), which benefit significantly from the lightweighting properties of carbon fiber composites. Technological disruptions, such as the development of new resin systems and improved manufacturing processes, are continuously enhancing the cost-effectiveness and performance of carbon fiber components. Consumer preferences are shifting towards vehicles that offer both high performance and sustainability, which further fuels the market's expansion. Intense competition among established players and emerging entrants fosters innovation and ensures continuous improvement in product quality and affordability. Market penetration of carbon fiber composites in the automotive sector is expected to reach xx% by 2033.

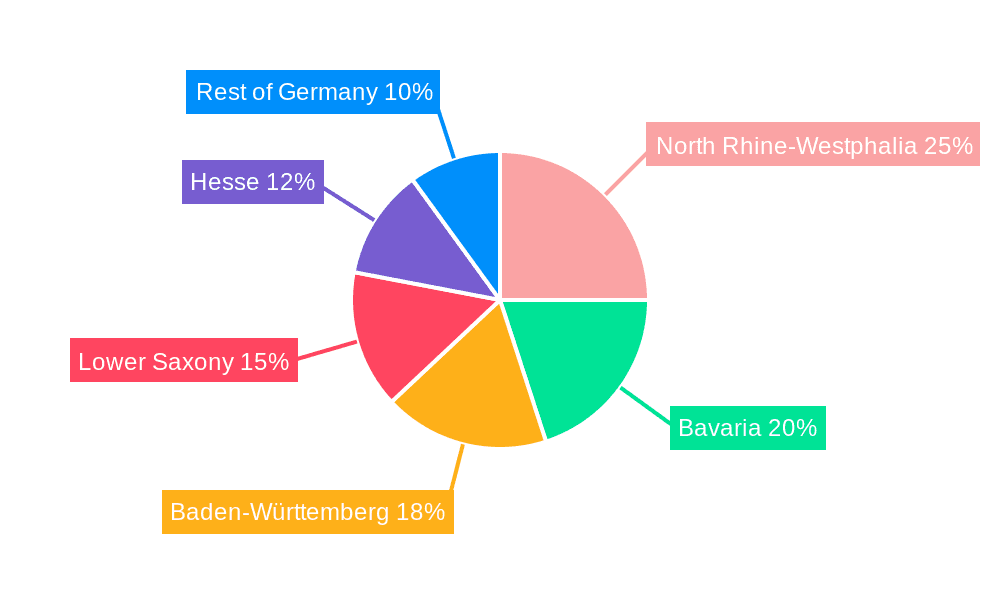

Dominant Regions & Segments in Germany Automotive Carbon Fiber Composites Industry

The automotive industry in Germany's Southern regions (Bavaria and Baden-Württemberg) dominates the carbon fiber composites market, driven by a high concentration of automotive manufacturers and suppliers. This region benefits from robust infrastructure, skilled labor, and supportive government policies.

Key Drivers:

- Strong Automotive Manufacturing Base: High density of OEMs and Tier-1 suppliers.

- Skilled Workforce: Access to engineers and technicians with expertise in composites manufacturing.

- Government Support: Industry-friendly policies and investment in research and development.

Segment Dominance:

- By Production Type: Resin Transfer Molding (RTM) holds the largest market share, due to its cost-effectiveness and suitability for high-volume production.

- By Application: Structural assembly is the leading application segment, owing to the crucial role of carbon fiber in enhancing vehicle safety and performance.

Germany Automotive Carbon Fiber Composites Industry Product Innovations

Recent innovations focus on developing advanced resin systems that improve the durability, recyclability, and cost-effectiveness of carbon fiber composites. New manufacturing processes, such as automated fiber placement, are also being adopted to boost production efficiency and reduce costs. These advancements allow for more complex and lightweight component designs, offering competitive advantages to automakers seeking to improve vehicle performance and fuel economy. The market is witnessing a shift towards sustainable and recyclable carbon fiber materials, addressing growing environmental concerns.

Report Scope & Segmentation Analysis

This report comprehensively segments the German automotive carbon fiber composites market by production type (Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, Compression Molding) and application (Structural Assembly, Powertrain Component, Interior, Exterior, Others). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail. For instance, the RTM segment is expected to witness substantial growth due to its versatility and cost-effectiveness, while the structural assembly application segment dominates due to the demand for lightweight and high-strength automotive parts.

Key Drivers of Germany Automotive Carbon Fiber Composites Industry Growth

The growth of the German automotive carbon fiber composites industry is driven by several factors: increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions, stringent government regulations promoting sustainable materials, and continuous technological advancements leading to cost reductions and performance enhancements in carbon fiber components. The high concentration of automotive manufacturers in Germany and the supportive government policies further propel market growth.

Challenges in the Germany Automotive Carbon Fiber Composites Industry Sector

The high cost of carbon fiber materials and manufacturing processes remains a significant challenge. Supply chain disruptions, especially related to the sourcing of raw materials, can also impact production and lead to price volatility. Competition from alternative materials, such as aluminum and high-strength steel, continues to pressure market growth. Furthermore, the need for skilled labor and specialized equipment can create barriers to entry for new players.

Emerging Opportunities in Germany Automotive Carbon Fiber Composites Industry

Emerging opportunities lie in the development of sustainable and recyclable carbon fiber composites, addressing environmental concerns. The growing demand for electric vehicles (EVs) presents a significant opportunity, given the suitability of carbon fiber for lightweighting EV components. Advancements in manufacturing technologies, such as additive manufacturing (3D printing), offer potential for producing complex and customized carbon fiber parts. Expansion into new applications, such as battery casings and hydrogen fuel cell components, also presents promising prospects.

Leading Players in the Germany Automotive Carbon Fiber Composites Industry Market

- Teijin Limited

- Delphi

- Kineco

- Owens Corning

- BASF

- General Motors Company

- Toray Industries

- Cytec Industries

- Far UK

- Gurit

- 3B-Fiberglass

- Johns Manville

- Base Group

- BMW

- Nippon Sheet Glass Co Ltd

- Jushi Group Co Ltd

- SGL Group

Key Developments in Germany Automotive Carbon Fiber Composites Industry Industry

- 2022 Q4: BASF announced a significant investment in expanding its carbon fiber production capacity in Germany.

- 2023 Q1: BMW launched a new electric vehicle model featuring extensively used carbon fiber components.

- 2023 Q2: A joint venture between Teijin Limited and a German automotive supplier was established to develop advanced carbon fiber composites for EVs.

Future Outlook for Germany Automotive Carbon Fiber Composites Market

The future outlook for the German automotive carbon fiber composites market is positive. Continued growth is expected, driven by the increasing demand for lightweight and sustainable vehicles, technological advancements, and supportive government policies. The focus on developing cost-effective and recyclable carbon fiber solutions will be crucial for unlocking the full potential of this market. Strategic partnerships and investments in R&D will be vital for companies seeking to capitalize on emerging opportunities in this rapidly evolving sector.

Germany Automotive Carbon Fiber Composites Industry Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vacuum Infusion Processing

- 1.4. Injection Molding

- 1.5. Compression Molding

-

2. Application

- 2.1. Structural Assembly

- 2.2. Power train Component

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

Germany Automotive Carbon Fiber Composites Industry Segmentation By Geography

- 1. Germany

Germany Automotive Carbon Fiber Composites Industry Regional Market Share

Geographic Coverage of Germany Automotive Carbon Fiber Composites Industry

Germany Automotive Carbon Fiber Composites Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Technological Advancements Driving Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automotive Carbon Fiber Composites Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vacuum Infusion Processing

- 5.1.4. Injection Molding

- 5.1.5. Compression Molding

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Structural Assembly

- 5.2.2. Power train Component

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teijin Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delphi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kineco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Owens Cornin

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Motors Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toray Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cytec Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Far UK

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gurit

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 3B-Fiberglass

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Johns Manville

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Base Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 BMW

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Nipposn Sheet Glass Co Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Jushi Group Co Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 SGL Group

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Teijin Limited

List of Figures

- Figure 1: Germany Automotive Carbon Fiber Composites Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Automotive Carbon Fiber Composites Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Production Type 2020 & 2033

- Table 2: Germany Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Germany Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Production Type 2020 & 2033

- Table 5: Germany Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Germany Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automotive Carbon Fiber Composites Industry?

The projected CAGR is approximately 14.98%.

2. Which companies are prominent players in the Germany Automotive Carbon Fiber Composites Industry?

Key companies in the market include Teijin Limited, Delphi, Kineco, Owens Cornin, BASF, General Motors Company, Toray Industries, Cytec Industries, Far UK, Gurit, 3B-Fiberglass, Johns Manville, Base Group, BMW, Nipposn Sheet Glass Co Ltd, Jushi Group Co Ltd, SGL Group.

3. What are the main segments of the Germany Automotive Carbon Fiber Composites Industry?

The market segments include Production Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Technological Advancements Driving Growth in the Market.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automotive Carbon Fiber Composites Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automotive Carbon Fiber Composites Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automotive Carbon Fiber Composites Industry?

To stay informed about further developments, trends, and reports in the Germany Automotive Carbon Fiber Composites Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence