Key Insights

The North American automotive upholstery market is poised for significant expansion, projected to reach $22.5 billion by 2025. This growth is propelled by escalating demand for premium and personalized vehicle interiors, particularly within the aftermarket. Consumers increasingly prioritize comfort, aesthetics, and durability, driving the adoption of sophisticated materials such as leather and advanced vinyl composites. Innovations in sustainable and lightweight upholstery manufacturing are enhancing both performance and environmental compliance. The burgeoning SUV and light truck segments further contribute to upholstery demand due to their larger cabin volumes. Key collaborations with Original Equipment Manufacturers (OEMs), including Adient Plc and Lear Corp, are instrumental in market supply chains. However, challenges like raw material price volatility and rising labor costs may impact profitability. The competitive environment is characterized by continuous innovation in materials, design, and production from both established and emerging entities.

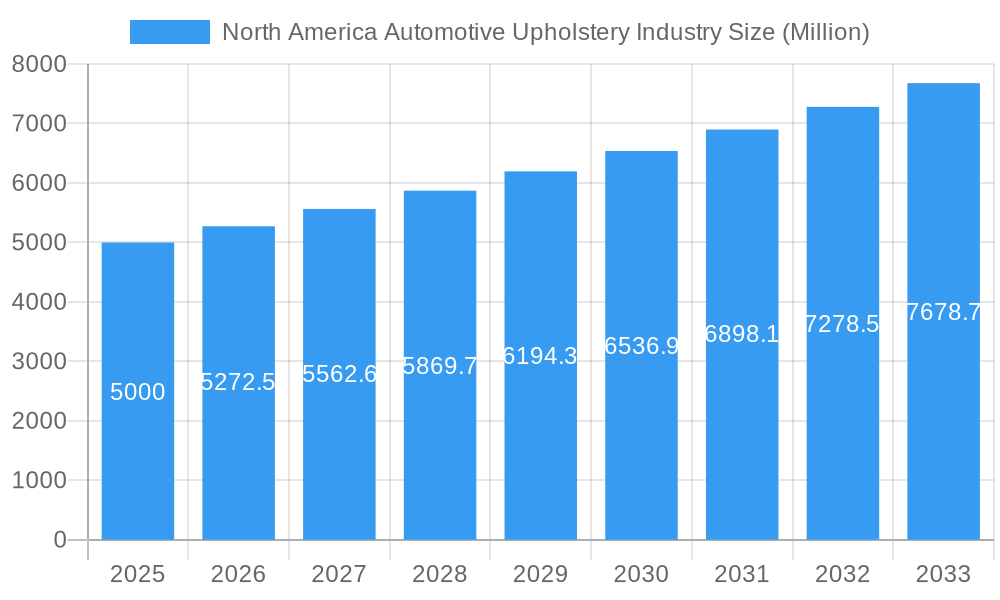

North America Automotive Upholstery Industry Market Size (In Billion)

Analysis by segment highlights a clear preference for leather in luxury vehicles, while vinyl and alternative materials serve the mass market. The OEM channel holds the largest market share, integral to new vehicle production. Concurrently, the aftermarket segment is experiencing robust growth fueled by customization trends and upholstery upgrades. Product segmentation shows a balanced demand across dashboards, seats, roof liners, and door trims, with seats representing the largest segment due to their critical role in occupant experience. Geographically, the United States leads the North American market, followed by Canada and Mexico. The forecast period (2025-2033) anticipates sustained market value growth, driven by a Compound Annual Growth Rate (CAGR) of 5.7%.

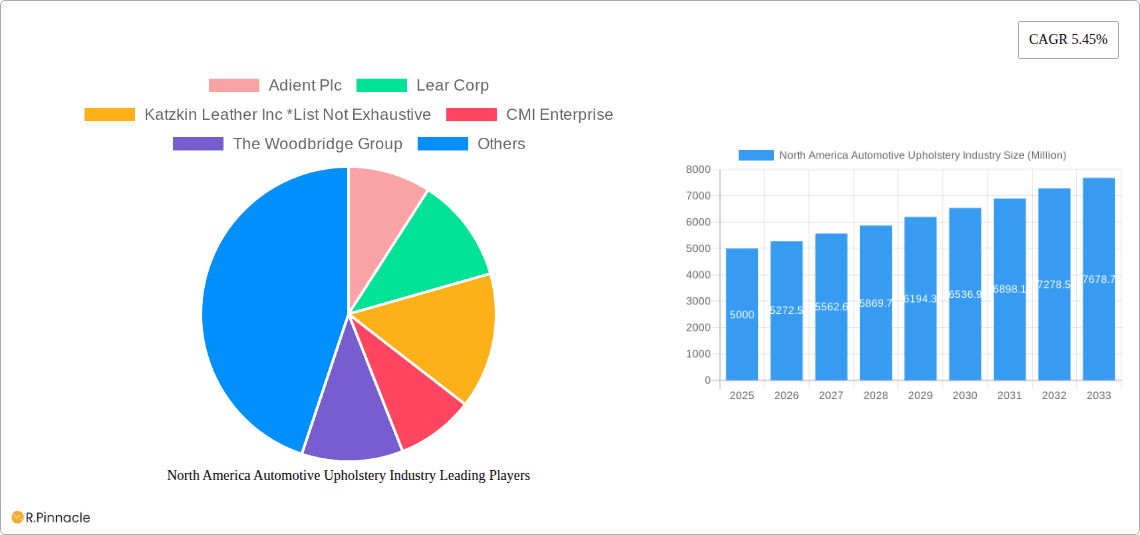

North America Automotive Upholstery Industry Company Market Share

North America Automotive Upholstery Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America automotive upholstery industry, offering valuable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The total market size is estimated to be at xx Million in 2025.

North America Automotive Upholstery Industry Market Structure & Innovation Trends

The North American automotive upholstery market is characterized by a moderately consolidated structure, with key players like Adient Plc, Lear Corp, and Katzkin Leather Inc. holding significant market share. However, several smaller players and specialized firms also contribute to the market's diversity. The market's overall concentration ratio is estimated to be at xx%. Innovation is driven by consumer demand for enhanced comfort, sustainability, and technological integration. Stringent regulatory frameworks concerning material safety and environmental impact are also shaping industry practices. The rise of electric vehicles and autonomous driving technologies presents both challenges and opportunities for material innovation and design. Recent M&A activities, though not extensively documented publicly, have seen deal values totaling an estimated xx Million in the past five years, mostly focused on consolidating smaller suppliers.

- Market Concentration: Moderately Consolidated (xx%)

- Innovation Drivers: Sustainability, Technological Integration, Consumer Preferences

- Regulatory Framework: Stringent safety and environmental regulations

- Product Substitutes: Growing use of alternative materials (e.g., vegan leather)

- End-User Demographics: Shifting towards younger demographics with increased emphasis on personalization.

- M&A Activity: xx Million in deal values over the past five years.

North America Automotive Upholstery Industry Market Dynamics & Trends

The North American automotive upholstery market is experiencing robust growth, driven by several factors. The increasing demand for passenger vehicles, particularly SUVs and luxury cars, is a primary catalyst. Technological advancements, such as the integration of advanced comfort features (e.g., heated and cooled seats, massage functions) are boosting market expansion. Consumer preference for customized interiors and aesthetically pleasing designs is further propelling growth. However, economic fluctuations and supply chain disruptions can impact market performance. The industry faces challenges from rising raw material costs and fluctuating fuel prices, which influence consumer purchasing behavior. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Competitive dynamics are intensifying with increased focus on sustainable and innovative materials.

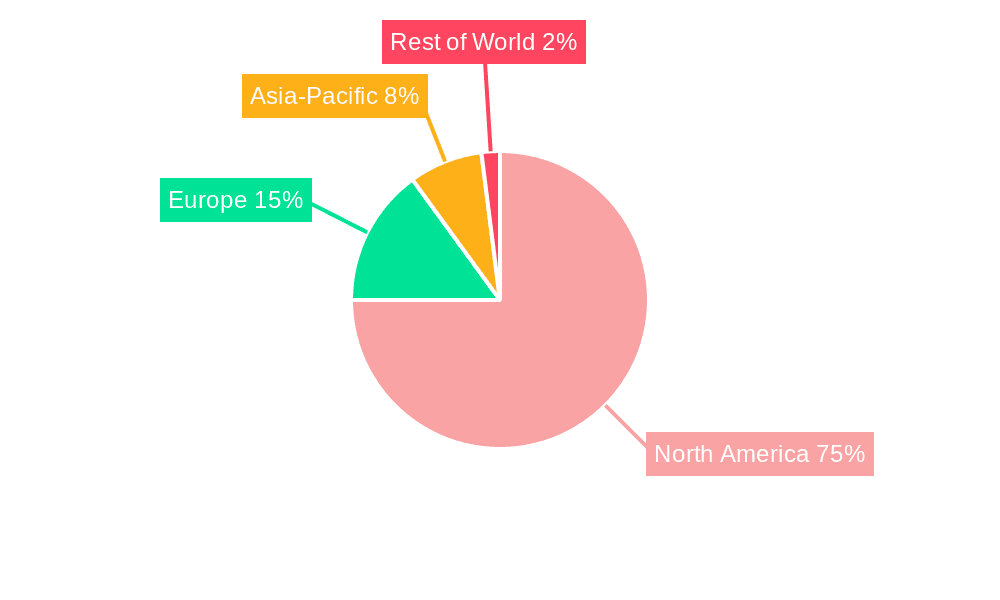

Dominant Regions & Segments in North America Automotive Upholstery Industry

The Seats segment dominates the North American automotive upholstery market, driven by the high demand for comfortable and functional seating solutions. The OEM sales channel also holds the largest market share, reflecting the significant role of original equipment manufacturers in the automotive industry. Within material types, Leather maintains a substantial share due to its luxurious appeal and durability, although Vinyl and "Other Material Types" segments are witnessing a surge, fueled by cost considerations and sustainability concerns. The US remains the leading market within North America, driven by robust automotive production and a large consumer base.

- Key Drivers for the Seats Segment: High demand for comfort and technological integration (heated/cooled/massaging seats).

- Key Drivers for the OEM Channel: Direct relationships with major automobile manufacturers, large volume purchases.

- Key Drivers for the Leather Segment: Superior comfort, aesthetics, and durability.

- Key Drivers for the US Market: Strong automotive manufacturing base, large consumer market.

North America Automotive Upholstery Industry Product Innovations

Recent innovations include the development of sustainable and eco-friendly materials like bio-attributed vinyl, as seen with Polestar's use of INEOS BIOVYN. Modular seat designs, as introduced by Faurecia, improve sustainability through easier component recycling and upgradeability. Advanced comfort features, such as Bentley's Airline Seats, are enhancing the luxury segment. These innovations reflect the industry's focus on meeting evolving consumer preferences for environmentally conscious and technologically advanced products.

Report Scope & Segmentation Analysis

This report comprehensively segments the North American automotive upholstery market by Material Type (Leather, Vinyl, Other Material Types), Sales Channel (OEM, Aftermarket), and Product (Dashboard, Seats, Roof Liners, Door Trim). Each segment is analyzed based on its market size, growth projections, and competitive dynamics. The "Other Material Types" category shows significant future growth potential, driven by increasing demand for sustainable materials. The Aftermarket segment is projected to register robust growth driven by increased vehicle customization and aftermarket modifications.

Key Drivers of North America Automotive Upholstery Industry Growth

Several factors contribute to the growth of the North American automotive upholstery industry: rising vehicle production, increasing demand for luxury vehicles, consumer preference for personalized interiors, and technological advancements in seat comfort and safety features. Stringent government regulations concerning vehicle safety and environmental impact also create growth opportunities for manufacturers committed to sustainability. The rise of electric vehicles and increased focus on driver and passenger comfort in new vehicle models are additional key drivers.

Challenges in the North America Automotive Upholstery Industry Sector

The automotive upholstery sector faces challenges such as volatile raw material prices, supply chain disruptions, and intense competition. Fluctuations in the global economy affect vehicle sales impacting the demand for upholstery materials. Meeting stringent environmental regulations presents significant technical and cost challenges. The competitive landscape is intense, with established players and new entrants vying for market share. These factors result in an estimated xx Million annual loss to the industry due to supply chain disruptions.

Emerging Opportunities in North America Automotive Upholstery Industry

Emerging opportunities exist in developing sustainable and eco-friendly materials, creating personalized interior designs, and integrating advanced technologies such as smart fabrics and in-seat connectivity. The growing demand for luxury vehicles and rising disposable incomes among consumers provide significant growth potential for premium upholstery materials. Focus on lightweight and durable materials for electric vehicles, as well as incorporating advanced safety features, offer further opportunities.

Leading Players in the North America Automotive Upholstery Industry Market

- Adient Plc

- Lear Corp

- Katzkin Leather Inc

- CMI Enterprise

- The Woodbridge Group

- IMS Nonwoven

- Seiren Co Ltd

- Toyota Boshoku Corp

- Faurecia SE

Key Developments in North America Automotive Upholstery Industry Industry

- August 2023: Bentley's launch of the Bentayga EWB Mulliner with Airline Seats showcases a high-end focus on comfort and luxury.

- June 2023: Faurecia's modular and sustainable seat design highlights the industry's move towards eco-friendly solutions.

- June 2023: The redesigned 2024 Lexus GX underscores the importance of ergonomic seating in attracting consumers.

- November 2022: Polestar's use of INEOS BIOVYN demonstrates the growing adoption of sustainable materials.

- September 2022: BMW Group's commitment to vegan interiors reflects growing consumer demand for ethical choices.

Future Outlook for North America Automotive Upholstery Industry Market

The North American automotive upholstery market is poised for sustained growth, driven by continuous innovation in materials and technologies, increasing demand for luxury vehicles, and a growing focus on sustainability. Strategic partnerships, expansion into emerging markets, and effective supply chain management will be crucial for success. The market's future hinges on successfully balancing luxury, sustainability, and technological advancement.

North America Automotive Upholstery Industry Segmentation

-

1. Material Type

- 1.1. Leather

- 1.2. Vinyl

- 1.3. Other Material Types

-

2. Sales Channel

- 2.1. OEM

- 2.2. Aftermarket

-

3. Product

- 3.1. Dashboard

- 3.2. Seats

- 3.3. Roof Liners

- 3.4. Door Trim

North America Automotive Upholstery Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Automotive Upholstery Industry Regional Market Share

Geographic Coverage of North America Automotive Upholstery Industry

North America Automotive Upholstery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Passenger Car Sales Propelling Market Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Leather

- 5.1.2. Vinyl

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Dashboard

- 5.3.2. Seats

- 5.3.3. Roof Liners

- 5.3.4. Door Trim

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. United States North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Leather

- 6.1.2. Vinyl

- 6.1.3. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Dashboard

- 6.3.2. Seats

- 6.3.3. Roof Liners

- 6.3.4. Door Trim

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Canada North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Leather

- 7.1.2. Vinyl

- 7.1.3. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Dashboard

- 7.3.2. Seats

- 7.3.3. Roof Liners

- 7.3.4. Door Trim

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Rest Of North America North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Leather

- 8.1.2. Vinyl

- 8.1.3. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. Dashboard

- 8.3.2. Seats

- 8.3.3. Roof Liners

- 8.3.4. Door Trim

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Adient Plc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Lear Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Katzkin Leather Inc *List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 CMI Enterprise

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 The Woodbridge Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 IMS Nonwoven

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Seiren Co Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Toyota Boshoku Corp

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Faurecia SE

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Adient Plc

List of Figures

- Figure 1: North America Automotive Upholstery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automotive Upholstery Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 3: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: North America Automotive Upholstery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 7: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: North America Automotive Upholstery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 10: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 11: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 12: North America Automotive Upholstery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 14: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 15: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 16: North America Automotive Upholstery Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Upholstery Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the North America Automotive Upholstery Industry?

Key companies in the market include Adient Plc, Lear Corp, Katzkin Leather Inc *List Not Exhaustive, CMI Enterprise, The Woodbridge Group, IMS Nonwoven, Seiren Co Ltd, Toyota Boshoku Corp, Faurecia SE.

3. What are the main segments of the North America Automotive Upholstery Industry?

The market segments include Material Type, Sales Channel, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Passenger Car Sales Propelling Market Growth.

6. What are the notable trends driving market growth?

Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

August 2023: Bentley unveiled the Bentayga Extended Wheelbase Mulliner during Monterey Car Week in California. The Bentayga EWB Mulliner flagship has greater cabin room than any similar premium competition, owing to its Airline Seats. The rear compartment, which is available in 4+1 and 4-seat configurations, comes standard with the Bentley Airline Seat specification, the world's most sophisticated vehicle seating arrangement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Upholstery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Upholstery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Upholstery Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Upholstery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence