Key Insights

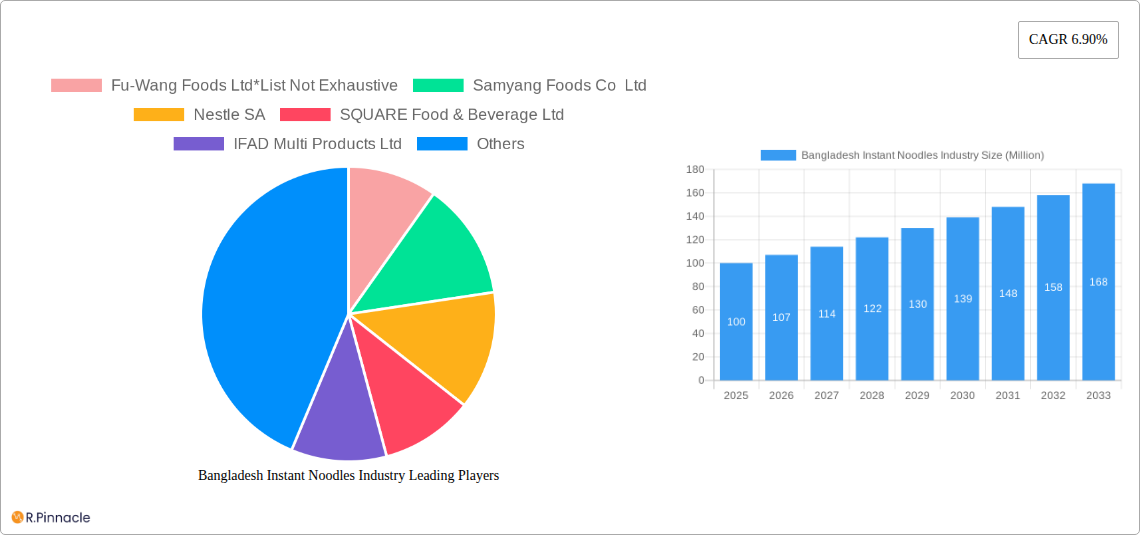

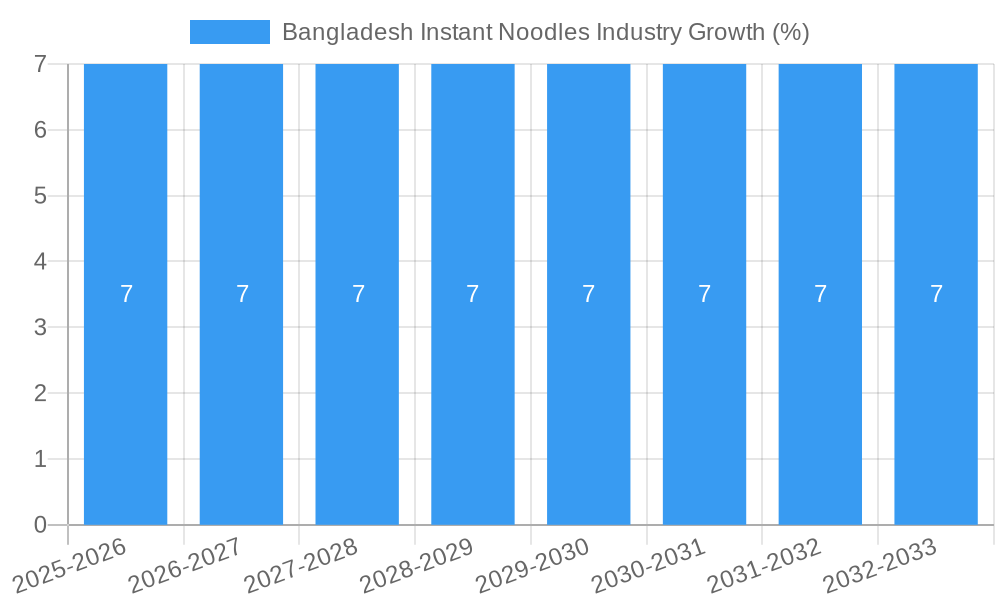

The Bangladesh instant noodles market, valued at approximately \$XX million in 2025, exhibits robust growth potential, projected to achieve a compound annual growth rate (CAGR) of 6.90% from 2025 to 2033. This expansion is driven by several key factors. Rising urbanization and disposable incomes fuel increased consumer demand for convenient and affordable food options, making instant noodles a popular choice, particularly among young adults and working professionals. The diverse distribution network, encompassing supermarkets, hypermarkets, grocery stores, and a rapidly expanding online retail sector, further enhances market accessibility. Furthermore, continuous product innovation, such as the introduction of new flavors catering to local preferences and healthier options, contributes to market growth. However, fluctuating raw material prices and increasing competition from other convenient food alternatives represent potential restraints. The market is segmented by product type (cups/bowls, packets) and distribution channel, with packets currently holding a larger market share due to their affordability. Key players like Fu-Wang Foods Ltd, Samyang Foods Co Ltd, Nestle SA, and others compete intensely, focusing on branding, distribution strategies, and product diversification to capture market share. The Asia-Pacific region, specifically Bangladesh, presents a significant growth opportunity given its large and young population.

The forecast for the Bangladesh instant noodles market indicates sustained growth throughout the 2025-2033 period, driven by continued urbanization, economic development, and evolving consumer preferences. The dominance of established players will likely persist, although smaller, local brands might gain traction through targeted marketing and localization strategies. Opportunities exist for companies to capitalize on the increasing demand for healthier and more diverse instant noodle options, including those with reduced sodium content or added nutritional value. Further expansion of online retail channels offers significant potential for reaching a wider customer base. Monitoring raw material costs and adapting to changing consumer trends will be crucial for maintaining profitability and competitiveness in this dynamic market.

This comprehensive report provides a detailed analysis of the Bangladesh instant noodles market, offering actionable insights for industry professionals and investors. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, competitive landscapes, and future growth potential. The study period spans 2019-2024 (Historical Period), with 2025 serving as the base and estimated year, and a forecast period extending from 2025-2033. Market values are expressed in Millions.

Bangladesh Instant Noodles Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of the Bangladesh instant noodles market. The market is characterized by a mix of multinational corporations and local players. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller companies cater to niche segments. Innovation is driven by consumer demand for novel flavors, healthier options, and convenient formats. Regulatory frameworks concerning food safety and labeling impact product development and marketing. Product substitutes, such as rice noodles and other quick-meal options, pose a competitive challenge. End-user demographics primarily consist of young adults and students seeking affordable and convenient meals. M&A activity has been moderate, with deal values varying depending on the size and strategic importance of the acquired company. For example, a recent significant transaction resulted in a xx Million deal in 2024. Key players' market share is as follows (2024 estimates):

- PRAN-RFL Group Ltd: xx%

- Nestle SA: xx%

- Unilever PLC: xx%

- Others: xx%

Bangladesh Instant Noodles Industry Market Dynamics & Trends

The Bangladesh instant noodles market exhibits robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and changing consumer lifestyles. Technological advancements in production processes and packaging contribute to efficiency and product innovation. Consumer preferences lean towards spicier and more diverse flavors, reflecting evolving taste buds and cultural influences. Competitive dynamics are characterized by intense rivalry among major players focused on product differentiation, pricing strategies, and distribution network expansion. The compound annual growth rate (CAGR) for the period 2019-2024 was approximately xx%, and market penetration has reached xx% of the total instant food market, with projections of xx% by 2033.

Dominant Regions & Segments in Bangladesh Instant Noodles Industry

The Dhaka metropolitan area and major urban centers dominate the Bangladesh instant noodles market. This dominance stems from higher population density, increased purchasing power, and superior infrastructure supporting efficient distribution channels. Key drivers include thriving economies, robust infrastructure, and a large young population.

- Product Type: Packets currently represent the largest segment, driven by affordability and large pack sizes, followed by Cups/Bowls which are gaining popularity for convenience.

- Distribution Channel: Supermarkets/Hypermarkets and Grocery Stores constitute the primary distribution channels, benefiting from widespread accessibility, although online retail is experiencing substantial growth.

The analysis of each segment considers its market size, growth projections, and competitive dynamics, revealing significant opportunities within each category.

Bangladesh Instant Noodles Industry Product Innovations

Recent product innovations highlight a trend towards bolder flavors, catering to evolving consumer preferences for spicier and more exotic tastes, such as the introduction of Korean-inspired flavors. Technological advancements focus on improved production efficiency, sustainable packaging, and enhanced shelf life. Companies are also investing in healthier options, incorporating whole grains and reducing sodium content, demonstrating a commitment to meeting changing health concerns.

Report Scope & Segmentation Analysis

This report segments the Bangladesh instant noodles market based on product type (Cups/Bowls, Packets) and distribution channel (Supermarkets/Hypermarkets, Grocery Stores, Online Retail Stores, Other Distribution Channels). Each segment is analyzed individually, providing insights into market size, growth projections, and competitive dynamics. For example, the Cups/Bowls segment is projected to experience faster growth due to convenience, while the online retail channel is anticipated to expand rapidly, fueled by increasing internet penetration.

Key Drivers of Bangladesh Instant Noodles Industry Growth

Several factors fuel the growth of the Bangladesh instant noodles market. Rising disposable incomes allow consumers to spend more on convenience foods. Urbanization leads to increased demand for quick and easy meal options. Changing lifestyles and busier schedules make instant noodles a convenient choice. Technological advancements in production and packaging improve efficiency and product quality. Favorable government policies, such as investment in infrastructure and support for the food processing industry, also encourage the growth of the sector.

Challenges in the Bangladesh Instant Noodles Industry Sector

Challenges include maintaining consistent raw material quality and prices, as well as managing fluctuating energy costs. The highly competitive nature of the market presents pricing pressure, and adapting to evolving consumer preferences requires continuous product innovation. Ensuring adherence to stringent food safety regulations adds to the operational complexity. The industry also faces supply chain disruptions during natural calamities. These factors collectively impact profitability and growth.

Emerging Opportunities in Bangladesh Instant Noodles Industry

Emerging opportunities exist in expanding into rural markets, introducing premium and healthier products, and leveraging online sales channels. Further innovation in flavors and packaging, catering to specific dietary needs (e.g., vegetarian, gluten-free), presents lucrative opportunities for growth. Exploring export potential to neighboring countries can expand market reach.

Leading Players in the Bangladesh Instant Noodles Industry Market

- PRAN-RFL Group Ltd

- Fu-Wang Foods Ltd

- Samyang Foods Co Ltd

- Nestle SA

- SQUARE Food & Beverage Ltd

- IFAD Multi Products Ltd

- Cocola Food Products Ltd

- New Zealand Dairy Products Bangladesh Ltd

- Unilever PLC

- Thai President Foods PCL

Key Developments in Bangladesh Instant Noodles Industry

- September 2020: Samyang Foods launched Buldak kimchi-flavored spicy noodles, responding to the demand for fiery noodles.

- August 2021: PRAN-RFL Group Ltd launched 'Mr. Noodles Korean Super Spicy,' leveraging Korean spices and red chili.

Future Outlook for Bangladesh Instant Noodles Industry Market

The Bangladesh instant noodles market is poised for continued growth, driven by increasing urbanization, rising disposable incomes, and sustained demand for convenient food options. Strategic investments in product innovation, efficient distribution networks, and expanding into new markets will further fuel market expansion. The focus on healthier options and premium products will attract a wider consumer base and contribute to sustained growth and profitability over the forecast period (2025-2033).

Bangladesh Instant Noodles Industry Segmentation

-

1. Product Type

- 1.1. Cups/Bowls

- 1.2. Packets

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Bangladesh Instant Noodles Industry Segmentation By Geography

- 1. Bangladesh

Bangladesh Instant Noodles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Preference for Plant-based and Clean-label RTD Products; Consumer Inclination Toward Sugar-Free Drinks

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated With Beverages

- 3.4. Market Trends

- 3.4.1. Rising Demand for Minimal Cooking and Ready-To-Eat Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Instant Noodles Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cups/Bowls

- 5.1.2. Packets

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Japan Bangladesh Instant Noodles Industry Analysis, Insights and Forecast, 2019-2031

- 7. China Bangladesh Instant Noodles Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Bangladesh Instant Noodles Industry Analysis, Insights and Forecast, 2019-2031

- 9. Australia Bangladesh Instant Noodles Industry Analysis, Insights and Forecast, 2019-2031

- 10. South Korea Bangladesh Instant Noodles Industry Analysis, Insights and Forecast, 2019-2031

- 11. Thailand Bangladesh Instant Noodles Industry Analysis, Insights and Forecast, 2019-2031

- 12. New Zeland Bangladesh Instant Noodles Industry Analysis, Insights and Forecast, 2019-2031

- 13. Others Bangladesh Instant Noodles Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Fu-Wang Foods Ltd*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Samyang Foods Co Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Nestle SA

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 SQUARE Food & Beverage Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 IFAD Multi Products Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cocola Food Products Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 PRAN-RFL Group Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 New Zealand Dairy Products Bangladesh Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Unilever PLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Thai President Foods PCL

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Fu-Wang Foods Ltd*List Not Exhaustive

List of Figures

- Figure 1: Bangladesh Instant Noodles Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bangladesh Instant Noodles Industry Share (%) by Company 2024

List of Tables

- Table 1: Bangladesh Instant Noodles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bangladesh Instant Noodles Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Bangladesh Instant Noodles Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Bangladesh Instant Noodles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Bangladesh Instant Noodles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Japan Bangladesh Instant Noodles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: China Bangladesh Instant Noodles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Bangladesh Instant Noodles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Australia Bangladesh Instant Noodles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Bangladesh Instant Noodles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Thailand Bangladesh Instant Noodles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: New Zeland Bangladesh Instant Noodles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Others Bangladesh Instant Noodles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Bangladesh Instant Noodles Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Bangladesh Instant Noodles Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Bangladesh Instant Noodles Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Instant Noodles Industry?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Bangladesh Instant Noodles Industry?

Key companies in the market include Fu-Wang Foods Ltd*List Not Exhaustive, Samyang Foods Co Ltd, Nestle SA, SQUARE Food & Beverage Ltd, IFAD Multi Products Ltd, Cocola Food Products Ltd, PRAN-RFL Group Ltd, New Zealand Dairy Products Bangladesh Ltd, Unilever PLC, Thai President Foods PCL.

3. What are the main segments of the Bangladesh Instant Noodles Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Preference for Plant-based and Clean-label RTD Products; Consumer Inclination Toward Sugar-Free Drinks.

6. What are the notable trends driving market growth?

Rising Demand for Minimal Cooking and Ready-To-Eat Food.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated With Beverages.

8. Can you provide examples of recent developments in the market?

August 2021: Mr. Noodles, a brand under PRAN-RFL Group Ltd, launched a new flavor of instant noodles called 'Mr. Noodles Korean Super Spicy' in Bangladesh. This product was prepared using Korean masala as well as red chili.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Instant Noodles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Instant Noodles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Instant Noodles Industry?

To stay informed about further developments, trends, and reports in the Bangladesh Instant Noodles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence