Key Insights

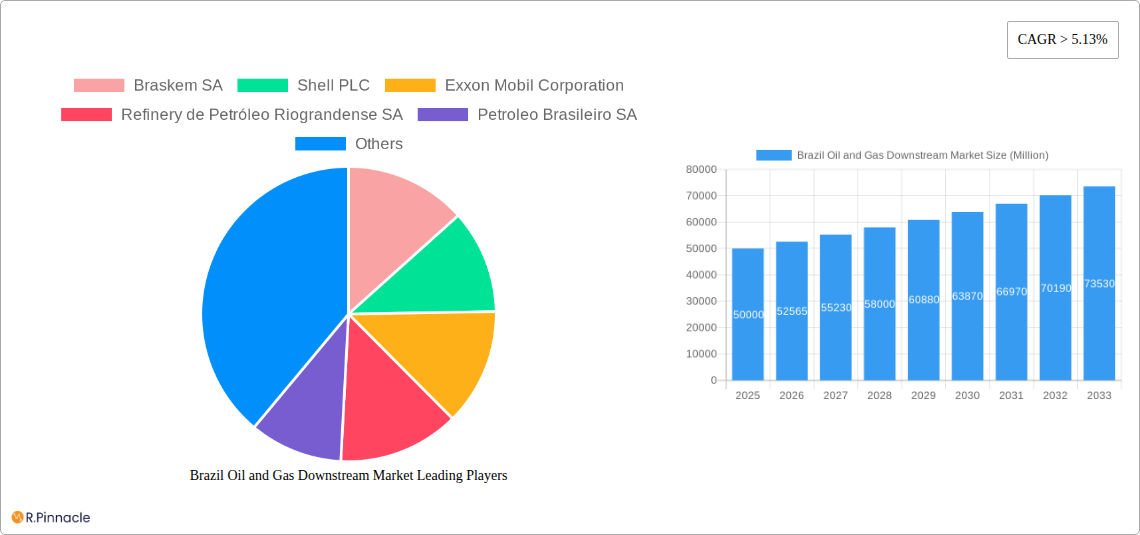

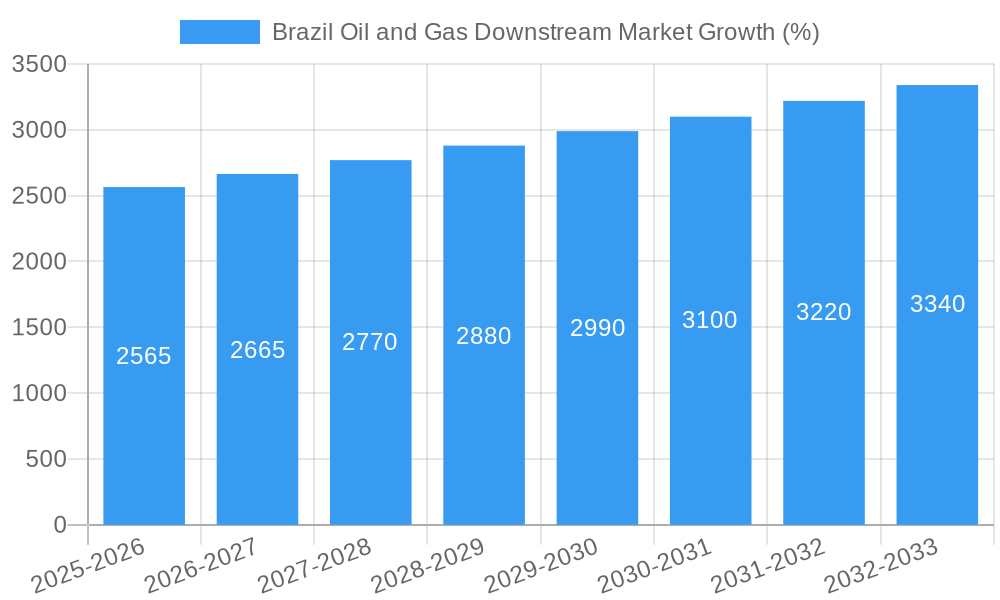

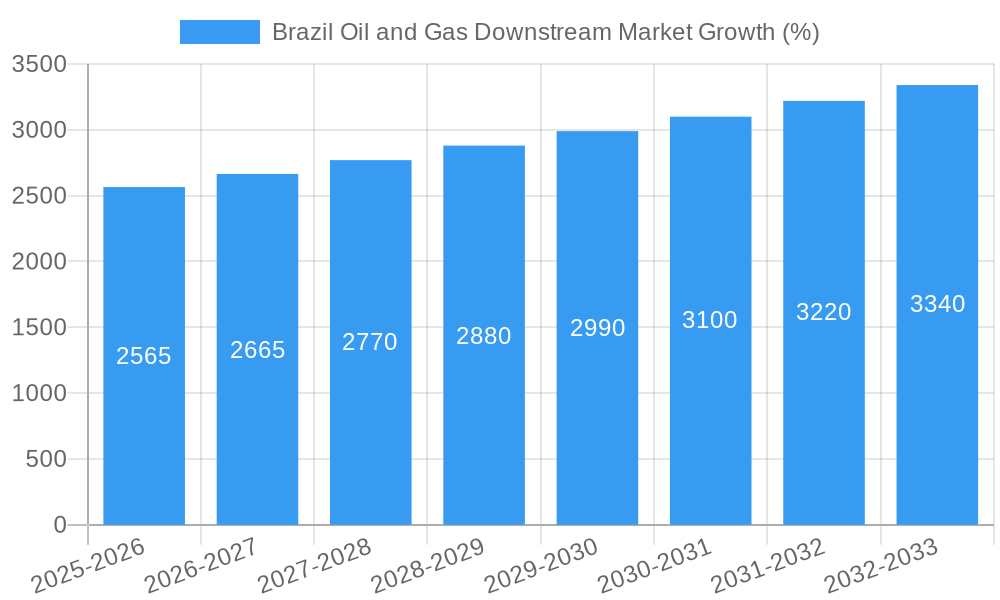

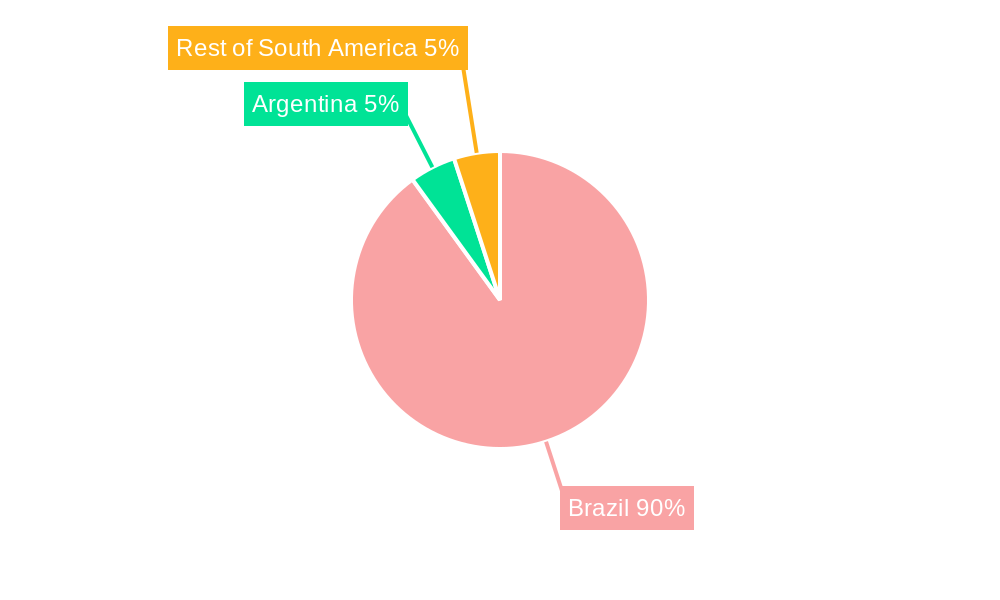

The Brazil oil and gas downstream market, valued at approximately $50 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 5.13% from 2025 to 2033. This growth is primarily fueled by increasing domestic demand driven by a growing population, expanding industrial sector, and rising urbanization leading to higher energy consumption in residential and commercial segments. Significant investments in infrastructure development, including refinery upgrades and pipeline expansions, further contribute to market expansion. While the market benefits from a relatively stable political landscape and robust government support for energy security, challenges remain. These include fluctuating global crude oil prices impacting profitability, environmental concerns leading to stricter regulations on emissions, and a need for diversification into cleaner energy sources like biofuels to meet sustainability goals. The refined products segment, particularly gasoline and diesel, currently dominates the market, but biofuels are expected to witness substantial growth, driven by government initiatives promoting renewable energy and reducing reliance on fossil fuels. Key players like Petroleo Brasileiro SA (Petrobras), Braskem SA, and international companies like Shell and ExxonMobil are actively shaping the market landscape through strategic investments and technological advancements. The South American region, specifically Brazil, enjoys a significant market share due to its substantial energy needs and robust domestic production.

The market segmentation reveals the automotive sector as the largest end-user, reflecting Brazil's sizeable automotive industry. However, industrial and commercial sectors are also experiencing significant growth, fueled by ongoing industrialization and infrastructural development. The product segmentation indicates a reliance on crude oil and refined products, while natural gas and biofuels represent emerging growth segments. The forecast period (2025-2033) anticipates further market consolidation, with larger players acquiring smaller companies, and a stronger emphasis on technological innovation focused on efficiency, sustainability, and environmental compliance. Competition is expected to intensify, prompting companies to adopt cost-effective strategies and focus on product differentiation to maintain market share.

Brazil Oil & Gas Downstream Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Brazil oil and gas downstream market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils market dynamics, growth drivers, challenges, and future opportunities. Key players like Petroleo Brasileiro SA, Shell PLC, and Braskem SA are analyzed, along with detailed segmentations across products and end-users. Discover actionable intelligence to navigate this dynamic market.

Brazil Oil and Gas Downstream Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of Brazil's oil and gas downstream market. We examine market concentration, revealing the market share held by key players like Petroleo Brasileiro SA (Petrobras), Shell PLC, and Exxon Mobil Corporation. The report also details M&A activity, including deal values (e.g., xx Million USD) and their impact on market structure. Furthermore, we explore the influence of regulatory frameworks, the presence of product substitutes (e.g., biofuels), and the evolving end-user demographics. Innovation drivers, such as technological advancements in refining processes and the push for cleaner fuels, are also carefully assessed.

- Market Concentration: Petrobras holds a significant market share (xx%), followed by Shell (xx%) and ExxonMobil (xx%).

- M&A Activity: Recent years have witnessed xx Million USD in M&A deals, primarily driven by consolidation and expansion strategies.

- Regulatory Framework: The Brazilian government's policies regarding fuel pricing, environmental regulations, and import/export tariffs significantly influence market dynamics.

- Innovation Drivers: The increasing adoption of biofuels and investment in advanced refining technologies are key innovation drivers.

Brazil Oil and Gas Downstream Market Market Dynamics & Trends

This section delves into the key factors shaping the growth trajectory of the Brazilian oil and gas downstream market. We analyze market growth drivers, including rising energy demand from various sectors (automotive, industrial, residential, and commercial), economic growth, and urbanization. Technological disruptions, such as the adoption of smart grids and digitalization in refining processes, are also considered. The report further explores evolving consumer preferences, including the growing demand for cleaner fuels and environmentally sustainable energy solutions. Finally, we examine the intense competitive dynamics among industry giants and smaller players, analyzing their market strategies and responses to evolving market conditions. Expected CAGR for the forecast period is estimated at xx%. Market penetration of biofuels is projected to reach xx% by 2033.

Dominant Regions & Segments in Brazil Oil and Gas Downstream Market

This section identifies the leading regions and segments within Brazil's oil and gas downstream market. Detailed analysis of regional dominance is provided, considering factors like infrastructure development, economic activity, and population density. For segments (Product: Crude Oil, Refined Products, Natural Gas, Biofuels; End-User: Automotive, Industrial, Residential, Commercial), we examine their relative contribution to the overall market size and growth trajectory.

Leading Region: The Southeast region dominates due to its high population density and industrial activity.

Dominant Product Segment: Refined products currently hold the largest market share, driven by high demand from the transportation sector.

Key Drivers for Refined Products:

- Strong economic growth and increasing vehicle ownership.

- Expanding industrial sector demanding refined petroleum products as feedstock.

- Robust infrastructure supporting the distribution of refined petroleum products.

Dominant End-User Segment: The automotive sector is the largest end-user, followed by the industrial sector.

Brazil Oil and Gas Downstream Market Product Innovations

Recent product developments emphasize the integration of renewable sources and advanced refining techniques to improve efficiency and sustainability. Technological trends are focused on enhancing fuel quality and reducing emissions. These innovations are crucial in meeting growing consumer demands for cleaner and more sustainable energy solutions. Biofuel production is receiving significant investment, while advanced refining techniques are being employed to maximize yield and minimize environmental impact.

Report Scope & Segmentation Analysis

This report covers the Brazilian oil and gas downstream market, segmented by product (crude oil, refined products, natural gas, biofuels) and end-user (automotive, industrial, residential, commercial). Each segment’s growth projections, market size (in Million USD), and competitive dynamics are analyzed, providing a granular understanding of the market's composition and future trajectory.

Key Drivers of Brazil Oil and Gas Downstream Market Growth

The Brazilian oil and gas downstream market is experiencing growth spurred by several factors. Economic growth fuels demand for energy, particularly in transportation and industry. Government investments in infrastructure projects further boost market expansion. Technological advancements, such as improved refining processes and the development of biofuels, enhance efficiency and sustainability. Regulatory support for renewable energy sources adds another layer of growth impetus.

Challenges in the Brazil Oil and Gas Downstream Market Sector

The Brazilian oil and gas downstream market faces several challenges. Regulatory uncertainty and fluctuating fuel prices impact market stability. Supply chain disruptions, particularly those related to crude oil imports, can hamper operations. Intense competition from both domestic and international players creates a dynamic and often unpredictable market environment. These factors lead to price volatility and reduced profitability for some operators.

Emerging Opportunities in Brazil Oil and Gas Downstream Market

The Brazilian market presents several opportunities. The growing demand for cleaner fuels opens avenues for biofuels and other sustainable alternatives. Investments in renewable energy infrastructure create opportunities for companies involved in the production and distribution of these fuels. Technological innovation in refining and distribution creates space for efficiency gains and cost reduction, offering promising returns on investment.

Leading Players in the Brazil Oil and Gas Downstream Market Market

- Braskem SA

- Shell PLC

- Exxon Mobil Corporation

- Refinery de Petróleo Riograndense SA

- Petroleo Brasileiro SA

- Chevron Corporation

- Repsol SA

Key Developments in Brazil Oil and Gas Downstream Market Industry

- February 2022: Acelen announced a USD 210 Million investment in its Brazilian refinery, expanding capacity by 14% of Brazil's total refining capacity.

- November 2022: Petrobras revised the timeline for commissioning a new natural gas processing unit at the Polo GasLub Itaboraí hub.

Future Outlook for Brazil Oil and Gas Downstream Market Market

The Brazilian oil and gas downstream market holds significant potential for growth. Continued economic expansion and rising energy demand will drive market expansion. Investment in renewable energy sources and technological advancements will further stimulate the market. The focus on sustainability will shape future investment decisions and product offerings. Strategic partnerships and collaborations will be key to navigating the evolving market landscape and capitalizing on emerging opportunities.

Brazil Oil and Gas Downstream Market Segmentation

- 1. Refineries

- 2. Petrochemical Plants

Brazil Oil and Gas Downstream Market Segmentation By Geography

- 1. Brazil

Brazil Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Recovering Number of Air Passengers

- 3.2.2 on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries

- 3.4. Market Trends

- 3.4.1. Refineries Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.2. Market Analysis, Insights and Forecast - by Petrochemical Plants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Brazil Brazil Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Brazil Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America Brazil Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Braskem SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Shell PLC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Exxon Mobil Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Refinery de Petróleo Riograndense SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Petroleo Brasileiro SA

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Chevron Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Repsol SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Braskem SA

List of Figures

- Figure 1: Brazil Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 4: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Refineries 2019 & 2032

- Table 5: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemical Plants 2019 & 2032

- Table 6: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Petrochemical Plants 2019 & 2032

- Table 7: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Brazil Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil Brazil Oil and Gas Downstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Brazil Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Brazil Oil and Gas Downstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America Brazil Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Brazil Oil and Gas Downstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Refineries 2019 & 2032

- Table 18: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Refineries 2019 & 2032

- Table 19: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Petrochemical Plants 2019 & 2032

- Table 20: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Petrochemical Plants 2019 & 2032

- Table 21: Brazil Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Oil and Gas Downstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Oil and Gas Downstream Market?

The projected CAGR is approximately > 5.13%.

2. Which companies are prominent players in the Brazil Oil and Gas Downstream Market?

Key companies in the market include Braskem SA, Shell PLC, Exxon Mobil Corporation, Refinery de Petróleo Riograndense SA, Petroleo Brasileiro SA, Chevron Corporation, Repsol SA.

3. What are the main segments of the Brazil Oil and Gas Downstream Market?

The market segments include Refineries, Petrochemical Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Recovering Number of Air Passengers. on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population.

6. What are the notable trends driving market growth?

Refineries Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries.

8. Can you provide examples of recent developments in the market?

In February 2022, Acelen, the owner of a Brazilian refinery, intends to invest roughly USD 210 million. The CEO of the company revealed the details during a presentation at the Rio Oil & Gas conference. The plant has a capacity of over 50% in the northeastern region and 14% of Brazil's total refining capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Brazil Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence