Key Insights

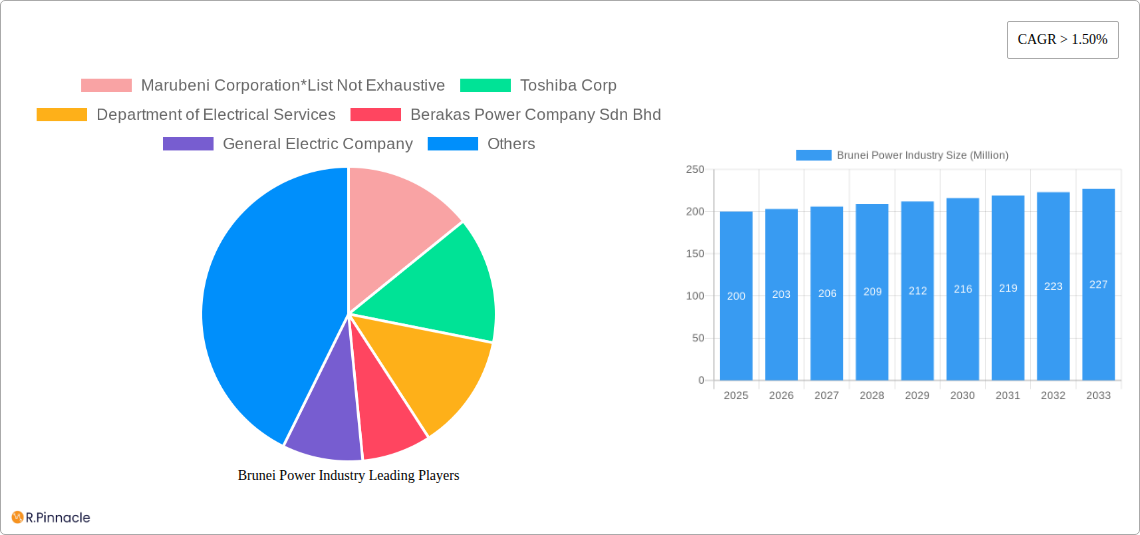

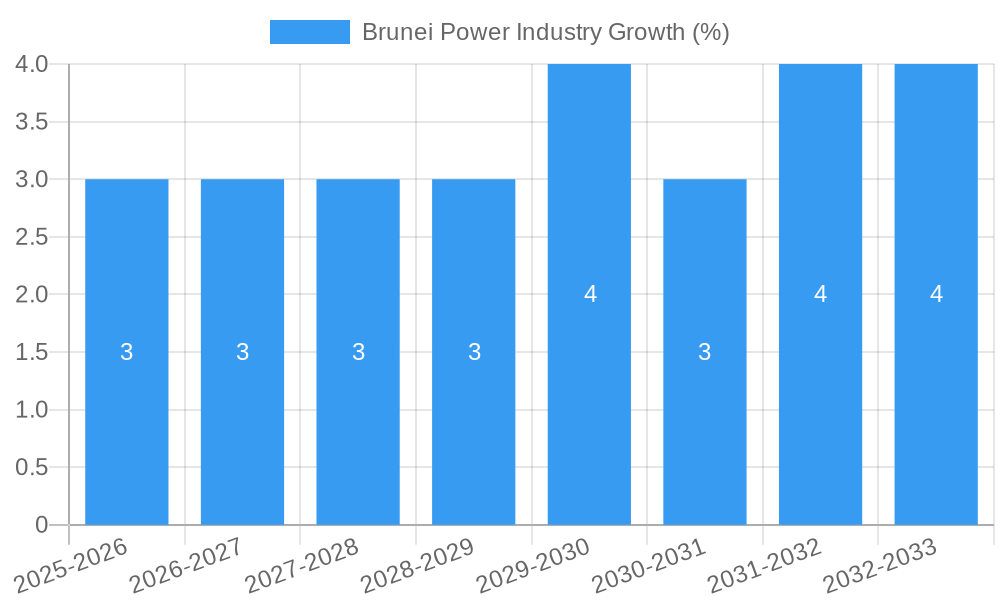

The Brunei power industry, valued at approximately $XX million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) exceeding 1.50% from 2025 to 2033. This growth is driven by several factors. Firstly, increasing industrialization and urbanization in Brunei necessitate a consistent expansion of electricity infrastructure to meet rising energy demands from residential, commercial, and industrial sectors. Secondly, the government's ongoing investments in infrastructure development and economic diversification initiatives further stimulate power sector growth. Furthermore, a gradual shift towards renewable energy sources, such as solar and wind power, is anticipated, although thermal power generation will likely remain dominant in the forecast period due to existing infrastructure and energy security concerns. However, the industry faces challenges, including the volatile prices of fossil fuels and the need for significant capital investments in new renewable energy projects. Effective grid management and integration of renewable sources into the existing network are crucial for achieving sustainable growth.

The market segmentation reveals that thermal power generation currently holds the largest share, reflecting Brunei's reliance on traditional energy sources. However, the renewables segment is poised for expansion driven by government policies promoting sustainable energy solutions and growing environmental awareness. Key players in the Brunei power industry, including Marubeni Corporation, Toshiba Corp, and General Electric Company, are expected to play a pivotal role in shaping the sector's future through investments in new infrastructure and technological advancements. The competitive landscape is relatively concentrated, with a few major players dominating the market. The forecast period will see a gradual but significant transformation, with a gradual increase in the contribution of renewable energy sources to the overall energy mix. This shift requires strategic planning, technological upgrades, and effective policy support to ensure a reliable and sustainable electricity supply for Brunei's future needs.

Brunei Power Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Brunei power industry, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages detailed data analysis to illuminate market trends, opportunities, and challenges. The report is structured for easy navigation and incorporates key performance indicators (KPIs) to provide actionable insights. Total market size figures are estimated in Millions.

Brunei Power Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of Brunei's power industry, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activity. The historical period (2019-2024) reveals a market dominated by a few key players, with xx Million market share held by the top three companies. The current market structure exhibits a moderate level of concentration, with the Department of Electrical Services playing a significant regulatory role.

- Market Concentration: xx% market share for the top three players in 2024, indicating a moderately concentrated market.

- Innovation Drivers: Increasing demand for renewable energy sources, coupled with government initiatives to diversify the energy mix, is a key driver.

- Regulatory Framework: The Department of Electrical Services plays a vital role in shaping market dynamics through licensing, grid management, and renewable energy policies.

- Product Substitutes: Limited direct substitutes exist; however, improvements in energy efficiency and the rise of renewable energy sources offer indirect substitution.

- End-User Demographics: The residential, commercial, and industrial sectors constitute the primary end-users, with varying electricity consumption patterns.

- M&A Activities: Over the historical period, M&A activity was relatively low, with a total estimated deal value of xx Million. Future M&A activity is predicted to increase, particularly in the renewable energy sector.

Brunei Power Industry Market Dynamics & Trends

This section explores the market dynamics and trends influencing the Brunei power industry. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing energy demand and government investments in infrastructure development. Key drivers include rising urbanization, industrial expansion, and government initiatives supporting renewable energy integration. Technological disruptions, primarily driven by advancements in renewable energy technologies and smart grid solutions, are expected to further shape the market. Consumer preferences are shifting towards environmentally friendly energy sources. Competitive dynamics are largely influenced by the increasing participation of private sector players in renewable energy projects and the ongoing efforts by the Department of Electrical Services to maintain a stable and reliable power supply. Market penetration for renewable energy is projected to reach xx% by 2033.

Dominant Regions & Segments in Brunei Power Industry

Brunei's power industry is geographically concentrated, with the majority of generation and consumption occurring in urban areas. The thermal power generation segment currently holds the largest market share, due to its established infrastructure and historical reliance on fossil fuels. However, the renewable energy segment is expected to experience the highest growth during the forecast period, driven by government policies promoting renewable energy adoption and the successful implementation of several solar power projects.

- Key Drivers for Thermal Power Generation: Existing infrastructure, established supply chains, and relatively lower initial investment costs.

- Key Drivers for Renewable Power Generation: Government support, declining technology costs, environmental concerns, and diversification of energy sources.

- Key Drivers for Other Power Generation Sources: Technological advancements, niche market applications, and increasing demand for specialized power solutions.

The dominance of thermal power is primarily due to its established infrastructure and historical reliance on fossil fuels. However, the renewable energy segment shows significant growth potential, driven by government initiatives and the increasing cost competitiveness of solar and other renewable sources.

Brunei Power Industry Product Innovations

The Brunei power industry is witnessing increasing adoption of smart grid technologies, advanced metering infrastructure (AMI), and energy storage solutions. These innovations aim to enhance grid efficiency, reliability, and integration of renewable energy sources. The focus is on developing more efficient and environmentally friendly power generation technologies, improving grid management, and offering advanced energy management solutions to consumers. The market fit for these innovations is high, driven by the increasing demand for sustainable and reliable energy solutions.

Report Scope & Segmentation Analysis

This report segments the Brunei power industry based on power generation sources: Thermal, Renewables, and Other Power Generation Sources.

- Thermal: This segment encompasses conventional power plants, with a projected market size of xx Million in 2025, and a CAGR of xx% during the forecast period. Competition is relatively concentrated.

- Renewables: This segment primarily includes solar and, potentially, other renewable sources. The projected market size in 2025 is xx Million, exhibiting the highest CAGR of xx% due to government support. Competition is expected to increase with more private sector involvement.

- Other Power Generation Sources: This segment encompasses other less prominent sources, projected to be xx Million in 2025 with a CAGR of xx%. The competitive landscape is relatively niche.

Key Drivers of Brunei Power Industry Growth

The Brunei power industry's growth is driven by several factors: rising energy demand from residential, commercial, and industrial sectors fueled by economic development; government initiatives to promote energy efficiency and renewable energy adoption; investments in grid infrastructure modernization; and technological advancements that improve the efficiency and reliability of power generation and distribution. The government's commitment to reducing carbon emissions is also a significant driver.

Challenges in the Brunei Power Industry Sector

Challenges include the country's reliance on imported fossil fuels, posing vulnerability to price fluctuations and supply disruptions. The integration of renewable energy sources into the existing grid presents technological and regulatory hurdles. Competition for investment in renewable energy projects may also prove challenging. These factors can impact the stability and cost of electricity supply.

Emerging Opportunities in Brunei Power Industry

Significant opportunities exist in expanding renewable energy generation capacity, particularly solar and potentially other renewable sources. The development of smart grids, energy storage solutions, and energy efficiency programs offers substantial potential. The government's commitment to sustainable development paves the way for private sector investment in these areas.

Leading Players in the Brunei Power Industry Market

- Marubeni Corporation

- Toshiba Corp

- Department of Electrical Services

- Berakas Power Company Sdn Bhd

- General Electric Company

- Brunei LNG Sdn Bhd

Key Developments in Brunei Power Industry

- April 2021: Brunei Shell Petroleum (BSP) launched a 3.3 MWp solar power plant in Panaga.

- February 2021: Brunei's energy ministry announced plans for a 30 MW solar power plant in Kampung Sungai Akar.

These developments highlight the growing emphasis on renewable energy and demonstrate the government's commitment to sustainable energy solutions.

Future Outlook for Brunei Power Industry Market

The Brunei power industry's future is bright, driven by ongoing investments in renewable energy and grid modernization. The government's commitment to diversifying energy sources and promoting sustainable development will create significant opportunities for growth and innovation. The market is poised for substantial expansion, with renewable energy playing an increasingly important role in meeting the nation's energy needs.

Brunei Power Industry Segmentation

-

1. Power Generation from Sources

- 1.1. Thermal

- 1.2. Renewables

- 1.3. Other Power Generation Sources

- 2. Transmission and Distribution (T&D)

Brunei Power Industry Segmentation By Geography

- 1. Brunei

Brunei Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Offshore Oil and Gas Exploration Activities in the American

- 3.2.2 Asia-Pacific

- 3.2.3 and Middle-East and African Regions4.; Growing Offshore Renewable Technologies

- 3.3. Market Restrains

- 3.3.1. 4.; Ban on Offshore Exploration and Production Activities in Multiple Regions

- 3.4. Market Trends

- 3.4.1. Thermal Power Source is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brunei Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 5.1.1. Thermal

- 5.1.2. Renewables

- 5.1.3. Other Power Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brunei

- 5.1. Market Analysis, Insights and Forecast - by Power Generation from Sources

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Marubeni Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Department of Electrical Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Berakas Power Company Sdn Bhd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brunei LNG Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Marubeni Corporation*List Not Exhaustive

List of Figures

- Figure 1: Brunei Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brunei Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Brunei Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brunei Power Industry Volume gigawatts Forecast, by Region 2019 & 2032

- Table 3: Brunei Power Industry Revenue Million Forecast, by Power Generation from Sources 2019 & 2032

- Table 4: Brunei Power Industry Volume gigawatts Forecast, by Power Generation from Sources 2019 & 2032

- Table 5: Brunei Power Industry Revenue Million Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 6: Brunei Power Industry Volume gigawatts Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 7: Brunei Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brunei Power Industry Volume gigawatts Forecast, by Region 2019 & 2032

- Table 9: Brunei Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brunei Power Industry Volume gigawatts Forecast, by Country 2019 & 2032

- Table 11: Brunei Power Industry Revenue Million Forecast, by Power Generation from Sources 2019 & 2032

- Table 12: Brunei Power Industry Volume gigawatts Forecast, by Power Generation from Sources 2019 & 2032

- Table 13: Brunei Power Industry Revenue Million Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 14: Brunei Power Industry Volume gigawatts Forecast, by Transmission and Distribution (T&D) 2019 & 2032

- Table 15: Brunei Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brunei Power Industry Volume gigawatts Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brunei Power Industry?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Brunei Power Industry?

Key companies in the market include Marubeni Corporation*List Not Exhaustive, Toshiba Corp, Department of Electrical Services, Berakas Power Company Sdn Bhd, General Electric Company, Brunei LNG Sdn Bhd.

3. What are the main segments of the Brunei Power Industry?

The market segments include Power Generation from Sources, Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Offshore Oil and Gas Exploration Activities in the American. Asia-Pacific. and Middle-East and African Regions4.; Growing Offshore Renewable Technologies.

6. What are the notable trends driving market growth?

Thermal Power Source is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Ban on Offshore Exploration and Production Activities in Multiple Regions.

8. Can you provide examples of recent developments in the market?

In April 2021, Brunei Shell Petroleum (BSP) launched the country's second solar power plant of capacity 3.3 MWp in Panaga to power its Seria headquarters and reduce its environmental footprint. The solar power plant will provide enough power to supply 600 households and will be connected to the national grid to offset some power usage in the BSP headquarters on Jalan Utara.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brunei Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brunei Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brunei Power Industry?

To stay informed about further developments, trends, and reports in the Brunei Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence