Key Insights

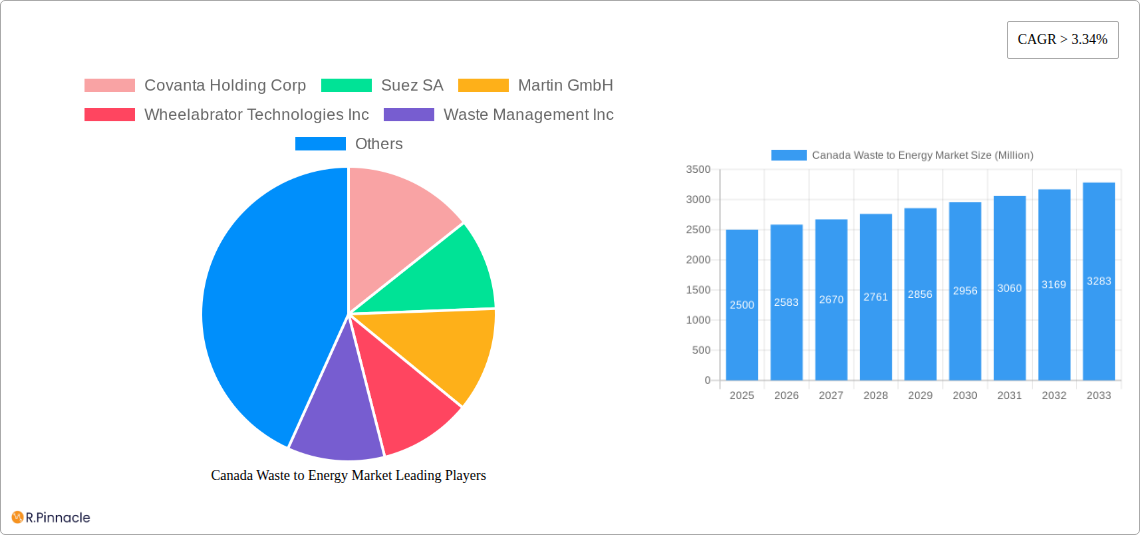

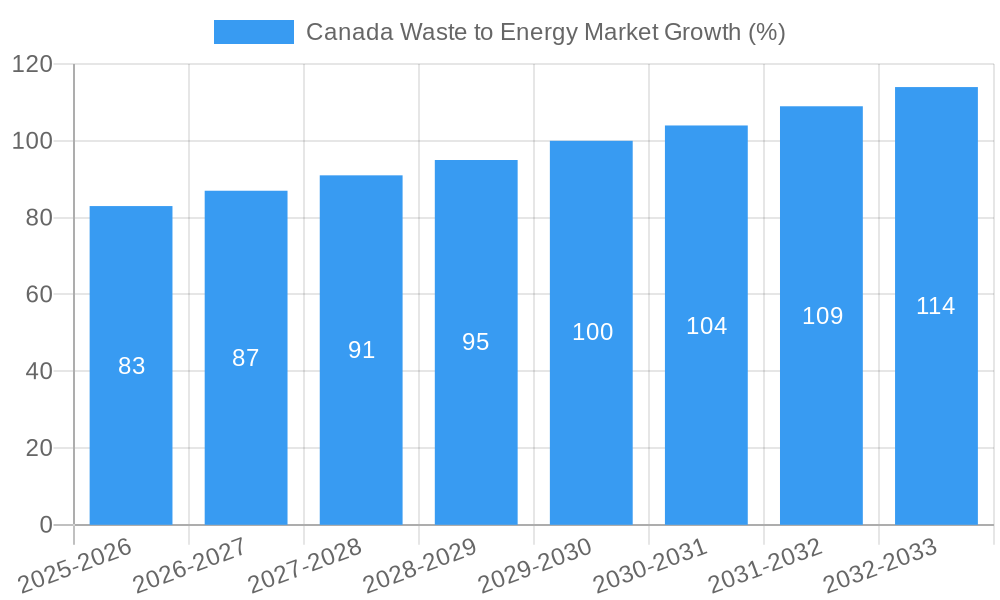

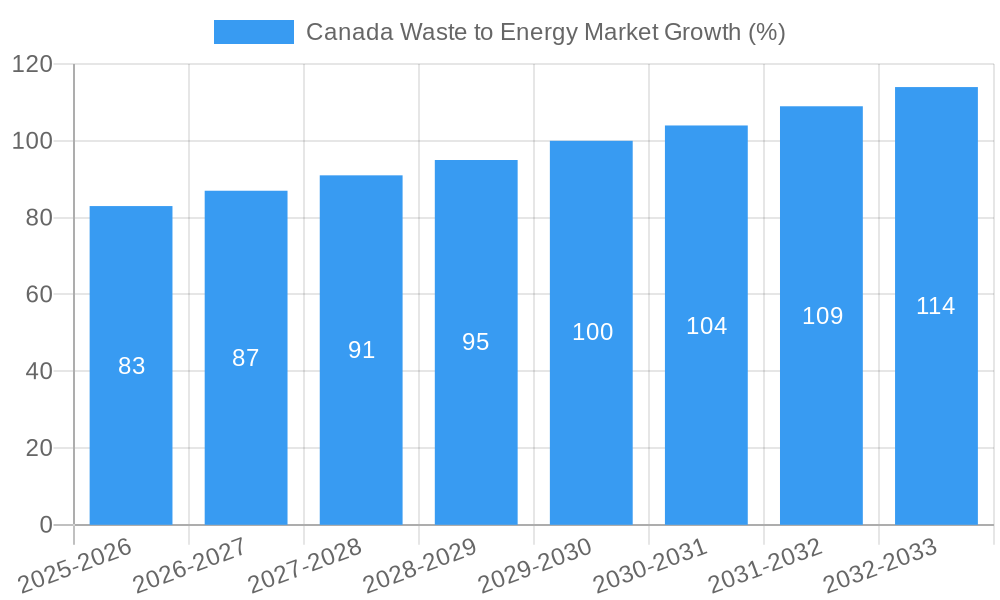

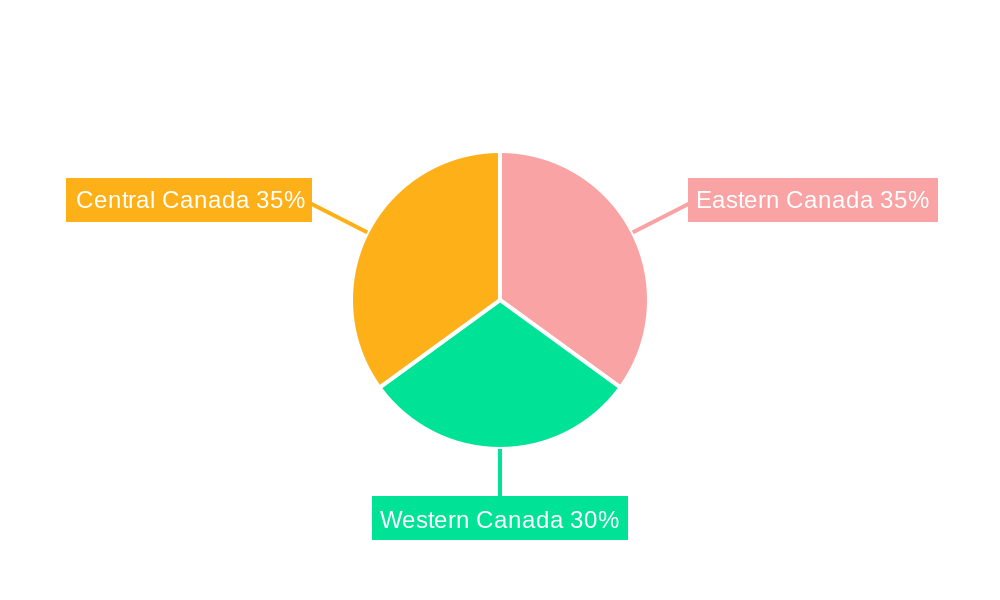

The Canadian waste-to-energy market, exhibiting a CAGR exceeding 3.34%, presents a lucrative opportunity for investors and stakeholders. Driven by stringent environmental regulations aimed at reducing landfill waste and increasing renewable energy generation, the market is experiencing robust growth. Technological advancements in incineration, gasification, and pyrolysis are further fueling this expansion, offering increasingly efficient and environmentally sound waste management solutions. The industrial sector currently dominates the market share, followed by the commercial sector, with residential waste-to-energy adoption steadily increasing. The geographical distribution of the market demonstrates significant potential across Eastern, Western, and Central Canada, albeit with variations in growth rates potentially driven by regional infrastructure development and policy differences. Key players like Covanta Holding Corp, Suez SA, and Waste Management Inc are actively shaping the market landscape through strategic investments and technological innovations. However, challenges remain, including high capital investment costs for waste-to-energy facilities and the need for robust public acceptance to mitigate potential environmental concerns. The forecast period of 2025-2033 promises continued growth, with ongoing government support for renewable energy and increasing public awareness of sustainable waste management likely boosting market expansion.

The segmentation of the Canadian market into technologies (incineration, gasification, pyrolysis, and others) and sectors (industrial, commercial, and residential) allows for a nuanced understanding of market dynamics. The dominance of incineration technology is likely to persist in the short term, given its established infrastructure and cost-effectiveness. However, the growing interest in gasification and pyrolysis, offering higher energy recovery rates and potentially reduced environmental impact, is expected to drive market diversification in the coming years. The increasing focus on circular economy principles and resource recovery will likely stimulate further innovation and investment in advanced waste-to-energy technologies. Regional variations in market growth will likely be influenced by factors such as population density, waste generation patterns, and the availability of suitable infrastructure. Competitive landscape analysis reveals the presence of both established international players and emerging local companies, leading to a dynamic and evolving market structure.

Canada Waste to Energy Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada Waste to Energy market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages robust data analysis to present a clear picture of market trends, growth drivers, and challenges. The report segments the market by technology (Incineration, Gasification, Pyrolysis, Others) and sector (Industrial, Commercial, Residential), providing granular insights into market dynamics. Expect detailed analysis of leading companies such as Covanta Holding Corp, Suez SA, Martin GmbH, Wheelabrator Technologies Inc, Waste Management Inc, Green Conversion Systems LLC, Ze-gen Inc, and Mitsubishi Heavy Industries Ltd. The report's findings will help you navigate the complexities of this evolving market and capitalize on emerging opportunities.

Canada Waste to Energy Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Canadian waste-to-energy market, including market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a moderate level of concentration, with a few major players holding significant market share. However, smaller players are also active, particularly in niche segments like pyrolysis and gasification. Innovation is primarily driven by the need for more efficient and sustainable waste management solutions, alongside stricter environmental regulations.

- Market Concentration: The top five players account for approximately xx% of the market share in 2025 (estimated).

- M&A Activity: The past five years have witnessed xx M&A deals, with a total value of approximately xx Million. These deals reflect the consolidation trend within the industry.

- Regulatory Framework: The Canadian government's focus on renewable energy and waste reduction has spurred investment and innovation in waste-to-energy technologies.

- Product Substitutes: Recycling and landfilling remain primary alternatives, but their increasing costs and environmental concerns are driving a shift towards waste-to-energy solutions.

- End-User Demographics: The industrial sector currently accounts for the largest share of the market, followed by commercial and residential sectors.

Canada Waste to Energy Market Market Dynamics & Trends

The Canada waste-to-energy market is poised for significant growth over the forecast period. Driven by increasing waste generation, stringent environmental regulations, and government support for renewable energy, the market is expected to experience a CAGR of xx% from 2025 to 2033. This growth will be fuelled by technological advancements leading to higher efficiency and lower operating costs. Increased consumer awareness of environmental sustainability and government incentives further boost market expansion. Competitive dynamics are marked by intense rivalry among existing players and entry of new innovative technologies. Market penetration for waste-to-energy technologies continues to increase, driven by government support and growing demand for renewable energy.

Dominant Regions & Segments in Canada Waste to Energy Market

Ontario and British Columbia currently dominate the Canadian waste-to-energy market, driven by factors including higher waste generation, robust infrastructure, and supportive government policies. Incineration remains the dominant technology segment due to its maturity and established infrastructure, but gasification and pyrolysis are expected to experience increased market share owing to technological advancements and improved cost-effectiveness.

- Key Drivers in Ontario: Higher population density, established infrastructure, favorable government regulations, and strong industrial presence.

- Key Drivers in British Columbia: Growing environmental awareness, government initiatives for renewable energy, and increasing waste generation from the commercial and residential sectors.

- Dominant Technology: Incineration holds the largest market share (approximately xx% in 2025), driven by its maturity, technological reliability, and established infrastructure.

- Dominant Sector: The industrial sector dominates, comprising approximately xx% of the market in 2025.

Canada Waste to Energy Market Product Innovations

Recent innovations have focused on improving efficiency, reducing emissions, and enhancing the recovery of valuable resources from waste. Advances in gasification and pyrolysis technologies are enabling the production of biofuels and other valuable byproducts, increasing the economic viability of waste-to-energy solutions. Furthermore, the integration of smart technologies and data analytics is improving operational efficiency and reducing environmental impact. These innovations are improving market fit by providing more sustainable and economically attractive solutions to waste management.

Report Scope & Segmentation Analysis

The report covers the Canadian waste-to-energy market, segmented by technology (Incineration, Gasification, Pyrolysis, Others) and sector (Industrial, Commercial, Residential). The incineration segment is currently the largest, with a projected market size of xx Million in 2025, and is expected to grow at a CAGR of xx% during the forecast period. Gasification and pyrolysis segments show promising growth potential, driven by technological advancements and increased environmental awareness. The industrial sector dominates the market, with significant contributions from commercial and residential sectors.

Key Drivers of Canada Waste to Energy Market Growth

The Canadian waste-to-energy market is propelled by a confluence of factors: increasing waste generation, stringent environmental regulations aimed at reducing landfill reliance, government incentives promoting renewable energy sources, and the rising cost of traditional waste disposal methods. Technological advancements in waste-to-energy technologies, offering improved efficiency and reduced emissions, also contribute significantly to market growth.

Challenges in the Canada Waste to Energy Market Sector

Significant challenges exist, including the high capital costs associated with establishing waste-to-energy facilities, which often act as a barrier to entry for new players. Public perception and concerns about potential environmental impacts, including air and water pollution, represent another challenge. Furthermore, securing permits and navigating regulatory complexities can prove time-consuming and costly. These factors can potentially delay project implementation and impact market expansion.

Emerging Opportunities in Canada Waste to Energy Market

Emerging opportunities lie in advancements in waste-to-energy technologies and the integration of smart technologies for optimized energy production and environmental monitoring. The potential to recover valuable materials from waste streams (e.g., metals, plastics) offers a further avenue for growth and market expansion. Additionally, collaboration between public and private entities to address funding gaps and streamline project approvals could significantly enhance market growth.

Leading Players in the Canada Waste to Energy Market Market

- Covanta Holding Corp (Covanta Holding Corp)

- Suez SA (Suez SA)

- Martin GmbH

- Wheelabrator Technologies Inc (Wheelabrator Technologies Inc)

- Waste Management Inc (Waste Management Inc)

- Green Conversion Systems LLC

- Ze-gen Inc

- Mitsubishi Heavy Industries Ltd (Mitsubishi Heavy Industries Ltd)

Key Developments in Canada Waste to Energy Market Industry

- February 2022: A waste-to-energy plant came online in Meadow Lake, Saskatchewan, Canada. The plant is expected to provide power to around 5,000 homes in Saskatchewan and provide heat and power for a new continuous kiln. This development showcases the increasing adoption of waste-to-energy solutions in smaller communities.

- March 2022: ANDION Global Inc. announced securing USD 20 Million in multi-partner financing to expand operations, acquire equity stakes in existing projects, and accelerate the development of projects worldwide, including Canada. This investment highlights the growing interest and funding opportunities in the waste-to-energy sector.

Future Outlook for Canada Waste to Energy Market Market

The Canadian waste-to-energy market exhibits substantial growth potential driven by escalating waste generation, government policies supporting renewable energy, and technological advancements leading to enhanced efficiency and cost-effectiveness. Strategic partnerships between private and public entities will be crucial in addressing funding challenges, facilitating project development, and driving innovation. The market is expected to continue expanding, with a focus on sustainable and environmentally responsible waste management solutions.

Canada Waste to Energy Market Segmentation

- 1. Physical Technology

- 2. Thermal Technology

- 3. Biological Technology

Canada Waste to Energy Market Segmentation By Geography

- 1. Canada

Canada Waste to Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.34% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strict Regulations for Wastewater Treatment Across Residential and Industrial Sector; Rising Use for Recovery in the Oil and Gas and Mining Industries

- 3.3. Market Restrains

- 3.3.1. High Operation and Maintenance Costs4.; Volatility in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Thermal-based Waste to Energy Conversion May Have Increasing Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Waste to Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Physical Technology

- 5.2. Market Analysis, Insights and Forecast - by Thermal Technology

- 5.3. Market Analysis, Insights and Forecast - by Biological Technology

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Physical Technology

- 6. Eastern Canada Canada Waste to Energy Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Waste to Energy Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Waste to Energy Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Covanta Holding Corp

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Suez SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Martin GmbH

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Wheelabrator Technologies Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Waste Management Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Green Conversion Systems LLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Ze-gen Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Mitsubishi Heavy Industries Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Covanta Holding Corp

List of Figures

- Figure 1: Canada Waste to Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Waste to Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Waste to Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Waste to Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Canada Waste to Energy Market Revenue Million Forecast, by Physical Technology 2019 & 2032

- Table 4: Canada Waste to Energy Market Volume Gigawatt Forecast, by Physical Technology 2019 & 2032

- Table 5: Canada Waste to Energy Market Revenue Million Forecast, by Thermal Technology 2019 & 2032

- Table 6: Canada Waste to Energy Market Volume Gigawatt Forecast, by Thermal Technology 2019 & 2032

- Table 7: Canada Waste to Energy Market Revenue Million Forecast, by Biological Technology 2019 & 2032

- Table 8: Canada Waste to Energy Market Volume Gigawatt Forecast, by Biological Technology 2019 & 2032

- Table 9: Canada Waste to Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Canada Waste to Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 11: Canada Waste to Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Canada Waste to Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 13: Eastern Canada Canada Waste to Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Eastern Canada Canada Waste to Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Western Canada Canada Waste to Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Western Canada Canada Waste to Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Central Canada Canada Waste to Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Central Canada Canada Waste to Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Canada Waste to Energy Market Revenue Million Forecast, by Physical Technology 2019 & 2032

- Table 20: Canada Waste to Energy Market Volume Gigawatt Forecast, by Physical Technology 2019 & 2032

- Table 21: Canada Waste to Energy Market Revenue Million Forecast, by Thermal Technology 2019 & 2032

- Table 22: Canada Waste to Energy Market Volume Gigawatt Forecast, by Thermal Technology 2019 & 2032

- Table 23: Canada Waste to Energy Market Revenue Million Forecast, by Biological Technology 2019 & 2032

- Table 24: Canada Waste to Energy Market Volume Gigawatt Forecast, by Biological Technology 2019 & 2032

- Table 25: Canada Waste to Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Canada Waste to Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Waste to Energy Market?

The projected CAGR is approximately > 3.34%.

2. Which companies are prominent players in the Canada Waste to Energy Market?

Key companies in the market include Covanta Holding Corp, Suez SA, Martin GmbH, Wheelabrator Technologies Inc, Waste Management Inc, Green Conversion Systems LLC, Ze-gen Inc, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Canada Waste to Energy Market?

The market segments include Physical Technology, Thermal Technology, Biological Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strict Regulations for Wastewater Treatment Across Residential and Industrial Sector; Rising Use for Recovery in the Oil and Gas and Mining Industries.

6. What are the notable trends driving market growth?

Thermal-based Waste to Energy Conversion May Have Increasing Adoption.

7. Are there any restraints impacting market growth?

High Operation and Maintenance Costs4.; Volatility in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

March 2022: ANDION Global Inc. announced that the company secured a USD 20 million multi-partner financing to expand Andion's operations and acquire equity stakes in existing projects and accelerate the development of Andion's projects located across the world, including Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Waste to Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Waste to Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Waste to Energy Market?

To stay informed about further developments, trends, and reports in the Canada Waste to Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence