Key Insights

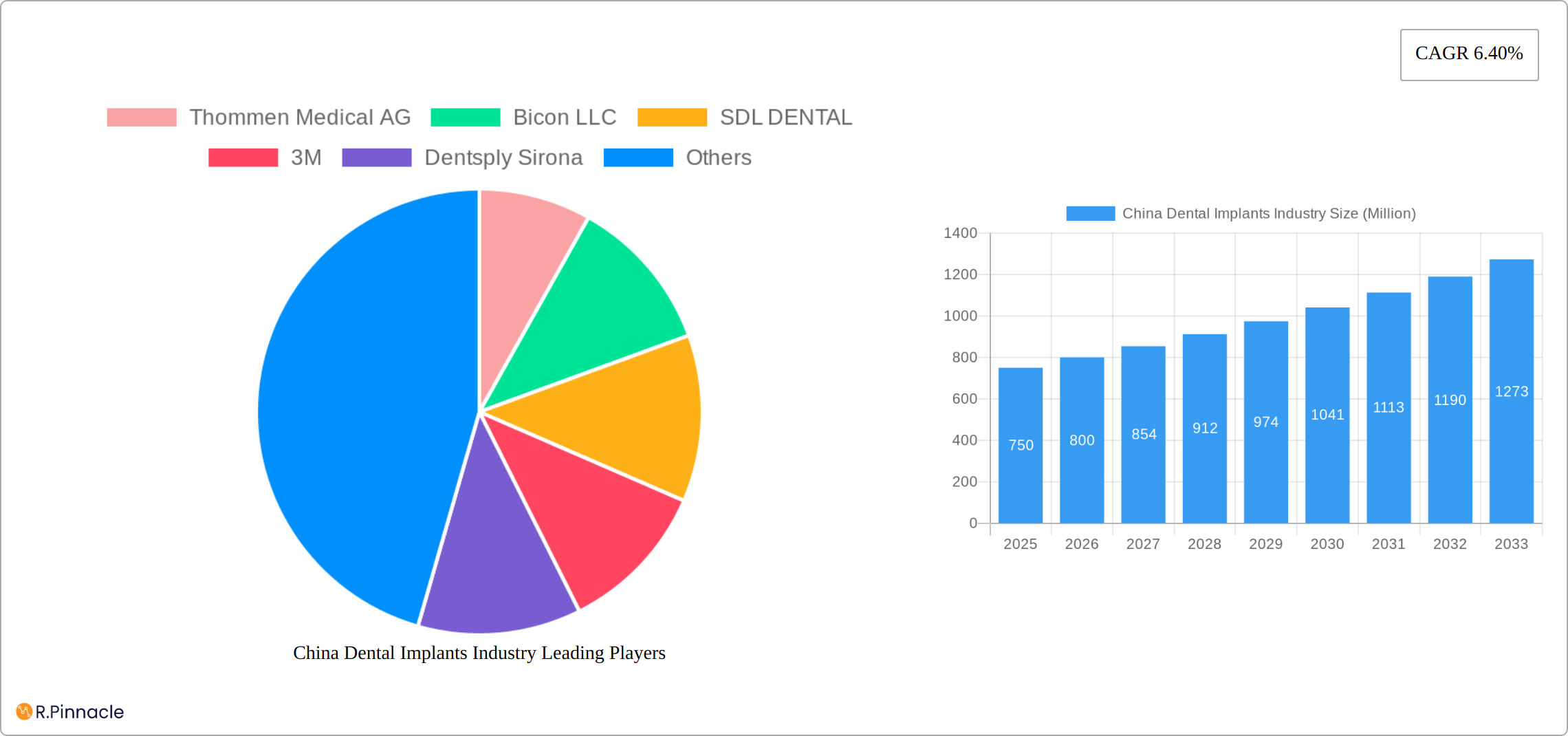

The China dental implants market, valued at $0.75 billion in 2025, exhibits robust growth potential, projected to expand significantly over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 6.40% indicates a steadily increasing demand driven by several key factors. Rising disposable incomes and improved healthcare infrastructure within China are fueling greater access to advanced dental care, including implant procedures. An aging population, coupled with increasing awareness of cosmetic dentistry and improved oral health, further contributes to market expansion. The market is segmented by fixture and abutment types, and materials such as titanium and zirconium implants, reflecting the diverse product offerings catering to various patient needs and preferences. Leading players like Thommen Medical AG, Bicon LLC, and Dentsply Sirona are actively shaping the market landscape through innovation, technological advancements, and strategic partnerships. The competitive dynamics are intense, fostering continuous improvements in implant technology, surgical techniques, and overall patient experience.

The market's growth trajectory is expected to remain positive, particularly given the government's initiatives to enhance healthcare access and affordability in China. However, challenges remain, including potential price sensitivity among a segment of the population and the need for sustained investment in dental infrastructure and skilled professionals to meet the rising demand. The market's future hinges on overcoming these hurdles and maintaining the momentum in technological innovation and accessibility to ensure the continued expansion of the dental implant market in China. The focus on materials like zirconium, offering potential biocompatibility advantages, may also contribute to differential market growth within the segment. Future market studies would benefit from a more granular breakdown of regional data within China, alongside further analysis of specific product categories within the fixture and abutment segments to paint a more detailed picture of market dynamics.

China Dental Implants Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning China dental implants market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report forecasts market trends through 2033, leveraging data from the historical period (2019-2024). The market size is expected to reach xx Million by 2033.

China Dental Implants Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Chinese dental implants market, encompassing market concentration, innovation drivers, regulatory frameworks, and key market activities. The market is characterized by a mix of both established global players and emerging domestic companies. Market share distribution is dynamic, with the top 5 players holding an estimated xx% of the market in 2025. Several key factors influence this structure:

- Market Concentration: The market shows a moderately concentrated structure, with a few major players holding significant market share, while numerous smaller players compete for the remainder.

- Innovation Drivers: Technological advancements in implant materials (e.g., Zirconium Implants) and design, alongside evolving surgical techniques, are driving innovation. The increasing demand for minimally invasive procedures and improved patient outcomes further fuels innovation.

- Regulatory Framework: The inclusion of dental implants in China's bulk-buy program (February 2022) significantly impacts market dynamics, fostering accessibility and potentially accelerating growth. Stringent regulatory standards ensure quality and safety, affecting market entry and competition.

- Product Substitutes: While no direct substitutes exist, alternative treatments like dentures and bridges pose indirect competition, influencing market penetration of implants.

- End-User Demographics: The growing middle class and increasing awareness of oral health are expanding the target patient base. An aging population also contributes to higher demand.

- M&A Activities: The acquisition of Legend Life Tech by Neoss Group in January 2022 illustrates the strategic M&A activity reshaping the market landscape. The total value of such deals in the period 2019-2024 is estimated to be xx Million. Key players engage in strategic partnerships and acquisitions to expand their market reach and product portfolios.

China Dental Implants Industry Market Dynamics & Trends

This section delves into the market's growth trajectory, highlighting key dynamics and influencing factors. The China dental implants market is experiencing robust growth, driven by several factors:

The market is predicted to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by a number of factors, including:

- Rising Disposable Incomes: Increased disposable incomes are allowing more people access to advanced dental treatments.

- Growing Awareness of Oral Health: Public awareness campaigns and rising awareness of the importance of oral hygiene are driving demand.

- Technological Advancements: Innovations in materials (Titanium Implants, Zirconium Implants) and surgical techniques are leading to improved outcomes and reduced treatment times.

- Government Initiatives: Government support for healthcare initiatives, including the bulk-buy program for dental implants, significantly boosts market accessibility.

- Competitive Dynamics: Intense competition among both domestic and international players spurs innovation and improves affordability.

Market penetration of dental implants remains relatively low compared to developed nations, indicating significant untapped potential.

Dominant Regions & Segments in China Dental Implants Industry

While specific regional data may vary, the coastal regions of China (e.g., Guangdong, Jiangsu, Zhejiang) are likely to remain dominant due to higher per capita income, better healthcare infrastructure, and greater awareness of advanced dental treatments.

Key Drivers for Dominant Regions:

- Economic Development: Higher disposable incomes in these regions translate into increased spending on healthcare.

- Healthcare Infrastructure: Well-developed healthcare infrastructure, including specialized dental clinics and hospitals, facilitates access to dental implant procedures.

- Urbanization: Higher urbanization rates contribute to increased demand for dental services.

Dominant Segments:

- Part: Fixtures currently hold the largest market share, followed by Abutments. The fixture segment's dominance stems from the fundamental role it plays in the implant procedure.

- Material: Titanium Implants currently dominate due to their established use and relatively lower cost. However, Zirconium Implants are gaining traction owing to their superior biocompatibility and aesthetic advantages. Growth in the Zirconium Implants segment is predicted to be significantly faster than Titanium Implants.

China Dental Implants Industry Product Innovations

Recent innovations in the Chinese dental implant market are revolutionizing the field. Emphasis is placed on enhancing osseointegration through improved implant designs, leveraging advanced materials like Zirconium and titanium alloys for superior biocompatibility, strength, and aesthetics. Minimally invasive surgical techniques, guided surgery, and digital workflows are gaining traction, leading to faster recovery times, reduced patient discomfort, and improved clinical outcomes. These advancements are not only enhancing treatment efficacy but also driving increased market appeal and competitiveness amongst manufacturers.

Report Scope & Segmentation Analysis

This report comprehensively segments the China dental implants market by:

Part: Fixture and Abutment. The Fixture segment is projected to grow at a CAGR of xx% during the forecast period, driven by increasing demand for implant-supported restorations. The Abutment segment is expected to experience a CAGR of xx%, mirroring the growth of the Fixture segment.

Material: Titanium Implants and Zirconium Implants. Titanium Implants are expected to maintain a significant market share but will see slower growth compared to Zirconium Implants. The Zirconium Implants segment is expected to demonstrate significant growth due to increasing consumer preference for aesthetic and biocompatible materials.

Each segment's growth is influenced by factors like pricing, technological advancements, and evolving consumer preferences.

Key Drivers of China Dental Implants Industry Growth

The robust growth of China's dental implant market is fueled by a confluence of factors. A burgeoning middle class with rising disposable incomes is seeking enhanced aesthetic and functional outcomes. Simultaneously, improved healthcare infrastructure, coupled with heightened public awareness of oral health and preventative care, is driving demand. Government support, including initiatives like the national bulk-purchase program for medical consumables, plays a crucial role in expanding market access and affordability. Furthermore, continuous technological advancements in implant materials, surgical techniques, and digital dentistry are significantly accelerating market expansion.

Challenges in the China Dental Implants Industry Sector

The industry faces challenges including: price competition from domestic manufacturers, stringent regulatory approvals, potential supply chain disruptions, and the need to address disparities in access to quality dental care across different regions. These challenges could negatively impact market expansion, although the overall growth trajectory remains positive.

Emerging Opportunities in China Dental Implants Industry

Significant untapped potential exists within the Chinese dental implant market. Expanding into underserved rural areas, where access to quality dental care remains limited, presents a considerable opportunity. Leveraging digital technologies, such as telehealth platforms for remote consultations and digital imaging for improved treatment planning, offers enhanced patient care and convenience. The development and adoption of innovative implant designs, focusing on personalized solutions and improved longevity, are also key growth drivers. Furthermore, ongoing research and development of biocompatible and aesthetically superior materials, including the exploration of novel surface treatments and coatings, offer substantial avenues for innovation and market differentiation.

Leading Players in the China Dental Implants Industry Market

- Thommen Medical AG

- Bicon LLC

- SDL DENTAL

- 3M

- Dentsply Sirona

- Dentium

- AB Dental Devices Ltd

- Ivoclar Vivadent

- Nobel Biocare Services AG

- Zimmer Biomet

Key Developments in China Dental Implants Industry

- February 2022: The inclusion of dental implants in China's national bulk-purchase program for drugs and medical consumables dramatically increased market accessibility and fueled a surge in demand. This initiative significantly lowered costs for patients and stimulated market growth.

- January 2022: Neoss Group's strategic acquisition of Legend Life Tech resulted in the establishment of Neoss China, significantly bolstering the company's market presence and distribution network within the country.

- Ongoing: Increased investment in research and development by both domestic and international companies is driving innovation in materials science, implant design, and surgical techniques.

Future Outlook for China Dental Implants Industry Market

The future of China's dental implant market is exceptionally promising. Continued economic growth, rising healthcare expenditure, and a sustained focus on improving oral health are expected to drive consistent market expansion. The strategic integration of technology, coupled with a commitment to expanding access to quality dental care across both urban and rural regions, will shape the market's trajectory. This presents lucrative opportunities for companies willing to adapt to evolving market dynamics, embrace technological advancements, and prioritize patient-centric solutions. The focus on advanced materials, minimally invasive techniques, and personalized treatment plans will define the future landscape of the industry.

China Dental Implants Industry Segmentation

-

1. Part

- 1.1. Fixture

- 1.2. Abutment

-

2. Material

- 2.1. Titanium Implants

- 2.2. Zirconium Implants

China Dental Implants Industry Segmentation By Geography

- 1. China

China Dental Implants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Dental Diseases and Geriatric Population; Increasing Application of CAD/CAM Technologies

- 3.3. Market Restrains

- 3.3.1. Reimbursement Issues and High Cost of Dental Implants

- 3.4. Market Trends

- 3.4.1. Titanium Implants Segment is Expected to have Largest Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Part

- 5.1.1. Fixture

- 5.1.2. Abutment

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Titanium Implants

- 5.2.2. Zirconium Implants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Part

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Thommen Medical AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bicon LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SDL DENTAL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3M

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dentsply Sirona

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dentium

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AB Dental Devices Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ivoclar Vivadent

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nobel Biocare Services AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zimmer Biomet

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Thommen Medical AG

List of Figures

- Figure 1: China Dental Implants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Dental Implants Industry Share (%) by Company 2024

List of Tables

- Table 1: China Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Dental Implants Industry Revenue Million Forecast, by Part 2019 & 2032

- Table 3: China Dental Implants Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 4: China Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Dental Implants Industry Revenue Million Forecast, by Part 2019 & 2032

- Table 7: China Dental Implants Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 8: China Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Dental Implants Industry?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the China Dental Implants Industry?

Key companies in the market include Thommen Medical AG, Bicon LLC, SDL DENTAL, 3M, Dentsply Sirona, Dentium, AB Dental Devices Ltd, Ivoclar Vivadent, Nobel Biocare Services AG, Zimmer Biomet.

3. What are the main segments of the China Dental Implants Industry?

The market segments include Part, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Dental Diseases and Geriatric Population; Increasing Application of CAD/CAM Technologies.

6. What are the notable trends driving market growth?

Titanium Implants Segment is Expected to have Largest Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Reimbursement Issues and High Cost of Dental Implants.

8. Can you provide examples of recent developments in the market?

In February 2022, China expanded the list of drugs and medical consumables included in China's bulk-buy program and included dental implants in the list.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Dental Implants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Dental Implants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Dental Implants Industry?

To stay informed about further developments, trends, and reports in the China Dental Implants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence