Key Insights

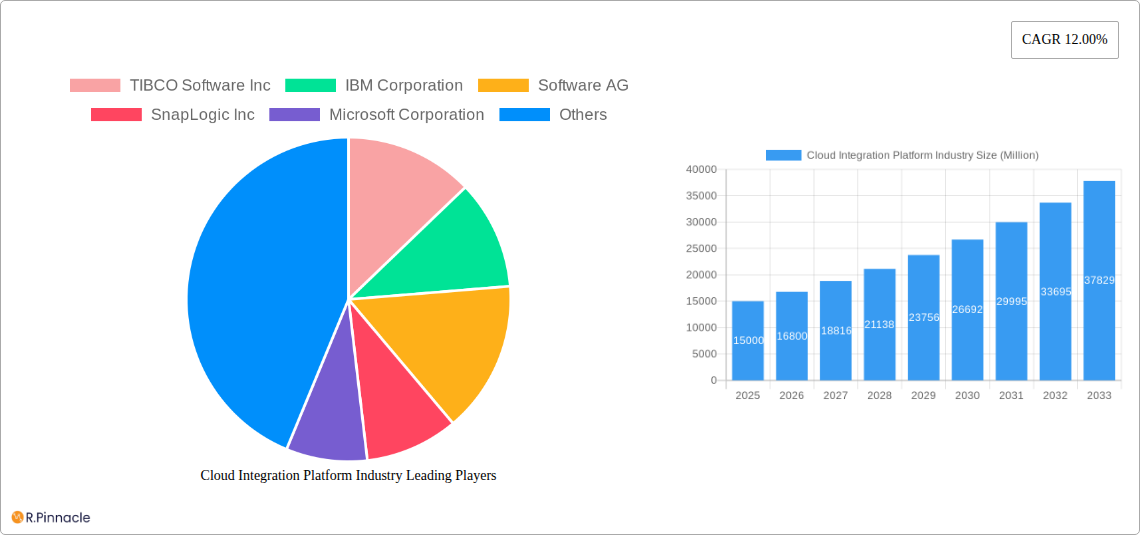

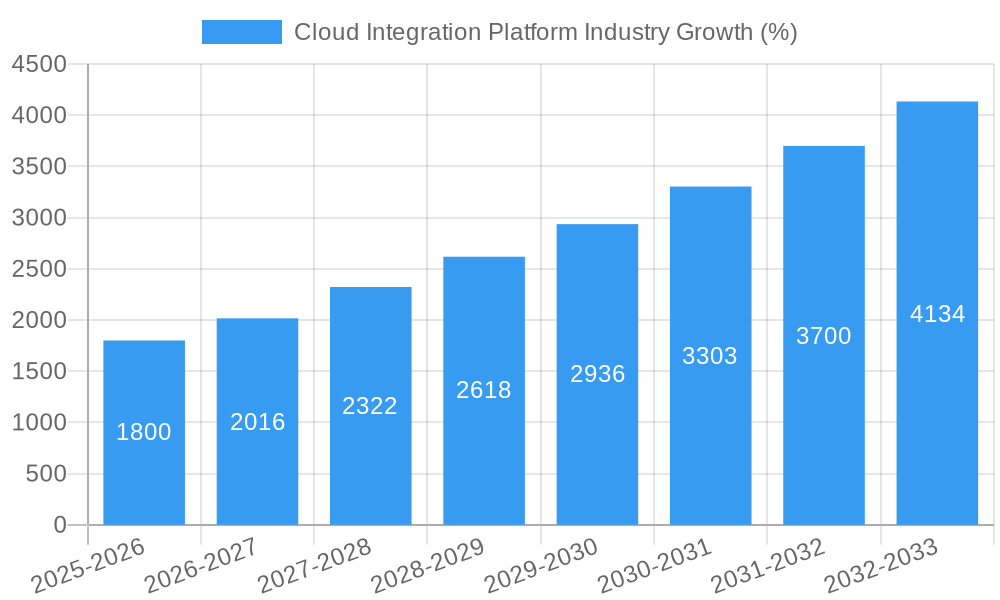

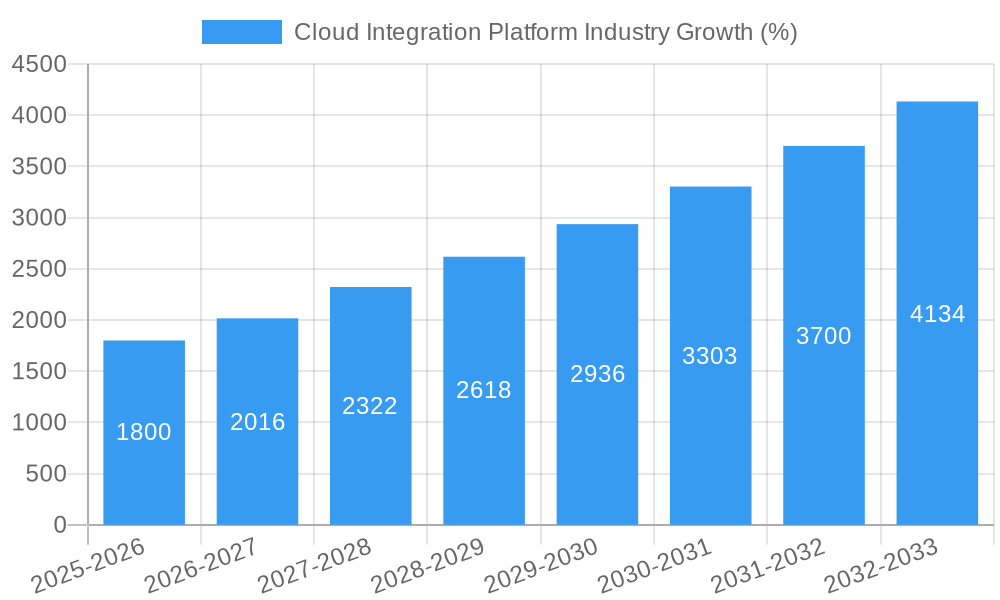

The Cloud Integration Platform (CIP) market is experiencing robust growth, fueled by the increasing adoption of cloud-based technologies and the need for seamless data exchange across diverse systems. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 12% from 2025 to 2033, driven by several key factors. The shift towards digital transformation initiatives across various industries, including BFSI (Banking, Financial Services, and Insurance), IT, Retail, Healthcare, and Education, is a primary catalyst. Businesses are increasingly seeking scalable, flexible, and cost-effective solutions to integrate their on-premise and cloud-based applications, leading to high demand for CIP solutions. Furthermore, the emergence of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) within CIPs is enhancing their capabilities, improving efficiency, and driving adoption. The market is segmented by deployment mode (PaaS, IaaS, SaaS) and end-user industry, with SaaS expected to dominate due to its ease of use and pay-as-you-go pricing model. Competitive rivalry is intense, with major players like TIBCO, IBM, Software AG, SnapLogic, Microsoft, MuleSoft, Oracle, Informatica, Accenture, Dell Boomi, and SAP vying for market share through innovation and strategic partnerships.

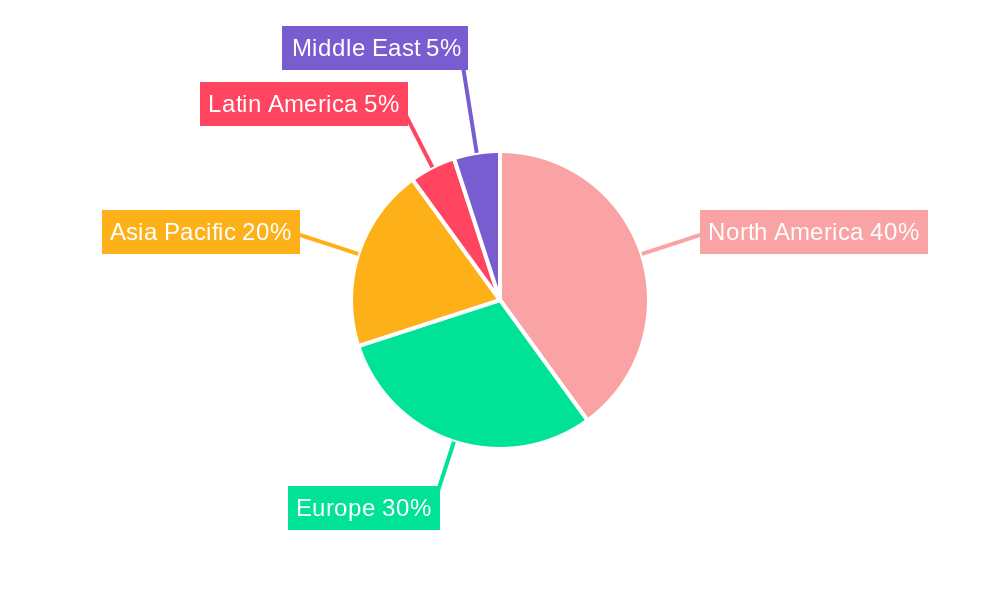

Geographic expansion is another key driver, with North America and Europe currently holding significant market shares. However, the Asia-Pacific region is anticipated to witness the fastest growth due to increasing digitalization and technological advancements. While the market faces some restraints, such as security concerns and integration complexities, these are being mitigated through robust security measures and improved integration methodologies offered by CIP vendors. The overall market outlook remains highly positive, indicating substantial growth opportunities for established players and new entrants alike in the coming years. The continuous evolution of cloud technologies and the increasing emphasis on data integration will further propel the expansion of the CIP market.

Cloud Integration Platform Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Cloud Integration Platform industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to deliver actionable intelligence. The global market value is projected to reach xx Million by 2033, showcasing significant growth potential.

Cloud Integration Platform Industry Market Structure & Innovation Trends

The Cloud Integration Platform market exhibits a moderately concentrated structure, with key players like TIBCO Software Inc, IBM Corporation, Software AG, SnapLogic Inc, Microsoft Corporation, MuleSoft Inc, Oracle Corporation, Informatica Corporation, Accenture Inc, Dell Boomi, and SAP SE holding significant market share. Market concentration is influenced by factors such as technological advancements, strategic acquisitions, and regulatory landscapes. Innovation is driven by the increasing demand for real-time data integration, improved data security, and the need for seamless integration across diverse platforms.

- Market Share: While precise market share figures for each player vary, the top ten companies account for approximately 70% of the market.

- M&A Activity: The past five years have witnessed several significant M&A activities valued at over xx Million collectively, driving consolidation within the industry and boosting innovation.

- Regulatory Frameworks: Compliance with data privacy regulations (e.g., GDPR, CCPA) significantly impacts the market, influencing product development and deployment strategies.

- Product Substitutes: Open-source integration solutions and custom-built integration systems act as partial substitutes but often lack the scalability and support offered by established platforms.

- End-user Demographics: The primary end-users are large enterprises across diverse sectors (BFSI, IT, Retail, Healthcare, etc.), with a growing adoption rate among mid-sized businesses.

Cloud Integration Platform Industry Market Dynamics & Trends

The Cloud Integration Platform market is experiencing robust growth, driven by the increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT). The market is expected to achieve a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of serverless architectures and AI-powered integration tools, are reshaping the competitive landscape. Consumer preferences are shifting towards solutions that offer improved scalability, agility, and security.

The increasing demand for real-time data processing and the need for efficient data integration across hybrid and multi-cloud environments are key growth drivers. Furthermore, the rising adoption of API-led connectivity and the integration of cloud-native applications are fueling market expansion. Market penetration is high among large enterprises, but significant growth opportunities exist in the mid-market segment. The competitive dynamics are marked by both intense rivalry among established players and the emergence of new entrants offering innovative solutions.

Dominant Regions & Segments in Cloud Integration Platform Industry

The North American region currently holds the largest market share in the Cloud Integration Platform industry, driven by high adoption rates among enterprises and the presence of major technology players. However, the Asia-Pacific region is expected to witness significant growth in the coming years due to increasing digital transformation initiatives and government investments in cloud infrastructure.

By Deployment Mode:

- SaaS: The SaaS segment is expected to dominate due to its ease of deployment, scalability, and cost-effectiveness.

- PaaS: The PaaS segment is growing rapidly, enabling greater flexibility and customization.

- IaaS: While smaller than SaaS and PaaS, IaaS still finds use in specific integration needs.

By End-user Industry:

- BFSI: High security and regulatory compliance needs drive robust growth in this segment.

- IT: High adoption rates within the IT industry itself drive significant demand.

- Retail: E-commerce growth fuels demand for real-time inventory and supply chain integration.

- Healthcare: Patient data management, compliance with HIPAA regulations, and digital transformation drive growth.

Cloud Integration Platform Industry Product Innovations

Recent product innovations focus on AI-powered automation, improved security features, and enhanced integration capabilities with diverse platforms. Many platforms now integrate seamlessly with various cloud services, allowing for faster data integration and improved operational efficiency. The emphasis is on creating flexible, scalable, and secure solutions that meet the evolving needs of businesses across diverse sectors. This emphasis drives competitive advantage by improving time-to-market and reducing overall integration complexity.

Report Scope & Segmentation Analysis

This report segments the Cloud Integration Platform market by deployment mode (SaaS, PaaS, IaaS) and end-user industry (BFSI, IT, Retail, Education, Healthcare, and Others). Each segment's growth projection is assessed, considering factors like market size, competitive landscape, and technological advancements. The SaaS segment is anticipated to experience the highest growth rate, driven by its affordability and ease of implementation. The BFSI and IT sectors show higher adoption rates due to the critical need for robust data integration and management.

Key Drivers of Cloud Integration Platform Industry Growth

The growth of the cloud integration platform industry is propelled by several factors: the increasing adoption of cloud computing, the exponential growth of data, the need for real-time data integration, and the rise of big data analytics. Government initiatives promoting digital transformation and the increasing demand for robust data security also contribute significantly to market expansion.

Challenges in the Cloud Integration Platform Industry Sector

The industry faces challenges such as the complexity of integrating legacy systems, ensuring data security and compliance with stringent regulations, and managing the costs associated with cloud deployment. The competitive landscape is intensely competitive, with established players and new entrants vying for market share.

Emerging Opportunities in Cloud Integration Platform Industry

Emerging opportunities lie in the integration of AI and machine learning capabilities, the expansion into new vertical markets (e.g., IoT, edge computing), and the development of solutions that support hybrid and multi-cloud environments. The focus on improved user experience and streamlined integration processes presents significant growth potential.

Leading Players in the Cloud Integration Platform Industry Market

- TIBCO Software Inc

- IBM Corporation

- Software AG

- SnapLogic Inc

- Microsoft Corporation

- MuleSoft Inc

- Oracle Corporation

- Informatica Corporation

- Accenture Inc

- Dell Boomi

- SAP SE

Key Developments in Cloud Integration Platform Industry

- November 2022: Qlik launched Qlik Cloud Data Integration, an eiPaaS designed to create a real-time enterprise data fabric. This launch significantly expands Qlik's presence in the cloud integration market.

- September 2022: UiPath's partnership with Snowflake improved automation capabilities by connecting data directly to business processes, accelerating time-to-value for enterprises.

Future Outlook for Cloud Integration Platform Industry Market

The future of the Cloud Integration Platform market looks promising, with continued growth driven by technological advancements, increased cloud adoption, and the growing need for seamless data integration across diverse systems. Strategic partnerships, acquisitions, and innovation will play key roles in shaping the market's future. The market is poised for substantial growth, presenting significant opportunities for both established players and new entrants.

Cloud Integration Platform Industry Segmentation

-

1. Deployment Mode

- 1.1. PaaS

- 1.2. IaaS

- 1.3. SaaS

-

2. End-user Industry

- 2.1. BFSI

- 2.2. IT

- 2.3. Retail

- 2.4. Education

- 2.5. Healthcare

- 2.6. Other End-user Industries

Cloud Integration Platform Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Cloud Integration Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Cloud Computing Services; Advancements In Industrial IT Infrastructure

- 3.3. Market Restrains

- 3.3.1. Data Security Concerns

- 3.4. Market Trends

- 3.4.1. BFSI Expected to Have Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.1.1. PaaS

- 5.1.2. IaaS

- 5.1.3. SaaS

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. BFSI

- 5.2.2. IT

- 5.2.3. Retail

- 5.2.4. Education

- 5.2.5. Healthcare

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6. North America Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.1.1. PaaS

- 6.1.2. IaaS

- 6.1.3. SaaS

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. BFSI

- 6.2.2. IT

- 6.2.3. Retail

- 6.2.4. Education

- 6.2.5. Healthcare

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7. Europe Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.1.1. PaaS

- 7.1.2. IaaS

- 7.1.3. SaaS

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. BFSI

- 7.2.2. IT

- 7.2.3. Retail

- 7.2.4. Education

- 7.2.5. Healthcare

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8. Asia Pacific Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.1.1. PaaS

- 8.1.2. IaaS

- 8.1.3. SaaS

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. BFSI

- 8.2.2. IT

- 8.2.3. Retail

- 8.2.4. Education

- 8.2.5. Healthcare

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9. Latin America Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.1.1. PaaS

- 9.1.2. IaaS

- 9.1.3. SaaS

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. BFSI

- 9.2.2. IT

- 9.2.3. Retail

- 9.2.4. Education

- 9.2.5. Healthcare

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10. Middle East Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.1.1. PaaS

- 10.1.2. IaaS

- 10.1.3. SaaS

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. BFSI

- 10.2.2. IT

- 10.2.3. Retail

- 10.2.4. Education

- 10.2.5. Healthcare

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 11. North America Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Cloud Integration Platform Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 TIBCO Software Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IBM Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Software AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 SnapLogic Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Microsoft Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mule Soft Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Oracle Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Informatica Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Accenture Inc *List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Dell Boomi

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 SAP SE

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 TIBCO Software Inc

List of Figures

- Figure 1: Global Cloud Integration Platform Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Cloud Integration Platform Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 13: North America Cloud Integration Platform Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 14: North America Cloud Integration Platform Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Cloud Integration Platform Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Cloud Integration Platform Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 19: Europe Cloud Integration Platform Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 20: Europe Cloud Integration Platform Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Cloud Integration Platform Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Cloud Integration Platform Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 25: Asia Pacific Cloud Integration Platform Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 26: Asia Pacific Cloud Integration Platform Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Cloud Integration Platform Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Cloud Integration Platform Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 31: Latin America Cloud Integration Platform Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 32: Latin America Cloud Integration Platform Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Cloud Integration Platform Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Cloud Integration Platform Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 37: Middle East Cloud Integration Platform Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 38: Middle East Cloud Integration Platform Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East Cloud Integration Platform Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East Cloud Integration Platform Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Cloud Integration Platform Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cloud Integration Platform Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Integration Platform Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 3: Global Cloud Integration Platform Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Cloud Integration Platform Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Cloud Integration Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Cloud Integration Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Cloud Integration Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Cloud Integration Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Cloud Integration Platform Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Cloud Integration Platform Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 16: Global Cloud Integration Platform Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Cloud Integration Platform Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 19: Global Cloud Integration Platform Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Cloud Integration Platform Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 22: Global Cloud Integration Platform Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Cloud Integration Platform Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 25: Global Cloud Integration Platform Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Cloud Integration Platform Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 28: Global Cloud Integration Platform Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Cloud Integration Platform Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Integration Platform Industry?

The projected CAGR is approximately 12.00%.

2. Which companies are prominent players in the Cloud Integration Platform Industry?

Key companies in the market include TIBCO Software Inc, IBM Corporation, Software AG, SnapLogic Inc, Microsoft Corporation, Mule Soft Inc, Oracle Corporation, Informatica Corporation, Accenture Inc *List Not Exhaustive, Dell Boomi, SAP SE.

3. What are the main segments of the Cloud Integration Platform Industry?

The market segments include Deployment Mode, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Cloud Computing Services; Advancements In Industrial IT Infrastructure.

6. What are the notable trends driving market growth?

BFSI Expected to Have Significant Growth.

7. Are there any restraints impacting market growth?

Data Security Concerns.

8. Can you provide examples of recent developments in the market?

November 2022: Qlik launched the new cloud-based data integration platform, Qlick Cloud Data Integration, its Enterprise Integration Platform as a Service (eiPaaS) to Enable a Real-Time Enterprise Data Fabric With Automated Data Movement and Advanced Transformations. The platform is a set of SaaS services designed for analytics and data engineers deploying enterprise integration and transformation initiatives. The services form a data fabric that unifies, transforms, and delivers data across an organization via flexible, governed, and reusable data pipelines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Integration Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Integration Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Integration Platform Industry?

To stay informed about further developments, trends, and reports in the Cloud Integration Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence