Key Insights

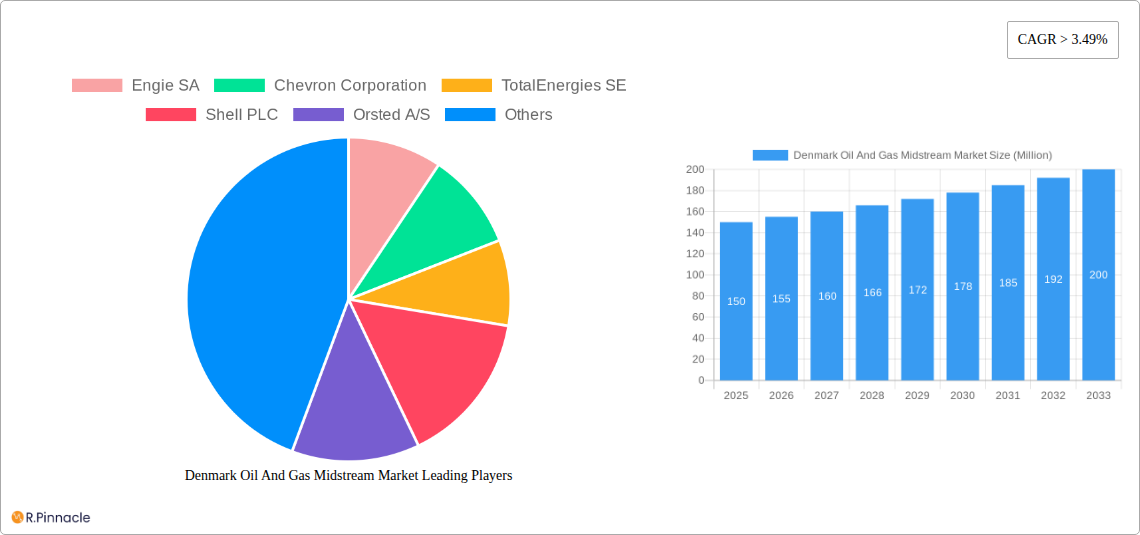

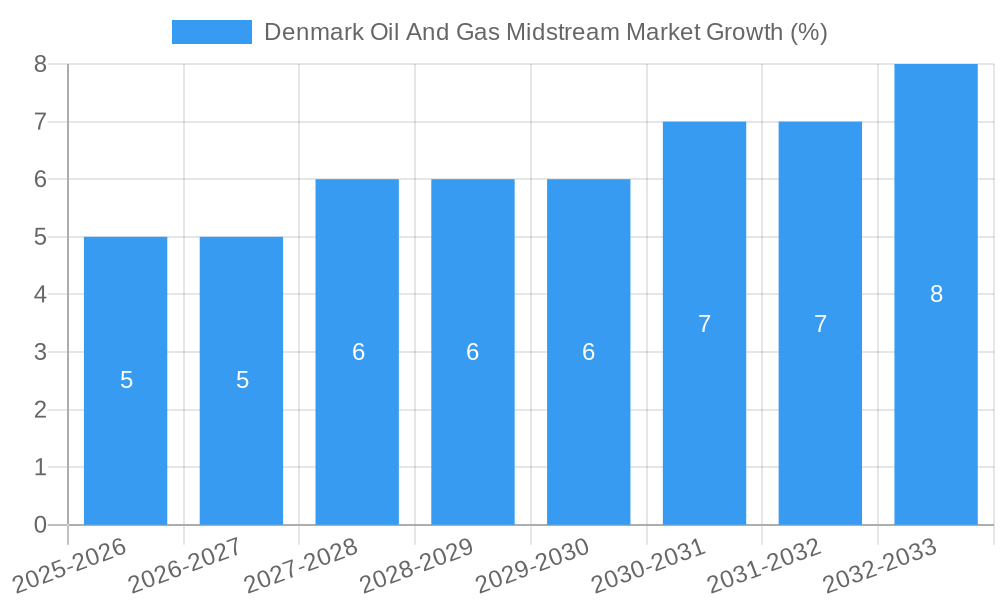

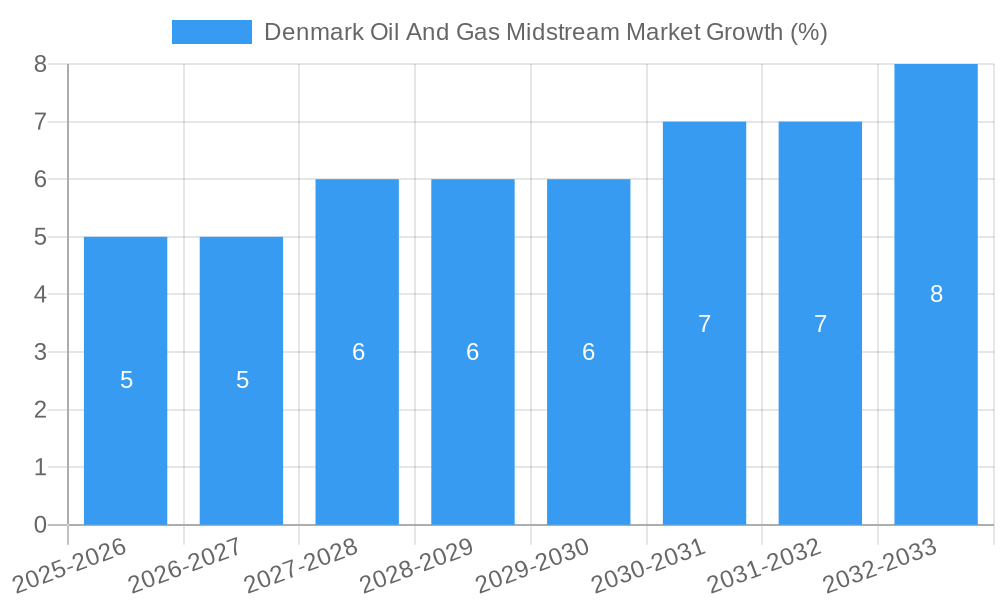

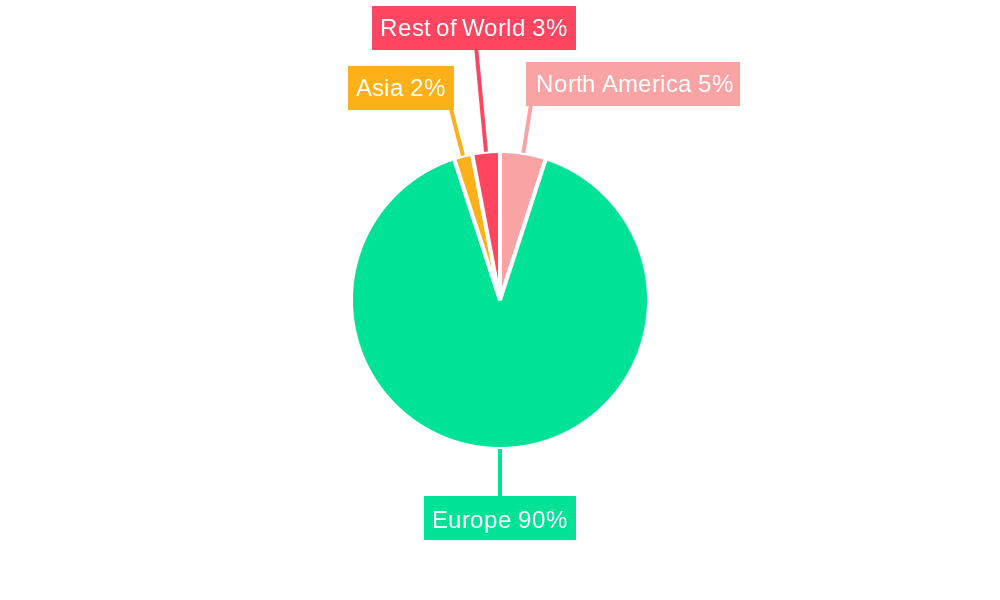

The Denmark Oil and Gas Midstream market, while smaller than major global players, exhibits a steady growth trajectory, driven primarily by increasing domestic energy demand and the ongoing transition towards cleaner energy sources. The market's CAGR exceeding 3.49% indicates a positive outlook, particularly considering Denmark's commitment to renewable energy integration. This commitment, however, also presents a restraint, as investment in midstream infrastructure may be tempered by the gradual phasing out of fossil fuels. The market's segmentation, focused on products like oil, gas, and condensate, reflects the current energy mix, with natural gas likely holding a significant share given its role in the energy transition as a bridging fuel. Key players like Engie SA, TotalEnergies SE, and Orsted A/S (with its growing energy portfolio) are strategically positioned to navigate this evolving landscape, potentially through diversification into related sectors, such as carbon capture and storage, or by focusing on infrastructure servicing the remaining natural gas demand. The North American market, while geographically distant, may indirectly influence Denmark’s market through technological advancements and investment flows. Analyzing historical data from 2019-2024 is crucial for understanding baseline trends and projecting future market behavior accurately. The focus on the period 2025-2033 underscores the market's longer-term potential, despite near-term challenges posed by energy transition policies. The absence of specific market size data for Denmark prevents precise quantification; however, extrapolating from global trends and the CAGR, a reasonable, though speculative, estimation of the market value could be made to inform decision-making.

The forecast for the Denmark Oil and Gas Midstream market suggests a moderate but consistent growth pattern over the next decade. The interplay between energy security concerns, the push for renewable energy, and the existing midstream infrastructure will significantly shape the market's evolution. While a decline in oil and gas production is anticipated over the long term due to climate policies, the ongoing need for natural gas as a transitional fuel source and the existing infrastructure will sustain a level of midstream activity. Further growth could be driven by potential investments in upgrading existing infrastructure for enhanced efficiency and reduced environmental impact. Therefore, understanding the balance between long-term decarbonization goals and short-term energy demand remains paramount in accurately predicting future market dynamics. A detailed analysis of regulatory policies and government incentives related to the energy sector in Denmark would enhance the accuracy of any projections.

Denmark Oil & Gas Midstream Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Denmark Oil & Gas Midstream Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages rigorous data analysis to illuminate market trends, growth drivers, and potential challenges. The report includes detailed segmentation by Product (Oil, Gas, Condensate) and identifies key players such as Engie SA, Chevron Corporation, TotalEnergies SE, Shell PLC, and Orsted A/S.

Denmark Oil And Gas Midstream Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Danish oil and gas midstream market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. We explore the interplay of these factors and their impact on market dynamics.

- Market Concentration: The report details the market share held by key players like Engie SA, Chevron Corporation, TotalEnergies SE, Shell PLC, and Orsted A/S, assessing the degree of competition and potential for consolidation. We will analyze xx Million in M&A deal values over the historical period.

- Innovation Drivers: The report identifies key drivers of innovation, including technological advancements in pipeline infrastructure, storage solutions, and digitalization efforts.

- Regulatory Frameworks: Analysis of the regulatory landscape, including environmental regulations and their impact on market operations and investment decisions.

- Product Substitutes: Exploration of alternative energy sources and their potential to impact the demand for oil and gas midstream services.

- End-User Demographics: Profiling of the end-users of midstream services, including power generation companies, industrial consumers, and residential sectors.

- M&A Activities: A detailed overview of significant mergers and acquisitions within the market, including their impact on market structure and competition. xx Million represents the estimated total value of M&A deals over the forecast period.

Denmark Oil And Gas Midstream Market Market Dynamics & Trends

This section delves into the market's dynamic forces, including growth drivers, technological disruptions, and competitive dynamics. We analyze the historical period (2019-2024) to understand past trends and project future growth using a robust forecasting methodology.

The report will analyze the Compound Annual Growth Rate (CAGR) of the Danish oil and gas midstream market during the forecast period (2025-2033) and examine factors influencing market penetration. The analysis will consider the impact of fluctuating oil and gas prices, government policies promoting energy transition, and evolving consumer preferences on market growth. The discussion will also incorporate a comprehensive assessment of competitive dynamics, including pricing strategies, market share, and technological innovation among key players. We will examine the roles of Engie SA, Chevron Corporation, TotalEnergies SE, Shell PLC, and Orsted A/S and their strategic approaches within this evolving landscape.

Dominant Regions & Segments in Denmark Oil And Gas Midstream Market

This section identifies the leading regions and segments within the Danish oil and gas midstream market, focusing on the Product segment (Oil, Gas, Condensate).

- Key Drivers for Dominance:

- Economic Policies: Government support for infrastructure development and energy security initiatives.

- Infrastructure: Existing pipeline networks and storage facilities.

- Proximity to Markets: Convenient access to consumers and export markets.

- Geopolitical Factors: Denmark's strategic location in the Baltic region.

A detailed analysis will be provided to explain the factors contributing to the dominance of a specific region or segment in detail. We'll compare the performance of different regions and segments, evaluating their growth trajectories and market shares. The analysis will include estimates for market size for each segment (Oil, Gas, Condensate) over the study period (2019-2033).

Denmark Oil And Gas Midstream Market Product Innovations

This section summarizes recent product developments, highlighting technological advancements and their impact on market competitiveness. We will showcase innovative pipeline technologies, enhanced storage solutions, and the integration of digital technologies for improved efficiency and safety. This analysis will underscore the competitive advantages derived from these innovations and their market fit within the Danish context.

Report Scope & Segmentation Analysis

This report segments the Denmark Oil & Gas Midstream Market primarily by Product: Oil, Gas, and Condensate. Each segment's analysis includes growth projections, market size estimations, and competitive dynamics. Detailed breakdowns of each segment will be provided, offering insights into their unique characteristics and future growth potential.

- Oil: Detailed analysis of the oil segment, including growth projections and market size estimations.

- Gas: Detailed analysis of the gas segment, including growth projections and market size estimations.

- Condensate: Detailed analysis of the condensate segment, including growth projections and market size estimations.

Key Drivers of Denmark Oil And Gas Midstream Market Growth

Several factors contribute to the growth of the Denmark Oil & Gas Midstream Market. These include technological advancements improving efficiency and safety, supportive government policies promoting energy security, and the rising demand for energy in the region. Furthermore, strategic investments in infrastructure development play a crucial role.

Challenges in the Denmark Oil And Gas Midstream Market Sector

The Denmark Oil & Gas Midstream Market faces challenges such as stringent environmental regulations, increasing costs associated with infrastructure maintenance and upgrades, and the growing pressure to reduce carbon emissions. These factors pose potential hurdles to market growth and require careful management by stakeholders. The report quantifies the impact of these challenges on market growth.

Emerging Opportunities in Denmark Oil And Gas Midstream Market

Despite challenges, opportunities exist for growth. These include expanding offshore oil and gas exploration activities, investments in renewable gas infrastructure, and the adoption of innovative technologies to enhance operational efficiency and sustainability. Furthermore, the report explores opportunities in emerging markets and new technologies within the sector.

Leading Players in the Denmark Oil And Gas Midstream Market Market

Key Developments in Denmark Oil And Gas Midstream Market Industry

- November 2022: The Baltic Pipe LNG receiving terminal in Nybro near Varde in Western Jutland, Denmark, was operated at half its total capacity (6,700 MWh/h), highlighting challenges in scaling up LNG infrastructure.

- November 2022: GAZ-SYSTEM signed an agreement with Rambøll Danmark A/S to design the marine infrastructure for a floating storage regasification unit (FSRU) terminal, signifying investments in expanding LNG import capacity.

Future Outlook for Denmark Oil And Gas Midstream Market Market

The future of the Denmark Oil & Gas Midstream Market is tied to the country's energy transition strategy. While the market faces challenges related to decarbonization, opportunities abound in renewable gas infrastructure and innovative solutions for reducing emissions. Strategic partnerships and investments will be crucial for sustainable growth in the coming years. The report concludes with a projection of market size and key opportunities for growth through 2033.

Denmark Oil And Gas Midstream Market Segmentation

- 1. Transportation

- 2. Storage

- 3. LNG Terminals

Denmark Oil And Gas Midstream Market Segmentation By Geography

- 1. Denmark

Denmark Oil And Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Transportation Sector is expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Oil And Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. United States Denmark Oil And Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada Denmark Oil And Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Denmark Oil And Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Engie SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Chevron Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 TotalEnergies SE

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Shell PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Orsted A/S

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.1 Engie SA

List of Figures

- Figure 1: Denmark Oil And Gas Midstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Oil And Gas Midstream Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 4: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Transportation 2019 & 2032

- Table 5: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 6: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Storage 2019 & 2032

- Table 7: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 8: Denmark Oil And Gas Midstream Market Volume Million Forecast, by LNG Terminals 2019 & 2032

- Table 9: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 13: United States Denmark Oil And Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Denmark Oil And Gas Midstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Denmark Oil And Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Denmark Oil And Gas Midstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Denmark Oil And Gas Midstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Denmark Oil And Gas Midstream Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 20: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Transportation 2019 & 2032

- Table 21: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 22: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Storage 2019 & 2032

- Table 23: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 24: Denmark Oil And Gas Midstream Market Volume Million Forecast, by LNG Terminals 2019 & 2032

- Table 25: Denmark Oil And Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Denmark Oil And Gas Midstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Oil And Gas Midstream Market?

The projected CAGR is approximately > 3.49%.

2. Which companies are prominent players in the Denmark Oil And Gas Midstream Market?

Key companies in the market include Engie SA, Chevron Corporation, TotalEnergies SE, Shell PLC, Orsted A/S.

3. What are the main segments of the Denmark Oil And Gas Midstream Market?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Transportation Sector is expected to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

November 2022: The Baltic Pipe LNG receiving terminal in Nybro near Varde in Western Jutland, Denmark, was operated at half the total capacity (6,700 MWh/h).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Oil And Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Oil And Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Oil And Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Denmark Oil And Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence