Key Insights

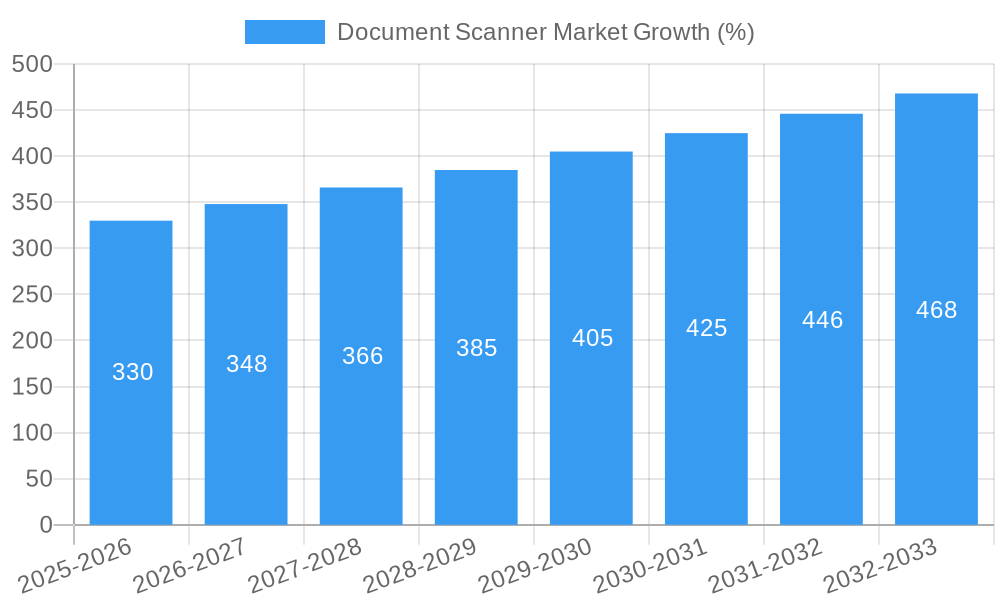

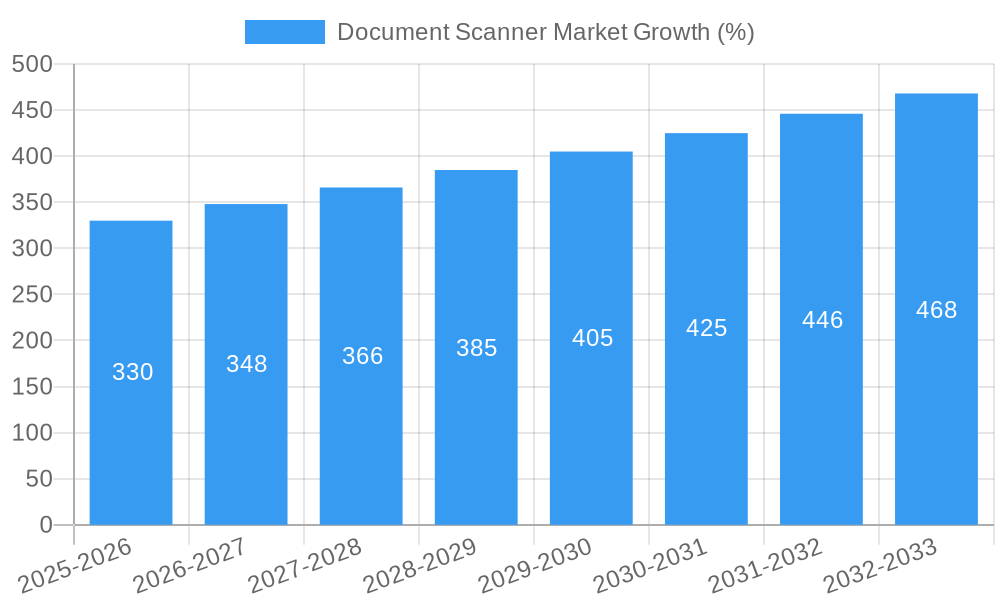

The global document scanner market, valued at $6.40 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.09% from 2025 to 2033. This expansion is fueled by several key factors. The increasing digitization of businesses across sectors like BFSI (Banking, Financial Services, and Insurance), government, IT & Telecom, and educational institutions is a primary driver. The need for efficient document management, improved data security, and streamlined workflows are compelling organizations to adopt document scanners for improved productivity and reduced operational costs. Furthermore, technological advancements in scanner technology, including improved image quality, faster scanning speeds, and enhanced features like cloud integration and automated data extraction, are further propelling market growth. The rising adoption of cloud-based solutions for document storage and management also contributes significantly to this market's expansion. While the market faces challenges such as the initial investment costs associated with scanner acquisition and implementation, the long-term benefits in terms of efficiency and cost savings are outweighing these concerns. Competition among established players like Canon, Xerox, HP, Fujitsu, Epson, and Brother, along with emerging players, ensures continuous innovation and a wide range of choices for consumers. Geographic expansion, particularly in developing economies experiencing rapid digitization, presents lucrative growth opportunities.

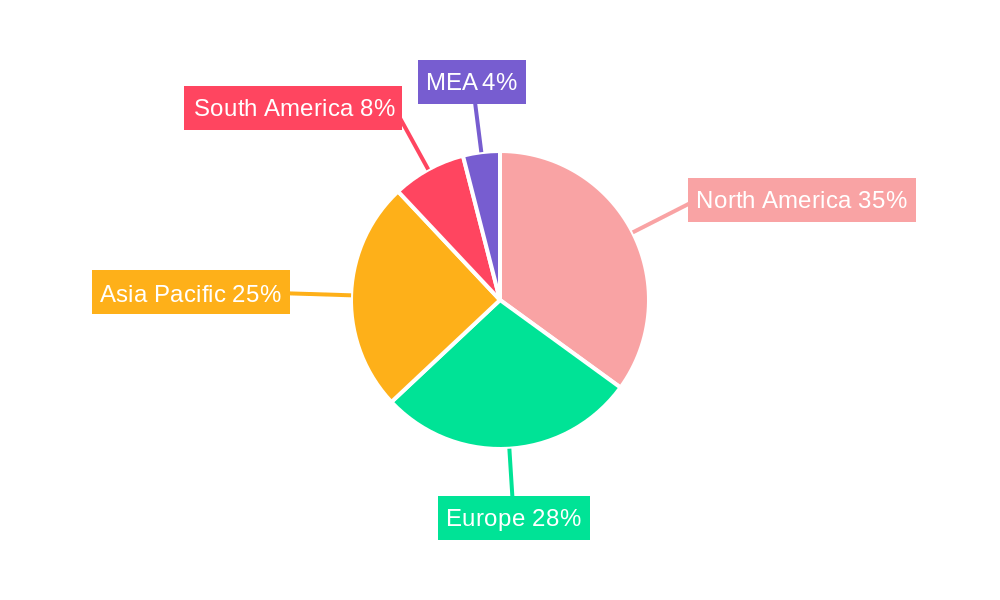

The market segmentation reveals a strong demand across diverse applications. Government agencies are increasingly adopting document scanners for efficient record-keeping and archival purposes. The BFSI sector relies heavily on scanners for processing large volumes of financial documents, ensuring compliance, and reducing manual errors. IT and Telecom companies utilize scanners for various purposes, including contract management, technical documentation, and customer service. Educational institutions employ them for digitizing academic records, research papers, and administrative documents. While North America and Europe currently hold significant market share, the Asia-Pacific region is poised for substantial growth, driven by increasing government initiatives promoting digitalization and rapid economic expansion in countries like China and India. The forecast period (2025-2033) anticipates continued market expansion, reflecting the ongoing trend toward digital transformation and the sustained demand for efficient document management solutions.

Document Scanner Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Document Scanner Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Study Period), with a base year of 2025 and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and opportunities. The market is segmented by application, encompassing Government, BFSI, IT & Telecom, Educational Institutions, and Other Applications. Key players analyzed include Canon Inc, Xerox Corporation, HP Inc, Fujitsu Limited, Seiko Epson Corporation, Brother Industries Ltd, Mustek Systems Inc, Plustek Corp, and others.

Document Scanner Market Structure & Innovation Trends

The Document Scanner Market exhibits a moderately concentrated structure, with a few major players holding significant market share. Precise market share figures for each company are unavailable and will be included in the final report; however, Canon, Epson, and HP are expected to be among the leading players. Innovation is driven by the increasing need for efficient document management, particularly within the digital workplace. Regulatory frameworks concerning data privacy and security are impacting product development and market adoption. Significant M&A activity has not been observed recently, though strategic alliances, such as the August 2023 partnership between Konica Minolta and Epson America, showcase the collaborative nature of market expansion. The report delves into these trends, providing a detailed analysis of market concentration, innovation drivers, regulatory impact, substitute products, end-user demographics, and significant M&A activities including deal values (if available). The analysis includes quantitative metrics such as market share and M&A deal values where data is available.

Document Scanner Market Dynamics & Trends

The Document Scanner Market is experiencing robust growth, driven by factors such as the increasing digitization of businesses across all sectors, a growing preference for cloud-based document management solutions, and the expanding adoption of workflow automation. The market's Compound Annual Growth Rate (CAGR) during the forecast period is projected to be xx%. Market penetration is particularly high in developed economies, with developing nations showing significant growth potential. Technological disruptions, such as advancements in AI-powered image processing and improved optical character recognition (OCR) capabilities, are further enhancing market growth. The report provides a detailed examination of these factors, quantifying their influence on market expansion and providing projections for future market dynamics.

Dominant Regions & Segments in Document Scanner Market

The report identifies xx as the leading region in the Document Scanner Market in 2025, driven by a robust economy and advanced infrastructure. The BFSI sector is expected to be the largest application segment, owing to the high volume of document processing involved in banking and financial transactions.

Key Drivers for Dominant Regions/Segments:

- North America: Strong IT infrastructure, high adoption rate of digital technologies, and stringent data security regulations.

- BFSI Segment: High volume of document processing, strict compliance requirements, and growing need for efficient document management systems.

Detailed analysis will be provided for each segment and region, exploring their unique market characteristics, drivers, and future growth potential.

Document Scanner Market Product Innovations

Recent innovations in the document scanner market include the development of compact, high-speed scanners with enhanced OCR capabilities and improved connectivity options. Epson's recent launch of the DS-C330, DS-C480W, and DS-C490 models, focusing on space-saving design, exemplifies this trend. These advancements enable businesses to streamline their workflows and improve efficiency while reducing their environmental impact.

Report Scope & Segmentation Analysis

The report segments the Document Scanner Market by application:

Government: This segment is characterized by high demand for secure and reliable scanners, driven by increasing digitization initiatives. Growth is projected to be xx% during the forecast period.

BFSI: This segment is anticipated to show substantial growth due to the high volume of documents processed. Market size is expected to reach xx Million by 2033.

IT & Telecom: This segment's growth is driven by the demand for efficient document management in a fast-paced, digital environment.

Educational Institutions: This segment's growth is closely linked to increased digitalization in schools and universities.

Other Applications: This segment comprises a diverse range of applications, showcasing steady growth potential.

Key Drivers of Document Scanner Market Growth

The Document Scanner Market is propelled by several key factors:

- Increasing Digitization: Businesses across various sectors are increasingly adopting digital technologies, creating higher demand for document scanners.

- Workflow Automation: Efficient document management via automation is a key requirement for modern businesses, driving market growth.

- Stringent Regulatory Compliance: Growing data security and privacy regulations are encouraging adoption of secure document management solutions, positively impacting demand.

Challenges in the Document Scanner Market Sector

Challenges faced by the Document Scanner Market include:

- High Initial Investment Costs: The high cost of advanced document scanners can be a barrier for some businesses, especially small and medium-sized enterprises.

- Technological Advancements: The rapid evolution of scanning technology requires continuous upgrades and adaptations, posing challenges for businesses.

- Intense Competition: The presence of multiple established players creates intense competition, impacting profit margins and market share.

Emerging Opportunities in Document Scanner Market

The Document Scanner Market presents several significant growth opportunities:

- Expansion into Emerging Markets: Developing economies present a vast untapped market potential with increasing digitalization.

- Integration with Cloud Platforms: Cloud-based document management systems offer enhanced scalability and accessibility, creating lucrative growth avenues.

- Development of AI-powered Solutions: AI-powered features such as advanced OCR and automated document classification offer significant opportunities.

Leading Players in the Document Scanner Market Market

- Canon Inc

- Xerox Corporation

- HP Inc

- Fujitsu Limited

- Seiko Epson Corporation

- Brother Industries Ltd

- Mustek Systems Inc

- Plustek Corp

Key Developments in Document Scanner Market Industry

August 2023: Konica Minolta Business Solutions U.S.A., Inc. announced a strategic alliance with Epson America, Inc., expanding Konica Minolta's scanning solutions portfolio. This collaboration strengthens both companies' market positions and expands their reach to a wider customer base.

August 2023: Epson America introduced the DS-C330, DS-C480W, and DS-C490 compact desktop document scanners, focusing on space-saving design and improved efficiency. This launch directly addresses the market demand for compact, high-performance scanners.

Future Outlook for Document Scanner Market Market

The Document Scanner Market is poised for continued growth, driven by sustained digitization across various sectors and the growing need for efficient document management solutions. Emerging technologies like AI and cloud integration will play a significant role in shaping future market dynamics. Strategic partnerships and collaborations, as seen with the Konica Minolta-Epson alliance, will further fuel market expansion, presenting lucrative opportunities for both established players and new entrants.

Document Scanner Market Segmentation

-

1. Application

- 1.1. Government

- 1.2. BFSI

- 1.3. IT & Telecom

- 1.4. Educational Institutions

- 1.5. Other Applications

Document Scanner Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Document Scanner Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.09% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of High-speed Document Scanners

- 3.3. Market Restrains

- 3.3.1. Digital Transformation Solutions (Mobile Printing) Being Integrated into the Workplace

- 3.4. Market Trends

- 3.4.1. Increasing Use of High-speed Document Scanners to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Government

- 5.1.2. BFSI

- 5.1.3. IT & Telecom

- 5.1.4. Educational Institutions

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Government

- 6.1.2. BFSI

- 6.1.3. IT & Telecom

- 6.1.4. Educational Institutions

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Government

- 7.1.2. BFSI

- 7.1.3. IT & Telecom

- 7.1.4. Educational Institutions

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Government

- 8.1.2. BFSI

- 8.1.3. IT & Telecom

- 8.1.4. Educational Institutions

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Government

- 9.1.2. BFSI

- 9.1.3. IT & Telecom

- 9.1.4. Educational Institutions

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Government

- 10.1.2. BFSI

- 10.1.3. IT & Telecom

- 10.1.4. Educational Institutions

- 10.1.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East and Africa Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Government

- 11.1.2. BFSI

- 11.1.3. IT & Telecom

- 11.1.4. Educational Institutions

- 11.1.5. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. North America Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. North America Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United States

- 16.1.2 Canada

- 16.1.3 Mexico

- 17. MEA Document Scanner Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 Saudi Arabia

- 17.1.3 South Africa

- 17.1.4 Rest of Middle East and Africa

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Canon Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Xerox Corporation

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 HP Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Fujitsu Limited

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Seiko Epson Corporation

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Brother Industries Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Mustek Systems Inc *List Not Exhaustive

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Plustek Corp

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.1 Canon Inc

List of Figures

- Figure 1: Global Document Scanner Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Document Scanner Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Document Scanner Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Document Scanner Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Document Scanner Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Document Scanner Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Asia Document Scanner Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Asia Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Australia and New Zealand Document Scanner Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Australia and New Zealand Document Scanner Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Australia and New Zealand Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Australia and New Zealand Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Document Scanner Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Document Scanner Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America Document Scanner Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Document Scanner Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Middle East and Africa Document Scanner Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Middle East and Africa Document Scanner Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East and Africa Document Scanner Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Document Scanner Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Document Scanner Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Document Scanner Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Belgium Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherland Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Nordics Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Southeast Asia Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Australia Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Phillipes Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Thailandc Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia Pacific Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Peru Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Chile Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Colombia Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Ecuador Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Venezuela Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: United States Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Canada Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Mexico Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Arab Emirates Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Saudi Arabia Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East and Africa Document Scanner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Document Scanner Market Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global Document Scanner Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Document Scanner Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Document Scanner Market Revenue Million Forecast, by Application 2019 & 2032

- Table 56: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Global Document Scanner Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Document Scanner Market Revenue Million Forecast, by Application 2019 & 2032

- Table 60: Global Document Scanner Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Document Scanner Market?

The projected CAGR is approximately 5.09%.

2. Which companies are prominent players in the Document Scanner Market?

Key companies in the market include Canon Inc, Xerox Corporation, HP Inc, Fujitsu Limited, Seiko Epson Corporation, Brother Industries Ltd, Mustek Systems Inc *List Not Exhaustive, Plustek Corp.

3. What are the main segments of the Document Scanner Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of High-speed Document Scanners.

6. What are the notable trends driving market growth?

Increasing Use of High-speed Document Scanners to Drive the Market.

7. Are there any restraints impacting market growth?

Digital Transformation Solutions (Mobile Printing) Being Integrated into the Workplace.

8. Can you provide examples of recent developments in the market?

August 2023: Konica Minolta Business Solutions U.S.A., Inc. reported a strategic alliance with Epson America, Inc. Konica Minolta will offer Epson’s retail scanning solutions to its nationwide network of channel partners and office equipment dealers. The collaboration will enable Konica Minolta to provide a broad range of scanning solutions to meet the growing needs of its consumers and partners. In advanced document management technologies, IT Services, and application solutions, Konica Minolta concentrates on comprehensive solutions, including business systems, digital services, production print methods and printers, vertical application solutions, and related services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Document Scanner Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Document Scanner Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Document Scanner Market?

To stay informed about further developments, trends, and reports in the Document Scanner Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence