Key Insights

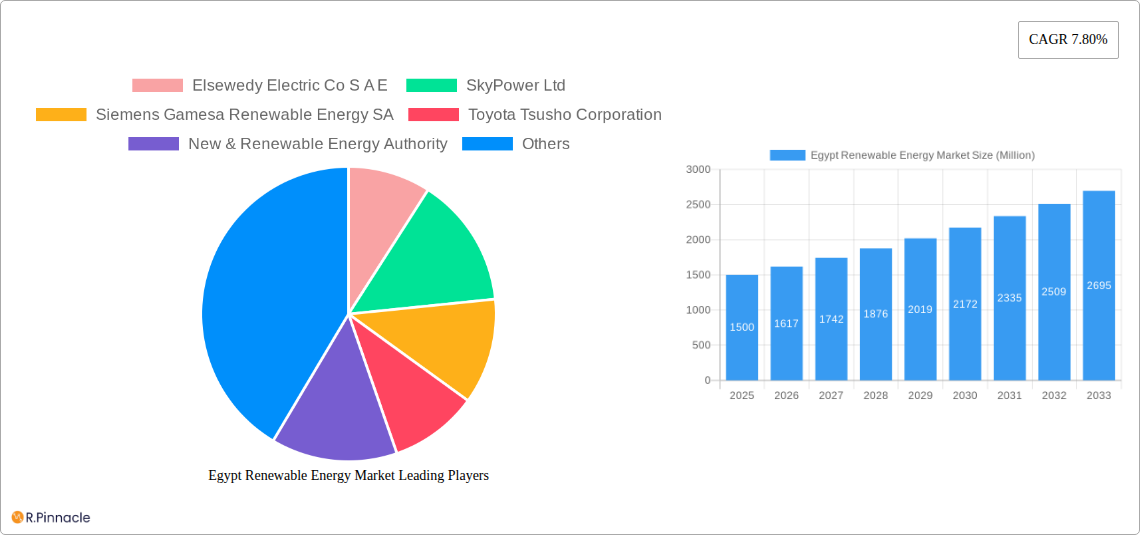

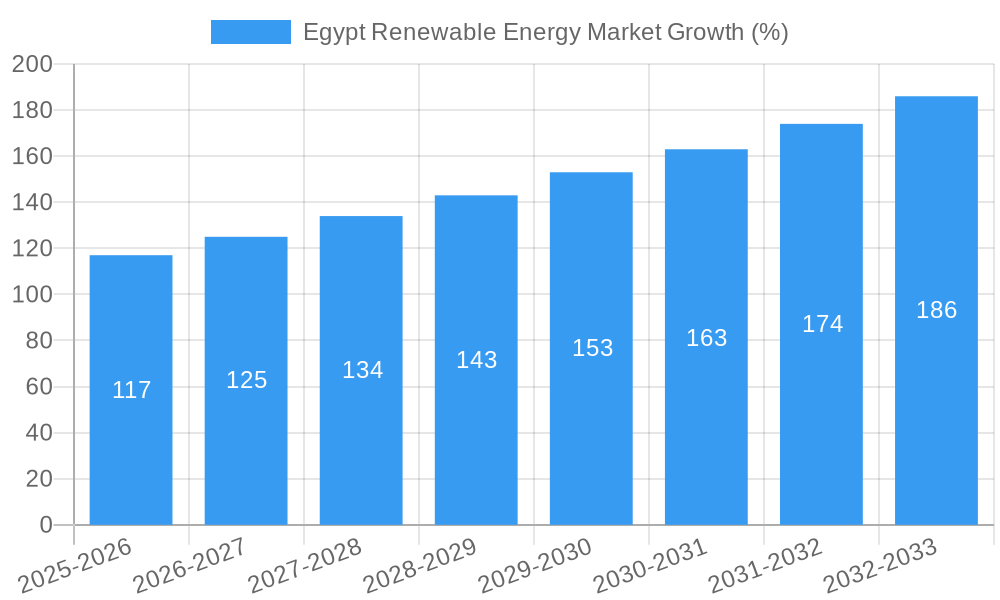

The Egypt renewable energy market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.80% from 2019 to 2024, is poised for significant expansion over the forecast period (2025-2033). Driven by the government's ambitious renewable energy targets, decreasing technology costs, and increasing electricity demand, the market is witnessing considerable investments in various renewable energy sources. Hydropower, solar, and wind power constitute the major segments, with solar likely experiencing the fastest growth due to its cost-effectiveness and abundant sunlight. Key players like Elsewedy Electric, SkyPower, Siemens Gamesa, and Vestas are actively involved in project development, contributing to the market's expansion. While regulatory frameworks and grid infrastructure limitations present challenges, ongoing government initiatives aimed at streamlining the permitting process and grid modernization are addressing these constraints. The market's growth is expected to be further fueled by increasing private sector participation and favorable investment policies, attracting international players and fostering innovation within the sector.

The projected market size for 2025, considering the provided CAGR and a base year of 2025, allows for a reasonable projection of the market's trajectory beyond 2025. While specific market size figures for 2019-2024 are absent, the consistent 7.80% CAGR suggests a steadily growing market. Utilizing the 2025 value (which needs to be provided) as a base, the forecast period (2025-2033) can be projected based on this consistent growth, allowing for a clear understanding of market size and growth at each stage of the forecast period. This growth will likely be unevenly distributed across segments. Solar and wind energy are anticipated to take the lead, supported by technological advancements making them increasingly competitive with fossil fuels. Hydropower, while a significant contributor, may witness a comparatively slower growth rate due to its geographic limitations and environmental considerations.

Egypt Renewable Energy Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Egypt renewable energy market, offering valuable insights for industry professionals, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future potential. The report leverages extensive data and analysis to provide a clear picture of the Egyptian renewable energy landscape, highlighting key segments, leading players, and emerging opportunities. The total market size is projected to reach xx Million USD by 2033.

Egypt Renewable Energy Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory frameworks shaping the Egyptian renewable energy market. The market is characterized by a mix of international and domestic players, with varying degrees of market concentration across different segments. Key metrics such as market share and M&A deal values are analyzed to provide a nuanced understanding of the market structure.

Market Concentration: The market exhibits moderate concentration, with key players holding significant market share in specific segments like solar and wind. Elsewedy Electric, for example, holds a substantial share of the solar PV market. However, increasing participation from international players suggests a trend toward greater competition.

Innovation Drivers: Government support through feed-in tariffs, renewable energy targets, and investment incentives are major drivers of innovation. Technological advancements in solar PV and wind turbine technology further contribute to market growth.

Regulatory Framework: Egypt's regulatory framework is evolving, with initiatives aimed at streamlining permitting processes and fostering private sector investment. However, regulatory uncertainty remains a challenge in certain areas.

Product Substitutes: While renewable energy sources are increasingly competitive with fossil fuels, the market also sees some competition from alternative renewable sources such as biomass.

End-User Demographics: The primary end-users are primarily utilities, independent power producers (IPPs), and increasingly, industrial and commercial consumers. Residential adoption is growing but slower than the utility-scale deployment.

M&A Activities: Recent years have witnessed significant M&A activity, with deals valued at several billion USD. The acquisition of xx by xx in 202x illustrates the ongoing consolidation trend within the sector.

Egypt Renewable Energy Market Market Dynamics & Trends

This section delves into the key market dynamics influencing the growth trajectory of Egypt's renewable energy sector. Analysis includes drivers, disruptions, consumer preferences, and competitive dynamics. The compound annual growth rate (CAGR) and market penetration rates for different segments are presented. The market exhibits significant growth potential, fueled by the government's ambitious renewable energy targets and the decreasing costs of renewable technologies.

The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), driven by favorable government policies, increasing energy demand, and falling technology costs. Market penetration for solar and wind energy is projected to significantly increase, reaching xx% and xx%, respectively, by 2033.

Dominant Regions & Segments in Egypt Renewable Energy Market

This section identifies the leading regions and segments within the Egyptian renewable energy market. Detailed analysis is provided for each segment – Hydro Power, Solar, Wind, and Other Types – highlighting key drivers of growth. The solar segment is expected to be the dominant type, particularly in the Aswan governorate. The Red Sea governorate's potential for wind energy is being tapped, with significant investment already planned.

Solar: Key drivers include abundant solar resources, government incentives, and declining solar PV costs. The Aswan governorate is a primary area for large-scale solar projects.

Wind: The Red Sea governorate’s high wind speeds make it an attractive location for wind power development. Government policies supporting large-scale wind farms further bolster this segment's growth.

Hydro Power: While existing hydropower capacity contributes significantly, future growth in this segment is limited due to geographical constraints.

Other Types: This segment encompasses other renewable energy sources such as biomass and geothermal energy.

Egypt Renewable Energy Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages within the Egyptian renewable energy market. Technological advancements, particularly in solar PV and wind turbine technologies, are driving improvements in efficiency and cost reduction, making renewable energy increasingly competitive. The focus is on grid integration technologies to ensure the smooth functioning of the increasing renewable energy share within the grid.

Report Scope & Segmentation Analysis

This report provides a detailed analysis of the Egyptian renewable energy market across various segments including Hydro Power, Solar, Wind, and Other Types. Growth projections for each segment are presented, along with their corresponding market size and competitive dynamics. The solar sector exhibits the fastest projected growth. The wind sector also shows considerable potential driven by large-scale project investments. The hydropower segment shows relatively less growth potential, given existing capacity limitations. The 'Other Types' segment’s growth will depend on developments in biomass and geothermal.

Key Drivers of Egypt Renewable Energy Market Growth

The growth of the Egyptian renewable energy market is driven by several factors including:

- Government Policies: Ambitious renewable energy targets and supportive policies, including feed-in tariffs and investment incentives.

- Decreasing Technology Costs: The cost of solar PV and wind energy has significantly decreased in recent years, making them increasingly competitive.

- Increasing Energy Demand: Egypt's growing population and economy are driving increased energy demand, presenting an opportunity for renewable energy sources.

Challenges in the Egypt Renewable Energy Market Sector

Several challenges hinder the growth of Egypt’s renewable energy sector:

- Grid Infrastructure: The existing grid infrastructure may not be fully adequate to support the rapid integration of renewable energy sources.

- Financing: Securing sufficient financing for large-scale renewable energy projects can be challenging.

- Land Acquisition: Acquiring suitable land for large renewable energy projects can sometimes be a lengthy and complex process.

Emerging Opportunities in Egypt Renewable Energy Market

Several opportunities exist for growth within the Egyptian renewable energy market:

- Large-scale Projects: The potential for developing large-scale solar and wind farms remains significant.

- Energy Storage: The development of energy storage solutions to address the intermittency of renewable energy sources presents significant opportunities.

- Green Hydrogen: Egypt is well-positioned to leverage its renewable resources for green hydrogen production, providing additional growth avenues.

Leading Players in the Egypt Renewable Energy Market Market

- Elsewedy Electric Co S A E

- SkyPower Ltd

- Siemens Gamesa Renewable Energy SA

- Toyota Tsusho Corporation

- New & Renewable Energy Authority

- Scatec Solar ASA

- Vestas Wind Systems AS

- Orascom Development Holding AG

Key Developments in Egypt Renewable Energy Market Industry

- June 2023: A USD 10 billion agreement for a 10 GW wind farm secured by a consortium including Masdar and the New and Renewable Energy Authority.

- December 2022: A USD 1.1 billion agreement signed with AMEA Power for a 1 GW combined solar and wind project.

Future Outlook for Egypt Renewable Energy Market Market

The future of the Egyptian renewable energy market is bright. Continued government support, decreasing technology costs, and increasing energy demand will drive significant growth in the coming years. Strategic investments in grid infrastructure and energy storage will further enhance the sector's potential. The market is poised to become a major player in the global renewable energy landscape.

Egypt Renewable Energy Market Segmentation

-

1. Type

- 1.1. Hydro Power

- 1.2. Solar

- 1.3. Wind

- 1.4. Other Types

Egypt Renewable Energy Market Segmentation By Geography

- 1. Egypt

Egypt Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Regulations 4.; Growing Demand for Solar Energy

- 3.3. Market Restrains

- 3.3.1. 4.; The Slow Pace of Energy Infrastructure Development and Restricted Land

- 3.4. Market Trends

- 3.4.1. Solar Energy is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydro Power

- 5.1.2. Solar

- 5.1.3. Wind

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Elsewedy Electric Co S A E

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SkyPower Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Gamesa Renewable Energy SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toyota Tsusho Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 New & Renewable Energy Authority

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Scatec Solar ASA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vestas Wind Systems AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Orascom Development Holding AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Elsewedy Electric Co S A E

List of Figures

- Figure 1: Egypt Renewable Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Renewable Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Renewable Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Egypt Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Egypt Renewable Energy Market Volume gigawatt Forecast, by Type 2019 & 2032

- Table 5: Egypt Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Egypt Renewable Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Egypt Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Egypt Renewable Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Egypt Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Egypt Renewable Energy Market Volume gigawatt Forecast, by Type 2019 & 2032

- Table 11: Egypt Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Egypt Renewable Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Renewable Energy Market?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the Egypt Renewable Energy Market?

Key companies in the market include Elsewedy Electric Co S A E , SkyPower Ltd, Siemens Gamesa Renewable Energy SA, Toyota Tsusho Corporation, New & Renewable Energy Authority, Scatec Solar ASA, Vestas Wind Systems AS, Orascom Development Holding AG.

3. What are the main segments of the Egypt Renewable Energy Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Regulations 4.; Growing Demand for Solar Energy.

6. What are the notable trends driving market growth?

Solar Energy is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; The Slow Pace of Energy Infrastructure Development and Restricted Land.

8. Can you provide examples of recent developments in the market?

In June 2023, a group of companies, including Abu Dhabi’s Masdar, have inked an agreement with Egypt’s New and Renewable Energy Authority. The agreement is to secure land for a USD 10 billion wind farm. The farm will have a capacity of 10 GW and will produce 47,790 gigawatt hours of clean energy annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Egypt Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence