Key Insights

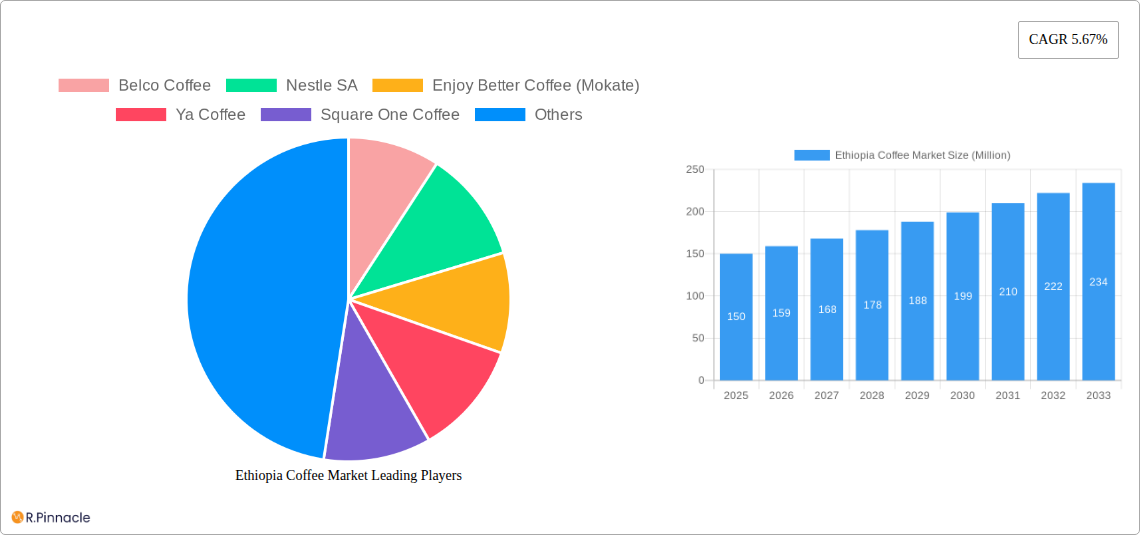

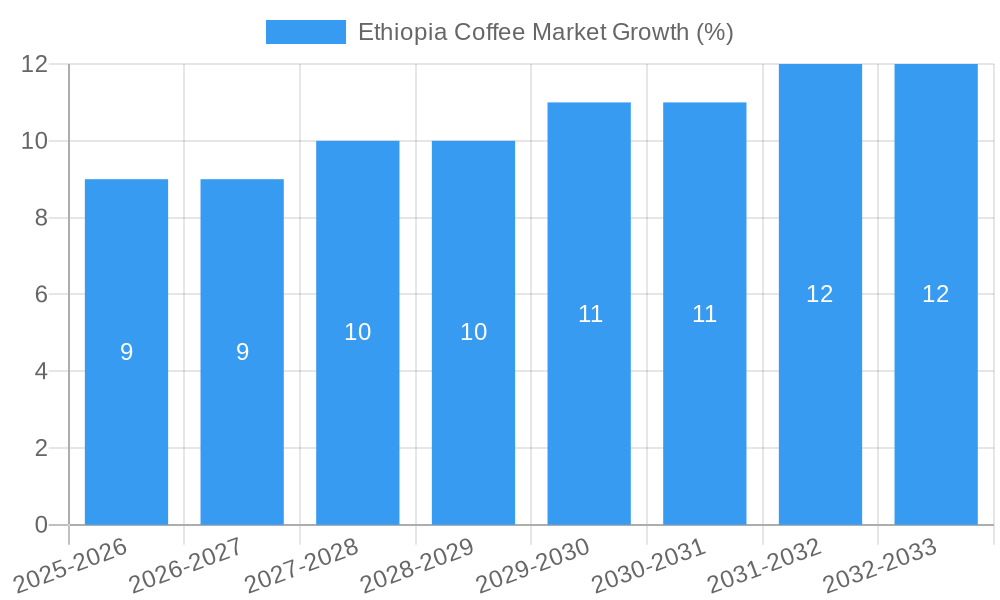

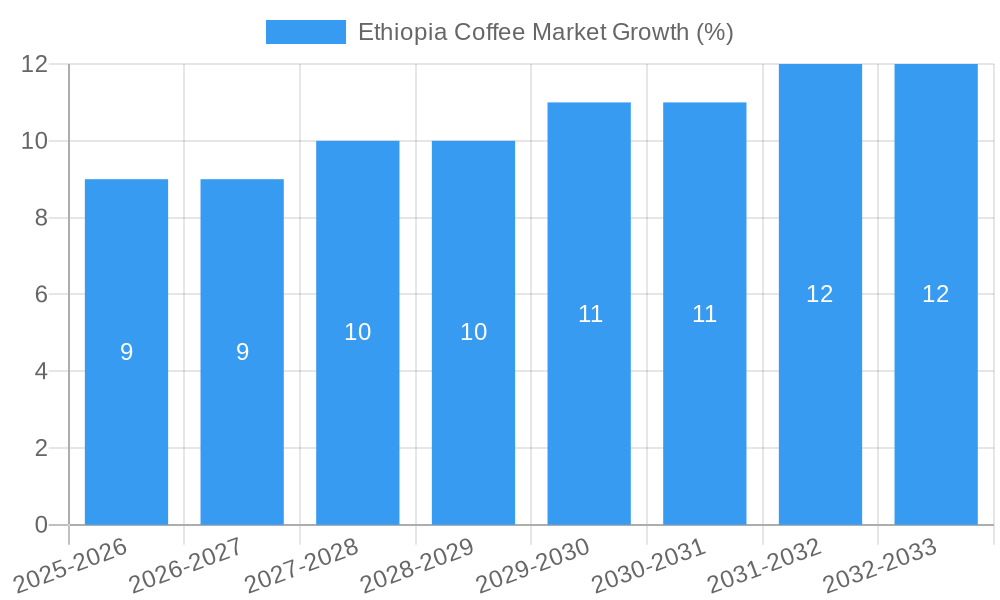

The Ethiopian coffee market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.67% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes within Ethiopia are increasing consumer spending on premium coffee products, particularly among younger demographics embracing specialty coffee culture. Furthermore, the growth of the food service sector, including cafes and restaurants, significantly boosts demand for whole bean and ground coffee. The increasing popularity of single-origin Ethiopian coffee, globally recognized for its unique flavor profiles, is another significant driver, attracting both domestic and international consumers. However, challenges remain, including fluctuations in coffee bean production due to climate change and the need for consistent quality control to maintain international competitiveness. Increased investment in sustainable farming practices and improved infrastructure are crucial for mitigating these restraints and ensuring the long-term success of the Ethiopian coffee industry.

The market segmentation reveals a significant share held by the off-trade channel (retail sales), but the on-trade (food service) segment is experiencing rapid growth, indicating a shift towards coffee consumption outside the home. While whole bean coffee maintains a strong presence, the demand for ground and instant coffee is also rising, driven by convenience and affordability. Key players like Nestle SA, Belco Coffee, and numerous local cooperatives are competing intensely, focusing on product differentiation, branding, and distribution networks to capture market share. The forecast for 2033 suggests a market size exceeding $YY million (calculated using the provided CAGR and 2025 market size), indicating substantial potential for investment and expansion in the Ethiopian coffee industry. This growth trajectory underscores the importance of Ethiopia's coffee sector in its national economy and its potential as a global coffee powerhouse.

Ethiopia Coffee Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Ethiopia coffee market, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market size, growth drivers, challenges, and emerging opportunities. The report leverages extensive data analysis and incorporates key industry developments to provide a holistic view of the Ethiopian coffee landscape. Expected market value is estimated at xx Million in 2025.

Ethiopia Coffee Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of the Ethiopian coffee market. Market concentration is moderate, with key players such as Nestle SA, Belco Coffee, and others controlling significant shares but with a considerable presence of smaller, local brands contributing to the dynamism.

- Market Concentration: The market is characterized by a mix of large multinational corporations and smaller, local players. xx% market share is held by the top 5 players in 2025, with the remainder divided among numerous smaller entities. M&A activity has been relatively low in recent years, with reported deal values totaling xx Million in the past five years.

- Innovation Drivers: Sustainability initiatives, technological advancements in processing and roasting, and consumer demand for premium and specialty coffees drive innovation.

- Regulatory Framework: The Ethiopian Coffee and Tea Authority (ECTA) plays a significant role in regulating the industry, impacting production, export, and quality standards.

- Product Substitutes: Tea and other beverages pose some level of competition. However, the strong cultural preference for coffee in Ethiopia limits the impact of substitutes.

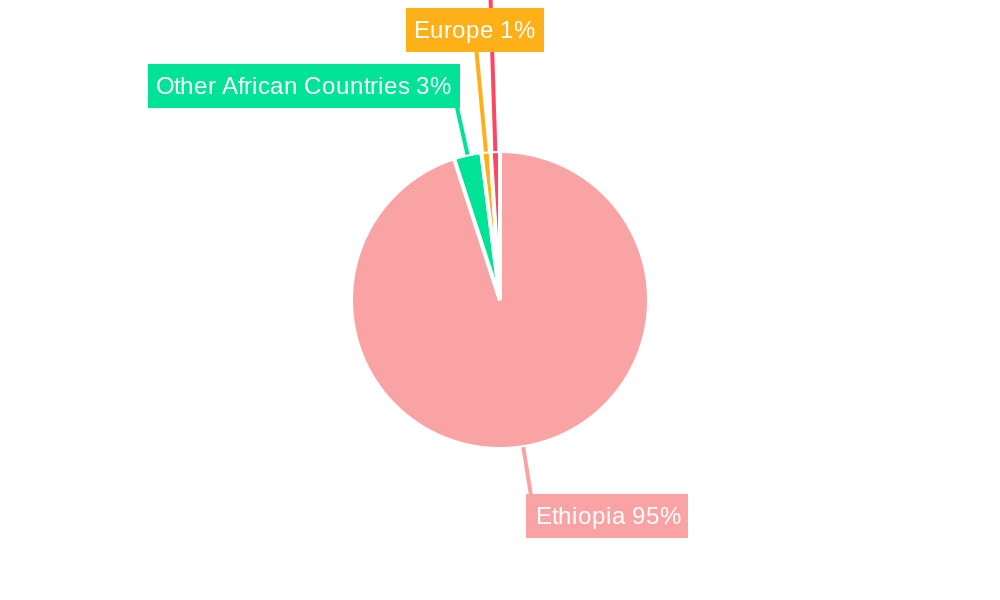

- End-User Demographics: The primary consumers are within the domestic market, with a growing segment of export-oriented businesses catering to international demand.

- M&A Activities: Recent years have seen limited large-scale mergers and acquisitions, with most activity focusing on smaller, local players.

Ethiopia Coffee Market Dynamics & Trends

The Ethiopian coffee market is experiencing dynamic growth driven by a complex interplay of factors. Consumer preferences are shifting towards specialty and high-quality coffee, while technological advancements enhance production efficiency and processing methods. The market is anticipated to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of premium coffee segments is increasing, driven by rising disposable incomes and a growing middle class. The competitive landscape is becoming more sophisticated, with both local and international players investing in expanding their presence.

Dominant Regions & Segments in Ethiopia Coffee Market

This section identifies the leading regions and segments within the Ethiopian coffee market.

Leading Region: The major coffee-producing regions of Ethiopia, particularly those known for high-quality arabica beans, contribute significantly to the overall market. Factors such as climate, altitude, and soil conditions influence regional dominance.

Leading Product Type: Whole-bean coffee is predicted to remain a dominant segment due to strong cultural preference. However, the instant coffee segment is anticipated to show significant growth due to convenience and rising urban population.

Leading Distribution Channel: The off-trade channel (retail stores, supermarkets) represents a larger market share compared to the on-trade (cafes, restaurants) segment because of widespread availability. The on-trade is growing steadily as the cafe culture expands within the country.

Key Drivers (Bullet Points):

- Favorable climatic conditions for coffee cultivation

- Government support and investment in coffee sector infrastructure

- Growing domestic demand and tourism

- Increasing export opportunities

Ethiopia Coffee Market Product Innovations

The Ethiopian coffee market witnesses ongoing product innovations. These include the introduction of new coffee blends, flavored coffees, and single-origin varieties tailored to specific consumer preferences. Technological advancements in processing and packaging are also prominent, with an emphasis on preserving the quality and freshness of the beans. These innovations enhance the market appeal of Ethiopian coffee both domestically and internationally.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Ethiopia coffee market based on product type (whole-bean, ground, instant) and distribution channel (on-trade, off-trade). Each segment's growth projections, market size (in Millions), and competitive dynamics are analyzed, highlighting the potential for investment and expansion within the market.

- Product Type Segmentation: Each segment exhibits unique growth trajectories, reflecting consumer demand and preferences. For example, while whole-bean retains dominance, instant coffee is showing rapid growth among urban consumers.

- Distribution Channel Segmentation: The off-trade channel displays larger market share due to widespread retail presence and consumer accessibility. The on-trade channel, though smaller, showcases promising growth, driven by the expanding cafe culture.

Key Drivers of Ethiopia Coffee Market Growth

Several factors fuel the growth of the Ethiopian coffee market. The country's favorable climate and rich coffee heritage are significant strengths. Government initiatives supporting the coffee industry, such as the 15-year development strategy, further boost growth. Rising domestic consumption driven by a growing middle class and increasing disposable incomes also play a vital role. Finally, expanding export opportunities to international markets contribute to market expansion.

Challenges in the Ethiopia Coffee Market Sector

The Ethiopian coffee market faces several challenges. These include infrastructure limitations that hinder efficient transportation and distribution, climate change impacting coffee yields, and the need to address issues of sustainability and fair trade practices. Competition from international brands presents another challenge. These factors may limit the market's full potential and affect profitability.

Emerging Opportunities in Ethiopia Coffee Market

The Ethiopian coffee market presents several opportunities. Expansion into niche segments like organic and specialty coffees, capitalizing on growing consumer preferences, represents a significant opportunity. Adopting sustainable agricultural practices and improving value chain efficiency can boost profitability and international appeal. Investing in coffee processing and packaging technology enhances quality and competitiveness. Finally, tapping into new export markets, particularly those with a high demand for high-quality coffee, could significantly drive market growth.

Leading Players in the Ethiopia Coffee Market Market

- Belco Coffee

- Nestle SA (Nestle SA)

- Enjoy Better Coffee (Mokate)

- Ya Coffee

- Square One Coffee

- Wild Coffee Company

- Hadero Coffee

- Klatch Coffee

- Oromia Coffee Farmers Cooperative Union

- Kalbe International

Key Developments in Ethiopia Coffee Market Industry

- June 2021: Launch of a state-of-the-art coffee training center aimed at improving sustainability and value chain efficiency.

- July 2022: Development of a 15-year coffee development strategy by ECTA, focusing on maximizing production potential.

- August 2022: World Coffee Research (WCR) collaboration with Ethiopian research institutions to improve coffee varieties.

Future Outlook for Ethiopia Coffee Market Market

The future outlook for the Ethiopian coffee market is positive, characterized by sustained growth driven by increasing domestic consumption, enhanced production practices, and expansion of export markets. Strategic investments in technology, sustainable farming practices, and value chain enhancements will be key to realizing the market's full potential and sustaining long-term growth.

Ethiopia Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole-bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

-

2. Distribution Channel

- 2.1. On-trade (Cafes and Foodservice)

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Off-trade Channels

Ethiopia Coffee Market Segmentation By Geography

- 1. Ethiopia

Ethiopia Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Strong Production Base in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ethiopia Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole-bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade (Cafes and Foodservice)

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Ethiopia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Belco Coffee

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enjoy Better Coffee (Mokate)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ya Coffee

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Square One Coffee

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wild Coffee Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hadero Coffee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Klatch Coffee

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oromia Coffee Farmers Cooperative Union*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kalbe International

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Belco Coffee

List of Figures

- Figure 1: Ethiopia Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ethiopia Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: Ethiopia Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ethiopia Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Ethiopia Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Ethiopia Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Ethiopia Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Ethiopia Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Ethiopia Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Ethiopia Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethiopia Coffee Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the Ethiopia Coffee Market?

Key companies in the market include Belco Coffee, Nestle SA, Enjoy Better Coffee (Mokate), Ya Coffee, Square One Coffee, Wild Coffee Company, Hadero Coffee, Klatch Coffee, Oromia Coffee Farmers Cooperative Union*List Not Exhaustive, Kalbe International.

3. What are the main segments of the Ethiopia Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Strong Production Base in the Country.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

August 2022: World Coffee Research (WCR) announced its plans to work with Ethiopia. In order to support their efforts to provide farmers with better varieties of coffee, WCR inked an agreement (MOU) with the Ethiopian Institute of Agricultural Research (EIAR) and the Jimma Agricultural Research Center (JARC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethiopia Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethiopia Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethiopia Coffee Market?

To stay informed about further developments, trends, and reports in the Ethiopia Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence