Key Insights

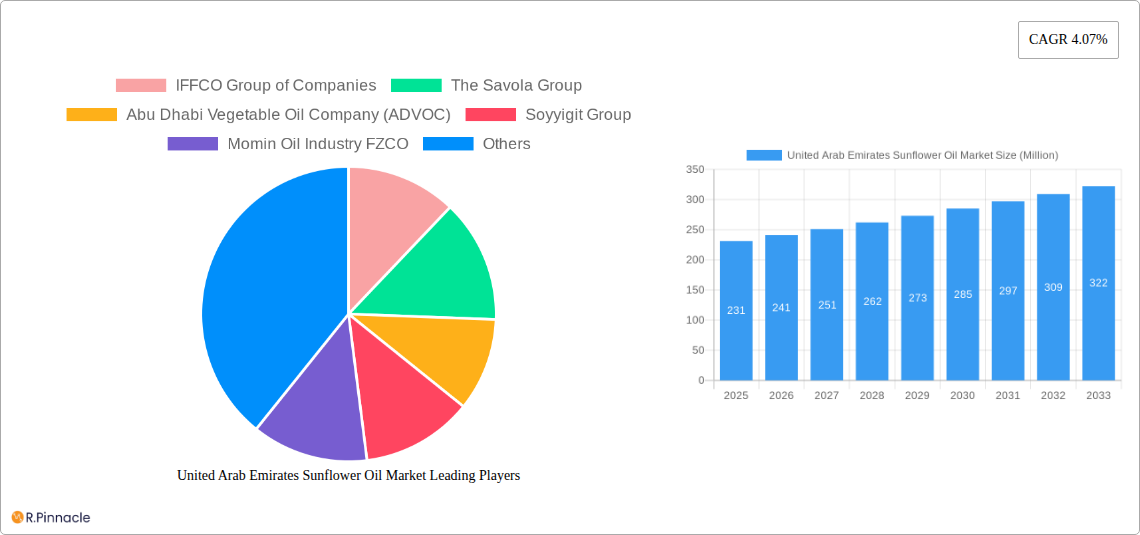

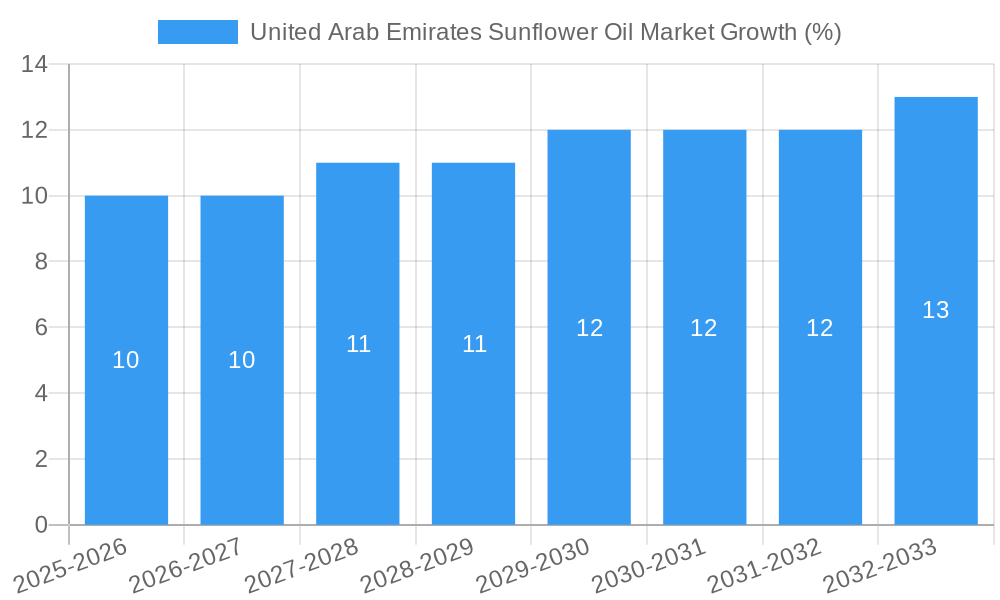

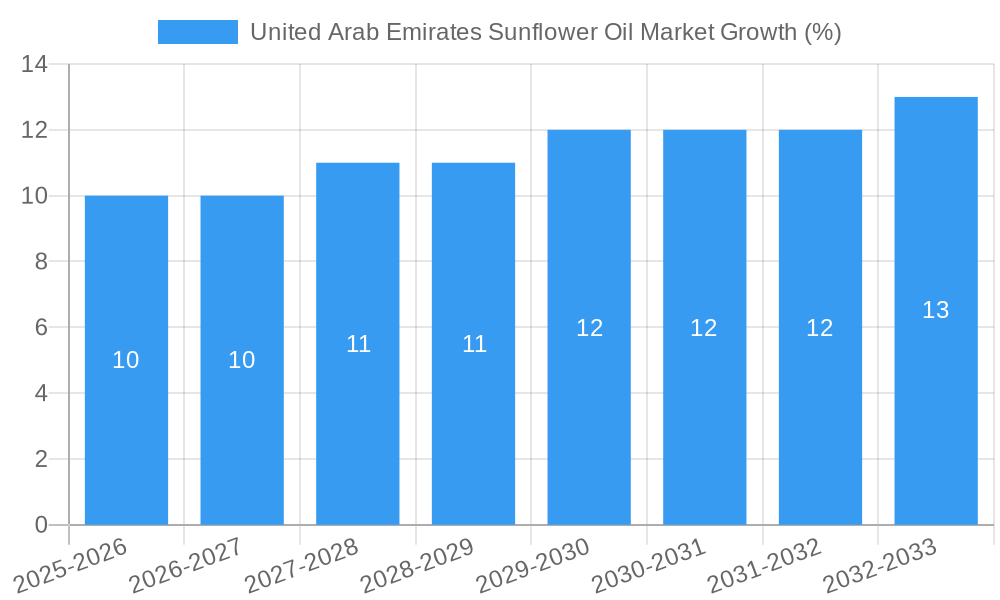

The United Arab Emirates (UAE) sunflower oil market, valued at $231 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.07% from 2025 to 2033. This expansion is fueled by several key factors. The UAE's burgeoning population and increasing urbanization contribute significantly to rising food consumption, particularly vegetable oils. A growing preference for healthier cooking oils, coupled with the perception of sunflower oil as a relatively healthier alternative compared to other vegetable oils, is further bolstering demand. The increasing popularity of processed food and ready-to-eat meals, which often utilize sunflower oil as an ingredient, also plays a crucial role. Furthermore, the UAE's robust food retail sector and strong import-export activities facilitate the seamless supply and distribution of sunflower oil, aiding market growth. However, potential price volatility in global sunflower seed production and fluctuations in international commodity prices pose challenges. Competition from other vegetable oils, such as olive oil and canola oil, also presents a restraint to market expansion. Major players like IFFCO Group of Companies, The Savola Group, and Abu Dhabi Vegetable Oil Company (ADVOC) are actively shaping the market landscape through strategic initiatives such as product diversification and expansion of distribution networks.

The market segmentation within the UAE sunflower oil industry is likely diverse, with variations in packaging sizes, brand offerings, and distribution channels. The competitive landscape is characterized by a mix of both established multinational companies and local players. Future growth will depend on factors like consumer preference shifts, government policies related to food safety and health, and global supply chain dynamics. Strategic alliances, product innovation, and efficient supply chain management will be crucial for companies seeking a larger market share in the coming years. The continued expansion of the food processing and hospitality sectors in the UAE further supports a positive outlook for sunflower oil market expansion. Further research into specific regional distribution patterns and consumer preferences within the UAE would offer a deeper understanding of market dynamics.

United Arab Emirates Sunflower Oil Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United Arab Emirates (UAE) sunflower oil market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The study incorporates data from key players like IFFCO Group of Companies, The Savola Group, Abu Dhabi Vegetable Oil Company (ADVOC), Soyyigit Group, Momin Oil Industry FZCO, Eatco General Trading LLC (Family Harvest), ACG Alokozay Group of Companies, AVES (Avesafya Oil), Avril Group, and LuLu Group International, among others.

United Arab Emirates Sunflower Oil Market Structure & Innovation Trends

This section analyzes the UAE sunflower oil market's structure, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. We delve into market share distribution among key players and assess the financial implications of significant M&A deals. The analysis includes an evaluation of the regulatory landscape impacting market growth and innovation, considering factors such as food safety standards and labeling regulations. The report also examines the role of product substitutes, such as other vegetable oils, and how consumer preferences and demographics influence market demand. Finally, we analyze recent M&A activities, quantifying deal values where possible, to understand their impact on market consolidation and competitiveness. For instance, the January 2022 acquisition of a 75% stake in ADVOC by IHC Food Holding for USD 24.7 Million significantly altered the market landscape. The report explores how such transactions reshape the competitive dynamics and influence market share. Market concentration is evaluated, and the overall level of competition within the market is assessed, considering the presence of both large multinational corporations and smaller, regional players. Further, the innovative trends within the market are assessed based on product development and improvements in production and distribution methodologies. The current market share distribution will be quantified with specific numbers and percentages reflecting the dominance and competitiveness among players. XX% market share is projected for the leading player by the year 2025.

United Arab Emirates Sunflower Oil Market Dynamics & Trends

This section explores the key dynamics driving the growth of the UAE sunflower oil market. It analyzes factors influencing market expansion, including changing consumer preferences (e.g., increasing health consciousness), technological disruptions (e.g., improved processing and packaging), and competitive dynamics (e.g., pricing strategies and branding). We present a detailed assessment of the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) based on market size estimations and historical data analysis. The market penetration rate of sunflower oil within the broader edible oil segment is also meticulously analyzed. Furthermore, this section will provide detailed insights into the role of imports and exports in shaping market dynamics. The influence of government policies and regulations on import and export volumes will also be examined. This section also includes a specific analysis of the impact of economic factors, like inflation and consumer spending patterns, on market demand. The study identifies emerging consumer preferences toward healthier and more sustainably produced sunflower oil, and the implications these preferences hold for market expansion and innovation. The effects of price fluctuations in raw materials, currency exchange rates and transportation costs on the overall profitability of market players are taken into consideration. The report also examines the competitive strategies of major players, including their product positioning and marketing activities.

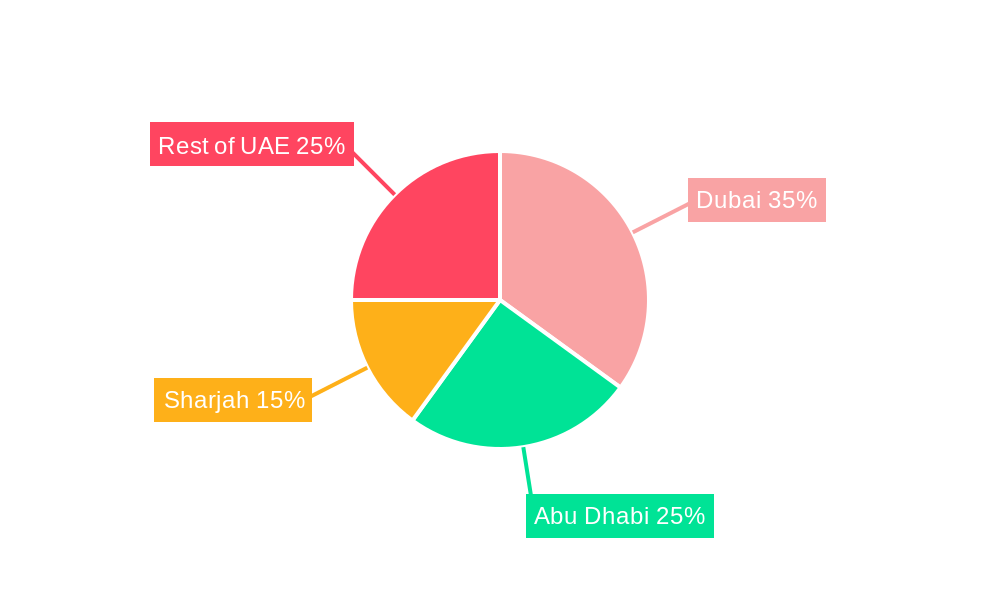

Dominant Regions & Segments in United Arab Emirates Sunflower Oil Market

This section identifies the leading regions and segments within the UAE sunflower oil market. Using a detailed breakdown of sales data and market share, this analysis clarifies which regions show the highest demand for sunflower oil and which segments drive market growth. The key drivers for dominance in these leading regions and segments are explained through specific examples and data. For example, the higher concentration of population and the presence of major food processing industries in a particular emirate can lead to higher demand. Similarly, a particular segment, such as the food service industry, may demonstrate higher growth potential due to the increasing preference for sunflower oil in restaurants and hotels.

- Key Drivers of Regional Dominance:

- Economic factors (GDP growth, disposable income)

- Population density and demographics

- Presence of major food processing industries

- Retail infrastructure and distribution networks

- Government policies and regulations

United Arab Emirates Sunflower Oil Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in the UAE sunflower oil market. It highlights technological advancements in oil processing, packaging, and quality control that lead to enhanced product offerings. The section further examines how these innovations cater to the changing preferences and demands of consumers, such as demand for healthier and more convenient products. It also addresses the strategies used by companies to differentiate their products in a competitive landscape, and how such differentiation impacts their competitiveness and market share. The impact of such advancements on both market competition and consumer choices will be explained.

Report Scope & Segmentation Analysis

This report segments the UAE sunflower oil market based on various factors, including product type (e.g., refined, unrefined), packaging (e.g., bottles, pouches), end-use (e.g., household, food service), and distribution channel (e.g., supermarkets, hypermarkets, online retailers). Each segment’s market size, growth projections, and competitive dynamics are thoroughly analyzed. For example, the growth rate and market size of the refined sunflower oil segment compared to unrefined sunflower oil is examined to provide a complete picture of market segmentation. Similarly, the report provides insights into the distribution channels, such as online retailers, which are becoming increasingly important in the overall market.

Key Drivers of United Arab Emirates Sunflower Oil Market Growth

The growth of the UAE sunflower oil market is propelled by several key factors. The increasing popularity of healthy cooking oils, the rise in food service industry, and government initiatives promoting food security all contribute to this. The growing population and increasing urbanization are further boosting demand. Expanding retail infrastructure and the rise of e-commerce are increasing accessibility and market penetration for sunflower oil. Economic growth and rising disposable incomes within the UAE are also driving demand for premium and specialized varieties of sunflower oil.

Challenges in the United Arab Emirates Sunflower Oil Market Sector

The UAE sunflower oil market faces various challenges, including fluctuating global sunflower seed prices, which directly impacts production costs. Supply chain disruptions due to global events and logistics hurdles can also affect availability and pricing. Intense competition among numerous domestic and international players, and the preference for other edible oils create competitive pressures on market share and pricing. Strict regulatory compliance concerning labeling and food safety standards requires significant investment and adherence. Furthermore, consumer sentiment can influence market demand and profitability.

Emerging Opportunities in United Arab Emirates Sunflower Oil Market

Emerging opportunities exist in the UAE sunflower oil market. The increasing demand for healthier, organic, and sustainably sourced sunflower oil presents significant growth potential. Innovative packaging solutions that improve shelf life and convenience are gaining traction. Developing niche product variants (e.g., flavored or fortified sunflower oil) targets the needs of specific consumer groups. Expanding into e-commerce and leveraging digital marketing open new market channels and increased customer reach. Focus on sustainability and reducing carbon footprints in the production process enhances brand image and appeals to environmentally conscious customers.

Leading Players in the United Arab Emirates Sunflower Oil Market Market

- IFFCO Group of Companies

- The Savola Group

- Abu Dhabi Vegetable Oil Company (ADVOC)

- Soyyigit Group

- Momin Oil Industry FZCO

- Eatco General Trading LLC (Family Harvest)

- ACG Alokozay Group of Companies

- AVES (Avesafya Oil)

- Avril Group

- LuLu Group International

Key Developments in United Arab Emirates Sunflower Oil Market Industry

- October 2023: LuLu Group opened its 24th hypermarket in Dubai Mall (72,000 sq ft), boosting Lulu-branded sunflower oil penetration.

- May 2023: Collaboration between DMT, Lulu Group International, and ADIO launched a new community center in Al Rahbah, including food and beverage outlets.

- January 2022: IHC Food Holding acquired a 75% stake in ADVOC for USD 24.7 Million, signaling expansion plans.

Future Outlook for United Arab Emirates Sunflower Oil Market Market

The UAE sunflower oil market exhibits promising growth prospects driven by expanding consumption patterns and diversification of product offerings. The increasing focus on health and wellness, coupled with strategic investments in sustainable production practices, sets the stage for robust market expansion. Opportunities lie in value-added product development, catering to the preferences of health-conscious consumers and enhancing the market appeal of sunflower oil. The continued development of the food processing and retail sectors will further stimulate market growth, making the UAE sunflower oil market attractive for both existing and new players. The anticipated CAGR for the forecast period, 2025-2033, is estimated at XX%.

United Arab Emirates Sunflower Oil Market Segmentation

-

1. Type

- 1.1. Refined Deodorized

- 1.2. Unrefined

-

2. End User

- 2.1. Industrial

- 2.2. Foodservice

-

2.3. Retail/Household

-

2.3.1. Packaging Type

- 2.3.1.1. Cans

- 2.3.1.2. Bottles

-

2.3.1. Packaging Type

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Retail Stores

United Arab Emirates Sunflower Oil Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Sunflower Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth

- 3.3. Market Restrains

- 3.3.1. Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Consumption of Refined Deodorized Sunflower Oil Supporting Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Sunflower Oil Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Refined Deodorized

- 5.1.2. Unrefined

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Industrial

- 5.2.2. Foodservice

- 5.2.3. Retail/Household

- 5.2.3.1. Packaging Type

- 5.2.3.1.1. Cans

- 5.2.3.1.2. Bottles

- 5.2.3.1. Packaging Type

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IFFCO Group of Companies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Savola Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abu Dhabi Vegetable Oil Company (ADVOC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Soyyigit Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Momin Oil Industry FZCO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eatco General Trading LLC (Family Harvest)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACG Alokozay Group of Companies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AVES (Avesafya Oil)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avril Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LuLu Group International*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IFFCO Group of Companies

List of Figures

- Figure 1: United Arab Emirates Sunflower Oil Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Sunflower Oil Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by End User 2019 & 2032

- Table 7: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 9: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by End User 2019 & 2032

- Table 15: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Sunflower Oil Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the United Arab Emirates Sunflower Oil Market?

Key companies in the market include IFFCO Group of Companies, The Savola Group, Abu Dhabi Vegetable Oil Company (ADVOC), Soyyigit Group, Momin Oil Industry FZCO, Eatco General Trading LLC (Family Harvest), ACG Alokozay Group of Companies, AVES (Avesafya Oil), Avril Group, LuLu Group International*List Not Exhaustive.

3. What are the main segments of the United Arab Emirates Sunflower Oil Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 231 Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth.

6. What are the notable trends driving market growth?

Rising Consumption of Refined Deodorized Sunflower Oil Supporting Market Growth.

7. Are there any restraints impacting market growth?

Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023: LuLu Group opened its hypermarket spread in a 72,000 sq. ft area in Dubai Mall, marking the company's 24th store in Dubai. The store offers primarily groceries, fresh food, fruits and vegetables, bakery, health and beauty, stationery, household, IT products, and fresh flowers, among others, resulting in an increasing penetration of Lulu-branded sunflower oil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Sunflower Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Sunflower Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Sunflower Oil Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Sunflower Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence