Key Insights

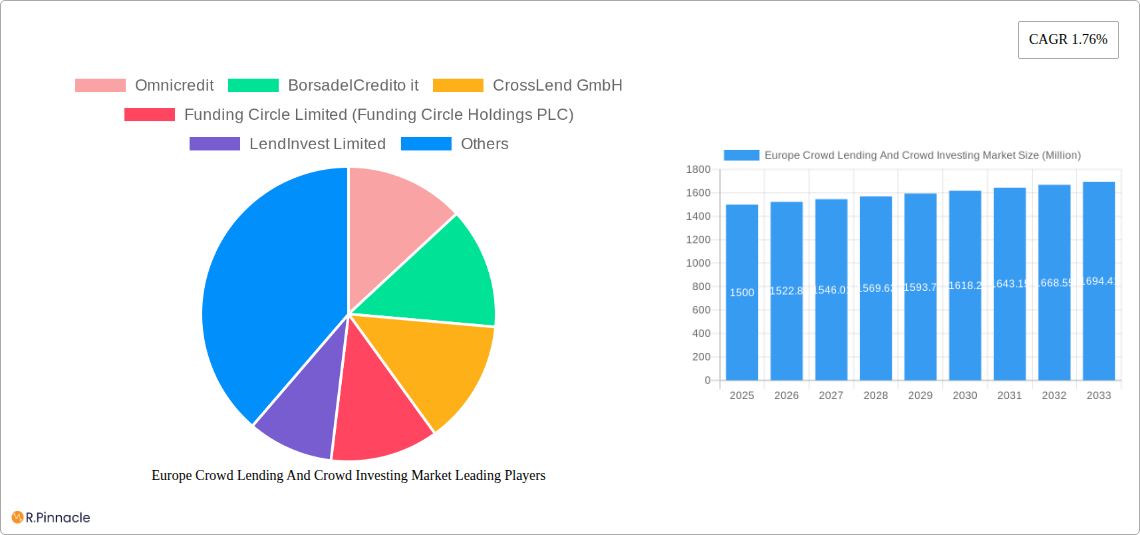

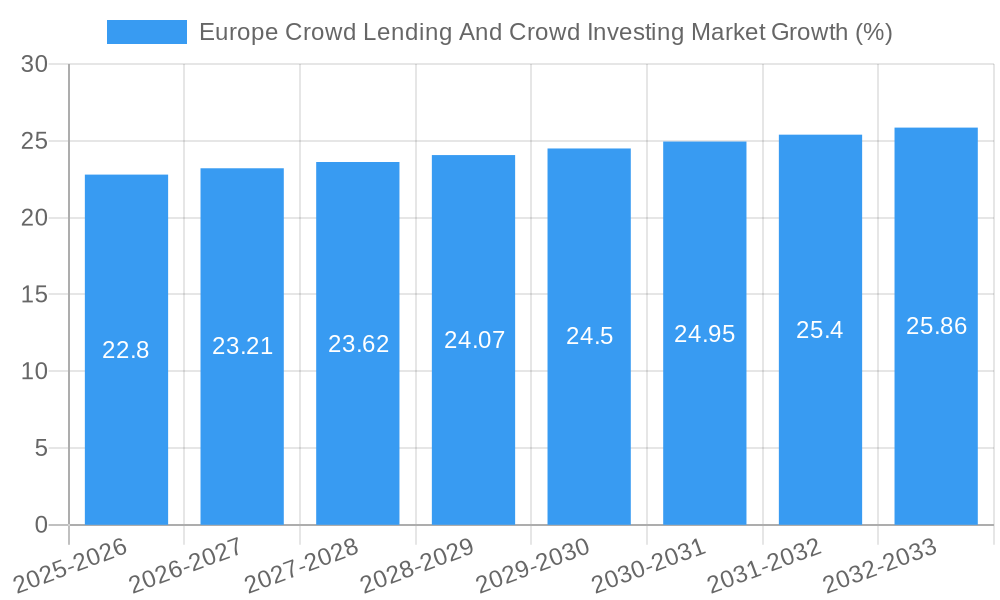

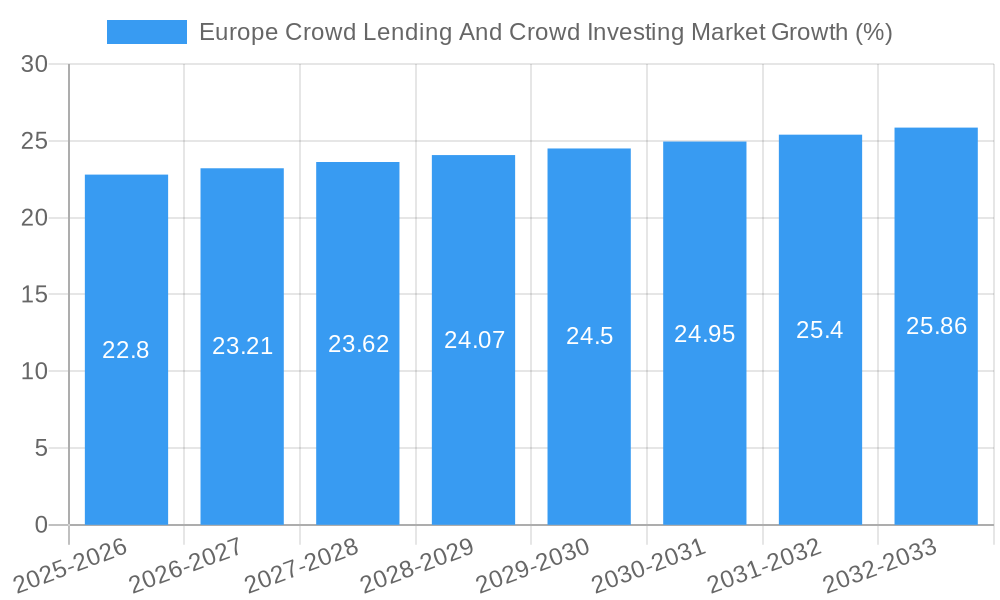

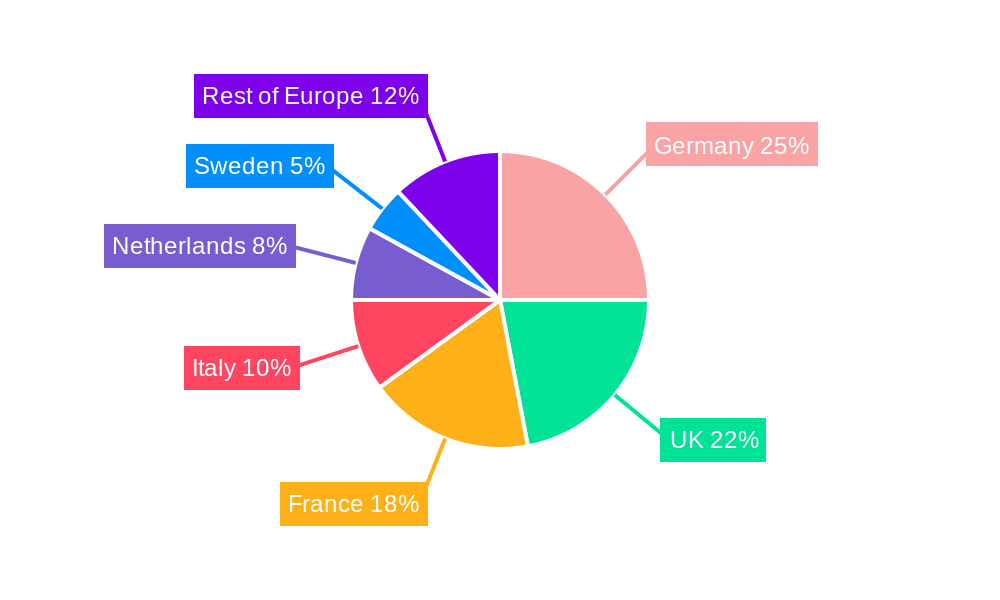

The European crowd lending and crowd investing market, currently experiencing a Compound Annual Growth Rate (CAGR) of 1.76%, presents a compelling investment landscape. Driven by increasing financial inclusion initiatives, a growing preference for alternative investment options among both businesses and consumers, and the rise of fintech innovation, the market is poised for continued expansion. The market's segmentation into business and consumer lending reflects diverse needs – businesses seeking capital beyond traditional channels and individuals accessing funding or investing in peer-to-peer loans. Key players like Omnicredit, Funding Circle, and Zopa are shaping the market, contributing to its maturation and broadening its reach. While regulatory hurdles and potential economic downturns remain potential restraints, the market’s adaptability and the increasing sophistication of platforms suggest resilience and ongoing growth. Germany, the United Kingdom, and France are expected to remain dominant regional players due to their established financial ecosystems and investor bases. However, other European nations are witnessing increasing participation, indicating a wider adoption of crowd lending and investing practices across the continent. The forecast period of 2025-2033 promises significant growth potential as technological advancements further streamline processes and enhance accessibility for both lenders and borrowers.

The continued growth trajectory depends heavily on factors such as regulatory clarity, investor confidence, and technological advancements facilitating trust and transparency within the platform. The success of established players will depend on their ability to innovate, offer competitive interest rates, enhance risk management strategies, and cultivate strong investor relationships. The market’s expansion into less-penetrated European regions will be critical for future growth, requiring targeted marketing and adaptation to local market conditions. The ongoing trend of integrating artificial intelligence (AI) and machine learning (ML) in credit scoring and risk assessment is also expected to positively impact market growth, improving efficiency and reducing risk. Increased investor education and awareness campaigns are crucial for further market expansion and ensuring sustainable growth.

Europe Crowd Lending and Crowd Investing Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European crowd lending and crowd investing market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, key players, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Europe Crowd Lending and Crowd Investing Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key players, innovation drivers, and regulatory influences. The market exhibits a moderately fragmented structure with several prominent players commanding significant market share. Key players such as Funding Circle Limited and Mintos Marketplace AS hold substantial positions, while numerous smaller firms contribute to the overall market dynamism.

- Market Concentration: The market is characterized by a mix of large established players and smaller, niche operators. The top five players likely account for approximately xx% of the total market share in 2025.

- Innovation Drivers: Technological advancements, particularly in fintech and blockchain, are major drivers of innovation, enabling enhanced security, transparency, and efficiency. Regulatory changes and the growing demand for alternative financing options also fuel innovation.

- Regulatory Frameworks: The regulatory landscape varies across European countries, influencing market growth and impacting the operational strategies of players. Harmonization efforts and evolving regulations are crucial factors shaping market dynamics.

- M&A Activities: Recent years have witnessed significant M&A activity, with deals like the Republic's acquisition of Seedrs in 2022 highlighting the consolidation trend in the market and expansion strategies for businesses. The total value of M&A deals in the observed period (2019-2024) is estimated to be around xx Million.

- Product Substitutes: Traditional banking and venture capital remain significant substitutes, however, crowd lending and investing offer attractive alternatives due to ease of access, speed, and diversification opportunities.

- End-User Demographics: The market caters to a growing number of both individual and institutional investors seeking diverse investment opportunities and businesses looking for alternative funding sources.

Europe Crowd Lending and Crowd Investing Market Market Dynamics & Trends

This section delves into the market’s growth trajectory, exploring key drivers, technological disruptions, and competitive pressures shaping the landscape. The market experienced significant growth during the historical period (2019-2024), fuelled by increased investor participation, technological advancements, and a supportive regulatory environment in some regions. The market is poised for continued expansion, driven by factors such as the rising popularity of alternative finance solutions, enhanced digital infrastructure, and evolving consumer preferences.

The adoption of innovative technologies such as AI and blockchain are further augmenting efficiency and transparency in the market, attracting a wider range of investors. Competitive dynamics are characterized by both collaboration and rivalry, with players constantly seeking to differentiate their offerings and expand their market reach. The CAGR is projected to remain strong, demonstrating the market's continued growth potential throughout the forecast period. Market penetration is expected to increase significantly across various segments, driven by growing awareness and adoption among both businesses and consumers.

Dominant Regions & Segments in Europe Crowd Lending And Crowd Investing Market

The report identifies the leading regions and segments within the European market. While data is not available for precise regional and segment-specific market dominance, the UK and Germany are likely to be among the most dominant markets due to their established financial ecosystems and robust entrepreneurial activity.

By Type:

- Business Lending: This segment is driven by the increasing demand for alternative financing solutions by SMEs and startups who find traditional financing channels less accessible. Key drivers include supportive government policies, digitalization efforts and favourable economic conditions in specific regions.

- Consumer Lending: This segment is influenced by factors such as growing financial inclusion, technological advancements making lending processes more efficient and transparent and the increasing popularity of peer-to-peer lending platforms.

(Further detailed analysis within the full report will quantify regional and segment dominance with specific market size figures).

Europe Crowd Lending And Crowd Investing Market Product Innovations

Recent innovations have focused on enhancing user experience, platform security, and diversifying investment opportunities. The integration of artificial intelligence for credit scoring and risk assessment, along with the incorporation of blockchain technology to enhance transparency and security, are notable advancements. New product offerings catering to niche segments, such as sustainable investments, are also emerging, demonstrating market responsiveness to evolving investor preferences.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation analysis, dividing the market into two key types: Business and Consumer.

Business: This segment encompasses loans and investments targeted at businesses of varying sizes. Growth is projected to be xx Million by 2033. Competitive dynamics are intense, with players differentiating through product features, pricing, and technological capabilities.

Consumer: This segment focuses on peer-to-peer lending and other consumer-focused investment opportunities. Growth is estimated at xx Million by 2033. Competition revolves around user experience, risk management strategies, and regulatory compliance.

Key Drivers of Europe Crowd Lending And Crowd Investing Market Growth

Several factors drive market growth, including:

- Technological Advancements: Fintech innovations and digitalization enhance accessibility, efficiency, and transparency.

- Favorable Regulatory Environments: Supportive regulations in certain European countries encourage market expansion.

- Growing Demand for Alternative Financing: SMEs and individuals increasingly seek alternative sources of funding due to the limitations of traditional finance channels.

- Increased Investor Awareness and Participation: Rising awareness and understanding of crowd lending and investing products are attracting more investors.

Challenges in the Europe Crowd Lending And Crowd Investing Market Sector

The market faces challenges including:

- Regulatory Uncertainty and Fragmentation: Varying regulations across European countries create complexities for market players.

- Cybersecurity Risks: The digital nature of the industry makes it vulnerable to cybersecurity threats, requiring robust security measures.

- Credit Risk Management: Accurate assessment and management of credit risk are crucial for maintaining platform stability and investor confidence. This often requires sophisticated technology and experienced personnel.

Emerging Opportunities in Europe Crowd Lending And Crowd Investing Market

- Expansion into Underserved Markets: Targeting under-banked populations and regions with limited access to traditional finance presents significant growth opportunities.

- Innovation in Investment Products: Developing innovative investment products that cater to diverse investor preferences and risk tolerances can create new market segments.

- Strategic Partnerships: Collaborations with traditional financial institutions and other stakeholders can broaden market reach and enhance service offerings.

Leading Players in the Europe Crowd Lending And Crowd Investing Market Market

- Omnicredit

- BorsadelCredito it

- CrossLend GmbH

- Funding Circle Limited (Funding Circle Holdings PLC)

- LendInvest Limited

- Mintos Marketplace AS

- Companist

- International Personal Finance PLC (IPF)

- Lidya

- OurCrowd

- CreamFinance

- Zopa Limited

- Crowdcube

- Monevo Inc

- Crowdestor

Key Developments in Europe Crowd Lending And Crowd Investing Market Industry

- November 2022: Oneplanetcrowd merged with Invesdor, expanding Invesdor's reach and portfolio. This merger highlights the consolidation trend within the European crowdfunding space.

- September 2022: Republic acquired Seedrs for approximately USD 100 Million, signifying the growing interest in and strategic value of European crowdfunding platforms for global players.

Future Outlook for Europe Crowd Lending And Crowd Investing Market Market

The European crowd lending and crowd investing market is poised for substantial growth. Continued technological advancements, increasing investor participation, and evolving regulatory frameworks will drive market expansion. Strategic partnerships and the development of innovative products will further shape the future trajectory of this dynamic market segment. The market's strong growth potential makes it an attractive space for investors and businesses alike.

Europe Crowd Lending And Crowd Investing Market Segmentation

-

1. Type

- 1.1. Business

- 1.2. Consumer

Europe Crowd Lending And Crowd Investing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Crowd Lending And Crowd Investing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Shift Towards Digital Transformation Opens up New Growth Opportunities; High Proliferation of Smartphones Combined with Vendor Efforts to Appeal to the Younger Population

- 3.3. Market Restrains

- 3.3.1. ; Privacy Concerns towards the Authentication Vendor and High Costs of Token

- 3.4. Market Trends

- 3.4.1. High Proliferation of Smartphones Combined with Vendor Efforts to Appeal to the Younger Population will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Business

- 5.1.2. Consumer

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Crowd Lending And Crowd Investing Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Omnicredit

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 BorsadelCredito it

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 CrossLend GmbH

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Funding Circle Limited (Funding Circle Holdings PLC)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 LendInvest Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Mintos Marketplace AS

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Companist

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 International Personal Finance PLC (IPF)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lidya

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 OurCrowd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 CreamFinance

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Zopa Limited

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Crowdcube

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Monevo Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Crowdestor

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Omnicredit

List of Figures

- Figure 1: Europe Crowd Lending And Crowd Investing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Crowd Lending And Crowd Investing Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Crowd Lending And Crowd Investing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Crowd Lending And Crowd Investing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Crowd Lending And Crowd Investing Market?

The projected CAGR is approximately 1.76%.

2. Which companies are prominent players in the Europe Crowd Lending And Crowd Investing Market?

Key companies in the market include Omnicredit, BorsadelCredito it, CrossLend GmbH, Funding Circle Limited (Funding Circle Holdings PLC), LendInvest Limited, Mintos Marketplace AS, Companist, International Personal Finance PLC (IPF), Lidya, OurCrowd, CreamFinance, Zopa Limited, Crowdcube, Monevo Inc, Crowdestor.

3. What are the main segments of the Europe Crowd Lending And Crowd Investing Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Shift Towards Digital Transformation Opens up New Growth Opportunities; High Proliferation of Smartphones Combined with Vendor Efforts to Appeal to the Younger Population.

6. What are the notable trends driving market growth?

High Proliferation of Smartphones Combined with Vendor Efforts to Appeal to the Younger Population will Drive the Market.

7. Are there any restraints impacting market growth?

; Privacy Concerns towards the Authentication Vendor and High Costs of Token.

8. Can you provide examples of recent developments in the market?

November 2022: Oneplanetcrowd, a Netherlands-based operating firm, merged into Invesdor, a Finland-based larger European securities crowdfunding platform. Oneplanetcrowd platform enables early-stage firms, including sustainable energy projects, to raise capital from individuals interested in social impact investing. Oneplanetcrowd reports over 43,000 investors having completed 300 funding rounds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Crowd Lending And Crowd Investing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Crowd Lending And Crowd Investing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Crowd Lending And Crowd Investing Market?

To stay informed about further developments, trends, and reports in the Europe Crowd Lending And Crowd Investing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence