Key Insights

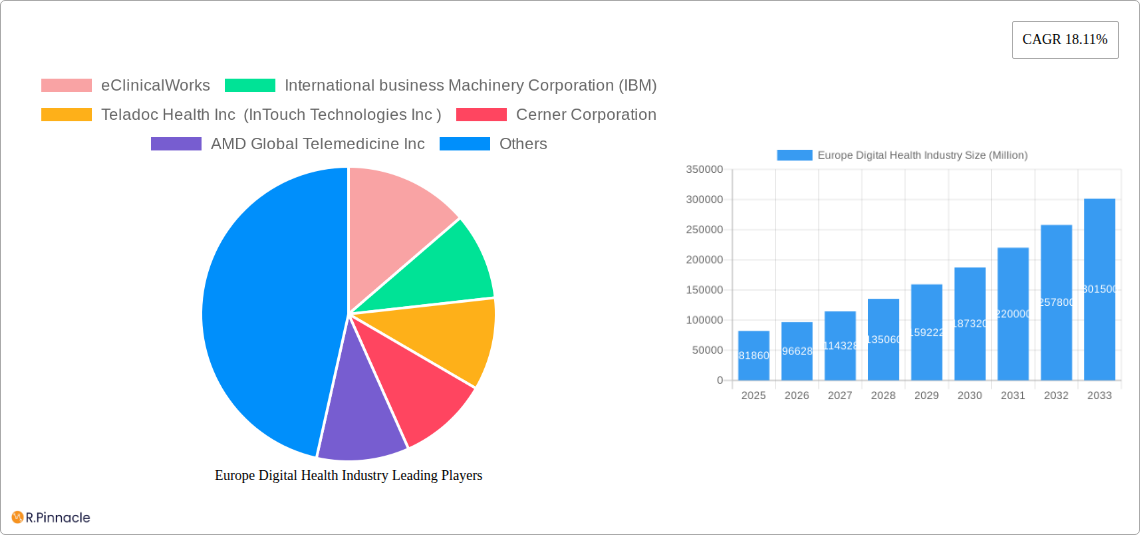

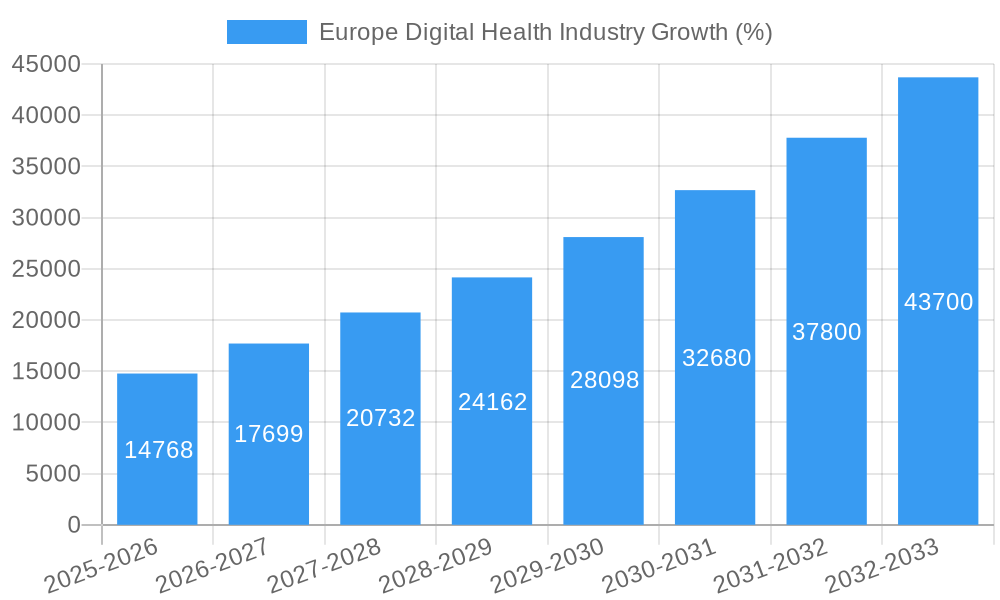

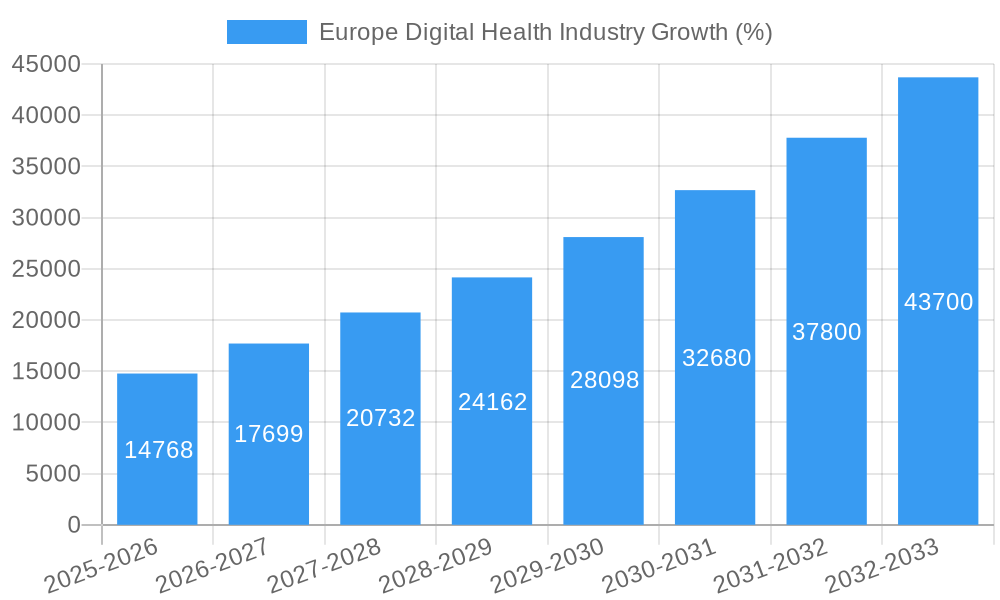

The European digital health market, valued at €81.86 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 18.11% from 2025 to 2033. This surge is driven by several key factors. Increasing prevalence of chronic diseases necessitates efficient remote patient monitoring and telehealth solutions. Furthermore, government initiatives promoting digital health infrastructure and data interoperability are accelerating market adoption. The rising adoption of smartphones and increasing internet penetration across Europe further fuels this growth, enabling wider access to mobile health (mHealth) applications and telehealth services. Technological advancements in areas like artificial intelligence (AI) and machine learning (ML) are enhancing diagnostic capabilities and improving treatment efficacy, contributing significantly to market expansion. Specific segments like cloud-based delivery models show particularly strong growth potential due to their scalability and cost-effectiveness. Leading companies like eClinicalWorks, IBM, and Teladoc Health are strategically positioning themselves to capitalize on these market trends through product innovation and strategic partnerships. However, challenges remain, including data privacy concerns, regulatory hurdles, and the need for robust cybersecurity measures. Addressing these concerns will be crucial for sustained market growth and widespread adoption of digital health technologies across Europe.

The European digital health market's segmentation reveals a diverse landscape. Hardware components, including medical devices and wearable technology, form a substantial part of the market, complemented by sophisticated software solutions for patient management and data analytics. Telehealth and mHealth applications are experiencing the most rapid expansion, driven by increased demand for remote consultations and chronic disease management. The cloud-based delivery model enjoys a competitive advantage due to its flexibility and accessibility, while health analytics and digital health systems are pivotal for data-driven healthcare improvements. Key European markets like Germany, France, and the UK are leading the charge, demonstrating significant investment in digital health infrastructure and technological advancements. The ongoing focus on improving healthcare outcomes while optimizing resource allocation will continue to propel the growth of the European digital health market in the coming years.

Europe Digital Health Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe digital health industry, covering market structure, dynamics, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategists. The report leverages extensive data and analysis to provide actionable insights into this rapidly evolving market, with a focus on key segments and leading companies. The market size is projected to reach xx Million by 2033.

Europe Digital Health Industry Market Structure & Innovation Trends

The European digital health market is characterized by a moderately fragmented landscape, with a few major players holding significant market share, alongside numerous smaller, specialized companies. Key players like IBM, eClinicalWorks, and Cerner Corporation dominate certain segments, but the market also exhibits strong potential for new entrants and disruptive technologies. Innovation is driven by advancements in artificial intelligence (AI), machine learning (ML), the Internet of Medical Things (IoMT), and big data analytics, enabling more efficient and effective healthcare delivery. Regulatory frameworks, such as GDPR and various national health data protection laws, significantly influence market activities. The rising adoption of cloud-based solutions and the increasing demand for telehealth services are key factors shaping the competitive landscape. M&A activity is robust, with deal values reaching xx Million in 2024, signaling consolidation and strategic expansion within the industry. This includes acquisitions focusing on enhancing technological capabilities and expanding service offerings.

- Market Concentration: Moderately fragmented, with top 5 players holding approximately xx% market share.

- Innovation Drivers: AI, ML, IoMT, Big Data Analytics, Cloud Computing.

- Regulatory Frameworks: GDPR, national health data protection laws.

- Product Substitutes: Traditional healthcare methods, legacy systems.

- End-User Demographics: Aging population, rising prevalence of chronic diseases.

- M&A Activity: xx Million in deal values in 2024.

Europe Digital Health Industry Market Dynamics & Trends

The European digital health market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The increasing prevalence of chronic diseases and an aging population are driving the demand for efficient healthcare solutions. Technological disruptions, particularly in areas like AI-powered diagnostics and remote patient monitoring, are revolutionizing healthcare delivery. Consumer preferences are shifting towards personalized and convenient healthcare options, further boosting market demand. The competitive landscape is dynamic, with both established players and startups vying for market share through innovation and strategic partnerships. Market penetration of digital health solutions remains relatively low, suggesting significant untapped potential for growth in the coming years. Significant government investments in digital health infrastructure and initiatives promoting telehealth are also contributing positively.

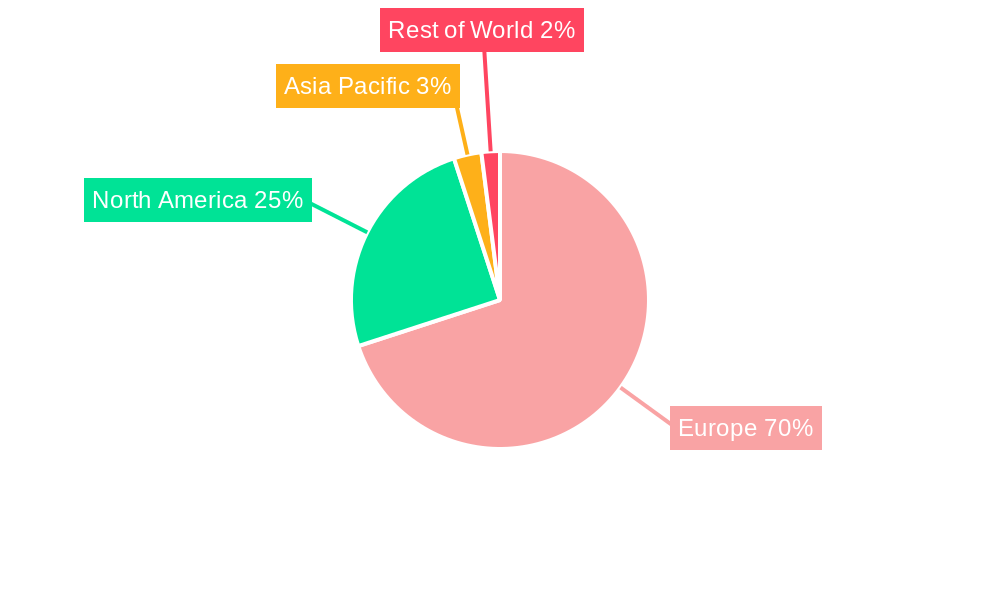

Dominant Regions & Segments in Europe Digital Health Industry

The digital health market in Europe shows strong regional variations. Germany, the UK, and France are leading markets driven by robust healthcare infrastructure, significant investments, and a high adoption rate of digital technologies. Specific segment dominance is outlined below:

Leading Segments:

- Component: Software holds the largest market share, followed by Hardware and Other Components. The software segment's growth is driven by increasing demand for sophisticated analytics and management tools.

- Technology: Tele-healthcare and mHealth are experiencing the fastest growth, driven by their ability to improve access and convenience of healthcare services.

- Apps: Health analytics and digital health systems applications are in high demand, particularly among hospitals and healthcare providers looking to improve operational efficiency and decision-making.

- Mode of Delivery: Cloud-based delivery is witnessing significant adoption owing to its scalability and cost-effectiveness.

Key Drivers (by Region/Segment):

- Germany: Strong government support for digital health initiatives, advanced IT infrastructure.

- UK: High adoption rates, focus on innovation and technological advancements.

- France: Growing investment in digital health, increasing awareness of telehealth benefits.

- Software: Growing need for efficient data management, analytics, and interoperability solutions.

- Telehealth: Growing demand for remote consultations, patient monitoring, and virtual care.

Europe Digital Health Industry Product Innovations

The European digital health market witnesses continuous product innovation, with a strong emphasis on AI-powered diagnostics, remote patient monitoring devices, and personalized medicine applications. These innovations are designed to improve accuracy, efficiency, and accessibility of healthcare services. Companies are focusing on developing user-friendly interfaces and seamless integration with existing healthcare systems to enhance market adoption. Competition is driven by the ability to offer cutting-edge technology, superior user experience, and strong data security measures.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the European digital health market, encompassing:

- Component: Hardware (xx Million in 2025), Software (xx Million in 2025), Other Components (xx Million in 2025)

- Technology: Tele-healthcare (xx Million in 2025), Mobile Health (mHealth) (xx Million in 2025)

- Apps: Health Analytics (xx Million in 2025), Digital Health Systems (xx Million in 2025)

- Mode of Delivery: On-premise Delivery (xx Million in 2025), Cloud-based Delivery (xx Million in 2025)

Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed in the report.

Key Drivers of Europe Digital Health Industry Growth

The European digital health market's growth is primarily driven by several factors: the increasing prevalence of chronic diseases and an aging population, demanding efficient healthcare solutions; technological advancements like AI and IoT enabling innovative healthcare services; growing government support for digital health initiatives and investments in digital infrastructure; a rising preference for convenient and personalized healthcare experiences; and supportive regulatory frameworks promoting innovation and data security.

Challenges in the Europe Digital Health Industry Sector

Despite its potential, the European digital health market faces challenges, including regulatory hurdles regarding data privacy and interoperability; supply chain disruptions affecting the availability of hardware and software components; concerns around data security and patient privacy; and intense competition among established players and new entrants. These factors can impact the market's growth trajectory and require careful consideration by stakeholders.

Emerging Opportunities in Europe Digital Health Industry

The European digital health market offers promising opportunities. The expansion of telehealth services into underserved areas holds significant potential; the increasing adoption of AI and ML for disease prediction and personalized medicine presents a vast opportunity space; and the growing interest in preventive healthcare and wellness apps creates a significant market for innovative solutions.

Leading Players in the Europe Digital Health Industry Market

- eClinicalWorks

- International Business Machines Corporation (IBM)

- Teladoc Health Inc (InTouch Technologies Inc)

- Cerner Corporation

- AMD Global Telemedicine Inc

- Cisco Systems

- Koninklijke Philips NV

- Allscripts Healthcare Solutions Inc

- McKesson Corporation

- Aerotel Medical Systems (1998) Ltd

Key Developments in Europe Digital Health Industry

- April 2022: University College London (UCL) and Amazon Web Services (AWS) partnered to establish a digital innovation center, fostering advancements in healthcare and education. This boosts the adoption of cloud-based solutions and accelerates innovation in the sector.

- July 2022: Smith+Nephew launched the Wound Compass Clinical Support App in the UK, enhancing wound care management and improving healthcare professionals’ decision-making. This reflects the increasing adoption of mobile health (mHealth) solutions.

Future Outlook for Europe Digital Health Industry Market

The future of the European digital health market is bright, with continued growth fueled by technological advancements, increasing demand for convenient healthcare, and supportive regulatory frameworks. The market is poised for significant expansion, particularly in areas like AI-driven diagnostics, personalized medicine, and remote patient monitoring. Strategic partnerships and investments in innovation will be crucial for companies to succeed in this rapidly evolving landscape.

Europe Digital Health Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Other Components

-

2. Technology

- 2.1. Tele-healthcare

-

2.2. Mobile Health (mHealth)

- 2.2.1. Wearables

- 2.2.2. Apps

- 2.3. Health Analytics

-

2.4. Digital Health Systems

- 2.4.1. E-Health Records

- 2.4.2. E-Prescription

-

3. Mode of Delivery

- 3.1. On-premise Delivery

- 3.2. Cloud-based Delivery

Europe Digital Health Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Digital Health Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Digital Health Services and Government Initiatives; Technological Advancements in the Area of Digital Health; Increasing Demand of Remote Patient Monitoring

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Concerns for Patient Data; High Deployment and Maintenance Expenditure

- 3.4. Market Trends

- 3.4.1. The Telehealthcare Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Other Components

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Tele-healthcare

- 5.2.2. Mobile Health (mHealth)

- 5.2.2.1. Wearables

- 5.2.2.2. Apps

- 5.2.3. Health Analytics

- 5.2.4. Digital Health Systems

- 5.2.4.1. E-Health Records

- 5.2.4.2. E-Prescription

- 5.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 5.3.1. On-premise Delivery

- 5.3.2. Cloud-based Delivery

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Germany Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Other Components

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Tele-healthcare

- 6.2.2. Mobile Health (mHealth)

- 6.2.2.1. Wearables

- 6.2.2.2. Apps

- 6.2.3. Health Analytics

- 6.2.4. Digital Health Systems

- 6.2.4.1. E-Health Records

- 6.2.4.2. E-Prescription

- 6.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 6.3.1. On-premise Delivery

- 6.3.2. Cloud-based Delivery

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. United Kingdom Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Other Components

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Tele-healthcare

- 7.2.2. Mobile Health (mHealth)

- 7.2.2.1. Wearables

- 7.2.2.2. Apps

- 7.2.3. Health Analytics

- 7.2.4. Digital Health Systems

- 7.2.4.1. E-Health Records

- 7.2.4.2. E-Prescription

- 7.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 7.3.1. On-premise Delivery

- 7.3.2. Cloud-based Delivery

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. France Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Other Components

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Tele-healthcare

- 8.2.2. Mobile Health (mHealth)

- 8.2.2.1. Wearables

- 8.2.2.2. Apps

- 8.2.3. Health Analytics

- 8.2.4. Digital Health Systems

- 8.2.4.1. E-Health Records

- 8.2.4.2. E-Prescription

- 8.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 8.3.1. On-premise Delivery

- 8.3.2. Cloud-based Delivery

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Italy Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Other Components

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Tele-healthcare

- 9.2.2. Mobile Health (mHealth)

- 9.2.2.1. Wearables

- 9.2.2.2. Apps

- 9.2.3. Health Analytics

- 9.2.4. Digital Health Systems

- 9.2.4.1. E-Health Records

- 9.2.4.2. E-Prescription

- 9.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 9.3.1. On-premise Delivery

- 9.3.2. Cloud-based Delivery

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Spain Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Other Components

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Tele-healthcare

- 10.2.2. Mobile Health (mHealth)

- 10.2.2.1. Wearables

- 10.2.2.2. Apps

- 10.2.3. Health Analytics

- 10.2.4. Digital Health Systems

- 10.2.4.1. E-Health Records

- 10.2.4.2. E-Prescription

- 10.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 10.3.1. On-premise Delivery

- 10.3.2. Cloud-based Delivery

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Rest of Europe Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Hardware

- 11.1.2. Software

- 11.1.3. Other Components

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Tele-healthcare

- 11.2.2. Mobile Health (mHealth)

- 11.2.2.1. Wearables

- 11.2.2.2. Apps

- 11.2.3. Health Analytics

- 11.2.4. Digital Health Systems

- 11.2.4.1. E-Health Records

- 11.2.4.2. E-Prescription

- 11.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 11.3.1. On-premise Delivery

- 11.3.2. Cloud-based Delivery

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Germany Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Digital Health Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 eClinicalWorks

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 International business Machinery Corporation (IBM)

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Teladoc Health Inc (InTouch Technologies Inc )

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Cerner Corporation

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 AMD Global Telemedicine Inc

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Cisco Systems

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Koninklijke Philips NV

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Allscripts Healthcare Solutions Inc

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 McKesson Corporation

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Aerotel Medical Systems (1998) Ltd

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 eClinicalWorks

List of Figures

- Figure 1: Europe Digital Health Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Digital Health Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Digital Health Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Digital Health Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Digital Health Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Europe Digital Health Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: Europe Digital Health Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Europe Digital Health Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 7: Europe Digital Health Industry Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 8: Europe Digital Health Industry Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 9: Europe Digital Health Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Digital Health Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Europe Digital Health Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Digital Health Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Germany Europe Digital Health Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe Digital Health Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: France Europe Digital Health Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Digital Health Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Digital Health Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Digital Health Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Europe Digital Health Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Digital Health Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Digital Health Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe Digital Health Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Digital Health Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Sweden Europe Digital Health Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Europe Digital Health Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Europe Digital Health Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Europe Digital Health Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 28: Europe Digital Health Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 29: Europe Digital Health Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 30: Europe Digital Health Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 31: Europe Digital Health Industry Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 32: Europe Digital Health Industry Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 33: Europe Digital Health Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Digital Health Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Europe Digital Health Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 36: Europe Digital Health Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 37: Europe Digital Health Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 38: Europe Digital Health Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 39: Europe Digital Health Industry Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 40: Europe Digital Health Industry Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 41: Europe Digital Health Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Digital Health Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Europe Digital Health Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 44: Europe Digital Health Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 45: Europe Digital Health Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 46: Europe Digital Health Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 47: Europe Digital Health Industry Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 48: Europe Digital Health Industry Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 49: Europe Digital Health Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Europe Digital Health Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: Europe Digital Health Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 52: Europe Digital Health Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 53: Europe Digital Health Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 54: Europe Digital Health Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 55: Europe Digital Health Industry Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 56: Europe Digital Health Industry Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 57: Europe Digital Health Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Europe Digital Health Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 59: Europe Digital Health Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 60: Europe Digital Health Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 61: Europe Digital Health Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 62: Europe Digital Health Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 63: Europe Digital Health Industry Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 64: Europe Digital Health Industry Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 65: Europe Digital Health Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Europe Digital Health Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: Europe Digital Health Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 68: Europe Digital Health Industry Volume K Unit Forecast, by Component 2019 & 2032

- Table 69: Europe Digital Health Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 70: Europe Digital Health Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 71: Europe Digital Health Industry Revenue Million Forecast, by Mode of Delivery 2019 & 2032

- Table 72: Europe Digital Health Industry Volume K Unit Forecast, by Mode of Delivery 2019 & 2032

- Table 73: Europe Digital Health Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Europe Digital Health Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Digital Health Industry?

The projected CAGR is approximately 18.11%.

2. Which companies are prominent players in the Europe Digital Health Industry?

Key companies in the market include eClinicalWorks, International business Machinery Corporation (IBM), Teladoc Health Inc (InTouch Technologies Inc ), Cerner Corporation, AMD Global Telemedicine Inc, Cisco Systems, Koninklijke Philips NV, Allscripts Healthcare Solutions Inc, McKesson Corporation, Aerotel Medical Systems (1998) Ltd.

3. What are the main segments of the Europe Digital Health Industry?

The market segments include Component, Technology, Mode of Delivery.

4. Can you provide details about the market size?

The market size is estimated to be USD 81.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Digital Health Services and Government Initiatives; Technological Advancements in the Area of Digital Health; Increasing Demand of Remote Patient Monitoring.

6. What are the notable trends driving market growth?

The Telehealthcare Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Concerns for Patient Data; High Deployment and Maintenance Expenditure.

8. Can you provide examples of recent developments in the market?

April 2022: University College London (UCL) and Amazon Web Services (AWS) teamed up to build a digital innovation center at the IDEALondon technology hub. The center will assist healthcare and education organizations to accelerate digital innovation and address global concerns in their fields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Digital Health Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Digital Health Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Digital Health Industry?

To stay informed about further developments, trends, and reports in the Europe Digital Health Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence