Key Insights

The European novel drug delivery systems (NDDS) market is experiencing robust growth, driven by a confluence of factors. The aging population across Europe is increasing the prevalence of chronic diseases requiring sophisticated drug delivery solutions. Furthermore, a rising demand for improved patient compliance and therapeutic efficacy is fueling the adoption of NDDS technologies, such as targeted and controlled release systems. Technological advancements in areas like nanotechnology and biomaterials are enabling the development of more efficient and safer drug delivery methods, further propelling market expansion. The market's segmentation reveals a strong focus on oral and injectable drug delivery systems, reflecting established preferences in pharmaceutical administration. However, pulmonary and transdermal drug delivery systems are showing significant growth potential, driven by the development of innovative inhalers and patches offering enhanced convenience and targeted delivery. Major pharmaceutical players like Bayer, Novartis, and Roche are heavily investing in R&D and strategic acquisitions to solidify their market position and capitalize on the burgeoning opportunities presented by NDDS. The competitive landscape is characterized by both large multinational corporations and smaller specialized companies, fostering innovation and driving the market forward.

While the market faces challenges like stringent regulatory approvals and high R&D costs associated with developing novel drug delivery systems, these hurdles are being progressively overcome by increasing collaboration between academia, research institutions, and pharmaceutical companies. The forecast period of 2025-2033 projects continued expansion, with specific growth rates within individual segments—oral, injectable, pulmonary, and transdermal—likely varying based on innovation and regulatory approvals within each segment. The geographic analysis, focusing on key European nations like Germany, the UK, France, Italy, and Spain, reveals a market landscape that is diverse yet driven by largely similar factors. Continued market penetration by existing players, alongside the entry of smaller innovative companies, will likely shape the competitive dynamics in the coming years. The market is poised for substantial growth, driven by innovation and a global demand for more effective and patient-friendly drug delivery solutions.

Europe Novel Drug Delivery Systems Industry: A Comprehensive Market Report (2019-2033)

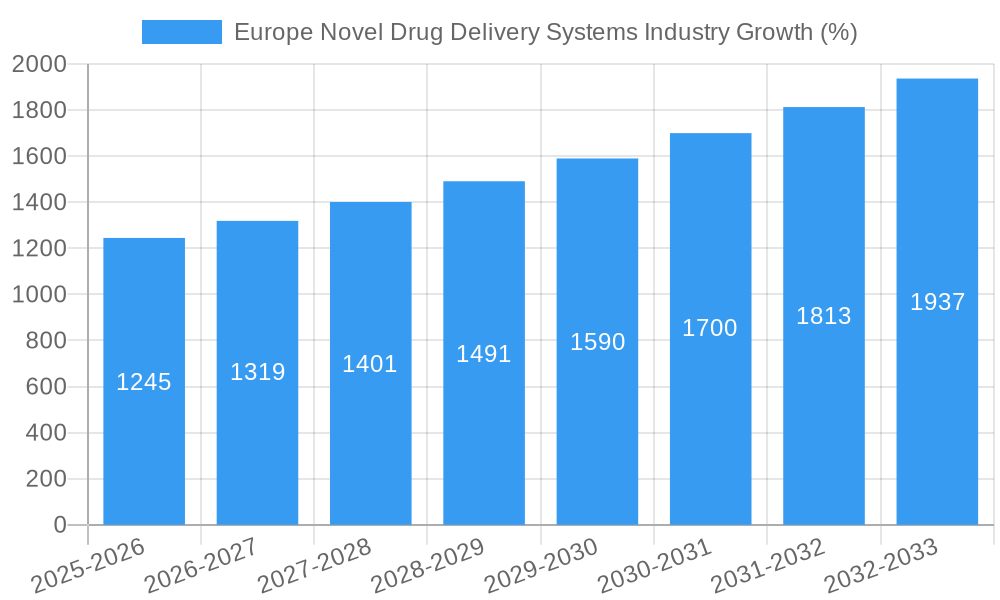

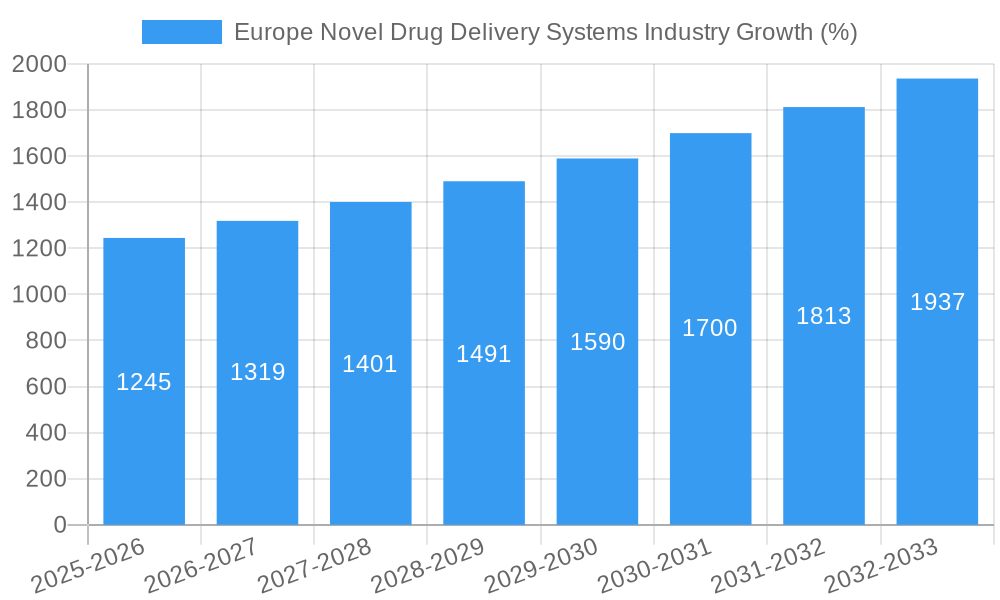

This in-depth report provides a comprehensive analysis of the European novel drug delivery systems (NDDS) industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report leverages extensive market research and data analysis to provide actionable intelligence on market size, growth drivers, challenges, and future opportunities. The market is expected to reach xx Billion by 2033.

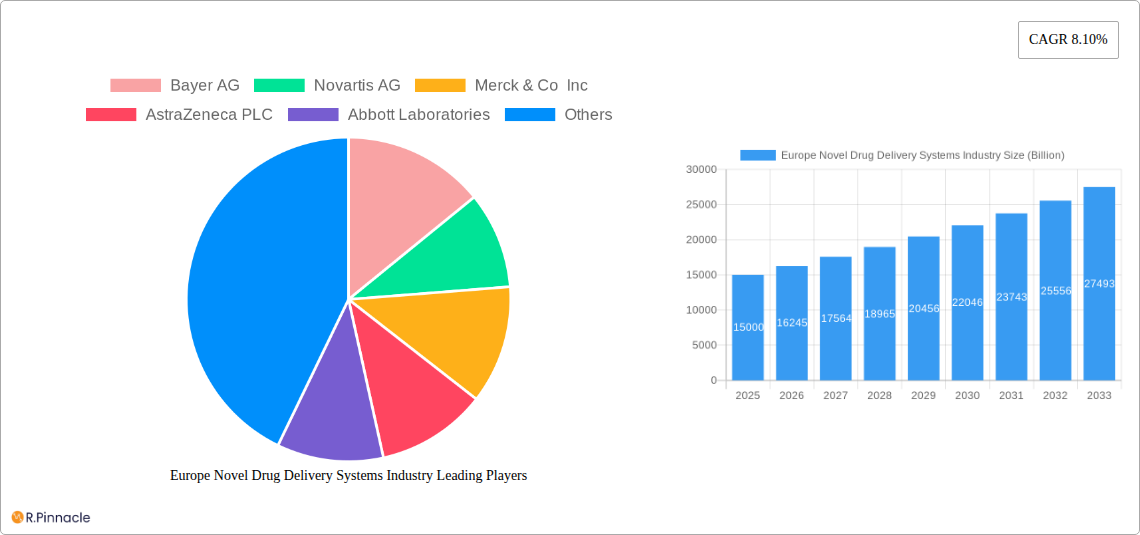

Europe Novel Drug Delivery Systems Industry Market Structure & Innovation Trends

The European NDDS market is characterized by a moderately concentrated structure, with key players like Bayer AG, Novartis AG, Merck & Co Inc, AstraZeneca PLC, Abbott Laboratories, F. Hoffmann-La Roche AG, Sanofi SA, Johnson & Johnson, GlaxoSmithKline PLC, and Pfizer Inc. holding significant market share. However, the market also features several smaller, specialized companies driving innovation. Market share is currently estimated at xx% for the top 5 players, with a predicted increase to xx% by 2033. Innovation is driven by the need for improved therapeutic efficacy, patient compliance, and reduced side effects. Stringent regulatory frameworks within the European Union impact the pace of new product approvals. The landscape is further shaped by ongoing mergers and acquisitions (M&A) activities, with several billion-dollar deals observed in the historical period (2019-2024), totaling an estimated xx Billion in value. Product substitutes, such as traditional drug delivery methods, present ongoing competitive pressure. End-user demographics, primarily focused on aging populations with chronic diseases, influence market demand significantly.

- Key Market Players: Bayer AG, Novartis AG, Merck & Co Inc, AstraZeneca PLC, Abbott Laboratories, F Hoffmann-La Roche AG, Sanofi SA, Johnson & Johnson, GlaxoSmithKline PLC, Pfizer Inc.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% of the market share in 2025.

- M&A Activity: Estimated xx Billion in deal value during 2019-2024.

- Innovation Drivers: Improved efficacy, patient compliance, reduced side effects.

Europe Novel Drug Delivery Systems Industry Market Dynamics & Trends

The European NDDS market exhibits robust growth, driven by factors such as the increasing prevalence of chronic diseases, technological advancements in drug delivery technologies, rising demand for personalized medicine, and supportive regulatory environments. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, particularly in nanotechnology and biopharmaceuticals, are revolutionizing drug delivery methods. Consumer preferences are shifting towards more convenient and patient-friendly delivery systems, boosting demand for innovative solutions. Competitive dynamics remain intense, with major pharmaceutical companies investing heavily in R&D and strategic partnerships to maintain their market positions. Market penetration of novel drug delivery systems is steadily increasing, reaching an estimated xx% in 2025, and projected to reach xx% by 2033.

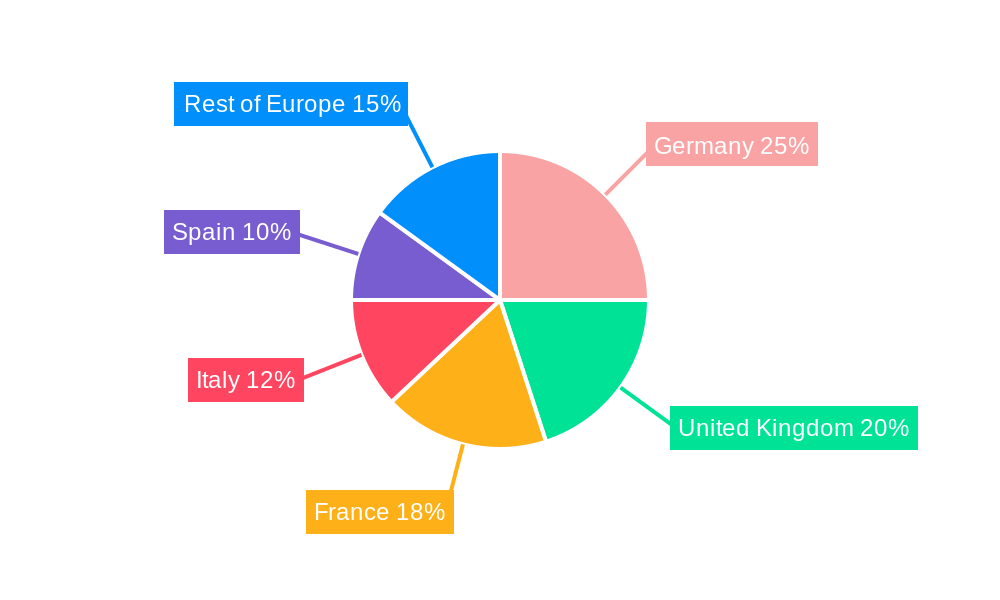

Dominant Regions & Segments in Europe Novel Drug Delivery Systems Industry

The German market currently holds the largest share within Europe, followed by the UK and France. This dominance is driven by factors such as robust healthcare infrastructure, strong R&D investment, and a large patient population requiring advanced drug delivery solutions.

By Route of Administration:

- Oral Drug Delivery Systems: This segment dominates the market due to ease of administration and patient preference. Key drivers include ongoing innovation in formulations for enhanced bioavailability and reduced side effects.

- Injectable Drug Delivery Systems: This segment is experiencing substantial growth due to the rising demand for biologics and targeted therapies. Key drivers include advancements in injection technology (e.g., auto-injectors) and sustained-release formulations.

- Pulmonary Drug Delivery Systems: This segment is driven by the increasing prevalence of respiratory diseases and the advantages of targeted delivery to the lungs. Growth is influenced by the development of more efficient and comfortable inhaler devices.

- Transdermal Drug Delivery Systems: Growth in this segment is fueled by improvements in patch technology, increasing patient convenience, and a desire for non-invasive drug administration.

- Other Routes of Administration: This segment includes ophthalmic, nasal, and rectal routes, which are experiencing moderate growth driven by increasing research and development in specialized drug delivery mechanisms.

By Mode of NDDS:

Targeted Drug Delivery Systems: Rapid growth in this segment is propelled by the need for improved therapeutic efficacy and reduced off-target effects.

Controlled Drug Delivery Systems: Strong growth in this area reflects the advantages of controlled drug release in minimizing side effects and improving treatment compliance.

Modulated Drug Delivery Systems: This segment is driven by innovations focusing on adjusting drug release based on physiological conditions.

Key Drivers (Germany): Strong healthcare infrastructure, high R&D investment, large patient population.

Key Drivers (UK & France): Similar factors to Germany, along with robust regulatory frameworks.

Europe Novel Drug Delivery Systems Industry Product Innovations

Recent product innovations focus on advanced formulations, such as liposomes, nanoparticles, and microspheres, to enhance drug solubility, stability, and targeted delivery. These innovations offer significant competitive advantages by improving therapeutic efficacy, reducing side effects, and increasing patient compliance. Technological trends, such as nanotechnology, microfluidics, and 3D printing, are revolutionizing drug delivery systems, enabling the creation of personalized and more efficient treatment options. Market fit is improved by tailored designs considering patient preferences and specific disease requirements.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the European NDDS market across various segments. By Route of Administration: Oral, Injectable, Pulmonary, Transdermal, and Other routes are evaluated, with detailed analysis of their respective market sizes, growth projections, and competitive landscapes. By Mode of NDDS: Targeted, Controlled, and Modulated drug delivery systems are analyzed similarly. Each segment's analysis includes key factors influencing market growth, including technological advancements and prevailing competitive dynamics. Detailed market size projections and growth forecasts for each segment are presented throughout the forecast period (2025-2033).

Key Drivers of Europe Novel Drug Delivery Systems Industry Growth

Several key factors contribute to the growth of the European NDDS market. Technological advancements in nanotechnology, microfluidics, and biomaterials are enabling the development of more effective and targeted drug delivery systems. The rising prevalence of chronic diseases, particularly among the aging population, fuels the demand for innovative treatment options. Furthermore, supportive regulatory frameworks in Europe encourage the development and adoption of novel drug delivery technologies. Finally, increasing investments in research and development by major pharmaceutical companies and biotech firms are driving market growth.

Challenges in the Europe Novel Drug Delivery Systems Industry Sector

The European NDDS market faces several challenges. Stringent regulatory pathways can lengthen the time required to bring new products to market, increasing development costs. Complex supply chains, potential manufacturing complexities, and dependence on specialized materials can introduce cost and supply uncertainties. Intense competition among established pharmaceutical companies and emerging biotech firms also poses a challenge. These factors can significantly impact the profitability and growth trajectory of companies in this sector.

Emerging Opportunities in Europe Novel Drug Delivery Systems Industry

Several emerging opportunities exist in the European NDDS market. The growing demand for personalized medicine and targeted therapies creates opportunities for customized drug delivery systems. Advancements in digital technologies offer opportunities for improving patient adherence and remote monitoring of drug delivery. Expansion into emerging markets within Europe with unmet needs represents a significant growth avenue. Finally, research collaborations and partnerships provide opportunities to accelerate innovation and market penetration.

Leading Players in the Europe Novel Drug Delivery Systems Industry Market

- Bayer AG

- Novartis AG

- Merck & Co Inc

- AstraZeneca PLC

- Abbott Laboratories

- F Hoffmann-La Roche AG

- Sanofi SA

- Johnson & Johnson

- GlaxoSmithKline PLC

- Pfizer Inc

Key Developments in Europe Novel Drug Delivery Systems Industry Industry

- January 2023: Company X launches a new injectable drug delivery system for diabetes treatment.

- June 2022: Company Y announces a strategic partnership to develop a novel pulmonary drug delivery system.

- October 2021: Company Z completes acquisition of a biotech company specializing in targeted drug delivery.

- Further key developments to be added based on data analysis.

Future Outlook for Europe Novel Drug Delivery Systems Industry Market

The future outlook for the European NDDS market is extremely positive, driven by ongoing technological advancements, an increasing prevalence of chronic diseases, and a supportive regulatory environment. Continued growth is anticipated, fueled by innovation in areas such as personalized medicine, targeted drug delivery, and digital health integration. Strategic partnerships and collaborations among industry stakeholders are expected to accelerate innovation and market expansion. The market is poised for significant growth, creating ample opportunities for both established players and emerging companies.

Europe Novel Drug Delivery Systems Industry Segmentation

-

1. Route of Administration

- 1.1. Oral Drug Delivery Systems

- 1.2. Injectable Drug Delivery Systems

- 1.3. Pulmonary Drug Delivery Systems

- 1.4. Transdermal Drug Delivery Systems

- 1.5. Other Routes of Administration

-

2. Mode of NDDS

- 2.1. Targeted Drug Delivery Systems

- 2.2. Controlled Drug Delivery Systems

- 2.3. Modulated Drug Delivery Systems

Europe Novel Drug Delivery Systems Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Novel Drug Delivery Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Technological Advancements Promoting the Development of NDDS; Rising Need for the Controlled Release of Drugs

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Guidelines; Stability Issues

- 3.4. Market Trends

- 3.4.1. Targeted Drug Delivery Systems Segment under Mode of NDDS is Expected to hold the Largest Market Share during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral Drug Delivery Systems

- 5.1.2. Injectable Drug Delivery Systems

- 5.1.3. Pulmonary Drug Delivery Systems

- 5.1.4. Transdermal Drug Delivery Systems

- 5.1.5. Other Routes of Administration

- 5.2. Market Analysis, Insights and Forecast - by Mode of NDDS

- 5.2.1. Targeted Drug Delivery Systems

- 5.2.2. Controlled Drug Delivery Systems

- 5.2.3. Modulated Drug Delivery Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Germany Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. United Kingdom Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. France Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. Italy Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10. Spain Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Bayer AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Novartis AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Merck & Co Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AstraZeneca PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Abbott Laboratories

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 F Hoffmann-La Roche AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sanofi SA*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Johnson & Johnson

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 GlaxoSmithKline PLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Pfizer Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Bayer AG

List of Figures

- Figure 1: Europe Novel Drug Delivery Systems Industry Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: Europe Novel Drug Delivery Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Route of Administration 2019 & 2032

- Table 3: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Mode of NDDS 2019 & 2032

- Table 4: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 8: France Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 10: Spain Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 12: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Route of Administration 2019 & 2032

- Table 13: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Mode of NDDS 2019 & 2032

- Table 14: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Germany Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 17: France Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 19: Spain Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Novel Drug Delivery Systems Industry?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Europe Novel Drug Delivery Systems Industry?

Key companies in the market include Bayer AG, Novartis AG, Merck & Co Inc, AstraZeneca PLC, Abbott Laboratories, F Hoffmann-La Roche AG, Sanofi SA*List Not Exhaustive, Johnson & Johnson, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Europe Novel Drug Delivery Systems Industry?

The market segments include Route of Administration, Mode of NDDS.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Billion as of 2022.

5. What are some drivers contributing to market growth?

; Technological Advancements Promoting the Development of NDDS; Rising Need for the Controlled Release of Drugs.

6. What are the notable trends driving market growth?

Targeted Drug Delivery Systems Segment under Mode of NDDS is Expected to hold the Largest Market Share during the Forecast Period.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Guidelines; Stability Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Novel Drug Delivery Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Novel Drug Delivery Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Novel Drug Delivery Systems Industry?

To stay informed about further developments, trends, and reports in the Europe Novel Drug Delivery Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence