Key Insights

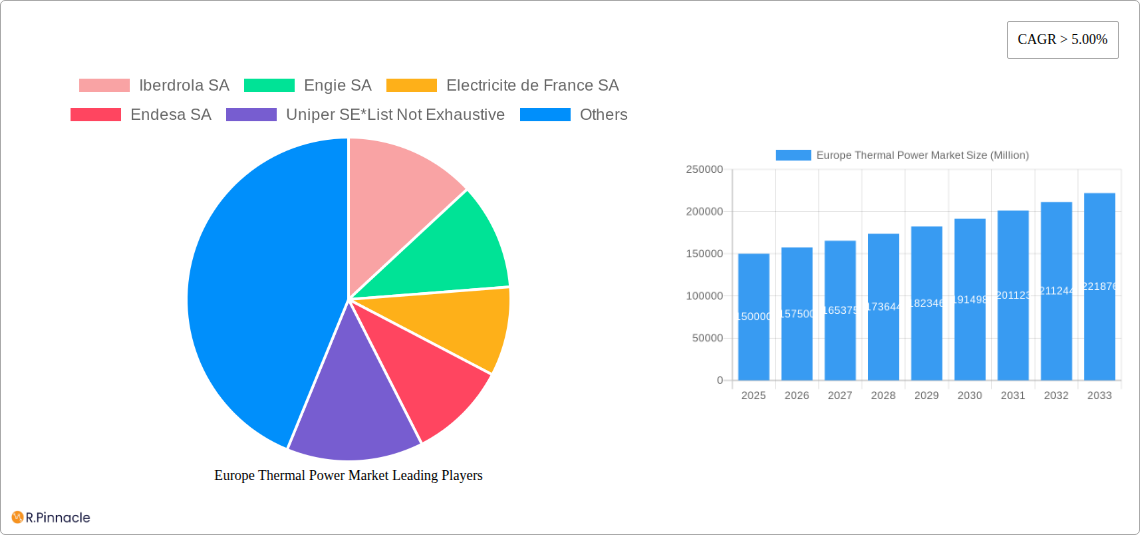

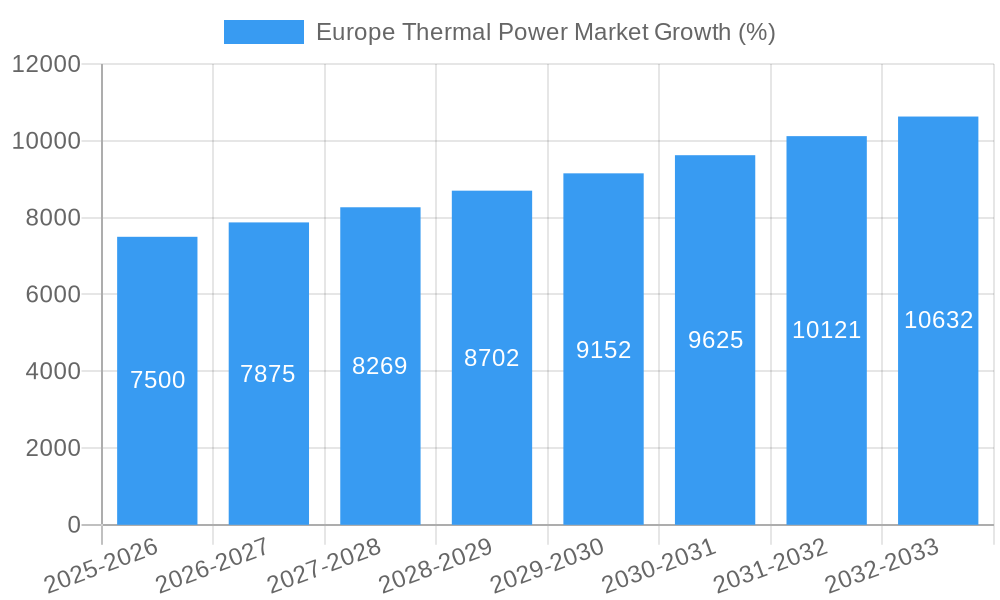

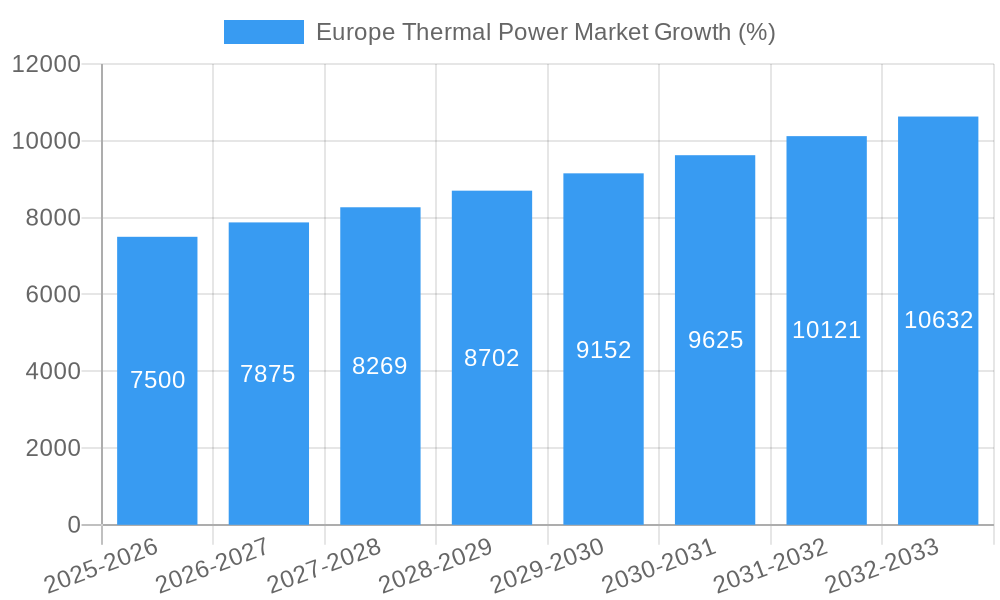

The European thermal power market, valued at approximately €[Estimate based on "Market size XX" and "Value Unit Million," assuming XX is a reasonable number, e.g., €150 billion in 2025], is experiencing robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 5%. This expansion is driven by several factors, including the increasing demand for electricity fueled by industrialization and population growth, particularly in developing economies within Europe. While renewable energy sources are gaining traction, thermal power plants, particularly those utilizing natural gas, continue to play a crucial role in ensuring energy security and grid stability, especially during peak demand periods. This is particularly true given Europe's current geopolitical landscape and its need for energy independence. However, the market faces significant headwinds. Stringent environmental regulations aimed at curbing greenhouse gas emissions are leading to increased compliance costs for thermal power generators. Furthermore, the fluctuating prices of fossil fuels (coal, oil, and natural gas) introduce considerable uncertainty, impacting plant profitability and investment decisions. The transition to cleaner energy sources, including nuclear power, is steadily reshaping the market landscape, pushing traditional thermal power plants toward modernization and potentially early retirement. The market segmentation reveals a diversified fuel mix, with natural gas likely holding the largest share due to its relative efficiency and lower carbon footprint compared to coal.

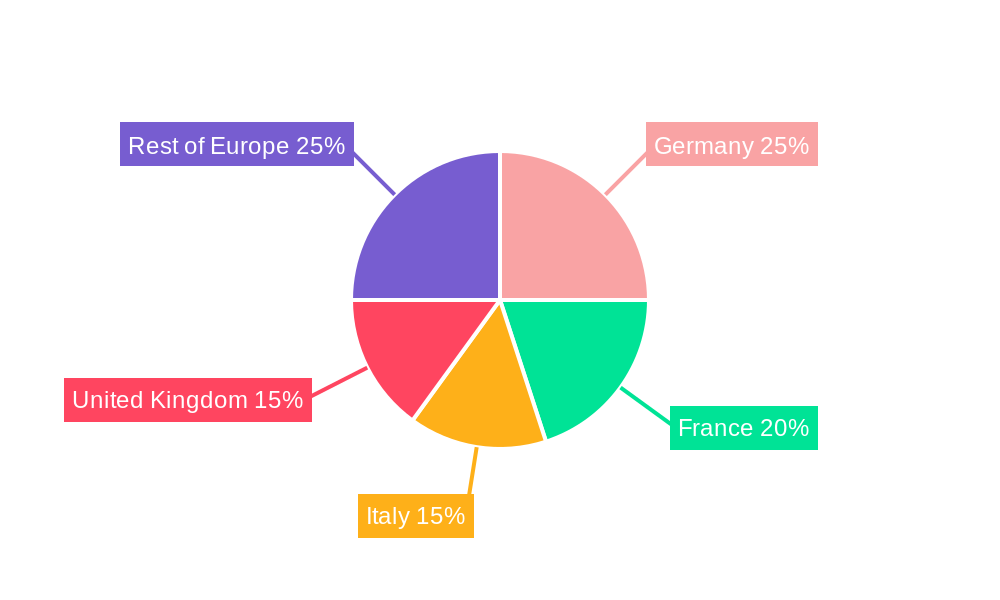

The competitive landscape is dominated by major players like Iberdrola SA, Engie SA, and EDF SA, who are strategically investing in upgrades and exploring diversified energy portfolios. Germany, France, Italy, and the UK represent the largest national markets within Europe, reflecting their higher electricity consumption and established power infrastructure. However, other European nations are also showing growth potential, driven by expanding economies and industrial activities. The forecast period (2025-2033) will likely witness a gradual shift towards a more sustainable mix within thermal power, with an emphasis on gas-fired plants and potentially advanced carbon capture technologies to mitigate environmental concerns. The interplay between regulatory pressures, fuel price volatility, and technological advancements will shape the trajectory of the European thermal power market in the coming years. Long-term market growth will likely depend on the pace of renewable energy adoption and the effective implementation of climate change mitigation policies across Europe.

Europe Thermal Power Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Thermal Power Market, covering the period 2019-2033, with a focus on market structure, dynamics, key players, and future outlook. The report leverages detailed data and expert insights to provide actionable intelligence for industry professionals. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033 and the historical period 2019-2024. The report is essential for strategic decision-making in this dynamic and evolving market.

Europe Thermal Power Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, regulatory aspects, and market dynamics within the European thermal power sector. We delve into market concentration, exploring the market share held by key players such as Iberdrola SA, Engie SA, Electricite de France SA, Endesa SA, Uniper SE, Siemens AG, Rosatom State Atomic Energy Corporation, and Enel S p A (list not exhaustive). We examine the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible (xx Million). The analysis includes an assessment of innovation drivers, such as technological advancements in power generation, regulatory frameworks influencing market participation and investment decisions, the presence and impact of product substitutes (e.g., renewable energy sources), and evolving end-user demographics and their energy consumption patterns. Furthermore, the report provides a detailed overview of the market’s innovative trends, including the adoption of advanced technologies and the role of research and development.

- Market Concentration: Analysis of market share distribution amongst major players.

- M&A Activity: Review of significant mergers and acquisitions, including deal values (xx Million).

- Innovation Drivers: Identification of key technological and regulatory factors stimulating innovation.

- Regulatory Frameworks: Assessment of the impact of environmental regulations and energy policies.

- Product Substitutes: Evaluation of the competitive pressures from renewable energy sources.

- End-User Demographics: Analysis of changes in energy demand based on population growth and economic factors.

Europe Thermal Power Market Dynamics & Trends

This section explores the key factors driving market growth, technological advancements, shifting consumer preferences, and competitive dynamics within the European thermal power market. We analyze historical data and project future trends, providing a comprehensive overview of market dynamics. This includes an examination of the Compound Annual Growth Rate (CAGR) and market penetration rates for different thermal power sources. We will further analyze the impact of geopolitical events and economic fluctuations.

- Market Growth Drivers: Factors such as increasing energy demand, industrialization, and economic growth.

- Technological Disruptions: Impact of innovations in power generation technologies, such as advanced gas turbines and carbon capture.

- Consumer Preferences: Shifting consumer priorities toward sustainability and environmental concerns.

- Competitive Dynamics: Analysis of market competition, including strategies of leading players.

- CAGR & Market Penetration: Quantitative assessment of market growth and technology adoption.

Dominant Regions & Segments in Europe Thermal Power Market

This section identifies the leading regions and segments (Coal, Natural Gas, Oil, Nuclear) within the European thermal power market. We will analyze the factors contributing to the dominance of specific regions and segments, focusing on underlying economic policies, infrastructure development, and resource availability. A detailed dominance analysis will be provided for each segment, outlining reasons for its success and current market position.

- Leading Region: Identification of the region with the highest market share and reasons for its dominance.

- Key Drivers (By Segment):

- Coal: Economic factors, existing infrastructure, and resource availability.

- Natural Gas: Increased gas pipeline infrastructure, reduced cost of gas, and transition from coal.

- Oil: Specific regional reliance on oil-fired power plants and geopolitical factors.

- Nuclear: Government policies favoring nuclear power, existing infrastructure, and safety standards.

- Country-level Analysis: Examination of individual country performance within the European market.

Europe Thermal Power Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in the European thermal power market. We will analyze emerging technologies and their potential to disrupt the market and highlight advancements in efficiency, emissions reduction, and overall performance. The focus will be on the market fit and adoption rate of new products and technologies.

Report Scope & Segmentation Analysis

This report segments the European thermal power market by source: Coal, Natural Gas, Oil, and Nuclear. Each segment’s growth projections, market size (in Million), and competitive dynamics will be analyzed separately.

- Coal: Market size, growth projections, and competitive landscape.

- Natural Gas: Market size, growth projections, and competitive landscape.

- Oil: Market size, growth projections, and competitive landscape.

- Nuclear: Market size, growth projections, and competitive landscape.

Key Drivers of Europe Thermal Power Market Growth

This section outlines the key factors driving the growth of the European thermal power market. We will focus on technological advancements, economic factors, and favorable regulatory environments. Specific examples will be provided to illustrate the impact of each driver.

Challenges in the Europe Thermal Power Market Sector

This section identifies and analyzes the major challenges facing the European thermal power market. These include regulatory hurdles (e.g., emission standards), supply chain disruptions, and intensifying competition from renewable energy sources. The quantifiable impact of these challenges will be assessed.

Emerging Opportunities in Europe Thermal Power Market

This section highlights emerging trends and opportunities in the European thermal power market, including the potential for new technologies, market expansion into underserved regions, and adaptation to evolving consumer preferences.

Leading Players in the Europe Thermal Power Market Market

- Iberdrola SA

- Engie SA

- Electricite de France SA

- Endesa SA

- Uniper SE

- Siemens AG

- Rosatom State Atomic Energy Corporation

- Enel S p A

Key Developments in Europe Thermal Power Market Industry

April 2022: The UK government announced the formation of Great British Nuclear, aiming to increase nuclear power generation capacity to 24 GW by 2050. This initiative signifies a significant commitment to nuclear energy and is expected to boost the market for nuclear power plant construction and related services.

July 2022: Energa SA ordered a GE 9HA.02 turnkey combined cycle power plant (745 MW) for the Ostroleka C power station, indicating continued investment in natural gas-fired power generation. The project also highlights the growing importance of gas infrastructure interconnections, like the Poland-Lithuania Interconnector.

January 2023: Polska Grupa Energetyczna (PGE) selected a contractor to build an 882 MW gas and steam plant in Rybnik, Poland. This further demonstrates the ongoing investment in natural gas power generation within the European Union.

Future Outlook for Europe Thermal Power Market Market

The future of the European thermal power market will be shaped by a complex interplay of factors, including the ongoing energy transition, technological advancements, and geopolitical influences. While renewable energy sources are gaining prominence, thermal power will likely continue to play a significant role in the energy mix, particularly during peak demand periods and in providing grid stability. The focus will increasingly shift towards cleaner technologies, such as combined cycle gas turbines and carbon capture, utilization, and storage (CCUS) to reduce environmental impact. Strategic opportunities will exist for companies that invest in these technologies and adapt to the changing regulatory landscape.

Europe Thermal Power Market Segmentation

-

1. Source

- 1.1. Coal

- 1.2. Natural Gas

- 1.3. Oil

- 1.4. Nuclear

Europe Thermal Power Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Russia

- 5. Rest of Europe

Europe Thermal Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies for Renewable Energy4.; Adoption of Cleaner Power Generation Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Nuclear Energy and Other Renewable Energy Alternatives

- 3.4. Market Trends

- 3.4.1. Natural Gas Based Thermal Power to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Coal

- 5.1.2. Natural Gas

- 5.1.3. Oil

- 5.1.4. Nuclear

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. France

- 5.2.3. Germany

- 5.2.4. Russia

- 5.2.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. United Kingdom Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Coal

- 6.1.2. Natural Gas

- 6.1.3. Oil

- 6.1.4. Nuclear

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. France Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Coal

- 7.1.2. Natural Gas

- 7.1.3. Oil

- 7.1.4. Nuclear

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Germany Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Coal

- 8.1.2. Natural Gas

- 8.1.3. Oil

- 8.1.4. Nuclear

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Russia Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Coal

- 9.1.2. Natural Gas

- 9.1.3. Oil

- 9.1.4. Nuclear

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Rest of Europe Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Coal

- 10.1.2. Natural Gas

- 10.1.3. Oil

- 10.1.4. Nuclear

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Germany Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Iberdrola SA

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Engie SA

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Electricite de France SA

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Endesa SA

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Uniper SE*List Not Exhaustive

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Siemens AG

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Rosatom State Atomic Energy Corporation

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Enel S p A

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.1 Iberdrola SA

List of Figures

- Figure 1: Europe Thermal Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Thermal Power Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Thermal Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Thermal Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Europe Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: Europe Thermal Power Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 5: Europe Thermal Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Thermal Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: Europe Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Europe Thermal Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Europe Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 11: France Europe Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Europe Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Italy Europe Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Europe Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Europe Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Europe Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Netherlands Europe Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherlands Europe Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Sweden Europe Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sweden Europe Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe Thermal Power Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Europe Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 24: Europe Thermal Power Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 25: Europe Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Thermal Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 27: Europe Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 28: Europe Thermal Power Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 29: Europe Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Thermal Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 31: Europe Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 32: Europe Thermal Power Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 33: Europe Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Thermal Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 35: Europe Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 36: Europe Thermal Power Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 37: Europe Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Europe Thermal Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 39: Europe Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 40: Europe Thermal Power Market Volume Gigawatt Forecast, by Source 2019 & 2032

- Table 41: Europe Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Thermal Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Thermal Power Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Thermal Power Market?

Key companies in the market include Iberdrola SA, Engie SA, Electricite de France SA, Endesa SA, Uniper SE*List Not Exhaustive, Siemens AG, Rosatom State Atomic Energy Corporation, Enel S p A.

3. What are the main segments of the Europe Thermal Power Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies for Renewable Energy4.; Adoption of Cleaner Power Generation Sources.

6. What are the notable trends driving market growth?

Natural Gas Based Thermal Power to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Competition from Nuclear Energy and Other Renewable Energy Alternatives.

8. Can you provide examples of recent developments in the market?

January 2023: The Polish 75% state-owned energy firm, Polska Grupa Energetyczna (PGE), announced the selection of a contractor to build an 882 MW gas and steam plant in the southern city of Rybnik. The facility is planned to be operational by 2027.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Thermal Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Thermal Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Thermal Power Market?

To stay informed about further developments, trends, and reports in the Europe Thermal Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence