Key Insights

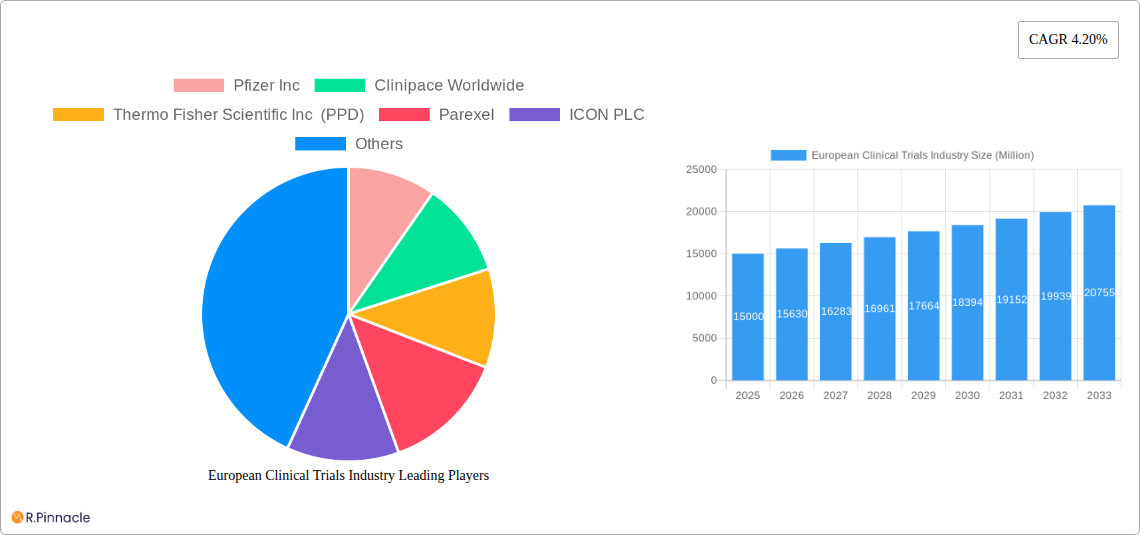

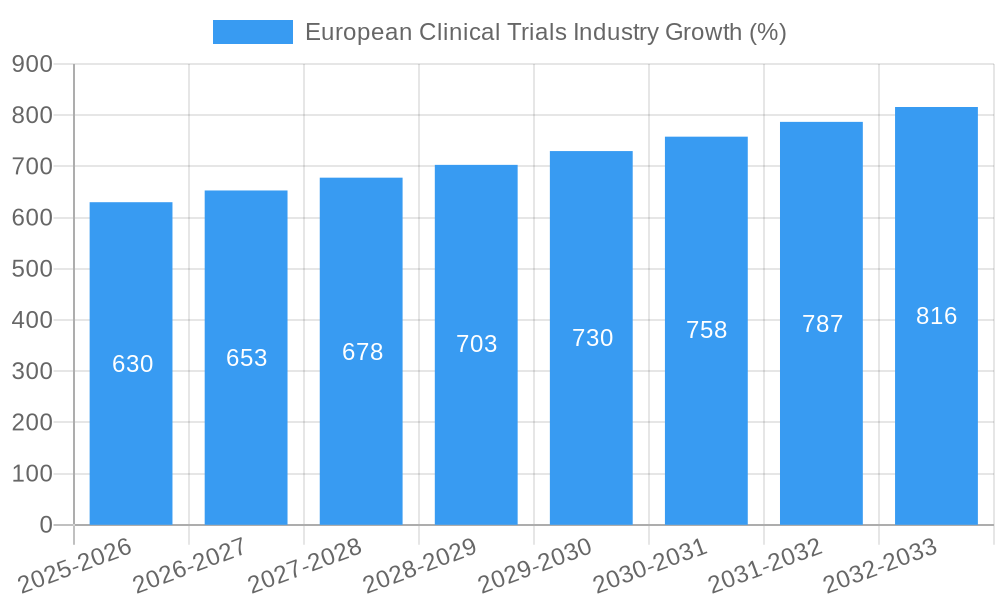

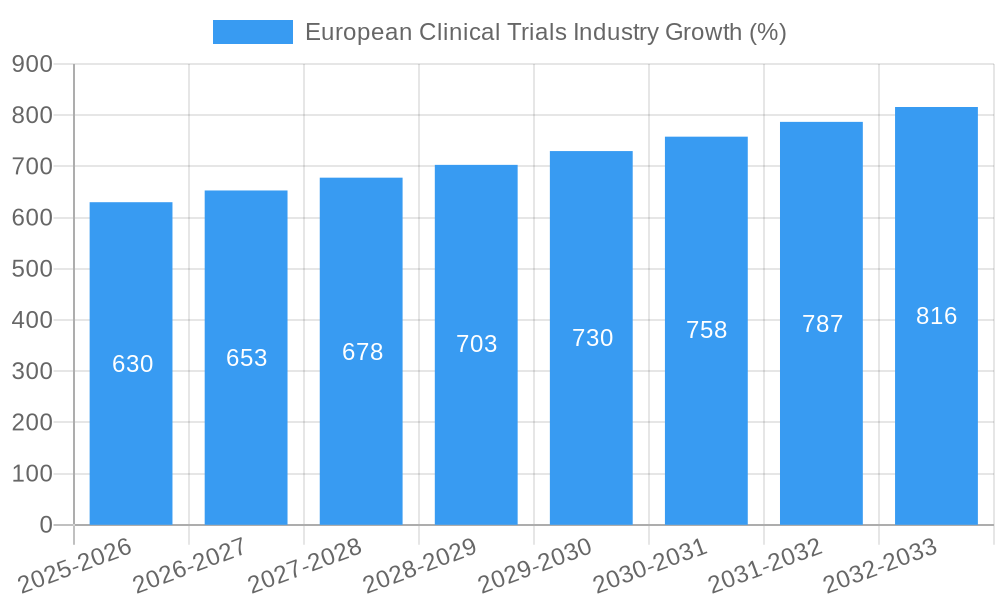

The European clinical trials market, a cornerstone of global pharmaceutical research and development, is poised for robust growth. Driven by an aging population, increasing prevalence of chronic diseases like cancer and diabetes, and a supportive regulatory environment, the market experienced considerable expansion in the period between 2019 and 2024. The projected Compound Annual Growth Rate (CAGR) of 4.20% from 2025 to 2033 indicates continued market expansion, with significant opportunities across various phases of clinical trials. The market is segmented by trial phase (I-IV), design (Treatment Studies, Observational Studies including Non-randomized Control Trials), and key players such as Pfizer, Sanofi, Roche, and IQVIA. Major European countries like Germany, France, the UK, and Italy contribute significantly to the overall market size, attracting substantial investments in research infrastructure and talent.

Growth is fueled by advancements in technology, leading to more efficient trial designs and data analysis. The increasing adoption of decentralized clinical trials (DCTs) and the use of real-world data (RWD) are further accelerating the market expansion. While challenges such as stringent regulatory approvals and increasing costs remain, the overall outlook is optimistic. The burgeoning focus on personalized medicine and innovative therapies will further stimulate demand for clinical trials in Europe, contributing to a substantial increase in market value throughout the forecast period. The dominance of major pharmaceutical companies reflects the capital-intensive nature of clinical trials, although the rise of specialized Contract Research Organizations (CROs) like Clinipace Worldwide and Parexel suggests a growing outsourcing trend.

European Clinical Trials Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the European clinical trials industry, encompassing market structure, dynamics, key players, and future outlook. Covering the period from 2019 to 2033, with a focus on 2025, this report offers actionable insights for industry professionals, investors, and researchers. The report leverages a robust methodology to deliver a thorough understanding of the market's current state and future trajectory. This detailed analysis includes granular segmentations, projections based on historical data (2019-2024), and forecasts extending to 2033. The expected market size for 2025 is estimated at xx Million.

European Clinical Trials Industry Market Structure & Innovation Trends

The European clinical trials market exhibits a moderately consolidated structure with several major players and numerous smaller CROs (Contract Research Organizations). Market share is dynamic, with ongoing M&A activity influencing the competitive landscape. Key innovation drivers include advancements in technology (e.g., AI, Big Data analytics), increasing demand for personalized medicine, and regulatory changes encouraging innovative trial designs. The regulatory framework, while stringent, is evolving to facilitate faster drug development. Product substitutes, such as alternative research methodologies, exert some competitive pressure. End-users primarily consist of pharmaceutical companies, biotechnology firms, and academic institutions. Recent M&A activity has involved significant financial transactions, with deals exceeding xx Million in value over the past five years.

- Market Concentration: Moderately consolidated with key players holding significant market share.

- Innovation Drivers: Technological advancements, personalized medicine, and regulatory changes.

- Regulatory Framework: Stringent but evolving to support innovation.

- M&A Activity: Significant transactions exceeding xx Million observed in the last five years.

European Clinical Trials Industry Market Dynamics & Trends

The European clinical trials market is experiencing robust growth, driven by several factors including an aging population, rising prevalence of chronic diseases, increased investment in R&D by pharmaceutical companies, and growing adoption of innovative technologies. The market’s Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological disruptions, such as the increasing use of AI and big data, are transforming trial design and execution, improving efficiency and reducing costs. Market penetration of these technologies is expected to reach xx% by 2033. Consumer preferences for faster access to innovative therapies are placing pressure on the industry to streamline clinical trial processes. Competitive dynamics are characterized by both cooperation and rivalry among large pharmaceutical companies and CROs.

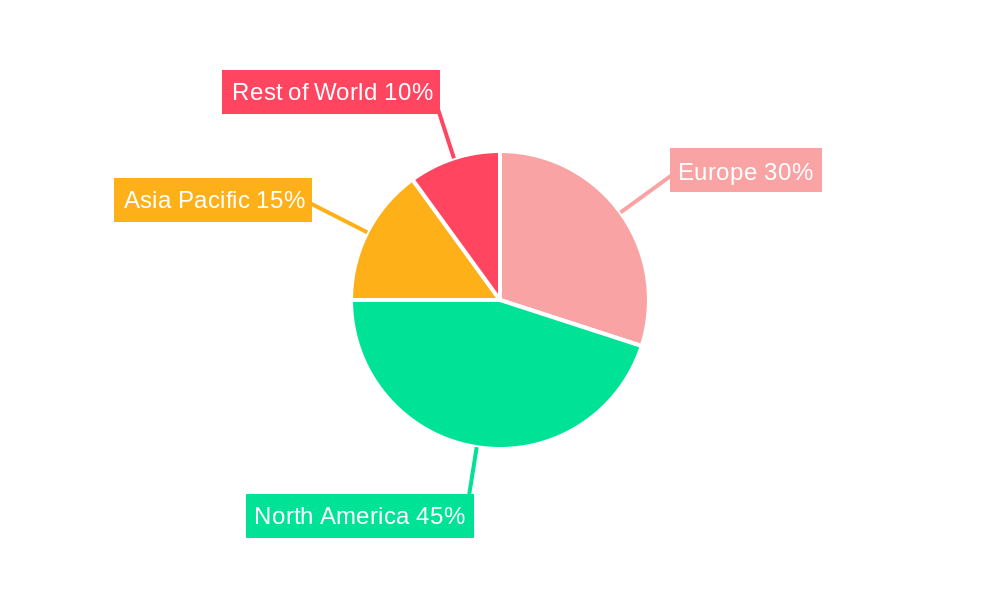

Dominant Regions & Segments in European Clinical Trials Industry

Germany, the United Kingdom, and France represent the leading regions for clinical trials in Europe. Their dominance stems from robust healthcare infrastructure, favorable regulatory environments, and a large pool of qualified researchers and patients. Within the various trial phases, Phase III trials command the largest share due to their crucial role in demonstrating efficacy and safety prior to market launch. Treatment studies constitute the dominant segment, followed by observational studies, reflecting the prevalent focus on evaluating new therapies.

- Key Drivers of Regional Dominance:

- Germany: Strong research infrastructure, government support for research and development.

- United Kingdom: Well-established healthcare system, experienced clinical trial professionals.

- France: Significant investment in pharmaceutical research, strong academic institutions.

- Phase I-IV Trial Dominance: Phase III trials represent the largest segment due to regulatory requirements.

- Treatment vs. Observational Studies: Treatment studies dominate, reflecting the emphasis on evaluating new therapies.

European Clinical Trials Industry Product Innovations

The clinical trials industry continuously experiences product innovations driven by advancements in technology and evolving research needs. Innovations include AI-powered platforms for patient recruitment and data analysis, decentralized clinical trials (DCTs), and the development of new biomarkers for improved trial design and outcome assessment. These innovations are improving efficiency, reducing costs, and enhancing the quality of clinical trials. The market fit is strong as these innovations directly address the challenges of speed, cost, and accuracy in clinical research.

Report Scope & Segmentation Analysis

This report segments the European clinical trials market by phase (Phase I, II, III, and IV), trial design (Treatment Studies, Observational Studies including Non-randomized Control Trials), and geography (major European countries). Each segment presents unique growth projections, market sizes, and competitive dynamics. The market for Phase III trials, for example, is expected to experience substantial growth due to the high demand for late-stage trials before drug launches. Similarly, Treatment Studies are projected to maintain a dominant share due to the focus on new therapeutic interventions.

Key Drivers of European Clinical Trials Industry Growth

The European clinical trials industry is driven by several factors: a rapidly aging population increasing the prevalence of chronic diseases, increased R&D spending by pharmaceutical and biotech companies, technological advancements such as AI and big data analytics improving trial efficiency and outcomes, and the continuous need for new therapies to address unmet medical needs. Favorable regulatory frameworks supporting innovation also contribute to market growth.

Challenges in the European Clinical Trials Industry Sector

The industry faces several challenges including stringent regulatory requirements potentially delaying trial timelines, complex and costly patient recruitment processes, and rising competition among CROs impacting pricing and profitability. Supply chain disruptions and data privacy concerns also present ongoing challenges. The cumulative effect of these factors can delay drug development and increase costs.

Emerging Opportunities in European Clinical Trials Industry

Emerging opportunities include the growing adoption of decentralized clinical trials (DCTs) leading to improved patient access and cost efficiency, an increased focus on Real-World Evidence (RWE) generating valuable post-market data, and expansion into emerging therapeutic areas like gene therapy and immunotherapy. These advancements present potential for market expansion and innovation.

Leading Players in the European Clinical Trials Industry Market

- Pfizer Inc

- Clinipace Worldwide

- Thermo Fisher Scientific Inc (PPD)

- Parexel

- ICON PLC

- Sanofi

- Eli Lilly and Company

- F Hoffmann-La Roche AG

- IQVIA

- Novo Nordisk

Key Developments in European Clinical Trials Industry Industry

- June 2022: Eli Lilly and Company released Phase III clinical trial AWARDS-PEDS results for Trulicity (dulaglutide), demonstrating superior A1C reductions in youth with type 2 diabetes. This strengthens the drug's position in the market.

- January 2022: Pfizer-BioNTech launched a clinical trial for a new COVID-19 Omicron variant vaccine, addressing the need for updated protection against emerging variants. This highlights the ongoing need for vaccine development and innovation.

Future Outlook for European Clinical Trials Industry Market

The European clinical trials market is poised for continued growth, driven by technological advancements, increasing R&D investment, and the unmet needs in various therapeutic areas. Strategic opportunities exist for companies that can leverage technological innovations, streamline processes, and focus on personalized medicine approaches. The market's potential is significant, with continued expansion projected throughout the forecast period.

European Clinical Trials Industry Segmentation

-

1. Phase

- 1.1. Phase I

- 1.2. Phase II

- 1.3. Phase III

- 1.4. Phase IV

-

2. Design

-

2.1. Treatment Studies

- 2.1.1. Randomized Control Trial

- 2.1.2. Adaptive Clinical Trial

- 2.1.3. Non-randomized Control Trial

-

2.2. Observational Studies

- 2.2.1. Cohort Study

- 2.2.2. Case Control Study

- 2.2.3. Cross Sectional Study

- 2.2.4. Ecological Study

-

2.1. Treatment Studies

European Clinical Trials Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

European Clinical Trials Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Research and Development Spending of the Healthcare Industry; Increasing Prevalence of Chronic and Infectious Diseases; Rising Focus on Rare Diseases and Multiple Orphan Drugs

- 3.3. Market Restrains

- 3.3.1. Lower Healthcare Reimbursement in Developing Countries; Stringent Regulations for Patient Enrollment

- 3.4. Market Trends

- 3.4.1. Phase III Segment is Expected to Hold the Major Revenue Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 5.1.1. Phase I

- 5.1.2. Phase II

- 5.1.3. Phase III

- 5.1.4. Phase IV

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Treatment Studies

- 5.2.1.1. Randomized Control Trial

- 5.2.1.2. Adaptive Clinical Trial

- 5.2.1.3. Non-randomized Control Trial

- 5.2.2. Observational Studies

- 5.2.2.1. Cohort Study

- 5.2.2.2. Case Control Study

- 5.2.2.3. Cross Sectional Study

- 5.2.2.4. Ecological Study

- 5.2.1. Treatment Studies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 6. Germany European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 6.1.1. Phase I

- 6.1.2. Phase II

- 6.1.3. Phase III

- 6.1.4. Phase IV

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Treatment Studies

- 6.2.1.1. Randomized Control Trial

- 6.2.1.2. Adaptive Clinical Trial

- 6.2.1.3. Non-randomized Control Trial

- 6.2.2. Observational Studies

- 6.2.2.1. Cohort Study

- 6.2.2.2. Case Control Study

- 6.2.2.3. Cross Sectional Study

- 6.2.2.4. Ecological Study

- 6.2.1. Treatment Studies

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 7. United Kingdom European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 7.1.1. Phase I

- 7.1.2. Phase II

- 7.1.3. Phase III

- 7.1.4. Phase IV

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Treatment Studies

- 7.2.1.1. Randomized Control Trial

- 7.2.1.2. Adaptive Clinical Trial

- 7.2.1.3. Non-randomized Control Trial

- 7.2.2. Observational Studies

- 7.2.2.1. Cohort Study

- 7.2.2.2. Case Control Study

- 7.2.2.3. Cross Sectional Study

- 7.2.2.4. Ecological Study

- 7.2.1. Treatment Studies

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 8. France European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 8.1.1. Phase I

- 8.1.2. Phase II

- 8.1.3. Phase III

- 8.1.4. Phase IV

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Treatment Studies

- 8.2.1.1. Randomized Control Trial

- 8.2.1.2. Adaptive Clinical Trial

- 8.2.1.3. Non-randomized Control Trial

- 8.2.2. Observational Studies

- 8.2.2.1. Cohort Study

- 8.2.2.2. Case Control Study

- 8.2.2.3. Cross Sectional Study

- 8.2.2.4. Ecological Study

- 8.2.1. Treatment Studies

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 9. Spain European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 9.1.1. Phase I

- 9.1.2. Phase II

- 9.1.3. Phase III

- 9.1.4. Phase IV

- 9.2. Market Analysis, Insights and Forecast - by Design

- 9.2.1. Treatment Studies

- 9.2.1.1. Randomized Control Trial

- 9.2.1.2. Adaptive Clinical Trial

- 9.2.1.3. Non-randomized Control Trial

- 9.2.2. Observational Studies

- 9.2.2.1. Cohort Study

- 9.2.2.2. Case Control Study

- 9.2.2.3. Cross Sectional Study

- 9.2.2.4. Ecological Study

- 9.2.1. Treatment Studies

- 9.1. Market Analysis, Insights and Forecast - by Phase

- 10. Italy European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 10.1.1. Phase I

- 10.1.2. Phase II

- 10.1.3. Phase III

- 10.1.4. Phase IV

- 10.2. Market Analysis, Insights and Forecast - by Design

- 10.2.1. Treatment Studies

- 10.2.1.1. Randomized Control Trial

- 10.2.1.2. Adaptive Clinical Trial

- 10.2.1.3. Non-randomized Control Trial

- 10.2.2. Observational Studies

- 10.2.2.1. Cohort Study

- 10.2.2.2. Case Control Study

- 10.2.2.3. Cross Sectional Study

- 10.2.2.4. Ecological Study

- 10.2.1. Treatment Studies

- 10.1. Market Analysis, Insights and Forecast - by Phase

- 11. Rest of Europe European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 11.1.1. Phase I

- 11.1.2. Phase II

- 11.1.3. Phase III

- 11.1.4. Phase IV

- 11.2. Market Analysis, Insights and Forecast - by Design

- 11.2.1. Treatment Studies

- 11.2.1.1. Randomized Control Trial

- 11.2.1.2. Adaptive Clinical Trial

- 11.2.1.3. Non-randomized Control Trial

- 11.2.2. Observational Studies

- 11.2.2.1. Cohort Study

- 11.2.2.2. Case Control Study

- 11.2.2.3. Cross Sectional Study

- 11.2.2.4. Ecological Study

- 11.2.1. Treatment Studies

- 11.1. Market Analysis, Insights and Forecast - by Phase

- 12. Germany European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 13. France European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe European Clinical Trials Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Pfizer Inc

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Clinipace Worldwide

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Thermo Fisher Scientific Inc (PPD)

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Parexel

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 ICON PLC

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Sanofi

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Eli Lilly and Company

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 F Hoffmann-La Roche AG

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 IQVIA

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Novo Nordisk

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Pfizer Inc

List of Figures

- Figure 1: European Clinical Trials Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Clinical Trials Industry Share (%) by Company 2024

List of Tables

- Table 1: European Clinical Trials Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 3: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 4: European Clinical Trials Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe European Clinical Trials Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 14: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 15: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 17: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 18: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 20: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 21: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 23: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 24: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 26: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 27: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: European Clinical Trials Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 29: European Clinical Trials Industry Revenue Million Forecast, by Design 2019 & 2032

- Table 30: European Clinical Trials Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Clinical Trials Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the European Clinical Trials Industry?

Key companies in the market include Pfizer Inc, Clinipace Worldwide, Thermo Fisher Scientific Inc (PPD), Parexel, ICON PLC, Sanofi, Eli Lilly and Company, F Hoffmann-La Roche AG, IQVIA, Novo Nordisk.

3. What are the main segments of the European Clinical Trials Industry?

The market segments include Phase, Design.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Research and Development Spending of the Healthcare Industry; Increasing Prevalence of Chronic and Infectious Diseases; Rising Focus on Rare Diseases and Multiple Orphan Drugs.

6. What are the notable trends driving market growth?

Phase III Segment is Expected to Hold the Major Revenue Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Lower Healthcare Reimbursement in Developing Countries; Stringent Regulations for Patient Enrollment.

8. Can you provide examples of recent developments in the market?

In June 2022, Eli Lilly and Company released phase III clinicals trail AWARDS-PEDS results for the drug Trulicity (dulaglutide) that it led to the superior A1C reductions at 26 weeks versus placebo in youth and adolescents with type 2 diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Clinical Trials Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Clinical Trials Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Clinical Trials Industry?

To stay informed about further developments, trends, and reports in the European Clinical Trials Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence