Key Insights

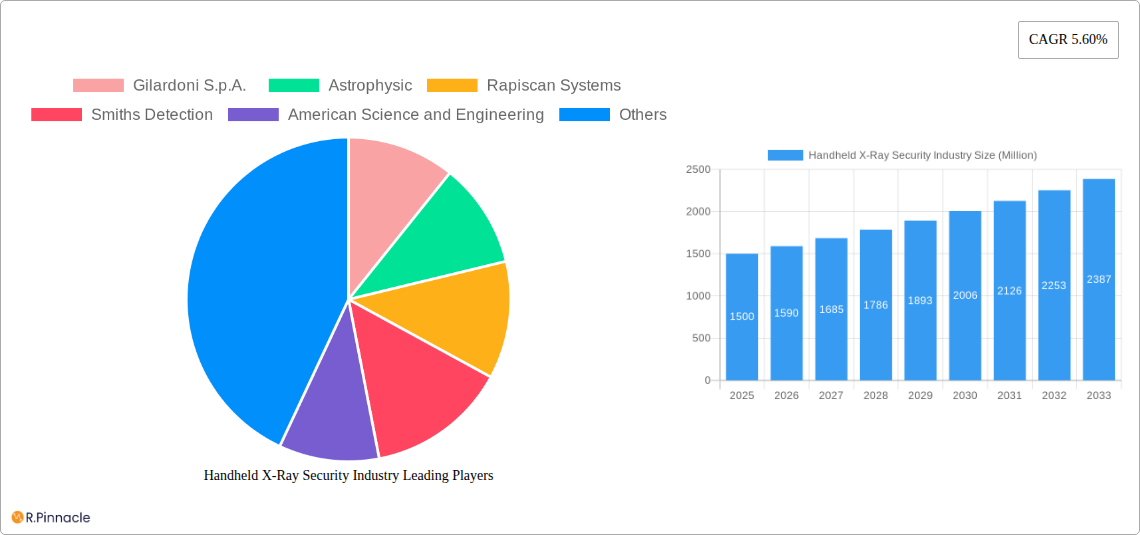

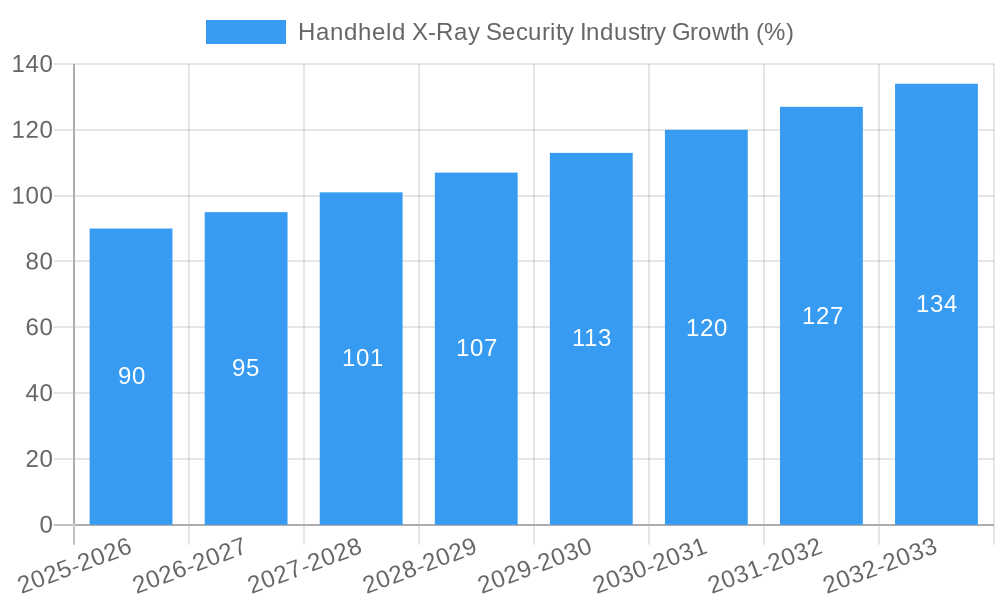

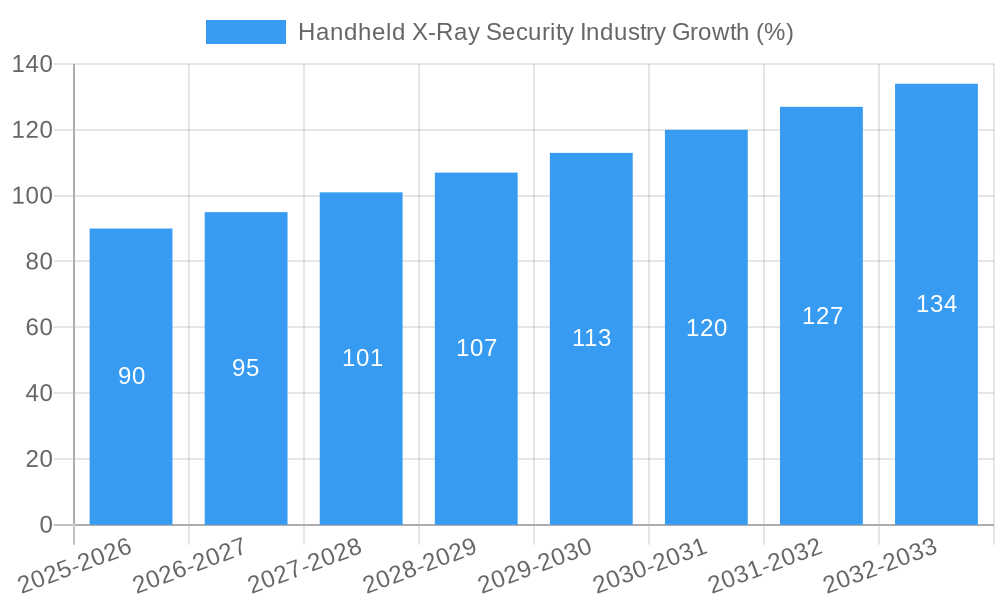

The global handheld X-ray security market, currently valued at approximately $XX million (assuming a reasonable market size based on similar technologies and growth rates), is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.60% from 2025 to 2033. This expansion is primarily driven by the increasing need for enhanced security measures across various sectors, including customs and border protection, law enforcement, critical infrastructure protection, and military and defense. The rising threat of terrorism and smuggling, coupled with stricter regulations and increasing government investments in security technologies, are key factors fueling market growth. Furthermore, advancements in X-ray technology, leading to smaller, lighter, and more user-friendly handheld devices with improved image quality and threat detection capabilities, are contributing significantly to market expansion.

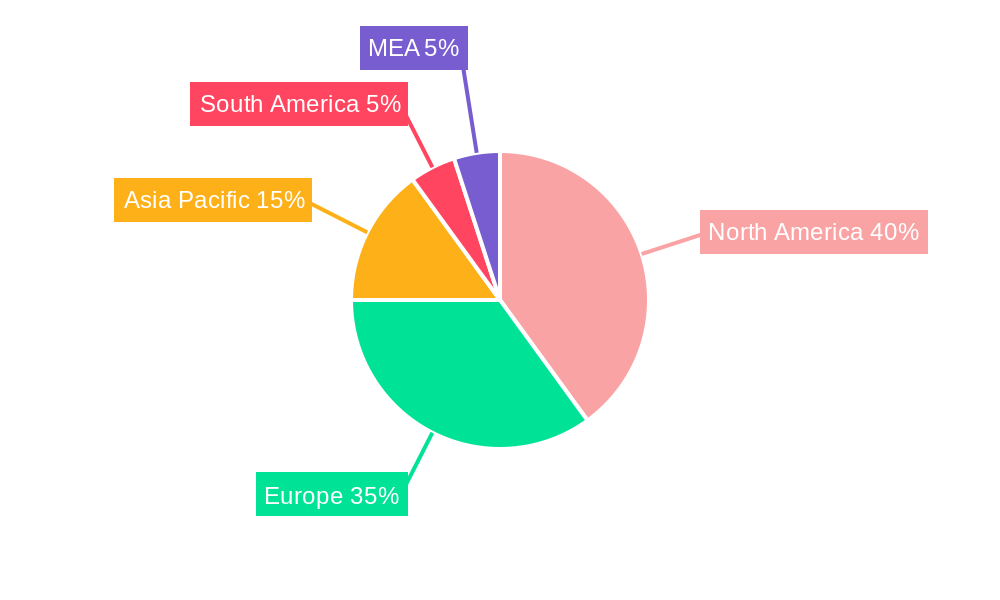

The market is segmented by end-user, with customs and border protection agencies representing a substantial portion of the market share, followed by law enforcement and critical infrastructure sectors. North America and Europe currently dominate the market, owing to high security awareness, robust technological infrastructure, and significant investments in security solutions. However, the Asia-Pacific region is anticipated to witness significant growth in the coming years, driven by rapid economic development, urbanization, and increasing security concerns in developing countries. Despite the promising outlook, market growth might face certain restraints, such as high initial investment costs for sophisticated equipment, the need for skilled personnel to operate the devices, and potential concerns regarding radiation exposure. Nevertheless, ongoing technological innovations and the persistent demand for effective security solutions are expected to mitigate these challenges and sustain market expansion throughout the forecast period. Key players like Gilardoni S.p.A., Astrophysic, Rapiscan Systems, Smiths Detection, American Science and Engineering, and Heimann Systems are actively shaping the market through product innovation and strategic partnerships.

Handheld X-Ray Security Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Handheld X-Ray Security industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future trajectory. We analyze key players like Gilardoni S.p.A., Astrophysic, Rapiscan Systems, Smiths Detection, American Science and Engineering, and Heimann Systems, across various segments including Customs and Border Protection, Law Enforcement, Critical Infrastructure, Military and Defense, and other end-users. The report projects a market valued at xx Million by 2033, demonstrating substantial growth opportunities.

Handheld X-Ray Security Industry Market Structure & Innovation Trends

This section dissects the competitive landscape of the handheld X-ray security market, examining market concentration, innovation drivers, and regulatory influences. We analyze market share distribution amongst key players, revealing the level of competition and the dominance of certain companies. For example, Smiths Detection and Rapiscan Systems are expected to hold significant market share. The report includes an assessment of M&A activities within the industry, analyzing deal values and their impact on market consolidation. Examples include recent acquisitions or mergers impacting market share (details to be included in the full report). Innovation drivers like advancements in image processing, improved portability, and the integration of AI are explored. The analysis also considers regulatory frameworks influencing market growth and technological advancements, including international standards and certifications for security equipment. Finally, the analysis delves into product substitutes (e.g., alternative screening technologies) and their potential impact on market growth. The analysis of end-user demographics helps paint a picture of the market's evolution, including the growing adoption of handheld X-ray technology in diverse sectors. We predict a xx Million increase in market value driven by these factors by 2033.

Handheld X-Ray Security Industry Market Dynamics & Trends

This section provides a comprehensive analysis of the market’s dynamic evolution, exploring growth drivers, technological disruptions, shifting consumer preferences, and competitive dynamics over the study period. The report quantifies market growth with a detailed Compound Annual Growth Rate (CAGR) analysis, projecting significant expansion driven by factors like rising security concerns globally, increasing adoption in various sectors, and ongoing technological improvements. We analyze the market penetration of handheld X-ray systems across different regions and end-user segments, highlighting areas of strong and weak growth. This assessment includes an evaluation of technological disruptions, such as the emergence of advanced imaging techniques, and their impact on market dynamics. Consumer preferences, focusing on ease of use, improved image quality, and reduced radiation exposure, are analyzed, influencing the direction of product development. Furthermore, the analysis of competitive dynamics incorporates pricing strategies, product differentiation, and the competitive intensity among key players. The report predicts that the market will reach xx Million USD by 2033 with a CAGR of xx%.

Dominant Regions & Segments in Handheld X-Ray Security Industry

This section identifies the leading regions and segments within the Handheld X-Ray Security industry. Through in-depth analysis, we determine the dominant region (e.g., North America, Europe, or Asia-Pacific) based on factors like market size, growth rate, and adoption levels. The report investigates the reasons behind this dominance, analyzing economic policies, infrastructure development, and security priorities.

- Customs and Border Protection: High security concerns and increasing passenger traffic fuel growth in this segment.

- Law Enforcement: The need for rapid and efficient screening of suspects and crime scenes drives demand.

- Critical Infrastructure: The protection of power plants, transportation hubs, and other essential facilities necessitates advanced screening technology.

- Military and Defense: The use of handheld X-ray systems for bomb disposal, IED detection, and other security applications is prevalent.

- Other End Users: This segment includes various applications, such as industrial security, healthcare, and event security.

Each segment's dominance is analyzed based on its specific market size, growth trajectory, and underlying drivers. The report will delve into the reasons for the dominance of specific regions or segments, identifying key factors and future growth potential. We project xx Million in revenue for the dominant segment by 2033.

Handheld X-Ray Security Industry Product Innovations

The handheld X-ray security market is characterized by continuous product innovation. Recent advancements include improved image resolution, enhanced portability, and integration with advanced software for improved threat detection and analysis. The integration of artificial intelligence (AI) and machine learning (ML) algorithms promises further advancements in image analysis and threat identification, leading to faster and more accurate screening. These innovations offer significant competitive advantages, allowing manufacturers to capture larger market shares and cater to evolving customer needs. Companies are focusing on developing products with features such as reduced radiation exposure, ease of use, and improved battery life to enhance user experience and expand the range of applications.

Report Scope & Segmentation Analysis

This report segments the handheld X-ray security market by end-user applications, providing a comprehensive analysis of each segment's growth projections, market size, and competitive landscape.

- Customs and Border Protection: This segment is expected to witness substantial growth due to increased security concerns at borders and airports. Market size and competitive intensity will be analyzed.

- Law Enforcement: This segment's growth is driven by the need for rapid and reliable screening of suspects and evidence. Competitive analysis and growth projections are included.

- Critical Infrastructure: The protection of vital assets drives the demand for high-performance handheld X-ray systems in this segment. Market size estimations and growth forecasts are provided.

- Military and Defense: This segment benefits from continuous technological advancements, which are shaping the market dynamics and growth trends. Specific details on growth projections are within the report.

- Other End Users: This diverse segment encompasses several applications, contributing to the overall market growth. Analysis of this segment will be provided within the report.

Each segment's market size, growth rate, and key players are detailed within the report, providing a comprehensive overview of the market landscape.

Key Drivers of Handheld X-Ray Security Industry Growth

The growth of the handheld X-ray security industry is fueled by several key factors. Increasing global security concerns, particularly related to terrorism and crime, drive demand for enhanced security measures. Technological advancements, such as improved image quality, portability, and AI-powered threat detection, are making handheld X-ray systems more effective and user-friendly. Favorable government regulations and initiatives promoting security upgrades are also contributing to market expansion. Furthermore, the increasing adoption of handheld X-ray systems across diverse sectors like transportation, healthcare, and industrial security further accelerates market growth.

Challenges in the Handheld X-Ray Security Industry Sector

Despite the positive growth outlook, the handheld X-ray security industry faces several challenges. Stringent regulatory hurdles and certification requirements can increase the cost and time involved in product development and market entry. Supply chain disruptions and component shortages can impact production and delivery timelines, especially in times of geopolitical instability. Intense competition among established players and the emergence of new entrants create pressure on pricing and profit margins. Addressing these challenges is crucial for sustainable growth in this market. The report estimates that these factors reduce the overall market growth by xx Million.

Emerging Opportunities in Handheld X-Ray Security Industry

The handheld X-ray security industry presents numerous emerging opportunities. Expanding applications in emerging markets, particularly in developing countries, are creating significant potential for growth. The integration of new technologies like AI, ML, and advanced imaging techniques can enhance system performance and open new avenues for market expansion. Growing demand for improved security in critical infrastructure, transportation hubs, and public spaces offers lucrative opportunities for market players. Furthermore, focusing on developing eco-friendly and energy-efficient systems can attract environmentally conscious customers, broadening market reach.

Leading Players in the Handheld X-Ray Security Industry Market

- Gilardoni S.p.A.

- Astrophysic

- Rapiscan Systems

- Smiths Detection

- American Science and Engineering

- Heimann Systems

Key Developments in Handheld X-Ray Security Industry Industry

- March 2021: OSI Systems' Security division received a USD 6 million order for Rapiscan 600 series baggage and parcel inspection systems. This highlights the growing demand for advanced inspection systems in the market.

Future Outlook for Handheld X-Ray Security Industry Market

The future of the handheld X-ray security industry looks promising, with continued growth driven by technological advancements, increasing security concerns, and expanding applications across various sectors. Strategic collaborations, mergers and acquisitions, and the development of innovative products with enhanced capabilities will be key factors shaping the industry's future. The market is poised for significant expansion, with opportunities for both established players and new entrants to capitalize on the growing demand for advanced security solutions. The report projects a significant increase in market value in the coming years, driven by the factors discussed above.

Handheld X-Ray Security Industry Segmentation

-

1. End User

- 1.1. Customs and Border Protection

- 1.2. Law Enforcement

- 1.3. Critical Infrastructure

- 1.4. Military and Defense

- 1.5. Other End Users

Handheld X-Ray Security Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Handheld X-Ray Security Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Highly Efficient and Easy-to-use Scanning Systems

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concers; Increased Cyber Attacks

- 3.4. Market Trends

- 3.4.1. Customs and Border Protection is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Customs and Border Protection

- 5.1.2. Law Enforcement

- 5.1.3. Critical Infrastructure

- 5.1.4. Military and Defense

- 5.1.5. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Customs and Border Protection

- 6.1.2. Law Enforcement

- 6.1.3. Critical Infrastructure

- 6.1.4. Military and Defense

- 6.1.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Customs and Border Protection

- 7.1.2. Law Enforcement

- 7.1.3. Critical Infrastructure

- 7.1.4. Military and Defense

- 7.1.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Customs and Border Protection

- 8.1.2. Law Enforcement

- 8.1.3. Critical Infrastructure

- 8.1.4. Military and Defense

- 8.1.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Customs and Border Protection

- 9.1.2. Law Enforcement

- 9.1.3. Critical Infrastructure

- 9.1.4. Military and Defense

- 9.1.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Customs and Border Protection

- 10.1.2. Law Enforcement

- 10.1.3. Critical Infrastructure

- 10.1.4. Military and Defense

- 10.1.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. North America Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. MEA Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Gilardoni S.p.A.

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Astrophysic

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Rapiscan Systems

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Smiths Detection

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 American Science and Engineering

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Heimann Systems

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.1 Gilardoni S.p.A.

List of Figures

- Figure 1: Global Handheld X-Ray Security Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Handheld X-Ray Security Industry Revenue (Million), by End User 2024 & 2032

- Figure 13: North America Handheld X-Ray Security Industry Revenue Share (%), by End User 2024 & 2032

- Figure 14: North America Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Handheld X-Ray Security Industry Revenue (Million), by End User 2024 & 2032

- Figure 17: Europe Handheld X-Ray Security Industry Revenue Share (%), by End User 2024 & 2032

- Figure 18: Europe Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Handheld X-Ray Security Industry Revenue (Million), by End User 2024 & 2032

- Figure 21: Asia Pacific Handheld X-Ray Security Industry Revenue Share (%), by End User 2024 & 2032

- Figure 22: Asia Pacific Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Handheld X-Ray Security Industry Revenue (Million), by End User 2024 & 2032

- Figure 25: Latin America Handheld X-Ray Security Industry Revenue Share (%), by End User 2024 & 2032

- Figure 26: Latin America Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Handheld X-Ray Security Industry Revenue (Million), by End User 2024 & 2032

- Figure 29: Middle East and Africa Handheld X-Ray Security Industry Revenue Share (%), by End User 2024 & 2032

- Figure 30: Middle East and Africa Handheld X-Ray Security Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Handheld X-Ray Security Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Handheld X-Ray Security Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 3: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Belgium Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherland Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Nordics Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Southeast Asia Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Australia Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Phillipes Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Thailandc Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia Pacific Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Peru Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Chile Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Colombia Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Ecuador Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Venezuela Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: United Arab Emirates Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Saudi Arabia Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East and Africa Handheld X-Ray Security Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Handheld X-Ray Security Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 46: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Global Handheld X-Ray Security Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Global Handheld X-Ray Security Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 50: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global Handheld X-Ray Security Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Handheld X-Ray Security Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 54: Global Handheld X-Ray Security Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Handheld X-Ray Security Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Handheld X-Ray Security Industry?

Key companies in the market include Gilardoni S.p.A. , Astrophysic, Rapiscan Systems , Smiths Detection, American Science and Engineering, Heimann Systems .

3. What are the main segments of the Handheld X-Ray Security Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Highly Efficient and Easy-to-use Scanning Systems.

6. What are the notable trends driving market growth?

Customs and Border Protection is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concers; Increased Cyber Attacks.

8. Can you provide examples of recent developments in the market?

March 2021 - OSI Systems announced that its Security division was awarded an order valued at approximately USD 6 million from an international customer to provide Rapiscan 600 series baggage and parcel inspection (BPI) systems, related accessories, ongoing maintenance and support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Handheld X-Ray Security Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Handheld X-Ray Security Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Handheld X-Ray Security Industry?

To stay informed about further developments, trends, and reports in the Handheld X-Ray Security Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence