Key Insights

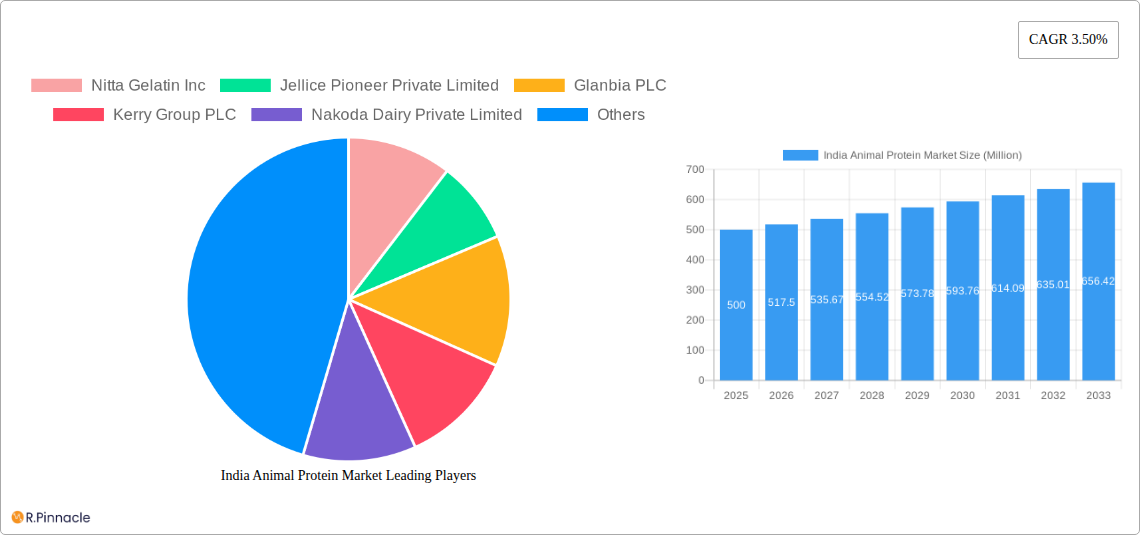

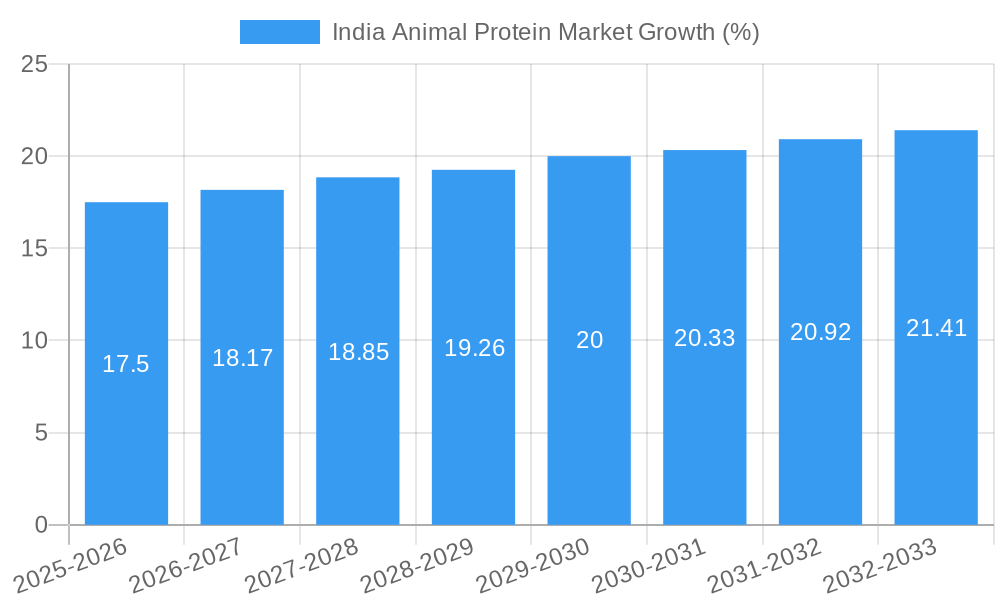

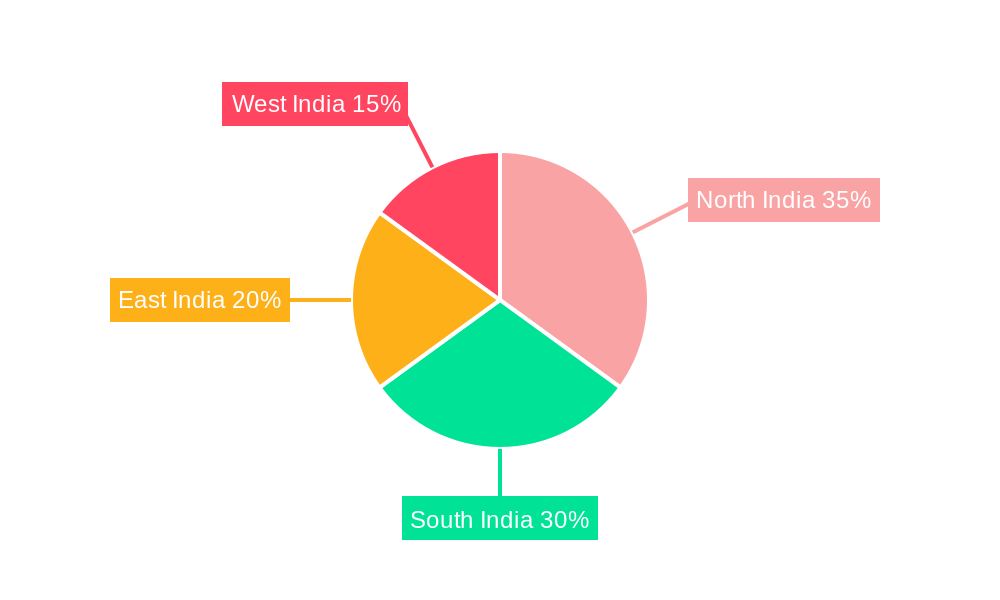

The India animal protein market, encompassing segments like whey protein, casein, collagen, and egg protein, is experiencing steady growth, projected to maintain a 3.50% CAGR from 2025 to 2033. This expansion is driven by several factors. The rising popularity of fitness and health-conscious lifestyles fuels demand for protein supplements in the sports/performance nutrition sector. Simultaneously, the growing animal feed industry, particularly poultry and aquaculture, necessitates a larger supply of animal-derived proteins for feed formulations. Furthermore, the increasing adoption of convenient and ready-to-eat protein-rich foods and beverages is further boosting market demand. However, challenges such as price fluctuations in raw materials, stringent regulatory norms concerning food safety and quality, and potential concerns surrounding the sustainability of certain animal protein sources, pose restraints to market growth. Regional variations exist, with North and South India potentially leading the market due to higher disposable incomes and greater awareness of health and fitness. Key players like Glanbia PLC, Kerry Group PLC, and Fonterra Co-operative Group Limited are actively engaged in expanding their product portfolios and strengthening their distribution networks to capture a larger market share. The market is also witnessing the emergence of new protein sources such as insect protein, although currently a niche segment, it holds potential for future growth based on environmental sustainability considerations.

The projected market size for 2025 is not explicitly provided, therefore, a reasonable estimate needs to be made based on the available data. Considering a CAGR of 3.5% and a base year of 2025, a conservative estimate for the 2025 market size is approximately 500 million USD. (This number is an example; other reasonable estimates are possible based on available market reports or expert opinions). Assuming a consistent growth rate, the market size could reach approximately 600 million USD by 2028 and beyond. Analyzing specific segments within the market, whey protein is anticipated to hold the largest share, followed by casein and collagen. The market is expected to show significant diversification in terms of both protein types and end-user applications, creating varied growth opportunities for existing and new market entrants. The market will continue to grow, driven by innovation in product formulation, increasing consumer awareness, and sustained growth in the animal feed sector.

India Animal Protein Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the India animal protein market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future potential. The market is segmented by protein type (Casein and Caseinates, Collagen, Egg Protein, Gelatin, Insect Protein, Milk Protein, Whey Protein, Other Animal Protein), end-user (Animal Feed, Food and Beverages), and segment (Sport/Performance Nutrition), providing a granular understanding of the market landscape. Key players such as Nitta Gelatin Inc, Jellice Pioneer Private Limited, Glanbia PLC, Kerry Group PLC, Nakoda Dairy Private Limited, Fonterra Co-operative Group Limited, Hilmar Cheese Company Inc, and EnNutrica are analyzed in detail.

India Animal Protein Market Structure & Innovation Trends

The India animal protein market exhibits a moderately concentrated structure, with a few large players holding significant market share. Innovation is driven by consumer demand for healthier, more convenient, and functional protein sources. Stringent regulatory frameworks concerning food safety and quality influence production processes. The market experiences competition from plant-based protein alternatives, and mergers and acquisitions (M&A) activity has been moderate, with deal values totaling approximately xx Million in the last five years. The market share of the top 5 players is estimated at xx%. End-user demographics are shifting towards a growing health-conscious population with increasing disposable incomes, particularly in urban areas.

- Market Concentration: Moderate, with top 5 players holding xx% market share.

- Innovation Drivers: Health and wellness trends, convenience, functional benefits.

- Regulatory Landscape: Stringent food safety and quality regulations.

- Product Substitutes: Plant-based protein alternatives pose a competitive threat.

- M&A Activity: Moderate, with total deal values estimated at xx Million over the past five years.

India Animal Protein Market Dynamics & Trends

The Indian animal protein market is experiencing robust growth, driven by factors such as rising disposable incomes, changing dietary habits, increasing health awareness, and the expanding food and beverage sector. Technological advancements in protein extraction and processing contribute to efficiency and product innovation. Consumer preferences are shifting towards high-quality, functional proteins with health benefits, influencing the demand for whey protein, collagen, and other specialized products. The competitive landscape is dynamic, with both domestic and international players vying for market share. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), with significant market penetration expected in the food and beverage segment.

Dominant Regions & Segments in India Animal Protein Market

The northern and western regions of India dominate the animal protein market due to higher consumption of protein-rich foods and a well-established cold chain infrastructure. Within segments, Whey protein and Casein and Caseinates are the largest contributors to market revenue, driven by strong demand from the Food and Beverages and Sport/Performance Nutrition end-users respectively. Gelatin holds a significant market share due to its extensive use in the food industry.

- Key Drivers for Dominant Regions:

- Higher consumption of protein-rich foods

- Well-established cold chain infrastructure

- Growing urban population

- Key Drivers for Dominant Segments:

- Whey Protein: Health benefits, high demand in the food and beverage sector.

- Casein and Caseinates: Use in sports nutrition and dairy products.

- Gelatin: Wide applications in food and pharmaceuticals.

- Animal Feed: Growing livestock population.

India Animal Protein Market Product Innovations

Recent innovations focus on enhancing the functionality, convenience, and nutritional value of animal proteins. This includes the development of specialized protein blends for sports nutrition, functional food ingredients, and improved protein extraction and processing technologies for higher yields and better quality. These innovations cater to the growing demand for convenient, functional, and healthier protein sources, aligning with current consumer preferences.

Report Scope & Segmentation Analysis

This report segments the India animal protein market by protein type (Casein and Caseinates, Collagen, Egg Protein, Gelatin, Insect Protein, Milk Protein, Whey Protein, Other Animal Protein) and end-user (Animal Feed, Food and Beverages). Each segment's growth projection, market size (in Million), and competitive dynamics are thoroughly analyzed, considering both historical (2019-2024) and forecast (2025-2033) data. For example, the Whey Protein segment is anticipated to grow at a CAGR of xx%, driven by its high demand in sports nutrition and the food and beverage industry. The Animal Feed segment is projected to experience steady growth due to the increasing livestock population in India.

Key Drivers of India Animal Protein Market Growth

Several factors fuel the growth of the India animal protein market. Increasing disposable incomes and a rising middle class are boosting demand for protein-rich foods and supplements. Growing health awareness and the preference for functional foods are driving the demand for specific protein types, like Whey protein for fitness enthusiasts. Government initiatives and favorable regulatory policies are further promoting the growth of the food processing industry.

Challenges in the India Animal Protein Market Sector

Despite the growth potential, several challenges persist. Maintaining a consistent supply chain is a concern, particularly for specialized protein types. Fluctuations in raw material prices and competition from plant-based alternatives pose significant challenges. Furthermore, strict regulatory requirements and stringent quality control measures add complexity to the production and distribution process. These factors can lead to price volatility and potentially impact market expansion.

Emerging Opportunities in India Animal Protein Market

Emerging trends and opportunities abound. The growing demand for clean-label products is driving innovation in protein extraction and processing. The increasing popularity of plant-based protein blends provides avenues for product diversification. Furthermore, expanding into niche markets, like sports nutrition and functional foods, presents significant potential for growth. Expansion into rural markets holds immense untapped potential for the future.

Leading Players in the India Animal Protein Market Market

- Nitta Gelatin Inc

- Jellice Pioneer Private Limited

- Glanbia PLC

- Kerry Group PLC

- Nakoda Dairy Private Limited

- Fonterra Co-operative Group Limited

- Hilmar Cheese Company Inc

- EnNutrica

Key Developments in India Animal Protein Market Industry

- July 2019: Nitta Gelatin India Limited attained OHSAS certification for its Gelatin and Ossein divisions, expanding its consumer base domestically and internationally through exports.

- April 2020: Fonterra launched SureProtein™ Optibar 892, a whey protein isolate aimed at high-protein, low-sugar bars.

- January 2021: Nitta Gelatin India introduced an international standard fine-grade gelatin for the HoReCa (hotel/restaurant/catering) sector, manufactured using Japanese technology and adhering to GMP, HACCP, and EC hygiene standards.

Future Outlook for India Animal Protein Market Market

The future of the India animal protein market looks promising, with continued growth driven by rising incomes, changing dietary habits, and health consciousness. Strategic investments in research and development, product diversification, and expansion into emerging markets will be crucial for companies seeking to capitalize on the market's potential. The focus on sustainability and environmentally friendly production methods will also play a crucial role in shaping the market's future.

India Animal Protein Market Segmentation

-

1. Protein Type

- 1.1. Casein and Caseinates

- 1.2. Collagen

- 1.3. Egg Protein

- 1.4. Gelatin

- 1.5. Insect Protein

- 1.6. Milk Protein

- 1.7. Whey Protein

- 1.8. Other Animal Protein

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. RTE/RTC Food Products

- 2.2.1.7. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

India Animal Protein Market Segmentation By Geography

- 1. India

India Animal Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Casein and Caseinates

- 5.1.2. Collagen

- 5.1.3. Egg Protein

- 5.1.4. Gelatin

- 5.1.5. Insect Protein

- 5.1.6. Milk Protein

- 5.1.7. Whey Protein

- 5.1.8. Other Animal Protein

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. RTE/RTC Food Products

- 5.2.2.1.7. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. North India India Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Animal Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nitta Gelatin Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Jellice Pioneer Private Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Glanbia PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kerry Group PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nakoda Dairy Private Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fonterra Co-operative Group Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hilmar Cheese Company Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 EnNutrica

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Nitta Gelatin Inc

List of Figures

- Figure 1: India Animal Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Animal Protein Market Share (%) by Company 2024

List of Tables

- Table 1: India Animal Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Animal Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 3: India Animal Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: India Animal Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Animal Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Animal Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Animal Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 11: India Animal Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: India Animal Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Animal Protein Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the India Animal Protein Market?

Key companies in the market include Nitta Gelatin Inc, Jellice Pioneer Private Limited, Glanbia PLC, Kerry Group PLC, Nakoda Dairy Private Limited, Fonterra Co-operative Group Limited, Hilmar Cheese Company Inc, EnNutrica.

3. What are the main segments of the India Animal Protein Market?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

January 2021: Nitta Gelatin India has introduced an international standard fine-grade gelatin in the hotel/restaurant/catering (HoReCa) business. The superior-grade gelatin is produced using Japanese technology in accordance with the Good Manufacturing Practice (GMP) and the Hazard Analysis and Critical Control Point (HACCP) system, in line with European Regulation hygiene standards (EC). This gelatin is derived from natural sources that contain all essential amino acids except tryptophan.April 2020: Fonterra launched SureProteinTM Optibar 892, a whey protein isolate that is more cohesive and helps fine-tune texture and composition while formulating high-protein and low-sugar bars. With this launch, the company aims to cover the aspirational trend of 1 g of protein to 1 g of sugar-type composition without making the bars chewy.July 2019: Nitta Gelatin India Limited attained OHSAS certification for its Gelatin and Ossein divisions, capturing an extended consumer base in the country and the international markets through exports.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Animal Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Animal Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Animal Protein Market?

To stay informed about further developments, trends, and reports in the India Animal Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence