Key Insights

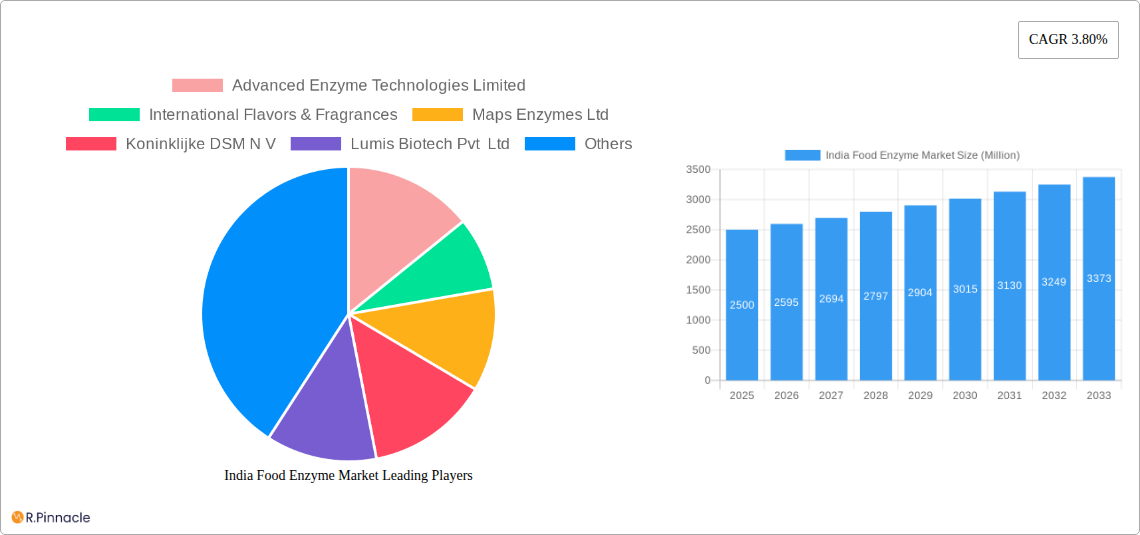

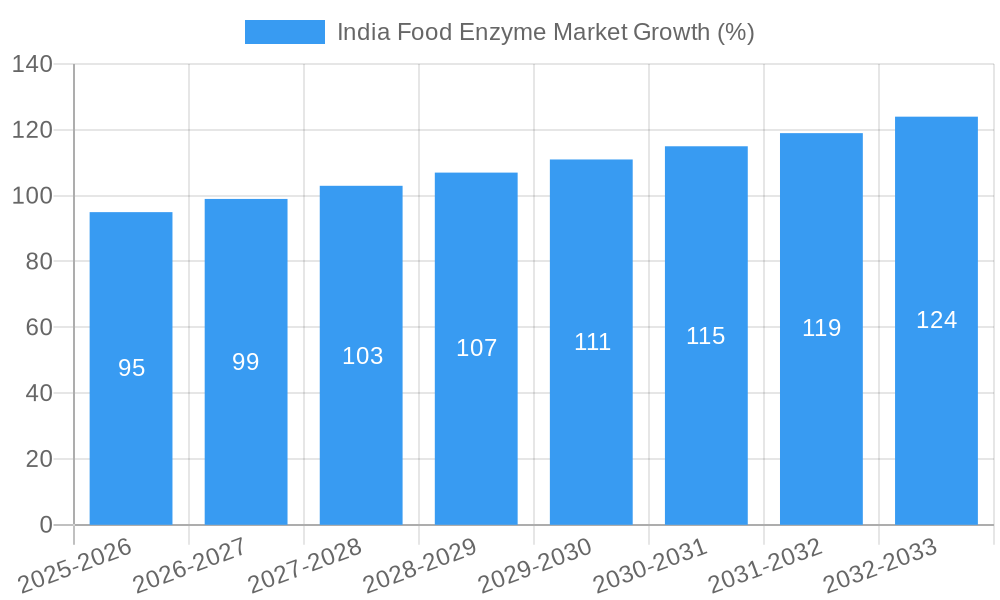

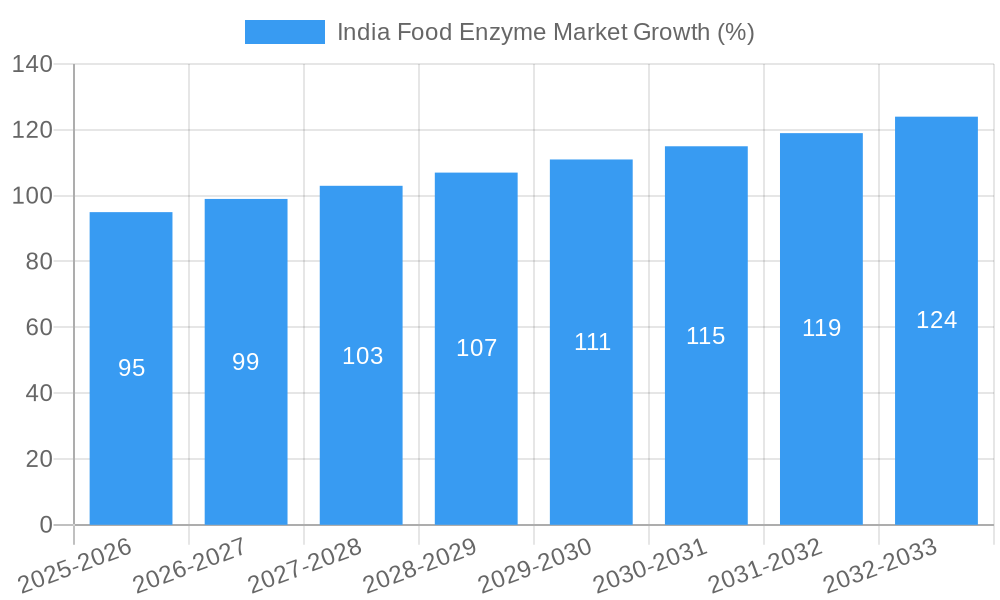

The India food enzyme market, valued at approximately ₹2500 million (estimated) in 2025, is projected to experience robust growth, driven by increasing demand for processed foods, the rising adoption of enzyme technology in various food applications, and the growing awareness of health benefits associated with natural food processing techniques. The market's Compound Annual Growth Rate (CAGR) of 3.80% from 2025 to 2033 indicates a steady expansion, exceeding ₹3500 million by 2033. Key drivers include the burgeoning food processing industry, increasing consumer preference for convenient and ready-to-eat meals, and the growing demand for improved food quality and shelf life. The market segments are diverse, with Carbohydrases, Proteases, and Lipases holding significant shares, largely driven by their extensive applications in bakery, confectionery, and dairy products. Meat, poultry, and seafood processing also contribute substantially to the market's growth. While challenges like regulatory hurdles and price fluctuations in raw materials exist, the overall market outlook remains optimistic, fueled by expanding consumer bases and technological advancements within the enzyme industry.

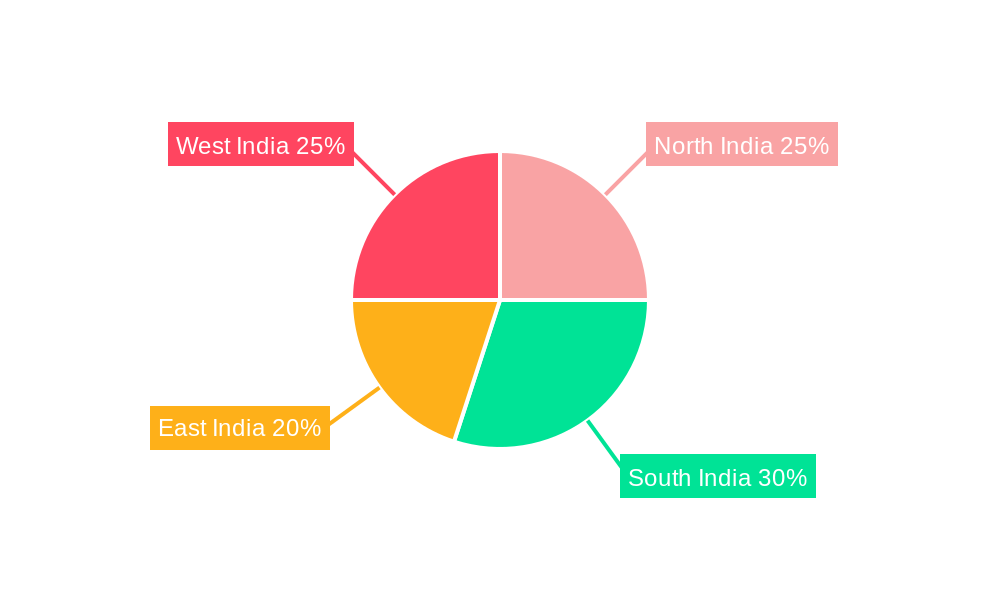

The regional distribution of the market shows a diverse landscape, with varying growth rates across North, South, East, and West India. While precise regional data is unavailable, it's plausible that regions with concentrated food processing activities – possibly South India and West India - will exhibit faster growth than others. The competitive landscape is fragmented, with both domestic and multinational players such as Advanced Enzyme Technologies Limited, Novozymes A/S, and Kerry Group PLC competing for market share. The presence of established players alongside emerging local companies creates a dynamic environment ripe for innovation and competition, further driving market expansion. Future growth hinges on technological innovations focusing on enzyme specificity, efficacy, and cost-effectiveness, alongside an increase in government support for the food processing sector.

India Food Enzyme Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Food Enzyme Market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant segments, and future outlook. The market is projected to reach xx Million by 2033.

India Food Enzyme Market Structure & Innovation Trends

The India Food Enzyme Market exhibits a moderately consolidated structure, with both multinational corporations and domestic players vying for market share. Key players include Advanced Enzyme Technologies Limited, International Flavors & Fragrances, Maps Enzymes Ltd, Koninklijke DSM N V, Lumis Biotech Pvt Ltd, Nature BioScience Pvt Ltd, Kerry Group PLC, Noor Enzymes, Novozymes A/S, and Infinita Biotech Private Limited. However, the market also accommodates numerous smaller, specialized firms.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Innovation Drivers: Growing demand for natural and clean-label food products, coupled with advancements in enzyme technology, are key drivers of innovation. This includes the development of enzymes with enhanced functionalities and improved stability.

- Regulatory Framework: The Indian government's focus on food safety and quality regulations influences the adoption of food enzymes, impacting both production and consumer perception.

- Product Substitutes: While synthetic additives exist, the increasing preference for natural ingredients drives demand for food enzymes.

- M&A Activities: Significant mergers and acquisitions (M&A) have shaped the market landscape, such as the 2022 merger of Novozymes and Chr. Hansen and the 2021 merger of International Flavors & Fragrances with DuPont's Nutrition and Biosciences Business. These deals have often involved significant financial investments, ranging from xx Million to xx Million. These activities consolidate market power and drive innovation.

India Food Enzyme Market Dynamics & Trends

The India Food Enzyme Market demonstrates robust growth, driven by factors such as the expanding food processing industry, changing consumer preferences toward convenient and healthier food products, and rising disposable incomes. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Technological disruptions, particularly in enzyme production and application, are accelerating market penetration. Consumer preferences for natural ingredients and clean labels are further boosting demand for enzymes in various food applications. The competitive landscape is characterized by intense competition among established players and emerging companies, focusing on product differentiation, pricing strategies, and market expansion. Market penetration is expected to increase to xx% by 2033.

Dominant Regions & Segments in India Food Enzyme Market

The report identifies key regional variations within the Indian market. Specific regions demonstrate higher growth based on factors such as economic growth, manufacturing capabilities, and consumer demand. Analyzing regional variations in growth is crucial for strategic market positioning.

Dominant Segments:

- Type: Proteases constitute the largest segment due to their wide applicability in various food processing applications. Carbohydrases and Lipases also represent significant market segments. Other Types showcase promising growth potential.

- Application: The Bakery segment and Dairy and Frozen Desserts segment hold the largest market share, driven by high consumption. The Meat Poultry and Seafood Products segment, and the Beverages segment, are expected to experience rapid growth in the coming years.

Key Drivers (by application):

- Bakery: Rising demand for convenience foods and improved bread quality.

- Dairy & Frozen Desserts: Increasing preference for creamy textures and extended shelf life.

- Meat, Poultry & Seafood: Growing demand for processed meat products and improved flavor profiles.

- Beverages: Increasing demand for functional and healthier beverages.

India Food Enzyme Market Product Innovations

Recent product innovations focus on enzymes with enhanced functionalities, improved stability, and tailored applications for specific food products. This includes enzymes engineered for increased efficiency and reduced processing times, particularly noticeable in the development of enzymes for high-protein beverages, such as Novozymes' Formea Prime launched in January 2021. These innovations address specific industry needs, improving product quality, shelf life, and cost-effectiveness.

Report Scope & Segmentation Analysis

This report segments the India Food Enzyme Market based on Type (Carbohydrases, Proteases, Lipases, Other Types) and Application (Bakery, Confectionery, Dairy and Frozen Desserts, Meat Poultry and Sea Food Products, Beverages, Other Applications). Each segment is analyzed considering market size, growth projections, and competitive dynamics. Detailed growth projections are provided for each segment, based on factors including consumer demand and technological advancements.

Key Drivers of India Food Enzyme Market Growth

Several factors fuel the growth of the India Food Enzyme Market. These include:

- Technological advancements: Development of novel enzymes with improved functionalities.

- Economic growth: Expanding food processing industry and increasing consumer spending.

- Regulatory changes: Favorable government policies promoting food safety and quality.

Challenges in the India Food Enzyme Market Sector

The India Food Enzyme Market faces challenges including:

- Stringent regulatory requirements: Compliance with food safety regulations can increase production costs.

- Supply chain complexities: Ensuring a consistent supply of raw materials can be challenging.

- Intense competition: The market is fiercely competitive, with both domestic and multinational players.

Emerging Opportunities in India Food Enzyme Market

Emerging opportunities include:

- Growth of the functional food market: Demand for healthier food products with enhanced nutritional benefits.

- Adoption of sustainable and eco-friendly technologies: Rising consumer awareness about environmental sustainability.

- Development of customized enzyme solutions: Tailoring enzymes to meet specific industry needs.

Leading Players in the India Food Enzyme Market Market

- Advanced Enzyme Technologies Limited

- International Flavors & Fragrances

- Maps Enzymes Ltd

- Koninklijke DSM N V

- Lumis Biotech Pvt Ltd

- Nature BioScience Pvt Ltd

- Kerry Group PLC

- Noor Enzymes

- Novozymes A/S

- Infinita Biotech Private Limited

Key Developments in India Food Enzyme Market Industry

- January 2021: Novozymes launched "Formea Prime," a new enzyme for high-protein beverages.

- February 2021: International Flavors & Fragrances merged with DuPont's Nutrition and Biosciences Business.

- December 2022: Novozymes and Chr. Hansen agreed to merge.

Future Outlook for India Food Enzyme Market Market

The India Food Enzyme Market is poised for continued growth, driven by factors like rising demand for processed food, increasing health consciousness, and technological advancements in enzyme production. Strategic partnerships and investments in research and development will be crucial for success in this dynamic market. The market is expected to witness significant expansion in the coming years, presenting attractive opportunities for both established and emerging players.

India Food Enzyme Market Segmentation

-

1. Type

- 1.1. Carbohydrases

- 1.2. Proteases

- 1.3. Lipases

- 1.4. Other Types

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy and Frozen Desserts

- 2.4. Meat Poultry and Sea Food Products

- 2.5. Beverages

- 2.6. Other Applications

India Food Enzyme Market Segmentation By Geography

- 1. India

India Food Enzyme Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Clean Label Bakery Products; Increasing Popularity of Specialty Ingredients

- 3.3. Market Restrains

- 3.3.1. Risk of Allergies

- 3.4. Market Trends

- 3.4.1. Rising Demand for Processed Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbohydrases

- 5.1.2. Proteases

- 5.1.3. Lipases

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy and Frozen Desserts

- 5.2.4. Meat Poultry and Sea Food Products

- 5.2.5. Beverages

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Advanced Enzyme Technologies Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 International Flavors & Fragrances

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Maps Enzymes Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke DSM N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lumis Biotech Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nature BioScience Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kerry Group PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Noor Enzymes

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Novozymes A/S

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Infinita Biotech Private Limited*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Advanced Enzyme Technologies Limited

List of Figures

- Figure 1: India Food Enzyme Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Food Enzyme Market Share (%) by Company 2024

List of Tables

- Table 1: India Food Enzyme Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Food Enzyme Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Food Enzyme Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: India Food Enzyme Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Food Enzyme Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Food Enzyme Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Food Enzyme Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Food Enzyme Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Food Enzyme Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Food Enzyme Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: India Food Enzyme Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: India Food Enzyme Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Food Enzyme Market?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the India Food Enzyme Market?

Key companies in the market include Advanced Enzyme Technologies Limited, International Flavors & Fragrances, Maps Enzymes Ltd, Koninklijke DSM N V, Lumis Biotech Pvt Ltd, Nature BioScience Pvt Ltd, Kerry Group PLC, Noor Enzymes, Novozymes A/S, Infinita Biotech Private Limited*List Not Exhaustive.

3. What are the main segments of the India Food Enzyme Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Clean Label Bakery Products; Increasing Popularity of Specialty Ingredients.

6. What are the notable trends driving market growth?

Rising Demand for Processed Food.

7. Are there any restraints impacting market growth?

Risk of Allergies.

8. Can you provide examples of recent developments in the market?

December 2022: Danish food ingredient and enzyme makers Novozymes and Chr. Hansen agreed to merge. In comparison, both firms produce enzymes, Chr. Hansen focuses on enzymes and microbials for the food industry, and Novozymes' major business areas include enzymes for household products, food and beverages, and biofuels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Food Enzyme Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Food Enzyme Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Food Enzyme Market?

To stay informed about further developments, trends, and reports in the India Food Enzyme Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence