Key Insights

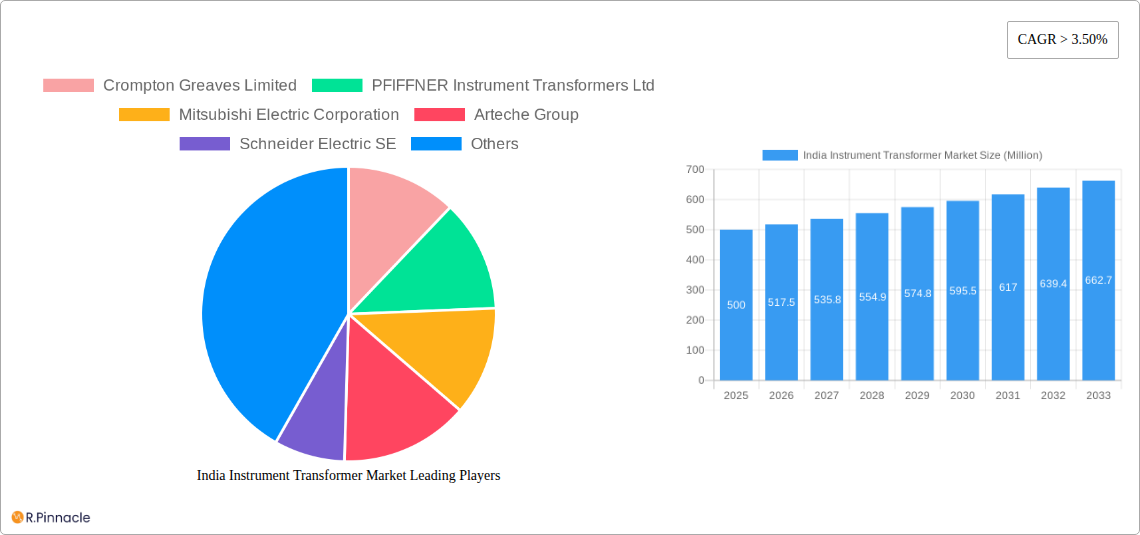

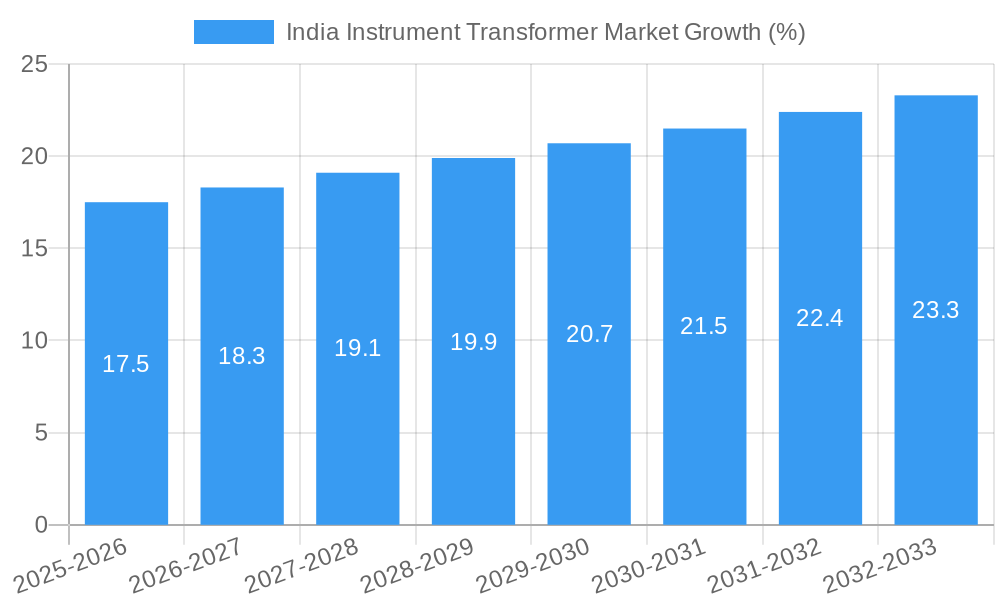

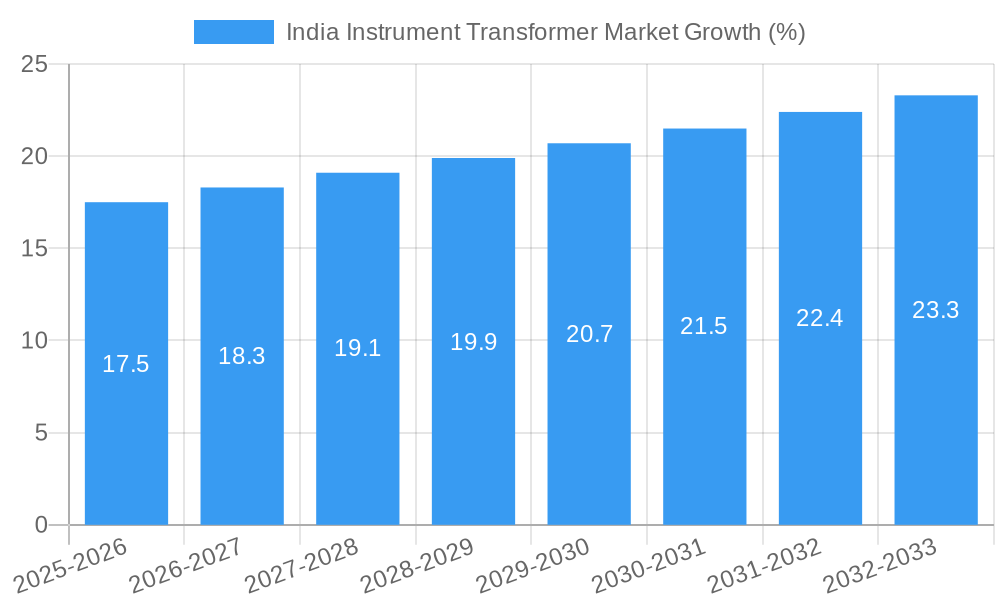

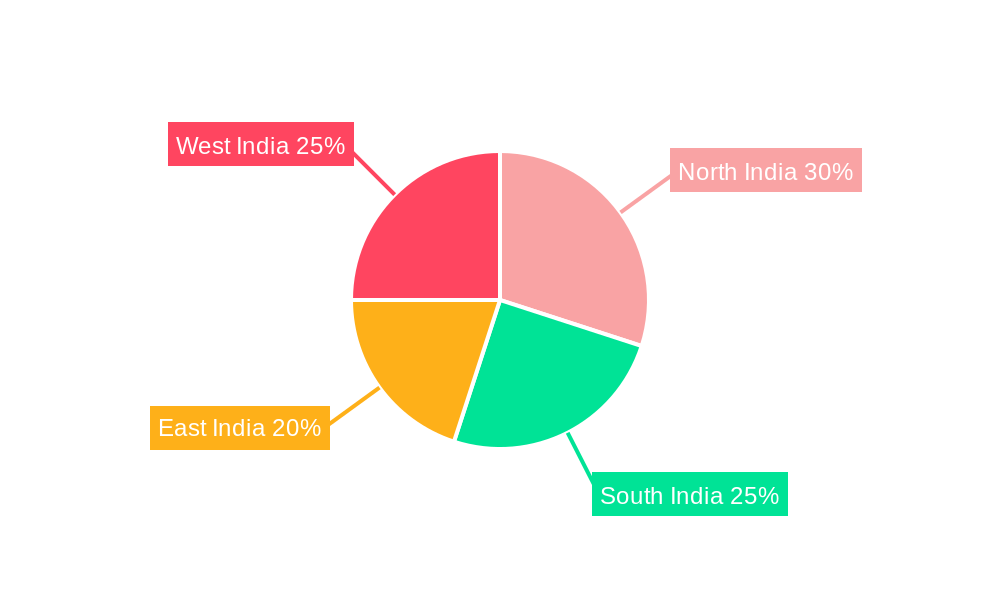

The India instrument transformer market is experiencing robust growth, driven by the expanding power infrastructure, industrial automation, and rising demand for reliable electricity supply. With a market size exceeding [Estimate based on available data, e.g., ₹500 million] in 2025 and a CAGR of over 3.5%, the market is projected to reach [Estimate based on CAGR and 2025 value, e.g., ₹800 million] by 2033. Key growth drivers include government initiatives promoting renewable energy integration, the modernization of existing power grids, and increasing industrialization across various sectors. The market is segmented by end-user (power utilities, industrial sector, others) and type (current transformer, potential transformer, others). Power utilities constitute the largest segment, driven by the need for accurate metering and protection of high-voltage transmission and distribution networks. The industrial sector's demand is fueled by automation needs and process monitoring requirements. Current transformers hold a larger market share compared to potential transformers, owing to their widespread application in power measurement and protection systems. Major players such as Crompton Greaves Limited, PFIFFNER Instrument Transformers Ltd, and Mitsubishi Electric Corporation are vying for market dominance through technological advancements, strategic partnerships, and expansion into new geographical areas. While the market faces challenges such as fluctuating raw material prices and intense competition, the overall outlook remains positive, driven by the sustained growth in India's electricity sector. Regional variations exist, with North and West India potentially exhibiting faster growth due to higher industrial activity and infrastructure development.

The competitive landscape is characterized by both domestic and international players. Established companies are investing in research and development to improve product efficiency and introduce smart solutions. The entry of new players is expected to increase competition, potentially leading to price reductions and further market expansion. Future growth will be influenced by factors such as policy changes related to grid modernization, advancements in smart grid technologies, and the increasing adoption of renewable energy sources. The market's success hinges on ensuring reliable and cost-effective instrument transformer solutions to meet the growing energy demands of a rapidly developing nation.

India Instrument Transformer Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Instrument Transformer Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by end-user (Power Utilities, Industrial Sector, Others) and type (Current Transformer, Potential Transformer, Others), providing granular data and analysis for informed strategic planning. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

India Instrument Transformer Market Structure & Innovation Trends

The Indian Instrument Transformer market exhibits a moderately consolidated structure, with key players like Crompton Greaves Limited, PFIFFNER Instrument Transformers Ltd, Mitsubishi Electric Corporation, Arteche Group, Schneider Electric SE, Hitachi ABB Power Grids, Vamet Industries Ltd, Siemens Energy AG, and General Electric Company holding significant market share. Precise market share figures for each company are unavailable for this report. However, based on industry analysis and revenue estimates, the top 5 players likely hold a combined xx% share, indicating a competitive landscape with opportunities for both established and emerging players.

M&A activity in the sector has been relatively low in recent years, with deal values remaining below xx Million annually, yet the potential for future consolidation remains high given the increasing demand and technological advancements. Innovation in this space is driven by the need for greater efficiency, improved accuracy, and enhanced environmental sustainability. Stringent regulatory frameworks regarding safety standards and environmental impact are influencing product development. The increasing adoption of smart grids and digital substations is driving demand for advanced instrument transformers with enhanced functionalities and digital connectivity. The market experiences some substitution pressure from alternative technologies in niche applications; however, instrument transformers continue to maintain their dominance in the energy sector due to reliability and established infrastructure.

India Instrument Transformer Market Dynamics & Trends

The Indian Instrument Transformer market is experiencing robust growth, propelled by several key factors. The expansion of the power transmission and distribution infrastructure, fueled by government initiatives to electrify rural areas and increase power generation capacity, is a primary driver. This growth is further supported by the increasing industrialization and urbanization across the country, leading to higher demand for electricity in both the industrial and commercial sectors. The burgeoning renewable energy sector is also contributing significantly to the market's expansion, demanding robust and reliable instrumentation for effective grid integration.

Technological advancements, such as the development of optical current transformers and digital substation components, are revolutionizing the sector. These innovations offer improved accuracy, reduced size and weight, and enhanced data transmission capabilities, leading to better grid management and reduced operational costs. Consumer preference shifts toward advanced features, higher reliability, and eco-friendly solutions further intensify the demand for innovative products. The competitive landscape is characterized by intense rivalry among established players and the emergence of new entrants, driving innovation and price competitiveness. The market penetration of digital instrument transformers is anticipated to increase from xx% in 2025 to xx% by 2033, mirroring the broader trend of digitization across the power sector.

Dominant Regions & Segments in India Instrument Transformer Market

The power utilities segment represents the largest end-user segment in the Indian Instrument Transformer market, driven by continuous investments in grid modernization and expansion projects across various states. This segment is anticipated to maintain its dominance throughout the forecast period due to the imperative of efficient power transmission and distribution. The industrial sector follows as a significant contributor, as industries like manufacturing, chemicals, and metals require sophisticated instrument transformers for process control and safety. The other segment is comparatively smaller, including niche applications in various sectors.

Key Drivers for Power Utilities Segment:

- Government initiatives promoting grid modernization

- Investments in renewable energy integration

- Expansion of transmission and distribution networks

- Smart grid development programs

Key Drivers for Industrial Sector Segment:

- Increased industrial activity and manufacturing output

- Demand for process automation and monitoring

- Growth of industrial automation and IoT applications

In terms of type, current transformers currently hold a larger market share due to their extensive application in power grids and industrial settings. However, the potential transformer market segment is witnessing significant growth due to rising adoption of advanced metering infrastructure (AMI) and smart metering solutions.

India Instrument Transformer Market Product Innovations

Recent product innovations focus on enhancing accuracy, reliability, and environmental sustainability. The development of optical current transformers and digital substation components, as demonstrated by BHEL's 400 kV optical current transformer, marks a notable technological advancement, enabling improved data management and grid stability. Furthermore, the industry is actively exploring and adopting eco-friendly alternatives to SF6 gas, addressing environmental concerns associated with traditional instrument transformers. These innovations offer competitive advantages by improving operational efficiency, reducing maintenance costs, and enhancing environmental performance, thus attracting environmentally conscious customers.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the India Instrument Transformer Market, segmented by both end-user and type.

End-User:

Power Utilities: This segment is projected to grow at a CAGR of xx% during the forecast period, driven by government initiatives and grid modernization projects. The market size is estimated at xx Million in 2025 and is expected to reach xx Million by 2033. Competition is high due to the large number of players catering to this segment.

Industrial Sector: This segment is expected to grow at a CAGR of xx%, driven by the growth of various industrial sectors. The market size is estimated at xx Million in 2025 and is expected to reach xx Million by 2033. The market is characterized by intense competition among several global and domestic players.

Others: This segment includes smaller applications, showing comparatively slower growth with an estimated market size of xx Million in 2025.

Type:

Current Transformer: This segment constitutes the largest share of the market, driven by its widespread use in power transmission and distribution. Its market size is estimated to be xx Million in 2025, expanding at a CAGR of xx% till 2033.

Potential Transformer: The market for potential transformers is growing steadily, driven by increasing adoption of smart metering and advanced metering infrastructure.

Others: This segment includes other types of instrument transformers with a relatively smaller market share.

Key Drivers of India Instrument Transformer Market Growth

The Indian Instrument Transformer market's growth is primarily fueled by several factors. The significant investments in grid infrastructure modernization and expansion are a primary driver, supported by government initiatives aimed at enhancing electricity access and reliability. The rapid industrialization and urbanization in India further increase demand, necessitating robust and reliable power distribution systems. Furthermore, the rising adoption of renewable energy sources, such as solar and wind, creates a significant demand for advanced instrument transformers capable of efficiently managing the integration of these intermittent sources into the grid.

Challenges in the India Instrument Transformer Market Sector

The Indian Instrument Transformer market faces several challenges. Strict regulatory compliance requirements necessitate significant investment and can impact market entry for new players. Supply chain disruptions, particularly concerning the availability of critical raw materials and components, can lead to production delays and cost escalation. Furthermore, intense competition from both domestic and international players exerts pressure on pricing and profitability, requiring strategic differentiation through innovation and value-added services.

Emerging Opportunities in India Instrument Transformer Market

Several emerging opportunities exist within the Indian Instrument Transformer market. The expanding smart grid initiatives present a significant growth opportunity for manufacturers of advanced digital instrument transformers with enhanced monitoring and control capabilities. The rising adoption of renewable energy sources creates a demand for specialized instrument transformers designed for integrating intermittent energy sources into the power grid. Moreover, the government's focus on rural electrification opens up new market segments for cost-effective and reliable instrument transformers.

Leading Players in the India Instrument Transformer Market Market

- Crompton Greaves Limited

- PFIFFNER Instrument Transformers Ltd

- Mitsubishi Electric Corporation

- Arteche Group

- Schneider Electric SE

- Hitachi ABB Power Grids

- Vamet Industries Ltd

- Siemens Energy AG

- General Electric Company

- List Not Exhaustive

Key Developments in India Instrument Transformer Market Industry

September 2020: Power Grid Corporation of India Limited and Bharat Heavy Electricals Limited (BHEL) successfully commissioned India's first natively developed 400 kV optical current transformer. This signifies a major step towards substation digitization and indigenization.

April 2021: GE Renewable Energy's Grid Solutions and Hitachi ABB Power Grids Ltd. signed an agreement to utilize a fluoronitrile-based gas alternative to SF6 in high-voltage equipment, including instrument transformers, promoting environmental sustainability.

Future Outlook for India Instrument Transformer Market Market

The Indian Instrument Transformer market is poised for continued growth, driven by sustained investment in grid infrastructure, the expansion of the industrial sector, and the increasing adoption of renewable energy. The ongoing transition to smart grids and digital substations will further fuel demand for advanced instrument transformers with enhanced capabilities. Strategic opportunities exist for manufacturers who can offer innovative, environmentally friendly, and cost-effective solutions catering to the evolving needs of the Indian power sector.

India Instrument Transformer Market Segmentation

-

1. Type

- 1.1. Current Transformer

- 1.2. Potential Transformer

- 1.3. Others

-

2. End-User

- 2.1. Power Utilities

- 2.2. Industrial Sector

- 2.3. Others

India Instrument Transformer Market Segmentation By Geography

- 1. India

India Instrument Transformer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; High Electricity Demand from Industries4.; Enhancement in Economic Activities

- 3.3. Market Restrains

- 3.3.1. 4.; The Complex Maintenance Process of Components And the Emergence of Toxic Wastes that Affect the Environment

- 3.4. Market Trends

- 3.4.1. Current Transformer Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Instrument Transformer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Current Transformer

- 5.1.2. Potential Transformer

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Power Utilities

- 5.2.2. Industrial Sector

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Instrument Transformer Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Instrument Transformer Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Instrument Transformer Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Instrument Transformer Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Crompton Greaves Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PFIFFNER Instrument Transformers Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Electric Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arteche Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Schneider Electric SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi ABB Power Grids

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Vamet Industries Ltd *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens Energy AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 General Electric Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Crompton Greaves Limited

List of Figures

- Figure 1: India Instrument Transformer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Instrument Transformer Market Share (%) by Company 2024

List of Tables

- Table 1: India Instrument Transformer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Instrument Transformer Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: India Instrument Transformer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Instrument Transformer Market Volume K Units Forecast, by Type 2019 & 2032

- Table 5: India Instrument Transformer Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: India Instrument Transformer Market Volume K Units Forecast, by End-User 2019 & 2032

- Table 7: India Instrument Transformer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Instrument Transformer Market Volume K Units Forecast, by Region 2019 & 2032

- Table 9: India Instrument Transformer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Instrument Transformer Market Volume K Units Forecast, by Country 2019 & 2032

- Table 11: North India India Instrument Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Instrument Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: South India India Instrument Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Instrument Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: East India India Instrument Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Instrument Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: West India India Instrument Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Instrument Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: India Instrument Transformer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: India Instrument Transformer Market Volume K Units Forecast, by Type 2019 & 2032

- Table 21: India Instrument Transformer Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 22: India Instrument Transformer Market Volume K Units Forecast, by End-User 2019 & 2032

- Table 23: India Instrument Transformer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Instrument Transformer Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Instrument Transformer Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the India Instrument Transformer Market?

Key companies in the market include Crompton Greaves Limited, PFIFFNER Instrument Transformers Ltd, Mitsubishi Electric Corporation, Arteche Group, Schneider Electric SE, Hitachi ABB Power Grids, Vamet Industries Ltd *List Not Exhaustive, Siemens Energy AG, General Electric Company.

3. What are the main segments of the India Instrument Transformer Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; High Electricity Demand from Industries4.; Enhancement in Economic Activities.

6. What are the notable trends driving market growth?

Current Transformer Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; The Complex Maintenance Process of Components And the Emergence of Toxic Wastes that Affect the Environment.

8. Can you provide examples of recent developments in the market?

In April 2021, GE Renewable Energy's Grid Solutions and Hitachi ABB Power Grids Ltd. have signed a landmark agreement to use an alternative gas to sulfur hexafluoride (SF6) used in high voltage equipment like instrument transformer, switchgear, etc. This fluoronitrile-based gas mixture has a significantly reduced impact on the environment compared to SF6. Under this landmark agreement, both companies are expected to share complementary intellectual property related to their respective SF6-free solutions. This helps accelerate the use of fluoronitrile-based eco-efficient insulation and switching gas in high-voltage equipment as an alternative to SF6.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Instrument Transformer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Instrument Transformer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Instrument Transformer Market?

To stay informed about further developments, trends, and reports in the India Instrument Transformer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence