Key Insights

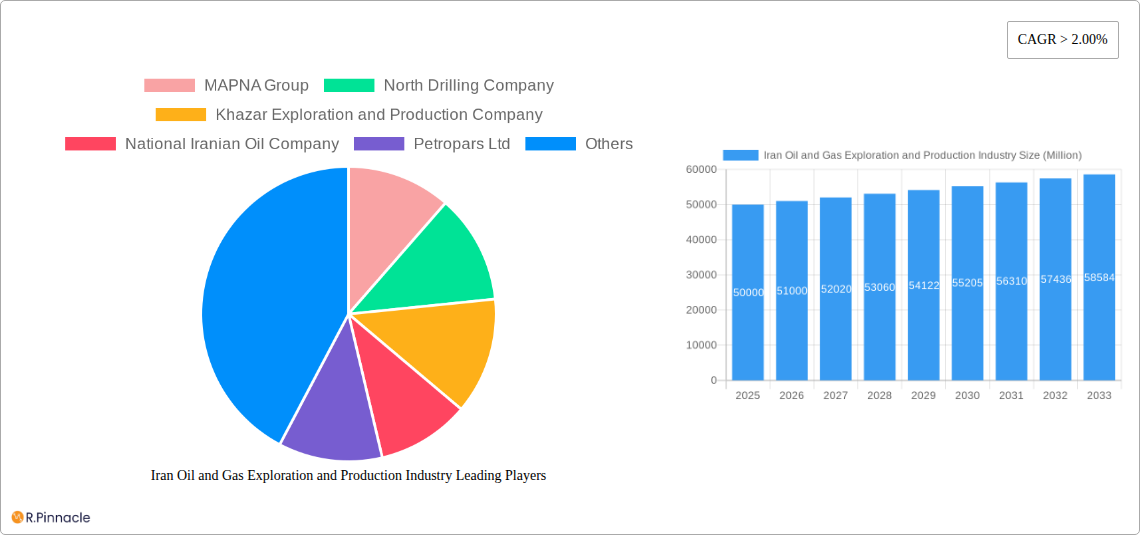

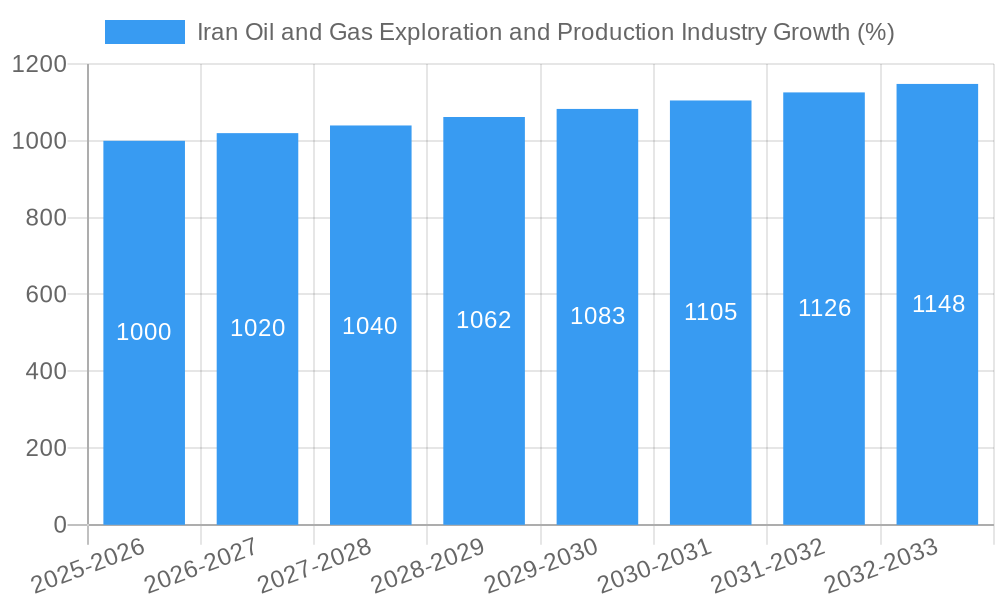

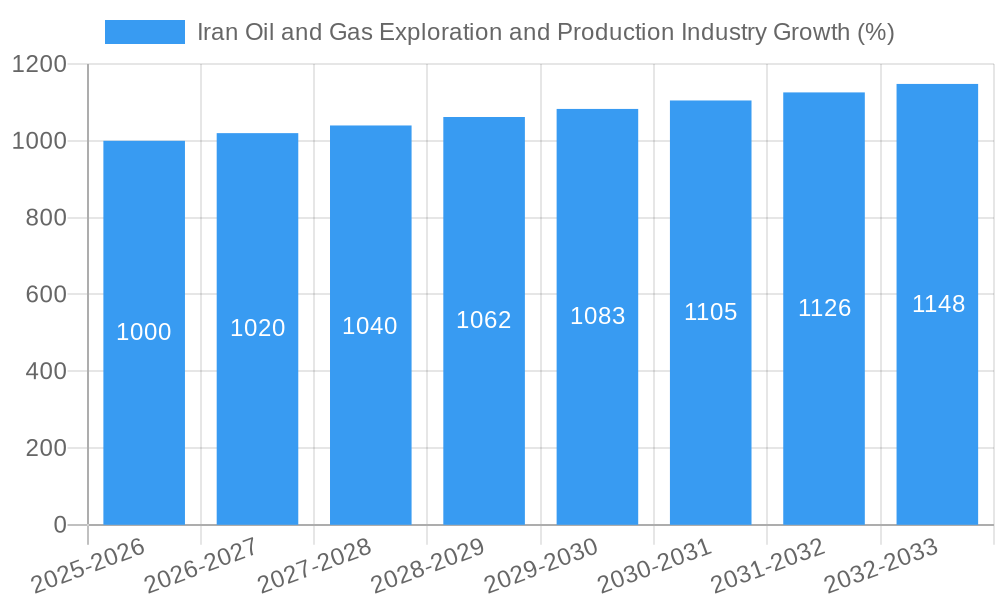

The Iranian oil and gas exploration and production industry, while facing geopolitical challenges, presents a dynamic market poised for moderate growth. The industry's size in 2025 is estimated at $50 billion USD (assuming a value unit of "million" refers to millions of USD and inferring a market size based on global oil & gas market trends and Iran's historical production). A compound annual growth rate (CAGR) exceeding 2% through 2033 suggests a steady, albeit conservative, expansion trajectory. Key drivers include Iran's significant hydrocarbon reserves, ongoing domestic demand for energy, and potential for increased international collaboration under a changing geopolitical landscape. However, the industry faces considerable restraints, including international sanctions impacting investment and technological advancement, along with the need for upgrading aging infrastructure and environmental concerns related to fossil fuel extraction. Market segmentation reveals the substantial role of the power generation sector in consumption, alongside significant industrial and residential applications. Major players such as MAPNA Group, National Iranian Oil Company, and Petropars Ltd. dominate the landscape, reflecting both state-owned and private sector involvement. The forecast period of 2025-2033 presents opportunities for strategic investments focused on technological innovation, efficient resource management, and compliance with evolving environmental regulations.

Growth within the industry will likely be driven by continued domestic demand for energy, particularly in power generation. However, the rate of expansion hinges significantly on the easing of sanctions and increased foreign investment. Technological advancements in exploration techniques, including enhanced oil recovery methods, could unlock further potential. While the residential segment is anticipated to show modest growth, the industrial sector will likely remain a significant consumer of oil and gas. The competitive landscape, dominated by large state-owned enterprises, may attract both domestic and international players seeking to capitalize on the nation's vast hydrocarbon resources. Overcoming the restraints requires a strategic focus on technological modernization, regulatory clarity, and a balanced approach between economic growth and environmental sustainability. The projected CAGR reflects a cautious outlook given the prevailing geopolitical uncertainties and requires continuous monitoring of developments on the international stage.

Iran Oil and Gas Exploration and Production Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Iranian oil and gas exploration and production industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Base Year: 2025, Forecast Period: 2025-2033), this report leverages rigorous data analysis and expert insights to illuminate current market dynamics and future growth potential. Key players like MAPNA Group, North Drilling Company, Khazar Exploration and Production Company, National Iranian Oil Company, Petropars Ltd, and Pasargad Energy Development Company are thoroughly examined.

Iran Oil and Gas Exploration and Production Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of Iran's oil and gas exploration and production sector, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The study period (2019-2024) reveals a complex interplay of factors shaping the industry's evolution.

Market Concentration: The market exhibits a moderate level of concentration, with a few dominant players controlling a significant share of the production. National Iranian Oil Company (NIOC) holds the largest market share, estimated at xx%. Petropars Ltd and MAPNA Group also hold significant market share, estimated at xx% and xx% respectively. Smaller players such as North Drilling and Khazar Exploration & Production Company compete in specialized niches.

Innovation Drivers: Government initiatives promoting technological advancements in exploration and extraction techniques, coupled with the need to enhance efficiency and reduce environmental impact, are key innovation drivers. Furthermore, increasing domestic energy demand and the pursuit of energy independence drive investment in technological upgrades.

Regulatory Framework: The regulatory landscape plays a crucial role, impacting investment decisions and operational strategies. Government policies regarding foreign investment, licensing, and environmental regulations significantly influence industry activity. Recent changes in sanctions also create both challenges and opportunities.

Product Substitutes: While oil and natural gas remain dominant, the industry faces increasing pressure from renewable energy sources, necessitating diversification strategies.

M&A Activities: The historical period (2019-2024) witnessed xx M&A deals, with a total estimated value of USD xx Million, primarily focused on consolidating assets and enhancing operational capabilities.

Iran Oil and Gas Exploration and Production Industry Market Dynamics & Trends

This section delves into the key factors influencing market growth, including technological advancements, evolving consumer preferences, and competitive dynamics. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several factors.

(Detailed paragraph analysis of market growth drivers, technological disruptions, consumer preferences, and competitive dynamics will be provided here, incorporating relevant statistics and data points.) Market penetration for natural gas in the residential sector is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions & Segments in Iran Oil and Gas Exploration and Production Industry

This section identifies the leading regions and segments within the Iranian oil and gas exploration and production industry.

Dominant Region: The Persian Gulf region is the dominant area for oil and gas exploration and production due to its substantial reserves.

Dominant Segments:

Oil: The oil segment currently dominates the market, contributing xx% to the overall revenue. The strong demand for oil and the existing infrastructure contribute to its dominance.

Natural Gas: Natural gas is a rapidly growing segment, experiencing a CAGR of xx% due to government focus on gas-based power generation and industrial use.

Applications:

- Power Generation: This segment represents the largest application of both oil and natural gas, driving significant demand and investments in infrastructure development.

- Industrial: The industrial sector is a major consumer of oil and natural gas, fueling growth in petrochemical and manufacturing industries.

- Residential: While still a smaller segment compared to power generation and industrial use, residential consumption of natural gas is steadily growing.

(Detailed paragraph analysis of key drivers for each dominant region and segment will be provided here.)

Iran Oil and Gas Exploration and Production Industry Product Innovations

(This section will provide a paragraph summarizing product developments, applications, and competitive advantages. It will emphasize technological trends and market fit, referencing specific examples.)

Report Scope & Segmentation Analysis

This report segments the Iranian oil and gas exploration and production industry based on type (Oil, Natural Gas) and application (Power Generation, Industrial, Residential). Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics.

(Paragraphs detailing each segment—oil, natural gas, power generation, industrial, and residential—will be included here with projected growth rates and market size in Million USD for each segment).

Key Drivers of Iran Oil and Gas Exploration and Production Industry Growth

(This section will outline key growth drivers—technological advancements, economic factors, and regulatory policies—using paragraphs or lists with specific examples.)

Challenges in the Iran Oil and Gas Exploration and Production Industry Sector

(This section will discuss significant barriers and restraints—regulatory hurdles, supply chain issues, competitive pressures—with quantifiable impacts.)

Emerging Opportunities in Iran Oil and Gas Exploration and Production Industry

(This section will highlight emerging trends and opportunities—new markets, technologies, consumer preferences—with specific examples.)

Leading Players in the Iran Oil and Gas Exploration and Production Industry Market

- MAPNA Group

- North Drilling Company

- Khazar Exploration and Production Company

- National Iranian Oil Company

- Petropars Ltd

- Pasargad Energy Development Company

Key Developments in Iran Oil and Gas Exploration and Production Industry Industry

September 2022: Iran offered ONGC Videsh Ltd a 30% interest in the development of the Farzad-B gas field in the Persian Gulf. This development signals a potential increase in foreign investment and expertise in the Iranian gas sector.

July 2022: Russian oil and gas major Gazprom signed a USD 40 Billion deal with the National Oil Company for the development of oil and gas projects in Iran. This significant investment signifies a boost in production capacity and potential for technological transfer.

Future Outlook for Iran Oil and Gas Exploration and Production Industry Market

(This section will summarize growth accelerators and future market potential, focusing on strategic opportunities.)

Iran Oil and Gas Exploration and Production Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Iran Oil and Gas Exploration and Production Industry Segmentation By Geography

- 1. Iran

Iran Oil and Gas Exploration and Production Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. New Discoveries and Upcoming Projects are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Oil and Gas Exploration and Production Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 MAPNA Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 North Drilling Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Khazar Exploration and Production Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Iranian Oil Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petropars Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pasargad Energy Development Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 MAPNA Group

List of Figures

- Figure 1: Iran Oil and Gas Exploration and Production Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Oil and Gas Exploration and Production Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Iran Oil and Gas Exploration and Production Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Oil and Gas Exploration and Production Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Iran Oil and Gas Exploration and Production Industry?

Key companies in the market include MAPNA Group, North Drilling Company, Khazar Exploration and Production Company, National Iranian Oil Company, Petropars Ltd, Pasargad Energy Development Company.

3. What are the main segments of the Iran Oil and Gas Exploration and Production Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector.

6. What are the notable trends driving market growth?

New Discoveries and Upcoming Projects are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In September 2022, Iran offered ONGC Videsh Ltd a 30% interest in the development of the Farzad-B gas field in the Persian Gulf.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Oil and Gas Exploration and Production Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Oil and Gas Exploration and Production Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Oil and Gas Exploration and Production Industry?

To stay informed about further developments, trends, and reports in the Iran Oil and Gas Exploration and Production Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence