Key Insights

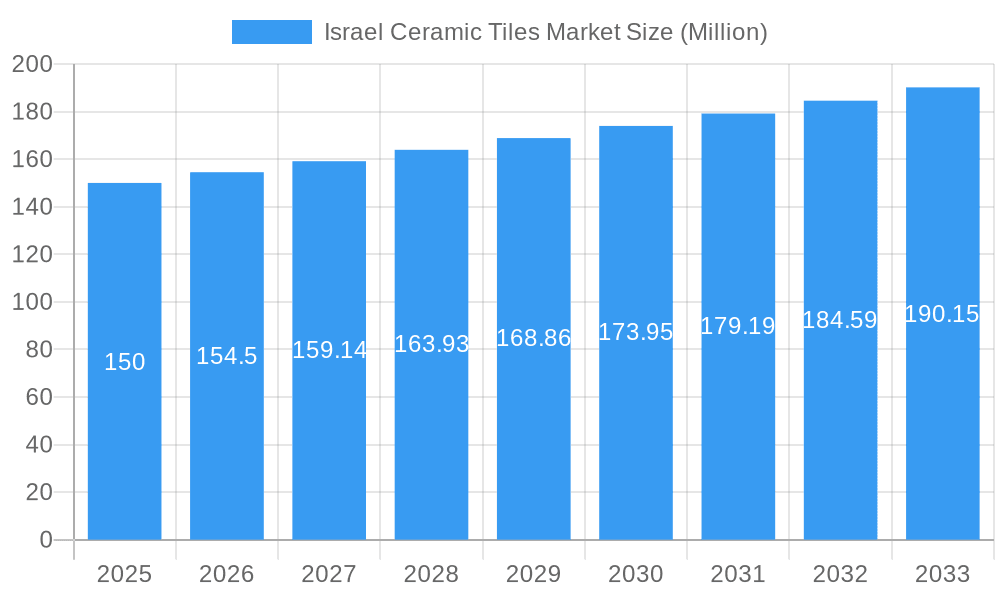

The Israeli ceramic tile market is projected to reach $293.1 million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.9% from 2025 to 2033. This robust expansion is driven by sustained construction activity, particularly in residential development, and a growing trend in renovation and replacement projects. Increased disposable incomes and a rising consumer demand for premium, aesthetically appealing, and durable surface solutions further stimulate market growth. Innovations in tile technology, such as scratch-resistant and advanced glazed finishes, are also key growth catalysts, catering to evolving design preferences.

Israel Ceramic Tiles Market Market Size (In Million)

The market segmentation highlights a preference for floor tiles over wall tiles, with glazed and porcelain tile types leading in demand due to their durability and aesthetic qualities. The new construction sector remains a primary market driver, while the renovation and replacement segment is expected to experience significant growth, fueled by the modernization of existing properties. Leading market participants, including Negev Ceramics Ltd and Marazzi, compete through product innovation, strategic pricing, and extensive distribution channels. The market is largely concentrated within Israel, underscoring the significance of local manufacturing and supply chains. Future growth is anticipated to be shaped by advancements in sustainable manufacturing and continued diversification in product design and application.

Israel Ceramic Tiles Market Company Market Share

Israel Ceramic Tiles Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Israel ceramic tiles market, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscape, and future growth potential, making it an essential resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive market research, incorporating data from the historical period (2019-2024), base year (2025), and estimated year (2025), to forecast market trends until 2033. The total market size in 2025 is estimated at xx Million.

Israel Ceramic Tiles Market Structure & Innovation Trends

This section analyzes the structure of the Israeli ceramic tile market, exploring key aspects of market concentration, innovation drivers, and regulatory influences. We examine the impact of product substitutes, end-user demographics, and M&A activities on market dynamics.

Market Concentration: The Israeli ceramic tile market exhibits a [Describe Level of Concentration - e.g., moderately concentrated] structure, with key players such as Negev Ceramics Ltd., Marazzi, and Caesarstone Ltd. holding significant market share. Precise market share data for each player is unavailable, however, the combined market share for the top three companies is estimated at xx%.

Innovation Drivers: Innovation in the sector is driven by the increasing demand for aesthetically appealing, durable, and sustainable tile solutions. Technological advancements in manufacturing processes, such as digital printing and advanced material formulations, are leading to a wider range of designs and enhanced product features.

Regulatory Frameworks: Government regulations concerning building materials and environmental standards significantly impact the market. Compliance with these regulations is a major factor for manufacturers.

Product Substitutes: Alternative flooring and wall covering materials, such as wood, laminate, and vinyl, pose competitive challenges to ceramic tiles. However, the durability and aesthetic versatility of ceramic tiles continue to support market growth.

End-User Demographics: The market is significantly influenced by the demographics of both residential and commercial construction sectors. Growing urbanization and increasing disposable income are key factors driving demand, particularly in the residential segment.

M&A Activities: The frequency of mergers and acquisitions in the Israeli ceramic tile market has been [Describe Frequency - e.g., moderate] over the past few years. While precise deal values remain undisclosed in many instances, M&A activity indicates a trend towards consolidation and expansion within the sector. One notable example is the partnership between Semihandmade and Caesarstone in March 2023, reflecting a potential trend towards collaborative growth.

Israel Ceramic Tiles Market Dynamics & Trends

This section delves into the key dynamics shaping the Israeli ceramic tiles market. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by a combination of factors:

The report thoroughly examines market growth drivers, analyzing the impact of technological advancements, evolving consumer preferences, and competitive dynamics. Key trends include a growing preference for larger format tiles, increased adoption of sustainable materials, and a rising demand for specialized tiles catering to specific aesthetic and functional needs. The market penetration of high-end porcelain tiles is increasing steadily, driven by rising disposable incomes and a growing preference for premium quality products.

Dominant Regions & Segments in Israel Ceramic Tiles Market

This section highlights the leading regions and segments within the Israeli ceramic tiles market. While precise regional data is limited, it's anticipated that major urban centers would dominate market share due to concentrated construction activity.

Product Segmentation: Porcelain tiles are expected to dominate the product segment due to their durability and versatility. Within the applications segment, floor tiles constitute the largest share. New construction projects are driving significant demand compared to the replacement and renovation sector. In the end-user segment, the residential market holds a larger share than the commercial sector.

Key Drivers:

- Economic Growth: Continued economic growth in Israel fuels investments in construction, boosting demand for ceramic tiles.

- Infrastructure Development: Ongoing infrastructure projects, including residential and commercial developments, fuel significant market growth.

- Government Policies: Supportive government policies towards construction and infrastructure development create a favorable environment for market expansion.

Dominance analysis further reveals that the combination of porcelain tiles for floor applications in new residential construction represents the most significant segment, driving the majority of market growth.

Israel Ceramic Tiles Market Product Innovations

Recent product innovations in the Israeli ceramic tile market focus on enhanced durability, aesthetic appeal, and sustainability. Manufacturers are introducing tiles with advanced surface treatments offering superior scratch resistance and stain protection. Furthermore, the incorporation of recycled materials and eco-friendly manufacturing processes is gaining traction, aligning with increasing environmental consciousness. The emphasis is on offering diverse designs and formats to meet varying aesthetic preferences.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Israel Ceramic Tiles Market, encompassing various aspects of product type (Glazed, Porcelain, Scratch Free, Others), application (Floor Tiles, Wall Tiles, Other Tiles), construction type (New Construction, Replacement & Renovation), and end-user (Residential, Commercial). Each segment's growth projections, market size, and competitive dynamics are meticulously analyzed to provide a detailed understanding of the market landscape. Market sizes for each segment are unavailable, however, relative sizes and growth projections can be inferred from the dominance analysis in the previous section.

Key Drivers of Israel Ceramic Tiles Market Growth

Several factors contribute to the growth of the Israel Ceramic Tiles Market. Strong economic growth, coupled with significant infrastructure development, fuels demand for construction materials, including ceramic tiles. Moreover, changing consumer preferences, such as a shift towards premium and aesthetically diverse tiles, are driving market expansion. Government policies promoting sustainable building practices also contribute positively.

Challenges in the Israel Ceramic Tiles Market Sector

The Israel ceramic tile market faces several challenges. Fluctuations in raw material prices and supply chain disruptions can impact profitability. Competition from substitute materials and the need to meet stringent environmental regulations add to the operational complexity. Economic downturns or changes in government policies can also significantly affect market growth.

Emerging Opportunities in Israel Ceramic Tiles Market

Emerging opportunities lie in the growing demand for large format tiles, eco-friendly options, and specialized designs. Technological innovations such as digitally printed tiles and smart tile integration are creating new avenues for market expansion. Moreover, tapping into niche markets with specialized tile solutions for specific applications presents lucrative opportunities.

Leading Players in the Israel Ceramic Tiles Market Market

- Negev Ceramics Ltd.

- Marazzi

- Fea Ceramics

- Caesarstone Ltd.

- Zuk Marble Products Ltd.

- Pekiin Tiles

- Balian Armenian ceramics tiles of Jerusalem

- Harash

- Milstone Marble Works Ltd.

- Ceramic Depot

Key Developments in Israel Ceramic Tiles Market Industry

- March 2023: Semihandmade's partnership with Caesarstone expands Caesarstone's reach into the home renovation market, potentially boosting its sales.

- October 2022: Mutina's new HQ launch showcases its tile collections and strengthens its brand image, indirectly influencing market trends.

Future Outlook for Israel Ceramic Tiles Market Market

The Israel ceramic tile market is poised for continued growth, driven by sustained economic expansion, infrastructural development, and evolving consumer preferences. Opportunities exist in technological advancements, sustainable options, and niche market penetration. Strategic partnerships and investments in innovation will be key to capitalizing on the market's future potential.

Israel Ceramic Tiles Market Segmentation

-

1. Product

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Others

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End-User

- 4.1. Residential

- 4.2. Commercial

Israel Ceramic Tiles Market Segmentation By Geography

- 1. Israel

Israel Ceramic Tiles Market Regional Market Share

Geographic Coverage of Israel Ceramic Tiles Market

Israel Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Safety and Security of Documents Drives the Market Growth; Facility Of Large Storage Space Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Complex Registration Restrictions; Poor Resistance To Water And Chemical Damage

- 3.4. Market Trends

- 3.4.1. Wall Application Segment is Gaining More Significance in the Current Scenario

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Negev Ceramics Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Marazzi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fea Ceramics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Caesarstone Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zuk Marble Products Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pekiin Tiles

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Balian Armenian ceramics tiles of Jerusalem

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harash

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Milstone Marble Works Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ceramic Depot

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Negev Ceramics Ltd

List of Figures

- Figure 1: Israel Ceramic Tiles Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Israel Ceramic Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: Israel Ceramic Tiles Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Israel Ceramic Tiles Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Israel Ceramic Tiles Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Israel Ceramic Tiles Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Israel Ceramic Tiles Market Revenue million Forecast, by Construction Type 2020 & 2033

- Table 6: Israel Ceramic Tiles Market Volume K Unit Forecast, by Construction Type 2020 & 2033

- Table 7: Israel Ceramic Tiles Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Israel Ceramic Tiles Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 9: Israel Ceramic Tiles Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: Israel Ceramic Tiles Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Israel Ceramic Tiles Market Revenue million Forecast, by Product 2020 & 2033

- Table 12: Israel Ceramic Tiles Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 13: Israel Ceramic Tiles Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: Israel Ceramic Tiles Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Israel Ceramic Tiles Market Revenue million Forecast, by Construction Type 2020 & 2033

- Table 16: Israel Ceramic Tiles Market Volume K Unit Forecast, by Construction Type 2020 & 2033

- Table 17: Israel Ceramic Tiles Market Revenue million Forecast, by End-User 2020 & 2033

- Table 18: Israel Ceramic Tiles Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 19: Israel Ceramic Tiles Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: Israel Ceramic Tiles Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Ceramic Tiles Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Israel Ceramic Tiles Market?

Key companies in the market include Negev Ceramics Ltd, Marazzi, Fea Ceramics, Caesarstone Ltd, Zuk Marble Products Ltd, Pekiin Tiles, Balian Armenian ceramics tiles of Jerusalem, Harash, Milstone Marble Works Ltd, Ceramic Depot.

3. What are the main segments of the Israel Ceramic Tiles Market?

The market segments include Product, Application, Construction Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 293.1 million as of 2022.

5. What are some drivers contributing to market growth?

Safety and Security of Documents Drives the Market Growth; Facility Of Large Storage Space Drives the Market Growth.

6. What are the notable trends driving market growth?

Wall Application Segment is Gaining More Significance in the Current Scenario.

7. Are there any restraints impacting market growth?

Complex Registration Restrictions; Poor Resistance To Water And Chemical Damage.

8. Can you provide examples of recent developments in the market?

March 2023: Semihandmade Debuts Partnership with Caesarstone to offer Quartz Surfaces. Semihandmade, the leading home remodeling brand known for pairing stylish doors with IKEA cabinets, is partnering with Caesarstone, a pioneer of quartz surfaces, helping Semihandmade customers realize their dream spaces by providing a one-stop shopping experience for all things home renovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the Israel Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence