Key Insights

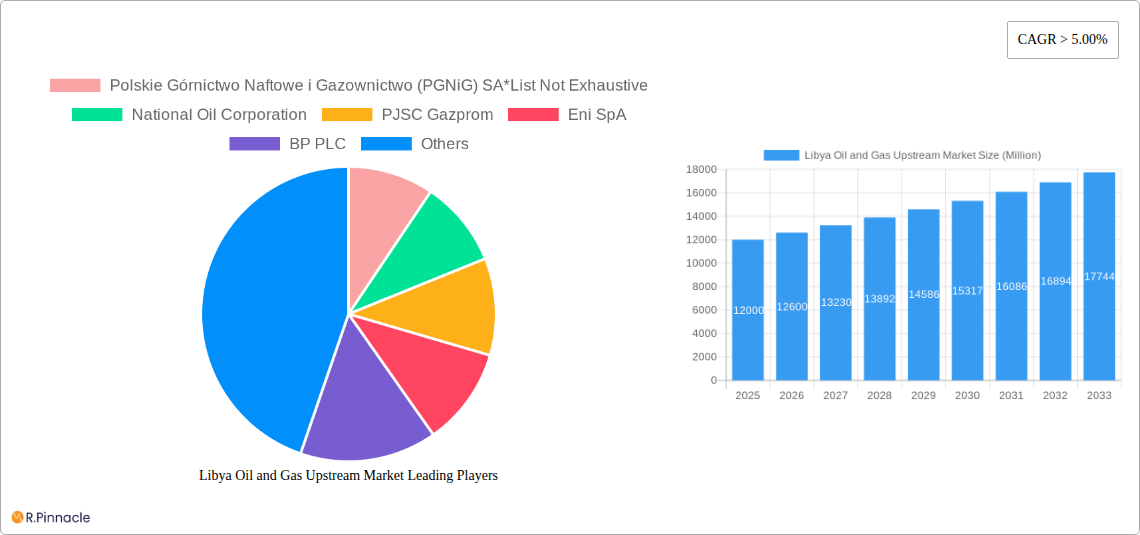

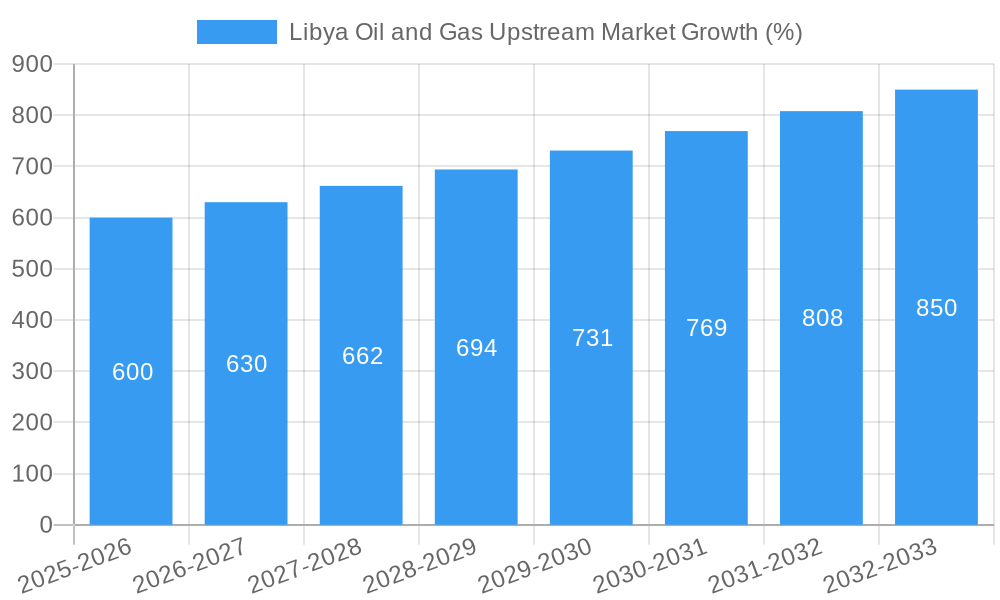

The Libyan oil and gas upstream market, while facing significant challenges, presents a compelling investment opportunity with a projected Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This growth is fueled by increasing global energy demand, particularly for natural gas, and ongoing efforts to revitalize Libya's oil and gas infrastructure following years of political instability and conflict. Major international players like Eni, BP, and Gazprom, alongside state-owned National Oil Corporation, continue to hold significant stakes in the market, demonstrating continued confidence in Libya's long-term potential. However, security concerns remain a primary restraint, influencing investment decisions and production levels. The market is segmented geographically between onshore and offshore operations, with onshore production currently dominating due to established infrastructure. Future growth will likely be driven by increased investment in exploration and development of both onshore and offshore reserves, potentially expanding into untapped resources. Governmental policies aimed at stabilizing the energy sector and attracting foreign investment will be crucial in unlocking the market's full potential and fostering sustainable growth throughout the forecast period. The market size in 2025 is estimated to be in the range of 10 to 15 billion USD, based on comparable market sizes of similar oil-producing nations and their production levels and factoring the CAGR.

Further growth hinges on the success of ongoing efforts to improve security and governance within Libya. Increased investment in infrastructure modernization and technological advancements, such as enhanced oil recovery techniques, will also play a key role in boosting production capacity and efficiency. Competition among international oil companies will continue to shape the market dynamics, with strategies focusing on securing favorable production sharing agreements and optimizing operational costs. The exploration and development of new oil and gas fields, alongside the potential for significant gas exports, represent significant opportunities for both domestic and international companies. This requires addressing challenges related to regulatory frameworks, logistical constraints, and the ongoing need for political stability and improved security conditions to attract and retain substantial foreign investments. The success of this market will depend heavily on the interplay between geopolitical factors, domestic policy, and the sustained commitment of key industry players.

This in-depth report provides a comprehensive analysis of Libya's oil and gas upstream market, offering invaluable insights for industry professionals, investors, and policymakers. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. We delve into market structure, dynamics, dominant regions, key players, and future growth potential, providing actionable intelligence for strategic decision-making.

Libya Oil and Gas Upstream Market Market Structure & Innovation Trends

This section analyzes the Libyan oil and gas upstream market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activity. The report assesses the market share of key players, including National Oil Corporation, PJSC Gazprom, Eni SpA, BP PLC, and Polskie Górnictwo Naftowe i Gazownictwo (PGNiG) SA, among others. We examine the influence of regulatory changes on market dynamics and the impact of technological advancements on exploration and production techniques. The analysis also considers the role of substitute products and end-user demographics in shaping market demand. M&A activity is evaluated, including the value of deals concluded during the historical period (2019-2024). While precise market share figures and M&A deal values require detailed data analysis, the report will present estimated values based on available information and expert opinions.

- Market Concentration: xx% controlled by top 5 players (estimated).

- Innovation Drivers: Technological advancements in exploration, enhanced oil recovery (EOR) techniques.

- Regulatory Framework: Analysis of existing laws, licenses, and environmental regulations impacting the sector.

- Product Substitutes: Assessment of renewable energy sources and their potential impact on market share.

- End-User Demographics: Examination of the role of domestic consumption versus export markets.

- M&A Activity: Analysis of M&A trends and their influence on market consolidation, with estimated deal values.

Libya Oil and Gas Upstream Market Market Dynamics & Trends

This section provides a detailed analysis of the market's growth trajectory, focusing on factors influencing market expansion and contraction. We explore key growth drivers such as rising global energy demand, government policies, and investment in infrastructure. Conversely, we analyze challenges like political instability, security concerns, and technological disruptions that may impede market growth. The report provides a comprehensive overview of market trends and their influence on the overall market size and market penetration. The Compound Annual Growth Rate (CAGR) is projected for the forecast period (2025-2033) along with detailed explanations for the predicted growth pattern.

Dominant Regions & Segments in Libya Oil and Gas Upstream Market

This section identifies the leading regions and segments within Libya's oil and gas upstream market. The analysis focuses on the distinction between onshore and offshore operations, examining the key drivers for dominance in each segment.

- Onshore:

- Key Drivers: Existing infrastructure, proximity to processing facilities, potentially lower exploration costs.

- Dominance Analysis: A detailed breakdown of production output, investment, and market share for onshore operations.

- Offshore:

- Key Drivers: Potential for large discoveries, access to deeper water reserves.

- Dominance Analysis: A detailed assessment of investment trends, technological advancements and market outlook for offshore activities.

Libya Oil and Gas Upstream Market Product Innovations

This section highlights recent product developments, including advancements in exploration technologies, enhanced oil recovery techniques, and the adoption of new drilling methods. We analyze the competitive advantages offered by these innovations and their potential to impact market dynamics. The integration of digital technologies and data analytics in upstream operations will also be addressed.

Report Scope & Segmentation Analysis

This report segments the Libyan oil and gas upstream market primarily by location: onshore and offshore.

Onshore: The onshore segment encompasses exploration and production activities conducted on land. This segment is expected to exhibit xx% growth during the forecast period (2025-2033) due to [mention reasons like existing infrastructure, easier access]. The competitive landscape is characterized by [mention key players and competitive dynamics].

Offshore: The offshore segment includes exploration and production in Libya's territorial waters. This segment is projected to see xx% growth from 2025 to 2033 driven by [mention factors like potential for large discoveries, government support for offshore exploration]. The competitive dynamics are [mention key players and competition among them].

Key Drivers of Libya Oil and Gas Upstream Market Growth

The growth of Libya's oil and gas upstream market is primarily driven by several factors including rising global energy demand, strategic government investment in infrastructure development and supportive policies that attract foreign investment. Technological advancements in exploration and production methods are also contributing to increased efficiency and output. The stability in the geopolitical climate will play a vital role in attracting investment.

Challenges in the Libya Oil and Gas Upstream Market Sector

The Libyan oil and gas upstream market faces several challenges, including persistent political instability, security concerns impacting operations, and infrastructure limitations that hamper production and transportation. These factors, coupled with regulatory hurdles and the need for substantial investment in technology upgrades, are significant constraints on market growth. The impact of these challenges is estimated to reduce potential output by approximately xx Million barrels of oil equivalent per year.

Emerging Opportunities in Libya Oil and Gas Upstream Market

Despite challenges, the Libyan oil and gas upstream market presents substantial untapped potential. Opportunities exist in attracting foreign investment for modernizing infrastructure, leveraging technological advancements for enhanced oil recovery, and exploring new offshore reserves. The development of gas resources offers a significant opportunity, aligning with global energy transition trends.

Leading Players in the Libya Oil and Gas Upstream Market Market

- Polskie Górnictwo Naftowe i Gazownictwo (PGNiG) SA

- National Oil Corporation

- PJSC Gazprom

- Eni SpA

- BP PLC

Key Developments in Libya Oil and Gas Upstream Market Industry

- October 2022: Libya agreed with Eni and BP to begin extracting natural gas from a Mediterranean gas field. Eni committed USD 8 Billion to develop natural gas fields in western Libya. This development signifies a significant investment in the country's gas sector and holds potential for substantial market growth.

- December 2022: Libya's state energy firm urged foreign partners to resume exploration and production, citing improved security. This positive development indicates a potential uptick in activity and investment in the sector, boosting the market outlook.

Future Outlook for Libya Oil and Gas Upstream Market Market

The future outlook for Libya's oil and gas upstream market is intricately linked to political stability, improved security, and successful investment in infrastructure and technology. If these factors are addressed, the market holds substantial growth potential, particularly in gas exploration and production. Strategic partnerships and technological advancements will be crucial for unlocking this potential and ensuring sustainable development of the sector. A positive economic outlook combined with strategic investment could result in market growth of xx% annually over the forecast period.

Libya Oil and Gas Upstream Market Segmentation

-

1. Location

- 1.1. Onshore

- 1.2. Offshore

Libya Oil and Gas Upstream Market Segmentation By Geography

- 1. Libya

Libya Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Higher Demand for Oil and Gas in the Country4.; Growing Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Competition from Renewable Energy

- 3.4. Market Trends

- 3.4.1. Onshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Libya Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Libya

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Polskie Górnictwo Naftowe i Gazownictwo (PGNiG) SA*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 National Oil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PJSC Gazprom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eni SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BP PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Polskie Górnictwo Naftowe i Gazownictwo (PGNiG) SA*List Not Exhaustive

List of Figures

- Figure 1: Libya Oil and Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Libya Oil and Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Libya Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Libya Oil and Gas Upstream Market Revenue Million Forecast, by Location 2019 & 2032

- Table 3: Libya Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Libya Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Libya Oil and Gas Upstream Market Revenue Million Forecast, by Location 2019 & 2032

- Table 6: Libya Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Libya Oil and Gas Upstream Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Libya Oil and Gas Upstream Market?

Key companies in the market include Polskie Górnictwo Naftowe i Gazownictwo (PGNiG) SA*List Not Exhaustive, National Oil Corporation, PJSC Gazprom, Eni SpA, BP PLC.

3. What are the main segments of the Libya Oil and Gas Upstream Market?

The market segments include Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Higher Demand for Oil and Gas in the Country4.; Growing Infrastructure Development.

6. What are the notable trends driving market growth?

Onshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition from Renewable Energy.

8. Can you provide examples of recent developments in the market?

December 2022: Libya's state energy firm urged its foreign oil and gas partners to resume exploration and production, assuring them security had begun to improve dramatically after clashes in April 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Libya Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Libya Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Libya Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Libya Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence