Key Insights

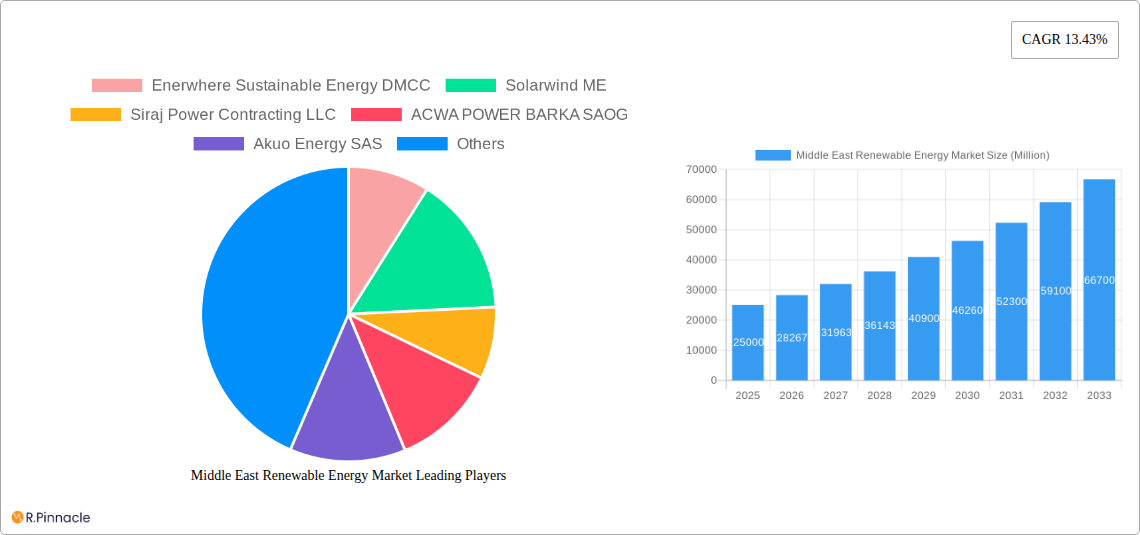

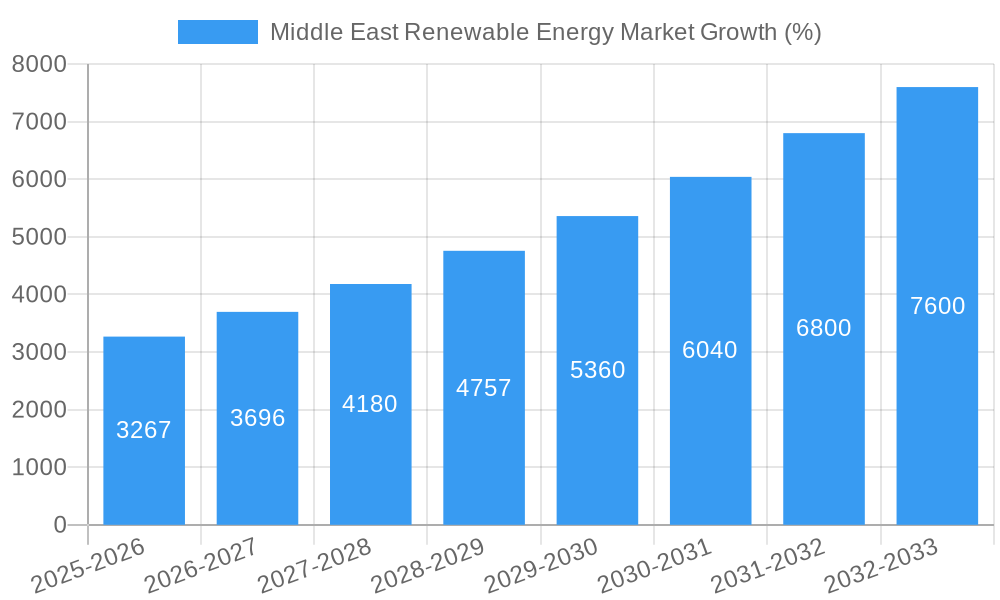

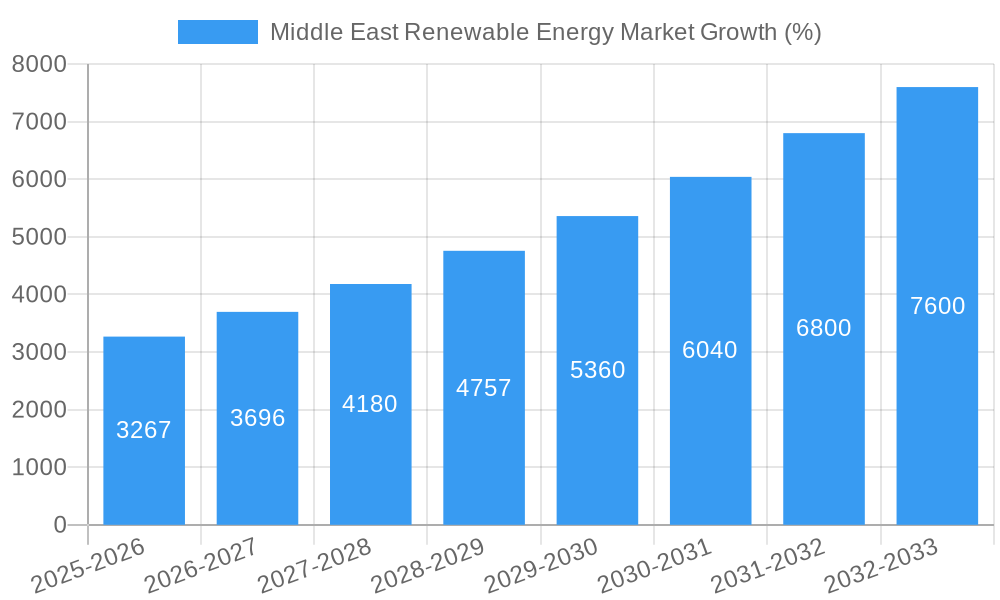

The Middle East renewable energy market is experiencing robust growth, driven by the region's commitment to diversifying its energy mix and mitigating climate change. A compound annual growth rate (CAGR) of 13.43% from 2019 to 2024 indicates a significant upward trajectory. This expansion is fueled by several key factors: increasing government support through substantial investments in renewable energy projects, ambitious national targets for renewable energy penetration, and the decreasing cost of renewable energy technologies, making them increasingly competitive with fossil fuels. The UAE, Saudi Arabia, and other nations are leading the charge, implementing large-scale solar and wind power initiatives. Furthermore, water scarcity in the region is accelerating interest in solar and other renewable energy solutions, reducing reliance on water-intensive energy sources. The market is segmented across various renewable energy types, with solar, wind, and hydro power leading the way, while other emerging technologies are contributing to a diversified energy landscape. Significant investments from both regional and international players are attracting further foreign direct investments (FDI).

Looking ahead to 2033, the market is projected to continue its expansion, driven by ongoing policy support, technological advancements, and the growing demand for clean energy. While challenges remain, such as grid integration complexities and the need for consistent regulatory frameworks, the overall outlook for the Middle East renewable energy sector is exceptionally positive. The continued growth will depend on addressing these challenges, fostering sustainable financing models, and leveraging technological innovations to further reduce costs and enhance efficiency. Key players, including both established international energy companies and regional developers, are well-positioned to capitalize on these opportunities. The development of large-scale renewable energy projects, especially in countries with abundant solar and wind resources, will be a defining characteristic of the market's evolution over the next decade.

Middle East Renewable Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East renewable energy market, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils the market's structure, dynamics, leading players, and future growth potential. Expect detailed segmentation analysis across Hydro, Solar, Wind, and Other Renewable Energy Types, incorporating key developments and challenges. The report uses Million (M) for all value notations.

Middle East Renewable Energy Market Structure & Innovation Trends

This section analyzes the competitive landscape, including market concentration, innovation drivers, regulatory frameworks, and M&A activities. We delve into the impact of product substitutes and end-user demographics on market growth. The analysis includes quantifiable metrics such as market share and M&A deal values (in Million).

- Market Concentration: The market shows a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. This is expected to slightly decrease to xx% by 2033 due to increased participation of smaller players.

- Innovation Drivers: Government support through subsidies and incentives, coupled with technological advancements in solar PV and wind energy, are driving innovation. R&D spending within the sector is estimated to reach xx Million by 2033.

- Regulatory Frameworks: Varied national policies and supportive regulatory frameworks across the Middle East are accelerating renewable energy adoption. However, inconsistencies in implementation across different countries pose a challenge.

- M&A Activities: The period 2019-2024 witnessed xx M&A deals, with a total value of approximately xx Million. This trend is expected to continue, driven by consolidation and the need for larger players to acquire specialized technology or project expertise.

- Product Substitutes: Natural gas remains a significant competitor, particularly for baseload power generation, though renewable energy sources are becoming increasingly cost-competitive.

- End-User Demographics: The key end-users include utilities, industrial consumers, and commercial businesses. The shift towards decentralized energy generation is creating new opportunities for smaller-scale renewable energy projects.

Middle East Renewable Energy Market Dynamics & Trends

This section explores market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We provide quantitative metrics, such as CAGR and market penetration rates. The market is exhibiting robust growth fueled by increasing energy demand, government initiatives promoting renewable energy, and falling technology costs. The projected CAGR for the period 2025-2033 is estimated at xx%. Market penetration of renewable energy in the total energy mix is expected to rise from xx% in 2025 to xx% by 2033.

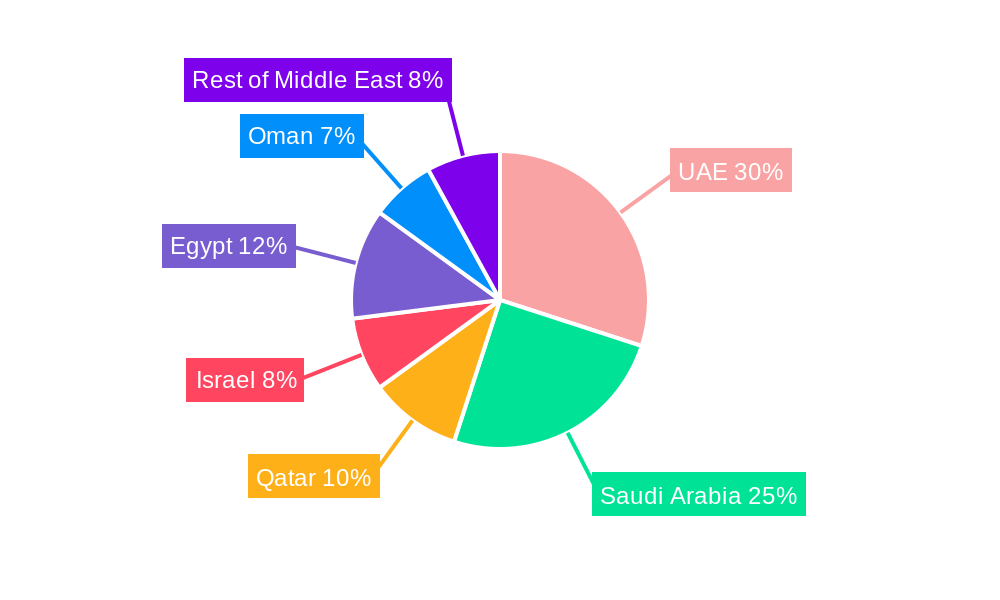

Dominant Regions & Segments in Middle East Renewable Energy Market

This section identifies the leading region(s) and segments (Hydro, Solar, Wind, Other Types) within the Middle East renewable energy market.

Solar Power: The UAE is currently the dominant region and segment, driving growth through large-scale solar PV projects like the Mohammed bin Rashid Solar Park and Al Dhafra PV2 Solar Power Plant. Key drivers include:

- Government-backed initiatives and ambitious renewable energy targets.

- Abundant solar irradiance leading to high energy yields.

- Significant investments from both public and private sectors.

Wind Power: Saudi Arabia is expected to show strong growth in wind energy due to increased government investments and conducive wind resources in certain regions. However, Solar will remain the larger segment.

Hydropower: Hydropower contributes a smaller share compared to solar and wind, due to limited suitable locations and resources within the region.

Other Renewables: This category encompasses geothermal, biomass, and other emerging technologies. Growth in this segment is expected to be slower due to limited availability of resources and early stage development.

Middle East Renewable Energy Market Product Innovations

Recent innovations focus on improving the efficiency and cost-effectiveness of solar PV and wind technologies, including advancements in thin-film solar cells, advanced turbine designs, and energy storage solutions. These developments enhance the competitiveness of renewable energy compared to traditional fossil fuels. The increasing affordability of renewable technologies further fuels market growth.

Report Scope & Segmentation Analysis

This report comprehensively segments the Middle East renewable energy market by type: Hydro, Solar, Wind, and Other Renewable Energy Types. Each segment’s growth projections, market sizes (in Million), and competitive dynamics are analyzed.

Solar: This segment is the largest and fastest-growing, driven by decreasing costs and supportive government policies. It is expected to reach a market size of xx Million by 2033.

Wind: Significant potential for growth exists in several countries. The market size is projected to reach xx Million by 2033.

Hydro: Limited growth potential due to geographical constraints. The market size is expected to remain relatively stable at xx Million.

Other: This segment's growth is expected to remain modest at approximately xx Million by 2033.

Key Drivers of Middle East Renewable Energy Market Growth

Several factors fuel the market's expansion. Government incentives, the decreasing cost of renewable energy technologies, and the increasing awareness of climate change are key drivers. Ambitious national targets for renewable energy adoption further accelerate market growth. The region's abundant solar and wind resources are also significant contributors.

Challenges in the Middle East Renewable Energy Market Sector

Challenges include the high initial investment costs for renewable energy projects, grid infrastructure limitations in some areas, and the intermittent nature of renewable energy sources. Regulatory uncertainties and dependence on foreign technology in some sectors also pose challenges. Overcoming these challenges requires significant investment in grid modernization and addressing technological dependence.

Emerging Opportunities in Middle East Renewable Energy Market

Opportunities exist in expanding renewable energy integration into existing grids, developing smart grids, incorporating energy storage solutions, and exploring innovative financing models for renewable energy projects. The growing demand for green hydrogen and the potential for regional cooperation in renewable energy projects present further opportunities for growth.

Leading Players in the Middle East Renewable Energy Market Market

- Enerwhere Sustainable Energy DMCC

- Solarwind ME

- Siraj Power Contracting LLC

- ACWA POWER BARKA SAOG

- Akuo Energy SAS

- Canadian Solar Inc

- EDF Renewables

- Yellow Door Energy Limited

- Masdar (Abu Dhabi Future Energy Co)

- MASE

Key Developments in Middle East Renewable Energy Market Industry

- July 2022: The fourth phase of the Mohammed bin Rashid Solar Park (0.95 GW capacity) was announced, boosting Dubai's clean energy share towards its 25% target by 2030.

- February 2022: The Al Dhafra PV2 Solar Power Plant Project (2.1 GW) commenced, significantly lowering carbon emissions in Abu Dhabi.

Future Outlook for Middle East Renewable Energy Market Market

The Middle East renewable energy market is poised for continued robust growth, driven by supportive government policies, technological advancements, and increasing private sector investment. The region's vast renewable energy potential and the global shift towards decarbonization will create significant opportunities for expansion and innovation in the coming years. The market is expected to experience substantial growth exceeding xx Million by 2033.

Middle East Renewable Energy Market Segmentation

-

1. Type

- 1.1. Hydro

- 1.2. Solar

- 1.3. Wind

- 1.4. Other Types

-

2. Geography

- 2.1. United Arab Emirates (UAE)

- 2.2. Saudi Arabia

- 2.3. Oman

- 2.4. Iran

- 2.5. Israel

- 2.6. Jordan

- 2.7. Rest of Middle East

Middle East Renewable Energy Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Oman

- 4. Iran

- 5. Israel

- 6. Jordan

- 7. Rest of Middle East

Middle East Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption

- 3.4. Market Trends

- 3.4.1. Solar Energy Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydro

- 5.1.2. Solar

- 5.1.3. Wind

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United Arab Emirates (UAE)

- 5.2.2. Saudi Arabia

- 5.2.3. Oman

- 5.2.4. Iran

- 5.2.5. Israel

- 5.2.6. Jordan

- 5.2.7. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Oman

- 5.3.4. Iran

- 5.3.5. Israel

- 5.3.6. Jordan

- 5.3.7. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Arab Emirates Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hydro

- 6.1.2. Solar

- 6.1.3. Wind

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United Arab Emirates (UAE)

- 6.2.2. Saudi Arabia

- 6.2.3. Oman

- 6.2.4. Iran

- 6.2.5. Israel

- 6.2.6. Jordan

- 6.2.7. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hydro

- 7.1.2. Solar

- 7.1.3. Wind

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United Arab Emirates (UAE)

- 7.2.2. Saudi Arabia

- 7.2.3. Oman

- 7.2.4. Iran

- 7.2.5. Israel

- 7.2.6. Jordan

- 7.2.7. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Oman Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hydro

- 8.1.2. Solar

- 8.1.3. Wind

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United Arab Emirates (UAE)

- 8.2.2. Saudi Arabia

- 8.2.3. Oman

- 8.2.4. Iran

- 8.2.5. Israel

- 8.2.6. Jordan

- 8.2.7. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Iran Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hydro

- 9.1.2. Solar

- 9.1.3. Wind

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United Arab Emirates (UAE)

- 9.2.2. Saudi Arabia

- 9.2.3. Oman

- 9.2.4. Iran

- 9.2.5. Israel

- 9.2.6. Jordan

- 9.2.7. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Israel Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hydro

- 10.1.2. Solar

- 10.1.3. Wind

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. United Arab Emirates (UAE)

- 10.2.2. Saudi Arabia

- 10.2.3. Oman

- 10.2.4. Iran

- 10.2.5. Israel

- 10.2.6. Jordan

- 10.2.7. Rest of Middle East

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Jordan Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Hydro

- 11.1.2. Solar

- 11.1.3. Wind

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. United Arab Emirates (UAE)

- 11.2.2. Saudi Arabia

- 11.2.3. Oman

- 11.2.4. Iran

- 11.2.5. Israel

- 11.2.6. Jordan

- 11.2.7. Rest of Middle East

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Middle East Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Hydro

- 12.1.2. Solar

- 12.1.3. Wind

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. United Arab Emirates (UAE)

- 12.2.2. Saudi Arabia

- 12.2.3. Oman

- 12.2.4. Iran

- 12.2.5. Israel

- 12.2.6. Jordan

- 12.2.7. Rest of Middle East

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. United Arab Emirates Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 14. Saudi Arabia Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 15. Qatar Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 16. Israel Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 17. Egypt Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 18. Oman Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Middle East Middle East Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Enerwhere Sustainable Energy DMCC

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Solarwind ME

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Siraj Power Contracting LLC

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 ACWA POWER BARKA SAOG

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Akuo Energy SAS

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Canadian Solar Inc

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 EDF Renewables

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Yellow Door Energy Limited

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Masdar (Abu Dhabi Future Energy Co )

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 MASE

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Enerwhere Sustainable Energy DMCC

List of Figures

- Figure 1: Middle East Renewable Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Renewable Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Middle East Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 5: Middle East Renewable Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: Middle East Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Middle East Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: United Arab Emirates Middle East Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Arab Emirates Middle East Renewable Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Saudi Arabia Middle East Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Saudi Arabia Middle East Renewable Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Qatar Middle East Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Qatar Middle East Renewable Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Israel Middle East Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Israel Middle East Renewable Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Egypt Middle East Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Egypt Middle East Renewable Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Oman Middle East Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Oman Middle East Renewable Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Rest of Middle East Middle East Renewable Energy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Middle East Middle East Renewable Energy Market Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Middle East Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 27: Middle East Renewable Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 29: Middle East Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 31: Middle East Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 33: Middle East Renewable Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 35: Middle East Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 37: Middle East Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 39: Middle East Renewable Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 41: Middle East Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 43: Middle East Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 45: Middle East Renewable Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 47: Middle East Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 49: Middle East Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 51: Middle East Renewable Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 52: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 53: Middle East Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 55: Middle East Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 57: Middle East Renewable Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 58: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 59: Middle East Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 61: Middle East Renewable Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 63: Middle East Renewable Energy Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 64: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 65: Middle East Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Middle East Renewable Energy Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Renewable Energy Market?

The projected CAGR is approximately 13.43%.

2. Which companies are prominent players in the Middle East Renewable Energy Market?

Key companies in the market include Enerwhere Sustainable Energy DMCC, Solarwind ME, Siraj Power Contracting LLC, ACWA POWER BARKA SAOG, Akuo Energy SAS, Canadian Solar Inc, EDF Renewables, Yellow Door Energy Limited, Masdar (Abu Dhabi Future Energy Co ), MASE.

3. What are the main segments of the Middle East Renewable Energy Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar.

6. What are the notable trends driving market growth?

Solar Energy Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption.

8. Can you provide examples of recent developments in the market?

July 2022: The fourth phase of Mohammed bin Rashid Solar Park was announced to be implemented by Noor Energy 1 PSC, which contains 0.7 GW CSP and 0.25 GW PV, including Parabolic Trough CSP plants of 0.6 GW ( 0.2 GW for each unit) & Molten Salt Tower CSP Plant of 0.1 GW. This project is expected to drive the cleanliness of Dubai to extend the clean energy share to 25% by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Middle East Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence