Key Insights

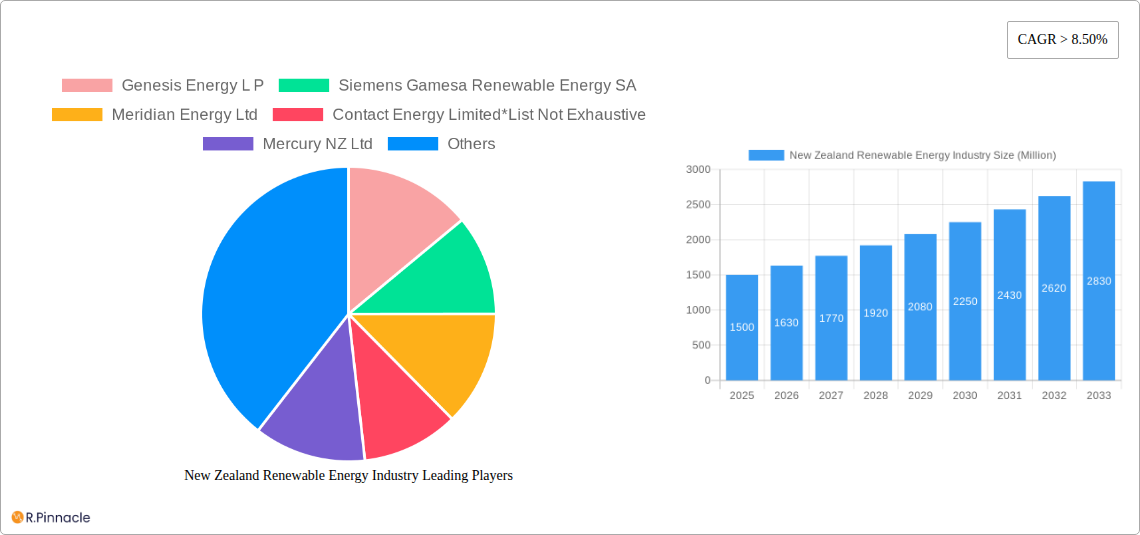

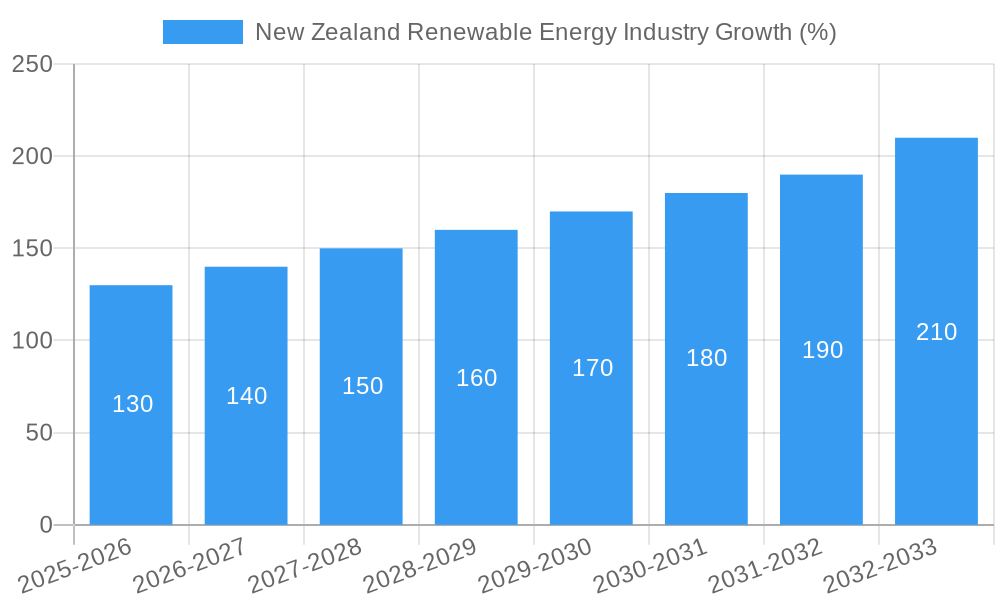

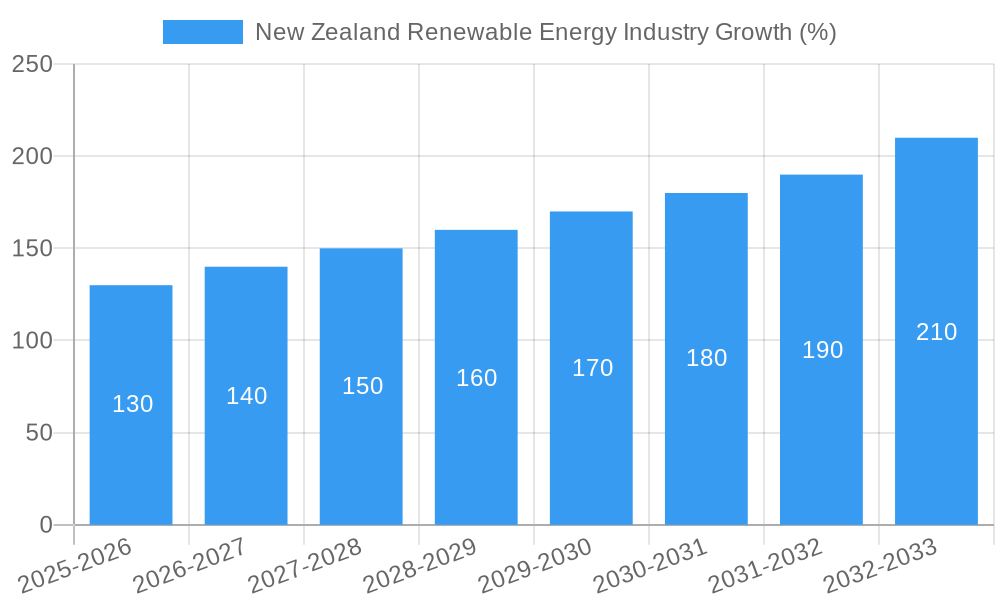

The New Zealand renewable energy market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8.5% from 2025 to 2033. This expansion is fueled by several key drivers. The country's commitment to reducing carbon emissions and achieving its climate change targets necessitates a significant shift towards cleaner energy sources. Government incentives, supportive policies, and increasing public awareness of environmental issues are further bolstering the sector's growth. Technological advancements in renewable energy technologies, particularly in solar and wind power, are also contributing to cost reductions and improved efficiency, making renewable energy increasingly competitive with traditional fossil fuels. The market is segmented by type (Geothermal, Hydro, Wind, Solar, Other) and end-user (Residential, Commercial, Industrial), with significant opportunities across all segments. Hydropower currently dominates the market due to New Zealand's abundant water resources, but solar and wind power are witnessing rapid expansion, driven by decreasing costs and technological advancements. Despite these positive factors, challenges remain, including the intermittent nature of some renewable energy sources (e.g., solar and wind) and the need for significant investment in grid infrastructure to accommodate the increasing supply of renewable energy. Furthermore, the geographical limitations of some renewable energy sources and the need for efficient energy storage solutions pose ongoing challenges. Despite these constraints, the overall outlook for the New Zealand renewable energy market remains highly positive, promising substantial growth and economic opportunities in the coming years.

The major players in this dynamic market include established energy companies such as Genesis Energy, Meridian Energy, and Contact Energy, alongside international players like Vestas and Siemens Gamesa. These companies are actively investing in new projects and expanding their renewable energy portfolios to capitalize on the growing demand. The increasing participation of smaller independent power producers and the emergence of innovative energy storage solutions are also shaping the competitive landscape. The residential sector is expected to witness significant growth in renewable energy adoption, driven by decreasing installation costs and increasing consumer awareness. Simultaneously, the commercial and industrial sectors are likely to see substantial investment in renewable energy projects to reduce operational costs and improve their environmental sustainability profiles. The strong growth trajectory and supportive government policies position New Zealand as a leading example of a nation successfully transitioning towards a sustainable energy future.

This comprehensive report provides an in-depth analysis of the New Zealand renewable energy market, offering invaluable insights for industry professionals, investors, and policymakers. With a focus on the period 2019-2033 (base year 2025), this report analyzes market dynamics, key players, technological advancements, and future growth potential. The report utilizes extensive data and forecasts to provide actionable intelligence on a market poised for significant expansion. Expect detailed breakdowns of market segments, including Geothermal, Hydro, Wind, and Solar, across Residential, Commercial, and Industrial end-users.

New Zealand Renewable Energy Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of New Zealand's renewable energy sector, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market exhibits a moderately concentrated structure, with several major players holding significant market share. Genesis Energy, Meridian Energy, and Contact Energy are key examples, although the market also includes numerous smaller independent power producers and developers.

- Market Concentration: The market share of the top 5 players is estimated at xx%.

- Innovation Drivers: Government incentives, technological advancements (particularly in wind and solar), and increasing environmental concerns are driving innovation.

- Regulatory Framework: Supportive government policies and regulations play a significant role in shaping market growth. The commitment to 100% renewable energy by 2030 is a primary driver.

- Product Substitutes: While limited, traditional fossil fuel-based energy sources remain a substitute, though their market share is steadily declining.

- End-User Demographics: The industrial sector currently dominates the demand, followed by commercial and then residential. However, residential uptake is projected to grow significantly.

- M&A Activities: Over the historical period (2019-2024), M&A activity totalled approximately NZ$ xx Million, with a significant increase expected over the forecast period (2025-2033).

New Zealand Renewable Energy Industry Market Dynamics & Trends

New Zealand's renewable energy market is experiencing robust growth, driven by factors such as increasing electricity demand, government support for renewable energy initiatives, and decreasing costs of renewable energy technologies. The market is characterized by a high level of competition, with both established players and new entrants vying for market share. Technological advancements, particularly in wind and solar technologies, are contributing to cost reductions and increased efficiency. Consumer preferences are shifting towards cleaner energy sources, fuelling market demand. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), leading to a market size of NZ$ xx Million by 2033. Market penetration of renewables in the energy mix is expected to reach xx% by 2033.

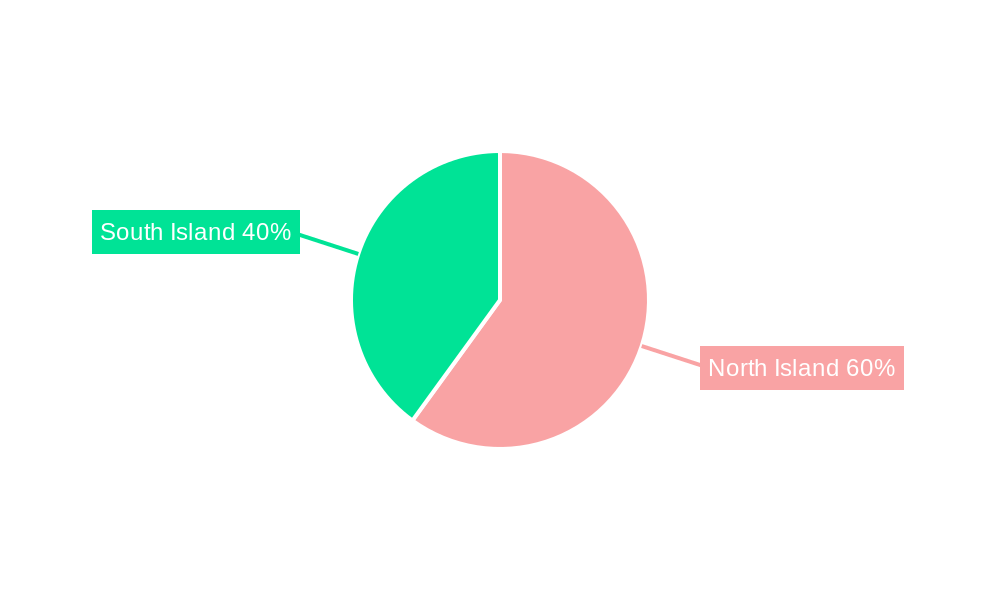

Dominant Regions & Segments in New Zealand Renewable Energy Industry

New Zealand's renewable energy sector is geographically diverse, with different regions specializing in various renewable energy sources. While specific regional data needs further refinement, initial estimations suggest the South Island holds a significant share due to its abundant hydro resources. Hydropower remains the dominant segment, although wind and solar are rapidly gaining traction.

- Key Drivers for Hydro: Abundant water resources, established infrastructure.

- Key Drivers for Wind: Favorable wind conditions in certain regions, government support for large-scale wind projects (e.g., Castle Hill Wind Farm).

- Key Drivers for Solar: Decreasing solar panel costs, increased awareness, government incentives for residential and commercial installations.

- Key Drivers for Geothermal: Existing geothermal plants, potential for expansion in geothermally active areas.

- Industrial End-User Dominance: Driven by high energy consumption and sustainability goals.

The industrial sector’s demand is primarily driven by its high energy consumption, coupled with increasing environmental awareness and government regulations pushing for decarbonization.

New Zealand Renewable Energy Industry Product Innovations

Technological advancements are significantly impacting the New Zealand renewable energy market. Innovations in wind turbine technology are leading to higher energy yields and reduced costs. Similarly, advancements in solar PV technology are improving efficiency and reducing the cost of solar energy. The integration of smart grids and energy storage solutions is enhancing grid stability and optimizing renewable energy utilization. These innovations are crucial for maximizing the potential of renewable energy sources and supporting the nation's sustainability goals.

Report Scope & Segmentation Analysis

This report segments the New Zealand renewable energy market by energy source (Geothermal, Hydro, Wind, Solar, Other) and end-user (Residential, Commercial, Industrial). Each segment's market size, growth projections, and competitive dynamics are analyzed, providing a granular understanding of the market landscape. Growth in the solar and wind segments is expected to outpace other segments in the forecast period. Competitive dynamics vary significantly across segments, with some experiencing intense competition while others are characterized by a more oligopolistic structure.

Key Drivers of New Zealand Renewable Energy Industry Growth

The growth of the New Zealand renewable energy industry is fueled by several factors:

- Government Policies: The ambitious goal of 100% renewable electricity generation by 2030 drives significant investment and policy support.

- Technological Advancements: Falling costs and improved efficiency of renewable energy technologies make them increasingly competitive.

- Environmental Concerns: Growing public awareness of climate change is increasing demand for clean energy solutions.

- Economic Incentives: Government subsidies and tax breaks encourage renewable energy adoption.

Challenges in the New Zealand Renewable Energy Industry Sector

Despite significant growth potential, the New Zealand renewable energy sector faces several challenges:

- Intermittency of Renewable Sources: Wind and solar power are inherently intermittent, requiring robust grid management and energy storage solutions.

- Transmission Infrastructure: Upgrading and expanding the electricity grid is crucial for accommodating increasing renewable energy generation.

- High Upfront Capital Costs: The initial investment required for renewable energy projects can be substantial, posing a barrier to entry for smaller players.

Emerging Opportunities in New Zealand Renewable Energy Industry

Several emerging opportunities exist within the New Zealand renewable energy sector:

- Energy Storage Solutions: The growing need for grid stability and efficient renewable energy integration creates a significant market for battery storage and other energy storage technologies.

- Green Hydrogen Production: Utilizing excess renewable energy to produce green hydrogen presents a promising avenue for decarbonizing hard-to-abate sectors.

- Offshore Wind Power: Exploring the potential for offshore wind farms could significantly expand New Zealand's renewable energy capacity.

Leading Players in the New Zealand Renewable Energy Industry Market

- Genesis Energy L P

- Siemens Gamesa Renewable Energy SA

- Meridian Energy Ltd

- Contact Energy Limited

- Mercury NZ Ltd

- Vector Limited

- Vestas Wind Systems AS

- General Electric Company

- Trustpower

- Tilt Renewables

Key Developments in New Zealand Renewable Energy Industry Industry

- September 2021: Hive Energy, Ethical Power, and Solar South West formed a JV to deploy 350 MW of solar PV capacity.

- Ongoing: Development of the 860 MW Castle Hill Wind Farm by Genesis Energy, expected commissioning in 2024.

Future Outlook for New Zealand Renewable Energy Industry Market

The New Zealand renewable energy market is poised for sustained growth, driven by strong government support, technological advancements, and increasing environmental awareness. The transition to a 100% renewable electricity system presents significant opportunities for investment and innovation. The market will see increased diversification of renewable energy sources, greater integration of energy storage solutions, and expansion into new sectors such as green hydrogen production. This will lead to significant economic benefits, job creation, and a reduction in New Zealand's carbon footprint.

New Zealand Renewable Energy Industry Segmentation

-

1. Type

- 1.1. Geothermal

- 1.2. Hydro

- 1.3. Wind

- 1.4. Solar

- 1.5. Other Types

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

New Zealand Renewable Energy Industry Segmentation By Geography

- 1. New Zealand

New Zealand Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Wind Energy is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Geothermal

- 5.1.2. Hydro

- 5.1.3. Wind

- 5.1.4. Solar

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Genesis Energy L P

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens Gamesa Renewable Energy SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meridian Energy Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Contact Energy Limited*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mercury NZ Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vector Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vestas Wind Systems AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trustpower

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tilt Renewables

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Genesis Energy L P

List of Figures

- Figure 1: New Zealand Renewable Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: New Zealand Renewable Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: New Zealand Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: New Zealand Renewable Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: New Zealand Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: New Zealand Renewable Energy Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 5: New Zealand Renewable Energy Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: New Zealand Renewable Energy Industry Volume Gigawatt Forecast, by End User 2019 & 2032

- Table 7: New Zealand Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: New Zealand Renewable Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: New Zealand Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: New Zealand Renewable Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: New Zealand Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: New Zealand Renewable Energy Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 13: New Zealand Renewable Energy Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: New Zealand Renewable Energy Industry Volume Gigawatt Forecast, by End User 2019 & 2032

- Table 15: New Zealand Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: New Zealand Renewable Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Renewable Energy Industry?

The projected CAGR is approximately > 8.50%.

2. Which companies are prominent players in the New Zealand Renewable Energy Industry?

Key companies in the market include Genesis Energy L P, Siemens Gamesa Renewable Energy SA, Meridian Energy Ltd, Contact Energy Limited*List Not Exhaustive, Mercury NZ Ltd, Vector Limited, Vestas Wind Systems AS, General Electric Company, Trustpower , Tilt Renewables.

3. What are the main segments of the New Zealand Renewable Energy Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas.

6. What are the notable trends driving market growth?

Wind Energy is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In September 2021, the UK solar project developer Hive Energy, Ethical Power, and Solar South West (SSW) formed a joint venture (JV) to deploy around 350 MW of utility-scale photovoltaic (PV) capacity in New Zealand. The joint venture will work together to support the New Zealand government's commitment to achieving 100% renewable energy generation in the country by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the New Zealand Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence