Key Insights

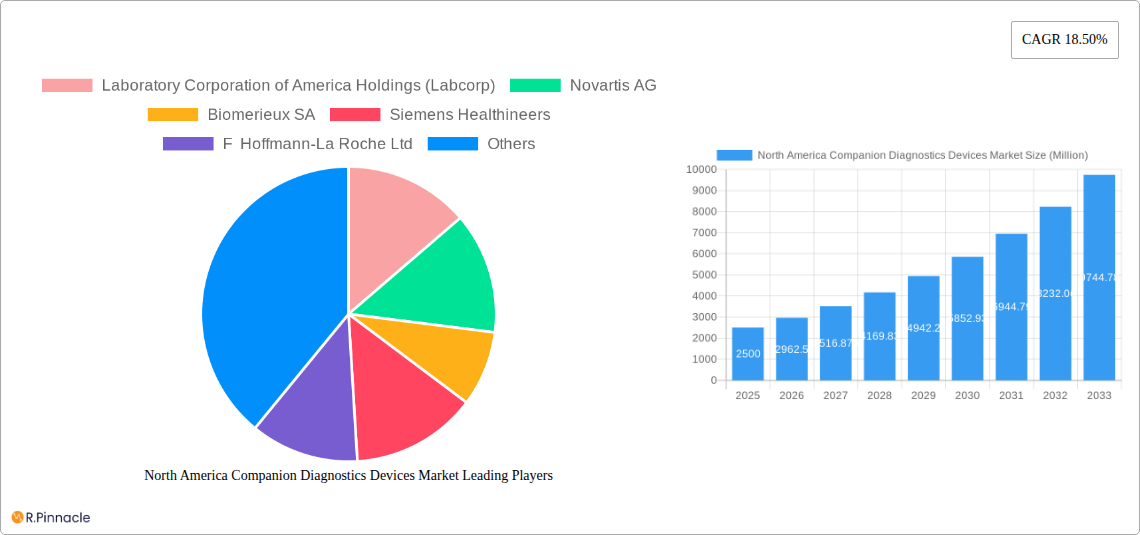

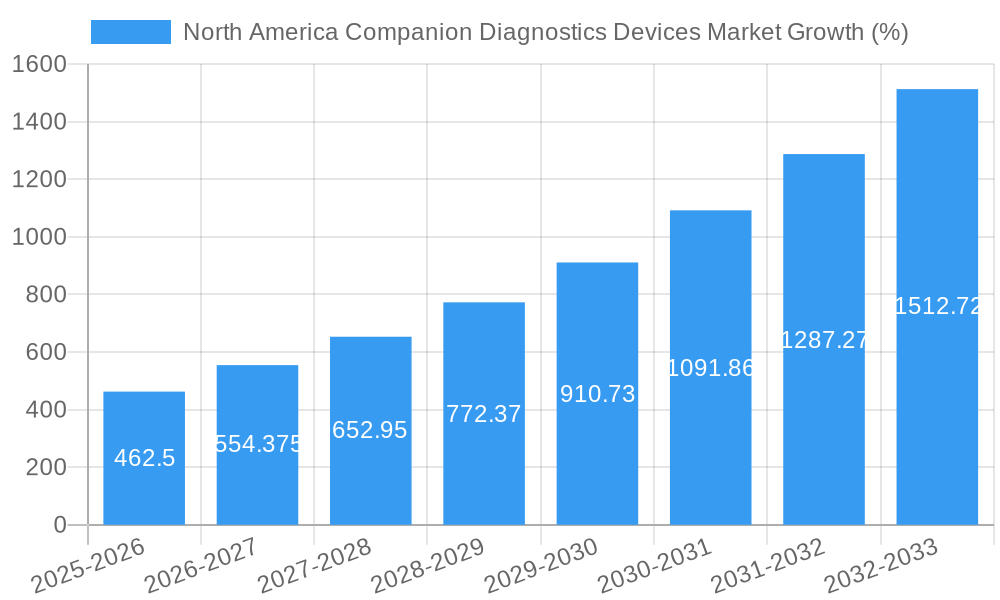

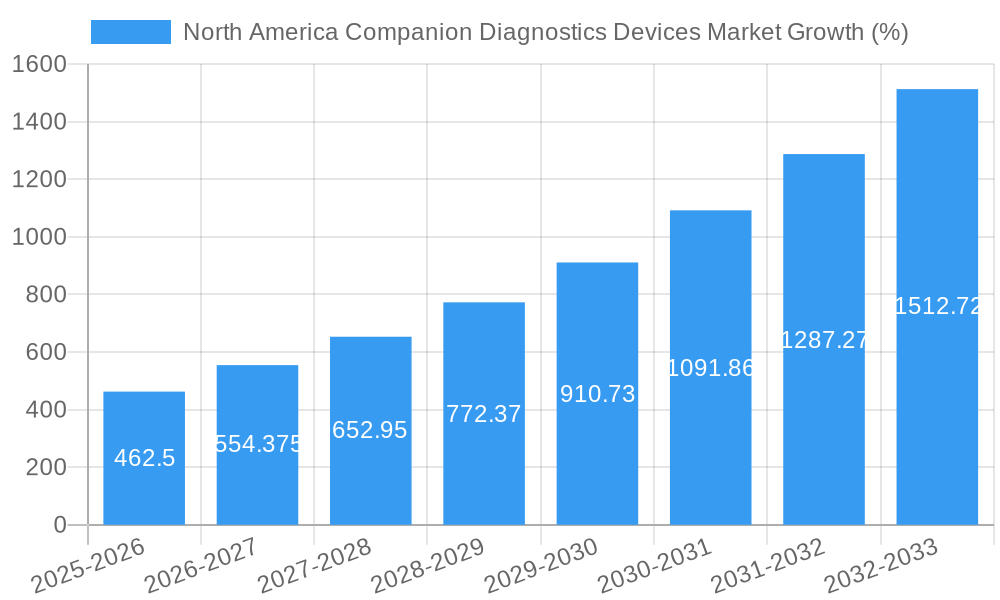

The North American companion diagnostics devices market is experiencing robust growth, projected to reach \$2.5 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 18.50% from 2025 to 2033. This expansion is fueled by several key factors. The rising prevalence of cancers, particularly lung, breast, colorectal, leukemia, and melanoma, creates a significant demand for companion diagnostics to personalize treatment strategies and improve patient outcomes. Advancements in technologies like immunohistochemistry (IHC), polymerase chain reaction (PCR), and next-generation sequencing (NGS) are enabling more precise and efficient diagnostic testing, further driving market growth. Furthermore, the increasing adoption of targeted therapies and the growing emphasis on precision oncology are pushing healthcare providers to utilize companion diagnostics for better treatment selection and monitoring. The strong presence of major players such as Labcorp, Novartis, Biomerieux, and Thermo Fisher Scientific within the North American market signifies a competitive yet innovative landscape, fostering continuous improvement and expansion of available diagnostic solutions.

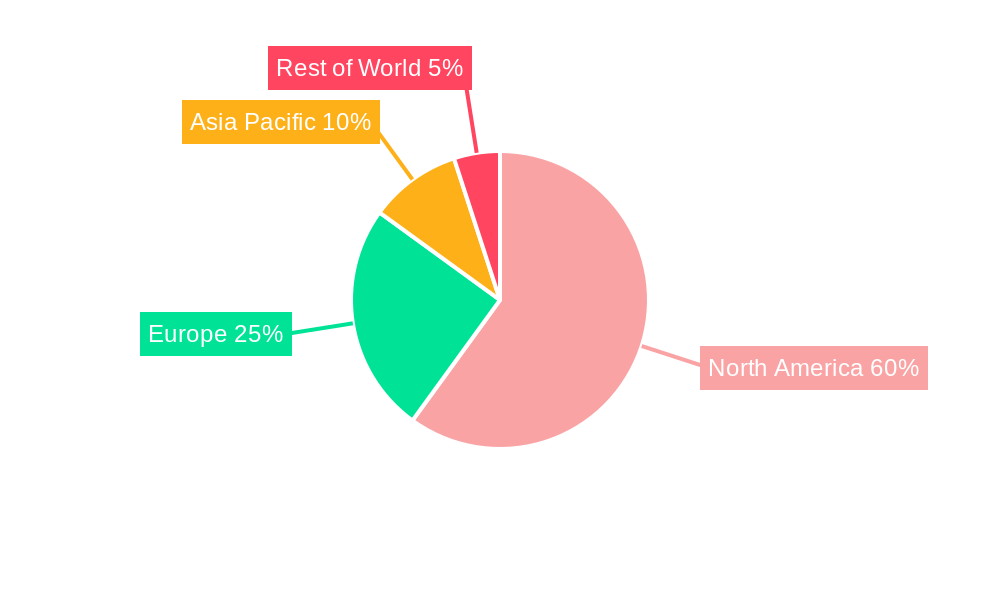

Within the North American market, the United States is the dominant force, owing to its advanced healthcare infrastructure, high healthcare expenditure, and strong regulatory support for innovative diagnostic technologies. Canada and Mexico are also experiencing growth, albeit at a potentially slower pace compared to the US. Segmentation reveals a significant contribution from oncology indications, especially lung, breast, and colorectal cancers. Technological advancements in PCR and NGS will likely fuel further market expansion in the coming years. However, factors such as high testing costs and potential reimbursement challenges might act as restraints on market growth. Nevertheless, the overall outlook for the North American companion diagnostics devices market remains highly positive, driven by continued technological innovation, increasing cancer prevalence, and the increasing adoption of personalized medicine.

North America Companion Diagnostics Devices Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Companion Diagnostics Devices Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes a robust methodology and incorporates data from the historical period (2019-2024) to project future market trends accurately. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America Companion Diagnostics Devices Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of the North American companion diagnostics devices market. The market exhibits a moderately consolidated structure, with key players like Laboratory Corporation of America Holdings (Labcorp), Novartis AG, Biomerieux SA, Siemens Healthineers, F Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc, Abbott Laboratories, ARUP Laboratories, Agilent Technologies Inc, Qiagen NV, Amgen Inc, and Danaher Corporation (Beckman Coulter Inc) holding significant market share. However, the presence of numerous smaller players indicates a dynamic and competitive environment.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025, indicating a moderate level of concentration.

- Innovation Drivers: Advancements in molecular diagnostics, personalized medicine, and the increasing prevalence of chronic diseases are key drivers of innovation. The development of more sensitive and specific tests, coupled with faster turnaround times, is reshaping the market.

- Regulatory Frameworks: The FDA's role in approving companion diagnostics significantly impacts market growth. Stringent regulatory requirements ensure product safety and efficacy but can also create barriers to entry for smaller companies.

- Product Substitutes: While direct substitutes are limited, alternative diagnostic methods (e.g., traditional pathology) compete for market share.

- End-User Demographics: The market caters primarily to hospitals, clinics, pathology labs, and research institutions. The growth of these end-users directly correlates with market expansion.

- M&A Activities: The market has witnessed significant M&A activity in recent years, with deal values totaling xx Million in 2024. These activities reflect the strategic importance of companion diagnostics and the pursuit of market consolidation.

North America Companion Diagnostics Devices Market Dynamics & Trends

The North American companion diagnostics devices market is characterized by robust growth, driven by several factors. The rising prevalence of cancer and other chronic diseases fuels the demand for companion diagnostics to guide treatment decisions. Technological advancements, including the development of more sensitive and specific assays, are also key drivers. The increasing adoption of personalized medicine further enhances market growth. However, high costs associated with these devices and the complexity of regulatory approvals pose challenges. The market's competitive dynamics are shaped by technological advancements, strategic partnerships, and M&A activities. The market penetration rate for companion diagnostics in key indications is currently estimated at xx% and is projected to increase significantly in the forecast period.

Dominant Regions & Segments in North America Companion Diagnostics Devices Market

The United States dominates the North American companion diagnostics devices market, driven by factors such as higher healthcare expenditure, advanced healthcare infrastructure, and a high prevalence of cancer. Within the technology segments, PCR and IHC are leading technologies, while lung cancer and breast cancer remain dominant indications.

Leading Regions:

- United States: Highest market share due to advanced healthcare infrastructure and high disease prevalence.

Leading Segments by Technology:

- Polymerase Chain Reaction (PCR): High market share due to its widespread use and adaptability to various applications.

- Immunohistochemistry (IHC): Significant market share due to its established role in cancer diagnosis.

Leading Segments by Indication:

- Lung Cancer: Highest market share due to its high prevalence and the availability of several companion diagnostics.

- Breast Cancer: Significant market share due to its prevalence and the ongoing development of new targeted therapies.

Key Drivers:

- High Healthcare Expenditure: The high healthcare spending in the US fuels adoption of advanced diagnostics.

- Advanced Healthcare Infrastructure: Well-established healthcare systems facilitate easy access to companion diagnostics.

- High Prevalence of Chronic Diseases: The high incidence of cancer and other chronic diseases creates a strong demand.

North America Companion Diagnostics Devices Market Product Innovations

Recent product innovations focus on improving assay sensitivity, specificity, and speed. The development of multiplexed assays allows for the simultaneous testing of multiple biomarkers, providing comprehensive diagnostic information. Miniaturization and point-of-care testing are emerging trends, aiming to improve accessibility and reduce turnaround time. These innovations enhance the market's appeal by increasing efficiency and reducing costs.

Report Scope & Segmentation Analysis

The report comprehensively segments the North American companion diagnostics devices market by technology (Immunohistochemistry (IHC), Polymerase Chain Reaction (PCR), In-situ Hybridization (ISH), Real-time PCR (RT-PCR), Gene Sequencing, Other Technologies) and indication (Lung Cancer, Breast Cancer, Colorectal Cancer, Leukemia, Melanoma, Other Indications). Each segment's analysis includes market size, growth projections, and competitive dynamics. For instance, the PCR segment is expected to exhibit robust growth due to its versatility, while lung cancer continues to drive the indication segment due to its high prevalence and availability of targeted therapies.

Key Drivers of North America Companion Diagnostics Devices Market Growth

Several factors contribute to the market's growth. These include rising prevalence of cancers, technological advancements leading to improved diagnostic accuracy and speed, increasing adoption of personalized medicine approaches, and supportive regulatory frameworks driving innovation and market expansion. Government initiatives promoting early disease detection and improved healthcare access further fuel market growth.

Challenges in the North America Companion Diagnostics Devices Market Sector

The market faces challenges, including high costs of devices and tests, stringent regulatory approvals that extend the time to market, reimbursement complexities, and the need for skilled personnel for operation and interpretation of results. These factors can create barriers to entry for smaller companies and limit market access in certain regions.

Emerging Opportunities in North America Companion Diagnostics Devices Market

Emerging opportunities lie in developing novel diagnostic platforms, integrating artificial intelligence for improved data analysis and diagnostic accuracy, and expanding into emerging markets with unmet needs. Focusing on liquid biopsies for minimally invasive cancer detection and exploring new indications beyond oncology also presents significant growth opportunities.

Leading Players in the North America Companion Diagnostics Devices Market Market

- Laboratory Corporation of America Holdings (Labcorp)

- Novartis AG

- Biomerieux SA

- Siemens Healthineers

- F Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc

- Abbott Laboratories

- ARUP Laboratories

- Agilent Technologies Inc

- Qiagen NV

- Amgen Inc

- Danaher Corporation (Beckman Coulter Inc)

Key Developments in North America Companion Diagnostics Devices Market Industry

- December 2022: QIAGEN received US FDA approval for its therascreen KRAS RGQ PCR kit as a companion diagnostic for Mirati Therapeutics' KRAZATI (adagrasib) in non-small cell lung cancer (NSCLC). This approval expands treatment options and reinforces the importance of companion diagnostics in oncology.

- January 2023: QIAGEN partnered with Helix to advance companion diagnostics for hereditary diseases, including cardiovascular, metabolic, neurodegenerative, and autoimmune conditions. This strategic partnership broadens QIAGEN's reach into the growing field of genetic testing and personalized medicine.

Future Outlook for North America Companion Diagnostics Devices Market Market

The North America companion diagnostics devices market is poised for continued growth, driven by technological advancements, increasing demand for personalized medicine, and a growing prevalence of chronic diseases. Strategic partnerships, M&A activities, and the development of innovative diagnostic platforms will shape the market's future. The market's expansion will be further fueled by the ongoing efforts to improve healthcare access and early disease detection.

North America Companion Diagnostics Devices Market Segmentation

-

1. Technology

- 1.1. Immunohistochemistry (IHC)

- 1.2. Polymerase Chain Reaction (PCR)

- 1.3. In-situ Hybridization (ISH)

- 1.4. Real-time PCR (RT-PCR)

- 1.5. Gene Sequencing

- 1.6. Other Technologies

-

2. Indication

- 2.1. Lung Cancer

- 2.2. Breast Cancer

- 2.3. Colorectal Cancer

- 2.4. Leukemia

- 2.5. Melanoma

- 2.6. Other Indications

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

-

3.1. North America

North America Companion Diagnostics Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Companion Diagnostics Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand and Awareness for Personalized Medicine and Targeted Therapy; Increasing Cases of Adverse Drug Reactions; Technological Advancements in the Devices

- 3.3. Market Restrains

- 3.3.1. High Cost of Drug Development and Associated Clinical Trials

- 3.4. Market Trends

- 3.4.1. The In-situ Hybridization (ISH) Segment is Expected to Exhibit the Fastest Growth Rate over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Companion Diagnostics Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Immunohistochemistry (IHC)

- 5.1.2. Polymerase Chain Reaction (PCR)

- 5.1.3. In-situ Hybridization (ISH)

- 5.1.4. Real-time PCR (RT-PCR)

- 5.1.5. Gene Sequencing

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Lung Cancer

- 5.2.2. Breast Cancer

- 5.2.3. Colorectal Cancer

- 5.2.4. Leukemia

- 5.2.5. Melanoma

- 5.2.6. Other Indications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Companion Diagnostics Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Companion Diagnostics Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Companion Diagnostics Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Companion Diagnostics Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Laboratory Corporation of America Holdings (Labcorp)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Novartis AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Biomerieux SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens Healthineers

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 F Hoffmann-La Roche Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Thermo Fisher Scientific Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Abbott Laboratories

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ARUP Laboratories

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Agilent Technologies Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Qiagen NV

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Amgen Inc *List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Danaher Corporation (Beckman Coulter Inc )

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Laboratory Corporation of America Holdings (Labcorp)

List of Figures

- Figure 1: North America Companion Diagnostics Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Companion Diagnostics Devices Market Share (%) by Company 2024

List of Tables

- Table 1: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Technology 2019 & 2032

- Table 5: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 6: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Indication 2019 & 2032

- Table 7: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 9: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: United States North America Companion Diagnostics Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Companion Diagnostics Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Companion Diagnostics Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Companion Diagnostics Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Companion Diagnostics Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Companion Diagnostics Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Companion Diagnostics Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Companion Diagnostics Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Technology 2019 & 2032

- Table 23: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 24: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Indication 2019 & 2032

- Table 25: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Geography 2019 & 2032

- Table 27: North America Companion Diagnostics Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Companion Diagnostics Devices Market Volume K Units Forecast, by Country 2019 & 2032

- Table 29: United States North America Companion Diagnostics Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States North America Companion Diagnostics Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 31: Canada North America Companion Diagnostics Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada North America Companion Diagnostics Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 33: Mexico North America Companion Diagnostics Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico North America Companion Diagnostics Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Companion Diagnostics Devices Market?

The projected CAGR is approximately 18.50%.

2. Which companies are prominent players in the North America Companion Diagnostics Devices Market?

Key companies in the market include Laboratory Corporation of America Holdings (Labcorp), Novartis AG, Biomerieux SA, Siemens Healthineers, F Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc, Abbott Laboratories, ARUP Laboratories, Agilent Technologies Inc, Qiagen NV, Amgen Inc *List Not Exhaustive, Danaher Corporation (Beckman Coulter Inc ).

3. What are the main segments of the North America Companion Diagnostics Devices Market?

The market segments include Technology, Indication, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand and Awareness for Personalized Medicine and Targeted Therapy; Increasing Cases of Adverse Drug Reactions; Technological Advancements in the Devices.

6. What are the notable trends driving market growth?

The In-situ Hybridization (ISH) Segment is Expected to Exhibit the Fastest Growth Rate over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Drug Development and Associated Clinical Trials.

8. Can you provide examples of recent developments in the market?

In January 2023, QIAGEN entered into an exclusive strategic partnership with Helix o advance companion diagnostics for hereditary diseases such as cardiovascular, metabolic, neurodegenerative, auto-immune diseases, and others. Under the terms of the agreement, QIAGEN will be the exclusive marketing and contracting partner in the United States for Helix's companion diagnostic services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Companion Diagnostics Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Companion Diagnostics Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Companion Diagnostics Devices Market?

To stay informed about further developments, trends, and reports in the North America Companion Diagnostics Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence