Key Insights

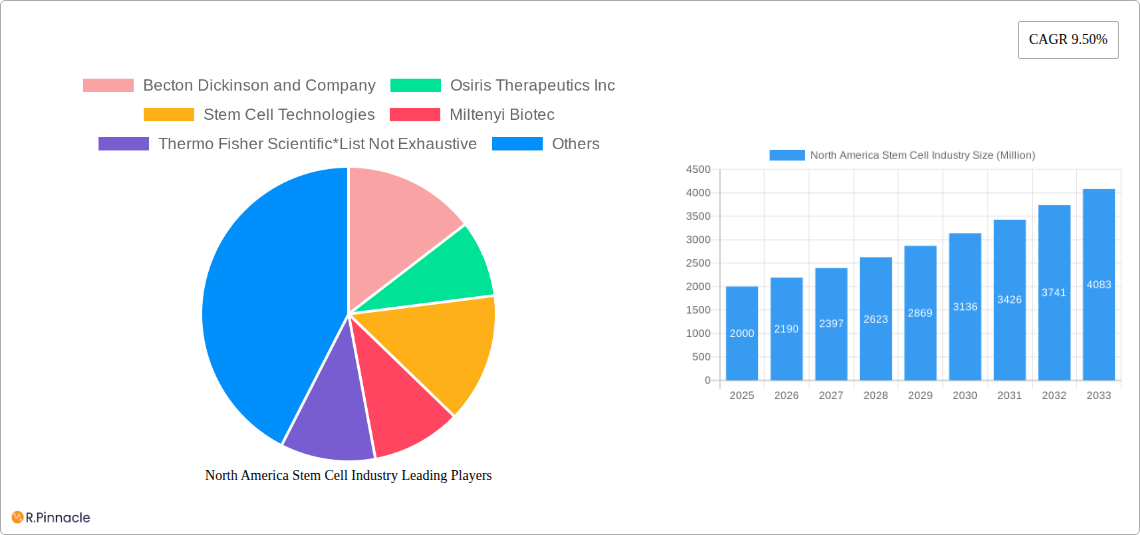

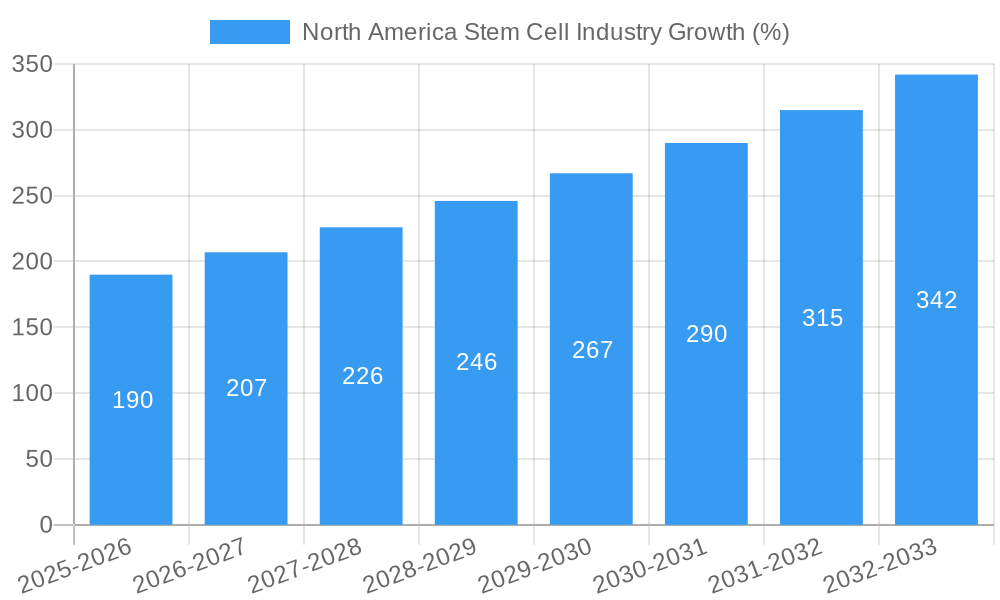

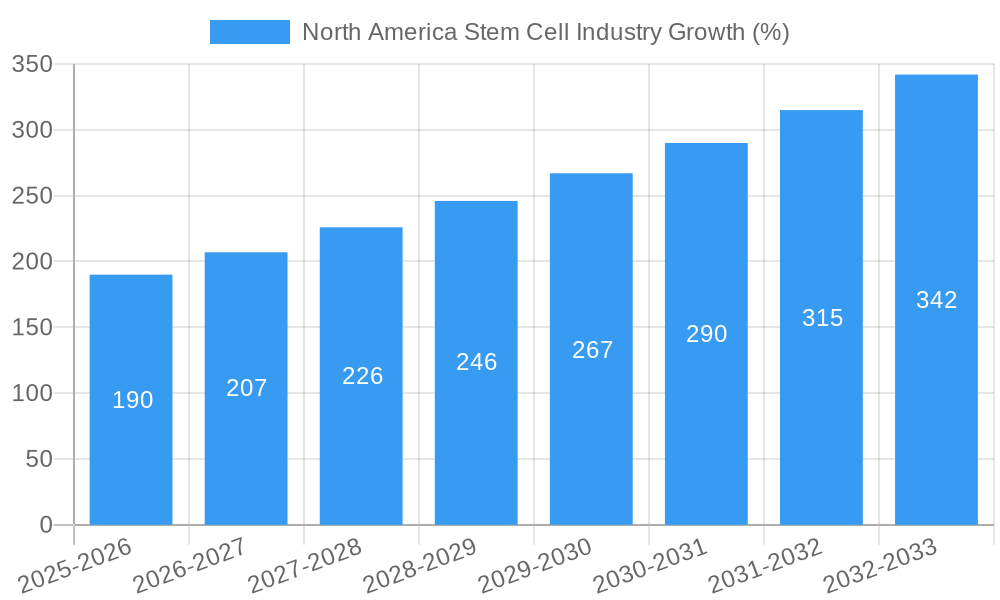

The North American stem cell therapy market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a 9.5% CAGR through 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases like neurological disorders, cardiovascular diseases, and cancer is creating a substantial demand for innovative treatment options. Stem cell therapy offers a promising alternative, particularly for conditions with limited effective treatments. Secondly, advancements in stem cell research and technology are leading to improved efficacy, safety, and accessibility of these therapies. This includes the development of more precise targeting methods, enhanced cell culture techniques, and novel delivery systems. Furthermore, increased regulatory approvals and funding for clinical trials are accelerating the commercialization of stem cell-based therapies. Finally, rising awareness among patients and healthcare providers regarding the potential of stem cell therapies is driving adoption rates.

However, the market also faces certain challenges. The high cost of stem cell therapies remains a significant barrier to access, particularly for patients without comprehensive insurance coverage. Furthermore, the lengthy and complex regulatory approval processes can delay the market entry of promising new therapies. Concerns about the long-term safety and efficacy of stem cell therapies also persist, requiring ongoing rigorous clinical research. Nevertheless, the overall outlook for the North American stem cell market remains positive, with continued innovation and regulatory support expected to drive substantial growth in the coming years. The market segmentation reveals a significant share held by adult stem cell therapies, driven by their relative safety profile and ease of procurement. Neurological and orthopedic applications represent the largest therapeutic segments, reflecting the high prevalence and unmet medical needs in these areas. Allogeneic stem cell therapy, offering off-the-shelf accessibility, is currently capturing significant market share, although autologous therapies are expected to grow with advancements in personalized medicine.

North America Stem Cell Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America stem cell industry, offering invaluable insights for industry professionals, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report forecasts robust growth and explores the key trends shaping this dynamic sector. The report leverages extensive data analysis, including market sizing, segmentation, and competitive landscaping to provide actionable intelligence.

North America Stem Cell Industry Market Structure & Innovation Trends

The North American stem cell industry exhibits a moderately concentrated market structure, with several key players holding significant market share. Companies like Becton Dickinson and Company, Osiris Therapeutics Inc, Stem Cell Technologies, Miltenyi Biotec, and Thermo Fisher Scientific dominate the landscape. However, a significant number of smaller companies, including Brainstorm Cell Therapeutics, Lineage Cell Therapeutics Inc, International Stem Cell Corp, Sigma Aldrich (Merck KGaA), and Bristol-Myers Squibb Company, contribute to the overall market activity. The market share distribution is dynamic, with ongoing mergers and acquisitions (M&A) significantly impacting the competitive landscape. Recent M&A deals have involved xx Million in value, contributing to market consolidation. Innovation is driven by advancements in cell processing technologies, improved cell culture techniques, and the development of novel therapeutic applications. Stringent regulatory frameworks, such as those enforced by the FDA, play a crucial role in shaping industry practices. Substitute therapies, including traditional pharmaceuticals and other regenerative medicine approaches, exert competitive pressure. The end-user demographics encompass a wide range of healthcare providers, research institutions, and pharmaceutical companies.

North America Stem Cell Industry Market Dynamics & Trends

The North America stem cell industry is experiencing significant growth, driven by increasing prevalence of chronic diseases, rising demand for effective therapeutic options, and continuous technological advancements. The market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as advancements in gene editing and personalized medicine, are transforming the treatment landscape and expanding the therapeutic potential of stem cells. Shifting consumer preferences towards minimally invasive and regenerative therapies fuels demand. The market is characterized by intense competition, with companies focusing on product differentiation, strategic partnerships, and aggressive R&D to maintain their market position. Market penetration varies across different therapeutic applications, with neurological disorders and orthopedic treatments demonstrating significant growth potential. By 2033, market penetration is projected to reach xx%.

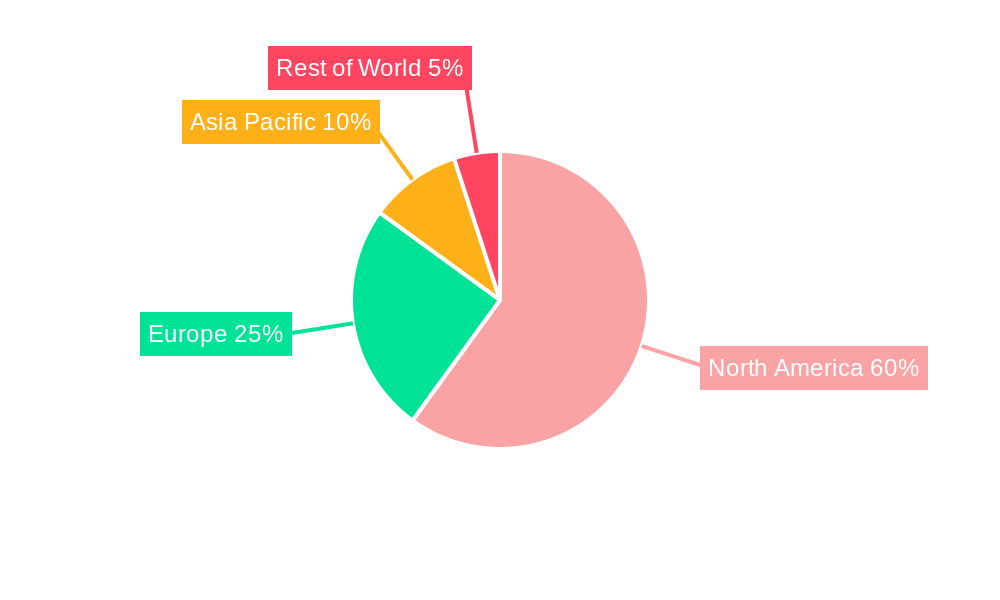

Dominant Regions & Segments in North America Stem Cell Industry

The United States holds the dominant position in the North American stem cell market, driven by robust research infrastructure, substantial funding for R&D, and a favorable regulatory environment. California and Massachusetts emerge as leading regional hubs.

- By Product Type: Adult stem cells currently represent the largest segment, owing to their accessibility and established clinical applications. However, Pluripotent stem cells are exhibiting faster growth due to their therapeutic versatility.

- By Therapeutic Application: Neurological disorders constitute the largest therapeutic application segment, reflecting the significant unmet medical needs in areas such as Alzheimer's disease and Parkinson's disease. Orthopedic treatments and oncology disorders also represent sizable market segments.

- By Treatment Type: Allogeneic stem cell therapy holds the largest market share due to its cost-effectiveness and scalability. However, autologous stem cell therapy is gaining traction owing to the reduced risk of immune rejection.

Key drivers for the dominance of these segments include:

- Substantial government funding for research and development.

- A large pool of skilled researchers and clinicians.

- Presence of leading stem cell research institutions and companies.

- Favorable regulatory environment promoting clinical trials and product approvals.

North America Stem Cell Industry Product Innovations

Recent years have witnessed significant advancements in stem cell technology, leading to the development of innovative products with enhanced efficacy and safety profiles. These innovations include improved cell isolation and culture techniques, the development of novel delivery systems, and the integration of advanced biomaterials to enhance cell survival and engraftment. This translates into better therapeutic outcomes for patients suffering from various diseases. Furthermore, there is increasing focus on personalized stem cell therapies, tailored to individual patients' genetic and clinical characteristics.

Report Scope & Segmentation Analysis

This report segments the North America stem cell market across various parameters:

By Product Type: Adult Stem Cell, Human Embryonic Cell, Pluripotent Stem Cell, Other Product Types. Each segment's market size, growth projections, and competitive landscape are analyzed. Adult stem cell segment is expected to dominate, while pluripotent stem cells showcase highest growth.

By Therapeutic Application: Neurological Disorders, Orthopedic Treatments, Oncology Disorders, Injuries and Wounds, Cardiovascular Disorders, Other Therapeutic Applications. Growth projections vary significantly across applications, with neurological disorders and oncology showing strong potential.

By Treatment Type: Allogeneic Stem Cell Therapy, Autologic Stem Cell Therapy, Syngeneic Stem Cell Therapy. Allogeneic therapy holds the largest market share currently.

Key Drivers of North America Stem Cell Industry Growth

The North American stem cell industry's growth is propelled by a confluence of factors: a surge in chronic diseases, increasing government funding for stem cell research, technological breakthroughs enabling more precise and efficient stem cell therapies, and growing patient awareness and acceptance of these treatments.

Challenges in the North America Stem Cell Industry Sector

The industry faces challenges including stringent regulatory approval processes resulting in lengthy development timelines and high costs. Supply chain complexities and a shortage of skilled professionals further add to the hurdles. Intense competition among established players and emerging biotech companies also poses significant pressure. The estimated cost for regulatory approvals is xx Million per product.

Emerging Opportunities in North America Stem Cell Industry

Emerging opportunities lie in personalized medicine approaches, development of novel stem cell-based therapies for unmet medical needs, expansion into new therapeutic areas, and the growing adoption of advanced manufacturing technologies for large-scale stem cell production. The use of artificial intelligence in stem cell research also presents exciting possibilities.

Leading Players in the North America Stem Cell Industry Market

- Becton Dickinson and Company

- Osiris Therapeutics Inc

- Stem Cell Technologies

- Miltenyi Biotec

- Thermo Fisher Scientific

- Brainstorm Cell Therapeutics

- Lineage Cell Therapeutics Inc

- International Stem Cell Corp

- Sigma Aldrich (Merck KGaA)

- Bristol-Myers Squibb Company

Key Developments in North America Stem Cell Industry Industry

- July 2022: CORESTEM (South Korea) continued enrolling participants for the Phase 3 clinical trial of NeuroNata-R, a stem cell therapy conditionally approved to treat amyotrophic lateral sclerosis (ALS) in South Korea.

- September 2021: Stemedica Cell Technologies received investigational new drug (IND) approval from the US FDA for intravenous allogeneic mesenchymal stem cells (MSCs) to treat moderate to severe COVID-19.

Future Outlook for North America Stem Cell Industry Market

The future of the North American stem cell industry is bright, with projected significant growth driven by continuous technological advancements, expanding therapeutic applications, and increasing investments in R&D. Strategic collaborations, mergers and acquisitions, and focus on personalized medicine will further accelerate market expansion. The market is poised for substantial growth, making it an attractive sector for both investors and industry players.

North America Stem Cell Industry Segmentation

-

1. Product Type

- 1.1. Adult Stem Cell

- 1.2. Human Embryonic Cell

- 1.3. Pluripotent Stem Cell

- 1.4. Other Product Types

-

2. Therapeutic Application

- 2.1. Neurological Disorders

- 2.2. Orthopedic Treatments

- 2.3. Oncology Disorders

- 2.4. Injuries and Wounds

- 2.5. Cardiovascular Disorders

- 2.6. Other Therapeutic Applications

-

3. Treatment Type

- 3.1. Allogeneic Stem Cell Therapy

- 3.2. Auto logic Stem Cell Therapy

- 3.3. Syngeneic Stem Cell Therapy

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Stem Cell Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Stem Cell Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Approval for Clinical Trials in Stem Cell Research; Growing Demand for Regenerative Treatment Option; Rising R&D Initiatives to Develop Therapeutic Options for Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures; Regulatory Complications

- 3.4. Market Trends

- 3.4.1. The Oncology Segment is Expected to Show Lucrative Growth in the Therapeutic Application Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Adult Stem Cell

- 5.1.2. Human Embryonic Cell

- 5.1.3. Pluripotent Stem Cell

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Therapeutic Application

- 5.2.1. Neurological Disorders

- 5.2.2. Orthopedic Treatments

- 5.2.3. Oncology Disorders

- 5.2.4. Injuries and Wounds

- 5.2.5. Cardiovascular Disorders

- 5.2.6. Other Therapeutic Applications

- 5.3. Market Analysis, Insights and Forecast - by Treatment Type

- 5.3.1. Allogeneic Stem Cell Therapy

- 5.3.2. Auto logic Stem Cell Therapy

- 5.3.3. Syngeneic Stem Cell Therapy

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Adult Stem Cell

- 6.1.2. Human Embryonic Cell

- 6.1.3. Pluripotent Stem Cell

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Therapeutic Application

- 6.2.1. Neurological Disorders

- 6.2.2. Orthopedic Treatments

- 6.2.3. Oncology Disorders

- 6.2.4. Injuries and Wounds

- 6.2.5. Cardiovascular Disorders

- 6.2.6. Other Therapeutic Applications

- 6.3. Market Analysis, Insights and Forecast - by Treatment Type

- 6.3.1. Allogeneic Stem Cell Therapy

- 6.3.2. Auto logic Stem Cell Therapy

- 6.3.3. Syngeneic Stem Cell Therapy

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Adult Stem Cell

- 7.1.2. Human Embryonic Cell

- 7.1.3. Pluripotent Stem Cell

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Therapeutic Application

- 7.2.1. Neurological Disorders

- 7.2.2. Orthopedic Treatments

- 7.2.3. Oncology Disorders

- 7.2.4. Injuries and Wounds

- 7.2.5. Cardiovascular Disorders

- 7.2.6. Other Therapeutic Applications

- 7.3. Market Analysis, Insights and Forecast - by Treatment Type

- 7.3.1. Allogeneic Stem Cell Therapy

- 7.3.2. Auto logic Stem Cell Therapy

- 7.3.3. Syngeneic Stem Cell Therapy

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Adult Stem Cell

- 8.1.2. Human Embryonic Cell

- 8.1.3. Pluripotent Stem Cell

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Therapeutic Application

- 8.2.1. Neurological Disorders

- 8.2.2. Orthopedic Treatments

- 8.2.3. Oncology Disorders

- 8.2.4. Injuries and Wounds

- 8.2.5. Cardiovascular Disorders

- 8.2.6. Other Therapeutic Applications

- 8.3. Market Analysis, Insights and Forecast - by Treatment Type

- 8.3.1. Allogeneic Stem Cell Therapy

- 8.3.2. Auto logic Stem Cell Therapy

- 8.3.3. Syngeneic Stem Cell Therapy

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. United States North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Becton Dickinson and Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Osiris Therapeutics Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Stem Cell Technologies

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Miltenyi Biotec

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Thermo Fisher Scientific*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Brainstorm Cell Therapeutics

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Lineage Cell Therapeutics Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 International Stem Cell Corp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Sigma Aldrich (Merck KGaA)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bristol-Myers Squibb Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: North America Stem Cell Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Stem Cell Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Stem Cell Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Stem Cell Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Stem Cell Industry Revenue Million Forecast, by Therapeutic Application 2019 & 2032

- Table 4: North America Stem Cell Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 5: North America Stem Cell Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Stem Cell Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Stem Cell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Stem Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Stem Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Stem Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Stem Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Stem Cell Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: North America Stem Cell Industry Revenue Million Forecast, by Therapeutic Application 2019 & 2032

- Table 14: North America Stem Cell Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 15: North America Stem Cell Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America Stem Cell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America Stem Cell Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: North America Stem Cell Industry Revenue Million Forecast, by Therapeutic Application 2019 & 2032

- Table 19: North America Stem Cell Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 20: North America Stem Cell Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America Stem Cell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America Stem Cell Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: North America Stem Cell Industry Revenue Million Forecast, by Therapeutic Application 2019 & 2032

- Table 24: North America Stem Cell Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 25: North America Stem Cell Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Stem Cell Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Stem Cell Industry?

The projected CAGR is approximately 9.50%.

2. Which companies are prominent players in the North America Stem Cell Industry?

Key companies in the market include Becton Dickinson and Company, Osiris Therapeutics Inc, Stem Cell Technologies, Miltenyi Biotec, Thermo Fisher Scientific*List Not Exhaustive, Brainstorm Cell Therapeutics, Lineage Cell Therapeutics Inc, International Stem Cell Corp, Sigma Aldrich (Merck KGaA), Bristol-Myers Squibb Company.

3. What are the main segments of the North America Stem Cell Industry?

The market segments include Product Type, Therapeutic Application, Treatment Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Approval for Clinical Trials in Stem Cell Research; Growing Demand for Regenerative Treatment Option; Rising R&D Initiatives to Develop Therapeutic Options for Chronic Diseases.

6. What are the notable trends driving market growth?

The Oncology Segment is Expected to Show Lucrative Growth in the Therapeutic Application Type.

7. Are there any restraints impacting market growth?

Expensive Procedures; Regulatory Complications.

8. Can you provide examples of recent developments in the market?

In July 2022, CORESTEM (South Korea) continued enrolling participants for the Phase 3 clinical trial of NeuroNata-R, a stem cell therapy that is conditionally approved to treat amyotrophic lateral sclerosis (ALS) in South Korea.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Stem Cell Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Stem Cell Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Stem Cell Industry?

To stay informed about further developments, trends, and reports in the North America Stem Cell Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence