Key Insights

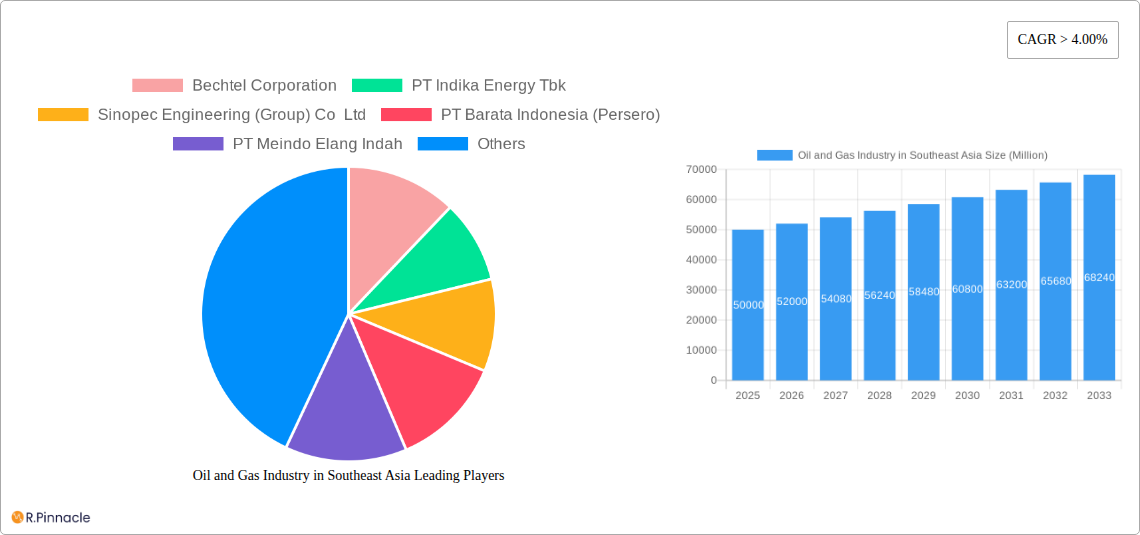

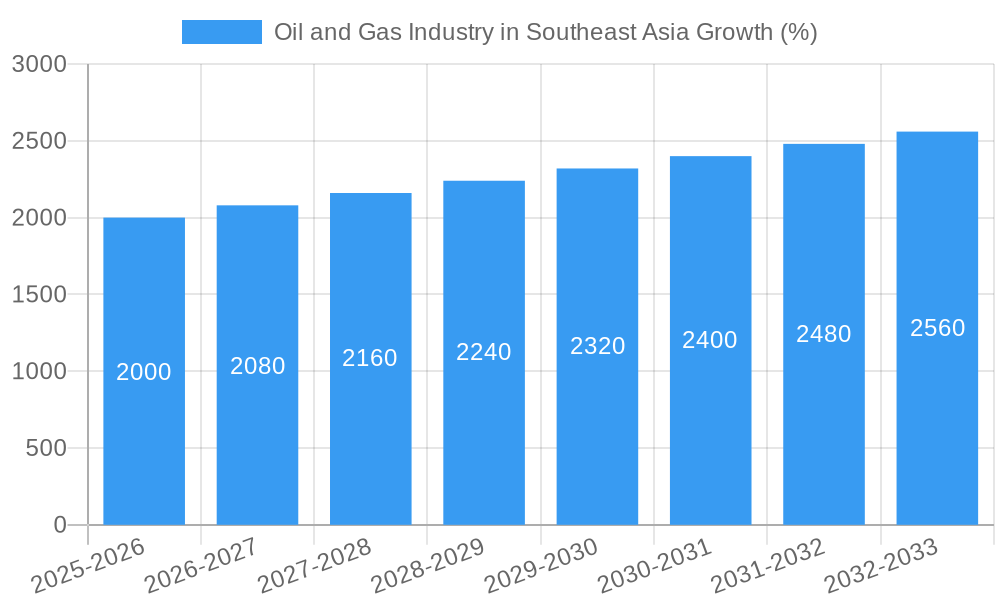

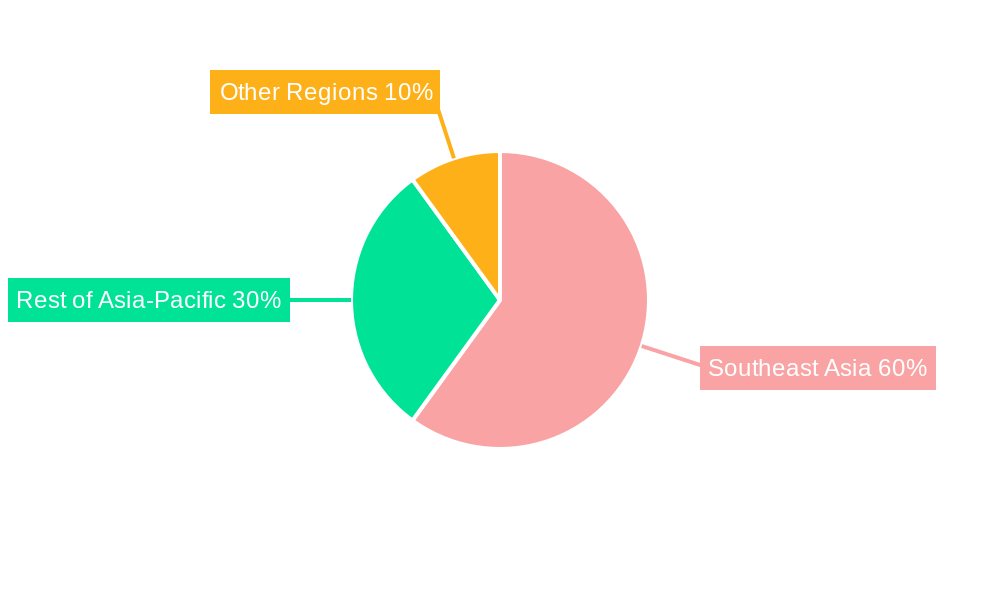

The Southeast Asian oil and gas market, encompassing upstream, midstream, and downstream sectors, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is fueled by increasing energy demand driven by rapid industrialization and population growth across the region, particularly in countries like China, India, and Indonesia. Significant investments in infrastructure development, including pipelines and refineries, are further stimulating market expansion. However, the industry faces challenges such as geopolitical instability, fluctuating crude oil prices, and growing concerns about environmental sustainability, which influence investment decisions and project timelines. The upstream segment, focusing on exploration and production, is anticipated to witness considerable growth, driven by the discovery and development of new reserves. The downstream sector, encompassing refining and petrochemical production, is also poised for expansion, benefiting from increasing demand for refined products. The midstream sector, involving transportation and storage, will see corresponding growth to support the increased volumes in upstream and downstream segments. Key players such as Bechtel, Sinopec, and Petrofac are strategically positioning themselves to capitalize on these growth opportunities, focusing on projects that address both energy security and sustainability goals. The Asia-Pacific region, with its substantial energy requirements, represents a significant portion of the overall market share, and Southeast Asia is a vital component of this.

Competition within the Southeast Asian oil and gas market is intensifying, with both international and domestic companies vying for market share. This competition is stimulating innovation and driving efficiency improvements across the value chain. The industry is witnessing a shift towards cleaner energy sources, creating opportunities for companies investing in renewable energy projects and technologies aimed at reducing carbon emissions. Governments in the region are increasingly implementing policies to promote energy diversification and sustainable development, prompting companies to adapt their strategies accordingly. While the market faces certain headwinds, the long-term growth outlook remains positive, driven by persistent energy demand, ongoing infrastructure development, and a gradual shift toward cleaner energy solutions. The market is segmented by product type (crude oil, natural gas, refined products) and sector (upstream, midstream, downstream), providing diverse investment and growth possibilities.

Southeast Asia Oil and Gas Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Southeast Asian oil and gas industry, covering market structure, dynamics, key players, and future projections from 2019 to 2033. Leveraging data from the base year 2025, this report offers crucial insights for industry professionals, investors, and policymakers. The study period covers 2019-2033, with a forecast period spanning 2025-2033. Market values are expressed in millions of USD.

Oil and Gas Industry in Southeast Asia Market Structure & Innovation Trends

This section analyzes the competitive landscape of Southeast Asia's oil and gas sector, examining market concentration, innovation drivers, regulatory frameworks, and M&A activity. The report delves into the influence of product substitutes and end-user demographics on market trends.

The market is characterized by a mix of international and national players, with varying degrees of market concentration across different segments. Major players include Bechtel Corporation, PT Indika Energy Tbk, Sinopec Engineering (Group) Co Ltd, PT Barata Indonesia (Persero), PT Meindo Elang Indah, Petrofac Limited, PT Rekayasa Industri, Saipem SpA, Fluor Corporation, John Wood Group PLC, Samsung Engineering Co Ltd, TechnipFMC PLC (list not exhaustive). Market share data for key players will be provided, along with analysis of M&A deal values exceeding $xx million in the historical period (2019-2024).

- Market Concentration: Analysis will include Herfindahl-Hirschman Index (HHI) calculations to assess market concentration levels within the upstream, midstream, and downstream segments.

- Innovation Drivers: The report will identify key innovation drivers, such as government incentives for renewable energy integration and technological advancements in exploration and production techniques.

- Regulatory Frameworks: A detailed examination of the regulatory environment and its impact on market growth and investment decisions across Southeast Asian countries.

- Product Substitutes: Assessment of the impact of renewable energy sources and alternative fuels on the demand for oil and gas products.

- End-User Demographics: Analysis of the consumption patterns of oil and gas products across various end-user sectors and their influence on future demand.

- M&A Activities: An in-depth analysis of significant mergers and acquisitions during the study period (2019-2024), including transaction values and their strategic implications.

Oil and Gas Industry in Southeast Asia Market Dynamics & Trends

This section explores the key market dynamics influencing the Southeast Asian oil and gas sector. It will analyze market growth drivers, technological disruptions, shifting consumer preferences, and competitive dynamics within the industry. Specific metrics, including the Compound Annual Growth Rate (CAGR) and market penetration rates, will be used to quantify market trends.

The report will examine the impact of factors such as fluctuating global oil and gas prices, government policies, economic growth in the region, and infrastructure development on market growth. It will also analyze technological advancements like digitalization and automation in exploration and production, their influence on operational efficiency, and the adoption of innovative technologies to reduce environmental impact. The analysis will consider evolving consumer preferences and the transition towards cleaner energy sources. Competitive dynamics, including strategies employed by major players to maintain market share, will also be discussed. The report projects a CAGR of xx% for the forecast period (2025-2033), with specific segment-wise CAGRs provided. Market penetration of various products (crude oil, natural gas, refined products) will also be analyzed in detail.

Dominant Regions & Segments in Oil and Gas Industry in Southeast Asia

This section identifies the leading regions, countries, and segments within the Southeast Asian oil and gas sector. The analysis will cover upstream, midstream, and downstream segments, as well as the primary products: crude oil, natural gas, and refined products.

- Dominant Region/Country: The report will determine the leading region or country based on production volume, reserves, investment levels, and market size. Factors contributing to dominance, such as favorable geological conditions, robust regulatory frameworks, and investment infrastructure, will be highlighted.

- Dominant Upstream Segment: Key drivers will include:

- Exploration and production activities

- Technological advancements in enhanced oil recovery

- Government policies promoting domestic oil and gas production

- Dominant Midstream Segment: Key drivers will include:

- Pipeline infrastructure development

- LNG import and export terminal capacity

- Strategic partnerships and joint ventures

- Dominant Downstream Segment: Key drivers will include:

- Refinery capacity expansion

- Petrochemical production

- Growth of downstream industries (e.g., plastics, fertilizers)

- Dominant Product: Analysis will determine which product (crude oil, natural gas, refined products) holds the largest market share and growth potential in Southeast Asia.

Oil and Gas Industry in Southeast Asia Product Innovations

The section summarizes recent product developments, applications, and their competitive advantages. It highlights the role of technology in shaping new product offerings and their market fit. Examples include the development of new refining technologies that produce higher-value products like biofuels and the use of advanced drilling techniques to access harder-to-reach reserves. The impact of these innovations on market competitiveness and environmental sustainability will be discussed.

Report Scope & Segmentation Analysis

This report segments the Southeast Asian oil and gas market based on sector (Upstream, Midstream, Downstream) and product (Crude oil, Natural Gas, Refined products). Each segment will be analyzed regarding its size, growth projection, and competitive landscape.

- Upstream: This segment covers exploration, drilling, and production of crude oil and natural gas. Growth will be projected based on investment in new exploration activities, technological advancements, and government policies. Competitive dynamics will be based on the number of players and their market share.

- Midstream: Encompasses the transportation, storage, and processing of oil and gas. Projections will consider pipeline infrastructure development, the expansion of LNG terminals, and the rise of alternative transportation methods. Competition analysis will focus on the major pipeline operators and storage facility owners.

- Downstream: Focuses on refining, petrochemicals, and marketing of refined products. Growth projections are tied to refinery expansions, demand for petrochemicals, and the growth of related downstream industries. The competitive landscape will feature analysis of major refinery operators and fuel retailers.

- Crude Oil: This segment's growth will depend on global oil prices, regional demand, and exploration activities. Competitive dynamics are shaped by the production capacity of various countries in the region.

- Natural Gas: This segment's growth relies on domestic demand for power generation, industrial use, and LNG exports. Competitive analysis focuses on gas production companies and LNG exporters.

- Refined Products: Growth in this segment will hinge on regional demand for gasoline, diesel, and other fuels. Competitive dynamics will center on refinery capacity, market share of fuel retailers, and government regulations.

Key Drivers of Oil and Gas Industry in Southeast Asia Growth

Several factors fuel growth in Southeast Asia's oil and gas industry. These include increasing energy demand driven by economic growth and industrialization. Government initiatives supporting energy infrastructure development, such as new pipelines and refineries, further stimulate growth. Technological advancements, particularly in enhanced oil recovery techniques and exploration, improve resource extraction efficiency. Finally, strategic partnerships and foreign direct investment contribute to the market's expansion.

Challenges in the Oil and Gas Industry in Southeast Asia Sector

The industry faces challenges, including price volatility in global oil and gas markets, impacting profitability. Regulatory hurdles and obtaining necessary permits for exploration and production pose obstacles. Supply chain disruptions, such as equipment delays or logistical issues, hinder operations and increase costs. Lastly, intense competition from both regional and international players creates pressures.

Emerging Opportunities in Oil and Gas Industry in Southeast Asia

Growth opportunities exist in the growing demand for energy, creating potential for expansion of infrastructure and production capacity. Technological advancements, such as improved extraction methods and renewable energy integration, create opportunities for innovation and efficiency improvements. Regional integration projects, such as pipeline networks, allow for increased trade and cooperation within the sector. Government support for energy diversification is opening up new avenues for sustainable development.

Leading Players in the Oil and Gas Industry in Southeast Asia Market

- Bechtel Corporation

- PT Indika Energy Tbk

- Sinopec Engineering (Group) Co Ltd

- PT Barata Indonesia (Persero)

- PT Meindo Elang Indah

- Petrofac Limited

- PT Rekayasa Industri

- Saipem SpA

- Fluor Corporation

- John Wood Group PLC

- Samsung Engineering Co Ltd

- TechnipFMC PLC

Key Developments in Oil and Gas Industry in Southeast Asia Industry

- March 2023: Thai Oil's USD 1 billion investment to expand refinery capacity to 400 kb/d and transition to higher-value fuel products. This significantly impacts the downstream segment and highlights the shift towards cleaner fuels.

- January 2023: Approval of a USD 67 million LNG import terminal project in the Philippines, marking a key step in developing the country's LNG industry. This signifies the growing importance of natural gas in the region's energy mix.

- December 2022: Petronas' discovery of oil and gas at the Nahara-1 well in Malaysia, boosting the country's hydrocarbon reserves and potential production. This development underscores the ongoing exploration activities and their potential to increase oil and gas output.

Future Outlook for Oil and Gas Industry in Southeast Asia Market

The Southeast Asian oil and gas industry has strong growth potential driven by sustained energy demand and infrastructure development. The increasing adoption of advanced technologies and a focus on cleaner energy solutions promise improvements in efficiency and sustainability. Strategic collaborations and investments in exploration and production will be critical to unlocking the region's substantial resources. The sector’s future hinges on successfully navigating the challenges posed by global energy transitions while capitalizing on regional growth opportunities.

Oil and Gas Industry in Southeast Asia Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Oil and Gas Industry in Southeast Asia Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Vietnam

- 4. Malaysia

- 5. Rest of Southeast Asia

Oil and Gas Industry in Southeast Asia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. The Downstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.2.2. Thailand

- 5.2.3. Vietnam

- 5.2.4. Malaysia

- 5.2.5. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Indonesia Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Thailand Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Vietnam Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Malaysia Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Rest of Southeast Asia Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Upstream

- 10.1.2. Midstream

- 10.1.3. Downstream

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. China Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 12. Japan Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 13. India Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 16. Australia Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Oil and Gas Industry in Southeast Asia Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Bechtel Corporation

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 PT Indika Energy Tbk

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Sinopec Engineering (Group) Co Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 PT Barata Indonesia (Persero)

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 PT Meindo Elang Indah

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Petrofac Limited

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 PT Rekayasa Industri

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Saipem SpA

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Fluor Corporation

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 John Wood Group PLC

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Samsung Engineering Co Ltd *List Not Exhaustive

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 TechnipFMC PLC

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.1 Bechtel Corporation

List of Figures

- Figure 1: Oil and Gas Industry in Southeast Asia Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oil and Gas Industry in Southeast Asia Share (%) by Company 2024

List of Tables

- Table 1: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Japan Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Korea Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Taiwan Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Australia Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia-Pacific Oil and Gas Industry in Southeast Asia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 15: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 19: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Sector 2019 & 2032

- Table 21: Oil and Gas Industry in Southeast Asia Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Industry in Southeast Asia?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Oil and Gas Industry in Southeast Asia?

Key companies in the market include Bechtel Corporation, PT Indika Energy Tbk, Sinopec Engineering (Group) Co Ltd, PT Barata Indonesia (Persero), PT Meindo Elang Indah, Petrofac Limited, PT Rekayasa Industri, Saipem SpA, Fluor Corporation, John Wood Group PLC, Samsung Engineering Co Ltd *List Not Exhaustive, TechnipFMC PLC.

3. What are the main segments of the Oil and Gas Industry in Southeast Asia?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

The Downstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

March 2023: Thai Oil announced plans to invest USD 1 billion in the capital between 2023 and 2025 to grow its business, including USD 500 million to expand its refinery capacity and transition to higher added-value fuel products as part of its Clean Fuel Project (CFP) strategy. The business intends to expand its oil refinery capacity in Sriracha (Thailand) to 400 kb/d, up from 280 kb/d, and upgrade fuel oil to higher-value products such as diesel and jet fuel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Industry in Southeast Asia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Industry in Southeast Asia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Industry in Southeast Asia?

To stay informed about further developments, trends, and reports in the Oil and Gas Industry in Southeast Asia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence