Key Insights

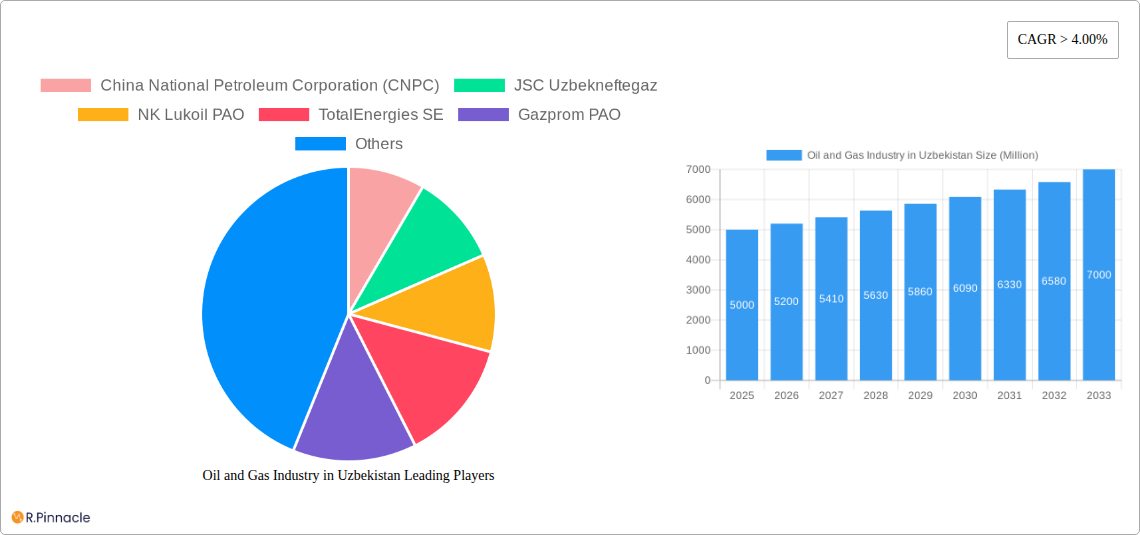

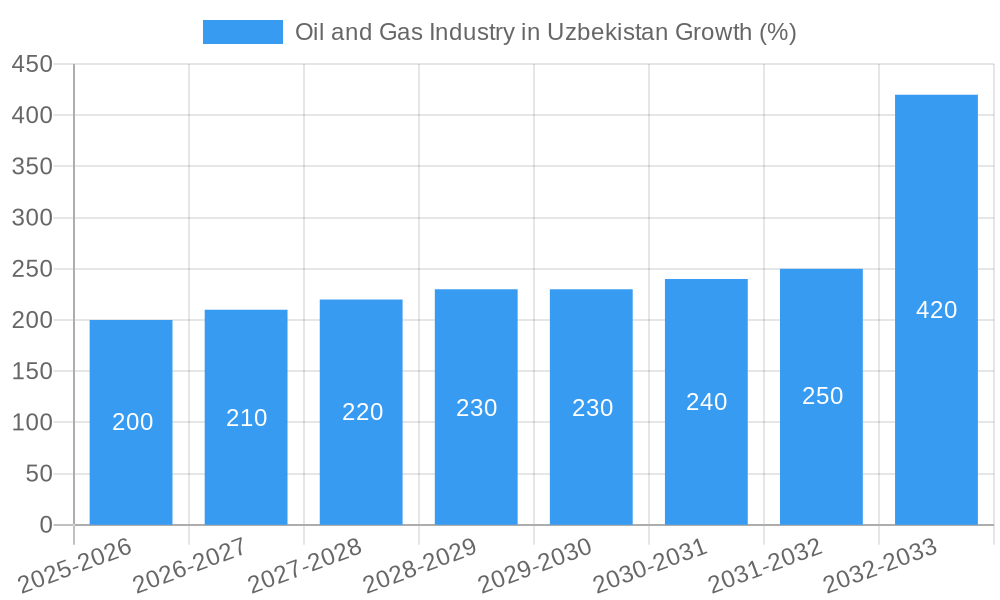

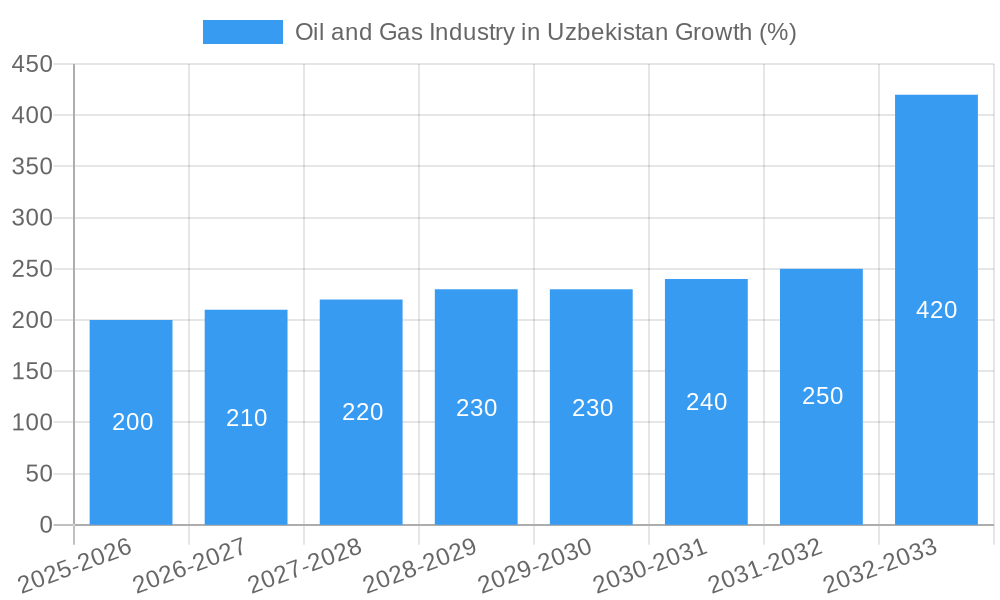

The Uzbekistani oil and gas industry, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is driven by several factors, including increasing domestic energy demand fueled by economic growth and infrastructure development. Furthermore, Uzbekistan's strategic location and efforts to attract foreign investment are playing a significant role. The upstream sector, encompassing exploration and production, is a key driver, with ongoing efforts to enhance extraction capabilities and explore new reserves. The midstream sector, focused on transportation and storage, is also expanding to support the increasing production volumes. The downstream sector, encompassing refining and distribution, is witnessing modernization and capacity expansion to meet growing domestic demand and potentially export refined products. Major players like JSC Uzbekneftegaz, alongside international companies such as Lukoil and TotalEnergies, are central to this growth, contributing significantly to the sector's development. However, challenges persist, including the need for continued investment in infrastructure, technological advancements to improve efficiency and environmental sustainability, and the potential volatility of global oil and gas prices. The industry's future trajectory will depend on the effective management of these challenges and the continuation of supportive government policies.

The market size in 2025 is estimated at $5 billion USD (assuming a reasonable market size based on regional comparisons and growth rate). Given the projected CAGR of >4%, the market is expected to steadily increase, reaching an estimated $7 billion USD by 2033. Sectoral growth will likely be uneven, with upstream possibly experiencing the highest growth initially due to exploration and production investments, followed by midstream and downstream as supporting infrastructure and refining capacities expand to meet increased demand. The dominance of state-owned entities like JSC Uzbekneftegaz will likely continue, while private and international companies will play crucial roles in technology transfer, capital injection, and market expansion. Regional competition within Central Asia will impact growth, requiring Uzbekistan to continuously optimize its operational efficiency and investment attraction strategies.

This in-depth report provides a comprehensive analysis of the Uzbekistan oil and gas industry, covering the period from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and policymakers seeking to understand the market dynamics, growth drivers, and future potential of this vital sector. The report leverages extensive data analysis and expert insights to offer actionable intelligence for strategic decision-making. With a focus on key players like China National Petroleum Corporation (CNPC), JSC Uzbekneftegaz, NK Lukoil PAO, TotalEnergies SE, and Gazprom PAO, this report is an essential resource for navigating the complexities of the Uzbekistani oil and gas market.

Oil and Gas Industry in Uzbekistan: Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of Uzbekistan's oil and gas industry. The market is moderately concentrated, with JSC Uzbekneftegaz holding a significant market share, estimated at xx% in 2025. Other major players, including CNPC, Lukoil, TotalEnergies, and Gazprom, collectively account for approximately xx% of the market.

Market Concentration:

- JSC Uzbekneftegaz: xx% market share (2025)

- CNPC, Lukoil, TotalEnergies, Gazprom: xx% combined market share (2025)

- High dependence on state-owned enterprises.

Innovation Drivers:

- Growing demand for cleaner energy sources is driving innovation in gas processing and refining technologies.

- Investments in exploration and production technologies to enhance efficiency and reduce environmental impact.

- Focus on digitalization and automation to optimize operations and reduce costs.

Regulatory Framework:

- The government's focus on attracting foreign investment and fostering a more competitive market.

- Increasing emphasis on environmental regulations and sustainable practices.

M&A Activities:

- Over the historical period (2019-2024), M&A activity totaled approximately $xx Million, with an average deal value of $xx Million.

- The forecast period (2025-2033) anticipates a rise in M&A activity, driven by the need for consolidation and access to new technologies.

Product Substitutes:

- Increasing adoption of renewable energy sources, such as solar and wind power, presents a potential challenge.

End-User Demographics:

- The primary end-users are domestic consumers and industrial sectors. Export markets are growing, particularly to China.

Oil and Gas Industry in Uzbekistan: Market Dynamics & Trends

The Uzbekistan oil and gas market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The increasing domestic demand for energy, driven by economic growth and population increase, is a significant driver. Furthermore, the government's ongoing investments in infrastructure development and exploration activities are expected to stimulate production and enhance market capacity. Export opportunities, particularly to neighboring countries and China, also play a key role in boosting market growth. However, geopolitical factors and global energy price fluctuations can impact the market's trajectory. Technological advancements in exploration and extraction techniques, as well as in refining and processing, are also influencing market dynamics. The market penetration of new technologies, such as enhanced oil recovery (EOR) methods, is gradually increasing, enhancing the efficiency and sustainability of operations. Competitive dynamics remain complex, with both domestic and international players vying for market share, leading to a dynamic and evolving competitive landscape.

Dominant Regions & Segments in Oil and Gas Industry in Uzbekistan

Upstream Sector: The dominant region for upstream activities is currently concentrated in the xx region of Uzbekistan, known for its significant reserves of natural gas and oil. Key drivers include:

- Favorable Geological Conditions: The presence of substantial hydrocarbon reserves fuels exploration and production activities.

- Government Incentives: Government policies aimed at attracting foreign investment and promoting exploration have contributed to growth.

- Infrastructure Development: Investments in pipelines and other infrastructure support increased production and transportation capabilities.

Midstream Sector: The midstream segment is characterized by a relatively centralized processing and transportation infrastructure. The government is investing in expanding pipeline capacity and improving logistics. This segment’s growth is directly tied to the expansion of upstream activities.

Downstream Sector: The downstream sector's growth is primarily fueled by the rising domestic demand for refined products. The government’s initiatives, such as the agreement between Sanoat Energetika Guruhi (SEG) and AD Ports Group in July 2022, focus on improving the export capabilities of refined products. This points to a potential shift towards greater regional and global market integration for Uzbekistan's refined oil and gas products.

Oil and Gas Industry in Uzbekistan: Product Innovations

Technological advancements in drilling, enhanced oil recovery techniques, and gas processing are transforming the industry. The focus is shifting toward more efficient and environmentally friendly operations. Improved refining technologies are producing higher-quality fuels and reducing emissions. These innovations are enhancing the competitiveness of Uzbekistan’s oil and gas sector both domestically and on the global stage.

Report Scope & Segmentation Analysis

Upstream: This segment encompasses exploration, drilling, and production activities. The market size is projected to reach $xx Million by 2033, with a CAGR of xx%. Competition is relatively concentrated among a few major players.

Midstream: This segment includes processing, transportation, and storage of oil and gas. It is expected to grow at a CAGR of xx%, reaching $xx Million by 2033. The market is seeing investment in pipeline infrastructure and upgrading processing facilities.

Downstream: This segment involves refining, marketing, and distribution of petroleum products. It’s expected to reach $xx Million by 2033, with a CAGR of xx%. Increased domestic consumption and potential export market expansion are driving this segment's growth.

Key Drivers of Oil and Gas Industry in Uzbekistan Growth

The growth of Uzbekistan's oil and gas industry is driven by a combination of factors. Increasing domestic demand fueled by economic growth and population increase is a key driver. Government initiatives, such as incentives for foreign investment and infrastructure development, are significantly impacting the industry’s expansion. The development of export markets, including agreements for gas exports to China (prior to temporary halts), adds to growth momentum. Technological advancements in exploration and production methods are also improving efficiency and sustainability.

Challenges in the Oil and Gas Industry in Uzbekistan Sector

The industry faces challenges like the reliance on aging infrastructure, necessitating significant investment in upgrades and modernization to improve efficiency and safety. Geopolitical instability and fluctuating global energy prices present significant risks to market stability. Competition from renewable energy sources is also posing a longer-term challenge. Supply chain disruptions and the need to comply with increasingly stringent environmental regulations present further obstacles.

Emerging Opportunities in Oil and Gas Industry in Uzbekistan

The development of new gas fields and the expansion of existing infrastructure present significant growth opportunities. The country’s strategic location and increasing integration into regional energy markets open up export potential. Opportunities exist for technology upgrades and the development of cleaner energy technologies to enhance sustainability and meet evolving environmental standards. Foreign direct investment is crucial to unlocking the industry’s full potential.

Leading Players in the Oil and Gas Industry in Uzbekistan Market

- China National Petroleum Corporation (CNPC)

- JSC Uzbekneftegaz

- NK Lukoil PAO

- TotalEnergies SE

- Gazprom PAO

Key Developments in Oil and Gas Industry in Uzbekistan Industry

- December 2022: Temporary halt of natural gas exports to China by Uzbekneftegaz and Lukoil due to domestic energy shortages. This highlights the tension between domestic energy needs and export commitments.

- July 2022: Sanoat Energetika Guruhi (SEG)'s agreement with AD Ports Group to improve logistics and expand access to global markets for refined products signals a strategic move to diversify export destinations and enhance market reach.

Future Outlook for Oil and Gas Industry in Uzbekistan Market

The Uzbekistan oil and gas industry is poised for continued growth, driven by increasing domestic demand and potential export opportunities. However, managing the challenges related to infrastructure upgrades, geopolitical risks, and environmental regulations is critical for sustainable development. Strategic investments in technology and infrastructure, alongside a focus on environmental sustainability, will be crucial in shaping the industry's future success. The government’s role in fostering a supportive regulatory environment and attracting foreign investment will remain a pivotal factor.

Oil and Gas Industry in Uzbekistan Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Oil and Gas Industry in Uzbekistan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oil and Gas Industry in Uzbekistan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Sector is Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Upstream

- 10.1.2. Midstream

- 10.1.3. Downstream

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 China National Petroleum Corporation (CNPC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 JSC Uzbekneftegaz

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NK Lukoil PAO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TotalEnergies SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gazprom PAO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 China National Petroleum Corporation (CNPC)

List of Figures

- Figure 1: Global Oil and Gas Industry in Uzbekistan Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Uzbekistan Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 3: Uzbekistan Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 27: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Sector 2019 & 2032

- Table 35: Global Oil and Gas Industry in Uzbekistan Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Industry in Uzbekistan?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Oil and Gas Industry in Uzbekistan?

Key companies in the market include China National Petroleum Corporation (CNPC), JSC Uzbekneftegaz, NK Lukoil PAO, TotalEnergies SE, Gazprom PAO.

3. What are the main segments of the Oil and Gas Industry in Uzbekistan?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Upstream Sector is Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

December 2022: Uzbekistan ordered state-run gas producer Uzbekneftegaz and Russia's Lukoil, the second-largest gas producer in the country, to temporarily halt natural gas exports to China as the country deals with a wave of blackouts and disruptions to local gas networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Industry in Uzbekistan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Industry in Uzbekistan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Industry in Uzbekistan?

To stay informed about further developments, trends, and reports in the Oil and Gas Industry in Uzbekistan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence