Key Insights

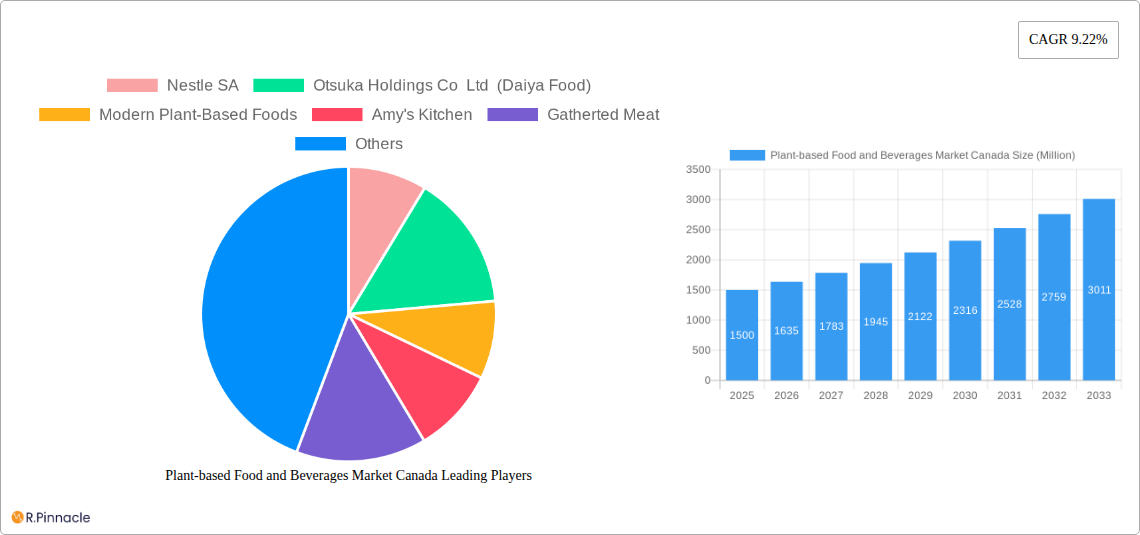

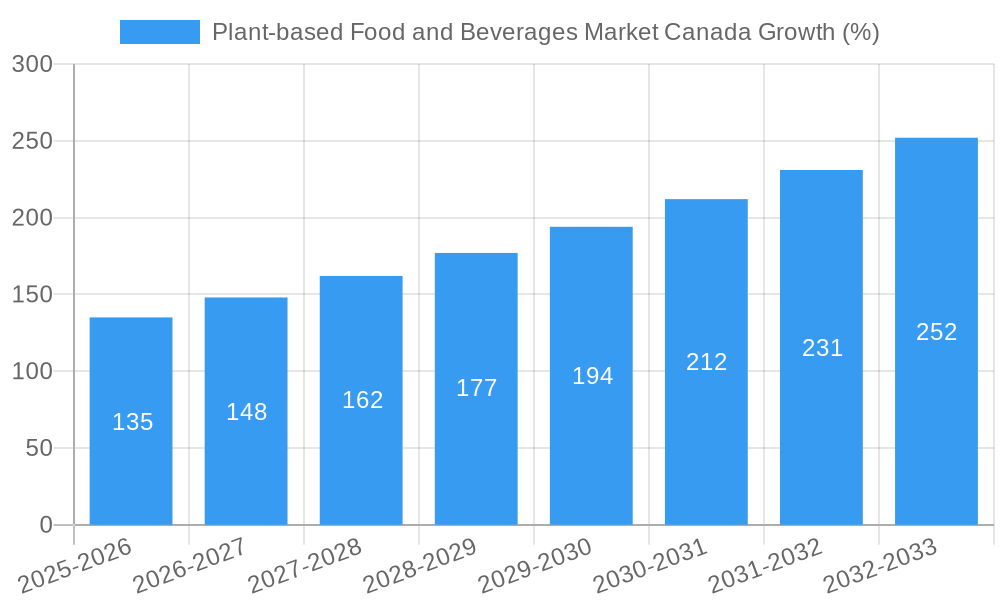

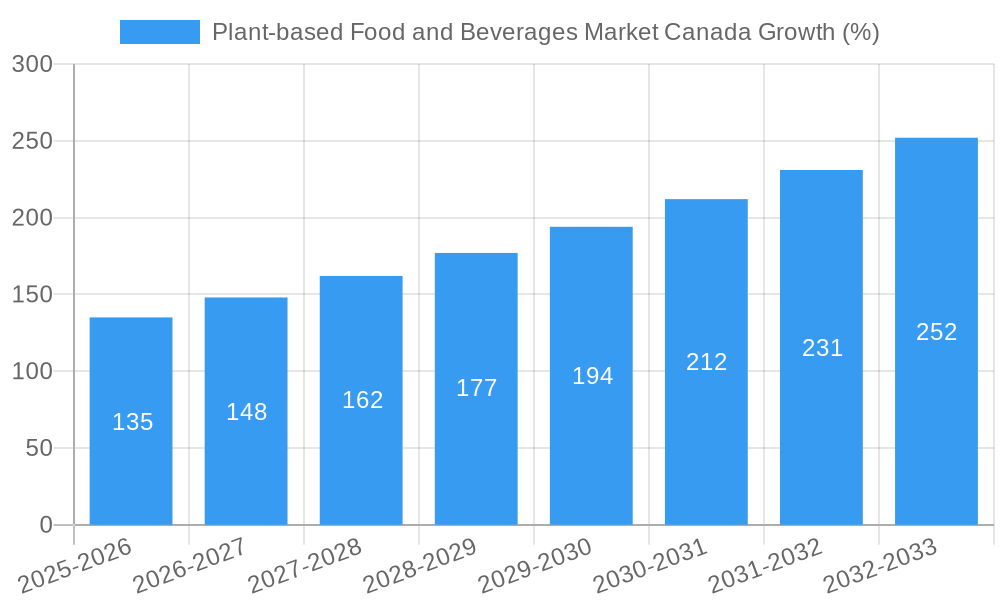

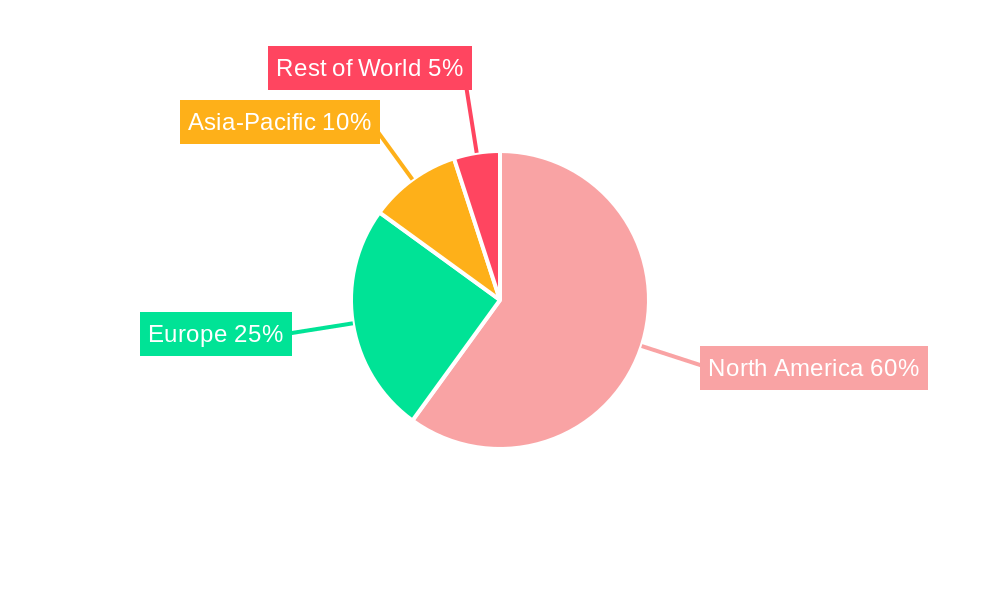

The Canadian plant-based food and beverage market is experiencing robust growth, driven by increasing consumer awareness of health and environmental benefits, coupled with a rising preference for sustainable and ethical food choices. The market, segmented by product type (meat substitutes, dairy alternatives, others) and distribution channels (supermarkets, convenience stores, online retail, others), shows strong potential across all categories. Meat substitutes, including burgers and sausages, are a major driver, fueled by technological advancements leading to improved taste and texture, making them increasingly appealing to flexitarians and vegetarians. Dairy alternatives, such as plant-based milk and yogurt, are also experiencing significant expansion, driven by lactose intolerance and allergy concerns, and a growing demand for vegan options. Online retail channels are emerging as a key distribution channel, offering convenience and broader product selection to consumers. While precise market size data for Canada specifically is unavailable, considering the global CAGR of 9.22% and North American market dominance, a reasonable estimation suggests the Canadian market size in 2025 to be around $1.5 billion CAD, extrapolated from global figures and relative market shares. This figure is expected to see consistent growth, driven by sustained consumer demand and innovative product developments. Challenges, however, remain, including price sensitivity for some consumers and potential supply chain limitations in meeting the growing demand.

Future growth in the Canadian market will likely hinge on several factors. First, continued innovation in product development is crucial to maintain appeal to consumers. This means focusing on improved taste, texture, and nutritional value to ensure that plant-based products compete effectively with their traditional counterparts. Second, wider distribution and accessibility across diverse retail channels are necessary to reach a broader consumer base. Third, effective marketing and education campaigns will be vital to address consumer concerns and dispel misconceptions surrounding plant-based foods. Companies such as Nestle, Beyond Meat, and Danone, with their established distribution networks and strong brand recognition, are well-positioned to capitalize on the growing market, alongside smaller, innovative players focusing on niche segments and specific consumer needs. The market's trajectory points to a continued expansion, with considerable opportunities for established players and new entrants alike.

Plant-based Food and Beverages Market Canada: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Plant-based Food and Beverages Market in Canada, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a detailed study period spanning from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report unravels the market's dynamics, trends, and future potential. The Canadian market is experiencing significant growth, fueled by increasing consumer demand for sustainable and healthy food options. This report provides actionable intelligence, crucial for navigating this rapidly evolving landscape.

Plant-based Food and Beverages Market Canada Market Structure & Innovation Trends

The Canadian plant-based food and beverage market exhibits a moderately concentrated structure, with key players like Nestle SA, Otsuka Holdings Co Ltd (Daiya Food), and Beyond Meat holding significant market share. However, the market also features a diverse range of smaller companies and startups, fostering innovation. The market is driven by increasing consumer awareness of health and environmental benefits, growing vegan and vegetarian populations, and the rising popularity of flexitarianism. Regulatory frameworks, while generally supportive of plant-based options, are evolving to address labeling and ingredient standards. Significant M&A activity, as exemplified by HumanCo's acquisition of Coconut Bliss, points to the sector's attractiveness to investors. Market share data for 2024 indicates Nestle SA holds approximately xx% market share, followed by Otsuka Holdings Co Ltd (Daiya Food) at xx% and Beyond Meat at xx%. Total M&A deal value in the period 2019-2024 is estimated at $xx Million.

Plant-based Food and Beverages Market Canada Market Dynamics & Trends

The Canadian plant-based food and beverage market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) projected at xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Firstly, shifting consumer preferences towards healthier and more sustainable diets are driving strong demand for plant-based alternatives. Secondly, technological advancements in plant-based protein production are leading to improved product quality and taste, enhancing consumer acceptance. Thirdly, increased availability of plant-based products across diverse distribution channels is making them more accessible to consumers. Market penetration of plant-based meat substitutes currently stands at approximately xx% and is projected to reach xx% by 2033. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of innovative startups. The market is also witnessing increasing private investment and strategic partnerships, fostering further growth.

Dominant Regions & Segments in Plant-based Food and Beverages Market Canada

Dominant Region: Ontario and British Columbia are currently the leading regions, driven by higher population density, greater consumer awareness, and robust retail infrastructure.

Dominant Product Type: Meat substitutes currently hold the largest market share, fueled by the growing demand for alternatives to traditional meat products. Dairy alternative beverages represent a significant and rapidly growing segment.

Dominant Distribution Channel: Supermarkets/hypermarkets remain the dominant distribution channel, offering wide reach and convenient access for consumers. However, online retail channels are experiencing rapid growth, driven by increased e-commerce adoption and convenience.

The dominance of these regions and segments is primarily attributed to higher consumer purchasing power, greater awareness of health and environmental concerns, and well-established retail networks. Government initiatives promoting sustainable food systems also contribute to the growth in these areas.

Plant-based Food and Beverages Market Canada Product Innovations

The Canadian plant-based food and beverage market showcases continuous product innovation, focusing on improving taste, texture, and nutritional profiles. Technological advancements in plant-based protein extraction and formulation are delivering products that closely mimic the characteristics of traditional meat and dairy products. This, coupled with increased focus on sustainability and ethical sourcing, is driving consumer adoption. Companies are actively exploring novel ingredients and processing techniques to enhance product appeal and expand product lines. The market is witnessing a rise in innovative products, including plant-based cheeses, yogurt, ice cream, and ready-to-eat meals.

Report Scope & Segmentation Analysis

This report segments the Canadian plant-based food and beverage market by product type (Meat Substitutes, Dairy Alternative Beverages, Others) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Channels, Other Distribution Channels). Each segment's growth projections, market size, and competitive dynamics are analyzed extensively. The market size for meat substitutes is estimated at $xx Million in 2025, projected to reach $xx Million by 2033. Dairy alternative beverages are projected to experience even faster growth, with a market size of $xx Million in 2025, growing to $xx Million by 2033. The analysis highlights the competitive landscape within each segment, offering insights into market share, competitive strategies, and future opportunities.

Key Drivers of Plant-based Food and Beverages Market Canada Growth

Several factors are driving the growth of the Canadian plant-based food and beverage market. These include increasing consumer awareness of health and environmental benefits, the rise of veganism and vegetarianism, and government support for sustainable food systems. Technological advancements in plant-based protein production and improved product quality also contribute significantly. Furthermore, increased product availability through diverse distribution channels and strategic marketing campaigns are fueling market expansion. Growing consumer demand for convenient and ready-to-eat plant-based options also plays a pivotal role.

Challenges in the Plant-based Food and Beverages Market Canada Sector

The Canadian plant-based food and beverage market faces certain challenges. Price remains a barrier for some consumers, especially when compared to conventional meat and dairy products. Supply chain limitations and the need for consistent product quality can also pose difficulties. Maintaining consistent product quality and taste while addressing cost-effectiveness remain ongoing challenges. Furthermore, the regulatory environment, while generally supportive, requires ongoing attention regarding labeling and ingredient standards. The high intensity of competition also demands sustained innovation and strategic marketing to capture market share.

Emerging Opportunities in Plant-based Food and Beverages Market Canada

Significant opportunities exist for growth within the Canadian plant-based food and beverage market. The expanding market for plant-based convenience foods, including ready-meals and snacks, presents a significant opportunity. The development of novel plant-based proteins with enhanced nutritional value and functional properties offers considerable potential. Furthermore, tapping into emerging consumer demand for customized and personalized plant-based products based on individual dietary needs and preferences will be crucial. Expanding into new distribution channels and exploring export opportunities also provide avenues for future growth.

Leading Players in the Plant-based Food and Beverages Market Canada Market

- Nestle SA

- Otsuka Holdings Co Ltd (Daiya Food)

- Modern Plant-Based Foods

- Amy's Kitchen

- Gatherted Meat

- Danone S A

- Beyond Meat

- Impossible Foods Inc

- Tonnies Holding Aps & Co KG

- The Meatless Farm Company

Key Developments in Plant-based Food and Beverages Market Canada Industry

- May 2022: Danone Canada launched Nextmil, a dairy-free beverage under its Silk Canada brand, signifying increased innovation in the dairy-alternative segment.

- August 2021: Beyond Meat's partnership with A&W Canada to launch plant-based chicken nuggets showcased the growing acceptance of plant-based options in mainstream foodservice.

- July 2020: HumanCo's acquisition of Coconut Bliss highlighted the investment interest and consolidation within the plant-based sector, especially within the organic ice cream market.

Future Outlook for Plant-based Food and Beverages Market Canada Market

The future of the Canadian plant-based food and beverage market looks promising. Continued growth is anticipated, driven by sustained consumer demand, technological advancements, and increased investment. Innovation in product development, expansion into new market segments, and strategic partnerships will be key to success. The market's evolution will be shaped by consumer preferences for sustainable, ethical, and convenient plant-based options. Companies that successfully adapt to these evolving consumer preferences and embrace sustainable practices are well-positioned for significant growth in this dynamic market.

Plant-based Food and Beverages Market Canada Segmentation

-

1. Product Type

-

1.1. Meat Substitutes

- 1.1.1. Textured Vegetable Protein

- 1.1.2. Tofu

- 1.1.3. Tempeh

- 1.1.4. Others

-

1.2. Dairy Alternative Beverages

- 1.2.1. Soy Milk

- 1.2.2. Almond Milk

- 1.2.3. Other Dairy Alternative Beverages

- 1.3. Non-dairy Ice Cream

- 1.4. Non-dairy Cheese

- 1.5. Non-dairy Yogurt

- 1.6. Other Plant Based Products

-

1.1. Meat Substitutes

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convinience Sores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

Plant-based Food and Beverages Market Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plant-based Food and Beverages Market Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exotic Flavor Combined with Nutritional Value; Growing Demand for Convenient Foods

- 3.3. Market Restrains

- 3.3.1. Increasing Prevalence of Diabetes and Obesity Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Awareness About Benefits Associated with Vegan Diet

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Meat Substitutes

- 5.1.1.1. Textured Vegetable Protein

- 5.1.1.2. Tofu

- 5.1.1.3. Tempeh

- 5.1.1.4. Others

- 5.1.2. Dairy Alternative Beverages

- 5.1.2.1. Soy Milk

- 5.1.2.2. Almond Milk

- 5.1.2.3. Other Dairy Alternative Beverages

- 5.1.3. Non-dairy Ice Cream

- 5.1.4. Non-dairy Cheese

- 5.1.5. Non-dairy Yogurt

- 5.1.6. Other Plant Based Products

- 5.1.1. Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convinience Sores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Meat Substitutes

- 6.1.1.1. Textured Vegetable Protein

- 6.1.1.2. Tofu

- 6.1.1.3. Tempeh

- 6.1.1.4. Others

- 6.1.2. Dairy Alternative Beverages

- 6.1.2.1. Soy Milk

- 6.1.2.2. Almond Milk

- 6.1.2.3. Other Dairy Alternative Beverages

- 6.1.3. Non-dairy Ice Cream

- 6.1.4. Non-dairy Cheese

- 6.1.5. Non-dairy Yogurt

- 6.1.6. Other Plant Based Products

- 6.1.1. Meat Substitutes

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Convinience Sores

- 6.2.3. Online Retail Channels

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Meat Substitutes

- 7.1.1.1. Textured Vegetable Protein

- 7.1.1.2. Tofu

- 7.1.1.3. Tempeh

- 7.1.1.4. Others

- 7.1.2. Dairy Alternative Beverages

- 7.1.2.1. Soy Milk

- 7.1.2.2. Almond Milk

- 7.1.2.3. Other Dairy Alternative Beverages

- 7.1.3. Non-dairy Ice Cream

- 7.1.4. Non-dairy Cheese

- 7.1.5. Non-dairy Yogurt

- 7.1.6. Other Plant Based Products

- 7.1.1. Meat Substitutes

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Convinience Sores

- 7.2.3. Online Retail Channels

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Meat Substitutes

- 8.1.1.1. Textured Vegetable Protein

- 8.1.1.2. Tofu

- 8.1.1.3. Tempeh

- 8.1.1.4. Others

- 8.1.2. Dairy Alternative Beverages

- 8.1.2.1. Soy Milk

- 8.1.2.2. Almond Milk

- 8.1.2.3. Other Dairy Alternative Beverages

- 8.1.3. Non-dairy Ice Cream

- 8.1.4. Non-dairy Cheese

- 8.1.5. Non-dairy Yogurt

- 8.1.6. Other Plant Based Products

- 8.1.1. Meat Substitutes

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Convinience Sores

- 8.2.3. Online Retail Channels

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Meat Substitutes

- 9.1.1.1. Textured Vegetable Protein

- 9.1.1.2. Tofu

- 9.1.1.3. Tempeh

- 9.1.1.4. Others

- 9.1.2. Dairy Alternative Beverages

- 9.1.2.1. Soy Milk

- 9.1.2.2. Almond Milk

- 9.1.2.3. Other Dairy Alternative Beverages

- 9.1.3. Non-dairy Ice Cream

- 9.1.4. Non-dairy Cheese

- 9.1.5. Non-dairy Yogurt

- 9.1.6. Other Plant Based Products

- 9.1.1. Meat Substitutes

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Convinience Sores

- 9.2.3. Online Retail Channels

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Meat Substitutes

- 10.1.1.1. Textured Vegetable Protein

- 10.1.1.2. Tofu

- 10.1.1.3. Tempeh

- 10.1.1.4. Others

- 10.1.2. Dairy Alternative Beverages

- 10.1.2.1. Soy Milk

- 10.1.2.2. Almond Milk

- 10.1.2.3. Other Dairy Alternative Beverages

- 10.1.3. Non-dairy Ice Cream

- 10.1.4. Non-dairy Cheese

- 10.1.5. Non-dairy Yogurt

- 10.1.6. Other Plant Based Products

- 10.1.1. Meat Substitutes

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/ Hypermarkets

- 10.2.2. Convinience Sores

- 10.2.3. Online Retail Channels

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. United States Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 12. Canada Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Nestle SA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Otsuka Holdings Co Ltd (Daiya Food)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Modern Plant-Based Foods

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Amy's Kitchen

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Gatherted Meat

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Danone S A

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Beyond Meat

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Impossible Foods Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Tonnies Holding Aps & Co KG

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 The Meatless Farm Company*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Nestle SA

List of Figures

- Figure 1: Global Plant-based Food and Beverages Market Canada Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 11: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 23: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Turkey Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Israel Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: GCC Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: North Africa Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Africa Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 43: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 44: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: ASEAN Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Oceania Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-based Food and Beverages Market Canada?

The projected CAGR is approximately 9.22%.

2. Which companies are prominent players in the Plant-based Food and Beverages Market Canada?

Key companies in the market include Nestle SA, Otsuka Holdings Co Ltd (Daiya Food), Modern Plant-Based Foods, Amy's Kitchen, Gatherted Meat, Danone S A, Beyond Meat, Impossible Foods Inc, Tonnies Holding Aps & Co KG, The Meatless Farm Company*List Not Exhaustive.

3. What are the main segments of the Plant-based Food and Beverages Market Canada?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exotic Flavor Combined with Nutritional Value; Growing Demand for Convenient Foods.

6. What are the notable trends driving market growth?

Increasing Awareness About Benefits Associated with Vegan Diet.

7. Are there any restraints impacting market growth?

Increasing Prevalence of Diabetes and Obesity Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

In May 2022, Danone Canada launched a fresh-new dairy-free beverage called - Nextmil under its Silk Canada brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plant-based Food and Beverages Market Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plant-based Food and Beverages Market Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plant-based Food and Beverages Market Canada?

To stay informed about further developments, trends, and reports in the Plant-based Food and Beverages Market Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence