Key Insights

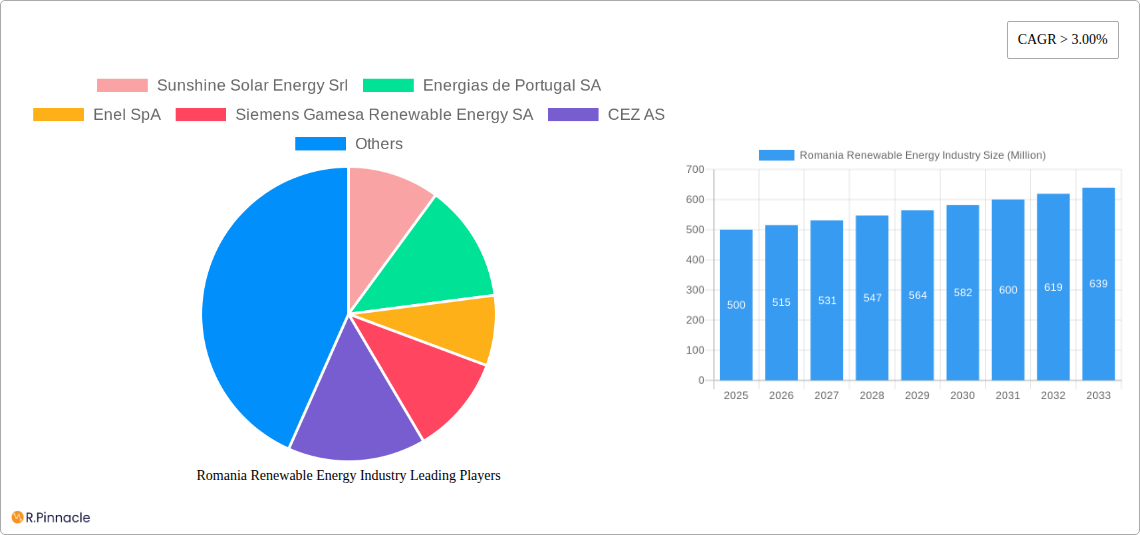

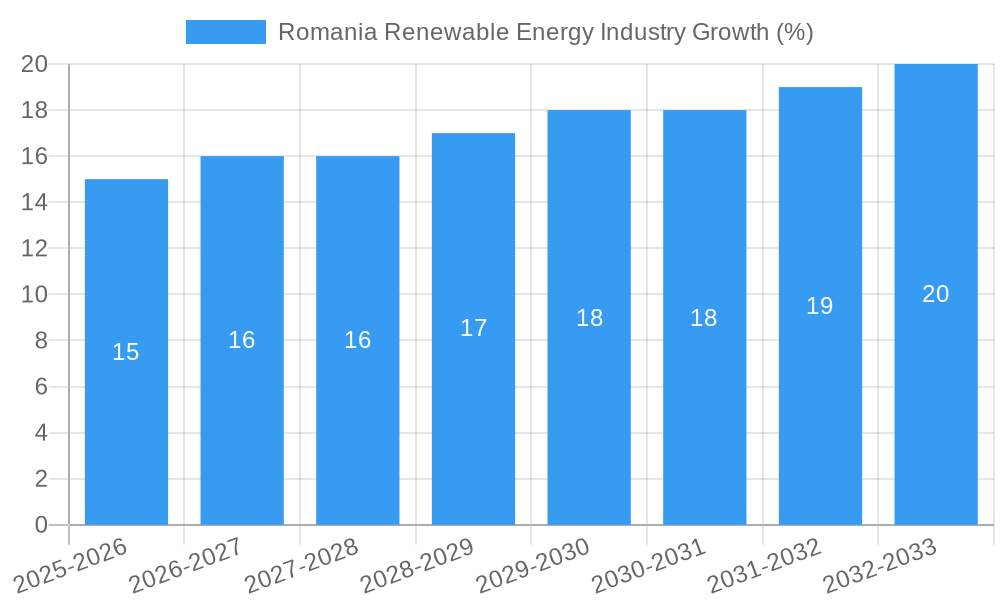

The Romanian renewable energy market presents a compelling investment opportunity, exhibiting strong growth potential fueled by supportive government policies, increasing energy security concerns, and the declining costs of renewable energy technologies. With a current market size (estimated in 2025) of approximately €500 million (based on a CAGR of >3% and extrapolation from available data), the sector is projected to experience significant expansion over the forecast period (2025-2033). Key drivers include the European Union's ambitious renewable energy targets, which Romania is actively pursuing through investments in solar, wind, and hydropower projects. Furthermore, the country's abundant natural resources, particularly its wind potential along the Black Sea coast and its considerable hydropower capacity in the Carpathian Mountains, provide a solid foundation for renewable energy development. While challenges remain, such as grid infrastructure limitations and bureaucratic hurdles, these are being actively addressed through government initiatives and private sector investment. The market is segmented by type, with solar, wind, and hydropower representing the dominant sectors, while "other types" (geothermal, biomass) contribute a smaller, albeit growing, share. Major players, including both international corporations like Siemens Gamesa and local entities like Energias de Portugal SA, are driving innovation and competition within this dynamic market.

The sustained growth trajectory of the Romanian renewable energy sector is expected to continue over the next decade. The projected CAGR of >3% points towards a steadily expanding market, reaching an estimated value of over €750 million by 2030. This expansion will be driven by several factors, including ongoing technological advancements leading to reduced costs, increased energy efficiency, and the escalating demand for cleaner energy sources. Furthermore, the ongoing development of smart grids and improved energy storage solutions will help to address existing infrastructure challenges and optimize renewable energy integration. The sector will continue to see significant investment, attracting both domestic and international players. However, success will depend on the effective implementation of government policies, the streamlining of regulatory processes, and the continued commitment to sustainable development practices within Romania's energy sector.

Romania Renewable Energy Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Romanian renewable energy market, offering invaluable insights for industry professionals, investors, and policymakers. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth potential. We analyze key segments – Solar Energy, Wind, Hydropower, and Other Renewable Types – identifying dominant players and emerging opportunities within this dynamic market. The report includes detailed market sizing, CAGR projections, and analysis of significant M&A activity.

Romania Renewable Energy Industry Market Structure & Innovation Trends

This section examines the Romanian renewable energy market's structure, analyzing market concentration, innovation drivers, and regulatory frameworks. We delve into product substitutes, end-user demographics, and mergers & acquisitions (M&A) activity, providing insights into market share and deal values.

Market Concentration: The Romanian renewable energy market exhibits a moderately concentrated structure, with key players like Enel SpA, Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, and General Electric Company holding significant market share. Smaller, specialized companies like Sunshine Solar Energy Srl are also contributing to market growth. Precise market share figures for 2025 are estimated at xx%.

Innovation Drivers: Government incentives, EU funding, and the increasing demand for sustainable energy solutions are driving innovation within the sector. Technological advancements, such as improved solar panel efficiency and larger wind turbine capacities, are also key drivers.

Regulatory Frameworks: Romania's regulatory landscape plays a crucial role, shaping the investment climate and promoting renewable energy adoption. Recent policy changes aimed at simplifying permitting processes and guaranteeing power purchase agreements (PPAs) are contributing to market expansion.

M&A Activity: Recent years have witnessed significant M&A activity, with deals totaling an estimated xx Million EUR in 2024. The acquisition of projects, like the Rezolv Energy acquisition mentioned below, exemplifies the strategic consolidation within the sector.

Romania Renewable Energy Industry Market Dynamics & Trends

This section explores the key dynamics driving the Romanian renewable energy market's growth. We analyze market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing insights into the Compound Annual Growth Rate (CAGR) and market penetration rates. The estimated CAGR for the forecast period (2025-2033) is projected at xx%. Market penetration of renewable energy in the total energy mix is expected to reach xx% by 2033. Factors like increasing electricity prices, energy security concerns, and the EU's ambitious renewable energy targets are propelling market expansion.

Dominant Regions & Segments in Romania Renewable Energy Industry

This section identifies the leading regions and segments within the Romanian renewable energy market. While data limitations prevent precise quantification of regional dominance, we can highlight trends.

Solar Energy: The western region of Romania, particularly Arad county, is emerging as a significant hub for solar energy development, driven by favorable solar irradiance levels and supportive government policies. The Rezolv Energy project highlights this trend.

Wind Energy: Areas with higher wind speeds, such as Ialomita County, are witnessing significant wind power project development. The EDPR Romania project illustrates this.

Hydropower: Existing hydropower infrastructure contributes significantly, with additional developments concentrated primarily in mountainous areas.

Other Types: Smaller contributions come from biomass, geothermal, and other renewable sources.

Key Drivers:

- Government Policies: Romania's ambitious renewable energy targets and supportive regulatory frameworks are attracting significant investment.

- Infrastructure Development: Investments in grid infrastructure and transmission lines are vital for integrating renewable energy sources.

- Economic Factors: Falling costs of renewable energy technologies are making them increasingly competitive with fossil fuels.

Romania Renewable Energy Industry Product Innovations

Recent innovations include higher-efficiency solar panels, larger-capacity wind turbines, and advanced energy storage solutions. These advancements enhance the cost-competitiveness and reliability of renewable energy systems, improving market penetration and enhancing energy independence. Specific examples of product development in this arena are unavailable at this time; further research would be needed.

Report Scope & Segmentation Analysis

This report segments the Romanian renewable energy market by technology type: Solar Energy, Wind, Hydropower, and Other Renewable Types. Each segment presents unique growth projections, market sizes, and competitive dynamics. The estimated market size for solar energy in 2025 is xx Million EUR, wind is at xx Million EUR, hydropower is at xx Million EUR, and other types is at xx Million EUR. Growth projections vary considerably among segments, influenced by factors like technology advancements, resource availability, and government support.

Key Drivers of Romania Renewable Energy Industry Growth

Several factors are driving the growth of Romania's renewable energy industry:

- Government Support: Subsidies, tax breaks, and streamlined permitting processes are encouraging investment.

- EU Targets: Alignment with EU renewable energy goals creates a strong incentive for growth.

- Falling Technology Costs: Reduced costs of solar and wind technologies enhance competitiveness.

- Energy Security: Diversification of energy sources enhances national energy security.

Challenges in the Romania Renewable Energy Industry Sector

The Romanian renewable energy sector faces several challenges:

- Grid Infrastructure: Upgrading existing grid infrastructure to accommodate increased renewable energy integration presents a significant hurdle.

- Permitting Processes: Despite improvements, bureaucratic processes can still delay project development.

- Intermittency: Managing the intermittent nature of solar and wind power requires robust energy storage solutions.

- Funding Availability: Secure financing for large-scale projects continues to be an obstacle.

Emerging Opportunities in Romania Renewable Energy Industry

The Romanian renewable energy sector presents several exciting opportunities:

- Energy Storage: Growing demand for energy storage solutions to address intermittency issues creates opportunities for new technologies and investment.

- Green Hydrogen: Production of green hydrogen using renewable energy sources presents a potential growth area.

- Offshore Wind: Exploration of offshore wind resources could unlock significant potential.

- Smart Grid Technologies: Integrating smart grid technologies will improve the efficiency of renewable energy integration.

Leading Players in the Romania Renewable Energy Industry Market

- Sunshine Solar Energy Srl

- Energias de Portugal SA

- Enel SpA

- Siemens Gamesa Renewable Energy SA

- CEZ AS

- Vestas Wind Systems AS

- General Electric Company

Key Developments in Romania Renewable Energy Industry

- November 2022: Rezolv Energy acquired the rights to build and operate a 1,044 MW photovoltaic plant in Arad county, representing a significant boost to Romania's solar energy capacity and potentially the largest PV plant in Europe.

- October 2022: EDPR Romania received grid connection approval for a 226.5 MW wind project in Ialomita County, demonstrating continued investment in wind energy.

Future Outlook for Romania Renewable Energy Industry Market

The Romanian renewable energy market is poised for robust growth over the forecast period. Continued government support, falling technology costs, and increasing energy security concerns will drive investment and expansion. The integration of smart grid technologies and energy storage solutions will be crucial for optimizing renewable energy utilization and ensuring grid stability. The market's future success hinges on overcoming challenges related to grid infrastructure and permitting processes. The market is expected to surpass xx Million EUR by 2033.

Romania Renewable Energy Industry Segmentation

-

1. Type

- 1.1. Solar Energy

- 1.2. Wind

- 1.3. Hydropower

- 1.4. Other Types

Romania Renewable Energy Industry Segmentation By Geography

- 1. Romania

Romania Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Demand for Renewable Energy and Favorable Government Policies4.; The Reduced Wind Power Tariff

- 3.3. Market Restrains

- 3.3.1. 4.; The Increasing Adoption of Alternate Clean Power Sources Such as Solar and Biomass

- 3.4. Market Trends

- 3.4.1. Ambitious Targets and Supportive Government Policies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Romania Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solar Energy

- 5.1.2. Wind

- 5.1.3. Hydropower

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Romania

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sunshine Solar Energy Srl

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Energias de Portugal SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enel SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens Gamesa Renewable Energy SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CEZ AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vestas Wind Systems AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Electric Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Sunshine Solar Energy Srl

List of Figures

- Figure 1: Romania Renewable Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Romania Renewable Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Romania Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Romania Renewable Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Romania Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Romania Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 5: Romania Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Romania Renewable Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Romania Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Romania Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Romania Renewable Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Romania Renewable Energy Industry Volume gigawatt Forecast, by Type 2019 & 2032

- Table 11: Romania Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Romania Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Romania Renewable Energy Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Romania Renewable Energy Industry?

Key companies in the market include Sunshine Solar Energy Srl, Energias de Portugal SA, Enel SpA, Siemens Gamesa Renewable Energy SA, CEZ AS, Vestas Wind Systems AS, General Electric Company.

3. What are the main segments of the Romania Renewable Energy Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Demand for Renewable Energy and Favorable Government Policies4.; The Reduced Wind Power Tariff.

6. What are the notable trends driving market growth?

Ambitious Targets and Supportive Government Policies.

7. Are there any restraints impacting market growth?

4.; The Increasing Adoption of Alternate Clean Power Sources Such as Solar and Biomass.

8. Can you provide examples of recent developments in the market?

November 2022- Rezolv Energy acquired the rights to build and operate a 1,044 MW photovoltaic plant in Arad county, western Romania, from the Monsson Group. The project is in the late-stage development phase, and once constructed, it is expected to be the largest PV plant in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Romania Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Romania Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Romania Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the Romania Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence