Key Insights

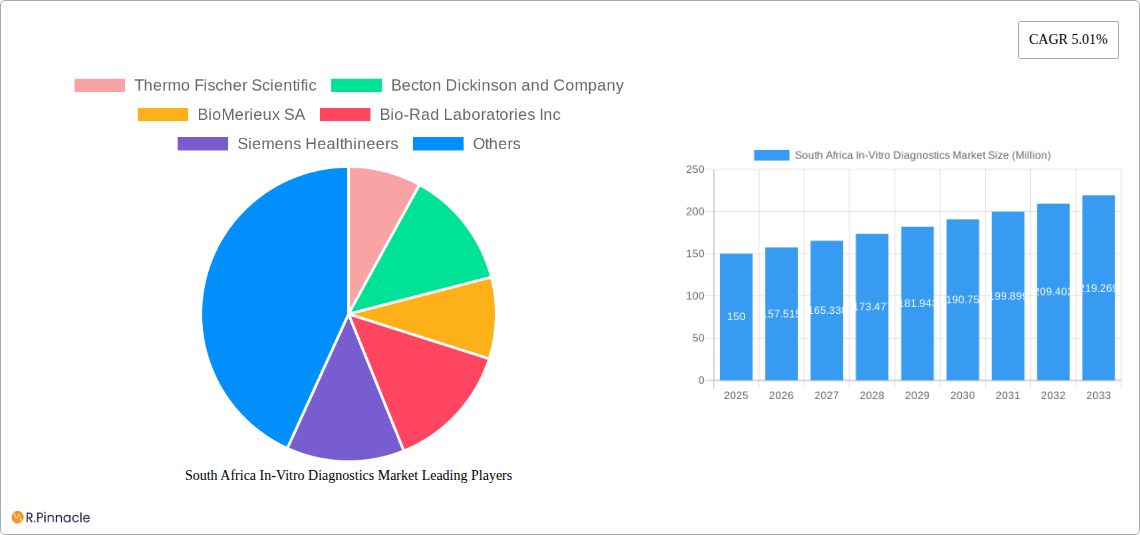

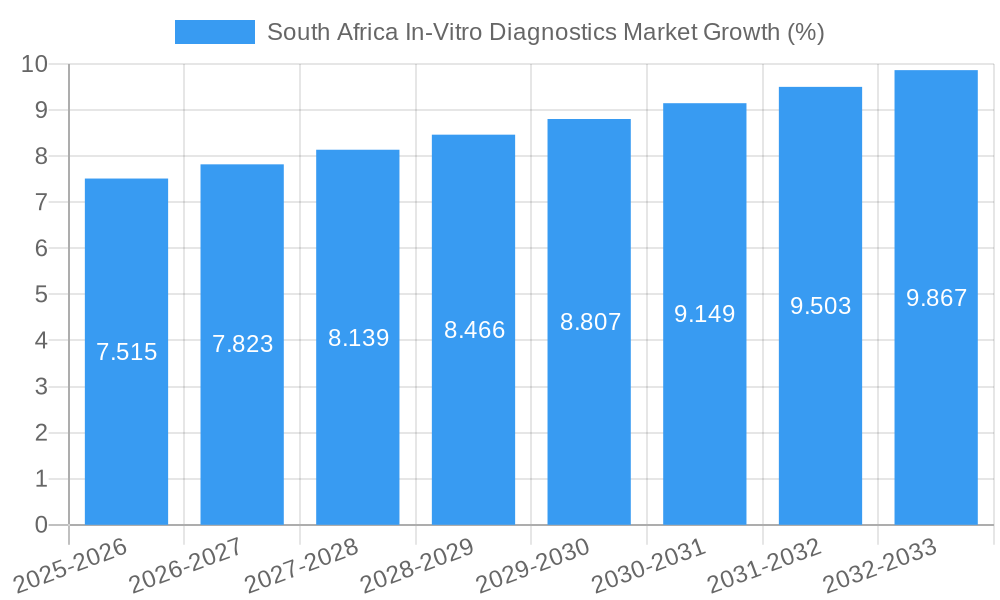

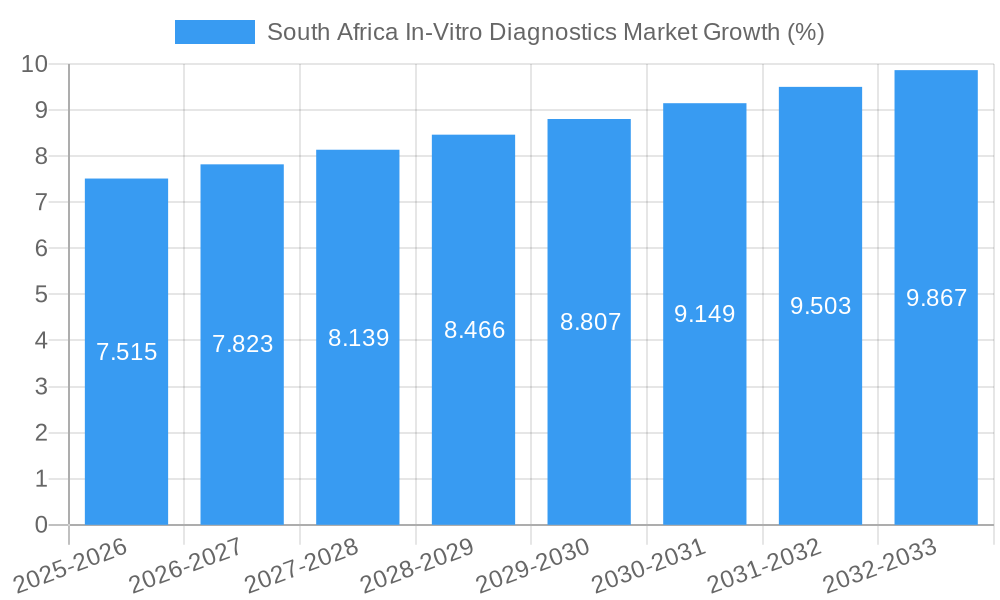

The South African In-Vitro Diagnostics (IVD) market, valued at approximately $150 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.01% from 2025 to 2033. This expansion is fueled by several key factors. Rising prevalence of chronic diseases like diabetes, cancer, and cardiovascular diseases, coupled with an increasing geriatric population, drives demand for diagnostic testing. Furthermore, improving healthcare infrastructure and growing government initiatives promoting preventative healthcare contribute significantly to market growth. The clinical chemistry segment, encompassing routine blood tests, likely holds the largest market share due to its widespread use in diagnosing various conditions. Technological advancements, such as the introduction of automated and point-of-care testing systems, further enhance efficiency and accessibility, stimulating market expansion. However, challenges remain, including the uneven distribution of healthcare resources across the country and cost constraints limiting access to advanced diagnostic technologies in certain regions. The market is dominated by major global players like Thermo Fisher Scientific, Becton Dickinson, and Roche, alongside regional players catering to the specific needs of the South African market. The adoption of molecular diagnostics is expected to increase significantly, driven by the need for rapid and accurate infectious disease diagnosis.

The competitive landscape is characterized by both multinational corporations and local distributors. Growth will likely be driven by increased investment in infrastructure, particularly in rural areas, and government initiatives to enhance the quality and affordability of healthcare services. The increasing adoption of telehealth and remote diagnostics could also positively impact market growth, expanding access to testing services in underserved regions. The market segmentation, with instruments, reagents, and other products, indicates a need for holistic solutions rather than isolated products, fostering partnerships and acquisitions amongst market participants. Hospitals and diagnostic laboratories represent major end-users, highlighting the importance of strategic collaborations to effectively penetrate these key segments. Focus on improving healthcare access, technological innovation, and tailored solutions will be crucial for success in this expanding market.

South Africa In-Vitro Diagnostics Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South Africa In-Vitro Diagnostics (IVD) market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, segmentation, key players, and future trends. The South Africa IVD market is segmented by test type (Clinical Chemistry, Molecular Diagnostics, Immuno Diagnostics, Haematology, Other Test Types), product (Instrument, Reagent, Other Products), usability (Disposable IVD Device, Reusable IVD Device), application (Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, Other Applications), and end-user (Diagnostic Laboratories, Hospitals and Clinics, Other End-users).

South Africa In-Vitro Diagnostics Market Structure & Innovation Trends

The South African IVD market exhibits a moderately concentrated structure, with key players like Thermo Fischer Scientific, Becton Dickinson and Company, BioMerieux SA, Bio-Rad Laboratories Inc, Siemens Healthineers, F Hoffmann-La Roche Ltd, DiaSorin SpA, Abbott Laboratories, Danaher Corporation, and Nihon Kohden Corporation holding significant market share. Precise market share data for each company is unavailable for this report (xx%). However, the market is characterized by ongoing innovation driven by the need for faster, more accurate, and cost-effective diagnostic solutions. Regulatory frameworks, primarily governed by the South African Health Products Regulatory Authority (SAHPRA), play a crucial role in shaping market dynamics. The market also witnesses considerable M&A activity, with deal values fluctuating based on the size and strategic importance of the acquired companies (xx Million). The prevalence of substitute products and services, along with evolving end-user demographics (ageing population, increasing prevalence of chronic diseases), fuels further market activity.

South Africa In-Vitro Diagnostics Market Market Dynamics & Trends

The South African IVD market is experiencing substantial growth, driven by factors including rising prevalence of chronic diseases (diabetes, cancer, cardiovascular diseases), increasing healthcare expenditure, and improving healthcare infrastructure. Technological advancements, such as the adoption of molecular diagnostics and point-of-care testing, are significantly impacting market dynamics. Consumer preferences are shifting towards more convenient and rapid diagnostic tests. The market also witnesses intense competition among established players and emerging companies. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%. Market penetration of advanced diagnostic technologies remains relatively low but is projected to increase significantly during the forecast period.

Dominant Regions & Segments in South Africa In-Vitro Diagnostics Market

While precise regional dominance data is not currently available (xx), Gauteng and Western Cape provinces likely represent the largest markets due to higher healthcare infrastructure density and concentration of diagnostic facilities.

- Key Drivers for Market Dominance:

- Well-established healthcare infrastructure

- Higher concentration of diagnostic laboratories and hospitals

- Government initiatives promoting healthcare access

- Higher concentration of private healthcare facilities

Within market segments, Clinical Chemistry and Immuno Diagnostics are expected to dominate in terms of revenue generation, followed by Molecular Diagnostics. The Disposable IVD Device segment holds significant market share, driven by convenience and cost-effectiveness. Infectious diseases, cancer, and diabetes are major application areas driving growth. Diagnostic laboratories account for the majority of the end-user market.

South Africa In-Vitro Diagnostics Market Product Innovations

Recent product innovations focus on point-of-care diagnostics, rapid diagnostic tests, and molecular diagnostic platforms. These innovations improve diagnostic speed, accuracy, and accessibility, particularly in resource-limited settings. Companies are increasingly integrating digital technologies, like mobile apps, to enhance data management and patient engagement. This trend aligns well with the growing demand for efficient and user-friendly diagnostic solutions.

Report Scope & Segmentation Analysis

This report comprehensively segments the South Africa IVD market across several parameters:

Test Type: Clinical Chemistry (xx Million), Molecular Diagnostics (xx Million), Immuno Diagnostics (xx Million), Haematology (xx Million), Other Test Types (xx Million). Growth projections vary across segments, with Molecular Diagnostics anticipated to experience the highest growth rate.

Product: Instrument (xx Million), Reagent (xx Million), Other Products (xx Million). The reagent segment is expected to dominate due to high consumption volume.

Usability: Disposable IVD Device (xx Million), Reusable IVD Device (xx Million). Disposable devices have a larger market share owing to convenience and hygiene.

Application: Infectious Disease (xx Million), Diabetes (xx Million), Cancer/Oncology (xx Million), Cardiology (xx Million), Autoimmune Disease (xx Million), Nephrology (xx Million), Other Applications (xx Million). Infectious diseases and cancer are key application areas.

End-User: Diagnostic Laboratories (xx Million), Hospitals and Clinics (xx Million), Other End-users (xx Million). Diagnostic laboratories represent a significant portion of the end-user market.

Key Drivers of South Africa In-Vitro Diagnostics Market Growth

Several factors contribute to the market's expansion:

- Increasing Prevalence of Chronic Diseases: The rising incidence of diabetes, cancer, and cardiovascular diseases necessitates enhanced diagnostic capabilities.

- Government Initiatives: Government investment in healthcare infrastructure and disease control programs fuels market growth.

- Technological Advancements: The introduction of sophisticated diagnostic technologies drives market expansion.

Challenges in the South Africa In-Vitro Diagnostics Market Sector

The market faces challenges such as:

- High Costs of Advanced Technologies: The affordability of sophisticated diagnostic equipment and reagents poses a barrier to market penetration.

- Regulatory Hurdles: Stringent regulatory requirements can hinder product launch and market entry.

- Supply Chain Disruptions: Global supply chain challenges can impact the availability of diagnostic products.

Emerging Opportunities in South Africa In-Vitro Diagnostics Market

Significant opportunities exist in:

- Point-of-Care Diagnostics: Expansion of point-of-care testing to improve accessibility and reduce turnaround times.

- Molecular Diagnostics: Increased adoption of PCR and other molecular diagnostic techniques for faster and more accurate results.

- Telemedicine Integration: Integration of IVD with telemedicine platforms to improve remote diagnostics.

Leading Players in the South Africa In-Vitro Diagnostics Market Market

- Thermo Fischer Scientific

- Becton Dickinson and Company

- BioMerieux SA

- Bio-Rad Laboratories Inc

- Siemens Healthineers

- F Hoffmann-La Roche Ltd

- DiaSorin SpA

- Abbott Laboratories

- Danaher Corporation

- Nihon Kohden Corporation

Key Developments in South Africa In-Vitro Diagnostics Market Industry

- March 2022: Audere partnered with Medical Diagnostech to integrate its MD SARS-nCoV-2 Antigen Device with Audere's HealthPulse app, enhancing rapid diagnostic capabilities.

- February 2022: Datar Cancer Genetics launched the Blood-based Trucheck cancer screening test, expanding cancer diagnostics options.

Future Outlook for South Africa In-Vitro Diagnostics Market Market

The South African IVD market is poised for significant growth, driven by continuous technological advancements, increasing healthcare investments, and a rising prevalence of chronic diseases. Strategic partnerships, product diversification, and expansion into underserved regions will be crucial for success in this dynamic market. The market will continue to see increased adoption of advanced technologies and a focus on improved patient outcomes.

South Africa In-Vitro Diagnostics Market Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Immuno Diagnostics

- 1.4. Haematology

- 1.5. Other Test Types

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Device

- 3.2. Reusable IVD Device

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Autoimmune Disease

- 4.6. Nephrology

- 4.7. Other Applications

-

5. End-User

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End-users

South Africa In-Vitro Diagnostics Market Segmentation By Geography

- 1. South Africa

South Africa In-Vitro Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Point-of-Care (POC) Diagnostics; Growing Burden of Chronic and Infectious Diseases; Technological Advancements in the Diagnostics

- 3.3. Market Restrains

- 3.3.1. Reimbursement Issues; High Cost of Advanced IVD Devices

- 3.4. Market Trends

- 3.4.1. Reagents are Expected to hold a Significant Market Share in the Product Segment Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Immuno Diagnostics

- 5.1.4. Haematology

- 5.1.5. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Device

- 5.3.2. Reusable IVD Device

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Autoimmune Disease

- 5.4.6. Nephrology

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End-User

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End-users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. South Africa South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Thermo Fischer Scientific

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Becton Dickinson and Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 BioMerieux SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bio-Rad Laboratories Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Siemens Healthineers

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 F Hoffmann-La Roche Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 DiaSorin SpA

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Abbott Laboratories

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Danaher Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Nihon Kohden Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Thermo Fischer Scientific

List of Figures

- Figure 1: South Africa In-Vitro Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa In-Vitro Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 5: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 7: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 16: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 17: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 18: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 20: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa In-Vitro Diagnostics Market?

The projected CAGR is approximately 5.01%.

2. Which companies are prominent players in the South Africa In-Vitro Diagnostics Market?

Key companies in the market include Thermo Fischer Scientific, Becton Dickinson and Company, BioMerieux SA, Bio-Rad Laboratories Inc, Siemens Healthineers, F Hoffmann-La Roche Ltd, DiaSorin SpA, Abbott Laboratories, Danaher Corporation, Nihon Kohden Corporation.

3. What are the main segments of the South Africa In-Vitro Diagnostics Market?

The market segments include Test Type, Product, Usability, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Point-of-Care (POC) Diagnostics; Growing Burden of Chronic and Infectious Diseases; Technological Advancements in the Diagnostics.

6. What are the notable trends driving market growth?

Reagents are Expected to hold a Significant Market Share in the Product Segment Over the Forecast Period.

7. Are there any restraints impacting market growth?

Reimbursement Issues; High Cost of Advanced IVD Devices.

8. Can you provide examples of recent developments in the market?

March 2022: Audere entered into a partnership with Medical Diagnostech, headquartered in South Africa, a developer, and manufacturer of lateral flow rapid diagnostic test kits. This partnership will pair Medical Diagnostech's MD SARS-nCoV-2 Antigen Device with Audere's HealthPulse digital companion app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa In-Vitro Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa In-Vitro Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa In-Vitro Diagnostics Market?

To stay informed about further developments, trends, and reports in the South Africa In-Vitro Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence