Key Insights

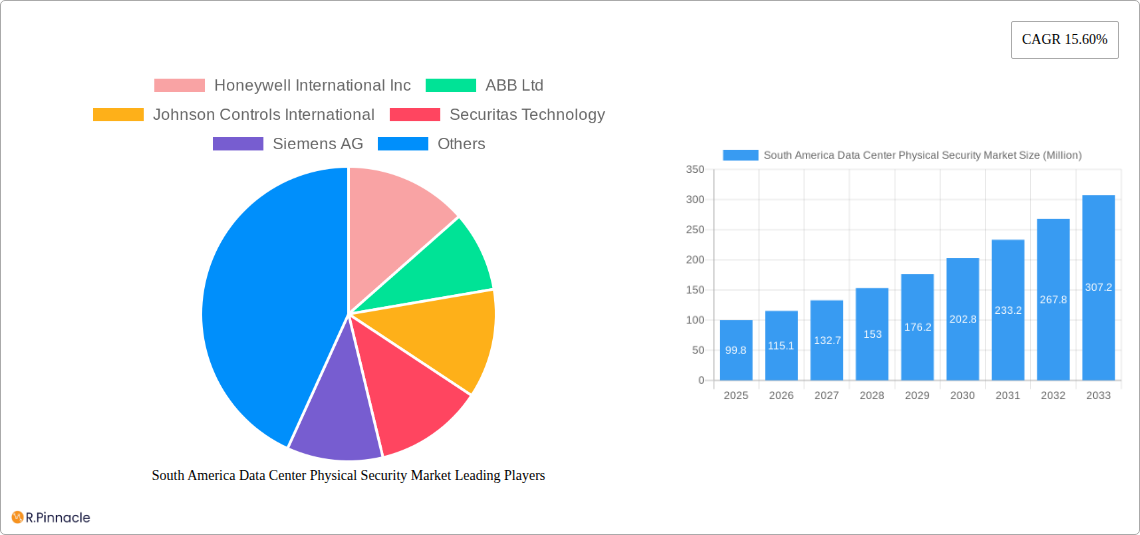

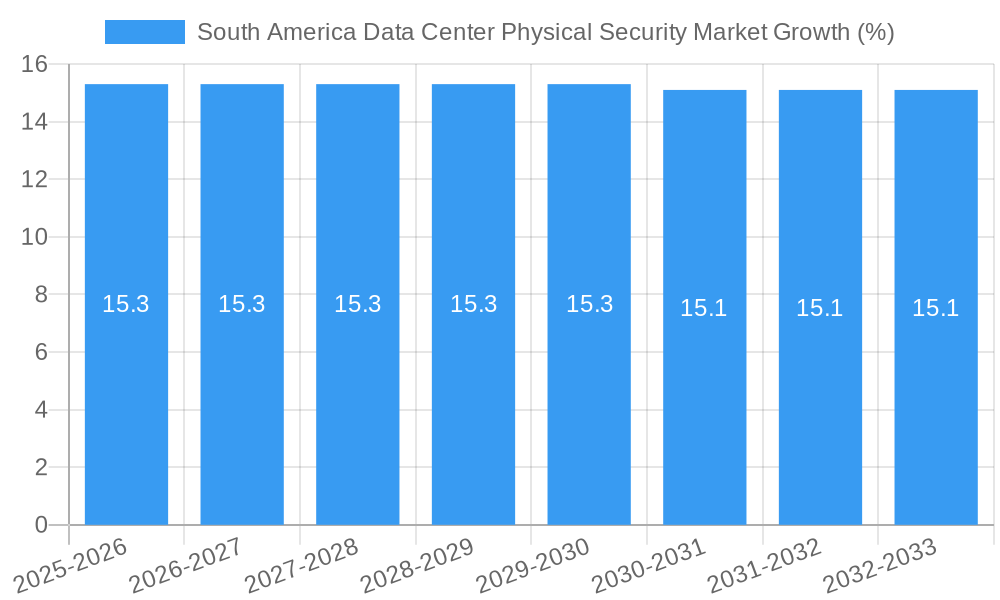

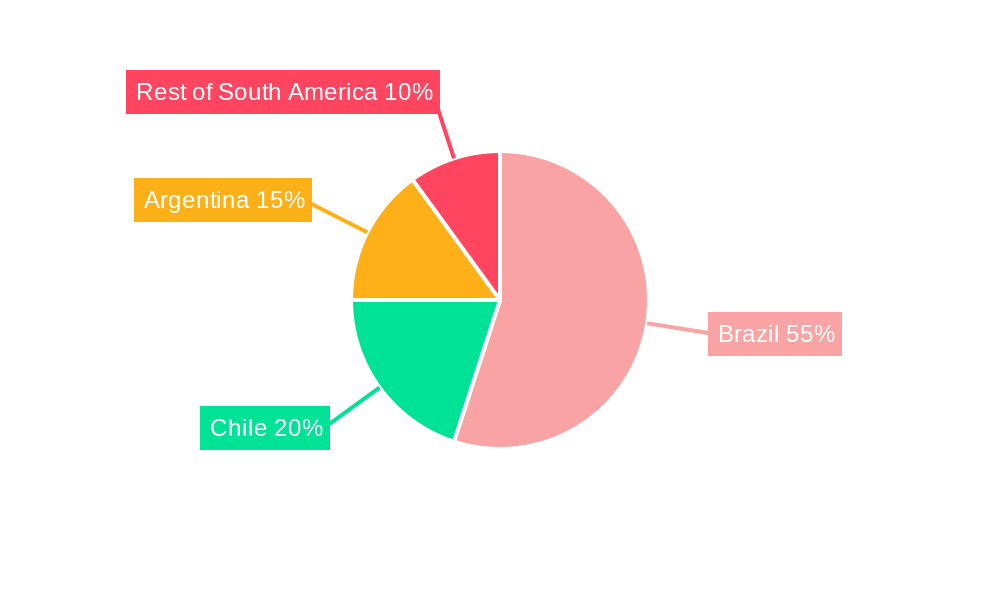

The South American data center physical security market, valued at $99.8 million in 2025, is projected to experience robust growth, driven by the increasing adoption of cloud computing and the expanding digital economy across Brazil, Chile, and Argentina. The compound annual growth rate (CAGR) of 15.6% from 2025 to 2033 indicates a significant market expansion. Key drivers include heightened concerns about data breaches and cyberattacks, prompting organizations to invest heavily in robust physical security measures. The rising adoption of advanced technologies such as video surveillance, access control systems, and integrated security solutions further fuels this growth. The market is segmented by solution type (video surveillance, access control, and other solutions like mantraps and fences), service type (consulting, professional, and system integration services), and end-user sectors (IT & telecommunications, BFSI, government, healthcare, and others). Brazil, with its larger economy and greater digital infrastructure investments, commands a significant market share within South America. However, growth is expected across the region as countries like Chile invest in strengthening their data center security infrastructure.

While the market presents significant opportunities, certain restraints exist. These include the relatively high initial investment costs associated with implementing sophisticated security systems, particularly for smaller data centers. Furthermore, the market faces challenges related to regulatory compliance and the need for skilled professionals to manage and maintain these complex security systems. The competitive landscape comprises both global players like Honeywell, ABB, and Johnson Controls, and regional players. This competitive dynamic will likely result in further innovation and price competition, enhancing market accessibility for diverse sized data centers. The projected growth trajectory suggests a lucrative investment opportunity for businesses involved in providing and servicing data center physical security solutions across South America.

South America Data Center Physical Security Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South America Data Center Physical Security Market, offering invaluable insights for industry professionals, investors, and strategic planners. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. We delve into market dynamics, segmentation, key players, and future growth potential, providing actionable intelligence to navigate this rapidly evolving landscape.

South America Data Center Physical Security Market Structure & Innovation Trends

The South American data center physical security market exhibits a moderately concentrated structure, with key players like Honeywell International Inc, ABB Ltd, and Johnson Controls International holding significant market share (estimated at xx% collectively in 2025). However, the market also accommodates several regional and specialized players. Innovation is driven by increasing data center density, stringent regulatory compliance requirements (e.g., GDPR-related data protection mandates in certain regions), and the growing adoption of cloud computing. The market is witnessing a shift towards integrated security solutions, incorporating AI-powered video analytics and biometrics. Product substitution is evident with the gradual replacement of legacy systems with more advanced, interconnected technologies. The end-user demographic is diverse, encompassing IT & Telecommunication, BFSI, Government, and Healthcare sectors, each with unique security needs. M&A activity has been moderate in recent years, with deal values averaging approximately xx Million annually during the historical period (2019-2024). Key acquisitions have focused on expanding technological capabilities and geographical reach.

- Market Concentration: Moderately concentrated, with top three players holding xx% market share (2025 est.)

- Innovation Drivers: Increased data center density, regulatory compliance, cloud adoption.

- M&A Activity: Average annual deal value xx Million (2019-2024).

- Product Substitution: Shift from legacy systems to advanced, integrated solutions.

South America Data Center Physical Security Market Dynamics & Trends

The South America Data Center Physical Security market is experiencing robust growth, driven by factors such as rising data center construction and expansion, increasing cyber threats, and the growing adoption of advanced security technologies. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological advancements, including AI, IoT, and biometrics, are significantly disrupting the market, enabling more sophisticated and proactive security solutions. Consumer preferences are shifting towards integrated systems that offer centralized management and enhanced situational awareness. The competitive landscape is highly dynamic, with both established players and emerging technology firms vying for market share through product innovation, strategic partnerships, and aggressive pricing strategies. Market penetration of advanced security solutions remains relatively low, offering significant opportunities for growth. Brazil and Chile currently represent the largest markets, with xx% and xx% market share respectively in 2025.

Dominant Regions & Segments in South America Data Center Physical Security Market

Brazil and Chile are the dominant markets in South America, driven by robust economic growth, increasing data center infrastructure investments, and a favorable regulatory environment.

- Brazil: Strong IT sector growth, government initiatives promoting digitalization.

- Chile: Well-developed telecommunications infrastructure, attracting significant foreign investment in data centers.

Within the segments, Video Surveillance and Access Control Solutions dominate the market, representing xx% and xx% respectively in 2025. This is primarily due to their mature technologies and widespread adoption across various data centers. The IT & Telecommunication and BFSI sectors are the leading end-users, exhibiting high demand for sophisticated security solutions to protect critical infrastructure and sensitive data.

- By Solution Type: Video Surveillance (xx%), Access Control Solutions (xx%), Other Solution Types (xx%)

- By Service Type: Consulting Services (xx%), Professional Services (xx%), Other Service Types (xx%)

- By End User: IT & Telecommunication (xx%), BFSI (xx%), Government (xx%), Healthcare (xx%), Other End Users (xx%)

South America Data Center Physical Security Market Product Innovations

Recent product innovations focus on integrating AI and machine learning capabilities into video surveillance systems for improved threat detection and response. Biometric access control solutions, using technologies like fingerprint and facial recognition, are gaining traction, offering enhanced security and convenience. The market is also seeing the adoption of integrated security platforms that provide unified management and control of various security systems, streamlining operations and enhancing situational awareness. These advancements address the need for robust, scalable, and user-friendly security solutions in the face of evolving threats.

Report Scope & Segmentation Analysis

This report segments the South America Data Center Physical Security Market by solution type (Video Surveillance, Access Control Solutions, Other Solution Types), service type (Consulting Services, Professional Services, Other Service Types), end-user (IT & Telecommunication, BFSI, Government, Healthcare, Other End Users), and country (Brazil, Chile). Each segment's growth projections, market size, and competitive dynamics are analyzed comprehensively. For example, the Video Surveillance segment is projected to experience significant growth, driven by the increasing adoption of high-definition cameras and advanced video analytics.

Key Drivers of South America Data Center Physical Security Market Growth

The growth of the South America Data Center Physical Security market is driven by several key factors: increasing government investments in data center infrastructure, stringent data privacy regulations, rising cybersecurity threats, and the burgeoning adoption of cloud computing. The expansion of digital services across key sectors, including finance and healthcare, is further bolstering the demand for advanced security solutions. Technological advancements in areas like AI and biometrics are also creating new opportunities.

Challenges in the South America Data Center Physical Security Market Sector

Challenges include high initial investment costs for advanced security solutions, limited skilled workforce in certain regions, and potential regulatory hurdles. Supply chain disruptions can also impact the availability and cost of security equipment, especially for specialized technologies. The highly competitive market also presents a challenge for smaller players. These factors can collectively impact the market's overall growth.

Emerging Opportunities in South America Data Center Physical Security Market

Emerging opportunities include the growing adoption of cloud-based security solutions, increasing demand for integrated security systems, and the penetration of advanced technologies like AI and biometrics. The expanding data center infrastructure in secondary cities presents untapped growth potential. New market entrants are also exploring innovative solutions to cater to specific needs, opening new avenues for growth and innovation.

Leading Players in the South America Data Center Physical Security Market Market

- Honeywell International Inc

- ABB Ltd

- Johnson Controls International

- Securitas Technology

- Siemens AG

- Genetec Inc

- Schneider Electric

- Hangzhou Hikvision Digital Technology Co Ltd

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

Key Developments in South America Data Center Physical Security Market Industry

- October 2023: Zwipe partnered with Schneider Electric's Security Solutions Group to integrate Zwipe Access fingerprint-scanning smart cards with Schneider Electric's platforms, expanding into data centers and other sectors.

- April 2023: Securitas signed a 5-year agreement with Microsoft to provide data center security services across 31 countries, showcasing the growing demand for comprehensive security solutions.

Future Outlook for South America Data Center Physical Security Market Market

The South America Data Center Physical Security Market is poised for continued growth, driven by expanding data center infrastructure, technological advancements, and increasing cybersecurity concerns. Strategic partnerships, acquisitions, and investments in research and development will be crucial for companies to capitalize on the market's potential. The focus on integrated security solutions and the adoption of AI-powered technologies will shape the future landscape. The market is expected to exhibit a strong growth trajectory throughout the forecast period.

South America Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Other

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Other Service Types (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End User

South America Data Center Physical Security Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems; Advancements in Video Surveillance Systems Connected to Cloud Systems

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Physical Security Infrastructure

- 3.4. Market Trends

- 3.4.1. The IT & Telecom Segment to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Other Service Types (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Brazil South America Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Honeywell International Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ABB Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Johnson Controls International

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Securitas Technology

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Siemens AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Genetec Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Schneider Electric

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Hangzhou Hikvision Digital Technology Co Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Bosch Sicherheitssysteme GmbH

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Axis Communications AB

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Honeywell International Inc

List of Figures

- Figure 1: South America Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: South America Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: South America Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: South America Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: South America Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 11: South America Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 12: South America Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 13: South America Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Chile South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Colombia South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Peru South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Venezuela South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Ecuador South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bolivia South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Paraguay South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Uruguay South America Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Data Center Physical Security Market?

The projected CAGR is approximately 15.60%.

2. Which companies are prominent players in the South America Data Center Physical Security Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Johnson Controls International, Securitas Technology, Siemens AG, Genetec Inc, Schneider Electric, Hangzhou Hikvision Digital Technology Co Ltd, Bosch Sicherheitssysteme GmbH, Axis Communications AB.

3. What are the main segments of the South America Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems; Advancements in Video Surveillance Systems Connected to Cloud Systems.

6. What are the notable trends driving market growth?

The IT & Telecom Segment to Hold Significant Share.

7. Are there any restraints impacting market growth?

High Costs Associated with Physical Security Infrastructure.

8. Can you provide examples of recent developments in the market?

October 2023: Zwipe partnered with Schneider Electric's Security Solutions Group. The France-based multinational Schneider Electric plans to introduce the Zwipe Access fingerprint-scanning smart card to its clientele. This card will be integrated with Schneider Electric's Continuum and Security Expert platforms, serving a client base from sectors including airports, transportation, healthcare, data centers, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the South America Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence