Key Insights

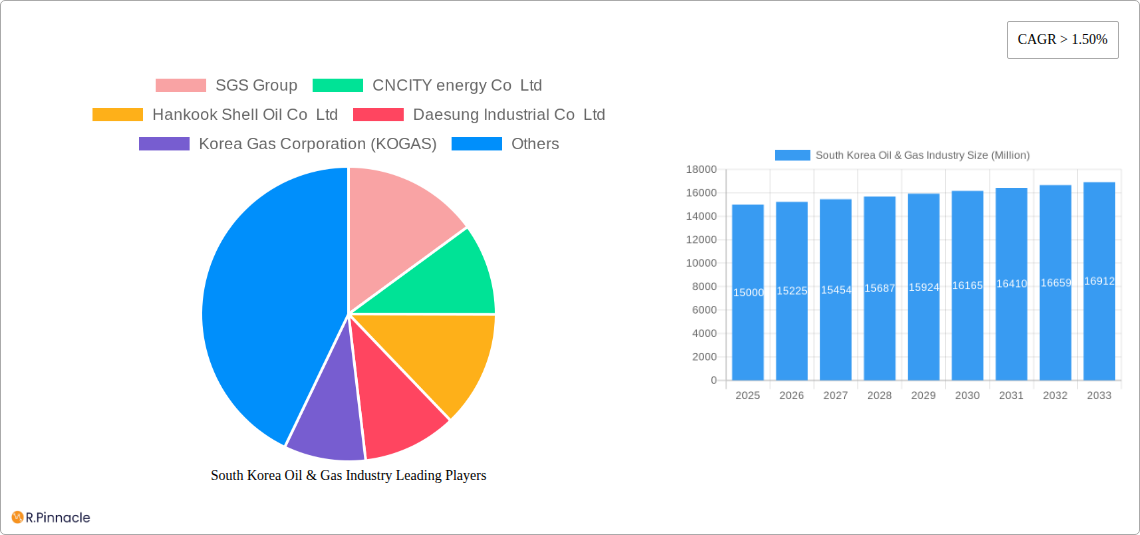

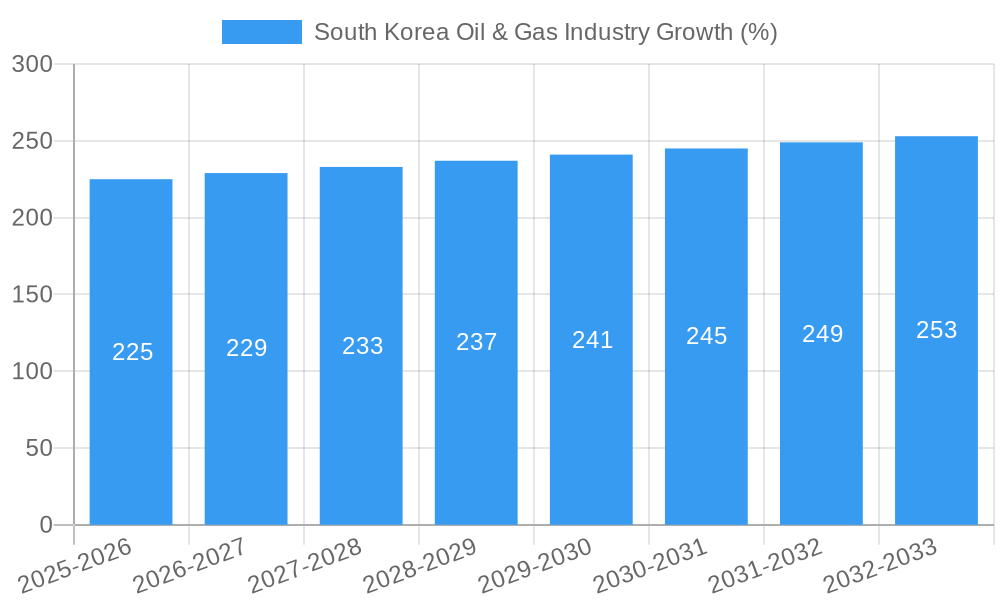

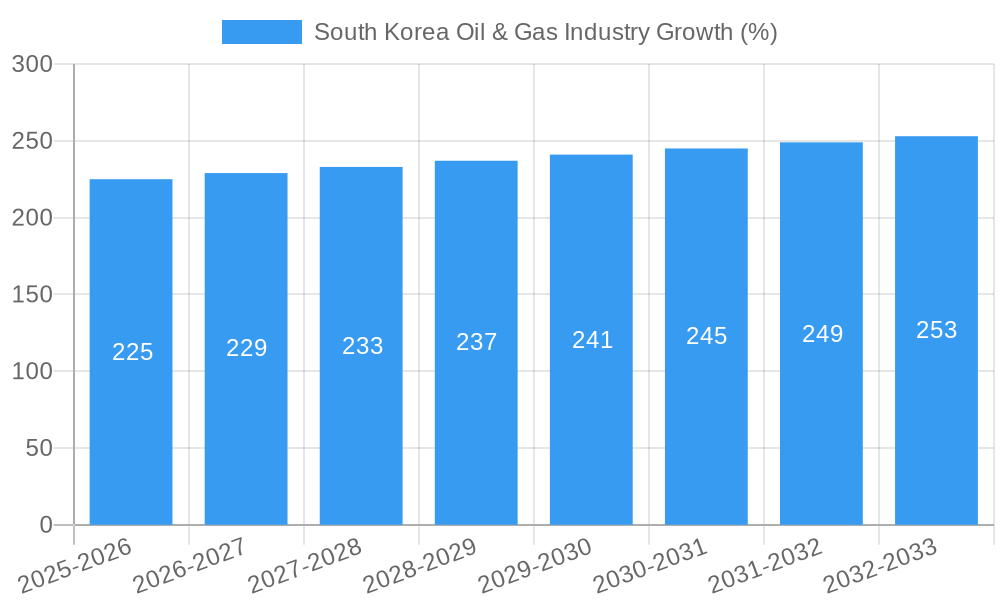

The South Korean oil and gas industry, currently valued at approximately $XX million in 2025 (assuming a reasonable market size based on regional context and global oil & gas market trends), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 1.50% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the nation's robust industrial sector, particularly its manufacturing and transportation segments, demands substantial energy resources, creating consistent demand for oil and gas. Secondly, growing energy consumption from a rising population and increasing urbanization further contribute to market growth. Strategic government initiatives focused on energy security and infrastructure development are also bolstering the industry. However, the market faces certain restraints, including the increasing global emphasis on renewable energy sources, which could lead to a gradual shift away from fossil fuels. Additionally, global price volatility in the oil and gas market could pose challenges for consistent growth. The industry is segmented by end-user, including tanker fleets, container fleets, bulk and general cargo fleets, ferries, offshore support vessels (OSVs), and others. Key players like SGS Group, CNCITY Energy Co Ltd, and major South Korean energy conglomerates such as SK Energy and GS Caltex Corp, dominate the market, vying for market share across these diverse segments.

The forecast period (2025-2033) presents both opportunities and challenges. Continued growth is expected, driven primarily by the nation's industrial and economic development. However, successful navigation of the sector requires a strategic adaptation to evolving global energy trends, focusing on diversification and operational efficiency to mitigate the risks associated with fluctuating oil prices and the increasing global adoption of renewable energy alternatives. The industry's success will hinge on embracing innovative technologies, optimizing supply chains, and strategically engaging in international collaborations to secure energy supplies and stay competitive in a dynamic global market. Further analysis is required to accurately determine the precise market size at the start of the forecast period and more granular segmentation data would significantly aid in assessing future growth prospects within the various market segments.

South Korea Oil & Gas Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the South Korea oil & gas industry, offering crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. We examine key players like SK Energy, GS Caltex Corp, and KOGAS, analyzing their market share and strategic moves within a rapidly evolving energy landscape. The report also details the impact of significant policy changes like the January 2022 designation of LNG as a green fuel.

South Korea Oil & Gas Industry Market Structure & Innovation Trends

This section analyzes the South Korean oil & gas market's competitive landscape, highlighting market concentration, innovation drivers, regulatory influences, and significant M&A activities from 2019-2024. The market is characterized by a mix of large, established players and smaller, specialized firms.

- Market Concentration: The top three players, SK Energy, GS Caltex Corp, and S-Oil Corporation, hold approximately xx% of the market share (2024 estimate).

- Innovation Drivers: Government initiatives promoting renewable energy alongside LNG's green designation are fostering innovation in cleaner technologies and carbon capture.

- Regulatory Framework: Stringent environmental regulations and energy security policies shape the industry's trajectory.

- Product Substitutes: Growth in renewable energy sources is increasing pressure on traditional fossil fuels.

- End-User Demographics: The report segments end-users into Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV, and Others. Details on consumption patterns by segment are provided in subsequent sections.

- M&A Activities: Between 2019 and 2024, xx M&A deals were recorded in the South Korean oil & gas sector, totaling approximately xx Million USD in value. Notable deals involved [mention specific examples if available, otherwise state "consolidation amongst smaller players"].

South Korea Oil & Gas Industry Market Dynamics & Trends

This section explores the market's growth trajectory, technological advancements, and competitive dynamics from 2019-2033. We analyze factors driving market expansion, disruptions from technological advancements (such as LNG's green status), evolving consumer preferences, and intense competitive pressures.

The South Korean oil & gas market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key drivers include rising energy demand, government investments in infrastructure, and the increasing adoption of LNG as a transition fuel. Technological disruptions, particularly in renewable energy integration and carbon capture, will influence market penetration and reshape the competitive landscape. The growing emphasis on environmental sustainability is prompting a shift towards cleaner energy solutions. Market penetration of LNG is expected to reach xx% by 2033, driven by government policies and long-term supply agreements like the one between KOGAS and Qatar.

Dominant Regions & Segments in South Korea Oil & Gas Industry

This section identifies the leading regions and end-user segments within the South Korean oil & gas industry.

Leading Region: The analysis highlights the dominance of specific regions based on factors like industrial concentration, energy infrastructure, and proximity to supply sources. [Describe the dominant region, providing details on its share of market size and volume, in around 200 words.]

Dominant Segments:

- Tanker Fleet: [Describe the significance of the tanker fleet segment, identifying key drivers such as international trade and transportation needs, in around 100 words.]

- Container Fleet: [Describe the significance of the container fleet segment, identifying key drivers such as international trade and transportation needs, in around 100 words.]

- Bulk and General Cargo Fleet: [Describe the significance of the bulk and general cargo fleet segment, identifying key drivers such as international trade and transportation needs, in around 100 words.]

- Ferries and OSV: [Describe the significance of the ferries and OSV segment, identifying key drivers such as domestic transportation and offshore operations, in around 100 words.]

- Others: [Describe the significance of the "others" segment, identifying key drivers and its overall market share in around 100 words.]

South Korea Oil & Gas Industry Product Innovations

The South Korean oil & gas industry is witnessing significant product innovations focused on efficiency and sustainability. Developments in LNG processing and transportation, alongside investments in carbon capture and storage (CCS) technologies, are driving improvements. These innovations aim to enhance operational efficiency, reduce environmental impact, and cater to evolving market needs. The integration of smart technologies in monitoring and managing energy resources is also gaining traction, creating competitive advantages for industry players.

Report Scope & Segmentation Analysis

This report comprehensively segments the South Korean oil & gas market by end-user: Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV, and Others. Each segment's market size, growth projections, and competitive landscape are analyzed, offering a granular understanding of market dynamics. For each segment, we provide a detailed assessment, including market size in Million USD for 2025 (estimated) and 2033 (forecast), along with insights into growth drivers, challenges, and key competitors.

Key Drivers of South Korea Oil & Gas Industry Growth

Several factors drive the growth of the South Korean oil & gas industry. These include increasing energy demand fueled by economic expansion, government support for infrastructure development, and strategic investments in LNG infrastructure. The recent designation of LNG as a green fuel is further boosting the sector's growth, attracting investments and fostering innovation in cleaner technologies.

Challenges in the South Korea Oil & Gas Industry Sector

The South Korean oil & gas industry faces challenges, including stringent environmental regulations, increasing global competition, and the transition towards renewable energy. Supply chain disruptions and volatile global oil and gas prices also pose significant risks. The industry's carbon footprint and its transition to a more sustainable model represent significant long-term challenges. These issues impact profitability and long-term investment strategies.

Emerging Opportunities in South Korea Oil & Gas Industry

Emerging opportunities include increased investment in LNG infrastructure, development of CCS technologies, and exploration of new markets for cleaner energy solutions. The growing emphasis on energy security and the government's support for a clean energy transition create exciting opportunities for both domestic and international players. This presents avenues for sustainable development and economic growth.

Leading Players in the South Korea Oil & Gas Industry Market

- SGS Group

- CNCITY energy Co Ltd

- Hankook Shell Oil Co Ltd

- Daesung Industrial Co Ltd

- Korea Gas Corporation (KOGAS)

- Hyundai Oilbank Co Ltd

- Kukdong Oil & Chemicals Co Ltd

- Korea National Oil Corporation (KNOC)

- SK Energy

- GS Caltex Corp

- S-Oil Corporation

Key Developments in South Korea Oil & Gas Industry Industry

- July 2021: KOGAS signed a 20-year LNG supply agreement with Qatar for 2 Million tons annually starting in 2025. This strengthens South Korea's energy security and underscores the growing importance of LNG.

- January 2022: South Korea classified LNG as a green fuel, significantly influencing the sector's decarbonization strategy and attracting green financing. This decision will affect carbon taxes, emissions caps, the decommissioning of coal plants, and the nation's overall energy mix.

Future Outlook for South Korea Oil & Gas Industry Market

The South Korean oil & gas industry's future is shaped by a combination of challenges and opportunities. The transition to a cleaner energy system will require strategic adaptations and investments in sustainable technologies. However, the growing demand for energy, coupled with government initiatives, presents significant opportunities for growth and innovation. The increasing focus on LNG as a transition fuel offers a pathway for sustainable development while ensuring energy security. The market is expected to consolidate further, with larger players acquiring smaller companies to achieve greater scale and efficiency.

South Korea Oil & Gas Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Korea Oil & Gas Industry Segmentation By Geography

- 1. South Korea

South Korea Oil & Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Demand across Industrial Sector4.; Remote Location of Several Industries and the Unreliability of the Power Supply

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital and Operational Expenditures

- 3.4. Market Trends

- 3.4.1. Downstream segment to dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Oil & Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SGS Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNCITY energy Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hankook Shell Oil Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daesung Industrial Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Korea Gas Corporation (KOGAS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyundai Oilbank Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kukdong Oil & Chemicals Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Korea National Oil Corporation (KNOC)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SK Energy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GS Caltex Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 S-Oil Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SGS Group

List of Figures

- Figure 1: South Korea Oil & Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Oil & Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Oil & Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 3: South Korea Oil & Gas Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Production Analysis 2019 & 2032

- Table 5: South Korea Oil & Gas Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 7: South Korea Oil & Gas Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: South Korea Oil & Gas Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: South Korea Oil & Gas Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: South Korea Oil & Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Region 2019 & 2032

- Table 15: South Korea Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Country 2019 & 2032

- Table 17: South Korea Oil & Gas Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Production Analysis 2019 & 2032

- Table 19: South Korea Oil & Gas Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Consumption Analysis 2019 & 2032

- Table 21: South Korea Oil & Gas Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: South Korea Oil & Gas Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: South Korea Oil & Gas Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: South Korea Oil & Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Korea Oil & Gas Industry Volume metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Oil & Gas Industry?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the South Korea Oil & Gas Industry?

Key companies in the market include SGS Group, CNCITY energy Co Ltd, Hankook Shell Oil Co Ltd, Daesung Industrial Co Ltd, Korea Gas Corporation (KOGAS), Hyundai Oilbank Co Ltd, Kukdong Oil & Chemicals Co Ltd, Korea National Oil Corporation (KNOC), SK Energy, GS Caltex Corp, S-Oil Corporation.

3. What are the main segments of the South Korea Oil & Gas Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Demand across Industrial Sector4.; Remote Location of Several Industries and the Unreliability of the Power Supply.

6. What are the notable trends driving market growth?

Downstream segment to dominate the market.

7. Are there any restraints impacting market growth?

4.; High Capital and Operational Expenditures.

8. Can you provide examples of recent developments in the market?

In January 2022, the country passed a resolution labelling LNG as a green fuel, as a part of its decarbonisation strategy to achieve a clean energy transition. This move is expected to have an impact on green financing, the future course of carbon taxes/emissions caps, the decommissioning pathway of coal-fired plants and South Korea's future energy mix

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Oil & Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Oil & Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Oil & Gas Industry?

To stay informed about further developments, trends, and reports in the South Korea Oil & Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence