Key Insights

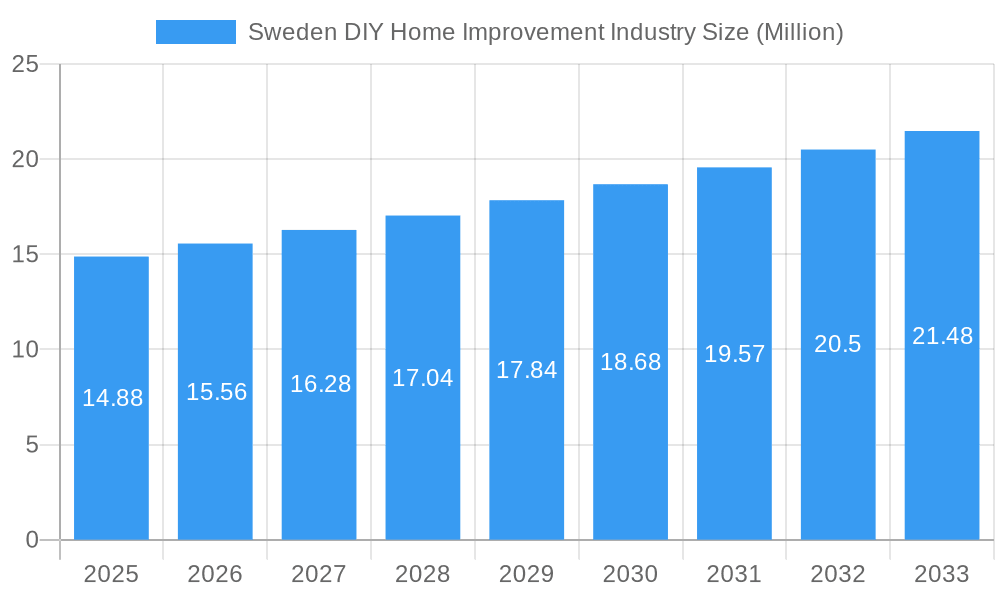

The Swedish DIY home improvement market, valued at €14.88 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.67% from 2025 to 2033. This growth is fueled by several key factors. A rising homeowner population, coupled with increasing disposable incomes, is driving demand for home renovation and improvement projects. The increasing popularity of sustainable and eco-friendly building materials and practices further contributes to market expansion. Additionally, the growing trend of homeowners undertaking DIY projects, facilitated by readily available online resources and improved accessibility of tools and materials through various distribution channels (DIY stores, specialty stores, and e-commerce), fuels this growth. The market segmentation reveals significant opportunities across various product categories, including lumber and landscape management, kitchen renovations, and bathroom upgrades. Companies like Geberit, Dahl, and Bygma are key players, leveraging their established market presence and diverse product offerings.

Sweden DIY Home Improvement Industry Market Size (In Million)

However, certain restraints are expected to influence market growth. Fluctuations in raw material prices, particularly lumber, and potential economic downturns could impact consumer spending on home improvements. Furthermore, increased competition, both from established players and new entrants, may lead to price pressure and reduced profit margins. Despite these challenges, the Swedish DIY home improvement market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and a sustained focus on enhancing home aesthetics and functionality. The expanding online retail segment presents a significant opportunity for players to reach a wider customer base and optimize their distribution strategies. Strategic partnerships and product innovation will be crucial for companies seeking to capitalize on this dynamic market.

Sweden DIY Home Improvement Industry Company Market Share

Sweden DIY Home Improvement Industry: A Comprehensive Market Report (2019-2033)

This report provides an in-depth analysis of the Swedish DIY home improvement market, offering invaluable insights for industry professionals, investors, and strategists. The study covers the period from 2019 to 2033, with a focus on the estimated year 2025. We analyze market size, segmentation, key players, growth drivers, challenges, and future opportunities, leveraging data from the historical period (2019-2024) and forecasting market trends until 2033. The total market value is predicted to reach xx Million by 2033.

Sweden DIY Home Improvement Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Swedish DIY home improvement market, exploring market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational corporations and smaller specialized firms. Key players like Geberit Aktiebolag, Dahl Sverige Aktiebolag, Bygma AB, Onninen Aktiebolag, Villeroy & Boch Gustavsberg AB, Svedbergs i Dalstorp AB, Eksjohus Aktiebolag, AB Karl Hedin Bygghandel, Solar Sverige Aktiebolag, LK Systems AB, Optimera Svenska AB, and Lundagrossisten Bo Johansson Aktiebolag hold significant market share.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players dominating certain segments. Precise market share figures for each company require further analysis and will be detailed in the full report.

- Innovation Drivers: Sustainability, smart home technology integration, and increasing demand for personalized solutions drive innovation.

- Regulatory Frameworks: Building codes and environmental regulations significantly impact product development and market access.

- Product Substitutes: The increasing availability of affordable alternatives influences consumer choices.

- End-User Demographics: The target demographic includes homeowners, renters, and property developers of all age groups and socioeconomic backgrounds.

- M&A Activities: The report will detail M&A activities in the sector over the study period, analyzing the values of significant deals and their impact on market dynamics. The total value of M&A deals during the historical period is estimated at xx Million.

Sweden DIY Home Improvement Industry Market Dynamics & Trends

This section delves into the dynamic forces shaping the Swedish DIY home improvement market, including market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market experienced a CAGR of xx% during the historical period (2019-2024). This growth is driven by several factors including rising disposable incomes, increasing homeownership rates, and a growing preference for home renovation projects. The penetration of online sales channels is also increasing, contributing to market expansion. Technological disruptions like the rise of e-commerce and the adoption of smart home technologies are transforming the industry. Consumer preferences are shifting towards sustainable and eco-friendly products, while competition is intensifying among both traditional and online retailers. Market penetration rates for different product segments will be detailed in the complete report.

Dominant Regions & Segments in Sweden DIY Home Improvement Industry

This section identifies the leading regions and segments within the Swedish DIY home improvement market. While precise regional dominance data requires further analysis, the larger urban centers are expected to show higher market penetration. The dominant segments are analyzed in detail.

- Product Type: The Kitchen, Building Materials, and Plumbing & Equipment segments are expected to be among the largest. Key drivers for the growth of these segments include: increased housing construction, renovation trends, and rising consumer spending.

- Distribution Channel: DIY home improvement stores remain the primary distribution channel, but online sales are experiencing rapid growth.

Sweden DIY Home Improvement Industry Product Innovations

The Swedish DIY home improvement sector is experiencing a surge in product innovations, with a strong emphasis on elevating sustainability, enhancing practical functionality, and optimizing user convenience. Key advancements include the integration of smart home technology into appliances for seamless connectivity and control, the widespread adoption of advanced eco-friendly building materials that minimize environmental impact, and the development of ergonomically designed tools that prioritize user comfort and safety during projects. This wave of innovation is directly propelled by a discerning consumer base actively seeking sustainable solutions, a growing comfort with sophisticated technology, and an increasing desire for projects that are both efficient and enjoyable.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Swedish DIY home improvement market, providing in-depth analysis across key product categories: Lumber and Landscape management, Decor and Indoor Garden, Kitchen, Painting and Wallpaper, Tools and Hardware, Building Materials, Lighting, Plumbing and Equipment, Flooring, Repair and Replacement, and Electric Work. Furthermore, it dissects the market by crucial distribution channels, including DIY Home Improvement Stores, Specialty Stores, Online platforms, and Other channels. For each identified segment, the report will present a detailed evaluation of its current market size, projected growth trajectories, and the prevailing competitive landscape. Projections indicate that market sizes for individual segments in 2025 are anticipated to range broadly from [Insert Lower Range] Million to [Insert Higher Range] Million, offering valuable insights for strategic planning.

Key Drivers of Sweden DIY Home Improvement Industry Growth

The dynamic growth trajectory of the Swedish DIY home improvement market is underpinned by a confluence of robust economic and societal factors, including:

- Ascending Disposable Incomes: A sustained rise in disposable incomes directly translates to increased household budgets allocated towards home enhancement and renovation projects, fostering greater consumer spending.

- Expanding Homeownership Trends: The growing prevalence of homeownership is a fundamental driver, as more individuals and families actively engage in maintaining, upgrading, and personalizing their properties, thereby boosting demand for DIY solutions.

- Supportive Government Initiatives: Proactive government policies and targeted initiatives play a crucial role by encouraging homeownership and championing the adoption of sustainable and energy-efficient building practices, creating a favorable market environment.

Challenges in the Sweden DIY Home Improvement Industry Sector

The Swedish DIY home improvement sector faces several challenges:

- Supply Chain Disruptions: Global supply chain issues can lead to increased costs and product shortages.

- Fluctuating Raw Material Prices: The cost of raw materials impacts pricing and profitability.

- Intense Competition: The market is competitive, requiring companies to differentiate themselves through innovation and value-added services.

Emerging Opportunities in Sweden DIY Home Improvement Industry

The evolving landscape of the Swedish DIY home improvement sector presents a wealth of exciting opportunities, particularly in the following areas:

- Advanced Smart Home Technology Integration: The escalating consumer interest in connected living and intelligent home systems creates significant potential for innovative products that seamlessly integrate with existing smart home ecosystems, offering enhanced convenience and functionality.

- Pioneering Sustainable and Eco-Friendly Solutions: A pronounced and growing consumer preference for environmentally conscious products and practices presents a substantial growth avenue, driving demand for green building materials, energy-efficient fixtures, and sustainable design approaches.

- Expansion into Specialized Services: Moving beyond product sales, offering value-added services such as professional design consultation, installation assistance, and tailored project management solutions can significantly broaden market reach and enhance customer engagement.

Leading Players in the Sweden DIY Home Improvement Industry Market

- Geberit Aktiebolag

- Dahl Sverige Aktiebolag

- Bygma AB

- Onninen Aktiebolag

- Villeroy & Boch Gustavsberg AB

- Svedbergs i Dalstorp AB

- Eksjohus Aktiebolag

- AB Karl Hedin Bygghandel

- Solar Sverige Aktiebolag

- LK Systems AB

- Optimera Svenska AB

- Lundagrossisten Bo Johansson Aktiebolag

Key Developments in Sweden DIY Home Improvement Industry

- July 2022: IKEA City opened in Stockholm, increasing accessibility for residents.

- November 2023: Bauhaus expands to northern Sweden with new stores in Karlstad-Valsviken.

Future Outlook for Sweden DIY Home Improvement Industry Market

The Swedish DIY home improvement market is expected to experience continued growth over the forecast period (2025-2033), driven by sustained economic growth, increasing urbanization, and a strong focus on home improvement projects. Strategic opportunities lie in expanding online channels, embracing sustainable practices, and offering value-added services.

Sweden DIY Home Improvement Industry Segmentation

-

1. Product Type

- 1.1. Lumber and Landscape management

- 1.2. Decor and Indoor Garden

- 1.3. Kitchen

- 1.4. Painting and Wallpaper

- 1.5. Tools and Hardware

- 1.6. Building Materials

- 1.7. Ligthing

- 1.8. Plumbing and Equipment

- 1.9. Flooring, Repair and Replacement

- 1.10. Electric Work

-

2. Distribution Channel

- 2.1. DIY Home Improvement Stores

- 2.2. Speciality Stores

- 2.3. Online

- 2.4. Others

Sweden DIY Home Improvement Industry Segmentation By Geography

- 1. Sweden

Sweden DIY Home Improvement Industry Regional Market Share

Geographic Coverage of Sweden DIY Home Improvement Industry

Sweden DIY Home Improvement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Interest in Home Renovation and Personalization

- 3.3. Market Restrains

- 3.3.1. Lack of Expertise and Skills

- 3.4. Market Trends

- 3.4.1. Increasing Number of DIY Retail Stores in Sweden

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden DIY Home Improvement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lumber and Landscape management

- 5.1.2. Decor and Indoor Garden

- 5.1.3. Kitchen

- 5.1.4. Painting and Wallpaper

- 5.1.5. Tools and Hardware

- 5.1.6. Building Materials

- 5.1.7. Ligthing

- 5.1.8. Plumbing and Equipment

- 5.1.9. Flooring, Repair and Replacement

- 5.1.10. Electric Work

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. DIY Home Improvement Stores

- 5.2.2. Speciality Stores

- 5.2.3. Online

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Geberit Aktiebolag

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dahl Sverige Aktiebolag

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bygma AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Onninen Aktiebolag

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Villeroy & Boch Gustavsberg AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Svedbergs i Dalstorp AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eksjohus Aktiebolag

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AB Karl Hedin Bygghandel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solar Sverige Aktiebolag

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LK Systems AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Optimera Svenska AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lundagrossisten Bo Johansson Aktiebolag

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Geberit Aktiebolag

List of Figures

- Figure 1: Sweden DIY Home Improvement Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Sweden DIY Home Improvement Industry Share (%) by Company 2025

List of Tables

- Table 1: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Sweden DIY Home Improvement Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Sweden DIY Home Improvement Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden DIY Home Improvement Industry?

The projected CAGR is approximately 4.67%.

2. Which companies are prominent players in the Sweden DIY Home Improvement Industry?

Key companies in the market include Geberit Aktiebolag, Dahl Sverige Aktiebolag, Bygma AB, Onninen Aktiebolag, Villeroy & Boch Gustavsberg AB, Svedbergs i Dalstorp AB, Eksjohus Aktiebolag, AB Karl Hedin Bygghandel, Solar Sverige Aktiebolag, LK Systems AB, Optimera Svenska AB, Lundagrossisten Bo Johansson Aktiebolag.

3. What are the main segments of the Sweden DIY Home Improvement Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Interest in Home Renovation and Personalization.

6. What are the notable trends driving market growth?

Increasing Number of DIY Retail Stores in Sweden.

7. Are there any restraints impacting market growth?

Lack of Expertise and Skills.

8. Can you provide examples of recent developments in the market?

November 2023: Bauhaus is expanding to the north of Sweden, by opening new stores in Vaxjo and Umea (2022) and now Karlstad-Valsviken in the center Swedish province of Värmland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden DIY Home Improvement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden DIY Home Improvement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden DIY Home Improvement Industry?

To stay informed about further developments, trends, and reports in the Sweden DIY Home Improvement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence