Key Insights

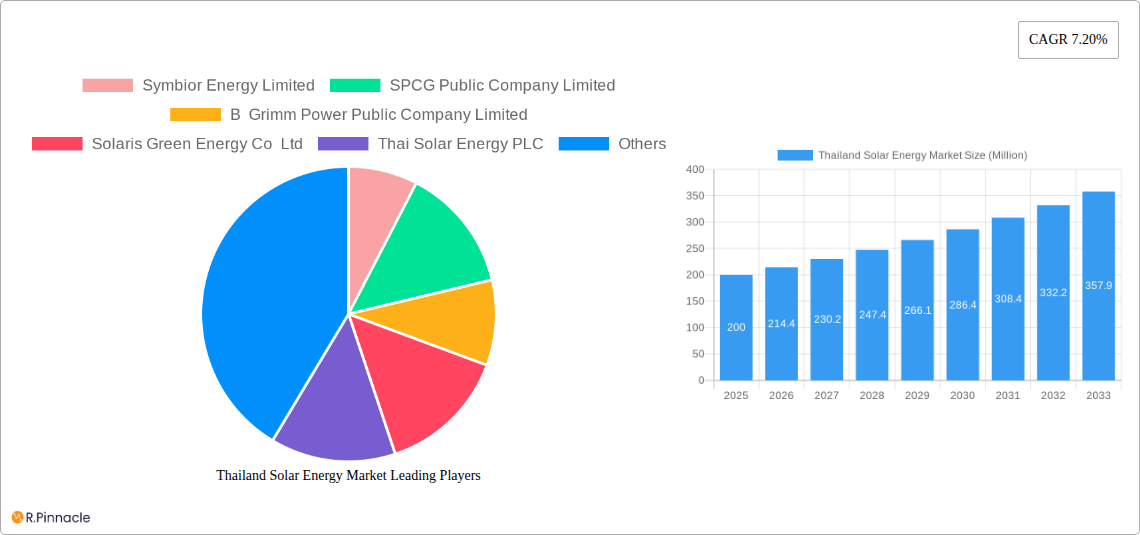

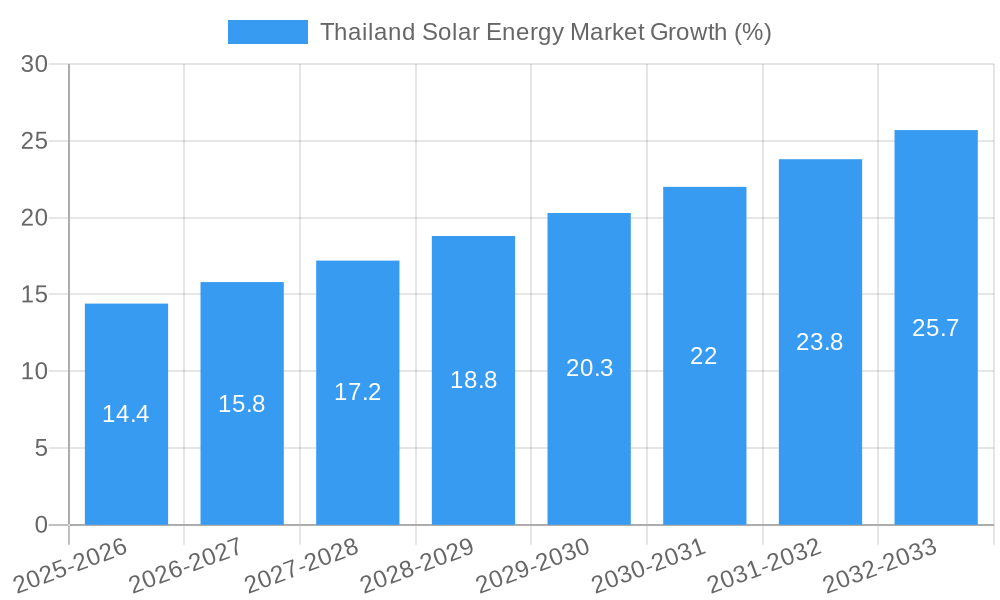

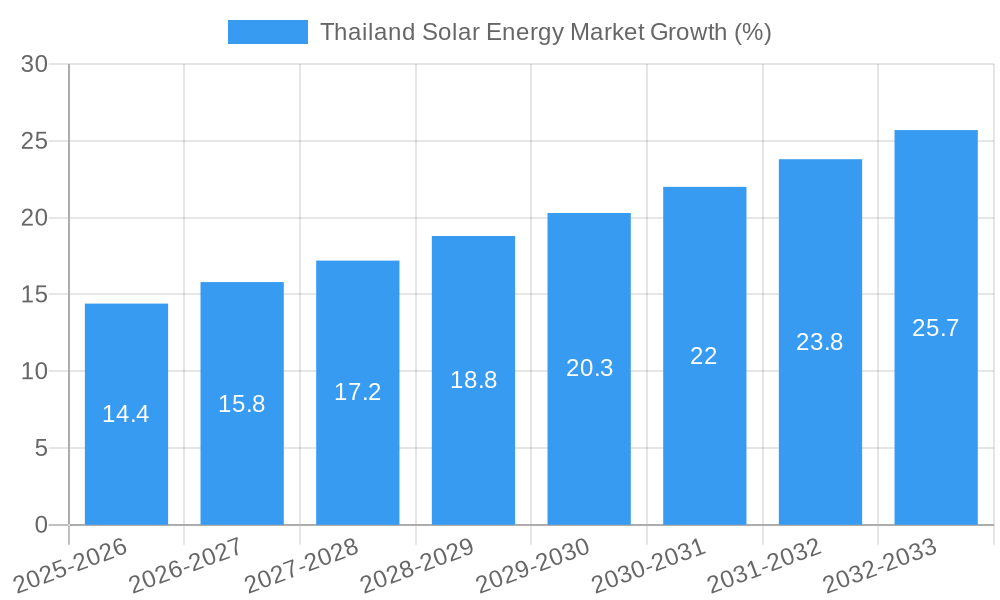

The Thailand solar energy market is experiencing robust growth, driven by the government's strong commitment to renewable energy targets, increasing electricity demand, and declining solar PV technology costs. The market, valued at approximately 200 million USD in 2025 (estimated based on the provided CAGR and market size), is projected to maintain a Compound Annual Growth Rate (CAGR) of 7.20% from 2025 to 2033. This expansion is fueled by significant investments in large-scale solar farms, coupled with growing adoption of rooftop solar systems in residential and commercial sectors. Key trends include the integration of solar energy with energy storage solutions to address intermittency challenges and the increasing adoption of advanced solar technologies like Concentrated Solar Power (CSP) to enhance efficiency. However, land availability and grid integration constraints pose potential challenges to the market’s sustained growth. The presence of established players like Symbior Energy Limited and B Grimm Power, alongside international companies such as Black & Veatch and Marubeni Corporation, indicates a competitive but dynamic market landscape.

The solar photovoltaic (PV) segment currently dominates the market, owing to its lower upfront costs and widespread accessibility. However, the Concentrated Solar Power (CSP) segment is expected to witness substantial growth over the forecast period, driven by government incentives and technological advancements aiming to improve energy storage and efficiency. The market's regional distribution is primarily concentrated in Thailand, with potential for expansion into neighboring countries through cross-border energy projects. Overall, the Thailand solar energy market presents a lucrative opportunity for investors and businesses, offering significant returns while contributing to the nation's sustainable energy goals and reducing its carbon footprint. Further growth will likely hinge on addressing regulatory hurdles, improving grid infrastructure, and fostering public-private partnerships to accelerate solar energy adoption.

Thailand Solar Energy Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Thailand solar energy market, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, dynamics, leading players, and future outlook. Leveraging extensive data and expert analysis, this report is crucial for understanding the growth trajectory of Thailand's burgeoning solar energy sector.

Thailand Solar Energy Market Market Structure & Innovation Trends

The Thailand solar energy market exhibits a moderately concentrated structure, with key players such as Symbior Energy Limited, SPCG Public Company Limited, B Grimm Power Public Company Limited, Solaris Green Energy Co Ltd, Thai Solar Energy PLC, Black & Veatch Holding Company, Solartron PLC, Marubeni Corporation, and Energy Absolute PCL holding significant market share. Market share data for 2024 indicates that the top five companies collectively account for approximately xx% of the market. Innovation is driven by government incentives, technological advancements in Solar Photovoltaic (PV) technology, and the increasing adoption of renewable energy sources. The regulatory framework, while supportive, faces occasional challenges in streamlining approvals. Product substitutes include traditional fossil fuel-based energy sources, but their market share is steadily decreasing due to the declining cost of solar energy. End-user demographics encompass residential, commercial, and industrial sectors, with significant growth anticipated in the industrial sector. M&A activity in the sector has seen xx deals valued at approximately $xx Million in the past five years, driven by a consolidation trend amongst smaller players.

Thailand Solar Energy Market Market Dynamics & Trends

The Thailand solar energy market is experiencing robust growth, driven by the government's ambitious renewable energy targets, rising electricity demand, and decreasing solar PV technology costs. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, reflecting the strong market momentum. Technological disruptions, such as advancements in PV efficiency and battery storage solutions, are further accelerating market expansion. Consumer preferences are shifting towards environmentally friendly energy sources, boosting demand for solar power. Competitive dynamics are characterized by price competition, innovation in technology, and efforts to secure favorable power purchase agreements. Market penetration of solar PV in the overall energy mix is projected to reach xx% by 2033, a significant increase from the current xx%.

Dominant Regions & Segments in Thailand Solar Energy Market

The dominant segment within the Thailand solar energy market is Solar Photovoltaic (PV), accounting for over xx% of the market share in 2024. Concentrated Solar Power (CSP) holds a relatively smaller share, but its growth potential is being explored.

- Key Drivers for PV Dominance:

- Government subsidies and feed-in tariffs.

- Declining PV module costs.

- Abundant solar irradiance.

- Extensive grid infrastructure in certain regions.

The Central region of Thailand dominates the solar energy market, driven by higher electricity demand from industrial and commercial consumers, and favorable government policies. This region benefits from well-established grid infrastructure and supportive government incentives. Other regions are experiencing growth, but at a slower pace due to limitations in grid infrastructure and access to financing.

Thailand Solar Energy Market Product Innovations

Recent product innovations include higher-efficiency PV modules, improved energy storage solutions, and the increasing adoption of floating solar power plants, enhancing the effectiveness and reducing the land requirements of solar energy projects. These innovations reflect a trend towards cost reduction and enhanced performance, improving the overall market fit.

Report Scope & Segmentation Analysis

This report segments the Thailand solar energy market based on technology (Solar Photovoltaic (PV) and Concentrated Solar Power (CSP)) and end-user (residential, commercial, and industrial). The PV segment is expected to experience significant growth during the forecast period (2025-2033), driven by declining costs and increasing demand. The CSP segment has a comparatively smaller market size, however, advancements in CSP technology and government support could lead to future growth. Competitive dynamics within each segment are influenced by factors such as technology, cost, and market access.

Key Drivers of Thailand Solar Energy Market Growth

The growth of the Thailand solar energy market is driven by several key factors:

- Government Policies: Supportive government policies, including feed-in tariffs, tax incentives, and renewable energy targets, significantly contribute to market growth.

- Decreasing Costs: The decreasing cost of solar PV technology makes it increasingly competitive with traditional energy sources.

- Technological Advancements: Advancements in PV efficiency and battery storage technology further enhance solar energy's attractiveness.

- Rising Energy Demand: Thailand's increasing energy demand necessitates a shift towards cleaner and more sustainable energy sources.

Challenges in the Thailand Solar Energy Market Sector

The Thailand solar energy market faces challenges including:

- Grid Integration: Integrating large-scale solar power plants into the existing grid infrastructure can pose technical and logistical challenges.

- Land Availability: Securing suitable land for large-scale solar projects can be a constraint.

- Financing: Access to affordable financing remains a challenge for some projects.

Emerging Opportunities in Thailand Solar Energy Market

Emerging opportunities include:

- Floating Solar Farms: Expanding utilization of floating solar farms on reservoirs and other water bodies to maximize land usage.

- Solar-plus-storage systems: Combining solar PV with battery storage solutions to improve grid stability and address intermittency.

- Rooftop Solar: Growing adoption of rooftop solar systems in residential and commercial sectors.

Leading Players in the Thailand Solar Energy Market Market

- Symbior Energy Limited

- SPCG Public Company Limited

- B Grimm Power Public Company Limited

- Solaris Green Energy Co Ltd

- Thai Solar Energy PLC

- Black & Veatch Holding Company

- Solartron PLC

- Marubeni Corporation

- Energy Absolute PCL

Key Developments in Thailand Solar Energy Market Industry

- June 2023: National Power Supply Public Company Limited (NPS) completed the first phase of a 60 MW floating solar power plant, with a 90 MW Phase 2 planned for completion in Q1 2024.

- March 2023: Falken Tires announced a 22 MW solar panel installation at its SRI factory, highlighting growing corporate adoption of solar energy.

Future Outlook for Thailand Solar Energy Market Market

The future outlook for the Thailand solar energy market is positive, with continued strong growth expected driven by supportive government policies, decreasing costs, and technological advancements. Strategic opportunities exist for companies to capitalize on this growth by investing in innovative technologies, expanding into new markets, and developing effective strategies for grid integration and project financing. The market is poised for significant expansion, with substantial potential for further investment and development in the coming years.

Thailand Solar Energy Market Segmentation

-

1. Technology

- 1.1. Solar Photovoltaic (PV)

- 1.2. Concentrated Solar Power (CSP)

Thailand Solar Energy Market Segmentation By Geography

- 1. Thailand

Thailand Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies and Increasing Adoption of Solar PV Systems4.; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption

- 3.3. Market Restrains

- 3.3.1. 4.; The Growth of Other Renewable Technologies Such as Wind and Bioenergy

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Symbior Energy Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SPCG Public Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 B Grimm Power Public Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solaris Green Energy Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thai Solar Energy PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Black & Veatch Holding Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Solartron PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Marubeni Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Energy Absolute PCL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Symbior Energy Limited

List of Figures

- Figure 1: Thailand Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Thailand Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Solar Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Thailand Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Thailand Solar Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 5: Thailand Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Thailand Solar Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Thailand Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Thailand Solar Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Thailand Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 10: Thailand Solar Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 11: Thailand Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Thailand Solar Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Solar Energy Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Thailand Solar Energy Market?

Key companies in the market include Symbior Energy Limited, SPCG Public Company Limited, B Grimm Power Public Company Limited, Solaris Green Energy Co Ltd, Thai Solar Energy PLC, Black & Veatch Holding Company, Solartron PLC, Marubeni Corporation, Energy Absolute PCL.

3. What are the main segments of the Thailand Solar Energy Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies and Increasing Adoption of Solar PV Systems4.; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growth of Other Renewable Technologies Such as Wind and Bioenergy.

8. Can you provide examples of recent developments in the market?

June 2023: National Power Supply Public Company Limited (NPS) has completed the installation of the first phase of the 60 MW floating solar power plant on the well. The plant will start generating electricity in the fourth quarter of 2023. Also, the company is installing a 90 MW Floating Solar Farm Phase 2 which is expected to be completed and ready to generate electricity in the first quarter of next year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Solar Energy Market?

To stay informed about further developments, trends, and reports in the Thailand Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence