Key Insights

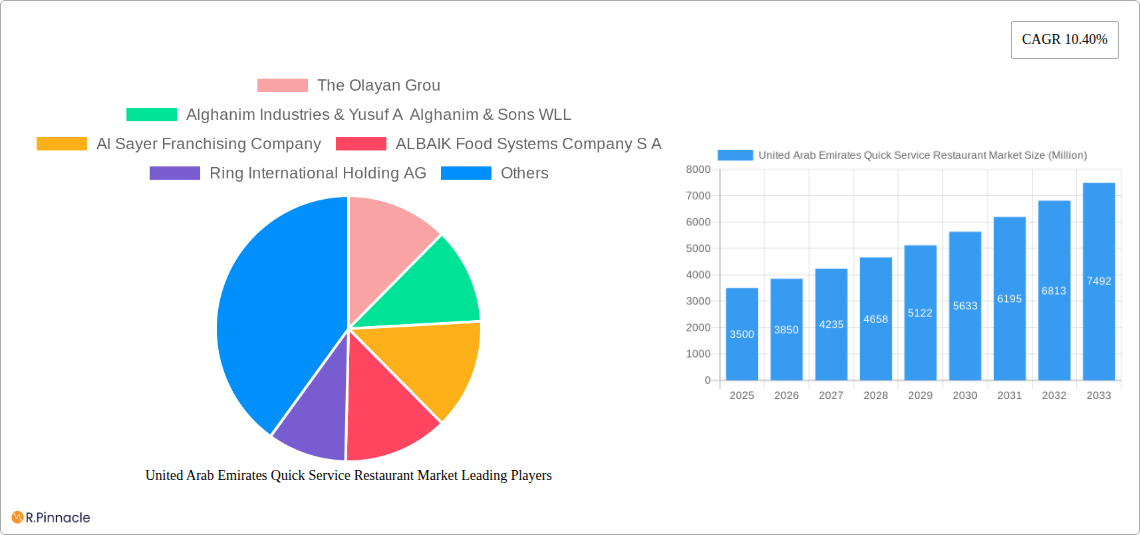

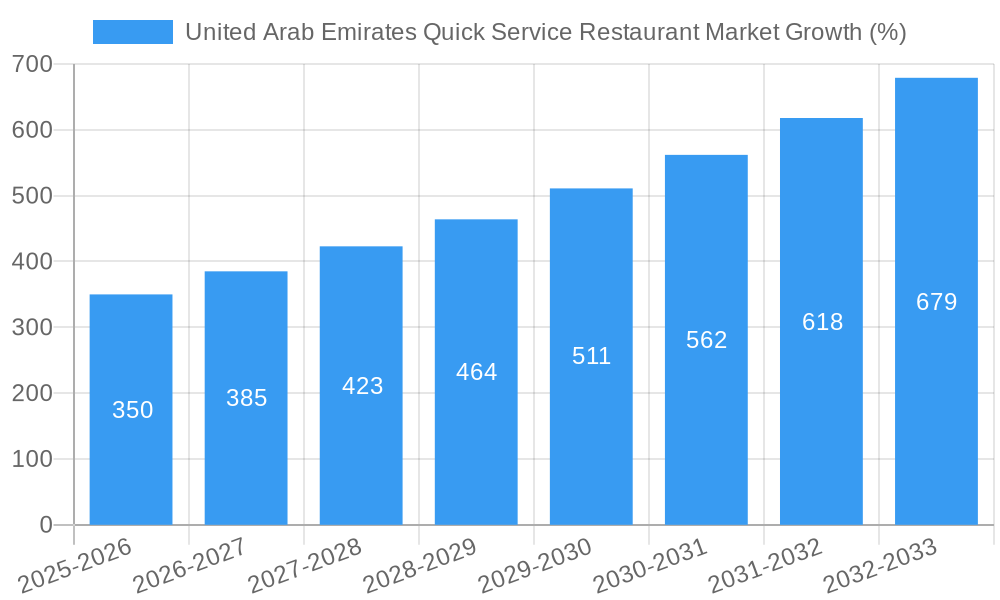

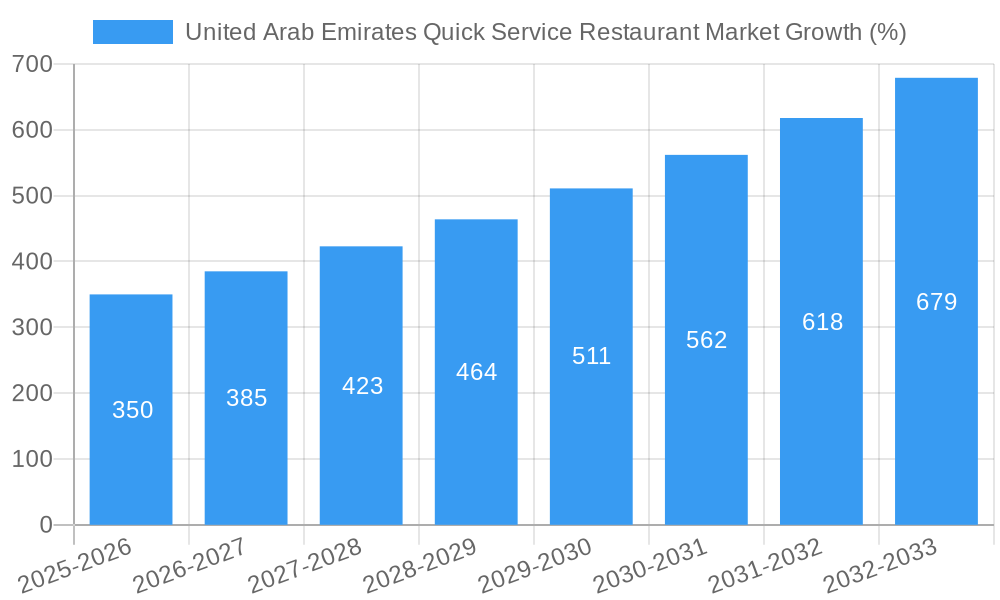

The United Arab Emirates (UAE) Quick Service Restaurant (QSR) market is experiencing robust growth, driven by a burgeoning population, increasing disposable incomes, and a preference for convenient and affordable dining options. The market's diverse culinary landscape, encompassing bakeries, burgers, ice cream, meat-based cuisines, pizza, and other QSR offerings, caters to a wide range of consumer preferences. The presence of both chained and independent outlets across various locations – leisure, lodging, retail, standalone, and travel – ensures widespread accessibility. While a precise market size for 2025 isn't provided, considering a global QSR CAGR of 10.40% and the UAE's strong economic performance, a reasonable estimate for the UAE QSR market size in 2025 would be in the range of $3-4 billion (USD). This substantial market value is fueled by the significant tourist influx and the high concentration of expatriates in the UAE, leading to a diverse demand for various cuisines. The competitive landscape includes both international giants like Americana Restaurants International PLC and M H Alshaya Co WLL, alongside successful local players such as ALBAIK Food Systems Company S A. Future growth will likely be influenced by factors such as evolving consumer tastes, the increasing adoption of food delivery platforms, and the rise of health-conscious options within the QSR sector. Expansion into less saturated segments, such as specialized healthy QSR options, could offer significant growth opportunities for market entrants.

The UAE QSR market segmentation reveals a dynamic mix of cuisine preferences and outlet types. The dominance of specific cuisines like burgers and pizza is likely, reflecting global trends. However, the growth of local and ethnic cuisine QSR options presents a unique opportunity. The distribution of outlets across various locations shows the strategic importance of accessibility for consumers, highlighting the need for diverse locations in the bustling urban landscape and strategic placement in tourist hotspots. The competitive landscape shows both established international players and strong local brands that have successfully catered to local preferences. Continued investment in technology, innovation in menu offerings, and a focus on customer experience will be crucial for success in this competitive but rapidly expanding market. The sustained growth projected for the next decade suggests a bright outlook for the UAE QSR sector.

United Arab Emirates Quick Service Restaurant (QSR) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United Arab Emirates' Quick Service Restaurant market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Expect in-depth analysis on market size, segmentation, key players, growth drivers, challenges, and future opportunities. The report includes extensive data and projections, using Million (M) as the unit for all values.

United Arab Emirates Quick Service Restaurant Market Structure & Innovation Trends

This section analyzes the UAE QSR market's competitive landscape, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. We examine the influence of product substitutes and end-user demographics on market dynamics. The report delves into the market share held by major players, including The Olayan Group, Alghanim Industries & Yusuf A Alghanim & Sons WLL, Al Sayer Franchising Company, ALBAIK Food Systems Company S.A., Ring International Holding AG, Americana Restaurants International PLC, M H Alshaya Co WLL, Kamal Osman Jamjoom Group LLC, Apparel Group, and AlAmar Foods Company. We also analyze M&A activities, providing insights into deal values (in M) and their impact on market structure. The xx% market share held by the top 5 players is detailed, along with an assessment of the overall market concentration. Innovation drivers, such as technological advancements and changing consumer preferences are investigated, along with regulatory frameworks and their influence.

United Arab Emirates Quick Service Restaurant Market Dynamics & Trends

This section explores the key dynamics driving the growth of the UAE QSR market, focusing on market growth drivers (projected at xx% CAGR during the forecast period), technological disruptions, evolving consumer preferences, and competitive dynamics. The report analyzes market penetration rates for various QSR segments, highlighting the impact of factors such as urbanization, increasing disposable incomes, and changing lifestyles. Detailed analysis of consumer behavior, including dining habits, preferred cuisines, and preferred channels for ordering food is also covered. We look at technological advancements like online ordering platforms and mobile payment systems and their influence on market growth and disruption. Finally, competitive dynamics, including pricing strategies, marketing campaigns, and product differentiation, are assessed.

Dominant Regions & Segments in United Arab Emirates Quick Service Restaurant Market

This section identifies the leading regions, cuisines, outlets, and locations within the UAE QSR market. We provide a detailed analysis of the dominance of specific segments and explore the key drivers behind this dominance.

Leading Cuisine: The report pinpoints the dominant cuisine (e.g., Burger, Pizza, etc.) and explains the reasons for its market leadership. This analysis considers factors like consumer preferences, brand presence, and pricing strategies. The market size (in M) for each cuisine segment will be detailed, along with growth projections for the forecast period.

Dominant Outlet Type: A comparative analysis of chained and independent outlets is undertaken, focusing on their respective market shares and growth trajectories. Factors such as operational efficiency, brand recognition, and investment capabilities are considered.

Top Performing Location: The report analyzes the performance of QSRs across different locations (Leisure, Lodging, Retail, Standalone, Travel) and pinpoints the most successful location type, backed by data and analysis. Factors driving the success of each location type, including demographics, foot traffic, and accessibility, are investigated.

United Arab Emirates Quick Service Restaurant Market Product Innovations

This section summarizes recent product developments, focusing on technological trends and their market fit. This includes innovations in menu offerings, service models, and customer engagement strategies. The competitive advantages derived from these innovations and their impact on market share are assessed. Examples include the adoption of automation, personalized ordering systems, and loyalty programs.

Report Scope & Segmentation Analysis

This report segments the UAE QSR market across various parameters:

Cuisine: Bakeries, Burger, Ice Cream, Meat-based Cuisines, Pizza, Other QSR Cuisines. Each segment's projected growth, market size (in M), and competitive dynamics are examined.

Outlet: Chained Outlets, Independent Outlets. The report provides growth projections, market size (in M) for each segment, and a competitive analysis.

Location: Leisure, Lodging, Retail, Standalone, Travel. Growth projections, market sizes (in M), and competitive dynamics within each location segment are included.

Key Drivers of United Arab Emirates Quick Service Restaurant Market Growth

Key factors driving the growth of the UAE QSR market are explored, including:

- Economic Growth: Rising disposable incomes and a growing population fuel demand.

- Tourism: The UAE's robust tourism sector contributes significantly to QSR market growth.

- Technological Advancements: Digital ordering and delivery platforms are transforming the industry.

- Changing Lifestyles: Busy schedules and convenience-seeking behavior drive demand for quick meals.

Challenges in the United Arab Emirates Quick Service Restaurant Market Sector

The report also identifies challenges facing the UAE QSR market:

- High Operating Costs: Rent, labor, and food costs present significant challenges.

- Intense Competition: The market is highly competitive, requiring constant innovation.

- Regulatory Compliance: Navigating regulations and licensing can be complex.

- Supply Chain Disruptions: Global events can affect food sourcing and pricing.

Emerging Opportunities in United Arab Emirates Quick Service Restaurant Market

This section highlights emerging opportunities for growth:

- Healthier Options: Growing demand for healthier food choices.

- Experiential Dining: Creating unique dining experiences to attract customers.

- Technology Integration: Leveraging technology for improved efficiency and customer engagement.

- Expansion into Niche Markets: Catering to specific dietary needs and preferences.

Leading Players in the United Arab Emirates Quick Service Restaurant Market Market

- The Olayan Group

- Alghanim Industries & Yusuf A Alghanim & Sons WLL

- Al Sayer Franchising Company

- ALBAIK Food Systems Company S.A.

- Ring International Holding AG

- Americana Restaurants International PLC

- M H Alshaya Co WLL

- Kamal Osman Jamjoom Group LLC

- Apparel Group

- AlAmar Foods Company

Key Developments in United Arab Emirates Quick Service Restaurant Market Industry

- January 2023: Maristo Hospitality signed a master franchisee agreement with German Doner Kebab (GDK), planning expansion in the UAE and the Middle East.

- December 2022: Apparel Group launched its 250th Tim Hortons store in Dubai, aiming for 500 outlets by 2025.

- October 2022: Maristo Hospitality opened Sisi's Eatery in Dubai Hills Mall.

Future Outlook for United Arab Emirates Quick Service Restaurant Market Market

The UAE QSR market is poised for continued growth, driven by factors such as increasing urbanization, a young and diverse population, and rising disposable incomes. Strategic opportunities exist for companies that can adapt to evolving consumer preferences, leverage technology effectively, and offer innovative products and services. The market is expected to witness further consolidation, with larger players acquiring smaller chains to expand their market share and geographic reach. The focus on healthy and sustainable options, along with personalized customer experiences, will shape the future of the UAE QSR landscape.

United Arab Emirates Quick Service Restaurant Market Segmentation

-

1. Cuisine

- 1.1. Bakeries

- 1.2. Burger

- 1.3. Ice Cream

- 1.4. Meat-based Cuisines

- 1.5. Pizza

- 1.6. Other QSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Arab Emirates Quick Service Restaurant Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Increase in the number of QSRs and rise in demand for fast food to fuel the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bakeries

- 5.1.2. Burger

- 5.1.3. Ice Cream

- 5.1.4. Meat-based Cuisines

- 5.1.5. Pizza

- 5.1.6. Other QSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. UAE United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA United Arab Emirates Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 The Olayan Grou

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alghanim Industries & Yusuf A Alghanim & Sons WLL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Al Sayer Franchising Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ALBAIK Food Systems Company S A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ring International Holding AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Americana Restaurants International PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 M H Alshaya Co WLL

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kamal Osman Jamjoom Group LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Apparel Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AlAmar Foods Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 The Olayan Grou

List of Figures

- Figure 1: United Arab Emirates Quick Service Restaurant Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Quick Service Restaurant Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 4: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Cuisine 2019 & 2032

- Table 5: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 6: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 7: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 8: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 9: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 11: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 13: UAE United Arab Emirates Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: UAE United Arab Emirates Quick Service Restaurant Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 15: South Africa United Arab Emirates Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa United Arab Emirates Quick Service Restaurant Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia United Arab Emirates Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Saudi Arabia United Arab Emirates Quick Service Restaurant Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of MEA United Arab Emirates Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of MEA United Arab Emirates Quick Service Restaurant Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 21: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 22: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Cuisine 2019 & 2032

- Table 23: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 24: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Outlet 2019 & 2032

- Table 25: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 26: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Location 2019 & 2032

- Table 27: United Arab Emirates Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Arab Emirates Quick Service Restaurant Market Volume Thousand Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Quick Service Restaurant Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the United Arab Emirates Quick Service Restaurant Market?

Key companies in the market include The Olayan Grou, Alghanim Industries & Yusuf A Alghanim & Sons WLL, Al Sayer Franchising Company, ALBAIK Food Systems Company S A, Ring International Holding AG, Americana Restaurants International PLC, M H Alshaya Co WLL, Kamal Osman Jamjoom Group LLC, Apparel Group, AlAmar Foods Company.

3. What are the main segments of the United Arab Emirates Quick Service Restaurant Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

Increase in the number of QSRs and rise in demand for fast food to fuel the market growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

January 2023: Maristo Hospitality signed a master franchisee agreement with German Doner Kebab (GDK), with plans to expand in the United Arab Emirates and the Middle East.December 2022: Apparel Group launched its 250th Tim Hortons store across the Middle East with a new store in Dubai's Mirdif City Centre. It plans to open 500 outlets across the region by 2025.October 2022: Maristo Hospitality opened Sisi's Eatery, its Australian cuisine restaurant, in Dubai Hills Mall, Dubai, United Arab Emirates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence