Key Insights

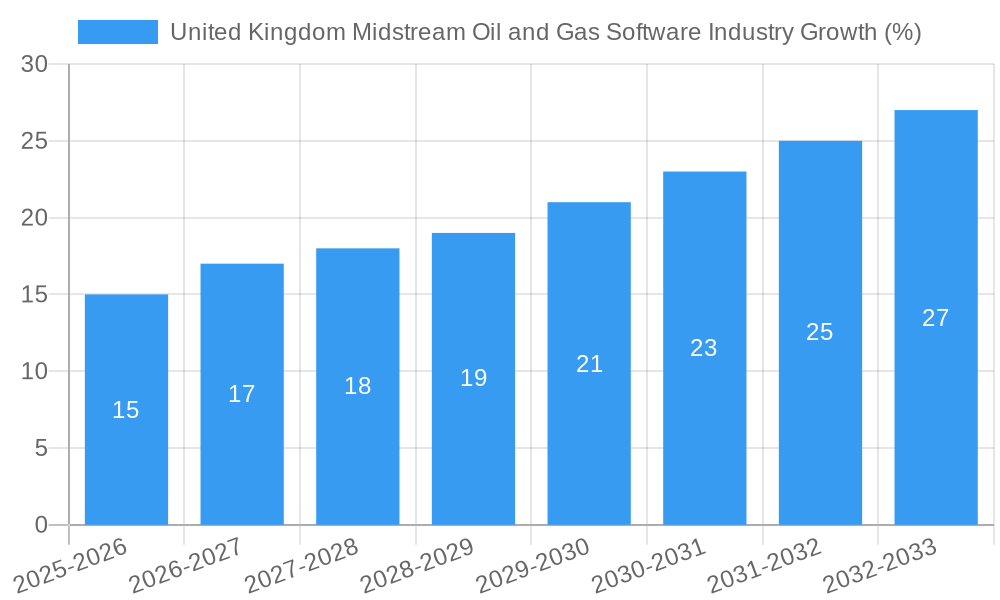

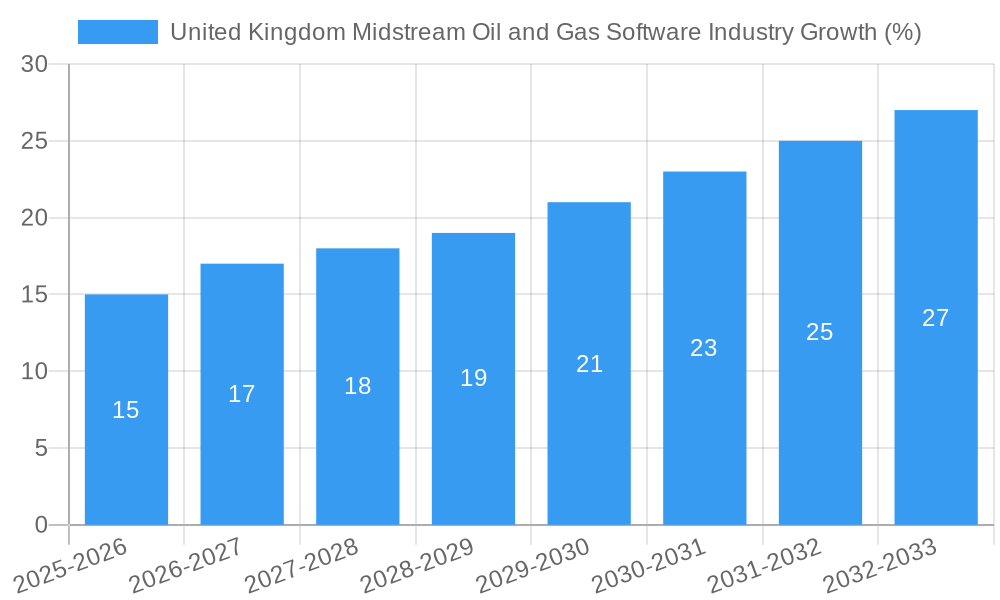

The United Kingdom midstream oil and gas software market is experiencing robust growth, driven by increasing demand for efficient operational management and regulatory compliance within the energy sector. The industry's reliance on sophisticated software solutions for pipeline management, gas processing optimization, and overall operational efficiency is a key factor fueling this expansion. From 2019 to 2024, the market demonstrated consistent growth, and this trajectory is expected to continue through 2033. Factors such as the ongoing digital transformation within the oil and gas industry, coupled with the UK government's focus on energy security and net-zero targets, are further bolstering market expansion. The adoption of cloud-based solutions, advanced analytics, and automation technologies is streamlining operations, reducing costs, and improving safety protocols, contributing significantly to the market's upward trend. This growth is further amplified by the increasing need for real-time data monitoring and predictive maintenance, enabling proactive issue resolution and minimizing downtime. A strong regulatory framework within the UK also plays a vital role, pushing companies to invest in robust and compliant software solutions.

The forecast period (2025-2033) anticipates sustained growth, propelled by continued investment in digital infrastructure and the integration of innovative technologies like AI and machine learning into existing workflows. Key players in the market are likely to focus on developing and integrating solutions that address specific challenges within the midstream sector, such as optimizing pipeline networks, enhancing gas processing efficiency, and improving overall supply chain management. Competition will remain intense, with established players and emerging technology providers vying for market share. The market's success hinges on the ability of software providers to deliver solutions that seamlessly integrate with existing infrastructure, provide enhanced data analytics, and comply with evolving regulatory standards, thus ensuring operational efficiency and sustainable growth for the UK midstream oil and gas industry.

United Kingdom Midstream Oil and Gas Software Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK midstream oil and gas software market, offering crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils market dynamics, growth drivers, challenges, and future opportunities within this vital sector. The report leverages extensive data analysis to provide actionable intelligence, including market sizing, segmentation, competitive landscape, and technological advancements.

United Kingdom Midstream Oil and Gas Software Industry Market Structure & Innovation Trends

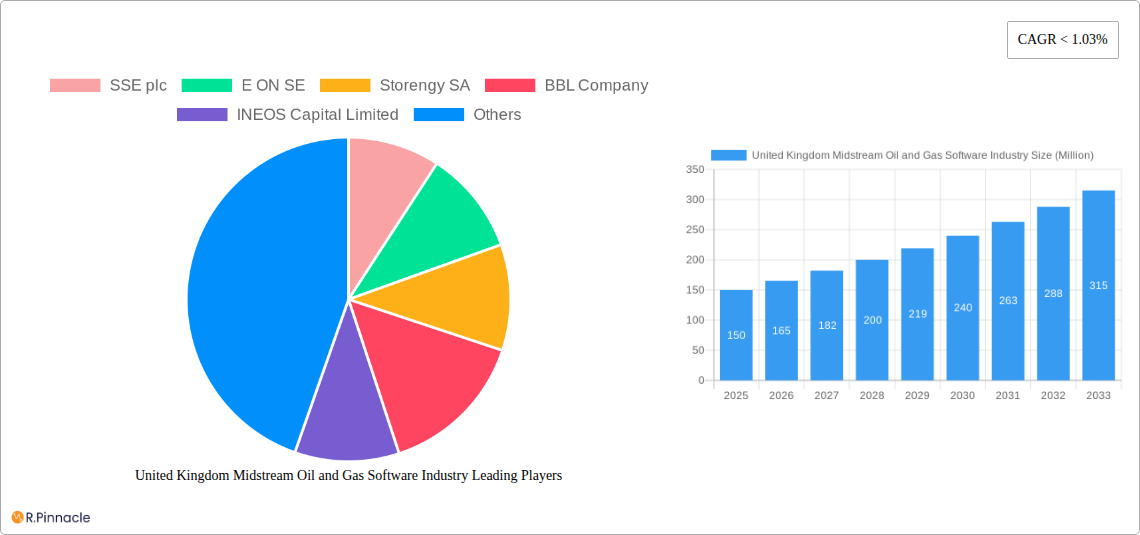

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of the UK midstream oil and gas software market. We examine market concentration, identifying key players and their respective market shares. The analysis includes an assessment of mergers and acquisitions (M&A) activity, quantifying deal values where possible. Furthermore, the report explores the impact of regulatory frameworks, the presence of substitute products, and evolving end-user demographics on market dynamics.

- Market Concentration: The UK midstream oil and gas software market exhibits a [xx]% concentration ratio, with the top 5 players accounting for approximately [xx]% of the total market share in 2025.

- Innovation Drivers: Key drivers include the increasing demand for digitalization, automation, and data analytics within the midstream sector, alongside government initiatives promoting technological advancements.

- M&A Activity: Between 2019 and 2024, the total value of M&A deals within the UK midstream oil and gas software sector reached approximately £xx Million. [Provide specific examples of significant M&A deals if available, otherwise, state "Further details on specific deals are available within the full report."]

- Regulatory Framework: The regulatory landscape significantly influences the market, impacting software development, deployment, and data security. [Briefly discuss relevant regulations].

- Product Substitutes: While software solutions are essential, the report analyzes potential substitute technologies or approaches that may influence market dynamics.

United Kingdom Midstream Oil and Gas Software Industry Market Dynamics & Trends

This section delves into the market’s growth trajectory, examining key drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The report provides a detailed analysis of the market’s Compound Annual Growth Rate (CAGR) and market penetration rates across various segments. We explore how factors such as increasing operational efficiency demands, stringent regulatory compliance, and the adoption of advanced technologies are shaping market growth. The impact of geopolitical events and economic fluctuations on market performance is also discussed. The report projects a CAGR of [xx]% for the forecast period (2025-2033), driven by [mention specific factors]. Market penetration for [specify a key software type] is estimated at [xx]% in 2025, projected to reach [xx]% by 2033.

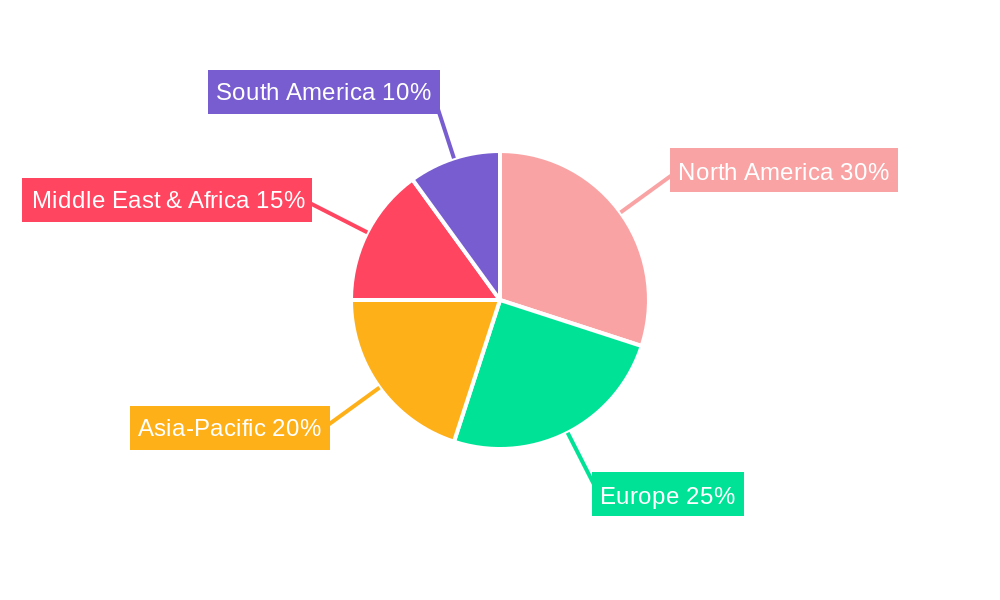

Dominant Regions & Segments in United Kingdom Midstream Oil and Gas Software Industry

This section identifies the dominant regions and segments within the UK midstream oil and gas software market. A detailed analysis of LNG Terminals, Transportation, and Storage segments is presented.

LNG Terminals: Overview

- Key Drivers: Increased LNG import capacity, government incentives for LNG infrastructure development.

- Dominance Analysis: The [Specific Region/Port] is identified as the dominant region due to [Specific Reasons].

Transportation: Overview

- Key Drivers: Expansion of pipeline networks, technological advancements in pipeline management software.

- Dominance Analysis: [Specific Pipeline Network/Region] holds a dominant position due to [Specific Reasons].

Storage: Overview

- Key Drivers: Rising demand for gas storage capacity, government policies promoting energy security.

- Dominance Analysis: [Specific Storage Facility/Region] exhibits market dominance, driven by factors like [Specific Reasons].

United Kingdom Midstream Oil and Gas Software Industry Product Innovations

The UK midstream oil and gas software market is witnessing significant product innovation, driven by the need for enhanced efficiency, improved safety, and real-time data analysis. New software solutions are emerging, focusing on areas like predictive maintenance, optimized pipeline management, and integrated data platforms. These innovations offer competitive advantages by enabling cost reductions, improved decision-making, and enhanced operational reliability. The adoption of cloud-based solutions and AI-powered analytics is also gaining traction.

Report Scope & Segmentation Analysis

This report segments the UK midstream oil and gas software market across various categories, including by software type (e.g., pipeline management, LNG terminal operations, storage optimization), deployment model (cloud-based, on-premise), and end-user (e.g., operators, service providers). Each segment's growth projections, market size, and competitive landscape are meticulously analyzed. [Provide a short paragraph detailing the scope and approach for each major segment, e.g., LNG Terminals, Transportation, Storage. Include estimations for market size in Million GBP for 2025, such as: The LNG Terminals segment is projected to be worth £xx Million in 2025].

Key Drivers of United Kingdom Midstream Oil and Gas Software Industry Growth

Several factors are driving the growth of the UK midstream oil and gas software industry. Technological advancements, such as AI and machine learning, are enabling the development of sophisticated software solutions for improved efficiency and safety. Furthermore, stringent government regulations related to environmental protection and operational safety are pushing companies to adopt advanced software to comply. Finally, increasing demand for energy and the need for efficient and reliable infrastructure are creating strong market demand.

Challenges in the United Kingdom Midstream Oil and Gas Software Industry Sector

The UK midstream oil and gas software industry faces several challenges. Regulatory hurdles related to data security and compliance can increase development and implementation costs. Supply chain disruptions can impact the availability of key components and expertise. Finally, intense competition from both established players and new entrants can pressure profit margins. These factors could result in a [xx]% reduction in market growth if not effectively addressed.

Emerging Opportunities in United Kingdom Midstream Oil and Gas Software Industry

The UK midstream oil and gas software market presents numerous emerging opportunities. The increasing adoption of digital twins and IoT-based solutions presents significant potential for growth. Furthermore, the need for decarbonization initiatives creates opportunities for software solutions focused on emissions monitoring and reduction. Finally, the development of advanced analytics capabilities can unlock valuable insights for improved operational efficiency and decision-making. [Further detail opportunities worth £xx Million].

Leading Players in the United Kingdom Midstream Oil and Gas Software Industry Market

- SSE plc

- E.ON SE

- Storengy SA

- BBL Company

- INEOS Capital Limited

- Interconnector Limited

- GASSCO

Key Developments in United Kingdom Midstream Oil and Gas Software Industry Industry

- [Month, Year]: [Company Name] launched a new software solution for [specific application]. This development is expected to improve efficiency by [percentage] and reduce operational costs by [percentage].

- [Month, Year]: [Company A] and [Company B] announced a strategic partnership to develop a joint software platform for [specific application]. This is anticipated to significantly improve [Specific metric] within the sector.

- [Add further bullet points with dates and details of significant developments]

Future Outlook for United Kingdom Midstream Oil and Gas Software Industry Market

The future outlook for the UK midstream oil and gas software market remains positive, driven by technological advancements, increased demand for energy, and stringent regulatory requirements. The continued adoption of digitalization strategies, coupled with the emergence of new technologies, will create significant opportunities for growth and innovation. The market is projected to reach £xx Million by 2033, presenting significant potential for industry participants.

United Kingdom Midstream Oil and Gas Software Industry Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in pipeline

- 1.1.3. Upcoming projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in pipeline

- 2.1.3. Upcoming projects

-

2.1. Overview

-

3. LNG Terminals

-

3.1. Overview

- 3.1.1. Existing Infrastructure

- 3.1.2. Projects in pipeline

- 3.1.3. Upcoming projects

-

3.1. Overview

United Kingdom Midstream Oil and Gas Software Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Midstream Oil and Gas Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies and Increasing Adoption of Solar PV Systems4.; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption

- 3.3. Market Restrains

- 3.3.1. 4.; The Growth of Other Renewable Technologies Such as Wind and Bioenergy

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Midstream Oil and Gas Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in pipeline

- 5.1.1.3. Upcoming projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in pipeline

- 5.2.1.3. Upcoming projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.1.1. Existing Infrastructure

- 5.3.1.2. Projects in pipeline

- 5.3.1.3. Upcoming projects

- 5.3.1. Overview

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Germany United Kingdom Midstream Oil and Gas Software Industry Analysis, Insights and Forecast, 2019-2031

- 7. France United Kingdom Midstream Oil and Gas Software Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy United Kingdom Midstream Oil and Gas Software Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom United Kingdom Midstream Oil and Gas Software Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands United Kingdom Midstream Oil and Gas Software Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden United Kingdom Midstream Oil and Gas Software Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe United Kingdom Midstream Oil and Gas Software Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 SSE plc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 E ON SE

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Storengy SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 BBL Company

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 INEOS Capital Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Interconnector Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 GASSCO

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 SSE plc

List of Figures

- Figure 1: United Kingdom Midstream Oil and Gas Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Midstream Oil and Gas Software Industry Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by Transportation 2019 & 2032

- Table 3: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by Storage 2019 & 2032

- Table 4: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 5: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany United Kingdom Midstream Oil and Gas Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France United Kingdom Midstream Oil and Gas Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy United Kingdom Midstream Oil and Gas Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom United Kingdom Midstream Oil and Gas Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands United Kingdom Midstream Oil and Gas Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden United Kingdom Midstream Oil and Gas Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe United Kingdom Midstream Oil and Gas Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by Transportation 2019 & 2032

- Table 15: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by Storage 2019 & 2032

- Table 16: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 17: United Kingdom Midstream Oil and Gas Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Midstream Oil and Gas Software Industry?

The projected CAGR is approximately < 1.03%.

2. Which companies are prominent players in the United Kingdom Midstream Oil and Gas Software Industry?

Key companies in the market include SSE plc, E ON SE, Storengy SA, BBL Company, INEOS Capital Limited, Interconnector Limited, GASSCO.

3. What are the main segments of the United Kingdom Midstream Oil and Gas Software Industry?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies and Increasing Adoption of Solar PV Systems4.; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption.

6. What are the notable trends driving market growth?

Transportation Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; The Growth of Other Renewable Technologies Such as Wind and Bioenergy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Midstream Oil and Gas Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Midstream Oil and Gas Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Midstream Oil and Gas Software Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Midstream Oil and Gas Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence