Key Insights

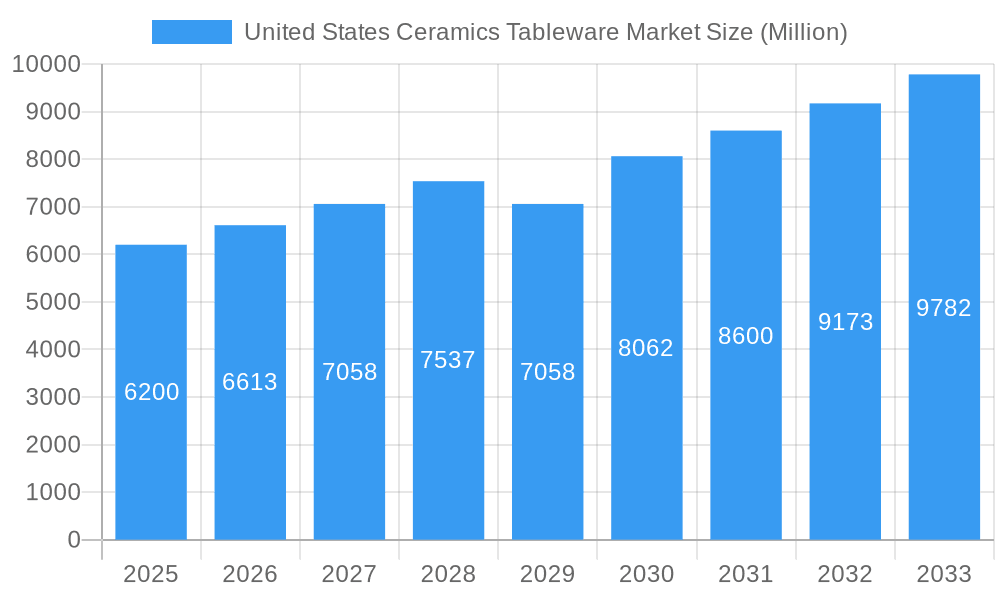

The United States ceramics tableware market, valued at $6.20 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.69% from 2025 to 2033. This expansion is fueled by several key factors. The increasing popularity of home cooking and dining experiences, coupled with a rising disposable income among consumers, fuels demand for high-quality and aesthetically pleasing tableware. Furthermore, the shift towards sustainable and eco-friendly products is boosting the adoption of ceramic tableware, perceived as a more durable and environmentally responsible alternative to disposable options. Growth within specific segments, such as porcelain and bone china, reflects a premiumization trend within the market, where consumers are willing to invest in higher-quality, longer-lasting pieces. The commercial sector, including restaurants and hotels, also contributes significantly to market growth, driven by the need for attractive and durable tableware to enhance the dining experience. Strong online distribution channels, facilitating easy access and wider product variety, are further propelling market expansion.

United States Ceramics Tableware Market Market Size (In Billion)

However, the market faces certain challenges. Fluctuations in raw material prices, particularly those impacting porcelain and bone china production, can impact profitability. Additionally, competition from other materials, such as melamine and plastic, which offer lower price points, presents a constraint to growth. Nevertheless, the enduring appeal of ceramic tableware, coupled with the ongoing focus on creating unique and stylish designs, ensures the continued relevance and expansion of this market segment in the United States. The market segmentation by type (porcelain, stoneware, etc.) and end-user (household, commercial) provides manufacturers with opportunities to tailor their offerings to specific consumer needs and preferences, capitalizing on varied price points and market niches.

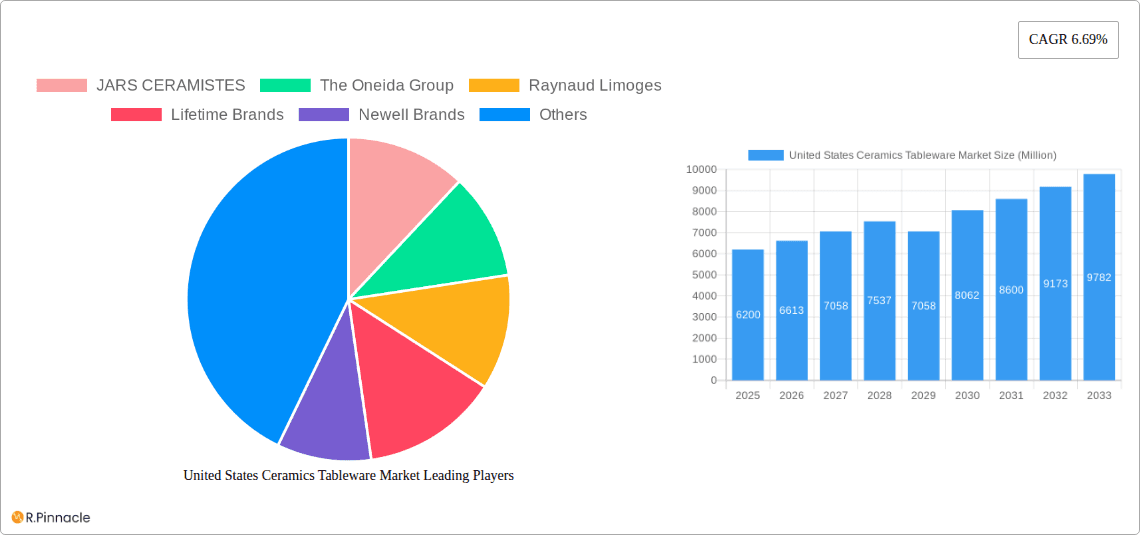

United States Ceramics Tableware Market Company Market Share

United States Ceramics Tableware Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States ceramics tableware market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. It leverages extensive market research and data analysis to deliver actionable intelligence on market size, growth drivers, competitive landscape, and future trends.

United States Ceramics Tableware Market Structure & Innovation Trends

This section analyzes the competitive landscape of the US ceramics tableware market, including market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report assesses the market share of key players such as JARS CERAMISTES, The Oneida Group, Raynaud Limoges, Lifetime Brands, Newell Brands, Homer Laughlin China, International Tableware, Meyer Corporation, CuisinArt, and Mikasa, providing a detailed understanding of their market positioning and strategies. The analysis also explores the impact of mergers and acquisitions (M&A) on market dynamics, estimating the value of significant deals concluded during the study period (2019-2024). For example, the xx Million acquisition of Can't Live Without It (d/b/a S'well Bottle) by Lifetime Brands in March 2022 significantly impacted the market. The report further examines the role of regulatory frameworks, explores the presence of substitute products (e.g., melamine tableware), and assesses the evolving demographics of end-users. Finally, a detailed analysis of innovation drivers like sustainable materials, design innovations, and technological advancements influencing product development and consumer preferences will be included. The report utilizes data on market share, M&A deal values, and other relevant metrics to provide a comprehensive overview of the market structure.

United States Ceramics Tableware Market Dynamics & Trends

This section delves into the key factors driving market growth and shaping market trends. The report will examine the Compound Annual Growth Rate (CAGR) of the US ceramics tableware market during the historical period (2019-2024) and forecast period (2025-2033). Key growth drivers, such as changing consumer preferences (e.g., rising demand for premium and artisanal tableware), technological disruptions (e.g., automation in manufacturing), and evolving distribution channels will be thoroughly analyzed. The report also assesses the impact of competitive dynamics, including pricing strategies, product differentiation, and branding initiatives on market growth and penetration. Specific market penetration rates for different product types and end-user segments will be provided, contributing to a comprehensive analysis of market dynamics and future trajectories.

Dominant Regions & Segments in United States Ceramics Tableware Market

This section identifies the leading regions, countries, and market segments within the US ceramics tableware market. The report analyzes the market dominance across various segments, including:

- Type: Porcelain and Bone China, Stoneware (Ceramic), Other Types

- End User: Household, Commercial

- Distribution Channel: Supermarkets and Hypermarkets, Specialty Stores, Wholesalers, Online, Other Distribution Channels

For each segment, the report identifies key drivers of dominance. For example, the high demand for durable and aesthetically pleasing tableware in the household segment will be explored, alongside the increasing adoption of online channels. The analysis will provide a detailed understanding of the factors contributing to the leading segment's success, including economic policies, infrastructure development, and consumer preferences.

United States Ceramics Tableware Market Product Innovations

The United States ceramics tableware market is experiencing a dynamic phase driven by relentless product innovation. Manufacturers are actively investing in research and development to introduce novel materials, sophisticated designs, and enhanced functionalities that cater to evolving consumer preferences and lifestyle trends. This section delves into the forefront of these advancements, highlighting the integration of advanced ceramics, such as technical ceramics with superior durability and heat resistance, alongside aesthetically appealing glazes and finishes. We will explore the rise of smart tableware, incorporating features like temperature regulation and embedded tracking capabilities. Furthermore, the report will showcase a curated selection of recently launched products, providing a detailed analysis of their unique selling propositions, competitive positioning, and initial market reception, thereby illuminating the strategies that are successfully resonating with US consumers.

Report Scope & Segmentation Analysis

The report provides a detailed analysis of the US ceramics tableware market, segmented by type, end-user, and distribution channel. Each segment's growth projections, market size (in Million), and competitive dynamics are discussed. The report explores the factors influencing market size and growth within each segment, such as consumer behavior, technological advancements, and economic conditions. For example, the report will cover the growth trajectory of the porcelain and bone china segment and the increasing popularity of online distribution channels.

Key Drivers of United States Ceramics Tableware Market Growth

This section outlines the key factors driving market growth. This includes factors like the increasing demand for premium tableware, the growth of the food service industry, and technological advancements in manufacturing and design. The report will provide specific examples of how these factors contribute to market expansion.

Challenges in the United States Ceramics Tableware Market Sector

The United States ceramics tableware sector is navigating a complex landscape marked by several significant challenges that are influencing its growth trajectory and operational efficiency. Foremost among these are persistent supply chain vulnerabilities, exacerbated by geopolitical factors and logistical bottlenecks, which are leading to extended lead times and increased transportation costs. The market is also characterized by fierce competition, not only from domestic manufacturers but also from an influx of competitively priced imports, placing considerable pressure on profit margins. Moreover, escalating raw material costs, including the price of high-quality clay, feldspar, and energy, are directly impacting production expenses. This section will provide a comprehensive quantitative assessment of the impact of these challenges on market expansion, overall profitability, and the strategic responses being adopted by industry players to mitigate their effects.

Emerging Opportunities in United States Ceramics Tableware Market

Amidst the challenges, the United States ceramics tableware market is ripe with emerging opportunities that signal significant potential for growth and diversification. A prominent trend is the burgeoning consumer demand for sustainable and eco-friendly tableware. This encompasses products made from recycled materials, those manufactured with reduced environmental impact, and items designed for longevity. The report will highlight innovative brands and initiatives that are capitalizing on this conscious consumerism. Additionally, there is considerable potential for expansion into niche and underserved markets, including bespoke tableware for the hospitality industry, artisanal collections catering to specific design aesthetics, and the growing e-commerce channels that offer direct-to-consumer access. This section will meticulously identify and analyze these emerging trends, quantifying their potential impact on market share and revenue generation.

Leading Players in the United States Ceramics Tableware Market Market

This section profiles the leading players in the US ceramics tableware market, including:

- JARS CERAMISTES

- The Oneida Group

- Raynaud Limoges

- Lifetime Brands

- Newell Brands

- Homer Laughlin China

- International Tableware

- Meyer Corporation

- CuisinArt

- Mikasa

Key Developments in United States Ceramics Tableware Market Industry

This section details key industry developments, including:

- October 2022: JARS CERAMISTES launches a new showroom at 41 Madison during the New York Tabletop Show, showcasing new stoneware collections.

- March 2022: Lifetime Brands acquires the business and certain assets of Can't Live Without It (d/b/a S'well Bottle).

The report analyzes the impact of these developments on market dynamics.

Future Outlook for United States Ceramics Tableware Market Market

The future outlook for the United States ceramics tableware market is characterized by a confluence of robust growth accelerators and strategic expansion opportunities. This section provides a forward-looking perspective, projecting the market's trajectory and identifying key areas poised for substantial investment and growth. We anticipate continued innovation in materials science, leading to more durable, aesthetically versatile, and sustainable ceramic options. The increasing consumer focus on home dining experiences and the desire for elevated everyday living are expected to fuel sustained demand. Furthermore, the integration of digital technologies, from enhanced online retail experiences to potential for smart functionalities, will shape future product development. The report will offer deep insights into the long-term prospects of the US ceramics tableware market, considering evolving consumer behaviors, economic indicators, and the strategic imperatives for businesses aiming to thrive in this dynamic sector.

United States Ceramics Tableware Market Segmentation

-

1. Type

- 1.1. Porcelain and Bone China

- 1.2. Stoneware (Ceramic)

- 1.3. Other Types

-

2. End User

- 2.1. Household

-

2.2. Commercial

- 2.2.1. Accomodation and Hospitality Segment

- 2.2.2. Food Service Segment

- 2.2.3. Other End Users

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Wholesalers

- 3.4. Online

- 3.5. Other Distribution Channels

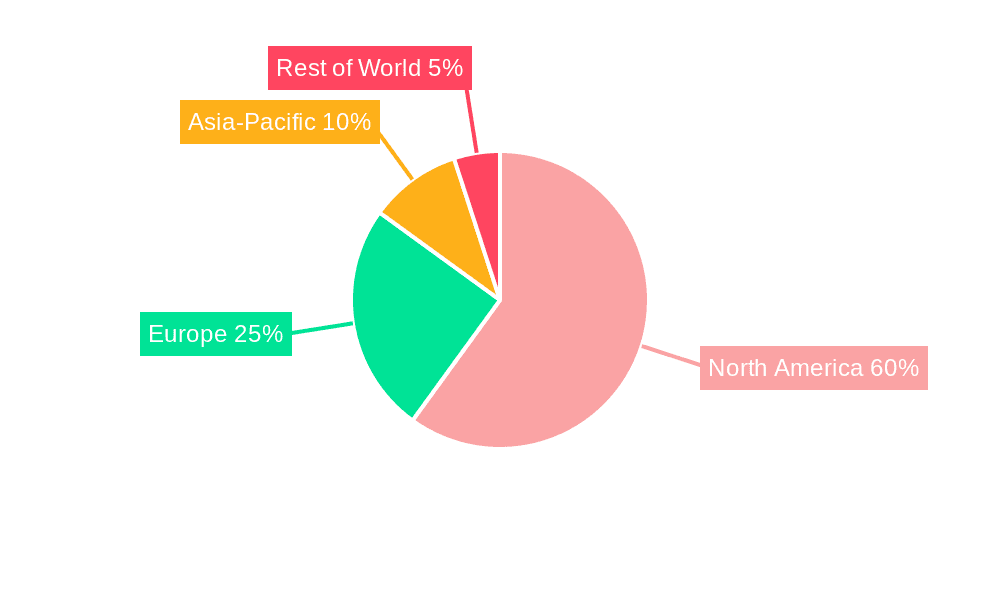

United States Ceramics Tableware Market Segmentation By Geography

- 1. United States

United States Ceramics Tableware Market Regional Market Share

Geographic Coverage of United States Ceramics Tableware Market

United States Ceramics Tableware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods

- 3.3. Market Restrains

- 3.3.1. Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power

- 3.4. Market Trends

- 3.4.1. Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Ceramics Tableware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Porcelain and Bone China

- 5.1.2. Stoneware (Ceramic)

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Household

- 5.2.2. Commercial

- 5.2.2.1. Accomodation and Hospitality Segment

- 5.2.2.2. Food Service Segment

- 5.2.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Wholesalers

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JARS CERAMISTES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Oneida Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raynaud Limoges

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lifetime Brands

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Newell Brands

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Homer Laughlin China

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Tableware

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Meyer Coroporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CuisinArt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mikasa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JARS CERAMISTES

List of Figures

- Figure 1: United States Ceramics Tableware Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Ceramics Tableware Market Share (%) by Company 2025

List of Tables

- Table 1: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Ceramics Tableware Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Ceramics Tableware Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: United States Ceramics Tableware Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Ceramics Tableware Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Ceramics Tableware Market?

The projected CAGR is approximately 6.69%.

2. Which companies are prominent players in the United States Ceramics Tableware Market?

Key companies in the market include JARS CERAMISTES, The Oneida Group, Raynaud Limoges, Lifetime Brands, Newell Brands, Homer Laughlin China, International Tableware, Meyer Coroporation, CuisinArt, Mikasa.

3. What are the main segments of the United States Ceramics Tableware Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods.

6. What are the notable trends driving market growth?

Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market.

7. Are there any restraints impacting market growth?

Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power.

8. Can you provide examples of recent developments in the market?

In October 2022, Jars Ceramics launches a new showroom at 41 Madison during the New York Tabletop Show. The company will showcase new stoneware pieces with rich glazes and colors including deep and moody blues, greens, and blacks in the Wabi and Dashi collections and vintage, charming pastels in the Canine collection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Ceramics Tableware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Ceramics Tableware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Ceramics Tableware Market?

To stay informed about further developments, trends, and reports in the United States Ceramics Tableware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence