Key Insights

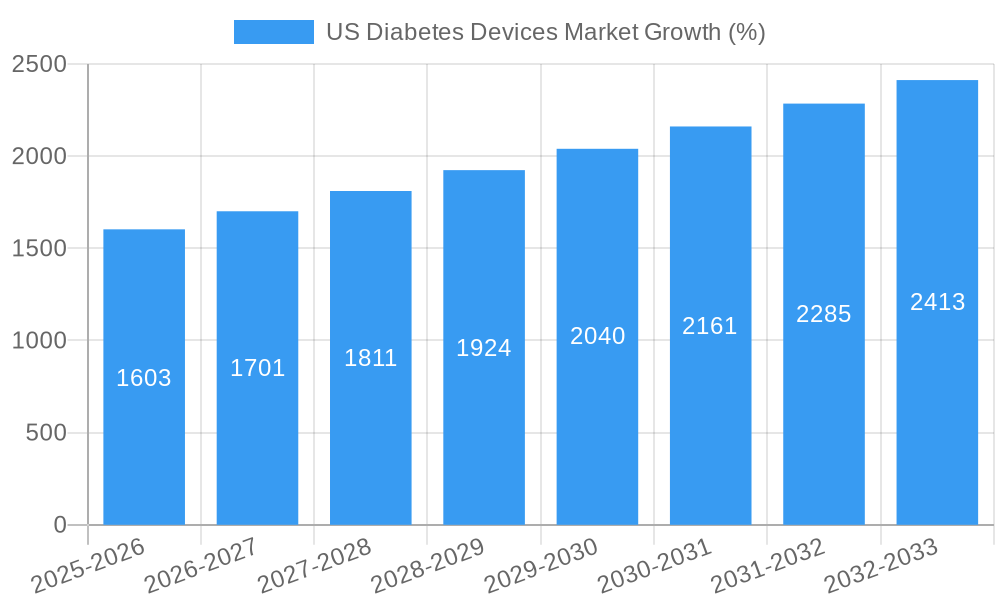

The US diabetes devices market, valued at $25.16 billion in 2025, is projected to experience robust growth, driven by rising diabetes prevalence, technological advancements in continuous glucose monitoring (CGM) and insulin delivery systems, and increasing demand for convenient and effective diabetes management solutions. The market's Compound Annual Growth Rate (CAGR) of 6.27% from 2025 to 2033 indicates substantial expansion. Key growth drivers include the increasing adoption of CGM systems offering real-time glucose data, the development of sophisticated insulin pumps with improved accuracy and features, and the rising preference for convenient insulin delivery methods such as insulin pens and jet injectors. The market is segmented into lancets, management devices (insulin pumps, infusion sets, insulin pens, and jet injectors), and monitoring devices (self-monitoring blood glucose meters and CGMs). Major players like Abbott, Medtronic, Dexcom, and Novo Nordisk are actively involved in innovation and market expansion, contributing to competitive market dynamics and fostering product diversification. Challenges may include high device costs, complexities associated with device usage and maintenance, and potential reimbursement issues. However, the increasing awareness of diabetes management and technological advancements are likely to overcome these challenges.

The regional breakdown within the US market reveals significant variations across the Northeast, Southeast, Midwest, Southwest, and West regions. The distribution of market share across these regions is likely influenced by factors such as population density, healthcare infrastructure, and socioeconomic characteristics. While precise regional market share data is not provided, it's reasonable to assume that regions with higher diabetes prevalence and better access to healthcare will contribute more substantially to overall market revenue. Future market growth will likely be further propelled by the emergence of advanced technologies, such as artificial pancreas systems and closed-loop insulin delivery systems, further improving diabetes management and patient outcomes. Continued research and development in this field will likely support continued market expansion throughout the forecast period.

US Diabetes Devices Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the US Diabetes Devices Market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, and future trajectory. The report uses Million as unit for all values.

US Diabetes Devices Market Market Structure & Innovation Trends

The US diabetes devices market exhibits a moderately concentrated structure, with key players like Medtronic, Abbott, Dexcom, and Novo Nordisk commanding substantial market share. However, a dynamic competitive landscape exists due to the presence of numerous smaller companies, particularly within the self-monitoring blood glucose (SMBG) and continuous glucose monitoring (CGM) sectors. Innovation is fueled by several factors: the escalating prevalence of diabetes, continuous advancements in sensor technology, and the increasing demand for user-friendly and convenient devices. The regulatory landscape, predominantly shaped by the FDA, plays a pivotal role in determining market access and influencing the pace of innovation. The market also experiences significant mergers and acquisitions (M&A) activity, with deal values exceeding [Insert Updated Deal Value] in recent years, contributing to further consolidation among major players. The end-user demographic is heavily weighted towards the aging population, reflecting the higher prevalence of type 2 diabetes. Furthermore, product substitution is increasingly driven by the emergence of sophisticated CGM systems offering superior accuracy and convenience.

- Market Concentration: Moderately concentrated, with top players holding [Insert Updated Market Share Percentage]% market share in 2025. [Optional: Add further detail on market share distribution amongst top players]

- Innovation Drivers: Technological advancements (e.g., miniaturization, improved accuracy, AI integration), expedited regulatory approvals, and addressing unmet clinical needs (e.g., improved ease of use, reduced cost).

- M&A Activity: [Insert Updated Deal Value] in deal value over the past five years, driving significant market consolidation and shaping the competitive landscape.

- Regulatory Framework: Primarily governed by the FDA, impacting product launch timelines, market access, and overall innovation trajectory. [Optional: Briefly discuss any relevant regulatory changes or trends.]

- Emerging Trends: Growth in telehealth integration, expansion of remote monitoring capabilities, and increasing focus on personalized diabetes management solutions.

US Diabetes Devices Market Market Dynamics & Trends

The US diabetes devices market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by the rising prevalence of diabetes, increasing awareness about disease management, and technological advancements leading to improved device accuracy and ease of use. Technological disruptions, such as the introduction of integrated CGM systems and smart insulin pumps, are reshaping the market landscape. Consumer preferences are shifting towards minimally invasive, user-friendly devices offering real-time data and improved connectivity. Competitive dynamics are characterized by intense rivalry among established players and the emergence of innovative startups, leading to price competition and product differentiation. Market penetration of CGM systems is steadily increasing, driven by technological advancements and rising demand for convenient glucose monitoring.

Dominant Regions & Segments in US Diabetes Devices Market

The US diabetes devices market is geographically concentrated, with the majority of sales stemming from densely populated states with high prevalence of diabetes. Among the segments, CGM devices represent the fastest-growing segment, driven by their superior accuracy and convenience compared to SMBG. Insulin pumps are another key segment, capturing significant market share.

- Leading Segment: Continuous Glucose Monitoring (CGM) devices, driven by technological advancements and convenience.

- Key Drivers:

- Rising diabetes prevalence

- Growing preference for minimally invasive devices

- Increased insurance coverage

- Dominant Region: California, Texas, and Florida.

US Diabetes Devices Market Product Innovations

Recent innovations significantly enhance diabetes management. These include: integrated CGM systems seamlessly coupled with insulin pumps, providing a streamlined approach to therapy; tubeless insulin delivery systems, increasing patient comfort and reducing the burden of traditional methods; and advanced sensor technologies boasting superior accuracy, extended wear time, and reduced calibration needs. These advancements collectively improve disease management, increase patient convenience, and lead to better clinical outcomes, thereby driving market expansion. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is revolutionizing predictive analytics and paving the way for highly personalized diabetes management strategies. For example, [mention specific examples of AI/ML applications in diabetes devices].

Report Scope & Segmentation Analysis

This report segments the US diabetes devices market by device type (CGM, Insulin Pumps, Insulin Delivery Devices, SMBG), technology (sensor technology, data analytics, connectivity), and end-user (hospitals, clinics, home care). Growth projections, market sizes, and competitive dynamics are analyzed for each segment.

- CGM: xx Million in 2025, projected to reach xx Million by 2033. High growth driven by technological advancements.

- Insulin Pumps: xx Million in 2025, with steady growth driven by demand for convenient insulin delivery.

- Insulin Delivery Devices: xx Million in 2025, with growth driven by increasing preference for disposables.

- SMBG: xx Million in 2025, expected to witness moderate growth.

Key Drivers of US Diabetes Devices Market Growth

The US diabetes devices market's growth is primarily fueled by the escalating prevalence of diabetes, technological advancements leading to better accuracy and patient convenience, and rising healthcare expenditure. Favorable regulatory policies and increased insurance coverage also contribute to market expansion. For example, the FDA's approval of innovative devices accelerates market penetration.

Challenges in the US Diabetes Devices Market Sector

The market faces challenges including high device costs, reimbursement complexities, and intense competition. Supply chain disruptions and regulatory hurdles can also impact market growth. The high cost of advanced CGM systems may limit access for some patients.

Emerging Opportunities in US Diabetes Devices Market

The market presents opportunities in personalized medicine, remote patient monitoring, and the development of integrated devices offering comprehensive diabetes management. Technological advancements like AI-powered predictive analytics are creating opportunities for improved patient outcomes and disease management.

Leading Players in the US Diabetes Devices Market Market

- Omnipod

- Insulin Devices (Multiple Companies - Specify Major Players if possible)

- LifeScan

- Dexcom

- Becton and Dickinson (BD)

- Abbott

- F Hoffmann-La Roche AG

- Novo Nordisk

- Medtronic

- Other Self-monitoring Blood Glucose Devices (Multiple Companies - Specify Major Players if possible)

- Sanofi

- Johnson & Johnson

- Ypsomed Holding

- Tandem Diabetes Care

- Insulet Corporation

- Eli Lilly and Company

Key Developments in US Diabetes Devices Market Industry

- August 2023: FDA clearance for Roche's Accu-Chek Solo micropump system. This tubeless patch pump significantly improves convenience for insulin-dependent diabetics. [Add further details on market impact and adoption]

- March 2022: Dexcom G7 launched in the U.K., with anticipated US release pending FDA approval. This expansion showcases the global reach of the CGM market. [Add information about the eventual US launch and market reception.]

- [Add 2-3 more recent key developments with details and impact]

Future Outlook for US Diabetes Devices Market Market

The US diabetes devices market is projected to experience sustained growth, driven by technological innovation, the increasing demand for sophisticated devices, and the rising prevalence of diabetes. The integration of AI and ML capabilities offers tremendous potential for enhancing disease management and providing truly personalized care. This will drive future growth and create lucrative strategic opportunities for market players. [Add projections for market growth, key challenges, and potential future disruptions.]

US Diabetes Devices Market Segmentation

-

1. Monitoring Devices

-

1.1. Self-monitoring Blood Glucose

- 1.1.1. Glucometer Devices

- 1.1.2. Blood Glucose Test Strips

- 1.1.3. Lancets

-

1.2. Continuous Glucose Monitoring

- 1.2.1. Sensors

- 1.2.2. Durables

-

1.1. Self-monitoring Blood Glucose

-

2. Management Devices

-

2.1. Insulin Pump

- 2.1.1. Insulin Pump Device

- 2.1.2. Insulin Pump Reservoir

- 2.1.3. Infusion Set

- 2.2. Insulin Syringes

- 2.3. Cartridges in Reusable pens

- 2.4. Insulin Disposable Pens

- 2.5. Jet Injectors

-

2.1. Insulin Pump

US Diabetes Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Diabetes Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Growing Diabetes and Obesity Population in the United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.1.1. Self-monitoring Blood Glucose

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Blood Glucose Test Strips

- 5.1.1.3. Lancets

- 5.1.2. Continuous Glucose Monitoring

- 5.1.2.1. Sensors

- 5.1.2.2. Durables

- 5.1.1. Self-monitoring Blood Glucose

- 5.2. Market Analysis, Insights and Forecast - by Management Devices

- 5.2.1. Insulin Pump

- 5.2.1.1. Insulin Pump Device

- 5.2.1.2. Insulin Pump Reservoir

- 5.2.1.3. Infusion Set

- 5.2.2. Insulin Syringes

- 5.2.3. Cartridges in Reusable pens

- 5.2.4. Insulin Disposable Pens

- 5.2.5. Jet Injectors

- 5.2.1. Insulin Pump

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6. North America US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6.1.1. Self-monitoring Blood Glucose

- 6.1.1.1. Glucometer Devices

- 6.1.1.2. Blood Glucose Test Strips

- 6.1.1.3. Lancets

- 6.1.2. Continuous Glucose Monitoring

- 6.1.2.1. Sensors

- 6.1.2.2. Durables

- 6.1.1. Self-monitoring Blood Glucose

- 6.2. Market Analysis, Insights and Forecast - by Management Devices

- 6.2.1. Insulin Pump

- 6.2.1.1. Insulin Pump Device

- 6.2.1.2. Insulin Pump Reservoir

- 6.2.1.3. Infusion Set

- 6.2.2. Insulin Syringes

- 6.2.3. Cartridges in Reusable pens

- 6.2.4. Insulin Disposable Pens

- 6.2.5. Jet Injectors

- 6.2.1. Insulin Pump

- 6.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 7. South America US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 7.1.1. Self-monitoring Blood Glucose

- 7.1.1.1. Glucometer Devices

- 7.1.1.2. Blood Glucose Test Strips

- 7.1.1.3. Lancets

- 7.1.2. Continuous Glucose Monitoring

- 7.1.2.1. Sensors

- 7.1.2.2. Durables

- 7.1.1. Self-monitoring Blood Glucose

- 7.2. Market Analysis, Insights and Forecast - by Management Devices

- 7.2.1. Insulin Pump

- 7.2.1.1. Insulin Pump Device

- 7.2.1.2. Insulin Pump Reservoir

- 7.2.1.3. Infusion Set

- 7.2.2. Insulin Syringes

- 7.2.3. Cartridges in Reusable pens

- 7.2.4. Insulin Disposable Pens

- 7.2.5. Jet Injectors

- 7.2.1. Insulin Pump

- 7.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 8. Europe US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 8.1.1. Self-monitoring Blood Glucose

- 8.1.1.1. Glucometer Devices

- 8.1.1.2. Blood Glucose Test Strips

- 8.1.1.3. Lancets

- 8.1.2. Continuous Glucose Monitoring

- 8.1.2.1. Sensors

- 8.1.2.2. Durables

- 8.1.1. Self-monitoring Blood Glucose

- 8.2. Market Analysis, Insights and Forecast - by Management Devices

- 8.2.1. Insulin Pump

- 8.2.1.1. Insulin Pump Device

- 8.2.1.2. Insulin Pump Reservoir

- 8.2.1.3. Infusion Set

- 8.2.2. Insulin Syringes

- 8.2.3. Cartridges in Reusable pens

- 8.2.4. Insulin Disposable Pens

- 8.2.5. Jet Injectors

- 8.2.1. Insulin Pump

- 8.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 9. Middle East & Africa US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 9.1.1. Self-monitoring Blood Glucose

- 9.1.1.1. Glucometer Devices

- 9.1.1.2. Blood Glucose Test Strips

- 9.1.1.3. Lancets

- 9.1.2. Continuous Glucose Monitoring

- 9.1.2.1. Sensors

- 9.1.2.2. Durables

- 9.1.1. Self-monitoring Blood Glucose

- 9.2. Market Analysis, Insights and Forecast - by Management Devices

- 9.2.1. Insulin Pump

- 9.2.1.1. Insulin Pump Device

- 9.2.1.2. Insulin Pump Reservoir

- 9.2.1.3. Infusion Set

- 9.2.2. Insulin Syringes

- 9.2.3. Cartridges in Reusable pens

- 9.2.4. Insulin Disposable Pens

- 9.2.5. Jet Injectors

- 9.2.1. Insulin Pump

- 9.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 10. Asia Pacific US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 10.1.1. Self-monitoring Blood Glucose

- 10.1.1.1. Glucometer Devices

- 10.1.1.2. Blood Glucose Test Strips

- 10.1.1.3. Lancets

- 10.1.2. Continuous Glucose Monitoring

- 10.1.2.1. Sensors

- 10.1.2.2. Durables

- 10.1.1. Self-monitoring Blood Glucose

- 10.2. Market Analysis, Insights and Forecast - by Management Devices

- 10.2.1. Insulin Pump

- 10.2.1.1. Insulin Pump Device

- 10.2.1.2. Insulin Pump Reservoir

- 10.2.1.3. Infusion Set

- 10.2.2. Insulin Syringes

- 10.2.3. Cartridges in Reusable pens

- 10.2.4. Insulin Disposable Pens

- 10.2.5. Jet Injectors

- 10.2.1. Insulin Pump

- 10.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 11. Northeast US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 15. West US Diabetes Devices Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 1 Omnipod

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Insulin Devices

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 4 Other Continuous Glucose Monitoring Devices

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 3 LifeScan

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 1 Dexcom

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Becton and Dickenson

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 3 Abbott

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 F Hoffmann-La Roche AG

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 2 Novo Nordisk

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 2 Medtronic

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 4 Other Self-monitoring Blood Glucose Devices

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Abbott

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Self-monitoring Blood Glucose Devices

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Novo Nordisk

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Eli Lilly and Company*List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Sanofi

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 Johnson & Johnson

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.18 Ypsomed Holding

- 16.2.18.1. Overview

- 16.2.18.2. Products

- 16.2.18.3. SWOT Analysis

- 16.2.18.4. Recent Developments

- 16.2.18.5. Financials (Based on Availability)

- 16.2.19 Medtronic

- 16.2.19.1. Overview

- 16.2.19.2. Products

- 16.2.19.3. SWOT Analysis

- 16.2.19.4. Recent Developments

- 16.2.19.5. Financials (Based on Availability)

- 16.2.20 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES

- 16.2.20.1. Overview

- 16.2.20.2. Products

- 16.2.20.3. SWOT Analysis

- 16.2.20.4. Recent Developments

- 16.2.20.5. Financials (Based on Availability)

- 16.2.21 2 F Hoffmann-La Roche AG

- 16.2.21.1. Overview

- 16.2.21.2. Products

- 16.2.21.3. SWOT Analysis

- 16.2.21.4. Recent Developments

- 16.2.21.5. Financials (Based on Availability)

- 16.2.22 3 Johnson & Johnson

- 16.2.22.1. Overview

- 16.2.22.2. Products

- 16.2.22.3. SWOT Analysis

- 16.2.22.4. Recent Developments

- 16.2.22.5. Financials (Based on Availability)

- 16.2.23 Dexcom

- 16.2.23.1. Overview

- 16.2.23.2. Products

- 16.2.23.3. SWOT Analysis

- 16.2.23.4. Recent Developments

- 16.2.23.5. Financials (Based on Availability)

- 16.2.24 1 Abbott

- 16.2.24.1. Overview

- 16.2.24.2. Products

- 16.2.24.3. SWOT Analysis

- 16.2.24.4. Recent Developments

- 16.2.24.5. Financials (Based on Availability)

- 16.2.25 Continuous Glucose Monitoring Devices

- 16.2.25.1. Overview

- 16.2.25.2. Products

- 16.2.25.3. SWOT Analysis

- 16.2.25.4. Recent Developments

- 16.2.25.5. Financials (Based on Availability)

- 16.2.26 Tandem

- 16.2.26.1. Overview

- 16.2.26.2. Products

- 16.2.26.3. SWOT Analysis

- 16.2.26.4. Recent Developments

- 16.2.26.5. Financials (Based on Availability)

- 16.2.27 4 Other Insulin Device

- 16.2.27.1. Overview

- 16.2.27.2. Products

- 16.2.27.3. SWOT Analysis

- 16.2.27.4. Recent Developments

- 16.2.27.5. Financials (Based on Availability)

- 16.2.28 Insulet Corporation

- 16.2.28.1. Overview

- 16.2.28.2. Products

- 16.2.28.3. SWOT Analysis

- 16.2.28.4. Recent Developments

- 16.2.28.5. Financials (Based on Availability)

- 16.2.1 1 Omnipod

List of Figures

- Figure 1: Global US Diabetes Devices Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Diabetes Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Diabetes Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Diabetes Devices Market Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 5: North America US Diabetes Devices Market Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 6: North America US Diabetes Devices Market Revenue (Million), by Management Devices 2024 & 2032

- Figure 7: North America US Diabetes Devices Market Revenue Share (%), by Management Devices 2024 & 2032

- Figure 8: North America US Diabetes Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America US Diabetes Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America US Diabetes Devices Market Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 11: South America US Diabetes Devices Market Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 12: South America US Diabetes Devices Market Revenue (Million), by Management Devices 2024 & 2032

- Figure 13: South America US Diabetes Devices Market Revenue Share (%), by Management Devices 2024 & 2032

- Figure 14: South America US Diabetes Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America US Diabetes Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe US Diabetes Devices Market Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 17: Europe US Diabetes Devices Market Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 18: Europe US Diabetes Devices Market Revenue (Million), by Management Devices 2024 & 2032

- Figure 19: Europe US Diabetes Devices Market Revenue Share (%), by Management Devices 2024 & 2032

- Figure 20: Europe US Diabetes Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe US Diabetes Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa US Diabetes Devices Market Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 23: Middle East & Africa US Diabetes Devices Market Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 24: Middle East & Africa US Diabetes Devices Market Revenue (Million), by Management Devices 2024 & 2032

- Figure 25: Middle East & Africa US Diabetes Devices Market Revenue Share (%), by Management Devices 2024 & 2032

- Figure 26: Middle East & Africa US Diabetes Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa US Diabetes Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific US Diabetes Devices Market Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 29: Asia Pacific US Diabetes Devices Market Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 30: Asia Pacific US Diabetes Devices Market Revenue (Million), by Management Devices 2024 & 2032

- Figure 31: Asia Pacific US Diabetes Devices Market Revenue Share (%), by Management Devices 2024 & 2032

- Figure 32: Asia Pacific US Diabetes Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific US Diabetes Devices Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Diabetes Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 3: Global US Diabetes Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 4: Global US Diabetes Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global US Diabetes Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global US Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 12: Global US Diabetes Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 13: Global US Diabetes Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global US Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 18: Global US Diabetes Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 19: Global US Diabetes Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global US Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 24: Global US Diabetes Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 25: Global US Diabetes Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global US Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 36: Global US Diabetes Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 37: Global US Diabetes Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global US Diabetes Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 45: Global US Diabetes Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 46: Global US Diabetes Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific US Diabetes Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Diabetes Devices Market?

The projected CAGR is approximately 6.27%.

2. Which companies are prominent players in the US Diabetes Devices Market?

Key companies in the market include 1 Omnipod, Insulin Devices, 4 Other Continuous Glucose Monitoring Devices, 3 LifeScan, 1 Dexcom, Becton and Dickenson, 3 Abbott, F Hoffmann-La Roche AG, 2 Novo Nordisk, 2 Medtronic, 4 Other Self-monitoring Blood Glucose Devices, Abbott, Self-monitoring Blood Glucose Devices, Novo Nordisk, Eli Lilly and Company*List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS, Sanofi, Johnson & Johnson, Ypsomed Holding, Medtronic, 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES, 2 F Hoffmann-La Roche AG, 3 Johnson & Johnson, Dexcom, 1 Abbott, Continuous Glucose Monitoring Devices, Tandem, 4 Other Insulin Device, Insulet Corporation.

3. What are the main segments of the US Diabetes Devices Market?

The market segments include Monitoring Devices, Management Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Growing Diabetes and Obesity Population in the United States.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

August 2023: The US Food and Drug Administration (FDA) has granted clearance for Roche's Accu-Chek Solo micropump system, a tubing-free "patch" pump for people with diabetes who use insulin.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Diabetes Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Diabetes Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Diabetes Devices Market?

To stay informed about further developments, trends, and reports in the US Diabetes Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence