Key Insights

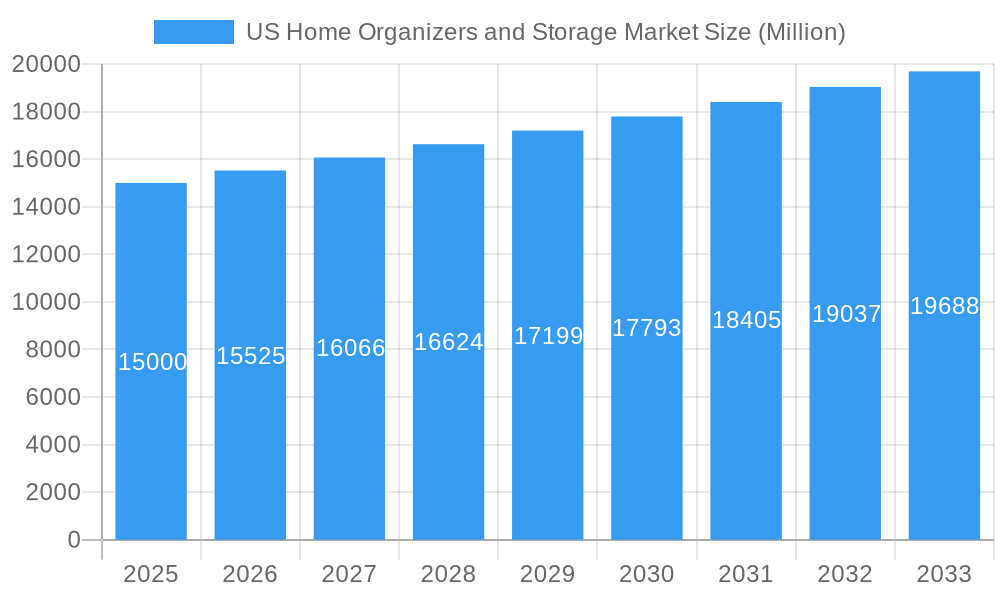

The US home organizers and storage market is poised for significant expansion, fueled by increasing urbanization, compact living spaces, and a growing consumer desire for efficient home organization. The market, valued at $13.27 billion in the base year 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 4.98% during the forecast period (2025-2033). Key growth catalysts include the adoption of minimalist lifestyles, heightened investment in home improvement, and the pervasive influence of e-commerce. High demand is observed for storage baskets, boxes, modular units, and specialized organizers for closets, pantries, and garages. The integration of multi-functional furniture and a commitment to sustainable storage solutions are further driving market evolution. Leading industry players such as Amazon, Wayfair, Walmart, and The Container Store dominate through established brand equity and expansive distribution. Conversely, escalating raw material costs and intensified competition from niche market entrants present potential headwinds. Demand is expected to be particularly robust in densely populated regions, including the Northeast and West Coast.

US Home Organizers and Storage Market Market Size (In Billion)

The burgeoning e-commerce sector is fundamentally altering distribution dynamics. While hypermarkets and supermarkets retain a considerable market presence, online platforms offer unparalleled convenience and product variety, contributing substantially to overall market growth. Concurrently, the increasing engagement with professional home organization services is spurring demand for premium, durable storage products. This trend is anticipated to persist as consumers increasingly prioritize both functionality and aesthetic appeal in their living environments. Market segmentation presents considerable opportunities for businesses to innovate and differentiate by focusing on specific product categories or consumer needs, fostering continuous advancement within this dynamic industry. The projected growth trajectory indicates a promising investment landscape for the home organizers and storage market.

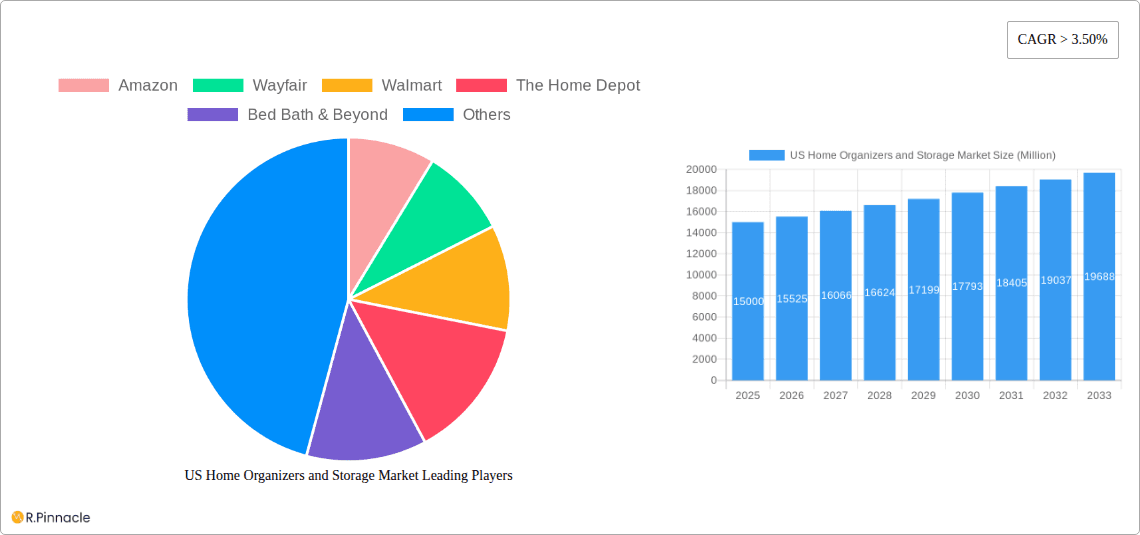

US Home Organizers and Storage Market Company Market Share

US Home Organizers and Storage Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US Home Organizers and Storage Market, offering invaluable insights for industry professionals, investors, and strategists. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. We analyze market dynamics, segmentation, key players, and future growth potential, providing actionable data and trends to help you navigate this dynamic market.

US Home Organizers and Storage Market Market Structure & Innovation Trends

This section delves into the competitive landscape of the US home organizers and storage market, examining market concentration, innovation drivers, and regulatory influences. We analyze mergers and acquisitions (M&A) activity, providing insights into market share distribution and deal values.

The market is characterized by a mix of large multinational corporations and smaller, specialized players. Key players like Amazon, Wayfair, Walmart, The Home Depot, Bed Bath & Beyond, The Container Store, Lowe's, Menards, IKEA, Target, Neat Method, and Houzz (list not exhaustive) compete across various segments and distribution channels.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players controlling a significant share. Amazon and Walmart, for example, hold substantial market share due to their extensive reach and online presence. Smaller players often focus on niche segments or specialized offerings. Precise market share data for each player in 2025 is currently unavailable (xx%).

- Innovation Drivers: Consumer demand for space-saving and aesthetically pleasing solutions, coupled with technological advancements in materials and design, fuels innovation. Smart storage solutions, modular furniture, and sustainable materials are driving growth.

- Regulatory Framework: Regulations related to product safety and environmental standards influence product development and manufacturing.

- Product Substitutes: Existing storage solutions face competition from innovative alternatives like multifunctional furniture and digital storage platforms.

- M&A Activity: The recent acquisition of Closet Works by The Container Store for USD 21.5 Million in January 2022 highlights the ongoing consolidation within the sector. Further M&A activity is expected as larger companies seek to expand their market share and product portfolios. The total value of M&A deals in the period 2019-2024 is estimated to be around $XX Million.

- End-User Demographics: The primary target demographic is homeowners, particularly millennials and Gen X, who are increasingly focused on home organization and efficient space utilization.

US Home Organizers and Storage Market Market Dynamics & Trends

This section analyzes market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics, providing a comprehensive overview of market trends.

The US home organizers and storage market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for minimalist living. Technological advancements are contributing to the development of smart storage solutions and personalized organization systems. The market is witnessing a shift towards online channels, with e-commerce platforms playing a crucial role in distribution. Consumer preferences are evolving towards sustainable and aesthetically pleasing products. Intense competition among established players and emerging brands is shaping market dynamics. The CAGR for the period 2025-2033 is projected at xx%, with a market penetration rate of xx% by 2033. Further, the increasing popularity of home renovation and remodeling projects is boosting the market. The preference for customized storage solutions, reflecting individual needs and preferences, has emerged as a powerful trend. The influence of social media and home organization influencers significantly impact consumer buying decisions, particularly amongst younger demographics.

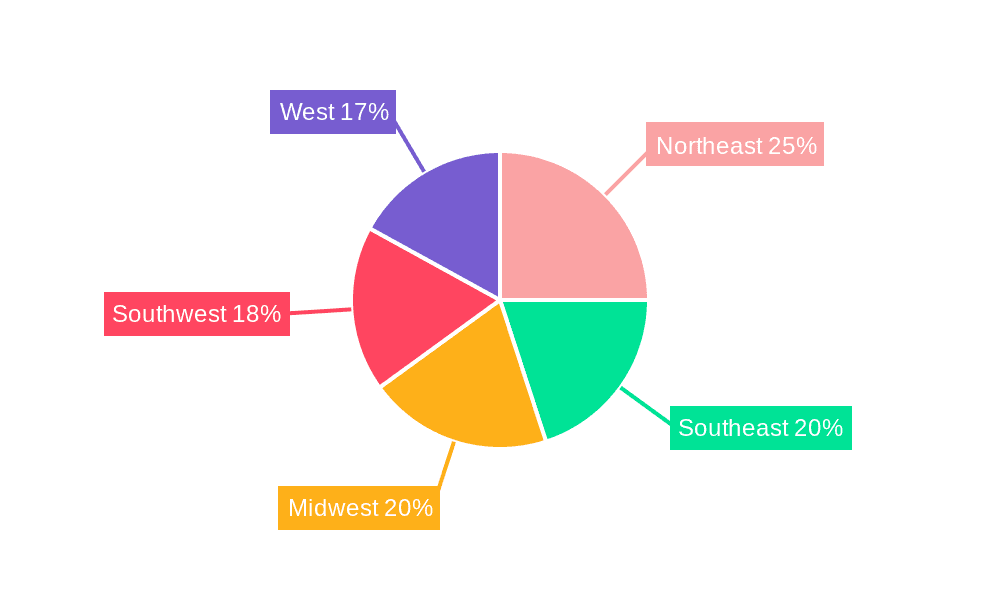

Dominant Regions & Segments in US Home Organizers and Storage Market

This section identifies the leading regions, countries, and segments within the US home organizers and storage market, examining key market drivers and competitive landscapes.

- By Product: Storage boxes represent the largest segment by volume and value, driven by versatility and affordability. Modular units are experiencing strong growth due to adaptability and space-saving design.

- By Application: Bedroom closets remain the largest application segment, followed by pantries and kitchens. The growing popularity of home offices is driving demand for specialized storage solutions in this category.

- By Distribution Channel: Online channels are experiencing significant growth, driven by convenience and accessibility. Hypermarkets and supermarkets continue to play a significant role, offering a wide range of products to a broader audience.

Key Drivers:

- Economic Growth: Rising disposable incomes are increasing consumer spending on home improvement and organization.

- Urbanization: Limited living spaces in urban areas drive the demand for efficient and space-saving storage solutions.

- Technological Advancements: Smart storage solutions and innovative materials are driving product innovation.

- Evolving Consumer Preferences: A growing preference for minimalist living and organized spaces is fueling market growth.

The Northeast region currently holds the largest market share due to higher household incomes and a greater concentration of homeowners.

US Home Organizers and Storage Market Product Innovations

Recent product innovations focus on smart storage solutions, modular designs, and sustainable materials. Products like smart shelves with integrated lighting and customizable modular units are gaining popularity. These innovations address the growing demand for space optimization and personalized storage solutions. The integration of technology enhances functionality and convenience, creating a competitive advantage in the market. The focus on sustainable materials such as bamboo and recycled plastics caters to environmentally conscious consumers.

Report Scope & Segmentation Analysis

This report segments the market by product (Storage Baskets, Storage Boxes, Storage Bags, Hanging Storage, Multipurpose Organizers, Travel Luggage Organizers, Modular Units, Other Products), application (Bedroom Closets, Laundry Rooms, Home Offices, Pantries and Kitchen, Garages, Other Applications), and distribution channel (Hypermarkets and Supermarkets, Specialty Stores, Online, Other Distribution Channels). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. For example, the online channel is projected to experience the highest growth rate due to increased e-commerce penetration.

Key Drivers of US Home Organizers and Storage Market Growth

The market is driven by rising disposable incomes, a growing preference for minimalist lifestyles, urbanization, and technological advancements leading to innovative storage solutions. Government initiatives promoting home improvement and the increasing popularity of home organization trends further contribute to market growth.

Challenges in the US Home Organizers and Storage Market Sector

Challenges include intense competition, fluctuating raw material prices, supply chain disruptions, and the increasing popularity of DIY solutions. These factors impact profitability and market expansion. The availability of substitutes also presents a challenge for growth.

Emerging Opportunities in US Home Organizers and Storage Market

Emerging opportunities lie in the development of smart storage solutions, sustainable products, and personalized organization systems. Expansion into niche markets and leveraging e-commerce channels offer significant growth potential.

Leading Players in the US Home Organizers and Storage Market Market

- Amazon

- Wayfair

- Walmart

- The Home Depot

- Bed Bath & Beyond

- The Container Store

- Lowe's

- Menards

- IKEA

- Target

- Neat Method

- Houzz

Key Developments in US Home Organizers and Storage Market Industry

- December 2022: Houzz Inc. launched Room Planner for Houzz Pro, enhancing design collaboration and visualization.

- January 2022: The Container Store acquired Closet Works for USD 21.5 Million, expanding its market reach and product offerings.

Future Outlook for US Home Organizers and Storage Market Market

The US home organizers and storage market is poised for continued growth, driven by urbanization, rising disposable incomes, and the increasing demand for efficient and aesthetically pleasing storage solutions. Companies focusing on innovation, sustainability, and e-commerce strategies are well-positioned to capitalize on future market opportunities.

US Home Organizers and Storage Market Segmentation

-

1. Product

- 1.1. Storage Baskets

- 1.2. Storage Boxes

- 1.3. Storage Bags

- 1.4. Hanging Storage

- 1.5. Multipurpose Organizers

- 1.6. Travel Luggage Organizers

- 1.7. Modular Units

- 1.8. Other Products

-

2. Application

- 2.1. Bedroom Closets

- 2.2. Laundry Rooms

- 2.3. Home Offices

- 2.4. Pantries and Kitchen

- 2.5. Garages

- 2.6. Other Applications

-

3. Distribution Channel

- 3.1. Hypermarkets and Supermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

US Home Organizers and Storage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Home Organizers and Storage Market Regional Market Share

Geographic Coverage of US Home Organizers and Storage Market

US Home Organizers and Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Creative Office Furniture; Growing Working Population is Boosting the Market

- 3.3. Market Restrains

- 3.3.1. High Competitive with a Large Number of Domestic and International Players; Changing Work Habits

- 3.4. Market Trends

- 3.4.1. Growing Residential Construction is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Home Organizers and Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Storage Baskets

- 5.1.2. Storage Boxes

- 5.1.3. Storage Bags

- 5.1.4. Hanging Storage

- 5.1.5. Multipurpose Organizers

- 5.1.6. Travel Luggage Organizers

- 5.1.7. Modular Units

- 5.1.8. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bedroom Closets

- 5.2.2. Laundry Rooms

- 5.2.3. Home Offices

- 5.2.4. Pantries and Kitchen

- 5.2.5. Garages

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets and Supermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America US Home Organizers and Storage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Storage Baskets

- 6.1.2. Storage Boxes

- 6.1.3. Storage Bags

- 6.1.4. Hanging Storage

- 6.1.5. Multipurpose Organizers

- 6.1.6. Travel Luggage Organizers

- 6.1.7. Modular Units

- 6.1.8. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bedroom Closets

- 6.2.2. Laundry Rooms

- 6.2.3. Home Offices

- 6.2.4. Pantries and Kitchen

- 6.2.5. Garages

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hypermarkets and Supermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America US Home Organizers and Storage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Storage Baskets

- 7.1.2. Storage Boxes

- 7.1.3. Storage Bags

- 7.1.4. Hanging Storage

- 7.1.5. Multipurpose Organizers

- 7.1.6. Travel Luggage Organizers

- 7.1.7. Modular Units

- 7.1.8. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bedroom Closets

- 7.2.2. Laundry Rooms

- 7.2.3. Home Offices

- 7.2.4. Pantries and Kitchen

- 7.2.5. Garages

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hypermarkets and Supermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe US Home Organizers and Storage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Storage Baskets

- 8.1.2. Storage Boxes

- 8.1.3. Storage Bags

- 8.1.4. Hanging Storage

- 8.1.5. Multipurpose Organizers

- 8.1.6. Travel Luggage Organizers

- 8.1.7. Modular Units

- 8.1.8. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bedroom Closets

- 8.2.2. Laundry Rooms

- 8.2.3. Home Offices

- 8.2.4. Pantries and Kitchen

- 8.2.5. Garages

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hypermarkets and Supermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa US Home Organizers and Storage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Storage Baskets

- 9.1.2. Storage Boxes

- 9.1.3. Storage Bags

- 9.1.4. Hanging Storage

- 9.1.5. Multipurpose Organizers

- 9.1.6. Travel Luggage Organizers

- 9.1.7. Modular Units

- 9.1.8. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bedroom Closets

- 9.2.2. Laundry Rooms

- 9.2.3. Home Offices

- 9.2.4. Pantries and Kitchen

- 9.2.5. Garages

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hypermarkets and Supermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific US Home Organizers and Storage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Storage Baskets

- 10.1.2. Storage Boxes

- 10.1.3. Storage Bags

- 10.1.4. Hanging Storage

- 10.1.5. Multipurpose Organizers

- 10.1.6. Travel Luggage Organizers

- 10.1.7. Modular Units

- 10.1.8. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bedroom Closets

- 10.2.2. Laundry Rooms

- 10.2.3. Home Offices

- 10.2.4. Pantries and Kitchen

- 10.2.5. Garages

- 10.2.6. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hypermarkets and Supermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amazon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Wayfair

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Walmart

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Home Depot

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bed Bath & Beyond

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Container Store

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lowe's

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Menards

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IKEA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Target

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Neat Method**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Houzz

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Amazon

List of Figures

- Figure 1: Global US Home Organizers and Storage Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Home Organizers and Storage Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America US Home Organizers and Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America US Home Organizers and Storage Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America US Home Organizers and Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Home Organizers and Storage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America US Home Organizers and Storage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America US Home Organizers and Storage Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America US Home Organizers and Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Home Organizers and Storage Market Revenue (billion), by Product 2025 & 2033

- Figure 11: South America US Home Organizers and Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: South America US Home Organizers and Storage Market Revenue (billion), by Application 2025 & 2033

- Figure 13: South America US Home Organizers and Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America US Home Organizers and Storage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: South America US Home Organizers and Storage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America US Home Organizers and Storage Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America US Home Organizers and Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Home Organizers and Storage Market Revenue (billion), by Product 2025 & 2033

- Figure 19: Europe US Home Organizers and Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Europe US Home Organizers and Storage Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Europe US Home Organizers and Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe US Home Organizers and Storage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Europe US Home Organizers and Storage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe US Home Organizers and Storage Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe US Home Organizers and Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Home Organizers and Storage Market Revenue (billion), by Product 2025 & 2033

- Figure 27: Middle East & Africa US Home Organizers and Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East & Africa US Home Organizers and Storage Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East & Africa US Home Organizers and Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa US Home Organizers and Storage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa US Home Organizers and Storage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa US Home Organizers and Storage Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Home Organizers and Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Home Organizers and Storage Market Revenue (billion), by Product 2025 & 2033

- Figure 35: Asia Pacific US Home Organizers and Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: Asia Pacific US Home Organizers and Storage Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Asia Pacific US Home Organizers and Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific US Home Organizers and Storage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific US Home Organizers and Storage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific US Home Organizers and Storage Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Home Organizers and Storage Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Home Organizers and Storage Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global US Home Organizers and Storage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global US Home Organizers and Storage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global US Home Organizers and Storage Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global US Home Organizers and Storage Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Global US Home Organizers and Storage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global US Home Organizers and Storage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global US Home Organizers and Storage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global US Home Organizers and Storage Market Revenue billion Forecast, by Product 2020 & 2033

- Table 13: Global US Home Organizers and Storage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global US Home Organizers and Storage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global US Home Organizers and Storage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global US Home Organizers and Storage Market Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Global US Home Organizers and Storage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global US Home Organizers and Storage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global US Home Organizers and Storage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global US Home Organizers and Storage Market Revenue billion Forecast, by Product 2020 & 2033

- Table 33: Global US Home Organizers and Storage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global US Home Organizers and Storage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global US Home Organizers and Storage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global US Home Organizers and Storage Market Revenue billion Forecast, by Product 2020 & 2033

- Table 43: Global US Home Organizers and Storage Market Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Global US Home Organizers and Storage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global US Home Organizers and Storage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Home Organizers and Storage Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Home Organizers and Storage Market?

The projected CAGR is approximately 4.98%.

2. Which companies are prominent players in the US Home Organizers and Storage Market?

Key companies in the market include Amazon, Wayfair, Walmart, The Home Depot, Bed Bath & Beyond, The Container Store, Lowe's, Menards, IKEA, Target, Neat Method**List Not Exhaustive, Houzz.

3. What are the main segments of the US Home Organizers and Storage Market?

The market segments include Product, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Creative Office Furniture; Growing Working Population is Boosting the Market.

6. What are the notable trends driving market growth?

Growing Residential Construction is Driving the Market.

7. Are there any restraints impacting market growth?

High Competitive with a Large Number of Domestic and International Players; Changing Work Habits.

8. Can you provide examples of recent developments in the market?

In December 2022, Houzz Inc. announced the launch of Room Planner for Houzz Pro, the all-in-one business management and marketing software for interior design and remodeling professionals. The Room Planner gives designers a highly visual, collaborative workspace to create, discuss, and share multiple design concepts internally with their team and externally with clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Home Organizers and Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Home Organizers and Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Home Organizers and Storage Market?

To stay informed about further developments, trends, and reports in the US Home Organizers and Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence