Key Insights

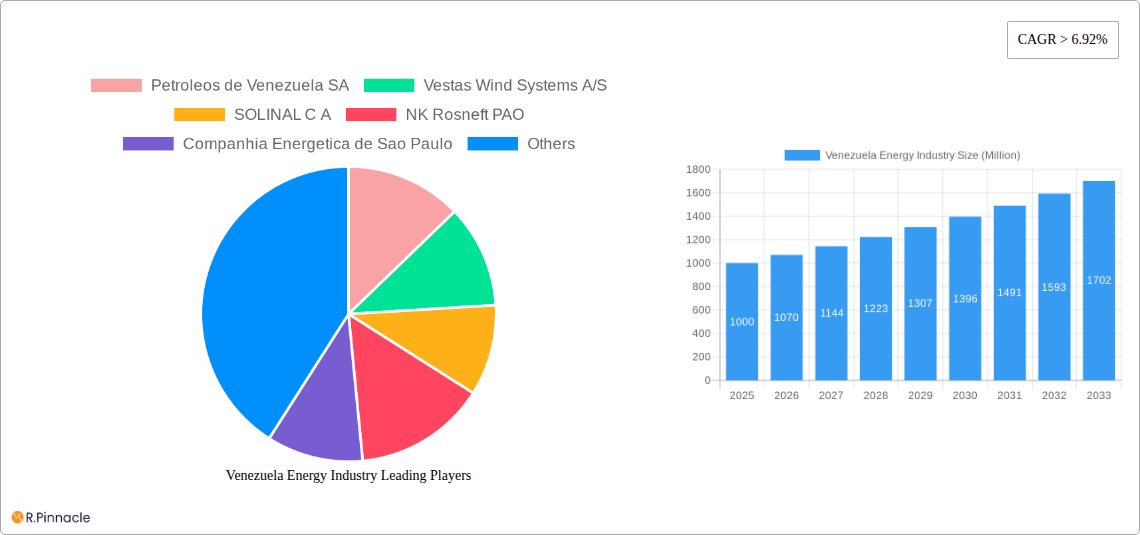

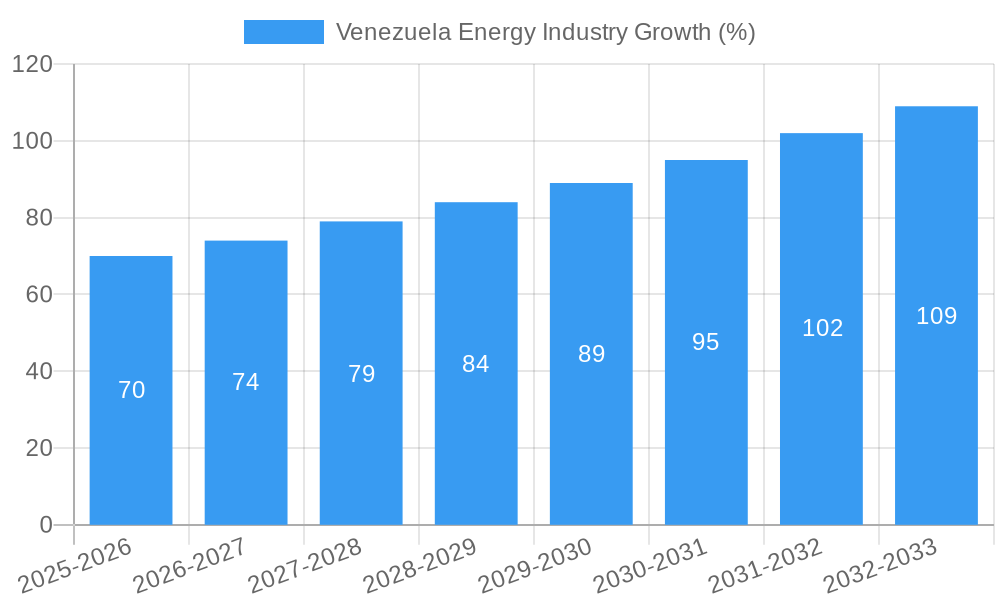

The Venezuelan energy industry, while facing significant challenges, presents a complex landscape of opportunities and risks. The market, valued at approximately $XX million in 2025 (the base year), exhibits a robust Compound Annual Growth Rate (CAGR) exceeding 6.92%. This growth is primarily driven by increasing energy demand fueled by a recovering economy and the government's focus on infrastructure development, despite persistent political and economic instability. Key growth drivers include investments in renewable energy sources, particularly hydropower, to diversify the energy mix and reduce reliance on fossil fuels. However, significant restraints remain, including outdated infrastructure, limited investment capital due to sanctions and political uncertainty, and a lack of technological advancements in certain sectors. The segmental breakdown reveals a significant portion attributed to thermal power generation, reflecting the country's dependence on traditional energy sources. Hydroelectric power also plays a vital role, leveraging the country's considerable water resources. Nuclear power and renewables represent smaller yet growing segments, indicating a shift towards a more sustainable energy future, though hampered by financing difficulties and technological limitations. Major players like Petroleos de Venezuela SA continue to dominate the thermal sector, while international companies like Vestas Wind Systems A/S are venturing into the renewable energy space, though their involvement is currently limited by the political climate.

The forecast period (2025-2033) projects continued expansion, albeit with potential fluctuations linked to geopolitical factors and economic volatility. Successful navigation of these obstacles necessitates targeted reforms, attracting foreign investment through improved transparency and policy stability, and prioritizing investments in modernizing the energy grid and fostering innovation in renewable energy technologies. The industry's growth trajectory hinges on the government's ability to address these challenges and create a more favorable environment for both domestic and foreign participation. A cautious approach is warranted, however, given the inherent risks associated with Venezuela's political and economic landscape. The competitive landscape involves a complex interplay between state-owned enterprises and a limited presence of international players, highlighting opportunities for strategic partnerships and technological collaborations to overcome the present limitations and unlock the industry’s growth potential.

Venezuela Energy Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides an in-depth analysis of the Venezuelan energy industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages rigorous data analysis and expert insights to present a clear picture of market dynamics, growth drivers, and future prospects.

Venezuela Energy Industry Market Structure & Innovation Trends

This section analyzes the Venezuelan energy market's structure, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The historical period (2019-2024) reveals a market dominated by Petróleos de Venezuela, S.A. (PDVSA), holding an estimated xx% market share in 2024. However, the entry of international players like Total SA and NK Rosneft PAO, coupled with increasing renewable energy investment, is slowly changing the landscape.

- Market Concentration: Highly concentrated in the historical period, gradually diversifying.

- Innovation Drivers: Government policies promoting renewable energy, albeit inconsistently applied. Technological advancements in solar and wind power are driving innovation.

- Regulatory Frameworks: Characterized by instability and frequent changes, impacting investment decisions and project timelines.

- Product Substitutes: Growing adoption of renewable energy sources (solar, wind) as substitutes for traditional fossil fuels.

- End-User Demographics: Primarily focused on the residential and industrial sectors, with significant potential in the transportation sector.

- M&A Activities: Limited M&A activity in recent years due to economic and political instability. Estimated total M&A deal value for 2019-2024 is approximately $xx Million.

Venezuela Energy Industry Market Dynamics & Trends

The Venezuelan energy market exhibits complex dynamics driven by fluctuating oil prices, political instability, and evolving energy consumption patterns. The Compound Annual Growth Rate (CAGR) for the overall energy market during 2019-2024 is estimated at xx%, significantly impacted by the decline in oil production and export. However, the forecast period (2025-2033) projects a CAGR of xx%, fueled by anticipated growth in renewable energy adoption and potential improvements in the overall economic climate. Market penetration of renewables remains low, currently at approximately xx% in 2024, but is projected to increase to xx% by 2033. Technological disruptions, particularly in renewable energy technologies, are shaping market dynamics. Consumer preferences are gradually shifting towards cleaner and more sustainable energy sources, influencing investments in renewable energy infrastructure. Competitive dynamics are evolving as international energy companies explore opportunities in the Venezuelan market.

Dominant Regions & Segments in Venezuela Energy Industry

The Venezuelan energy market is geographically concentrated, with the majority of energy production and consumption occurring in specific regions heavily reliant on oil and gas resources. The thermal power generation segment currently dominates the overall energy mix, driven by the country's abundant oil and gas reserves. However, the hydroelectric sector holds significant potential for future growth, owing to the nation's substantial hydropower resources.

- Key Drivers for Thermal Power Generation: Abundant natural gas reserves, existing infrastructure.

- Key Drivers for Hydroelectric Power Generation: Significant untapped hydropower potential, government support for large-scale projects (though implementation is often inconsistent).

- Nuclear Power Generation: Currently negligible, with no significant development plans.

- Renewables (Solar & Wind): Experiencing gradual growth, driven by government initiatives and private sector investments, although facing significant infrastructure challenges and limitations.

Venezuela Energy Industry Product Innovations

Recent product innovations in Venezuela's energy sector primarily center around improving the efficiency of existing thermal power plants and developing renewable energy technologies. There's a growing focus on integrating smart grid technologies to optimize energy distribution and minimize losses. However, a lack of investment and technological transfer limits the rate of innovation.

Report Scope & Segmentation Analysis

This report segments the Venezuelan energy market into four key power generation categories: Thermal, Hydroelectric, Nuclear, and Renewables. Each segment is analyzed based on market size, growth projections, competitive dynamics and technological advancements. The thermal segment currently holds the largest market share due to Venezuela's oil and gas wealth, but the renewable segment is projected to experience the fastest growth in the forecast period.

- Thermal: Dominated by PDVSA, showing moderate growth.

- Hydroelectric: Significant potential for expansion, but hampered by regulatory and financial constraints.

- Nuclear: Currently insignificant, unlikely to see significant growth in the forecast period.

- Renewables: Fastest-growing segment, driven by government targets and private investment, but facing infrastructure challenges.

Key Drivers of Venezuela Energy Industry Growth

Growth in the Venezuelan energy industry hinges upon several factors, including the stabilization of the political and economic landscape, attracting foreign investment, and focusing on renewable energy deployment. Successful implementation of government policies encouraging private sector participation and investment in infrastructure is crucial. Technological advancements in renewable energy, coupled with improved energy efficiency measures, will also contribute significantly to growth.

Challenges in the Venezuela Energy Industry Sector

Significant challenges impede the growth of the Venezuelan energy sector. These include political and economic instability, creating uncertainty for investors; aging infrastructure, requiring substantial investment for modernization and upgrading; and the lack of access to international financing, hindering major projects. Sanctions and political issues limit access to global technologies and expertise. These factors collectively result in reduced investment, limited capacity expansion, and inefficient energy production.

Emerging Opportunities in Venezuela Energy Industry

Despite the challenges, several opportunities exist. The vast untapped renewable energy potential presents significant prospects for development and investment. The demand for improved energy efficiency presents opportunities for technology providers and service companies. The growing need for reliable and sustainable energy solutions could attract international partnerships and collaborations.

Leading Players in the Venezuela Energy Industry Market

- Petróleos de Venezuela SA

- Vestas Wind Systems A/S

- SOLINAL C A

- NK Rosneft PAO

- Companhia Energética de São Paulo

- Centrais Elétricas do Norte do Brasil S A

- Total SA

- Andritz AG

Key Developments in Venezuela Energy Industry Industry

- 2022 Q3: Government announced new renewable energy targets, albeit with unclear implementation plans.

- 2023 Q1: PDVSA secured a small loan for upgrading an existing thermal power plant.

- 2024 Q2: A small-scale solar farm project commenced, financed by a private investor.

Future Outlook for Venezuela Energy Industry Market

The future of the Venezuelan energy market depends heavily on resolving political and economic uncertainties. Increased investment in renewable energy and infrastructure upgrades is crucial for sustainable growth. The potential for international partnerships and technological collaboration could unlock significant growth opportunities. However, significant progress hinges on creating a stable and predictable investment climate. The market's potential for growth remains substantial, particularly in the renewable energy sector, provided these obstacles are addressed.

Venezuela Energy Industry Segmentation

-

1. Power Generation

- 1.1. Thermal

- 1.2. Hydroelectric

- 1.3. Nuclear

- 1.4. Renewables

- 2. Power Transmission and Distribution

Venezuela Energy Industry Segmentation By Geography

- 1. Venezuela

Venezuela Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Emphasis Towards Renewable Energy Integration4.; Increasing Demand in the Commercial and Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Slow-Paced Installation of Rooftop Projects

- 3.4. Market Trends

- 3.4.1. Wind Potential to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Venezuela Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Thermal

- 5.1.2. Hydroelectric

- 5.1.3. Nuclear

- 5.1.4. Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Venezuela

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Petroleos de Venezuela SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vestas Wind Systems A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SOLINAL C A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NK Rosneft PAO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Companhia Energetica de Sao Paulo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Centrais Eletricas do Norte do Brasil S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Total SA*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Andritz AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Petroleos de Venezuela SA

List of Figures

- Figure 1: Venezuela Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Venezuela Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Venezuela Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Venezuela Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Venezuela Energy Industry Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 4: Venezuela Energy Industry Volume Gigawatt Forecast, by Power Generation 2019 & 2032

- Table 5: Venezuela Energy Industry Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 6: Venezuela Energy Industry Volume Gigawatt Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 7: Venezuela Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Venezuela Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Venezuela Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Venezuela Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: Venezuela Energy Industry Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 12: Venezuela Energy Industry Volume Gigawatt Forecast, by Power Generation 2019 & 2032

- Table 13: Venezuela Energy Industry Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 14: Venezuela Energy Industry Volume Gigawatt Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 15: Venezuela Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Venezuela Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Venezuela Energy Industry?

The projected CAGR is approximately > 6.92%.

2. Which companies are prominent players in the Venezuela Energy Industry?

Key companies in the market include Petroleos de Venezuela SA, Vestas Wind Systems A/S, SOLINAL C A, NK Rosneft PAO, Companhia Energetica de Sao Paulo, Centrais Eletricas do Norte do Brasil S A, Total SA*List Not Exhaustive, Andritz AG.

3. What are the main segments of the Venezuela Energy Industry?

The market segments include Power Generation, Power Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Emphasis Towards Renewable Energy Integration4.; Increasing Demand in the Commercial and Industrial Sector.

6. What are the notable trends driving market growth?

Wind Potential to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Slow-Paced Installation of Rooftop Projects.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Venezuela Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Venezuela Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Venezuela Energy Industry?

To stay informed about further developments, trends, and reports in the Venezuela Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence