Key Insights

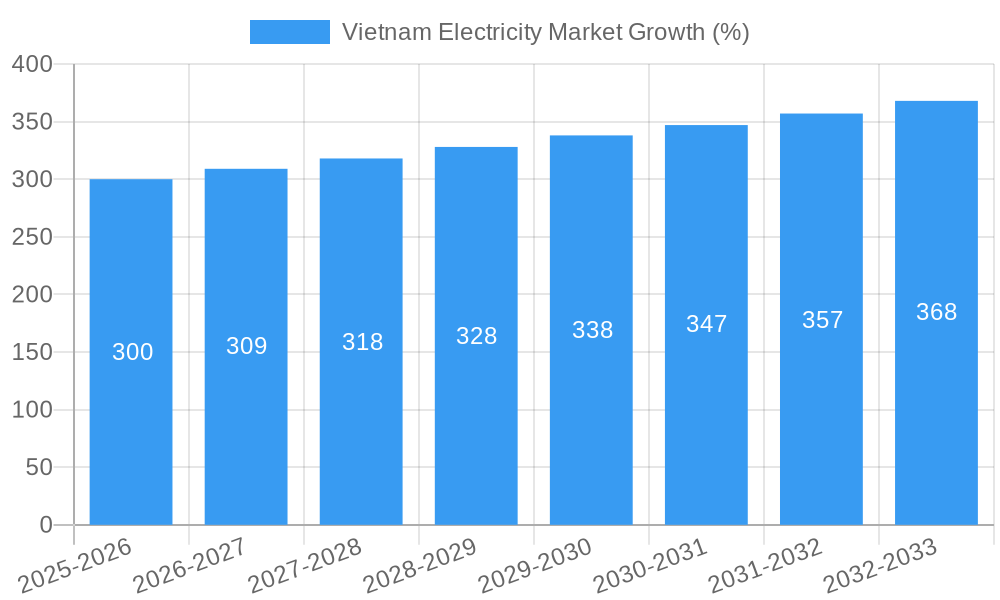

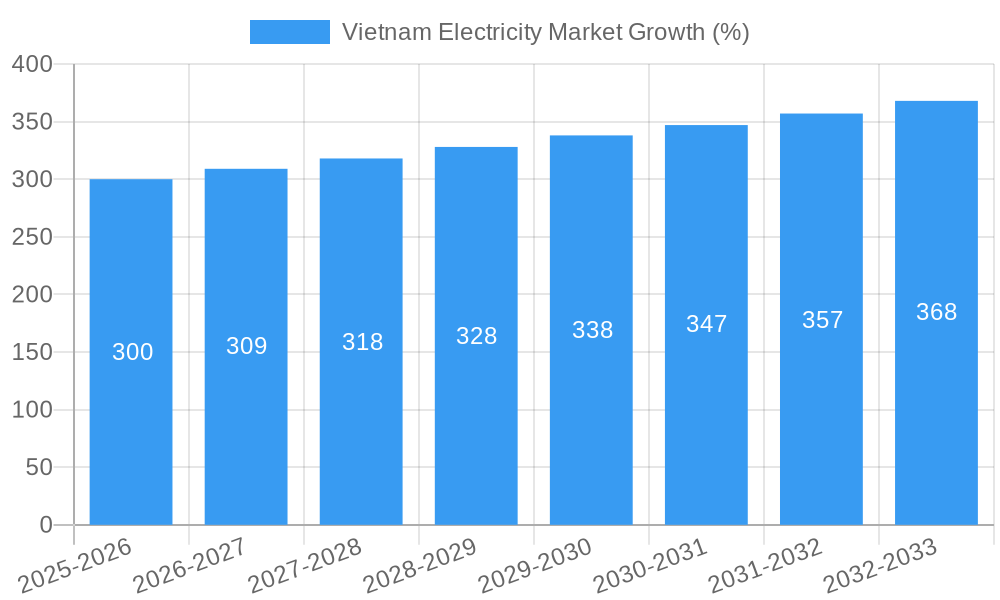

The Vietnam electricity market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 3% from 2025 to 2033. This expansion is fueled by several key drivers. Rapid economic development and urbanization in Vietnam are significantly increasing energy demand across residential, commercial, and industrial sectors. Government initiatives promoting renewable energy sources, such as solar and wind power, are further stimulating market growth. These initiatives aim to diversify the energy mix, reduce reliance on fossil fuels, and meet the nation's ambitious sustainability goals. However, challenges remain. Limited transmission and distribution infrastructure in certain regions may constrain the effective integration of new renewable energy capacities. Furthermore, securing sufficient investment for large-scale infrastructure projects and managing the transition from traditional power sources to cleaner alternatives require careful planning and policy coordination. The market is segmented by power generation type, including thermal, gas, renewable (solar, wind, hydro), nuclear, and others. Key players such as JGC Vietnam, IHI Infrastructure Systems, Toshiba, Doosan Heavy Industries, Lilama Corporation, PALMA VIETNAM, AES Corporation, and CTCI Corporation are actively shaping the competitive landscape through technological innovation and strategic partnerships. The market's future trajectory will be significantly influenced by the success of government policies aimed at both increasing energy access and achieving environmental sustainability targets.

The forecast period of 2025-2033 promises continued expansion for the Vietnamese electricity market. While the specific breakdown of market share by generation type is not explicitly detailed, it's reasonable to anticipate that renewable energy will gain significant market share driven by the government's supportive policies. Conversely, the share of thermal power might decrease gradually as Vietnam transitions towards a cleaner energy mix. The competitive landscape will remain dynamic, with both domestic and international players vying for market share through technological advancements, cost-efficiency, and strategic collaborations. Continuous investments in grid modernization and expansion will be crucial to efficiently integrate the influx of renewable energy and ensure reliable power supply across the nation. Factors such as fluctuating global energy prices and geopolitical events could also influence the market's overall trajectory during the forecast period.

Vietnam Electricity Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vietnam electricity market, covering the period from 2019 to 2033. It delves into market structure, dynamics, key players, and future projections, offering invaluable insights for industry professionals, investors, and policymakers. The report leverages extensive data analysis and forecasts to provide a clear understanding of the market's evolution and growth potential. The base year for the report is 2025, with estimations for 2025 and a forecast period spanning from 2025 to 2033. The historical period covered is 2019-2024.

Vietnam Electricity Market Market Structure & Innovation Trends

The Vietnam electricity market exhibits a complex structure characterized by a mix of state-owned enterprises (SOEs) and private players. Market concentration is moderate, with several large players holding significant market share, but a considerable number of smaller players also contributing. Innovation is driven by the government's push for renewable energy sources and improved grid infrastructure, alongside technological advancements in power generation and energy efficiency. The regulatory framework is evolving, aiming to attract foreign investment and encourage private sector participation while ensuring energy security. Product substitutes are limited, with the primary alternative being imported electricity. End-user demographics are diverse, encompassing residential, commercial, and industrial consumers with varying energy demands.

- Market Share (Estimated 2025): Dominant players hold approximately 60% of the market share, with the remaining 40% distributed amongst numerous smaller companies. Exact figures are confidential and require purchase of the full report.

- M&A Activity (2019-2024): Over the historical period, M&A activity in the Vietnam electricity market totaled approximately USD xx Million, with most deals involving smaller players seeking acquisition by larger corporations. Further data is within the full report.

Vietnam Electricity Market Market Dynamics & Trends

The Vietnam electricity market is experiencing robust growth, driven by rapid economic development, increasing urbanization, and rising energy consumption. The compound annual growth rate (CAGR) is projected to be xx% from 2025 to 2033. Technological disruptions, including the integration of renewable energy sources and smart grid technologies, are reshaping the market landscape. Consumer preferences are shifting towards cleaner and more sustainable energy solutions. Competitive dynamics are intense, with both domestic and international players vying for market share. Market penetration of renewable energy is gradually increasing, currently at approximately xx% and projected to reach xx% by 2033.

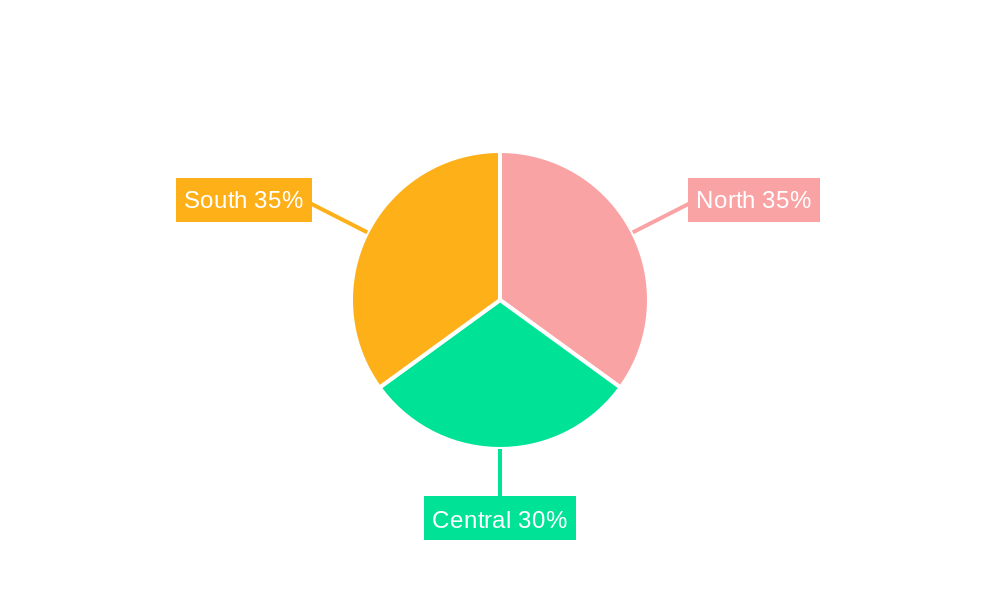

Dominant Regions & Segments in Vietnam Electricity Market

The southern region of Vietnam dominates the electricity market due to its higher population density, industrial activity, and economic development. Within the electricity generation segments, thermal power currently holds the largest market share, but renewable energy is expected to witness significant growth in the forecast period.

- Key Drivers of Southern Region Dominance: Higher energy demand from industries and densely populated areas, well-established power infrastructure.

- Thermal Power: Significant existing capacity and continuous investments, however facing environmental concerns and government push for diversification.

- Renewable Energy: Rapid growth expected due to government incentives, increasing awareness of climate change, and decreasing costs of solar and wind technologies. Hydropower also maintains a significant presence.

- Gas Power: Steady growth based on increasing natural gas availability and cleaner energy profile compared to coal.

- Nuclear Power: Limited presence but potential for future expansion, subject to regulatory approvals and public perception.

- Other Types: This segment includes biomass and waste-to-energy, with relatively small market share but potential for future growth.

Vietnam Electricity Market Product Innovations

Recent product innovations include advancements in solar panel technology, smart grid solutions, and energy storage systems. These innovations are improving efficiency, reliability, and sustainability across the power sector, enhancing market competitiveness and customer satisfaction. The focus is on technologies that improve grid stability and integrate renewable energy sources effectively.

Report Scope & Segmentation Analysis

This report segments the Vietnam electricity market by generation type: Thermal, Gas, Renewable, Nuclear, and Other. Each segment's growth projections, market sizes, and competitive dynamics are analyzed separately. For example, the renewable segment displays the highest projected growth rate, driven by governmental incentives and technological advancements. Thermal power remains substantial but faces decreasing market share due to environmental concerns. Detailed market sizes (in Millions of USD) are provided in the full report for each segment.

Key Drivers of Vietnam Electricity Market Growth

The Vietnam electricity market's growth is propelled by several factors, including rapid economic expansion, rising industrialization, increasing urbanization, and government support for renewable energy development. Economic policies focused on infrastructure development and foreign investment further contribute to market growth. Moreover, technological advancements in renewable energy technologies make them increasingly cost-competitive with traditional sources.

Challenges in the Vietnam Electricity Market Sector

The sector faces challenges including grid infrastructure limitations, dependence on imported fossil fuels, and fluctuating global energy prices impacting energy security and affordability. Regulatory hurdles and bureaucratic procedures can also slow down project development and implementation. Furthermore, maintaining a balance between economic growth and environmental sustainability remains a key challenge.

Emerging Opportunities in Vietnam Electricity Market

Significant opportunities exist in the expansion of renewable energy sources, especially solar and wind power. Smart grid technologies offer further opportunities for efficiency and grid stability improvements. The development of energy storage solutions also presents considerable potential. Finally, exploring regional cooperation in cross-border electricity trading could unlock new market access.

Leading Players in the Vietnam Electricity Market Market

- JGC Vietnam

- IHI Infrastructure Systems Co Ltd

- Toshiba Corporation

- Doosan Heavy Industries Construction Co Ltd

- Lilama Corporation

- PALMA VIETNAM

- AES Corporation

- CTCI Corporation

Key Developments in Vietnam Electricity Market Industry

- December 2021: Japan's Shikoku Electric Power Co Inc. invested USD 87 Million in Vietnam Vung Ang 2 coal-fired power plant, signaling continued interest despite renewable energy growth.

- October 2020: ExxonMobil and JERA signed an MOU for a potential LNG-to-power plant in Hai Phong, reflecting the shift towards cleaner fuels.

Future Outlook for Vietnam Electricity Market Market

The Vietnam electricity market is poised for sustained growth, driven by increasing energy demand, government policies supporting renewable energy, and continued investments in infrastructure. Strategic opportunities lie in developing renewable energy projects, improving grid infrastructure, and embracing smart grid technologies. The market will continue to evolve towards a more diversified and sustainable energy mix.

Vietnam Electricity Market Segmentation

-

1. Type

- 1.1. Thermal

- 1.2. Gas

- 1.3. Renewable

- 1.4. Nuclear

- 1.5. Other Types

Vietnam Electricity Market Segmentation By Geography

- 1. Vietnam

Vietnam Electricity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. The Thermal Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Electricity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Thermal

- 5.1.2. Gas

- 5.1.3. Renewable

- 5.1.4. Nuclear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JGC Vietnam

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IHI Infrastructure Systems Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toshiba Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Doosan Heavy Industries Construction Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lilama Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PALMA VIETNAM

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AES Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CTCI Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 JGC Vietnam

List of Figures

- Figure 1: Vietnam Electricity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Electricity Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Electricity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Electricity Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Vietnam Electricity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Vietnam Electricity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Vietnam Electricity Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Vietnam Electricity Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Electricity Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Vietnam Electricity Market?

Key companies in the market include JGC Vietnam, IHI Infrastructure Systems Co Ltd, Toshiba Corporation, Doosan Heavy Industries Construction Co Ltd, Lilama Corporation, PALMA VIETNAM, AES Corporation, CTCI Corporation.

3. What are the main segments of the Vietnam Electricity Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

The Thermal Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In December 2021, Japan's Shikoku Electric Power Co Inc. invested more than JPY 10 billion (USD 87 million) in buying a 15% stake in the Vietnam Vung Ang 2 coal-fired power plant project. The Japanese utility paid between JPY 10-20 billion to the Japanese trading house Mitsubishi Corp. to buy the stake.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Electricity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Electricity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Electricity Market?

To stay informed about further developments, trends, and reports in the Vietnam Electricity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence