Key Insights

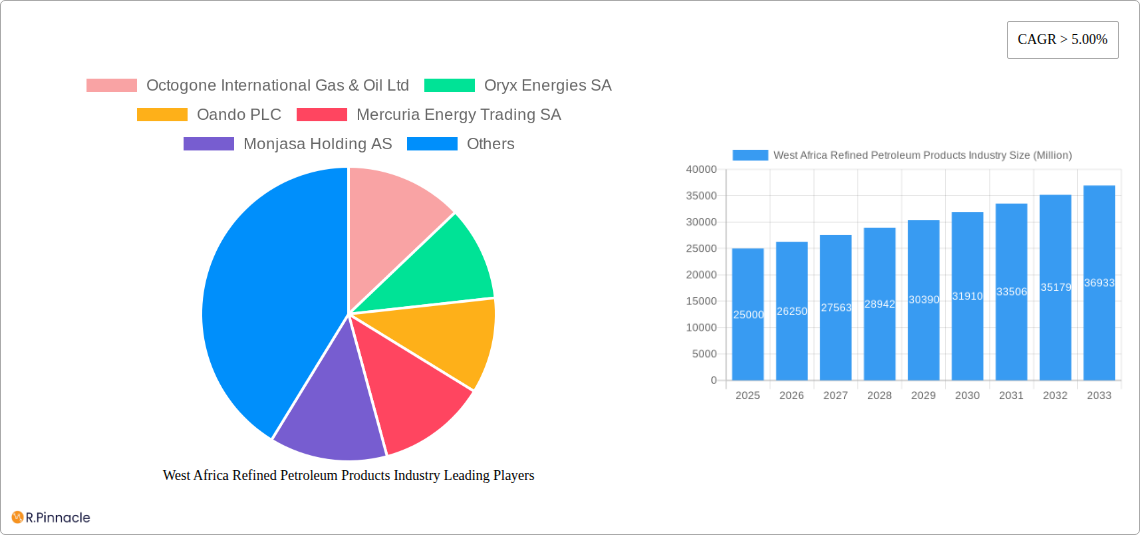

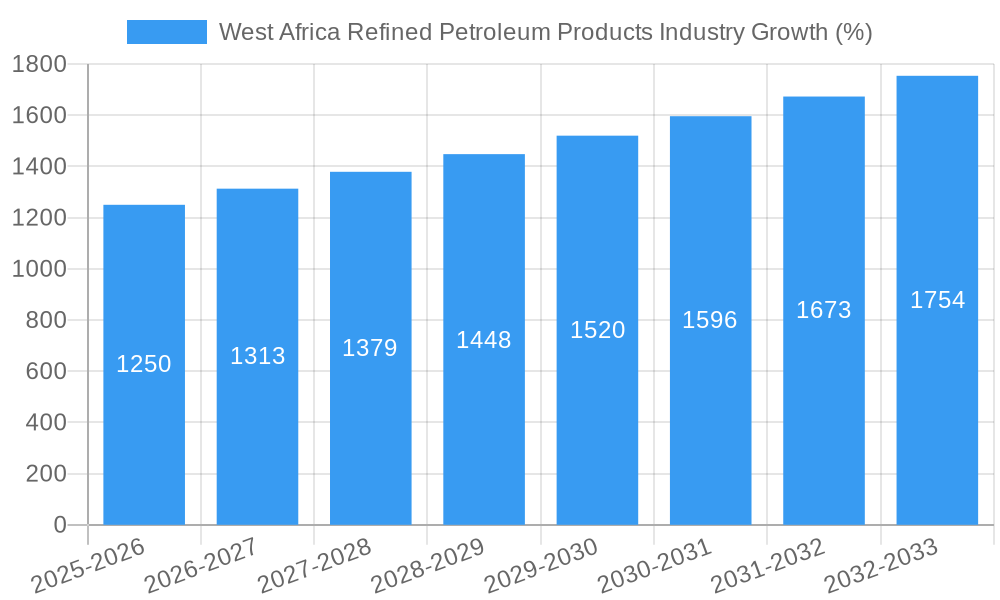

The West African Refined Petroleum Products market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 5% compound annual growth rate (CAGR) through 2033. This expansion is fueled by several key factors. Firstly, increasing urbanization and industrialization across the region are driving up energy demand. Secondly, the growing adoption of vehicles and rising disposable incomes are boosting fuel consumption, particularly in automotive fuels. Thirdly, while the region has significant oil reserves, refining capacity remains a constraint, leading to a reliance on imports and creating market opportunities for refined petroleum product distributors and traders. The segmental breakdown showcases automotive fuels as the largest contributor, followed by marine fuels, reflecting the region's dependence on maritime transport and growing economic activity. However, the Liquefied Petroleum Gas (LPG) segment is also expected to see substantial growth due to increasing government initiatives promoting cleaner cooking fuels and reducing reliance on traditional biomass. Key players such as Vitol, Trafigura, and Oryx Energies are strategically positioned to capitalize on this expanding market, competing on price, logistics efficiency, and supply reliability.

Despite the positive outlook, challenges persist. Political instability and infrastructural limitations in some West African nations can hinder efficient distribution and negatively impact market growth. Furthermore, fluctuating global crude oil prices pose a significant risk, potentially impacting profitability and market stability. The market's resilience, however, is supported by the steady growth of key sectors like transportation, manufacturing, and agriculture, which heavily depend on refined petroleum products. Competition amongst the major players is fierce, leading to price wars and a focus on optimizing supply chains and strategic partnerships to ensure a sustained market share in this rapidly evolving landscape. The forecast period, 2025-2033, promises further expansion, however, careful navigation of geopolitical and infrastructural hurdles is crucial for continued success in the West African refined petroleum products market.

West Africa Refined Petroleum Products Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the West Africa refined petroleum products industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, competitive landscapes, and future growth potential. The report leverages rigorous data analysis and expert insights to deliver actionable intelligence.

West Africa Refined Petroleum Products Industry Market Structure & Innovation Trends

This section analyzes the market structure of the West African refined petroleum products industry, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The study period covers 2019-2033, with 2025 as the base and estimated year.

Market Concentration: The market is characterized by a mix of multinational corporations and local players. The top five players hold an estimated xx% market share in 2025, indicating a moderately concentrated market. Further analysis details the market share distribution amongst key players like Vitol Holdings BV, Trafigura Group Pte Ltd, and Oryx Energies SA.

Innovation Drivers: The industry is driven by the need for cleaner fuels, increasing demand for LPG, and the adoption of advanced refining technologies. Government regulations promoting energy efficiency and environmental sustainability also play a significant role.

Regulatory Frameworks: Varying regulatory landscapes across West African nations influence pricing, import/export policies, and environmental standards, impacting overall market dynamics.

Product Substitutes: The emergence of biofuels and alternative energy sources presents a growing competitive threat to traditional refined petroleum products.

End-User Demographics: The report examines the diverse end-user segments, including transportation, industrial, and residential consumers, and their varying fuel demands.

M&A Activities: The report analyzes significant M&A deals, highlighting deal values and their impact on market consolidation. For instance, xx Million in M&A deals were recorded between 2020 and 2024.

West Africa Refined Petroleum Products Industry Market Dynamics & Trends

This section delves into the market dynamics and trends shaping the West African refined petroleum products industry. We explore market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing a detailed understanding of market evolution from 2019 to 2033. The CAGR for the forecast period (2025-2033) is projected at xx%. Market penetration of specific fuel types, such as LPG, is analyzed, revealing increasing consumer adoption driven by factors like affordability and government initiatives. Competitive dynamics are explored through detailed analysis of market share, pricing strategies, and product differentiation among key players. Technological disruptions stemming from innovations in refining technologies, fuel efficiency standards, and alternative energy sources are assessed for their impact on the industry.

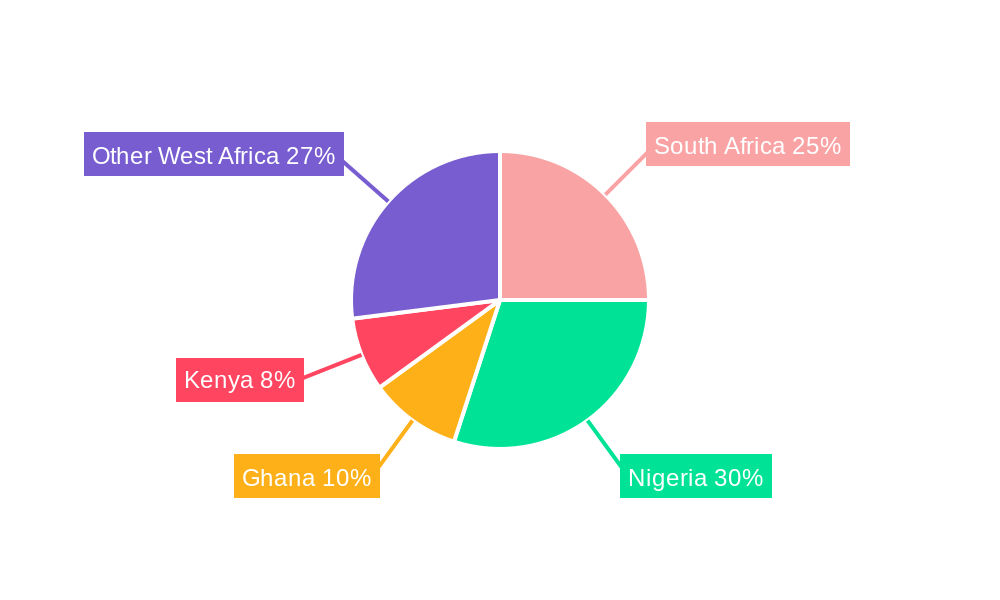

Dominant Regions & Segments in West Africa Refined Petroleum Products Industry

This section identifies the dominant regions and segments within the West African refined petroleum products market. The analysis covers Automotive Fuels, Marine Fuels, Aviation Fuels, Liquefied Petroleum Gas (LPG), and Others.

Dominant Region: Nigeria, due to its large population and industrial base, is identified as the dominant market, followed by Ghana and Côte d'Ivoire.

Dominant Segment: Automotive fuels constitute the largest segment, driven by the rapid growth of the transportation sector.

Key Drivers:

- Nigeria: Strong economic growth, expanding transportation infrastructure, and increasing vehicle ownership fuel the dominance of Nigeria.

- Ghana & Côte d'Ivoire: These countries benefit from relatively stable economies and growing industrial sectors.

- LPG Growth: Government initiatives promoting LPG adoption for cooking fuel contribute significantly to its market share growth.

Detailed analysis of each segment examines growth projections, market size, and competitive dynamics. For example, the Automotive Fuels segment is projected to reach xx Million in 2033, driven by increased vehicle ownership and economic development.

West Africa Refined Petroleum Products Industry Product Innovations

The West African refined petroleum products industry is witnessing significant product innovations driven by environmental concerns and technological advancements. The focus is shifting towards cleaner fuels, with the introduction of higher-quality gasoline and diesel blends that meet stricter emission standards. Innovations in fuel additives and refinery technologies enhance fuel efficiency and reduce harmful emissions. This focus on cleaner fuels is aligning with global environmental regulations and growing consumer demand for sustainable products.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the West African refined petroleum products market, segmented by product type: Automotive Fuels, Marine Fuels, Aviation Fuels, Liquefied Petroleum Gas (LPG), and Others. Each segment's market size, growth projections, and competitive landscape are detailed. For example, the Automotive Fuels segment is expected to experience significant growth due to increasing vehicle ownership and economic development across the region. The LPG segment exhibits substantial potential, driven by government support for cleaner cooking fuels. The Marine Fuels segment is influenced by maritime trade growth and port activity. Aviation Fuels' growth is linked to air passenger traffic and regional economic expansion. The “Others” segment includes specialty fuels and lubricants, whose development tracks broader industrial activity.

Key Drivers of West Africa Refined Petroleum Products Industry Growth

The growth of the West African refined petroleum products industry is fueled by several key factors: Rapid economic growth across several nations is driving increased demand for transportation fuels. Population growth and urbanization are contributing to higher energy consumption. Government investments in infrastructure development, particularly transportation networks, further stimulate demand. Finally, the rising adoption of LPG as a cleaner cooking fuel is expanding this specific market segment.

Challenges in the West Africa Refined Petroleum Products Industry Sector

The West African refined petroleum products industry faces several significant challenges. These include infrastructure limitations hindering efficient distribution networks, leading to supply chain bottlenecks. Regulatory inconsistencies across different countries add complexity and operational costs. The volatile global crude oil prices significantly impact profitability. Increasing competition from emerging alternative fuels presents a long-term challenge. Import dependency on refined products makes the region vulnerable to global price fluctuations and supply disruptions. Finally, environmental concerns and the growing push for cleaner energy solutions require industry adaptation and investment in sustainable technologies. The combined impact of these factors can limit profitability and constrain overall market growth.

Emerging Opportunities in West Africa Refined Petroleum Products Industry

Despite the challenges, numerous opportunities exist for growth and innovation. Investing in modern refinery infrastructure can enhance processing efficiency and reduce reliance on imports. Expanding LPG distribution networks through targeted government initiatives and private sector investment can tap into a large underserved market. The development of biofuels and other alternative energy sources offers a path towards sustainability and reduced reliance on fossil fuels. Finally, integrating technology to improve supply chain management and optimize logistics can address efficiency concerns. These opportunities are likely to contribute significantly to market expansion and diversification.

Leading Players in the West Africa Refined Petroleum Products Industry Market

- Octogone International Gas & Oil Ltd

- Oryx Energies SA (Oryx Energies SA)

- Oando PLC (Oando PLC)

- Mercuria Energy Trading SA

- Monjasa Holding AS

- Vitol Holdings BV (Vitol Holdings BV)

- Puma Energy Holdings Pte Ltd (Puma Energy Holdings Pte Ltd)

- Sahara Group Limited

- Trafigura Group Pte Ltd (Trafigura Group Pte Ltd)

- FuelSupply Co

Key Developments in West Africa Refined Petroleum Products Industry Industry

November 2021: Dangote Group announces the commissioning of its 650,000 b/d refinery in Lagos, Nigeria, expected to be Africa's largest integrated refinery. NNPC to acquire a 20% stake. This development is transformative for the West African refining landscape, significantly increasing local refining capacity and reducing reliance on imports.

2020: BUA Group contracts Axens Group to provide technology and services for a proposed 200,000 b/d integrated refinery and petrochemical plant in Akwa Ibom, Nigeria. This project signals significant private sector investment in expanding refining capacity, contributing to increased domestic supply.

Future Outlook for West Africa Refined Petroleum Products Industry Market

The future of the West African refined petroleum products industry is characterized by growth potential driven by economic expansion, population growth, and infrastructure development. However, adapting to changing environmental regulations and the rise of alternative fuels is crucial for sustained success. The industry's future hinges on strategically investing in efficient refineries, expanding LPG infrastructure, and exploring opportunities in biofuels and sustainable energy solutions to meet evolving demand and environmental requirements. Companies that successfully navigate these shifts will be well-positioned to capture significant growth opportunities in the coming years.

West Africa Refined Petroleum Products Industry Segmentation

-

1. Type

- 1.1. Automotive Fuels

- 1.2. Marine Fuels

- 1.3. Aviation Fuels

- 1.4. Liquefied Petroleum Gas(LPG)

- 1.5. Others

-

2. Geography

- 2.1. Nigeria

- 2.2. Ghana

- 2.3. Senegal

- 2.4. Others

West Africa Refined Petroleum Products Industry Segmentation By Geography

- 1. Nigeria

- 2. Ghana

- 3. Senegal

- 4. Others

West Africa Refined Petroleum Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Automotive fuels Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Automotive Fuels

- 5.1.2. Marine Fuels

- 5.1.3. Aviation Fuels

- 5.1.4. Liquefied Petroleum Gas(LPG)

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Ghana

- 5.2.3. Senegal

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Ghana

- 5.3.3. Senegal

- 5.3.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Nigeria West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Automotive Fuels

- 6.1.2. Marine Fuels

- 6.1.3. Aviation Fuels

- 6.1.4. Liquefied Petroleum Gas(LPG)

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Ghana

- 6.2.3. Senegal

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Ghana West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Automotive Fuels

- 7.1.2. Marine Fuels

- 7.1.3. Aviation Fuels

- 7.1.4. Liquefied Petroleum Gas(LPG)

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Ghana

- 7.2.3. Senegal

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Senegal West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Automotive Fuels

- 8.1.2. Marine Fuels

- 8.1.3. Aviation Fuels

- 8.1.4. Liquefied Petroleum Gas(LPG)

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Ghana

- 8.2.3. Senegal

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Others West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Automotive Fuels

- 9.1.2. Marine Fuels

- 9.1.3. Aviation Fuels

- 9.1.4. Liquefied Petroleum Gas(LPG)

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Ghana

- 9.2.3. Senegal

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa West Africa Refined Petroleum Products Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Octogone International Gas & Oil Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Oryx Energies SA

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Oando PLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Mercuria Energy Trading SA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Monjasa Holding AS

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Vitol Holdings BV

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Puma Energy Holdings Pte Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sahara Group Limited

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Trafigura Group Pte Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 FuelSupply Co

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Octogone International Gas & Oil Ltd

List of Figures

- Figure 1: West Africa Refined Petroleum Products Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: West Africa Refined Petroleum Products Industry Share (%) by Company 2024

List of Tables

- Table 1: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Region 2019 & 2032

- Table 3: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 5: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 7: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Region 2019 & 2032

- Table 9: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

- Table 11: South Africa West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 13: Sudan West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 15: Uganda West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 17: Tanzania West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 19: Kenya West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa West Africa Refined Petroleum Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa West Africa Refined Petroleum Products Industry Volume (Thousand liters) Forecast, by Application 2019 & 2032

- Table 23: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 25: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 27: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

- Table 29: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 31: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 33: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

- Table 35: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 37: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 39: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

- Table 41: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 42: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Type 2019 & 2032

- Table 43: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Geography 2019 & 2032

- Table 45: West Africa Refined Petroleum Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: West Africa Refined Petroleum Products Industry Volume Thousand liters Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the West Africa Refined Petroleum Products Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the West Africa Refined Petroleum Products Industry?

Key companies in the market include Octogone International Gas & Oil Ltd, Oryx Energies SA, Oando PLC, Mercuria Energy Trading SA, Monjasa Holding AS, Vitol Holdings BV, Puma Energy Holdings Pte Ltd, Sahara Group Limited, Trafigura Group Pte Ltd, FuelSupply Co.

3. What are the main segments of the West Africa Refined Petroleum Products Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Expanding Pipeline Infrastructure4.; Growing Energy Demand.

6. What are the notable trends driving market growth?

Automotive fuels Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

In November 2021, the Dangote group announced that they are likely to commission Dangote refinery in early 2022. The 650,000 b/d refinery is located in Lagos, Nigeria, and is believed to be Africa's largest upcoming integrated refinery, and the world's biggest single train facility. The state-owned company NNPC is expected to acquire 20% stake in the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "West Africa Refined Petroleum Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the West Africa Refined Petroleum Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the West Africa Refined Petroleum Products Industry?

To stay informed about further developments, trends, and reports in the West Africa Refined Petroleum Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence