Key Insights

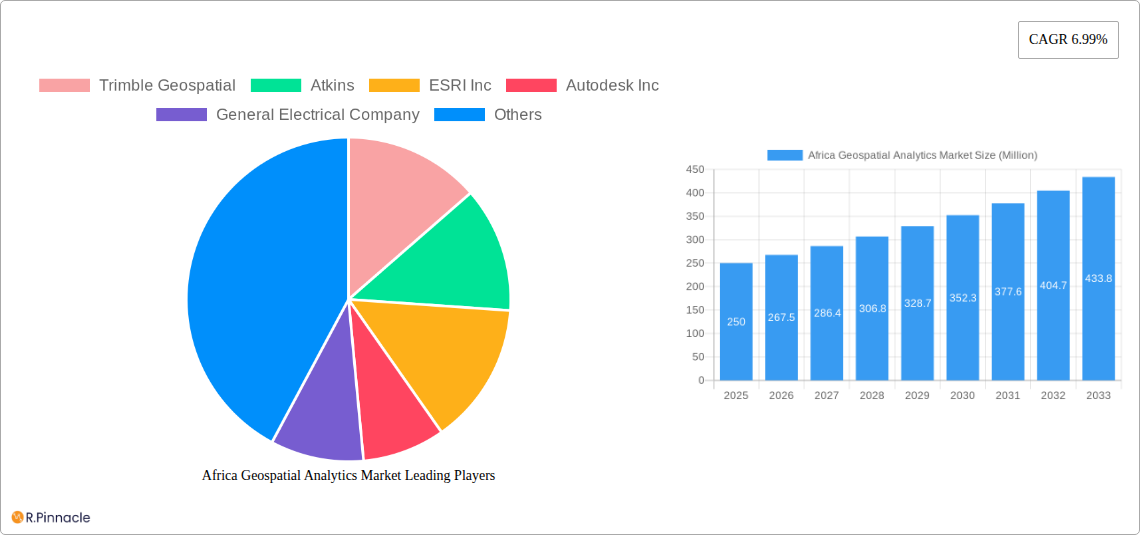

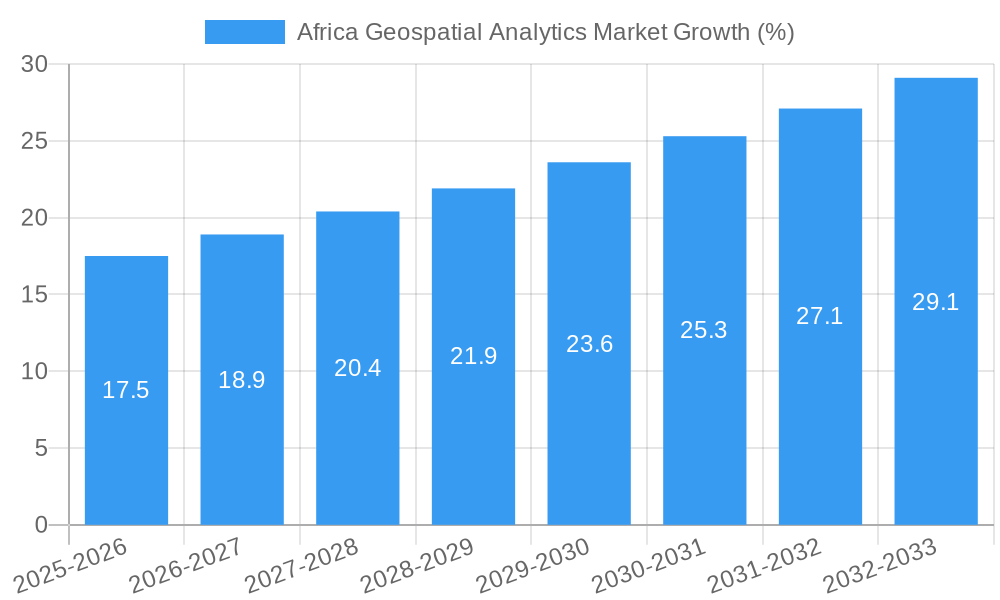

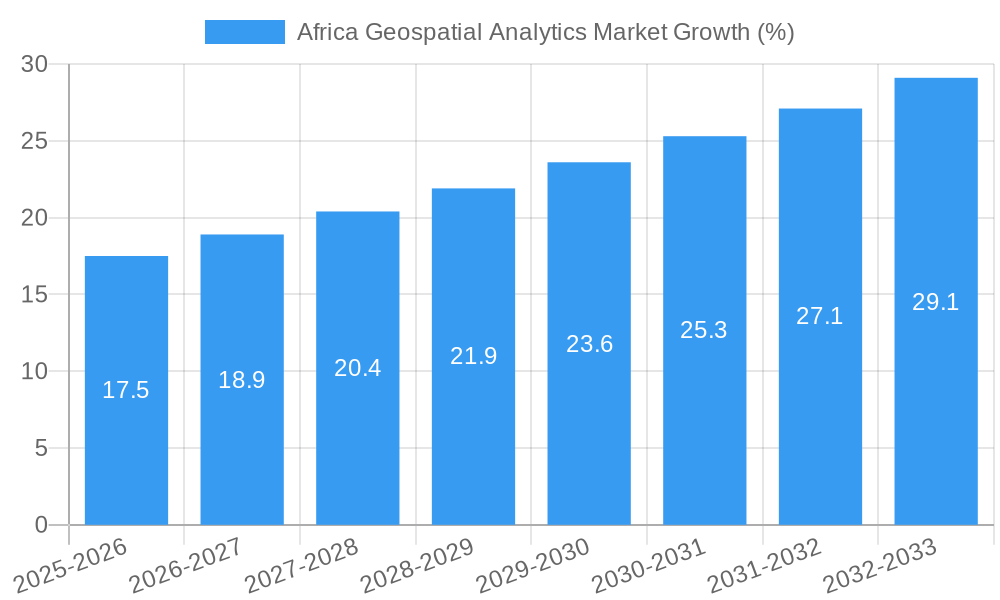

The African geospatial analytics market, currently valued at approximately $250 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.99% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, increasing government investments in infrastructure development and smart city initiatives across the continent are generating substantial demand for precise location intelligence and spatial data analysis. Secondly, the agricultural sector is leveraging geospatial technology for precision farming, yield optimization, and efficient resource management, significantly contributing to market growth. The burgeoning telecommunications sector, alongside the expanding adoption of advanced technologies like IoT and AI, is further accelerating the market's trajectory. Furthermore, the growing need for effective disaster management and environmental monitoring within the context of climate change is fueling demand for comprehensive geospatial analytics solutions.

However, certain challenges restrain the market's full potential. Limited digital infrastructure and internet penetration in certain regions of Africa pose a significant hurdle to widespread adoption. Furthermore, the scarcity of skilled professionals proficient in geospatial technologies creates a bottleneck in the effective implementation and utilization of such solutions. Nevertheless, the ongoing development of cost-effective solutions and the increasing awareness of the benefits of geospatial analytics are expected to gradually alleviate these restraints. Market segmentation reveals a robust demand across various verticals, including agriculture, utilities, defense, government, and mining. The surface analysis segment currently dominates, but network and geo-visualization segments are expected to show significant growth in the coming years due to increasing availability of data and advanced analytics capabilities. Key players in the market, such as Trimble Geospatial, ESRI Inc., and Autodesk Inc., are actively investing in expanding their presence in the African market, fueling competition and driving innovation. The rapid expansion in South Africa, Kenya, and other key economies within the region promises substantial growth opportunities for both established and emerging companies.

This comprehensive report provides an in-depth analysis of the Africa Geospatial Analytics Market, offering actionable insights for industry professionals and investors. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, dominant segments, leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR.

Africa Geospatial Analytics Market Market Structure & Innovation Trends

The Africa Geospatial Analytics Market exhibits a moderately concentrated structure, with key players such as Trimble Geospatial, ESRI Inc, and Autodesk Inc holding significant market share. However, numerous smaller, specialized firms are also contributing to innovation. The market is driven by increasing government initiatives promoting digitalization and infrastructure development, coupled with the growing adoption of geospatial technologies across various sectors. Regulatory frameworks, while evolving, present both opportunities and challenges. Product substitutes are limited, largely due to the specialized nature of geospatial analytics. M&A activity has been moderate, with deal values averaging xx Million in recent years, reflecting a strategic focus on expanding capabilities and market reach. End-user demographics are diverse, spanning governments, utilities, mining companies, and more.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Drivers: Government initiatives, digitalization, infrastructure development.

- Regulatory Framework: Evolving, presenting opportunities and challenges.

- Product Substitutes: Limited due to specialized nature.

- M&A Activity: Moderate, with average deal values around xx Million.

- End-User Demographics: Diverse, including governments, utilities, mining, etc.

Africa Geospatial Analytics Market Market Dynamics & Trends

The Africa Geospatial Analytics Market is experiencing significant growth, driven by several factors. Technological advancements, particularly in areas like AI and machine learning, are enhancing the capabilities of geospatial analytics tools, leading to increased accuracy and efficiency. Growing demand for improved infrastructure planning and management, coupled with the need for effective resource management in sectors like agriculture and mining, fuels market expansion. Consumer preference is shifting towards cloud-based solutions due to their scalability and cost-effectiveness. Competitive dynamics are characterized by both intense competition among established players and the emergence of new, innovative companies. The market penetration of geospatial analytics is still relatively low in Africa, presenting vast untapped potential. The CAGR during the forecast period (2025-2033) is estimated at xx%.

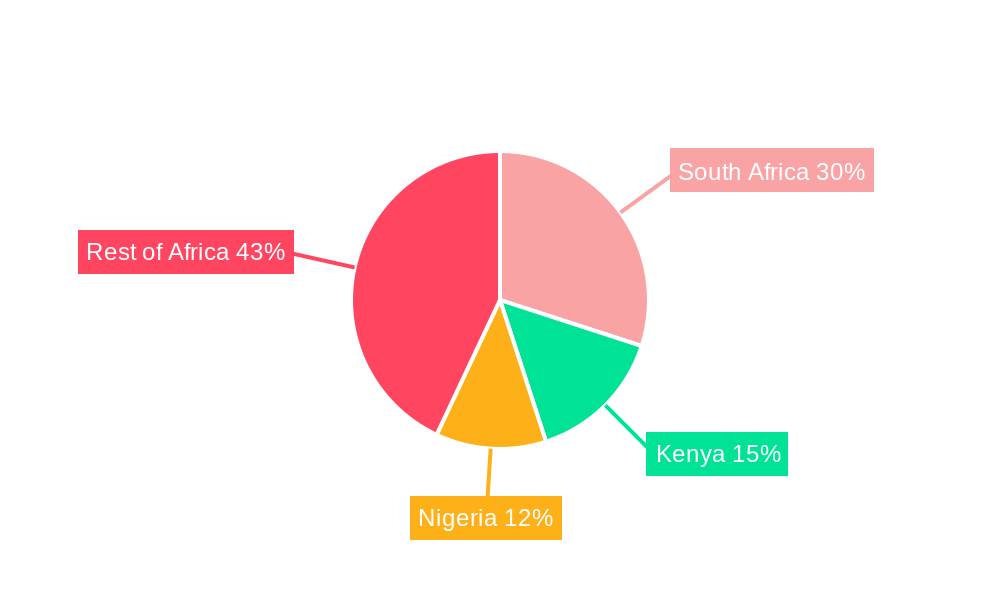

Dominant Regions & Segments in Africa Geospatial Analytics Market

While market penetration is widespread, certain regions and segments demonstrate more significant growth.

Dominant Regions: South Africa currently holds the largest market share, driven by its relatively advanced infrastructure and strong government support for technology adoption. However, other regions like East Africa are exhibiting rapid growth due to rising investments in infrastructure and burgeoning demand from diverse sectors.

Dominant Segments:

- By End-user Vertical: The Government, Mining and Natural Resources, and Agriculture segments are currently the most significant contributors to market revenue. High investments in infrastructure development and resource management drive this growth. The utility and communication sector is also growing rapidly.

- By Type: Surface analysis constitutes the largest segment, followed by Network Analysis and Geo-visualization. This is attributed to a higher demand for mapping and surveying applications in diverse sectors.

Key Drivers (Bullet Points):

- Government Initiatives: Funding for infrastructure projects and digitalization.

- Economic Growth: Increased investment across various sectors.

- Infrastructure Development: Demand for improved planning and management.

- Resource Management: Optimizing the use of natural resources.

Africa Geospatial Analytics Market Product Innovations

Recent product innovations focus on integrating AI and machine learning capabilities to enhance data processing speed, accuracy, and predictive modeling. Cloud-based solutions are gaining traction due to their scalability and cost-effectiveness. These innovations cater to growing demand for real-time data analysis and visualization across sectors, offering competitive advantages through improved decision-making and operational efficiency.

Report Scope & Segmentation Analysis

This report segments the Africa Geospatial Analytics Market by both end-user vertical and type of geospatial analysis. The end-user verticals include Agriculture, Utility and Communication, Defense and Intelligence, Government, Mining and Natural Resources, Automotive and Transportation, Healthcare, Real Estate and Construction, and Other End-user Verticals. The types of geospatial analysis covered are Surface Analysis, Network Analysis, and Geo-visualization. Each segment’s growth projection, market size, and competitive dynamics are detailed within the full report.

Key Drivers of Africa Geospatial Analytics Market Growth

Several key factors contribute to the market's growth. Firstly, increased government investment in infrastructure development across the continent fuels the demand for advanced geospatial solutions for planning and monitoring. Secondly, technological advancements in AI, machine learning, and cloud computing are enhancing data processing capabilities. Lastly, the growing need for effective resource management in sectors like mining and agriculture is driving adoption.

Challenges in the Africa Geospatial Analytics Market Sector

Challenges include limited access to high-quality data in some regions, a lack of skilled professionals, and high initial investment costs for implementing advanced geospatial systems. Furthermore, digital infrastructure limitations and inconsistent regulatory frameworks pose hurdles to market expansion. These factors can constrain market growth by xx% in certain regions.

Emerging Opportunities in Africa Geospatial Analytics Market

Emerging opportunities lie in expanding the use of geospatial analytics in sectors like precision agriculture, smart city development, and disaster management. The rising adoption of mobile technologies also presents opportunities for delivering location-based services. Further development of local talent and collaboration between international and local companies will unlock untapped potential.

Leading Players in the Africa Geospatial Analytics Market Market

- Trimble Geospatial (Trimble Geospatial)

- Atkins (Atkins)

- ESRI Inc (ESRI Inc)

- Autodesk Inc (Autodesk Inc)

- General Electrical Company

- Eos Data Analytics Inc

- Bentley Systems Inc (Bentley Systems Inc)

- Pitney Bowes Inc (Pitney Bowes Inc)

- Intergraph (Hexagon AB) (Hexagon AB)

- Fugro (Fugro)

Key Developments in Africa Geospatial Analytics Market Industry

- November 2022: A Memorandum of Understanding (MOU) was signed by SaskTel and Axiom Exploration Group to jointly explore opportunities to assist organizations in Saskatchewan with geospatial data analysis. (Note: While this event is outside of Africa, it highlights collaborative trends relevant to the market).

- September 2022: A two-day conference on Data Analytics and visualization was held in Kenya, showcasing the growing interest and expertise in the region.

Future Outlook for Africa Geospatial Analytics Market Market

The Africa Geospatial Analytics Market is poised for substantial growth, driven by increased investment in infrastructure, technological advancements, and growing demand across diverse sectors. Strategic partnerships, focusing on capacity building and technology transfer, will be crucial for unlocking the full potential of this market. The market is expected to witness significant expansion, particularly in regions with burgeoning economies and strong government support for technological advancements.

Africa Geospatial Analytics Market Segmentation

-

1. Type

- 1.1. Surface Analysis

- 1.2. Network Analysis

- 1.3. Geo-visualization

-

2. End-user Vertical

- 2.1. Agriculture

- 2.2. Utility and Communication

- 2.3. Defense and Intelligence

- 2.4. Government

- 2.5. Mining and Natural Resources

- 2.6. Automotive and Transportation

- 2.7. Healthcare

- 2.8. Real Estate and Construction

- 2.9. Other End-user Verticals

Africa Geospatial Analytics Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Geospatial Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.99% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Commercialization of spatial data; Increased smart city & infrastructure projects

- 3.3. Market Restrains

- 3.3.1. High costs associated with geospatial technologies

- 3.4. Market Trends

- 3.4.1. Commercialization of Spatial Data

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Analysis

- 5.1.2. Network Analysis

- 5.1.3. Geo-visualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Agriculture

- 5.2.2. Utility and Communication

- 5.2.3. Defense and Intelligence

- 5.2.4. Government

- 5.2.5. Mining and Natural Resources

- 5.2.6. Automotive and Transportation

- 5.2.7. Healthcare

- 5.2.8. Real Estate and Construction

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Geospatial Analytics Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Trimble Geospatial

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Atkins

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ESRI Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Autodesk Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 General Electrical Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Eos Data Analytics Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Bentley Systems Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Pitney Bowes Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Intergraph (Hexagon AB)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Fugro

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Trimble Geospatial

List of Figures

- Figure 1: Africa Geospatial Analytics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Geospatial Analytics Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Geospatial Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Geospatial Analytics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Africa Geospatial Analytics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Africa Geospatial Analytics Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Africa Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Africa Geospatial Analytics Market Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 7: Africa Geospatial Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Africa Geospatial Analytics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Africa Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Africa Geospatial Analytics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: South Africa Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Sudan Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Uganda Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Tanzania Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Kenya Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Africa Geospatial Analytics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Africa Geospatial Analytics Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 25: Africa Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 26: Africa Geospatial Analytics Market Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 27: Africa Geospatial Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Africa Geospatial Analytics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Nigeria Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Nigeria Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: South Africa Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Egypt Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Egypt Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Kenya Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Kenya Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Ethiopia Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ethiopia Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Morocco Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Morocco Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Ghana Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Ghana Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Algeria Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Algeria Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Tanzania Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Tanzania Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Ivory Coast Africa Geospatial Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Ivory Coast Africa Geospatial Analytics Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Geospatial Analytics Market?

The projected CAGR is approximately 6.99%.

2. Which companies are prominent players in the Africa Geospatial Analytics Market?

Key companies in the market include Trimble Geospatial, Atkins, ESRI Inc, Autodesk Inc, General Electrical Company, Eos Data Analytics Inc, Bentley Systems Inc, Pitney Bowes Inc , Intergraph (Hexagon AB), Fugro.

3. What are the main segments of the Africa Geospatial Analytics Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Commercialization of spatial data; Increased smart city & infrastructure projects.

6. What are the notable trends driving market growth?

Commercialization of Spatial Data.

7. Are there any restraints impacting market growth?

High costs associated with geospatial technologies.

8. Can you provide examples of recent developments in the market?

November 2022: A Memorandum of Understanding (MOU) was signed by SaskTel and Axiom Exploration Group to jointly explore opportunities to assist organizations throughout Saskatchewan in enhancing and modernizing their operations through the gathering and analysis of geospatial and other geophysical data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Geospatial Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Geospatial Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Geospatial Analytics Market?

To stay informed about further developments, trends, and reports in the Africa Geospatial Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence