Key Insights

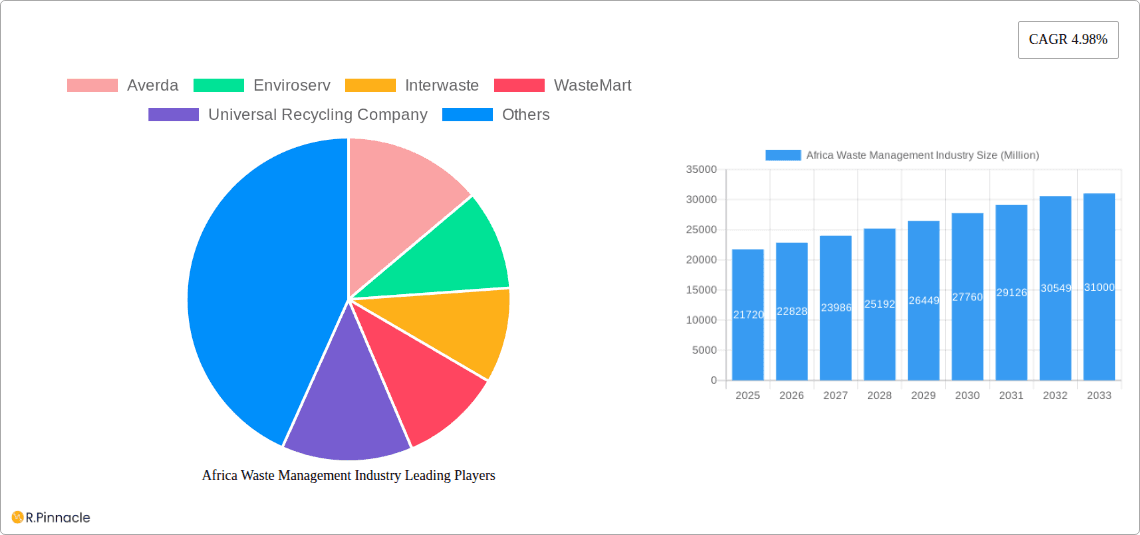

The African waste management industry, valued at $21.72 billion in 2025, is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.98% from 2025 to 2033. This expansion is driven by several key factors. Rapid urbanization across the continent is leading to increased waste generation, necessitating more robust and efficient waste management solutions. Growing environmental awareness among governments and citizens is fostering demand for sustainable waste disposal practices, including recycling and composting initiatives. Furthermore, increasing investment in infrastructure development, particularly in waste collection and processing facilities, is bolstering the industry's growth trajectory. Key players like Averda, Enviroserv, and Interwaste are leading the charge, but a fragmented landscape also presents opportunities for smaller, specialized firms focused on niche areas like e-waste recycling or medical waste management. Challenges remain, however, including inadequate infrastructure in many regions, limited access to financing for waste management projects, and a lack of standardized regulations across different African countries. Overcoming these hurdles will be crucial to unlocking the industry's full potential and ensuring environmentally sound and economically viable waste management solutions across the continent.

Africa Waste Management Industry Market Size (In Billion)

The forecast period (2025-2033) suggests a substantial increase in market value, largely influenced by the continued CAGR. Government regulations promoting waste reduction, reuse, and recycling will play a critical role in driving growth. The expanding middle class is also contributing to this growth by increasing consumer demand for better waste management services and sustainable products. The industry's evolution will likely be marked by technological advancements in waste sorting, processing, and energy recovery. Companies are also expected to invest in data-driven solutions to optimize waste collection routes and resource allocation. The integration of technology alongside public-private partnerships will be vital in overcoming existing infrastructural limitations and ensuring the long-term sustainability of the African waste management sector.

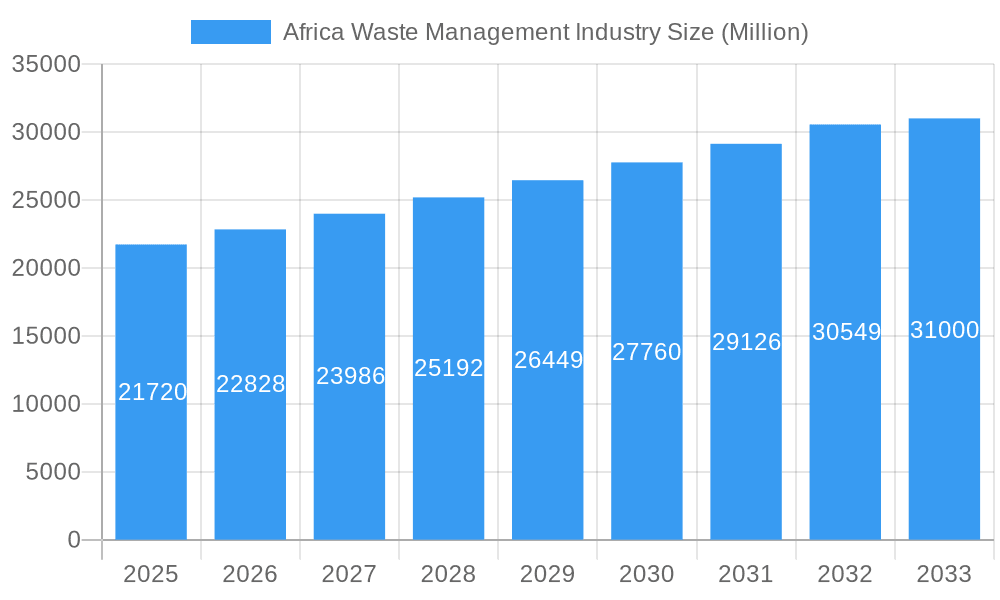

Africa Waste Management Industry Company Market Share

Africa Waste Management Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the African waste management industry, offering actionable insights for industry professionals, investors, and policymakers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future potential. The study encompasses key players like Averda, Enviroserv, Interwaste, WasteMart, and more, analyzing market segments and providing critical data for informed decision-making.

Africa Waste Management Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the African waste management sector. We examine mergers and acquisitions (M&A) activities, assessing their impact on market share and overall industry structure. The analysis includes a detailed examination of:

Market Concentration: We evaluate the market share of major players such as Averda, Enviroserv, and Interwaste, identifying any dominant firms and assessing the level of competition. The market is expected to be moderately concentrated, with a few large players holding significant shares, but with a substantial number of smaller regional operators. We predict a xx% market share for the top three players in 2025.

Innovation Drivers: The report explores factors driving innovation, including technological advancements in waste-to-energy technologies, smart waste management systems, and recycling processes. Government regulations and initiatives focused on sustainability also play a vital role.

Regulatory Frameworks: We analyze the existing regulatory frameworks across different African countries, including licensing requirements, waste disposal regulations, and environmental protection laws. Variations in regulations across countries impact market access and operational costs.

Product Substitutes: The study considers potential substitutes for traditional waste management methods, such as composting, anaerobic digestion, and incineration, analyzing their feasibility and market penetration.

End-User Demographics: We profile the diverse end-users of waste management services, including residential, commercial, and industrial sectors, and assess their specific waste generation patterns and service needs.

M&A Activities: The report examines recent M&A deals, such as the acquisition of EnviroServ by SUEZ, RBH, and AIIM in October 2022 (USD xx Million deal value, estimated), highlighting their implications for market consolidation and competitive landscape. Further analysis covers deal value trends and future M&A projections.

Africa Waste Management Industry Market Dynamics & Trends

This section delves into the key market dynamics driving growth and shaping the competitive landscape. It covers:

Market Growth Drivers: We analyze factors such as increasing urbanization, rising environmental awareness, and stricter government regulations promoting sustainable waste management practices. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033).

Technological Disruptions: The influence of technological advancements, such as smart bins, waste sorting technologies, and data analytics, is examined, assessing their impact on efficiency, cost optimization, and service delivery. Market penetration rates for these technologies will be projected.

Consumer Preferences: The evolving preferences of consumers concerning waste management services are explored, including the demand for sustainable and environmentally friendly solutions. This involves examining consumer willingness to pay for premium services and their adoption of recycling and waste reduction practices.

Competitive Dynamics: We assess the competitive intensity, identifying key strategies employed by major players, and their impact on market pricing, service offerings, and overall market share.

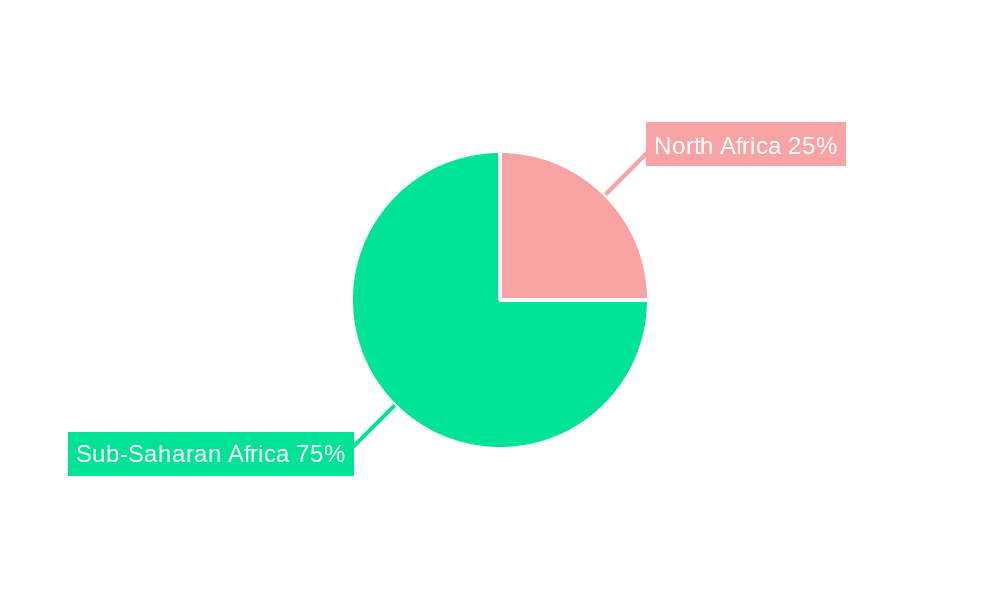

Dominant Regions & Segments in Africa Waste Management Industry

This section identifies the leading regions and segments within the African waste management industry. Analysis includes:

Leading Regions/Countries: The report identifies the dominant regions, highlighting key factors driving their market leadership. For instance, South Africa is likely to be a prominent market due to its established infrastructure and relatively higher economic development. We'll provide a detailed explanation of this dominance, along with a comparison to other regions.

Key Drivers (Bullet Points):

- Favorable government policies and regulations

- Strong private sector participation

- Relatively developed infrastructure

- Higher per capita income (in specific regions)

- Growing urbanization and industrialization

Segment Dominance Analysis: The report will analyze various segments, such as municipal solid waste management, industrial waste management, and hazardous waste management. A thorough analysis of the factors contributing to dominance within each segment will be provided.

Africa Waste Management Industry Product Innovations

This section summarizes the latest product developments, applications, and competitive advantages within the sector. Technological trends and market fit will be emphasized. The adoption of new technologies such as AI-powered waste sorting systems and waste-to-energy solutions are transforming the industry's efficiency and environmental impact. New business models are emerging as well, such as waste-as-a-service, offering tailored solutions to diverse end-user needs.

Report Scope & Segmentation Analysis

The report provides a detailed segmentation analysis including:

By Waste Type: Municipal solid waste, industrial waste, hazardous waste, medical waste, e-waste, etc. (Each segment will have a paragraph analyzing growth projections, market sizes and competitive dynamics).

By Service Type: Collection, transportation, processing, treatment, disposal, recycling, etc. (Each segment will have a paragraph analyzing growth projections, market sizes and competitive dynamics).

By Region: North Africa, Sub-Saharan Africa, etc. (Each segment will have a paragraph analyzing growth projections, market sizes and competitive dynamics).

Key Drivers of Africa Waste Management Industry Growth

Several key drivers propel the growth of the African waste management industry, including:

Technological advancements: The introduction of advanced waste management technologies improves efficiency and sustainability.

Economic growth and urbanization: Rapid urbanization and economic development lead to increased waste generation, creating greater demand for waste management services.

Stringent environmental regulations: Governments increasingly implement stricter environmental regulations, driving the adoption of sustainable waste management practices.

Challenges in the Africa Waste Management Industry Sector

The sector faces challenges including:

Inadequate infrastructure: Limited waste collection and processing infrastructure in many regions hinder effective waste management.

Lack of awareness and education: Insufficient public awareness about proper waste disposal practices limits the effectiveness of existing infrastructure.

Limited funding and investment: Lack of sufficient funding and investment hinders the development and expansion of waste management facilities.

Emerging Opportunities in Africa Waste Management Industry

Opportunities exist in:

Waste-to-energy technologies: Exploiting waste-to-energy technologies offers environmental and economic benefits.

Private sector involvement: Increased private sector participation brings efficiency and investment.

Recycling and resource recovery: Strengthening recycling infrastructure and resource recovery initiatives promotes sustainability.

Leading Players in the Africa Waste Management Industry Market

- Averda

- Enviroserv

- Interwaste

- WasteMart

- Universal Recycling Company

- Desco

- PETCO

- The Glass Recycling Company

- Oricol Environmental Services SA (PTY) LTD

- WeCyclers

- The Waste Group (Pty) Ltd

- SA Waste (PTY) Ltd (List Not Exhaustive)

Key Developments in Africa Waste Management Industry

October 2022: SUEZ, RBH, and AIIM finalized the acquisition of EnviroServ, strengthening SUEZ's African presence.

May 2022: IFC provided a USD 30 Million loan to Averda, supporting its expansion in Africa and the Middle East.

Future Outlook for Africa Waste Management Industry Market

The African waste management industry exhibits significant growth potential driven by urbanization, economic development, and rising environmental consciousness. Strategic investments in infrastructure, technology, and public-private partnerships are crucial for unlocking this potential, fostering sustainable waste management practices and creating substantial economic opportunities.

Africa Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic waste

- 1.6. Bio-medical waste

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

Africa Waste Management Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Waste Management Industry Regional Market Share

Geographic Coverage of Africa Waste Management Industry

Africa Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Awareness towards the Waste Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic waste

- 5.1.6. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Averda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enviroserv

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Interwaste

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WasteMart

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Universal Recycling Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Desco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PETCO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Glass Recycling Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oricol Environmental Services SA (PTY) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WeCyclers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Waste Group (Pty) Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SA Waste (PTY) Ltd **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Averda

List of Figures

- Figure 1: Africa Waste Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: Africa Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Africa Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 8: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 9: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 10: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 11: Africa Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Africa Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Nigeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: South Africa Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: South Africa Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Egypt Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Egypt Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Kenya Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Kenya Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Ethiopia Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ethiopia Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Morocco Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Morocco Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Ghana Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ghana Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Algeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Algeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Tanzania Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Tanzania Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Ivory Coast Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Ivory Coast Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Waste Management Industry?

The projected CAGR is approximately 4.98%.

2. Which companies are prominent players in the Africa Waste Management Industry?

Key companies in the market include Averda, Enviroserv, Interwaste, WasteMart, Universal Recycling Company, Desco, PETCO, The Glass Recycling Company, Oricol Environmental Services SA (PTY) LTD, WeCyclers, The Waste Group (Pty) Ltd, SA Waste (PTY) Ltd **List Not Exhaustive.

3. What are the main segments of the Africa Waste Management Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.72 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Awareness towards the Waste Management.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022- In line with the conditions stated on June 9, 2022, SUEZ, Royal Bafokeng Holdings (RBH), and African Infrastructure Investment Managers (AIIM) finalized the acquisition of EnviroServ Proprietary Holdings Ltd and its subsidiaries (collectively, "EnviroServ") after receiving permission from the regional antitrust authorities. By this purchase, SUEZ will be able to solidify both its presence in Africa and its position as a global leader in the treatment of municipal and industrial waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Waste Management Industry?

To stay informed about further developments, trends, and reports in the Africa Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence