Key Insights

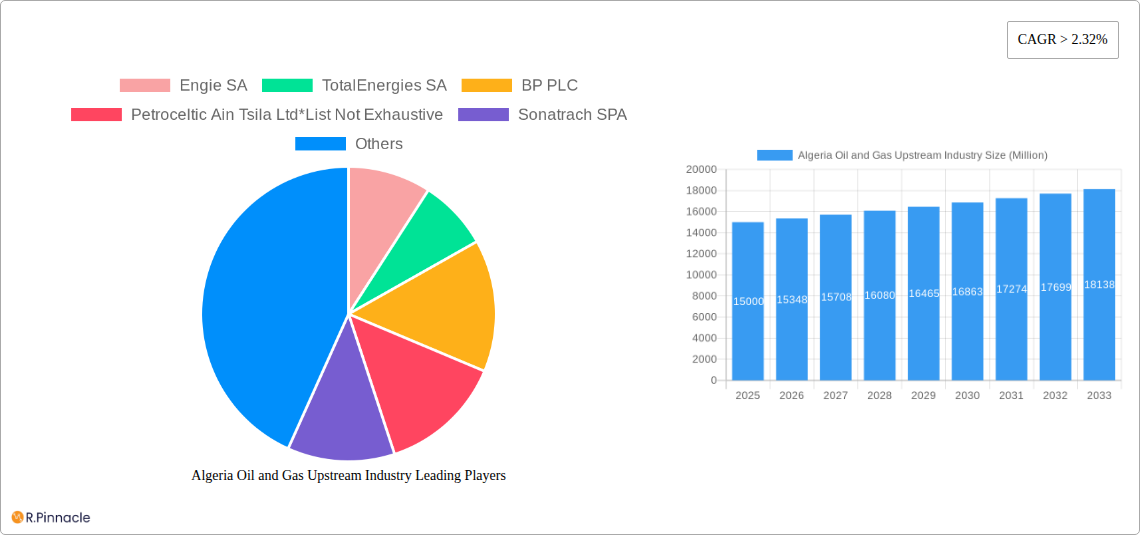

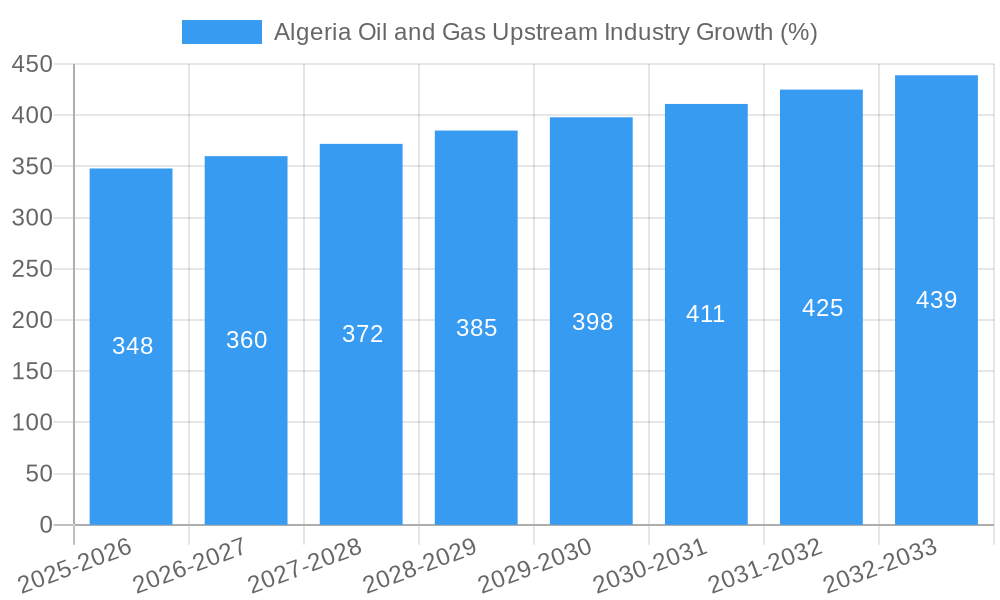

The Algerian oil and gas upstream industry, while facing challenges, presents a promising growth trajectory. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR of >2.32% and the available study period), is projected to experience sustained expansion through 2033. This growth is fueled by several key drivers. Firstly, ongoing investments in existing and pipeline projects, particularly in both onshore and offshore locations, indicate a strong commitment to production enhancement. Secondly, the presence of major international players like Engie SA, TotalEnergies SA, and BP PLC underscores the industry's attractiveness and potential for significant returns. The strategic involvement of Sonatrach SPA, the Algerian national oil company, also plays a pivotal role in shaping the industry's future. However, the industry faces constraints such as fluctuating global oil prices and the need for continuous investment in infrastructure upgrades and technological advancements to ensure sustainable and efficient operations. The segmentation, divided into onshore and offshore projects, with further breakdowns into existing, pipeline, and upcoming projects, provides a granular view of the industry's development stages. Analysis of each segment reveals varying growth prospects and investment priorities. The success of the industry will hinge on addressing these constraints while capitalizing on the ongoing projects and attractive investment climate.

The strategic focus on both onshore and offshore exploration and production demonstrates a balanced approach to resource utilization. Analyzing project pipelines reveals valuable insights into future production capacity and potential market share adjustments. Moreover, understanding the specific roles of major companies and Sonatrach’s strategic direction allows for a more precise prediction of future market trends. Considering the industry's historical performance (2019-2024), a robust assessment can be made regarding the accuracy of forecast estimations. While the absence of specific numerical market size data limits precise calculations, utilizing the provided CAGR and the known presence of major international players allows for the generation of plausible projections. This analysis clearly suggests that the Algerian oil and gas upstream sector, despite inherent risks, remains a compelling investment opportunity with substantial growth potential in the coming years.

Algeria Oil and Gas Upstream Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Algerian oil and gas upstream industry, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market dynamics, key players, and future trends, equipping you with the knowledge needed to navigate this dynamic sector.

Study Period: 2019–2033; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025–2033; Historical Period: 2019–2024

Algeria Oil and Gas Upstream Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of Algeria's upstream oil and gas sector, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activity. The Algerian upstream sector exhibits a relatively concentrated market structure, dominated by national oil company Sonatrach and international players such as Engie SA, TotalEnergies SA, and BP PLC. Petroceltic Ain Tsila Ltd and other companies also contribute to the market's dynamism.

- Market Concentration: Sonatrach holds a significant market share, estimated at xx% in 2025, with international players holding the remaining share.

- Innovation Drivers: Government incentives for exploration and production, technological advancements in enhanced oil recovery (EOR) techniques, and the pursuit of cost-efficient extraction methods drive innovation.

- Regulatory Framework: The regulatory landscape impacts exploration, production, and licensing, influencing investment decisions and overall industry activity. Recent regulatory changes have aimed to attract foreign investment and modernize the sector.

- Product Substitutes: The primary substitute for Algerian oil and gas is imports from other regions; however, the geographic proximity of Algeria to major European markets provides a competitive advantage.

- End-User Demographics: The primary end-users are domestic consumption and export markets, predominantly within Europe.

- M&A Activities: Significant M&A activity has characterized the sector in recent years, with notable transactions exceeding xx Million USD in value during the 2019-2024 period. The acquisition of gas-producing concessions in Amenas and Salah by Eni SpA from BP, for instance, reshaped the market dynamics.

Algeria Oil and Gas Upstream Industry Market Dynamics & Trends

The Algerian oil and gas upstream market is characterized by evolving dynamics, growth drivers, and technological disruptions. While the sector faces challenges posed by fluctuating global oil prices and ongoing geopolitical events, significant growth opportunities exist. The Compound Annual Growth Rate (CAGR) for the industry is estimated at xx% during the forecast period (2025-2033), driven by factors such as government investment in upstream projects, exploration activity in promising basins, and increasing domestic demand for energy.

Technological advancements play a crucial role in boosting efficiency and improving exploration outcomes. The adoption of advanced seismic imaging, digital oilfield technologies, and data analytics is improving exploration success rates and production optimization, leading to increased market penetration of these advanced technologies. Consumer preferences for cleaner energy sources pose a long-term challenge but also prompt investments in gas, which is positioned as a transition fuel. The intense competitive landscape, with both national and international players vying for market share, shapes strategic alliances, technological innovations, and operational efficiency.

Dominant Regions & Segments in Algeria Oil and Gas Upstream Industry

The Algerian oil and gas upstream industry is geographically concentrated in several key regions, both onshore and offshore.

Onshore:

- Key Drivers: Existing infrastructure, proximity to processing facilities, and established operational expertise.

- Dominance Analysis: Onshore production currently accounts for a larger share of overall output compared to offshore, primarily due to established infrastructure and historical exploration activity. However, future growth is expected to be more balanced, with increased focus on offshore exploration.

Offshore:

- Key Drivers: Potential for significant undiscovered reserves, technological advancements enabling deepwater exploration, and potential for large-scale projects.

- Dominance Analysis: While offshore production currently lags behind onshore, significant investments in exploration and development are poised to increase its contribution in the coming years.

Project Segments:

- Existing Projects: These projects contribute significantly to current production levels.

- Projects in Pipeline: These projects represent future growth potential, with varying levels of maturity in terms of development.

- Upcoming Projects: These projects are at an early stage of development and represent longer-term growth opportunities.

The Berkine Basin has emerged as a key region due to recent significant hydrocarbon discoveries, boosting the region's attractiveness for investment and further exploration activities.

Algeria Oil and Gas Upstream Industry Product Innovations

The Algerian upstream sector is witnessing the integration of innovative technologies to improve efficiency and optimize production. The focus is on enhancing oil recovery, streamlining operations, and reducing environmental impact. Examples include the application of digital oilfield technologies for real-time monitoring and data analysis, as well as the adoption of improved EOR methods. This drive for innovation aims to make Algerian oil and gas production more cost-effective and environmentally sustainable.

Report Scope & Segmentation Analysis

This report segments the Algerian oil and gas upstream industry based on location (onshore and offshore) and project status (existing, pipeline, upcoming). Each segment is analyzed to provide market size, growth projections, and competitive dynamics. The onshore segment currently dominates, benefiting from established infrastructure. However, the offshore segment is showing promising growth potential with ongoing exploration activities and planned developments. The pipeline and upcoming projects highlight future production increases. Market sizes for each segment are projected to increase significantly over the forecast period.

Key Drivers of Algeria Oil and Gas Upstream Industry Growth

Several key factors drive the growth of Algeria's oil and gas upstream sector. Government initiatives promoting investment in the sector provide substantial support. Technological advancements, such as EOR techniques and data analytics, enhance production efficiency. The strategic location of Algeria, near major European energy markets, allows for favorable export opportunities.

Challenges in the Algeria Oil and Gas Upstream Industry Sector

The Algerian oil and gas upstream industry faces challenges, including fluctuating global energy prices, impacting profitability and investment decisions. Infrastructure limitations, including pipeline capacity constraints and aging equipment, limit the sector's development. The ongoing need to balance investment in new exploration and production with investment for maintaining existing infrastructure presents a significant challenge.

Emerging Opportunities in Algeria Oil and Gas Upstream Industry

Algeria presents significant opportunities for growth in its upstream sector. The exploration and development of offshore resources unlock enormous potential reserves. Technological advancements provide opportunities to enhance production efficiency and lower costs. Further investment in infrastructure modernization addresses current limitations.

Leading Players in the Algeria Oil and Gas Upstream Industry Market

- Engie SA

- TotalEnergies SA

- BP PLC

- Petroceltic Ain Tsila Ltd

- Sonatrach SPA

Key Developments in Algeria Oil and Gas Upstream Industry

- March 2022: Eni and Sonatrach announced a substantial oil and gas discovery in the Zemlet el Arbi concession, potentially containing 140 Million barrels of oil.

- September 2022: Eni SpA acquired gas-producing concessions in Amenas and Salah from BP, significantly altering market share.

Future Outlook for Algeria Oil and Gas Upstream Industry Market

The Algerian oil and gas upstream sector exhibits strong potential for future growth driven by substantial reserves, ongoing exploration activities, and government initiatives. The focus on technological advancements, infrastructure improvements, and strategic partnerships enhances the sector’s prospects in the coming years. The continued exploration of offshore resources and the development of existing reserves will contribute to substantial production increases, while strategic alliances with international energy companies are set to bring in technology and capital to optimize production.

Algeria Oil and Gas Upstream Industry Segmentation

-

1. Location

-

1.1. Onshore

-

1.1.1. Overview

- 1.1.1.1. Existing Projects

- 1.1.1.2. Projects in Pipeline

- 1.1.1.3. Upcoming Projects

-

1.1.1. Overview

- 1.2. Offshore

-

1.1. Onshore

Algeria Oil and Gas Upstream Industry Segmentation By Geography

- 1. Algeria

Algeria Oil and Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Onshore Gas Field Production to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Algeria Oil and Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.1.1. Overview

- 5.1.1.1.1. Existing Projects

- 5.1.1.1.2. Projects in Pipeline

- 5.1.1.1.3. Upcoming Projects

- 5.1.1.1. Overview

- 5.1.2. Offshore

- 5.1.1. Onshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Algeria

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Engie SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TotalEnergies SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BP PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petroceltic Ain Tsila Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonatrach SPA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Engie SA

List of Figures

- Figure 1: Algeria Oil and Gas Upstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Algeria Oil and Gas Upstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 3: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 6: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algeria Oil and Gas Upstream Industry?

The projected CAGR is approximately > 2.32%.

2. Which companies are prominent players in the Algeria Oil and Gas Upstream Industry?

Key companies in the market include Engie SA, TotalEnergies SA, BP PLC, Petroceltic Ain Tsila Ltd*List Not Exhaustive, Sonatrach SPA.

3. What are the main segments of the Algeria Oil and Gas Upstream Industry?

The market segments include Location .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Onshore Gas Field Production to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

In March 2022, Eni and Sonatrach announced a substantial oil and accompanying gas discovery in the Zemlet el Arbi concession in the Algerian desert's Berkine North Basin. This concession is being operated in a joint venture with Sonatrach (51%), Eni (49%), and other parties. According to preliminary assessments of the extent of the discovery, there may be 140 million barrels of oil in place.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algeria Oil and Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algeria Oil and Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algeria Oil and Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Algeria Oil and Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence