Key Insights

The Asia-Pacific life and annuity insurance market, valued at $1.22 trillion in 2025, is projected to experience robust growth, driven by several key factors. A rising middle class across the region, particularly in rapidly developing economies like India and China, is fueling increased demand for financial security products. This demographic shift, coupled with growing awareness of the importance of long-term financial planning and retirement security, is a significant driver. Furthermore, favorable government regulations promoting financial inclusion and insurance penetration in several countries within the Asia-Pacific region are creating a supportive environment for market expansion. Technological advancements, such as the rise of Insurtech and digital distribution channels, are also streamlining operations, improving accessibility, and attracting younger demographics. While challenges remain, such as regulatory complexities in some markets and the need for increased financial literacy, the overall market outlook is positive.

The market's segmentation reveals a diversified landscape. Annuity insurance and life insurance are the dominant segments, reflecting the varied needs for long-term financial planning and risk mitigation. Distribution channels are also evolving, with traditional agents still playing a significant role alongside the growing influence of online platforms and bank partnerships. Key players like Ping An Insurance, Nippon Life Insurance, and LIC are vying for market share, investing heavily in product innovation and expansion strategies to cater to the diverse needs of consumers across the region. The projected CAGR of 3.89% indicates a sustained period of growth, although variations will likely occur among sub-regions and segments due to economic conditions and specific regulatory frameworks. The forecast period of 2025-2033 presents significant opportunities for both established players and new entrants looking to capture a piece of this expanding market.

Asia-Pacific Life and Annuity Insurance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific life and annuity insurance market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, key players, emerging trends, and future growth prospects. The report leverages robust data and analysis to provide actionable intelligence for informed decision-making.

Asia-Pacific Life And Annuity Insurance Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Asia-Pacific life and annuity insurance market. The market is characterized by a mix of established global players and rapidly growing regional insurers. Market concentration is moderate, with a few dominant players holding significant market share, but a considerable number of smaller insurers competing vigorously. For example, Ping An Insurance and Nippon Life Insurance Company are among the key players, holding a combined estimated xx% market share in 2025. The market's innovation is driven by factors such as technological advancements in digital platforms and data analytics, enabling personalized products and efficient customer service. However, stringent regulatory frameworks and evolving consumer preferences pose significant challenges. M&A activity is moderate, with deal values in the range of xx Million to xx Million observed during the historical period. Notable deals have involved the consolidation of regional players to expand their market reach and product offerings. The increase in digitalization has led to an upsurge in the usage of online channels, making it a pivotal distribution channel for insurance products.

Asia-Pacific Life And Annuity Insurance Market Market Dynamics & Trends

The Asia-Pacific life and annuity insurance market exhibits robust growth, driven by several factors. Rising disposable incomes, increasing health consciousness, and expanding middle classes across the region are primary contributors to market expansion. Technological advancements such as AI and big data analytics are transforming the industry, enabling insurers to provide more personalized and efficient services. Consumer preferences are shifting toward digital channels and customizable products. The market's competitive dynamics are intensifying, with both established players and new entrants vying for market share. This is further complicated by the varying regulatory environments across different countries. The CAGR for the market during the forecast period (2025-2033) is estimated to be xx%, and market penetration is projected to reach xx% by 2033. The market demonstrates considerable variation across different segments, and a robust regulatory environment is in place to maintain consumer confidence.

Dominant Regions & Segments in Asia-Pacific Life And Annuity Insurance Market

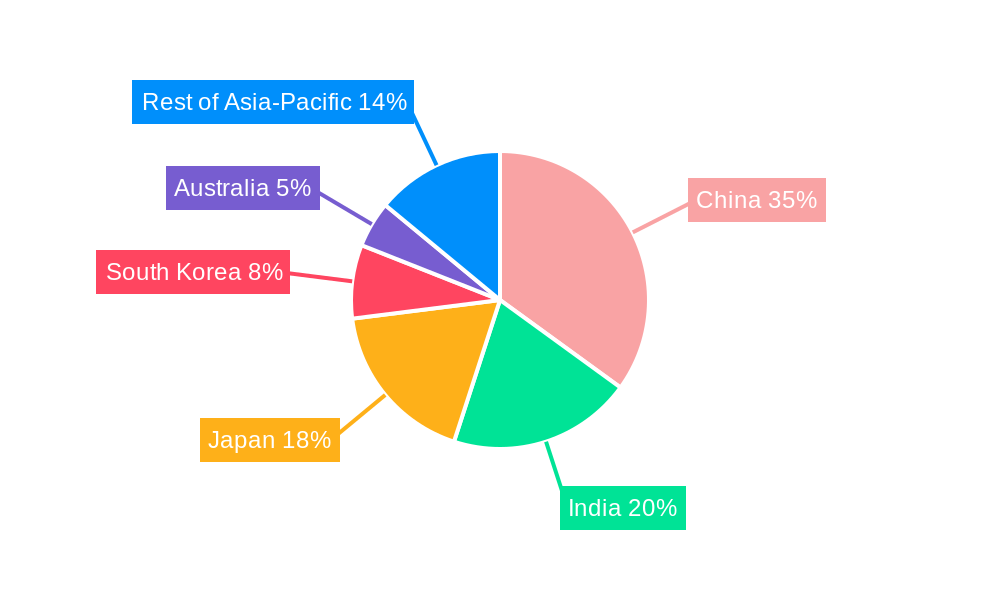

Leading Region: China remains the dominant market, driven by its vast population, economic growth, and increasing insurance penetration. Other significant markets include Japan, India, and South Korea.

Leading Segments:

- By Insurance Type: Life insurance accounts for the majority of the market share, propelled by a growing demand for protection and savings products. The annuity insurance segment is also experiencing significant growth due to increased awareness of retirement planning needs.

- By Distribution Channel: Agents continue to be the dominant distribution channel, while online distribution is rapidly gaining traction, thanks to increased internet penetration and consumer preference for digital convenience. Banks are also important distributors, leveraging their extensive customer network.

Key drivers in these leading regions and segments include supportive economic policies, growing urbanization, and investments in healthcare infrastructure. China's strong economic growth, coupled with government initiatives promoting financial inclusion, significantly influences market dominance. India's large and young population, combined with increasing financial literacy, presents immense growth opportunities.

Asia-Pacific Life And Annuity Insurance Market Product Innovations

The Asia-Pacific life and annuity insurance market is witnessing significant product innovations, driven by technological advancements and evolving consumer needs. Insurers are increasingly utilizing digital technologies to offer personalized products, simplified processes, and enhanced customer service. Insurtech solutions are streamlining operations, improving risk assessment, and creating new product offerings. These innovations focus on addressing the unique needs of different demographic segments, offering greater flexibility and customization options, and enhancing the overall customer experience. There is a rise in microinsurance products that cater to the needs of lower-income groups.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific life and annuity insurance market by insurance type (Life Insurance, Annuity Insurance) and distribution channel (Direct, Banks, Agents, Online, Other Distribution Channels).

By Insurance Type: The Life Insurance segment is projected to witness a CAGR of xx% during the forecast period, while the Annuity Insurance segment is expected to grow at a CAGR of xx%. Competitive dynamics vary across segments, with a higher level of competition in the life insurance segment due to its larger size.

By Distribution Channel: The Agents channel maintains a significant market share, although Online channels are experiencing rapid growth, propelled by changing consumer behavior and increased digital adoption. The competitive intensity is high within the online channel, with insurers focusing on providing enhanced user experience and value-added services.

Key Drivers of Asia-Pacific Life And Annuity Insurance Market Growth

Several factors drive the growth of the Asia-Pacific life and annuity insurance market. These include increasing disposable incomes, a growing awareness of the importance of financial security and retirement planning, and supportive government policies. Technological advancements like digitalization, AI-powered solutions, and improved data analytics contribute to improved customer experiences and greater efficiency. Furthermore, the rising prevalence of chronic diseases and an ageing population across the region are contributing factors.

Challenges in the Asia-Pacific Life And Annuity Insurance Market Sector

The Asia-Pacific life and annuity insurance market faces challenges such as stringent regulatory frameworks, intensifying competition, and the need to adapt to rapidly evolving customer preferences. Furthermore, maintaining customer trust and ensuring efficient risk management are crucial. Cybersecurity threats and data privacy concerns also pose risks to the industry. The impact of these challenges varies significantly based on geographic location and market segment. Estimated xx Million to xx Million in losses are potentially attributable to regulatory hurdles and cybersecurity threats each year.

Emerging Opportunities in Asia-Pacific Life And Annuity Insurance Market

The Asia-Pacific life and annuity insurance market presents significant opportunities. Expanding into underserved markets, developing innovative products to cater to the changing needs of consumers, and leveraging technological advancements are key avenues for growth. There is considerable potential in expanding microinsurance products and catering to the specific needs of different demographic groups.

Leading Players in the Asia-Pacific Life And Annuity Insurance Market Market

- Ping An Insurance

- Nippon Life Insurance Company

- Hong Leong Assurance Berhad

- Sun Life of Canada (Philippines) Inc

- China Life Insurance Company

- Muang Thai Life Assurance Public Co Ltd

- Samsung Life Insurance

- HDFC Life Insurance

- Aviva Ltd

- AIA Group

- AMP Life Limited

- Life Insurance Corporation of India (LIC)

Key Developments in Asia-Pacific Life And Annuity Insurance Market Industry

October 2023: Fanhua Inc. and Asia Insurance Co., Ltd. formed two joint ventures: a life insurance brokerage company and an insurance technology company. This strategic partnership is expected to enhance distribution capabilities and leverage technological advancements within the Chinese market.

October 2023: Chubb Life Hong Kong and AEON credit service companies launched a distribution partnership, expanding Chubb Life's reach through AEON's online and offline platforms. This collaboration demonstrates the increasing importance of cross-sector partnerships to access wider customer bases.

Future Outlook for Asia-Pacific Life And Annuity Insurance Market Market

The Asia-Pacific life and annuity insurance market is poised for sustained growth. Continued economic expansion, increasing insurance awareness, and technological advancements will drive market expansion. Strategic partnerships, product diversification, and the adoption of innovative technologies will be key factors in shaping the future of the industry. The market's future potential is significant, with opportunities for both established and emerging players.

Asia-Pacific Life And Annuity Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Annuity Insurance

- 1.2. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Banks

- 2.3. Agents

- 2.4. Online

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Singapore

- 3.4. Australia

- 3.5. Rest Asia-Pacific

Asia-Pacific Life And Annuity Insurance Market Segmentation By Geography

- 1. China

- 2. India

- 3. Singapore

- 4. Australia

- 5. Rest Asia Pacific

Asia-Pacific Life And Annuity Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiative is Expected to Drive the Growth of the Market; Increasing Awarness About Life and Annuity Insurane

- 3.3. Market Restrains

- 3.3.1. Strict Regulatory Landscape is Expected to Restrain the Growth of the Market; High Cost of Life and Annuity Insurance Products

- 3.4. Market Trends

- 3.4.1. Life Insurance is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Annuity Insurance

- 5.1.2. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Banks

- 5.2.3. Agents

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Singapore

- 5.3.4. Australia

- 5.3.5. Rest Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Singapore

- 5.4.4. Australia

- 5.4.5. Rest Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. China Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Annuity Insurance

- 6.1.2. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Banks

- 6.2.3. Agents

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Singapore

- 6.3.4. Australia

- 6.3.5. Rest Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. India Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Annuity Insurance

- 7.1.2. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Banks

- 7.2.3. Agents

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Singapore

- 7.3.4. Australia

- 7.3.5. Rest Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Singapore Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Annuity Insurance

- 8.1.2. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Banks

- 8.2.3. Agents

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Singapore

- 8.3.4. Australia

- 8.3.5. Rest Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. Australia Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Annuity Insurance

- 9.1.2. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Banks

- 9.2.3. Agents

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Singapore

- 9.3.4. Australia

- 9.3.5. Rest Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Rest Asia Pacific Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Annuity Insurance

- 10.1.2. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Banks

- 10.2.3. Agents

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Singapore

- 10.3.4. Australia

- 10.3.5. Rest Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. China Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific Life And Annuity Insurance Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Ping An Insurance

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Nippon Life Insurance Company

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Hong Leong Assurance Berhad

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Sun Life of Canada (Philippines) Inc **List Not Exhaustive

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 China Life Insurance Company

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Muang Thai Life Assurance Public Co Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Samsung Life Insurance

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 HDFC Life Insurance

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Aviva Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 AIA Group

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 AMP Life Limited

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Life Insurance Corporation of India (LIC)

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.1 Ping An Insurance

List of Figures

- Figure 1: Asia-Pacific Life And Annuity Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Life And Annuity Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Life And Annuity Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Life And Annuity Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Life And Annuity Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Life And Annuity Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Life And Annuity Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Life And Annuity Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Life And Annuity Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 15: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 19: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 23: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 27: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 31: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific Life And Annuity Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Life And Annuity Insurance Market?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the Asia-Pacific Life And Annuity Insurance Market?

Key companies in the market include Ping An Insurance, Nippon Life Insurance Company, Hong Leong Assurance Berhad, Sun Life of Canada (Philippines) Inc **List Not Exhaustive, China Life Insurance Company, Muang Thai Life Assurance Public Co Ltd, Samsung Life Insurance, HDFC Life Insurance, Aviva Ltd, AIA Group, AMP Life Limited, Life Insurance Corporation of India (LIC).

3. What are the main segments of the Asia-Pacific Life And Annuity Insurance Market?

The market segments include Insurance Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiative is Expected to Drive the Growth of the Market; Increasing Awarness About Life and Annuity Insurane.

6. What are the notable trends driving market growth?

Life Insurance is Dominating the Market.

7. Are there any restraints impacting market growth?

Strict Regulatory Landscape is Expected to Restrain the Growth of the Market; High Cost of Life and Annuity Insurance Products.

8. Can you provide examples of recent developments in the market?

October 2023: Fanhua Inc, an independent financial services provider in China, made a strategic partnership with Asia Insurance Co., Ltd, a wholly-owned subsidiary of Asia Financial Holdings Ltd. Together, the two companies formed two joint ventures: a life insurance brokerage company and an insurance technology company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Life And Annuity Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Life And Annuity Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Life And Annuity Insurance Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Life And Annuity Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence